power tong trucks for sale manufacturer

Torque range at 2200 PSI/15.2 MPA High gear 2,400 ft.lbs/3,254 Nm “Low gear 12,000 ft.lbs./16,272 Nm” Maximum RPM at 50 GPM/189 LPM High: 86 RPM Low: 17 RPM Hydraulic Requirements 50 GPM @ 1,000 PSI 189 LPM @ 6.9 Mpa 20 GPM @ 2,200 PSI 75 LPM @ 15.2 Mpa Length 47 inches/119.38 cm Overall Width 31 inches/78.74 cm Space Required on Pipe 8 inches/20.32 cm Maximum elevator diameter Unlimited (Tong comes off pipe) Center line of pipe to center line of anchor handle 34 inches/86.36 cm Weight (approximate) 1,050 lbs./476.7 kg

Tongs - Power - BJ sucker rod tong adopts advanced sucker rod or tubing technology and has a compact structure, high reliability and is safe and convenient to operate.

Tongs - Power - New Carter Tool Co. Inc., CT93R Hydraulic powered tubing tong. Complete with 2-3/8" to 3-1/2" jaw assemblies, standard motor, torque gauge assembly, pressure relief valve... More Info

Tongs - Power - New Carter Tool Co., Inc. 5-1/2" CTSX Hydraulic Tubing Tong with heavy case and cover; complete with rigid hanger assy., suspension spring assy., front end control assy.,... More Info

Tongs - Power - New Carter Tool Co. Inc. M-Series power sucker rod tongs, complete with spring hanger assy., gate assy., front end control assy., pressure gauge assy., two 90 degree XH s... More Info

Tongs - Power - New Carter Tool Co., Inc. 4-1/2" RSX Hydraulic Tubing Tong with heavy case and cover; complete with rigid hanger assy., suspension spring assy., front end control assy., ... More Info

Tongs - Power - D D 58-93-2-R Power Tubing Tong is smaller, lighter, and faster than the Foster 5893R. The D D 58-93-2-R Tong is capable of gripping tubulars from 1 5/16" to 7" o.d. More Info

Tongs - Power - FARR TONG MODEL KT 14,000 RINEER GA37 MOTOR, LIFT VALVE ASSEMBLY TORQUE CAPACITY: 50,000 FT/LB SIZE RANGE 4 1.2-14 WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN ... More Info

Tongs - Power - FARR TONG MODEL KT20,000 STAFFA 080 MOTOR, LIFT VALVE ASSEMBLY TORQUE CAPACITY: 50,000 FT/LB SIZE RANGE: 7-20 MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READ... More Info

Tongs - Power - FARR MODEL KT5500 HYDRAULIC TUBING TONG C/W 2 SPEED RINEER MOTOR, SIZE RANGE: 2-3/8 IN. - 5-1/2 IN. OD, TORQUE RTED: 18,700 FT/LB C/W SAFETY DOOR MOST SIZES OF FARR POWER... More Info

Tongs - Power - FARR TONG MODEL KT5500 TORQUE CAPACITY: 18000 FT/LB SIZE RANGE: 2 1/16-5 1/2 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIA... More Info

Tongs - Power - FARR TONG MODEL KT5500 5 1/2 IN. TONG TORQUE CAPACITY: 18,000 FT/LB SIZE RANGE: 2 1/16-5 1/2 IN. OD, RINEER 15-13 MOTOR, HIGH TORQUE CLINCHER BACKUP TRIPLE VALVE ASSEMBLY... More Info

Tongs - Power - FARR TONG MODEL KT7585 TORQUE CAPACITY: 25000 FT/LB SIZE RANGE: 2 1/16-8 5/8 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIA... More Info

Tongs - Power - FARR TONG MODEL KT7585 8 5/8 IN. TONG TORQUE CAPACITY 25,000 FT/LB SIZE RANGE: 2 1/16-8 5/8 IN. OD, RINEER 15-15 MOTOR CLINCHER BACKUP, TRIPLE VALVE MOST SIZES OF FARR PO... More Info

Tongs - Power - FARR TONG MODEL LW9625 TORQUE CAPACITY 12000 FT/LB SIZE RANGE 2 7/8 -9 5/8 OD WITH SAFETY DOOR MOST SIZES OF FARR POWER TONGS ARE IN HOUSTON, IN STOCK READY FOR IMMEDIATE... More Info

Tongs - Power - Farrs newest tubular connection tool offers a significantly reduced rig footprint, while continuing to deliver power & uncompromising reliability. The simple design drast... More Info

Tongs - Power - Farr Canada"s newest tubular connection tool offers a significantly reduced rig footprint, while continuing to deliver power and uncompromising reliability. The simple de... More Info

