pup joint incorporated pricelist

Pup Joint Inc. is a machine shop that sells down hole tubular and casing accessories and equipment. We are a leading supplier of pup joints & accessories with API5CT & premium threads at very competitive prices. Our machine shop is a threading facility for all your threading & precision machining needs. PJI commenced operations in Houma, LA in July of 1997. Our staff has over 65 years of combined experience supplying quality products & services to the oil & gas industry.

BLAZE is adequately equipped to supply NPST Pup joints made of high quality seamless pipeline with male & female detachable hammer union. NPST has uniform bore for greater flow capacity. NPST pup joints are available in 2″ to 4″ sizes, length for pup joint range from 1 feet to 20 feet at 15000 psi. Pup joint with Non- pressure seal thread union (NPST) are especially engineered for high pressure, abrasive services where welded connections are not desired. The design provides a strong, permanent end connection without butt welding. An epoxy thread-locking compound secures the connection.

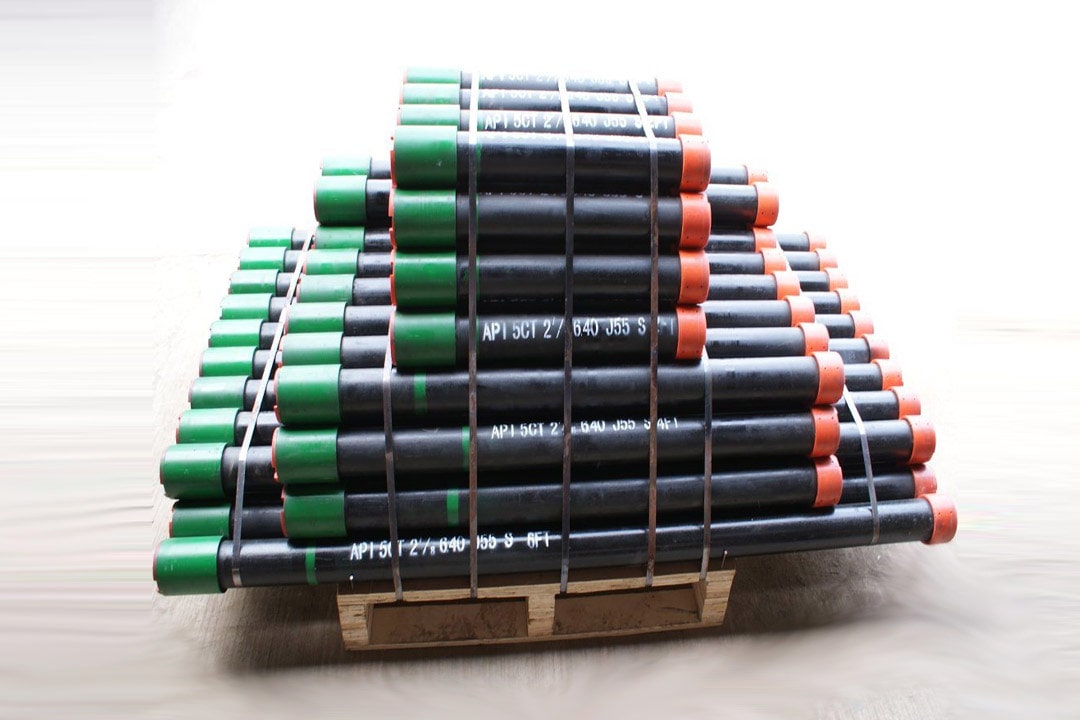

Casing or Tubing Pup Joints, Casing or Tubing Connectors and Casing or Tubing Couplings. In addition it is capable of Threading items at Groups 1, 2, 3 & 4 of API spec. 5CT. Items supplied by BLAZE meet the Quality Standards as defined in API 5CT assuring

BLAZE is also well equipped to supply Line Pipe Couplings/ NPST pup joints with wide range of specifications. In addition we can supply thread Line Pipes and its accessories of various sizes. Items meet the quality standards as laid down in API – 5L.

Pup joints are nonstandard pipes used to adjust the length of the tubular string to meet the exact requirements. In addition, the pup joints are used to change the length of the drill string for drilling operations and easy surface handling. The appearance of the pup joints is largely determined by their mechanical properties.

Further, thePup Joint marketis segmented by product type, Technology, End-User, and geography. On the basis of product type, the Pup Joint market is segmented under Crossover Pup Joint, Tubing Pup Joint. Based on the Technology, the market is segmented under the Hot Rolled and Cold Rolled. Based on End-User, the market is segmented into Chemical Industry, Mining, Oil & Gas, Construction, and Others. By geography, the market covers the major countries in North America, i.e., the US, Canada, and Mexico. For each segment, the market sizing and forecasts have been done on the basis of value (in USD Million).

