2 3 8 inch 1 foot pup joint brands

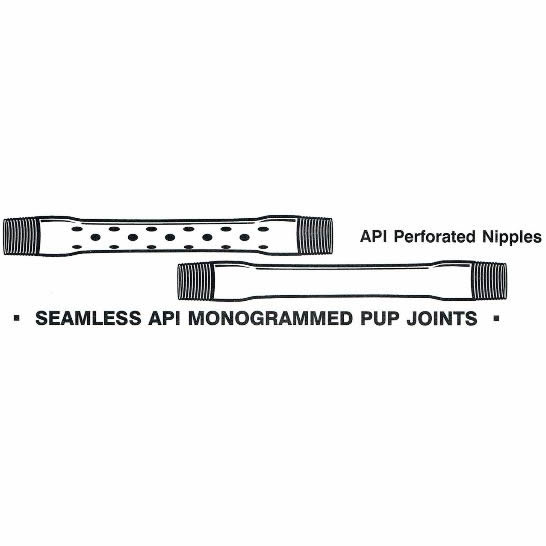

These J55, L80, N80Q & P110 pup joints are manufactured from seamless Grade J-55, L80 N80Q and P110 mechanical tubing. The API 5CT tubing pup joint is mainly used to adjust the height of the tubing strings. It is also used to adjust the depth of down-hole tools.

Pup Joints are a mandatory part of equipment in almost any well. Due to their shorter length, they are typically easier to handle and to use. At the same time, they provide the same performance as the tubing/casing/drill pipe that they are attached to.

We manufacture pup joints in all sizes, grades, and thread profiles to meet any requirement. Our tubing pup joints are manufactured out of seamless tubing and machined or upset to final dimensions. All API casing and tubing pup joints are manufactured according to API Spec 5CT. Special requirements are available on request.

Pup joints are manufactured from AISI 4145H or 4140H-modified alloy, heat-treated to a Brinell Hardness range of 285-341 with a Charpy “V” notch minimum impact strength of 40 ft/lb at 70° F and one inch below the surface. Pup joints are heat-treated to 110,000 psi minimum yield. All connections are phos-coated to impede galling during initial make-up. They are available in standard lengths of 5′, 10′, 15′ and 20′ with other configurations upon request.

Pup joints are commonly used to adjust the length of the drill string to the elevation of rotary table for easy surface handling and drilling practices. They undergo the same stresses as drill pipe and their performance depends primarily on their superior mechanical properties.

Here at OSR we sell new and refurbished swivel joints, pup joints, plug valves, mainfolds, plug catchers, etc. We also do repairs on all name brand swivel joints, plug valves, manifolds, etc. All of our refurbished and repaired flowiron comes with (3rd party) flowiron inspection reports and tested in shop with test reports, banded, and painted

Nr. SBI, Mamsa GIDC, Bhavnagar Survey No. 174, Plot No. 23,Mamsa-364070, TA-Ghogha, Dist. Bhavnagar (Guj.) India, Nr. SBI, Mamsa GIDC,, Bhavnagar - 364002, Dist. Bhavnagar, Gujarat

Gautam Budh Nagar Villa No 67, Lotus Villas Society, Opp Kc International School Jalpura Greater Noida, Gautam Budh Nagar - 201306, Dist. Gautam Budh Nagar, Uttar Pradesh

Vasai East, Vasai, Dist. Thane Gala No. 7, Bldg No. A, Swami Industrial Centre, Gaurai Pads, Vasai East, District Palghar, Vasai East, Vasai - 401208, Dist. Thane, Maharashtra

- Grant Prideco pup joints are manufactured from the same material as our drill collars. Heat-treatment processes ensure a hardness range of 285-341 Brinell. Charpy V minimum impact strength of 40 ft-lb at 70° F are guaranteed one inch below the surface.