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

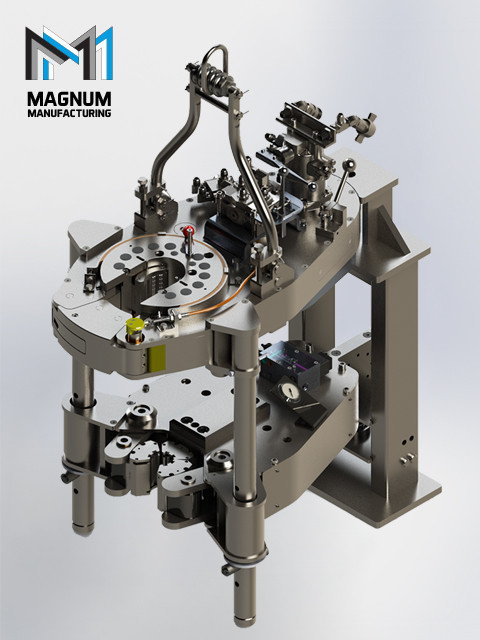

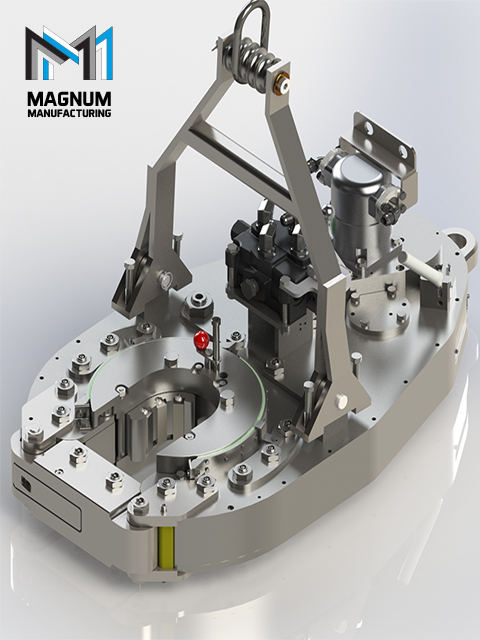

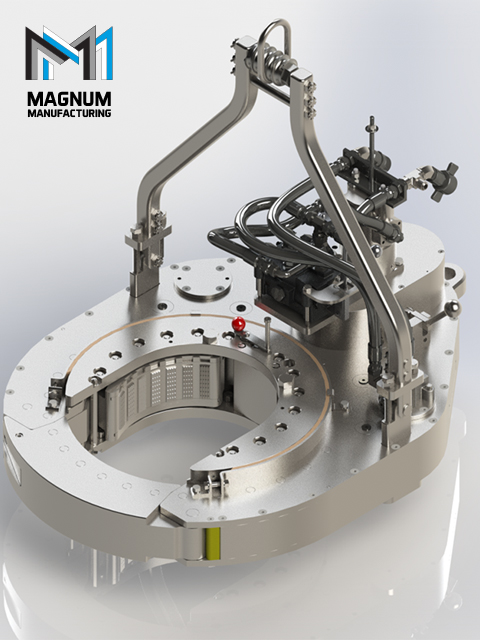

Magnum Manufacturing is a team of experienced casing running engineers and industry-leading professionals tired of working with existing substandard equipment. We have spent decades developing equipment to the highest industry standards, and we personally have been using the equipment we’ve developed. After 30+ years of partnering with a leading American TRS company to ensure optimal performance, we are prepared to stake our reputation on Performance, Longevity, & Safety.

For over 30 years, Clarkes Power Tong Service andClarkes Oilfield Services has been providing tubular running services to the oil & gas industry. We specialize in casing and tubing work primarily in Alberta and Western Saskatchewan. With new ownership in 2005, Clarkes continues to build on that solid foundation with an equal amount of new strength and energy. Progressive initiatives combined with an extensive maintenance and new equipment purchase program have ensured that Clarkes is at the forefront of the industry. Whether conventional oil and gas, tight shale or SAGD programs, we have the experience and equipment to get it done right.

Not just power tongs� in addition to maintenance and new equipment purchases of power tongs, integral tongs, handling, circulating, and all of the equipment used in our traditional business of running tubulars, Clarkes provides a number of complimentary services that include: BOP Pressure Testing, Computer Torque Monitoring, Threadwashing and new in 2013...Volant Casing Running Tools �CRTi�s�. These mechanical CRTi�s have 4-1/2� to 20� OD capabilities and are utilized on ADR Super Single rigs to perform the complete job of running and pulling casing; and/or conventional top drive double and triple rigs to fill, circulate and push casing in combination with power tongs for making up the casing.

Our personnel, fully equipped power tong and pressure testing trucks and CRTi�s are located throughout Alberta and Western Saskatchewan. Temporary and permanent relocation based on the ideal place to be based from for a project, is always accommodated. All locations are dispatched through our Calgary office which is contacted 24 hours a day.

Whether we provide all of our available services or a single service in combination with other service providers, Clarkes Power Tong Service / Clarkes Oilfield Services is serious about doing it right and takes pride in providing safe, reliable and quality service to our valued customers!

K&S Power Tongs committs to providing quality casing services in a safe, reliable, cost efficient and timely manner. Safety is everyone’s full time job and we are committed to the prevention and elimination of all safety nad health hazards. All operators are specially trained and industry safety certified. Safety is never compromised. Unsafe acts are never tolerated and our employees are held accountable to work safe.

K&S Power Tongs offers coventional and integral power tong services, volant casing running tools, computer torque-turn systems, power thread washing, thread inspection, handling equipment rentals and light oilfield hauling.

K&S Power Tongs committs to providing quality casing services in a safe, reliable, cost efficient and timely manner. Safety is everyone’s full time job and we are committed to the prevention and elimination of all safety nad health hazards. All operators are specially trained and industry safety certified. Safety is never compromised. Unsafe acts are never tolerated and our employees are held accountable to work safe.

