overshot the runway meaning in stock

It means that the aircraft has touched down on the runway before going off it. Overshoot is used in the same sense (note that overrun/overshoot occurs both in TO/landing).

However, there is one case where they are used differently. Overshooting the runway also can mean that the aircraft has touched beyond the end of the runway i.e. missed the runway entirely.

I understand its meaning in the context, but what does it exactly mean? I tried to Google the idiom, but I found only one hit in Urban Dictionary whose definition doesn"t seem to fit in the context (I don"t want to put it here).

I can"t find the origin of the idiom. I would like to know when and how the idiom started to mean what it means now. I can just speculate it could have started as a military term.

``This is no fair chance you put on me, proud Prince,"" said the yeoman, ``to compel me to peril myself against the best archers of Leicester And Staffordshire, under the penalty of infamy if they should overshoot me.

She merely kept the boat before the stream now, and rested on her oars, knowing well that if the face were not soon visible, it had gone down, and she would overshoot it.

This means that the earth"s population is currently consuming the resources of future generations.The Earth Overshoot Day fell this year on July 29, which is the earliest date ever, according to a report from the Global Footprint Network.

Earth Overshoot Day marks the day when human demand for food, fiber, timber, and carbon absorption (global Ecological Footprint) exceeds the amount of biological resources which Earth"s ecosystems can renew in the whole year (global biocapacity).

Slovakia"s Overshoot Day, calculated by Global Footprint Network, fell on May 27 last year, but it came earlier in 2019.Therefore, Slovakia"s current Overshoot Day suggests that Slovaks need 2.6 planets to satisfy their needs.

Further investigations also revealed that part of the cost overrun threatening to overshoot the $1.5bn Lagos-Ibadan standard gauge rail project includes: Apapa port rail sidings initially budgeted at 2.4km, but now estimated at 6.4km.

Earth overshoot day marks when people have used up the food, timber and other natural products Earth can sustainably provide, and has absorbed as much carbon emissions as a result of human activity as it can, for the year.

