what is overshot price

In economics, overshooting, also known as the exchange rate overshooting hypothesis, is a way to think about and explain high levels of volatility in currency exchange rates using the concept of price stickiness.

Overshooting was introduced to the world by Rüdiger Dornbusch, a renowned German economist focusing on international economics, including monetary policy, macroeconomic development, growth, and international trade. Dornbusch first introduced the model, now widely known as the Dornbusch Overshooting Model, in the famous paper "Expectations and Exchange Rate Dynamics," which was published in 1976 in the Journal of Political Economy.

Before Dornbusch, economists generally believed that markets should, ideally, arrive at equilibrium and stay there. Some economists had argued that volatility was purely the result of speculators and inefficiencies in the foreign exchange market, such as asymmetric information or adjustment obstacles.

Dornbusch rejected this view. Instead, he argued that volatility was more fundamental to the market than this, much closer to inherent in the market than to being simply and exclusively the result of inefficiencies. More basically, Dornbusch was arguing that in the short run, equilibrium is reached in the financial markets, and in the long run, the price of goods responds to these changes in the financial markets.

The overshooting model argues that the foreign exchange rate will temporarily overreact to changes in monetary policy to compensate for sticky prices of goods in the economy. This means that, in the short run, the equilibrium level will be reached through shifts in financial market prices, rather than through shifts in the prices of goods themselves. Gradually, as the prices of goods unstick and adjust to the reality of these financial market prices, the financial market, including the foreign exchange market, also adjusts to this financial reality.

So, initially, foreign exchange markets overreact to changes in monetary policy, which creates equilibrium in the short term. Then, as the prices of goods gradually respond to these financial market prices, the foreign exchange markets temper their reaction and create long-term equilibrium. Thus, there will be more volatility in the exchange rate due to overshooting and subsequent corrections than would otherwise be expected.

Although Dornbusch"s model was compelling, initially it was also regarded as somewhat radical due to its assumption of sticky prices. Today, sticky prices are accepted as fitting with empirical economic observations, and Dornbusch"s Overshooting Model is widely regarded as the forerunner to modern international economics. In fact, some have said it "marks the birth of modern international macroeconomics."

The overshooting model is considered especially significant because it explained exchange rate volatility during a time when the world was moving from fixed to floating rate exchanges. Kenneth Rogoff, during his stint as economic counselor and director of the research department at the International Monetary Fund (IMF), said Dornbusch"s paper imposed "rational expectations" on private actors about exchange rates. "Rational expectations is a way of imposing overall consistency on one"s theoretical analysis," Rogoff wrote on the paper"s 25th anniversary.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

You are viewing Bowen or Logan Overshots for sale by Pickett Oilfield, LLC. We have an extensive range of good used or rebuilt Overshots along with the accessories. Call us for your fishing tool needs. For more information contact us by phone at sales@pickettoilfield.com.

PickettOilfield.com offers prospective buyers an extensive selection of quality new, used, and refurbished Oilfield Equipment at competitive prices, including Overshots.

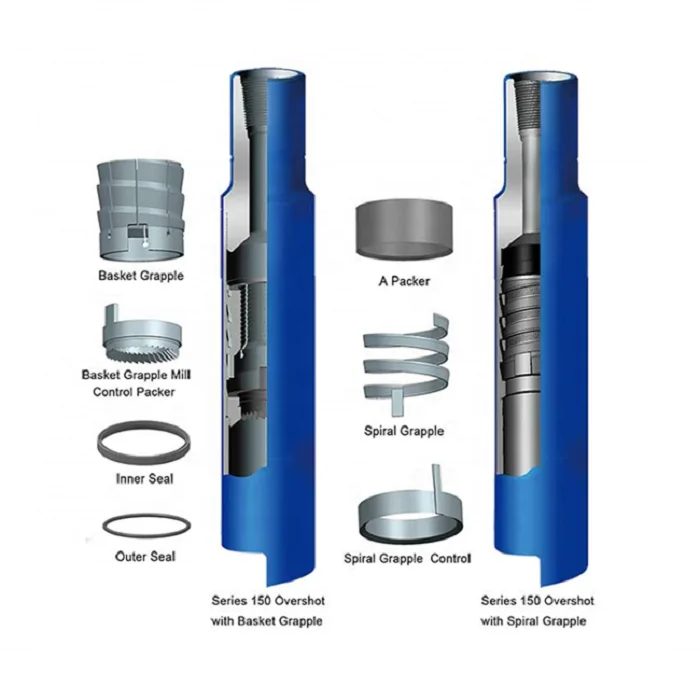

Overshots are a tool used on the downhole process during the fishing operations. It engages the tube or tool on the outside surface. A Grapple or other piece of equipment that is similar attaches onto the overshot and grabs the fish.

Lake Petro company is a professional supplier of various oilfield equipment, including oil drilling and service equipment,oil production equipment,OCTG ,wellhead & downhole tools and spare parts with API certification. our products have already been exported to USA, South America, Africa, Middle East, Russia and some other countries (regions). Lake Petro company has become VIP (assigned) supplier and built strategic partnership with some coutries" national petroleum companies.