Taluka Wada, Palghar, Dist. Thane Survey No. 23/1, 25/1, 25/2, Village Vasuri(Khurd), Behind Blue Star,, Taluka Wada, Palghar - 421312, Dist. Thane, Maharashtra

ADFO manufactures Pup Joints with Integral Hammer Union end connections.These Pup Joints are used on high pressure discharge lines, choke and kill lines, auxiliary flow and other applications.

Meerut Road Industrial Area, Ghaziabad C-23, Meerut Road Industrial Area, Meerut Road Industrial Area, Ghaziabad - 201003, Dist. Ghaziabad, Uttar Pradesh

Windlass manufactures Pup Joints with integral hammer lug union end connections. This enables faster, easier make-up and break-out of temporary flow lines.

Ashram Road, Ahmedabad Jivabhai Chamber, B/H. Ashram Road Police Chowk, Ashram Road Chowki, Ashram Road, Ashram Road, Ahmedabad - 380009, Dist. Ahmedabad, Gujarat

Shreeraj Industries offers NPST (Non-pressure Seal Thread) Pups in size 1-3 Fig 602 and 1502. The NPST connection offers a light weight pup capable of 6000-15000 CWP with a connection that isolates the thread from fluid’s flowpath. This connection is permanent and is well suited to abrasive applications where a weldedread more...

[115]In making a determination under paragraph 76.03(7)(a) of SIMA whether the rescission of the order is likely to result in the continuation or resumption of dumping of the goods, the CBSA may consider factors identified in subsection 37.2(1) of the SIMR, as well as any other factors relevant in the circumstances.

[116]Guided by the factors in the aforementioned SIMR and based on the documentation submitted by the various participants and consideration of the information on the administrative record, the ensuing list represents a summary of the analysis conducted in this review:

[117]As mentioned earlier in this summary, three parties provided responses to the CBSA’s ERQ: Canadian producer AOT; and related importer and exporter WestCan and Weijia. In addition to ERQ responses, AOT, WestCan and Weijia submitted case briefs. All three parties made representations that dumping of pup joints from China is likely to continue or resume should the CITT rescind its order.

“Global growth is expected to moderate from 5.9 in 2021 to 4.4 percent in 2022—half a percentage point lower for 2022 than in the October World Economic Outlook (WEO), largely reflecting forecast markdowns in the two largest economies. Global growth is expected to slow to 3.8 percent in 2023.”

[119]The IMF WEO for 2022 estimated that China’s economy grew 2.3% and 8.1% in 2020 and 2021 respectively, while projecting growth of 4.8% and 5.2% in 2022 and 2023 respectively.

[120]In April 2022, following the initial fallout of the conflict in Ukraine and sanctions against Russian oil, the IMF revised their projections in their WEO for 2022 stating that:

“This report projects global growth at 3.6 percent in 2022 and 2023—0.8 and 0.2 percentage points lower than in the January forecast, respectively. The downgrade largely reflects the war’s direct impacts on Russia and Ukraine and global spillovers.”

[122]Information on the record indicates that as of the latter part of 2021, China was planning significant investments in its oil and gas exploration. Chinese oil companies, China National Petroleum Company (CNPC), China National Offshore Oil Corporation (CNOOC) and Sinopec are expected to spend about $123 billion USD on drilling and well services in the next five years, an increase from the $96 billion spent between 2016 and 2020.

[123]The most recent information on the record, however, indicates that the oil market in China is in decline, attributable in part to decreases in demand from pandemic lockdowns. Projected declines for April 2022 represent a 1.2 million barrel per day drop from a year earlier.

[124]The IMF outlook for Canada was more moderate in January 2022 than the forecasts for global growth, with an estimated growth of 4.7% in 2021 and projections of 4.1% and 2.8% in 2022 and 2023, respectively.

[125]The market for pup joints in Canada will inevitably be impacted by the price of oil, as a higher price of oil will lead to more drilling, which will lead to a greater demand for drilling supplies, including OCTG and thus, pup joints.