Increasing consumption of natural gas and oil, technological advancements in drilling techniques, and fast-growing industrialization are the major factors contributing to the market growth. The rise in demand for high-grade pup joints from several end-use industries is expected to drive the use of pup joints. Demand for pup joints is expected to rise because of the growing demand for energy and significant investments in exploring onshore and offshore reserves by the oil & gas and mining industries. Increased energy consumption, the economic development of the shipping industry, and increased seaborne trade are the major factors driving the demand for pup joints during the forecast period.

The decline in petroleum production may hinder the market"s growth. Renewable energy will be more affordable than existing oil and gas sources during the forecast period, which will restrain the market for pup joints.

Due to COVID-19, the major end-user industries of pup joints were affected, which will hinder the demand for pup joints since the oil & gas industry is the largest end-user. COVID-19 has had a significant impact on the downstream oil & gas industry due to the significant drop in prices and reduced demand caused by the economic slowdown, which affected production rates in many countries. However, major countries such as the US and Canada implement dynamic and diverse approaches to navigate and deal with what is happening due to COVID-19. As a result, the market will experience moderate growth during the forecast period. The United States is a major revenue generator in the North American pup joint market.

With changes in energy arrangements and expanding political pressures, the market interest in pup joints and comparable items is changing. Government and privately owned businesses are showing a clear interest in finding new oil stores to meet future needs. Ventures by significant oil exploration companies are likely to support the pup joint market.

By Product Type,the Pup Joint Market is segmented into Crossover Pup Joint, Tubing Pup Joint, and Drill Pipe Pup Joint. The Tubing Pup Joint had the highest market share in 2021. Tubing pup joints are likely to have a huge demand because they are also used to handle production tubing accessories. Tubing pup joints are tubing that is short in size and operated for spacing.

By Technology, the Pup Joint Market is segmented into Hot Rolled and Cold Rolled. The Hot Rolled segment had the highest market share in 2021. Under high temperature and pressure processing conditions, the steel tube can be completely devoid of air bubbles, cracks, and porosity. It has a good mechanical effect and excellent intensity.

By End-User, the Pup Joint Market is segmented into Chemical Industry, Mining, Oil & Gas, Construction, and Others. The Oil & Gas segment had the highest market share in 2021. The oil & gas business has been positively impacted by the introduction of several drilling technologies. Due to the reliance on petroleum-based products by various emerging economies, oil & gas dependence has increased. Petroleum is used to make a variety of chemical products, such as fertilizers, pharmaceuticals, and solvents. To meet future demand for oil, both private and public companies are seeking to explore new oil reserves.

The objective of the report is to present a comprehensive analysis of theNorth AmericaPup Joint market to the stakeholders in the industry. The report provides trends that are most dominant in the North AmericaPup Joint market and how these trends will influence new business investments and market development throughout the forecast period. The report also aids in the comprehension of theNorth AmericaPup Joint Market dynamics and competitive structure of the market by analyzing market leaders, market followers, and regional players.

The qualitative and quantitative data provided in theNorth AmericaPup Joint market report is to help understand which market segments and regions are expected to grow at higher rates, factors affecting the market, and key opportunity areas, which will drive the industry and market growth through the forecast period. The report also includes the competitive landscape of key players in the industry along with their recent developments in theNorth AmericaPup Joint market. The report studies factors such as company size, market share, market growth, revenue, Product Type, and profits of the key players in theNorth AmericaPup Joint market.

The report provides Porter"s Five Force Model, which helps in designing the business strategies in the market. The report helps in identifying how many rivals exist, who they are, and how their Product Type quality is in theNorth AmericaPup Joint market. The report also analyses if theNorth AmericaPup Joint market is easy for a new player to gain a foothold in the market, do they enter or exit the market regularly, if the market is dominated by a few players, etc.

The report also includes a PESTEL Analysis, which aids in the development of company strategies. Political variables help in figuring out how much a government can influence theNorth AmericaPup Joint market. Economic variables aid in the analysis of economic performance drivers that have an impact on theNorth AmericaPup Joint market. Understanding the impact of the surrounding environment and the influence of environmental concerns on the North AmericaPup Joint market is aided by legal factors.

We manufacture pup joints in all sizes, grades, and thread profiles to meet any requirement. Our tubing pup joints are manufactured out of seamless tubing and machined or upset to final dimensions. All API casing and tubing pup joints are manufactured according to API Spec 5CT. Special requirements are available on request.

Endurance Technologies Inc. (ETI) wishes to announce that as of March 1, 2022, we will be assuming the distribution of our ENDURALLOY® (boronized) tubing, casing, pup joints, and downhole components into the United States market.

Endurance Technologies Inc. (ETI) has been a trusted name for more than 28 years as a provider of ENDURALLOY® products and industry leading customer support. We have revolutionized oilfield tubulars, casing, pup joints and downhole components by processing them with a thermal diffusion process under the registered name ENDURALLOY®. This ENDURALLOY® process provides high quality protection to mitigate holes in tubing by combating rod wear, erosion, abrasion and corrosion! We have the solutions that are ENGINEERED TO LAST!