K&S Power Tongs offers coventional and integral power tong services, volant casing running tools, computer torque-turn systems, power thread washing, thread inspection, handling equipment rentals and light oilfield hauling.

The 9-5/8” power tong with Rineer GA15-13 two-speed hydraulic motor, motor valve, lift cylinder valve, rigid sling, FARR® hydraulic backup, configured for compression load cell.

Power tongs are an essential tool in the drilling industry and are used to make up, break out, apply torque and to grip the tubular components. We are distributors for both Starr Power Tongs and McCoy Global hydraulic power tongs in multiple sizes and torque ranges from high torque to low torque that can be used to run both casing, drill pipe and tubing. When determining which power tong is best for your project, you will want to select the power tong that best fits your tubular size ranges and torque required.

All of our power tongs are available with either the McCoy\\\\\\\\\\\\\\\"s patented WinCatt data acquisition software recently updated to the MTT systems or AllTorque\\\\\\\\\\\\\\\"s computer monitoring system for all the torque and turn control system needed in today\\\\\\\\\\\\\\\"s market for the making of tubular connections. Discover our wide selection of McCoy and Starr casing tongs, tubing tongs and power tongs for sale below!

You are a manufacturer of wooden furniture in California. You plan to expand your operations to meet the growing demands of your customers. As a result, you need to purchase new manufacturing equipment that includes a table saw, a drill press, and a lathe. You want to know if your purchases will qualify for the Manufacturing, Research and Development partial exemption.

First, you need to find out whether your company is a qualified person for the purposes of the partial exemption. You have been primarily engaged in business for several years as a manufacturer of wooden furniture. You determine your company"s North American Industry Classification System (NAICS) code to be 337122. Since the NAICS code for your primary line of business is described within the range of 3111 to 3399, you determine that your company does qualify for the partial exemption.

Next, you examine whether the equipment you are purchasing qualifies for the partial exemption and whether it will be used in a qualifying manner. You are purchasing machinery and equipment that has a useful life greater than one year. You plan to use the equipment at least 50 percent of the time for manufacturing purposes. Therefore, you have determined that your purchases qualify for the partial exemption.

Now that you have determined that both your business and purchases qualify for the partial exemption, you are ready to start buying equipment. You and whether it will be used in a qualifying manner. need to download the Partial Exemption Certificate for Manufacturing, Research and Development Equipment. Fill it out, print it, and sign it. Then give it to the retailer of the equipment at the time you make your purchase.

The retailer will charge or collect from you at a reduced tax rate thereby saving you 3.9375 percent in sales or use tax on the purchase of your equipment.

In order to be considered a qualified person for the partial exemption, you must be primarily engaged in a line of businesses described in North American Industry Classification System (NAICS) code 3111 to 3399 for manufacturers, 541711 or 541712 if you are engaged in research and development or, beginning January 1, 2018, 22111 to 221118, and 221122 for qualifying electric power generators or distributors.

NAICS codes are used to classify business establishments by a six-digit code system. The first four digits represent the industry group, and the last two digits represent the specific industry. For example, a business that manufactures cardboard boxes will have a NAICS code of 322211:

Your business" NAICS code is that which best describes your line of business, based on either its primary revenues or primary operating expenses. If there is no six-digit NAICS code for your specific line of business, you may still qualify for the partial exemption if your business activities are reasonably described in a qualifying four-digit industry group.

Please note: The six-digit NAICS codes for research and development were changed in the 2017 edition. In general, the 2012 NAICS codes 541711 and 541712 were replaced by 2017 codes 541713 – 541715. Again, only the 2012 NAICS codes are relevant in determining whether a person is engaged in a qualifying line of business.

Most businesses or entities will have one NAICS code that best describes their line of business. However, if your entity is not primarily engaged in a line of business described in a qualifying NAICS code and you operate separate establishments within the entity, that constitute separate "cost centers" or "economic units," a separate establishment may qualify for the partial exemption if it is primarily engaged in a line of business described by a qualifying NAICS code. You must keep separate books and records for each establishment.

Generally, for purposes of the partial exemption, property that is capitalized and depreciated on your state income or franchise tax returns will be regarded as having a useful life of one or more years.

If property is not capitalized and depreciated for income tax purposes, it will be presumed that the property does not have a useful life of one or more years and will not qualify for the partial exemption. However, transactions involving certain property that is not capitalized and depreciated for state income or franchise tax purposes may qualify for the partial exemption in the following situations:

The cost of qualifying property is deducted under Revenue and Taxation Code (RTC) sections 17201 and 17255 or 24356 (similar to Section 179 of the Internal Revenue Code, but subject to lower deduction thresholds for state purposes).

Individual materials and fixtures purchased and installed as a component part(s) of a special purpose building. The special purpose building, as a whole, will be depreciated for tax reporting purposes.

Establishments that are primarily engaged in research and development in biotechnology, physical engineering, and life sciences may qualify for the partial exemption. To qualify for the partial exemption, the establishment must be classified under one of the following two North American Industry Classification System (NAICS) codes: 541711, 541712.