TheSeries 10 Sucker Rod Overshot is a professional fishing tool, designed for engagingand retrieving sucker rods, couplings, and other tubular from inside tubing strings.

cf the fish, there are two types of grapples available: Basket Grapple orSpiral GrappleTheSeries 10 is a simply tool to use, no matter engaging or releasingoperation, in fact just need to rotate the fishing string on right hand.

When overshot nears the top of the fish, slowly rotate to the right as the overshot is lowered overthe fish. After the fish is engaged, allow right-hand torque to release from the fishing string. Thenraise the fish by pulling upward on the fishing string.

Bump down or drop the weight of the fishing string against the Overshot to break the hold ofthe grapple within the bow. Elevate the fishing string while slowly rotating it to the right until theOvershot has cleared the fish.

DrillingParts.com is in no way affiliated with the companies referenced in this website. References and/or mention of company names or the accompanying computer code are for ID purposes only and are not Trade Marks or Trade Names used by or affiliated with DrillingParts.com. Although under affiliate program agreements, DrillingParts.com may earn on qualifying purchases completed through third party associates such as Amazon, eBay and our marketplace vendors.

The Mills Machine Overshot is a rugged, external catch, fishing tool that is economical and simple to use. Overshots are manufactured like taper taps except they go over the O.D. of the fish. Like taper taps, overshots are stocked in a variety of sizes and standard connections so we are able to get something to you rapidly. To build an overshot from scratch takes four to six days due to the heat treat process necessary to harden the teeth. It is speedier to build a sub to fit a stocked overshot and match your needs than to build the entire product. We can build the overshot with oversize guides to more easily catch the fish or with a wall hook to snag behind a fish leaning against the drill hole wall. Your Mills sales representative will work with you to get the fastest solution to your problem at the lowest cost. The carbonized threads on overshots are extremely hard and brittle. Be extra careful to avoid impact. In use, slowly lower the tool down the hole until the fish is engaged. Then slowly rotate the tool while applying some down pressure. Mark the drill rod to tell how far into the fish you have penetrated. Overshots can be reworked by annealing, re-threading the overshot and then re-heat treating the re-threaded area. We will quote you pricing as necessary.

The overshooting model, or the exchange rate overshoot hypothesis, first developed by economist Rudi Dornbusch, is a theoretical explanation for high levels of exchange rate volatility. The key features of the model include the assumptions that goods" prices are sticky, or slow to change, in the short run, but the prices of currencies are flexible, that arbitrage in asset markets holds, via the uncovered interest parity equation, and that expectations of exchange rate changes are "consistent": that is, rational. The most important insight of the model is that adjustment lags in some parts of the economy can induce compensating volatility in others; specifically, when an exogenous variable changes, the short-term effect on the exchange rate can be greater than the long-run effect, so in the short term, the exchange rate overshoots its new equilibrium long-term value.

Dornbusch developed this model back when many economists held the view that ideal markets should reach equilibrium and stay there. Volatility in a market, from this perspective, could only be a consequence of imperfect or asymmetric information or adjustment obstacles in that market. Rejecting this view, Dornbusch argued that volatility is in fact a far more fundamental property than that.

According to the model, when a change in monetary policy occurs (e.g., an unanticipated permanent increase in the money supply), the market will adjust to a new equilibrium between prices and quantities. Initially, because of the "stickiness" of prices of goods, the new short run equilibrium level will first be achieved through shifts in financial market prices. Then, gradually, as prices of goods "unstick" and shift to the new equilibrium, the foreign exchange market continuously reprices, approaching its new long-term equilibrium level. Only after this process has run its course will a new long-run equilibrium be attained in the domestic money market, the currency exchange market, and the goods market.

As a result, the foreign exchange market will initially overreact to a monetary change, achieving a new short run equilibrium. Over time, goods prices will eventually respond, allowing the foreign exchange market to dissipate its overreaction, and the economy to reach the new long run equilibrium in all markets.

That is to say, the position of the Investment Saving (IS) curve is determined by the volume of injections into the flow of income and by the competitiveness of Home country output measured by the real exchange rate.

The first assumption is essentially saying that the IS curve (demand for goods) position is in some way dependent on the real effective exchange rate Q.

That is, [IS = C + I + G +Nx(Q)]. In this case, net exports is dependent on Q (as Q goes up, foreign countries" goods are relatively more expensive, and home countries" goods are cheaper, therefore there are higher net exports).

If financial markets can adjust instantaneously and investors are risk neutral, it can be said the uncovered interest rate parity (UIP) holds at all times. That is, the equation r = r* + Δse holds at all times (explanation of this formula is below).

It is clear, then, that an expected depreciation/appreciation offsets any current difference in the exchange rate. If r > r*, the exchange rate (domestic price of one unit of foreign currency) is expected to increase. That is, the domestic currency depreciates relative to the foreign currency.