[126]Canada’s recent boon in oil and gas was preceded by a series of market shocks. The first was in Q4-2018 with the collapse in the price of oil benchmark Western Canadian Select (WCS),

[127]The oil and gas market subsequently plummeted in early 2020 as the pandemic and an oil price war between Russia and Saudi Arabia caused oil prices across the world to decline dramatically. The effects of this price collapse included Canadian oil and gas companies, many of whom mothballed their operations and halted new drilling.

[128]Global oil prices began to recover beginning in the late spring of 2020. The price of WCS rebounded throughout the year, and the improvement in oil prices led to the resumption of drilling, increasing demand for OCTG and pup joints in the second half of 2020. By the end of 2020, drilling activity in Canada had also recovered considerably, though it remained well below the pre-pandemic weekly peak of 257 rigs in February 2020.

[129]The recovery in oil and gas drilling activity that began in late 2020 continued throughout 2021. The spot price for WCS rose over 63 percent in 2021, from an average price of $40.04 USD/barrel in January 2021 to $65.60 USD/barrel in January 2022.

[130]The conflict in Ukraine in early 2022 caused substantial shocks in global oil and gas prices. For example, the spot price for WCS initially jumped from an average price of $79.10 USD/barrel in February 2022

[131]Information on the record indicates that Russian petroleum product exports represented eight percent of global exports and ten percent of global petroleum production; as such, present and future sanctions against Russia over the conflict in Ukraine may also continue to create pressure on world oil prices.

[132]On the other hand, China’s lockdown measures in April 2022 aimed to curb the spread of COVID-19 had an immediate effect on benchmark oil prices as fears of economic disruption and decreased consumption in China—a large user of oil—led to West Texas Intermediate (WTI)

[133]As such, global events are still rather volatile and the ultimate impact on the Canadian market for oil and gas remains in flux as does the trickle down impact on the demand for OCTG, including pup joints.

[134]Given the nature of pup joints as essentially short lengths of OCTG, the market trends seen in pup joints track closely with the trends seen in standard length OCTG.

“There are no industry publications or metrics that measure demand for pup joints specifically. However, since pup joints are produced from OCTG and are used to adjust lengths of OCTG tubing, the state of the Canadian OCTG market provides an accurate picture of the market for pup joints.”

[136]OCTG base grades, such as J55 are commodity type products, which run in similar pricing trends worldwide and as such the Canadian market will track closely with world trends, particularly with respect to the US market.

[138]In terms of the impact on pup joints during the POR, the information on the record indicates that the Canadian market experienced its own series of shocks, similar to those of the oil and gas industry at large.

[139]Imports of pup joints also followed this trend as noted previously in Table 2 of this document where imports rebounded from roughly 209 MT in 2020 to just under 300 MT in 2021.

[140]The net effect of the global shocks from the increase in the price of oil and the impact of Russian sanctions are projected to result in a heightened demand for drilling in Canada and thus pup joints by Q3 2022,

[141]The large production capabilities of pup joint producers in China coupled with a flattening domestic market for these goods in China necessitates an export imperative for Chinese pup joint producers.

[143]In the OCTG 1 expiry review decision, the CBSA stated that “Chinese seamless OCTG producers are heavily dependent on export markets” and that information on the record demonstrated that “China’s exports have consistently increased whereas Chinese imports have declined. Pipe and tube products accounted for 12% (i.e. 3.9 million MT) of China’s steel exports.”OCTG 1 expiry review, Chinese exports of OCTG were “more than 1.3 million MT.”

[144]Information on the administrative record also indicates that Chinese producers exported substantial volumes of seamless OCTG in 2021, of which pup joints would form a segment.

[146]Beyond the historical context which suggests China’s OCTG industry is dependent upon exports, there are sales and production evidence from the administrative record which supports the position that this trend continues.