(As noted above, the six-digit NAICS codes for research and development were changed in the 2017 edition. In general, the 2012 NAICS codes 541711 and 541712 were replaced by 2017 codes 541713 – 541715. Again, only the 2012 NAICS codes are relevant in determining whether a person is engaged in a qualifying line of business.)

If you are primarily engaged in research and development as described above, your purchase or lease of machinery, equipment, or other devices that have a useful life of one or more years, and which will be used primarily for research and development will generally qualify for the partial exemption.

A university has a research and development department. Research and development is not the primary line of business of the University. Therefore, as an entity, the University is not primarily engaged in a line of business described by a qualifying NAICS code. However, if the University can establish that the research and development department is a separate "establishment," then the research and development department may be qualified for purposes of the partial exemption. To be considered a separate establishment, the University must keep separate books and records for the research and development department.

On or after January 1, 2018, businesses that are primarily engaged in electric power generation or distribution may qualify for the partial exemption. To qualify for the partial exemption, the business must be primarily engaged in a line of business described under one of the following North American Industry Classification System (NAICS) codes (2012 edition).

In general, qualifying electric power generators includes businesses primarily engaged in operating power generation facilities that convert other forms of energy, such as water power, fossil fuels, nuclear power, and solar power, into electrical energy. Establishments in this industry produce electric energy and provide electricity to transmission systems or to electric power distribution systems.

For purposes of this partial exemption, solar electric power generators include those businesses that are primarily engaged in operating solar electric power generation facilities that use energy from the sun to produce electric energy. The energy produced in these businesses is provided to electric power transmission systems or to electric power distribution systems.

If you are a qualified person, your purchase of solar equipment or other electric power generating or producing equipment used to primarily run your manufacturing equipment may qualify for the exemption (see the Solar Power Equipment topic on this page).

The following are categories and examples of tangible personal property (TPP) that may be used in the generation or production and/or storage and distribution of electric power (in some cases as part of a special purpose building). As always, whether or not the sale or use of a particular item of TPP qualifies for the partial exemption is based on whether the three basic elements have been met: qualified person, qualified tangible personal property, and qualified use. (See Qualifications tab).

Equipment that converts renewable energy from sunlight into electricity, either directly using photovoltaics, indirectly using concentrated solar power, or a combination.

Energy conversion monitors and controllers, communications equipment, Supervisory Control and Data Acquisition (SCADA) equipment, protection equipment, power quality and metering equipment

You are a new company that manufactures breakfast cereal and you are planning to acquire a new oven for manufacturing. You have decided to lease the oven instead of purchasing it and you want to know if your lease of the oven qualifies for the partial Manufacturing, Research and Development exemption.

Will lease the oven for more than one year. The lessor did not make an election to report tax on the purchase price of the oven and will therefore collect tax on the lease receipts.

Your lease of the oven qualifies for the partial exemption. When you enter into the lease agreement, you can provide the leasing company a Partial Exemption Certificate for Manufacturing, Research and Development Equipment to obtain the partial exemption from sales and use tax on the lease payments.

During your lease agreement, the leasing company will charge you a monthly lease payment, with tax separately added. However, the Manufacturing, Research and Development partial exemption is only in effect until June 30, 2030. Any lease payments due after June 30, 2030, will be subject to the full sales and use tax rate even if the lease began during the exemption period.

You are a construction contractor hired by a manufacturer to build a special purpose building. Your sales or purchases of materials or fixtures that you furnish and install in the performance of a construction contract for a qualified person may qualify for the partial exemption.

Please note, beginning January 1, 2018, the definition of "qualified tangible personal property" expanded to include special purpose buildings and foundations used as an integral part of the generation or production, storage or distribution of electric power.

In order to document that the partial exemption applies, you must obtain from the qualified person, and keep in your records a valid partial exemption certificate signed by the qualified person. The exemption certificate must indicate that the qualified person and special purpose building meet the qualifications for the partial exemption, and that the property will be used in a qualifying manner. For this purpose, you may obtain a Partial Exemption Certificate for Manufacturing, Research and Development Equipment (CDTFA-230-M) prescribed by the CDTFA, or a similar form.

Depending on the percentage of usable volume of a building being used in a qualifying manner, the entire building or only a portion of the building may qualify for the partial exemption (see Special Purpose Buildings below). In the event that all materials and fixtures do not qualify for the partial exemption, it is necessary that the exemption certificate accurately lists the property to be purchased subject to the partial exemption.

As explained on the Industry Guide for Construction Contractors, the performance of a construction contract generally involves the furnishing and installation of materials and/or fixtures that are incorporated into realty. Due to the unique nature of the manufacturing, research and development partial exemption and the ability of the qualified person to pass the partial exemption on to a construction contractor that is furnishing and installing materials and/or fixtures as part of the construction of a special purpose building, a detailed explanation of the application of tax and the documentation requirements is provided below.

As a construction contractor, you are generally a consumer of materials that you furnish and install in the performance of a construction contract. Therefore, once you have obtained the required form CDTFA-230-M, Partial Exemption Certificate for Manufacturing, Research and Development Equipment" or similar form from the qualified person indicating that the partial exemption applies, you may purchase materials to be furnished and installed on the special purpose building at the partially exempt rate by issuing a form "CDTFA 230-MC, Construction Contracts-Partial Exemption Certificate for Manufacturing, Research and Development Equipment" to your suppliers.