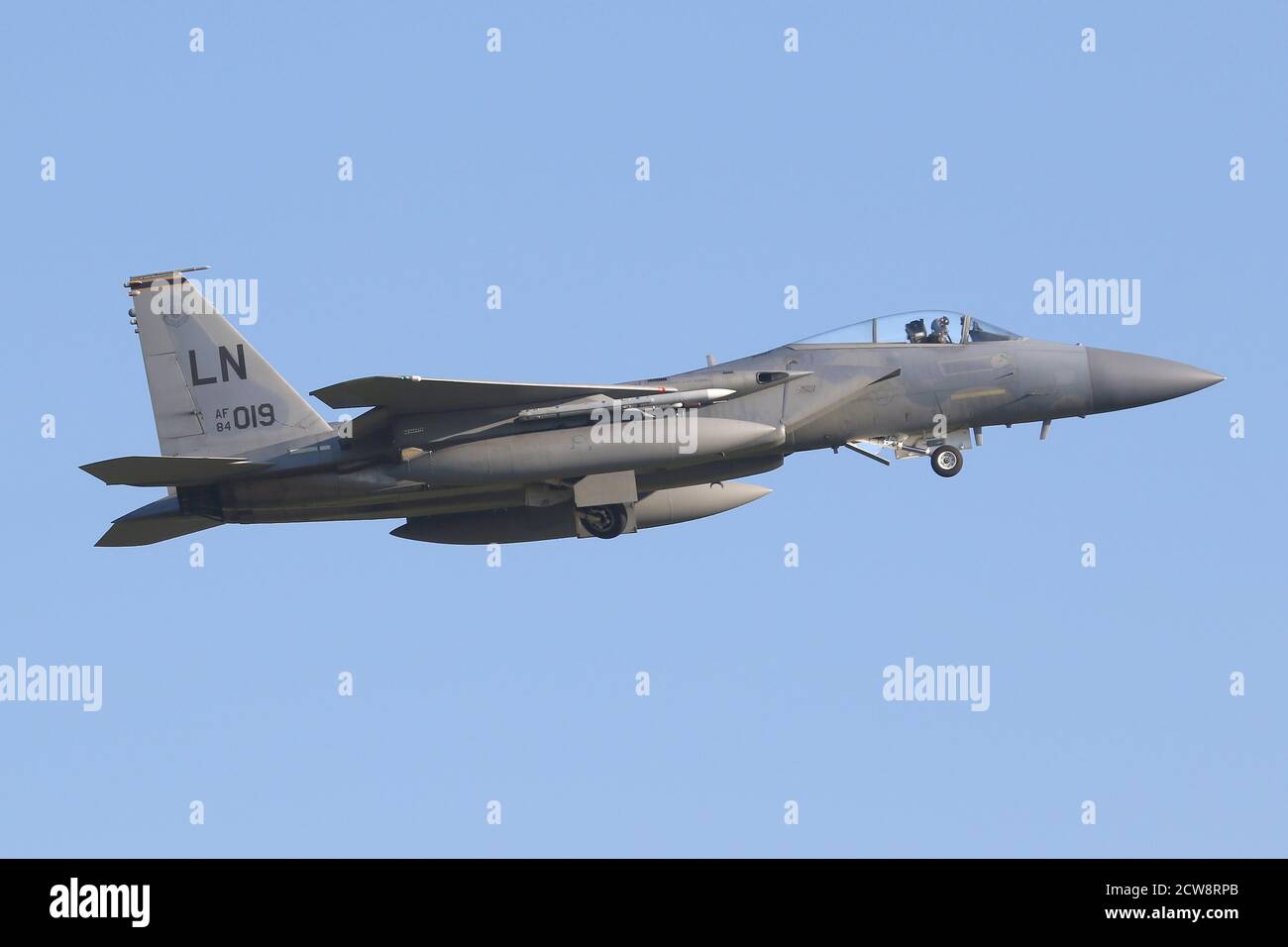

Summary: New Delhi [India], July 3 (ANI): In the wake of incidents of aircraft overshooting runways, Union Civil Aviation Minister Hardeep Singh Puri on Wednesday said such incidents happen sometimes due to excessive rains but everything is under control and there is no cause of concern.

Previous work has shown that the cloud-top reflectance in the near-infrared increases in middle-latitude, deep-convective overshooting tops--the overshooting tops appear lighter than the surrounding glaciated clouds due to smaller ice crystals (2-4 [micro]m in effective radius), which are frozen nearly instantaneously in intense thunderstorm updrafts.

Combining the effects of the TRAIN, inflation would become 3.58 percent, overshooting the midpoint target of 3 percent but not enough the target range of 2 to 4 percent.

However, the good news is that the rate at which the overshoot day is moving up the calendar has slowed to less than one day a year on average over the past five years, compared to an average of three days a year since we began overshooting in the early 1970s.

She added, "In a situation like this, clearer communication from the authorities will always be useful to help guide the market to avoid overshooting. Markets have a tendency to overshoot, which means if you are able to minimise overshooting, you also tend to reduce volatility."

That’s fodder for future research—but even without an overshoot effect, these results add support to the idea that you can and probably should taper your strength training at least a week before a big race.

to cause (an aircraft) to fly or taxi too far along (a runway) during landing or taking off, or (of an aircraft) to fly or taxi too far along a runway

Let’s cut right to the chase: there is a strong case to be made that many base-to-final accidents may have as a significant factor the pilot’s fear of a runway overshoot, fearing that any runway overshoot can only be disastrous. However, if pilots have flown even one deliberate runway overshoot and seen that the real issue is instead fear of the unknown, then just one five minute traffic pattern with a deliberate runway overshoot has the potential to significantly reduce loss of control accidents. After all, go arounds are routinely taught to reduce fear of the unknown, so why not runway overshoots? One university flight department is currently working to implement deliberate runway overshoots into its pre-solo curriculum.

This all started with the EAA Founder’s Innovation Prize contest, whose first year was 2016. The background research involved was analysis in great detail of 551 NTSB reports of homebuilt aircraft, sometimes reviewing them three or more times, plus supporting information from the docket and other sources. That in turn led to in-flight exercises to familiarize pilots with sight pictures and sensations outside of normal middle of the envelope flight.

Then came a breakthrough. One of the subject pilots severely botched a low speed steep turn and there was digital flight data of the event, thanks to the glass cockpit in the RV-9A. Based on that event, I hypothesized that loss of control in a base-to-final turn was not a problem of lack of information, but rather of not adequately processing all the information already available. That in turn led to the theory of cognitive availability, suspecting that the most effective remedy to loss of control was not teaching technique—which is already well covered—but exposing pilots to sensations and out the windshield pictures without being distracted by watching instruments, so that the pilots would remain cognitively available to process the required information in stressful, unfamiliar situations.

That in turn led to yet another pass through the data and the discovery that not all stall/spins were in fact stall/spins, but some were low speed spirals. But why?

In the development of the Expanded Envelope Exercises®, subject pilots, including retired airline pilots and very senior ex-military test pilots, gave useful information with their body language and facial expressions. On those flights, I didn’t describe the exercises until just before we flew them. The body language when I announced that we were going to deliberately fly through the final approach path spoke volumes.