In the short run, goods prices are "sticky". That is, aggregate supply is horizontal in the short run, though it is positively sloped in the long run.

comparing [9] & [10], it is clear that the only difference between them is the intercept (that is the slope of both is the same). This reveals that given a rise in money stock pushes up the long run values of both in equally proportional measures, the real exchange rate (q) must remain at the same value as it was before the market shock. Therefore, the properties of the model at the beginning are preserved in long run equilibrium, the original equilibrium was stable.

The rate of exchange is positive whenever the real exchange rate is above its equilibrium level, also it is moving towards the equilibrium level] - This yields the direction and movement of the exchange rate.

Both [11] & [12] together demonstrates that the exchange rate will be moving towards the long run equilibrium exchange rate, whilst being in a position that implies that it was initially overshot.

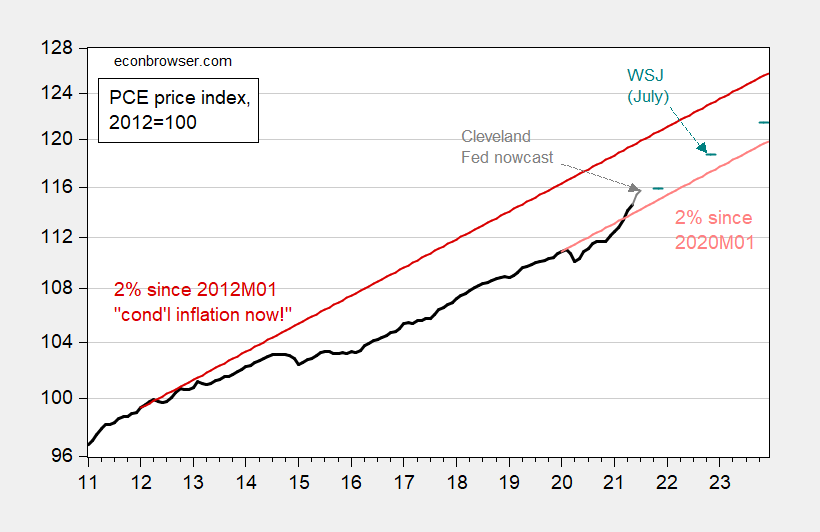

This demonstrated the overshooting and subsequent readjustment. In the graph on the top left, So is the initial long run equilibrium, S1 is the long run equilibrium after the injection of extra money and S2 is where the exchange rate initially jumps to (thus overshooting). When this overshoot takes place, it begins to move back to the new long run equilibrium S1.

Mar032016OILWELL SUPPLIES: BASKET GRAPPLE FOR 4 9/16OD SLIM HOLE RH OVERSHOT 3-1/8 (4 NOS) 2-7/8 (4 NOS) 3-1/16 (2 NOS) 2-3/8United StatesBombay SeaUNT12525,12543,760

Mar032016OILWELL SUPPLIES: BASKET GRAPPLE FOR 4 9/16OD SLIM HOLE LH OVERSHOT 3-1/8 (5 NOS) 2-7/8 (5 NOS) 3-1/16 (3 NOS) 2-3/8United StatesBombay SeaUNT16841,79952,612

A startling and compelling example showing that even the most seemingly simple everyday objects are enmeshed in complicated social, cultural, and historical politics. Combining detailed craft knowledge with anthropological breadth, the authors explore the ways in which race is subtly woven into stagings of slave and owner spaces in historical sites, the culture and politics of yeoman low-country ‘plain folk,’ and the use of craft to reinvigorate Appalachian tradition in new ways. A rare achievement in working across black and white, aesthetics, materials, and culture, this book is an important contribution to new materialisms, discussions of craft, and work on the larger contexts in which material things take on meaning.

This well-crafted book is impressive for what it tells us about the evolution of public history in an age when marginalized groups are competing for attention. As the text unfolds, Falls and Smith carefully knit evidence about coverlets into a larger story about how museums and historic houses interpret, and misinterpret, the work-life of African American women and women from yeoman households. Overshot captures the attention of the nonspecialist as well as the specialist in skillfully demonstrating that coverlets are both art and craft.

—Paul M. Pressly, Director Emeritus of the Ossabaw Island Education Alliance, author of On the Rim of the Caribbean: Colonial Georgia and the British Atlantic World

Contributes to expansive contemporary conversations about which stories get told, which histories are enshrined and by whom, and makes clear that coverlets indeed merit further scholarly consideration.

Falls and Smith harness an impressive range of source materials and guide the reader mindfully with them. Their investigative tone and almost ethnographic approach to museum collecting is especially effective in the early chapters, in which they critically confront biases of the archive around coverlet production and mobilize material knowledge of fiber to complicate contemporary perceptions of antebellum society.

Diamond core drilling tools is one of our key products, we specialized in design, production and sales of Q series including AQ, BQ, NQ, HQ, PQ etc sizes from 2009, currently our major products include diamond impregnated bits, surface set bits, PDC bits, reaming shell, core barrel, wireline drill rods, casing and casing shoe etc diamond core drilling consumables, which are applicable for mining, geotechnical exploration etc drilling jobs...

8613371530291

8613371530291