As a construction contractor, you are generally regarded as a retailer of fixtures that are furnished and installed in the performance of a construction contract. You may issue a resale certificate when purchasing fixtures from a vendor. You may purchase fixtures for resale and sell them subject to the partial exemption to the qualified person.

A construction contractor might install machinery and equipment in connection with a construction contract. Such a sale of machinery and equipment is considered a sale and installation of tangible personal property, rather than an improvement to realty. As with a fixture, the construction contractor may generally purchase the property for resale and the subsequent sale to the qualified person will be subject to the partial exemption (except where the retailer is the subcontractor, as discussed below.)

The same rules discussed above apply when subcontractors are hired by a prime or general contractor to construct all or part of a special purpose building for the qualified person. In order to document that the partial exemption applies to the contract to construct the special purpose building, the subcontractor must obtain from the prime contractor and retain in its records a copy of the CDTFA-230-M, Partial Exemption Certificate for Manufacturing, Research and Development Equipment or similar form that the qualified person provided to the prime contractor. The subcontractor must also obtain and retain in its records a CDTFA-230-MC, Construction Contracts - Partial Exemption Certificate for Manufacturing, Research and Development Equipment signed by the prime contractor for property the subcontractor is furnishing and installing for the prime contractor in order to document that the partial exemption applies. The subcontractor may issue the necessary documentation as discussed above to their vendor, depending on whether the subcontractor is a consumer or a retailer of the property that is furnished and installed.

The qualified person is responsible for issuing the CDTFA-230-M as evidence that the construction is for qualified tangible personal property. A prime or general contractor will be responsible for issuing a CDTFA-230-MC to a supplier of materials or fixtures if purchased tax-paid. In addition, if the person furnishing and installing the materials is a subcontractor, the prime or general contractor will also need to provide the subcontractor with a copy of the CDTFA-230-M issued by the qualified person. Subcontractors will need to also issue a CDTFA-230-MC to their suppliers of materials or fixtures if purchased tax-paid.

Qualified persons are responsible for tracking their purchases to ensure they do not exceed the $200 million annual cap. All materials consumed by a contractor or subcontractor, or fixtures, machinery or equipment sold by a contractor or subcontractor in the performance of a contract to construct or modify a special purpose building count against the $200,000,000 annual limit of the qualified person. All construction contractors, including subcontractors, must make available cost information regarding all items sold or used in performance of a qualifying construction contract for purposes of tracking the qualified person"s $200,000,000 yearly exemption limit.

If you construct a new special purpose building or modify an existing structure that is designed and constructed, or reconstructed, for manufacturing or research and development, or, beginning January 1, 2018, for the generation or production, storage or distribution of electric power, your purchases of materials and fixtures that become part of the building, and machinery and equipment installed in the building, may qualify for the partial exemption.

In order to qualify (be eligible), the special purpose building must be used for manufacturing, processing, refining, fabricating, recycling, or it may be used as a research or storage facility for these processes. Buildings such as warehouses, solely used to store product after it has completed the manufacturing process, are not eligible for the partial exemption.

For example, a semiconductor manufacturer is constructing a building for manufacturing microchips. The building is designed and constructed with certain requirements to control temperature, humidity, and contaminants that are necessary for microchip production. Materials and fixtures that become a component part of the building, as well as machinery and equipment purchased and installed in the building, are qualifying property for the partial exemption.

All materials and fixtures that become a component part of the building will qualify for the partial exemption if no more than one-third (1/3) of the building"s total usable volume (generally Length x Width x Height) is devoted to a non-qualifying use, such as administrative purposes, parking, break rooms, etc. However, in those instances where more than one-third (1/3) of the total usable volume is devoted to a non-qualifying use, only the materials and fixtures that become a component part of the building that is used in manufacturing, processing, refining, fabricating, or recycling, or as a research or storage facility for these processes, or the generation or production, storage or distribution of electric power will be qualifying property for the partial exemption.

ABC R&D Inc. is constructing a new research facility that is designed specifically for the type of research they conduct. The overall dimensions of the building are 400 feet long by 200 feet wide by 40 feet tall for a total usable volume of 3,200,000 cubic feet.

The building will be partitioned to have offices for management, the accounting department, and the marketing department, and areas for restrooms and break rooms. These areas will occupy an area of the building that measures 80 feet long by 60 feet wide by 40 feet tall for a total volume of 192,000 cubic feet.

Since the total volume of the non-qualifying area is less than one-third (1/3) of the building"s total usable volume, all of the materials and fixtures that become a component part of the building will qualify for the partial exemption.

XYZ Manufacturing is constructing a new facility that is designed with specifications to house its widget manufacturing equipment and other administrative departments of its business. The building will have a foundation that is 200 feet long by 100 feet wide. Based on the schematics of the building, the foundation of the manufacturing floor will be 100 feet by 100 feet and have a ceiling that is 15 feet tall to accommodate the large machinery. The offices for management, the accounting department, and the marketing department, restrooms, and break rooms will occupy the remaining floor area (100 feet by 100 feet). This area has a 10-foot ceiling. The total usable volume of the building is calculated as:

Since more than one-third (1/3) of the total usable volume is used for a non-qualifying use, not all of the materials and fixtures that become a component part of the building qualify for the partial exemption. Only the materials and fixtures that become a component part of the manufacturing area of the building will qualify. Qualified persons and contractors must know which purchases will qualify for the partial exemption.