There was also one very recent flight in which I misjudged the tailwind on base and was overshooting final myself. I could not believe how strong the temptation was to tighten up the turn and not overshoot. Marveling at my own psychology, I chose to overshoot the turn by one runway width rather than tighten it up excessively and unnecessarily. It was amazing that even with all of the research I’ve done and all the times I’ve taught the deliberate overshoot, I myself was still susceptible to very strong pressures not to overshoot. The law of primacy at work?

Pilots were distracted by spending too much attention focusing on runway alignment and were cognitively unavailable to pay attention to pitch and airspeed.

This leaves Hypotheses 1 and 2. There’s no real way of knowing the psychology of a pilot in a fatal accident, but these two hypotheses seem plausible. And Hypothesis 1 has a trivial solution—go out and try it!

First, observe that turning final late has the exact same aerodynamics as turning final at the correct time. The only differences are the psychological aspects and the need to maybe turn a bit more than 90 degrees. Then again, in a traffic pattern with a tailwind on base, the turn to final will be more than 90 degrees anyway. In other words, there is no extra risk to this exercise, aerodynamically.

Here’s the descriptor: Fly base leg to intercept the final approach leg at 500 feet or higher (the same altitude as turns around a point). Do not turn final until crossing the extended runway centerline. Using your normal bank angle, turn final to fly parallel to the extended runway centerline. Then, using the same technique used for S-turns on final, gradually and gracefully align with the runway centerline, and land normally.

Some will suggest that on any runway overshoot, the only acceptable option is to immediately go around. While there may be merit to that argument in real world operations, especially for pilots with limited experience or in very challenging conditions, this exercise is a learning experience, to see the sight picture and to feel the emotions. Doing an early go around while training will compromise that learning experience.

Analysis of the NSTB reports, flight tests and other sources indicate four ways to get into trouble turning base to final. Although the accident mechanisms differ, all four seem to be susceptible to either Hypothesis 1 or 2 as major factors.

Aggravated low speed spiral: same as above, but the pilot mistakes the low speed spiral for a spin entry and adds forward stick, aggravating the unusual attitude.

Spin out the bottom: pilot applies too much rudder to align with the runway while adding excessive back pressure, resulting in a spin out the bottom, as it used to be called.

Spin over the top: pilot banks too much, uses elevator to tighten the turn and rudder to keep the nose up, resulting in a spin over the top, as it used to be called.

This exercise will probably not solve all base to final loss of control situations, but it will definitely solve some. Given that the cost is only one lap around the pattern and the benefit is the possibility of saving lives, this exercise has much to commend it.

When somebody takes the time to thoroughly analyze stalls after takeoff, they are going to find that existing statistics are at best misleading and well worth a quite colorful description.

For example, in the General Aviation Joint Steering Committee (GAJSC) Loss of Control Working Group’s Approach and Landing & Departure and Enroute from October 29, 2014, they studied 85 NTSB reports, of which 29 were experimental, amateur built. I classified eight of those 29 events as primarily traffic pattern events—only one was on takeoff/go around, and that was a pitch up on go around. I classified seven as pilot skills events, two of those being first flights in a homebuilt, one pilot was known to be scared of the plane, and two pilots were unlicensed. Those five egregious events were not called out into a separate category as would have been appropriate. By the way, the GAJSC used this data set to recommend angle of attack indicators, a recommendation that is at best a stretch.

I also generated a set of 40 “stall after takeoff” events, according to the NTSB classification and again, those were experimental, amateur built aircraft. A half dozen of those were STOL aircraft that crashed immediately after takeoff, one of those being an instructor giving dual. He had rudder pedals on his side, but not a control stick. Eight or so of the “stall after takeoff” were more properly classified as failure to achieve sustained flight. One stall after takeoff occurred when the canopy came off the airplane at 1000 feet.

Ever heard the expression, when all you’ve got is a hammer, every problem looks like a nail? Similarly, if the only accident classification you’ve got for events after takeoff is stall, every event after takeoff will become a stall. But just becase a stall occurred after takeoff does not mean that the stall was causal or even that “stall” was an accurate descriptor. It certainly doesn’t mean that all those “stalls” could be remedied in the same way.

Yes, there are stalls after takeoff and in the pattern, but nobody yet has taken the time to classify all these events to appropriately high levels of detail. That analysis will be a major undertaking, and the results will be muddled and confused, but not clear cut.

In economics, overshooting, also known as the exchange rate overshooting hypothesis, is a way to think about and explain high levels of volatility in currency exchange rates using the concept of price stickiness.

Instead, a domino effect first impacts other factors—such as financial markets, money markets, derivatives markets, and bond markets—which then transfers its influence onto the prices of goods.