[147]Using the lone responding Chinese exporter in this proceeding as an example, Weijia noted that its sales within China “were made to export oriented Trading Companies that are 100% focused on the export market.”

[149]By comparison, the CBSA’s estimate of the Canadian pup joints market in 2021 from Table 2 in this document is about 800 MT. Consequently, even with the current anti-dumping measures in place, confidential information on the record indicates that Weijia accounted for a significant part of the Canadian market in 2021 and has substantial capacity.

“it is expected that we could increase our production capacity three-fold to take advantage of the expansion of our business in the Canadian market. Needless to say, we expect that we would have to compete head on with the hundreds of other Chinese exporters of pup joints, even if those prices are at dumped and subsidized levels.”

[151]The concession by Weijia is striking in how the company anticipates Chinese exporters would quickly pounce on the opportunity to undercut the current pricing in Canada but also how Weijia would potentially respond if left unrestrained by the anti-dumping measures in Canada, in order to compete with the anticipated price undercutting.

[153]Excess capacity can create pressure to produce more for purposes of export. In this respect, in its OCTG 1 expiry review decision, the CITT stated that:

[155]There are currently numerous anti-dumping measures in place by countries other than Canada aimed at protecting their domestic industries from the injurious effects of dumped tubular steel products from China.

[156]Information on the record indicates that there are at least ten anti-dumping measures against Chinese OCTG in countries other than Canada, including the United States and Mexico.

[157]In Canada, there are currently 16 different steel products from China that are subject to anti-dumping measures, in addition to pup joints. At the last pup joints expiry review, there were 11 such measures.

[158]Of note are many tubular products such as carbon steel welded pipe and piling pipe and, more closely related to pup joints, line pipe, OCTG and seamless casing. These latter three products, like pup joints, are all goods specifically designed for the oil and gas industry. Sucker rods, although not a tubular product, are used in conjunction with OCTG in the extraction of oil and anti dumping (and countervailing) measures against Chinese sucker rods have come into effect since the last expiry review.

[159]Exporters in China have limited access to other markets by virtue of the numerous anti-dumping and related trade measures against their steel tubing in those markets and that limited access is largely related to the dumping of OCTG. The existence of a substantial number of anti-dumping measures in place in various countries against tubular products from China and, more importantly, the existence of the same measures against OCTG products in Canada and the United States would indicate that exporters in China continue to aggressively sell these goods in export markets at dumped prices.

“In such circumstances, Hengshui Weijia will have no option but to lower its selling prices to Canada to compete with the dumped prices of the other Chinese exporters of pup joints; in order to do so, it will have to sell at prices significantly lower than their current prices (normal values) and resume shipping to Canada at dumped prices as it did prior to the initiation of the original investigation.”

[162]Weijia’s projection of how it would behave in absence of the order speaks to the ripple effect of an unregulated market, whereby even a party like Weijia which has been able to compete without dumping, would likely experience price pressure from the abundant number of other parties that have not been able to compete with the measures in place and force Weijia into dumping in order to continue making sales to Canada.

[163]In the CBSA’s original dumping investigation of pup joints from China, which was initiated in 2011, Weijia was the only exporter to participate. Weijia was one of four cooperative exporters to receive normal values in the 2015 re-investigation.

[165]It is noteworthy that Weijia has been able to sell to WestCan, its related importer in Canada, during the POR. Analysis of import data suggests that Weijia is the only exporter of subject goods with active normal values. There is no evidence that other exporters have availed themselves of their normal values.

[167]This was corroborated by WestCan’s market intelligence where they stated on the record that “WestCan is very active in the Canadian market where it resells the Hengshui Weijia pup joints and has not seen any evidence of other Chinese pup joints.”

[168]The limited number of parties that have received and availed themselves of normal values by making sales of subject goods to Canada is evidence that nearly all exporters continue to be unable to sell subject goods to Canada at non-dumped prices.

8613371530291

8613371530291