Determining which materials and fixtures will qualify may not be a straight allocation based on the ratio of qualifying volume to total volume. For instance, 50 percent of the foundation was for the manufacturing floor and the other 50 percent was for the administrative areas. Thus, 50 percent of the materials to construct the foundation may qualify.

Also, the manufacturing equipment requires significantly more electrical output to run than does the area occupying the administrative functions. The qualified person must identify which electrical materials are being used for manufacturing, a qualified use, and which materials are used for the area that is a non-qualifying use. Contractors involved in the project should be instructed to only purchase materials or sell fixtures at the partial tax rate if installed in the portion of the building used in manufacturing.

To determine whether materials or fixtures installed in a special purpose building may qualify for the partial exemption, you must look at whether the installed items are being used for a qualifying portion of the building.

If more than one-third (1/3) of the usable volume of a special purpose building is used for non-qualifying activities, only the materials or fixtures that are installed or used in the qualifying area may qualify for the partial exemption. For example, if only half of the structure is used in the manufacturing process or for research and development, new light fixtures installed in the manufacturing and research and development area of the building will qualify. However, light fixtures installed in the administration area of the building will not qualify for the partial exemption.

For example, 400,000 cubic feet of a 1,000,000 cubic feet building is being used for administrative functions while the remaining 600,000 cubic feet is being used for manufacturing. Since the useable volume of the administration area of the building is greater than one-third of the useable volume of the entire structure, the whole building will not qualify for the partial exemption. Any light fixtures installed in the manufacturing area of the structure will qualify for the partial exemption, while light fixtures installed in the administration area of the structure will not qualify for the partial exemption. An air conditioning unit will be installed outside the manufacturing area, but will be used for cooling the whole building. The primary function of the air conditioning unit will be used to cool the manufacturing area since this area represents more than 50 percent of the building. The air conditioning unit will qualify for the partial exemption even though it is not physically located in the manufacturing area.

If one-third or less of the useable volume of a special purpose building is used for a non-qualifying line of business, the entire building qualifies as a special purpose building. If the entire building qualifies, where the materials or fixtures are installed or how they will be used will not matter, and all materials and fixtures installed will qualify for the partial exemption. For example, if the entire building qualifies and the employee restroom needs to be remodeled, all materials and fixtures that are installed to remodel the restroom qualify for the partial exemption.

If you are a qualified person, your purchase of solar panels and solar power equipment used to primarily run your manufacturing equipment may qualify for the partial exemption.

If your solar power equipment is directly connected to qualifying manufacturing equipment to power the qualifying manufacturing equipment, your purchases of solar power equipment will qualify for the partial exemption.

If your solar power equipment is tied to the local power grid and is not directly attached to qualifying manufacturing equipment, your solar power equipment may still qualify if it is designed to generate power primarily for your manufacturing equipment. The solar equipment is deemed to generate power primarily for the qualifying manufacturing equipment if the solar power equipment is designed to generate at least 50 percent of the power used by the qualifying manufacturing equipment.

To determine whether solar power equipment is used at least 50 percent in manufacturing, divide the annual amount of power consumed by qualifying manufacturing equipment by the total annual amount of power generated by the solar equipment. Please note that the power generated by the solar equipment when the facility is not operating is regarded as power that is effectively "banked" in the local power grid such that the calculation is not limited to those periods when the facility is operating.

Your solar power equipment is used 60 percent in manufacturing, (600/1000 = 0.60, or 60 percent). Therefore, the solar power equipment is used at least 50 percent in manufacturing and is eligible for the partial exemption.

If your solar power equipment is purchased as part of the construction of a qualifying special purpose building, then your solar equipment will qualify for the partial exemption regardless of the percentage of generated power that is used to power manufacturing equipment.

If you are a manufacturer and you install equipment used to reduce or remove pollution, your purchases of this equipment may qualify for the partial exemption. The pollution control equipment must meet or exceed state or local government standards at the time it is purchased.

For example, you are in the printing industry. Your business"s primary line of business falls within one of the qualifying NAICS codes. You purchase a carbon absorber or catalytic reactor used to control pollution that meets or exceeds state or local government standards. Your purchase will generally qualify for the partial exemption.

If you are a qualified person purchasing parts that will be used to repair qualified manufacturing or research and development equipment, you may take advantage of the partial exemption. However, the repair or replacement parts must be treated as having a useful life of one or more years for state income or franchise tax purposes. Tools and other supply items are not considered repair or replacement parts and do not qualify for the partial exemption.

For example, you need to replace a motherboard in a computer that controls a certain piece of manufacturing equipment. As long as the motherboard has a useful life of one or more years as described above, you may purchase the replacement motherboard at the partially exempt tax rate.

To take advantage of the partial exemption you must download the CDTFA-230-M, Partial Exemption Certificate for Manufacturing, Research and Development Equipment. Fill it out, print it, and sign it. Then provide it to the retailer at the time you make your purchase.

If you are primarily engaged in truck-mixed concrete manufacturing and will use the mixing truck primarily for this purpose, your purchase of a concrete or cement mixing truck may qualify for the partial exemption.