Overshooting was introduced to the world by Rüdiger Dornbusch, a renowned German economist focusing on international economics, including monetary policy, macroeconomic development, growth, and international trade. Dornbusch first introduced the model, now widely known as the Dornbusch Overshooting Model, in the famous paper "Expectations and Exchange Rate Dynamics," which was published in 1976 in the Journal of Political Economy.

Before Dornbusch, economists generally believed that markets should, ideally, arrive at equilibrium and stay there. Some economists had argued that volatility was purely the result of speculators and inefficiencies in the foreign exchange market, such as asymmetric information or adjustment obstacles.

Dornbusch rejected this view. Instead, he argued that volatility was more fundamental to the market than this, much closer to inherent in the market than to being simply and exclusively the result of inefficiencies. More basically, Dornbusch was arguing that in the short run, equilibrium is reached in the financial markets, and in the long run, the price of goods responds to these changes in the financial markets.

The overshooting model argues that the foreign exchange rate will temporarily overreact to changes in monetary policy to compensate for sticky prices of goods in the economy. This means that, in the short run, the equilibrium level will be reached through shifts in financial market prices, rather than through shifts in the prices of goods themselves. Gradually, as the prices of goods unstick and adjust to the reality of these financial market prices, the financial market, including the foreign exchange market, also adjusts to this financial reality.

So, initially, foreign exchange markets overreact to changes in monetary policy, which creates equilibrium in the short term. Then, as the prices of goods gradually respond to these financial market prices, the foreign exchange markets temper their reaction and create long-term equilibrium. Thus, there will be more volatility in the exchange rate due to overshooting and subsequent corrections than would otherwise be expected.

Although Dornbusch"s model was compelling, initially it was also regarded as somewhat radical due to its assumption of sticky prices. Today, sticky prices are accepted as fitting with empirical economic observations, and Dornbusch"s Overshooting Model is widely regarded as the forerunner to modern international economics. In fact, some have said it "marks the birth of modern international macroeconomics."

The overshooting model is considered especially significant because it explained exchange rate volatility during a time when the world was moving from fixed to floating rate exchanges. Kenneth Rogoff, during his stint as economic counselor and director of the research department at the International Monetary Fund (IMF), said Dornbusch"s paper imposed "rational expectations" on private actors about exchange rates. "Rational expectations is a way of imposing overall consistency on one"s theoretical analysis," Rogoff wrote on the paper"s 25th anniversary.

Recent Examples on the Web Lawmakers boosted that number by $4.5 billion during a midyear budget revision that included bonus payments and pay raises for state employees and teachers but will still substantially undershoottotal revenue for the year.

Italy has blocked the export of 250,000 AstraZeneca doses (made in the country) to Australia, on the basis that AZ is likely to undershootits delivery commitments within the EU.

These example sentences are selected automatically from various online news sources to reflect current usage of the word "undershoot." Views expressed in the examples do not represent the opinion of Merriam-Webster or its editors. Send us feedback.

(Reuters) -A Korean Air Lines Co Ltd jet with 173 people on board overshot the runway at Cebu International Airport in the Philippines late on Sunday, the airline said, adding that there were no injuries and all passengers had evacuated safely.

The Airbus SE A330 widebody flying from Seoul to Cebu had tried twice to land in poor weather before it overran the runway on the third attempt at 23:07 (1507 GMT), Korean Air said in a statement on Monday.

"Passengers have been escorted to three local hotels and an alternative flight is being arranged," the airline said of flight KE361. "We are currently identifying the cause of the incident."

Korean Air President Keehong Woo issued an apology on the airline"s website, saying a thorough investigation would be carried out by Philippine and South Korean authorities to determine the cause.

The A330-300 jet involved in the accident was delivered new to Korean Air in 1998, according to flight tracking website FlightRadar24, which said that other flights to Cebu had diverted to other airports or returned to their origin.

The Cebu airport said on its Facebook page that it had temporarily closed the runway to allow for the removal of the plane, meaning all domestic and international flights were cancelled until further notice.

For instance - let"s say that a biotech company reveals that they have "cash runway" until the middle of 2018. This means that they expect to have enough money to fund operations until the middle of 2018. At this time, they will likely need to raise capital in order to keep the business running.

So, if a company has $30 million in cash and is burning through $5 million per month, they would have a cash runway of six months before they would have to raise more money.

entity pursuant the Georgia Administrative Procedures Act, O.C.G.A.§ 50-13-7(d) contact the State of Georgia"s Administrative Procedures Division at 678-364-3785 to enable these features for your location.)

8613371530291

8613371530291