Concrete or cement mixing trucks are considered Mobile Transportation Equipment for sales and use tax purposes. Leases of Mobile Transportation Equipment do not typically qualify for the partial exemption. Therefore, if you are a lessee of concrete or cement trucks, your lease will generally not qualify. For more information on leases of mobile transportation equipment, please see Regulation 1661, Leases of Mobile Transportation Equipment.

Your purchases of material handling equipment such as forklifts, pallet jacks, and reusable transport containers may qualify for the partial exemption under certain uses.

If you are a qualified person purchasing material handling equipment with a useful life of one or more years that will be used primarily in a stage of the manufacturing process, it will qualify for the partial exemption. The equipment must be for use in handling goods through a production line, and within a single geographic location. It will not qualify if the primary use is for handling goods after the establishment"s production has completed, or used to transport unfinished goods from one geographic location to another.

For example, you use a pallet jack to pick up a pallet of goods that has just completed one phase of processing and take it over to another area in the building to begin a second phase of processing. Since the use of the pallet jack is at the same geographic location and it is used to move the materials between production phases, the pallet jack qualifies for the partial exemption.

On the other hand, if you primarily use a forklift to move pallets of finished product from your warehouse onto delivery trucks for final shipment, it will generally not qualify for the partial exemption. A forklift used to transport unfinished goods between two facilities at different geographic locations will also not qualify since the transportation to or between facilities is not considered a part of the manufacturing process.

Not all out-of-state retailers are registered to collect California use tax. If your supplier does not collect use tax, it is your obligation to self-report the use tax to the CDTFA. You may do so by reporting the purchase amount on your California Sales and Use Tax return or Consumer Use Tax return. There is no need to provide an unregistered, out-of-state seller with an exemption certificate.

To ensure that tax is reported at the partial rate when filing a return, you will need to report the qualifying purchase amount on the line PURCHASES SUBJECT TO USE TAX as well as on the line SALES MADE SUBJECT TO THE MANUFACTURING AND RESEARCH AND DEVELOPMENT EQUIPMENT EXEMPTION.

Handling charges are generally subject to tax. If you charge a single amount for "postage and handling" or "shipping and handling," only the portion of the charge which represents the actual amount for shipping or delivery is not taxable, while the portion of the charge that represents handling is generally taxable (for more information, see publication 100, Shipping and Delivery Charges).

Taxable shipping or handling charges added to sales or purchases that qualify for the partial manufacturing and research and development equipment exemption are also partially exempt. For example, a qualified person purchases manufacturing equipment and pays $80 for "shipping and handling." The actual shipping cost by the common carrier for delivery to the qualified person is $30. The $30 shipping charge is exempt from tax. Tax applies to the remaining $50 handling charge at the partial tax rate. To support the nontaxable shipping charges, the seller must keep records of the actual shipping costs.

For example, if you purchased machinery and paid tax at the rate of 7.25 percent and your purchase qualifies for the partial exemption, then the applicable tax rate for the transaction is 3.3125 percent. A refund may generally be claimed at any time within the statute of limitations (generally, within three years). If you are seeking a refund for overpaid taxes on qualifying purchases of manufacturing or research and development equipment the procedures are different depending on whether the original purchase was subject to sales tax or use tax.

If the tax you paid is use tax (typically use tax applies when you purchase from an out-of-state vendor), you may file a claim for refund directly with the CDTFA. Simply complete form CDTFA-101, Claim for Refund or Credit and mail it to the address provided. Include as the reason for the refund that the property purchased qualifies for the manufacturing and research and development partial sales and use tax exemption.

If the tax you paid was sales tax, you must request a refund from the retailer. The retailer would then file a claim for refund with the CDTFA. As the purchaser, you will need to provide the retailer with a completed partial exemption certificate (CDTFA-230-M or similar form) and documentary evidence that the original purchase should have qualified for the partial exemption.

DC Power Tong continues to set the standard in the casing and tubing service industry by offering superior service & innovative casing technology. To exceed our customersʼ expectations, DC Power Tong also provides hydro test trucks, pressure test units, and equipment and pipe wrangler rentals to ensure your project is completed safely and efficiently. At DC Power Tong, we treat your project as if it is our very own, and thatʼs what weʼre all about.

FORKLIFTS -1985 TOYOTA LPG FORKLIFT 2FGG30 – 6000 LB, 3 stage Lift & Side Shift, Pneumatic Tires, 1981 NISSAN UFO3A35V FORKLIFT LPG 7000 LB, 2 Stage, Pneumatic Tires, 2-Stinger Attach. For Forklifts, Man Basket for Forklift

POWER TONGS -FARR - 13 3/8 TONG- 30,000 Ft/lb W/ JAWS: 13 3/8 “- 5 ½”, FARR/MCCOY 13 5/8 INTEGRAL TONG 35,000 Ft/lb (NEW) w/ BACKUPS AND JAWS: 13 3/8”-5 ½”, FARR/MCCOY 13 5/8 INTEGRAL TONG 35,000 ft/lb (NEW) w/ BACKUPS AND JAWS: 13 3/8 - 7", 2-FARR LW - 9 5/8 TONG -12,000 Ft/lb w/JAWS: 9 5/8” - 4 ½”, 2 -UNIVERSE - 9 5/8 TONG - 20,000 Ft/lb w/JAWS, UNIVERSE 9 5/8 INTEGRAL TONG 20,000 F/lb w/BACKUPS AND JAWS: 9 5/8”- 5 ½”, UNIVERSE 8 5/8 INTEGRAL TONG 19,000 Ft/lb 970703 w/BACKUPS AND JAWS: 9 5/8”- 4 ½”, UNIVERSE - 5 1/2 TONG15,000 ft/lb 970401 w/JAWS: 5 ½” - 4", 5 -UNIVERSE 5 1/2 INTEGRAL TONG 15,000 ft/lb w/BACKUPS, JAWS & DIES: 2 3/8 - 5 ½, BJ X HEAVY 13 3/8 MANUAL BACKUP , 3 ½” Power Tongs w/Backups, Note*ALL TONGS COME WITH TORQUE GAUGES*

4-Portable Pipe Handling Units / Skid Mt. Power Cat Walks 2500-3000 Lb Lift Cap. X 32Ft High (1-Located in Houston, Texas),2-350 Ton BJ Varco Air Operated Slips/Elevators – 7 5/8, 9 5/8, 13 3/8” w/Guides, Dies,& Interlocking Systems Back Up Tongs,Farr Winncat Torque Monitoring Computer Systems w/Electronic Load Cells, Torque Master Hydraulic Dump Systems,Power Thread Washers, Spiders,Include. Conventional, Single Joint Pick Up, YC, HYC, YT Slip Type, HYC, YC, YT Segments, CMSXL Button Dies, Surface Slips, Torque Gauges, Compression 24”, 26”, Pull 28”,30”,31”,36”, Circulating Equipment, Chicsans, Swages, 2-Type C Air Op Dog Collars, Drift Snakes, Etc

SHOP EQUIPMENT(Selling @ 10 AM) Waukasha VRG 2000 LPG Stationary Eng. w/Hyd. Power Pak Unit w/Skid, ALADIN 2260E Hi-Capacity Enviro-Friendly Parts Washer-3 Ph, 52”x72”, Hotsey 989 Ng Stationary Pressure Washer Steamer, KARCHER Pressure Washer/Steamer,2-Jib Crane 20 Foot w/ Electric Hoists, 11’x7’x9’ Open Face Spray Booth w/Fire Suppression, Horizontal Shop Air Compressor, Gym Lockers, Benches, Welders, Tools, Pallet Racking, Parts Washers, Grease Guns, Hand Wrenches, Pipe Wrenches, Spill Kits, Fire Extinguishers, Barrel Lifter & Dolly, 45 Gal DEF, 45 Gal Barrel Hydrex HV Hyd. All-Season Oil, Portable Air Greaser, Chains, Boomers, Electric Motors, Hyd. Winches, 112’x6000 Lb Eng. Shop Gantry, Sandblasting Cabinet, Set Hyd. Tanks, & Reels for Tong Truck, Oxy/Acc Sets, Web Slings, Chains, Shackles, Hyd. Jacks, Jack Stands, Bolts & Hardware, Bolt Bins, Shelving, Coats Rim Clamp Tire Machine, Coats Electronic Wheel Balancer, 2004 Westeel 2500 L Used Oil Tank, Fugi FM-VO-B Vertical Milling Machine – 1 Ph, Miller 251 Mig, Lincoln AC/DC, New $”x16’ Hyd. Ram, Thread Protectors, Operators Stands, 24 Pail API Thread Compound, Hammer Unions, & Much More

AUCTIONEERS NOTE: This is a complete dispersal of a prominent turn key business. It is good quality and well looked after. For more information and photos please see www.montgomeryauctions.com

Find parts you need to repair or maintain your machines. At Alibaba.com, you can shop for power tongs for sale at affordable rates to tackle new obstacles and challenges. In the ever-changing industry, you can find what you need and speak to the supplier directly. Thanks to Alibaba’s collection of wholesale power tongs for sale you also get to buy these parts at lower prices, which means you can explore new levels every day more comfortably. From bulldozers to dragline excavators, wheel tractor scrapers to shotcrete machines, any part you need for a heavy-duty mining machinery; you can find it at Alibaba.com.

Looking for purpose-built machine parts? Find them at Alibaba.com. From new components to used parts straight from the manufacturers. Plus, if you need custom-made pieces, you can chat with the supplier, give specifications and wait on delivery. From stone crushers to excavator undercarriage parts, buckets, and even drill bits to get you through the rocks, the power tongs for sale from Alibaba offers you the chance to continue operating without a hitch. Whether you are looking to introduce concrete into the rock walls for more consistency and safety during mining, then power tongs for sale that goes at wholesale prices at Alibaba will be an excellent addition to your machinery.

Before buying a component, you’d want the equipment to suit your application and offer value. The list of power tongs for sale at Alibaba.com lets you dig into earth deposits, and the compare tool checks out other similar parts to give you the information you need to make a purchasing decision. You’ll get wholesale power tongs for sale that specializes in mining, with reinforced chassis, and run on more powerful engines. Whether you want to transport minerals or the workers to the mining site, introduce explosives or arms to help you remove materials from your mine pits, Alibaba.com has it all.

8613371530291

8613371530291