We are the largest manufacturer of API pup joints in North America. All of our pup joints are manufactured from the highest quality API seamless tubing, and per API 5CT requirements. We have dedicated heat treat, NDT, and automated threading lines to provide you with best quality pup joints with quicker turnaround times.

Blast Joints are heavy wall pin by box connectors used in tubing strings and are designed to minimize the effect of external erosive action caused by production fluids. These are located opposite the location of perforations in the production casing or just below the tubing hanger in sand frac designs. Blast joints manufactured from seamless mechanical tube in sizes ranging from 2 3/8” to 4 1/2” OD. Any length, grade of material, and threading is available at the customer’s request. Typical lengths are 10" and 20".

Pursuant to subsection 31(1) of the Special Import Measures Act, the President of the Canada Border Services Agency initiated investigations on September 12, 2011, respecting the alleged injurious dumping and subsidizing of oil country tubular goods pup joints, made of carbon or alloy steel, welded or seamless, heat-treated or not heat-treated, regardless of end finish, having an outside diameter from 2 3/8 inches to 4 1/2 inches (60.3 mm to 114.3 mm), in all grades, in lengths from 2 feet to 12 feet (61 cm to 366 cm) originating in or exported from the People"s Republic of China.

On July 22, 2011, the Canada Border Services Agency (CBSA) received a written complaint from Alberta Oil Tool (AOT), a division of Dover Corporation (Canada) Limited of Edmonton, Alberta, (hereafter, “the Complainant”) alleging that imports of certain pup joints originating in or exported from the People"s Republic of China (China) are being dumped and subsidized and causing injury to the Canadian industry.

The Complainant provided evidence to support the allegations that certain pup joints from China have been dumped and subsidized. The evidence also discloses a reasonable indication that the dumping and subsidizing have caused injury and are threatening to cause injury to the Canadian industry producing these goods.

On September 12, 2011, pursuant to subsection 31(1) of SIMA, the President of the CBSA (President) initiated investigations respecting the dumping and subsidizing of certain pup joints from China.

Of the other producers certified to produce the like goods in Canada, only Tenaris Canada (Tenaris), of Sault Ste. Marie, Ontario, confirmed to be currently manufacturing them. Tenaris produces like goods which are premium pup joints in relatively small quantities and provided a letter supporting the complaint filed by Dover Corporation (Canada) Limited.

Oil country tubular goods pup joints, made of carbon or alloy steel, welded or seamless, heat-treated or not heat-treated, regardless of end finish, having an outside diameter from 2 3/8 inches to 4 1/2 inches (60.3 mm to 114.3 mm), in all grades, in lengths from 2 feet to 12 feet (61 cm to 366 cm) originating in or exported from the People"s Republic of China.

Pup joints are oil country tubular goods (OCTG) made from carbon or alloy steel pipes used for the exploration and exploitation of oil and natural gas. These pipes may be made by the electric resistance welded (ERW) or seamless production method, and are supplied to meet American Petroleum Institute (API) specifications 5CT or equivalent standard.1

Pup joints are primarily used for the purpose of adjusting the depth of strings or down hole tools, particularly where exact depth readings in a well are required for any given purpose, such as setting valves, packers, nipples or circulating sleeves. Pup joints are also used with down hole pumps. The number and lengths of pup joints may vary widely from well to well, depending on the various equipment and performance requirements established by engineers of the purchasing end users.

Pup joints may range from 2 feet to 12 feet in length with a permitted tolerance of plus or minus three inches. The sizes are generally 2, 4, 6, 8, 10 and 12 feet in length.

The pipe is produced in accordance with API 5CT, and may be produced using either seamless or welded (ERW) OCTG. While pup joints may be made with ERW, the Canadian market employs predominantly seamless OCTG. All pup joints produced by the Complainant are seamless products.2

Theoretically, subject pup joints may be supplied to meet any grade including and not limited to, H40, J55, K55, M65, N80, L80, L80 HC, L80 Chrome 13, L80 LT, L80 SS, C90, C95, C110, P110, P110 HC, P110 LT, T95, T95 HC, and Q125, or proprietary grades manufactured as substitutes for these specifications. The most common demand in the Canadian market is for J55 or L80 specifications.

The grade numbers define the minimum yield strength required of the grade in kilo-pounds [force] per square inch (“ksi” or 1,000 pounds per square inch). Pup joints may also be made to proprietary specifications. The Complainant makes or has the capability to produce pup joints in any of these grades.

As with all OCTG, a standard pup joint must be able to withstand outside pressure and internal yield pressures within the well. Also, it must have sufficient joint strength to hold its own weight and must be equipped with threads sufficiently tight to contain the well pressure where lengths are joined.

There is a small market segment for perforated pup joints. These are pup joints with holes in the body of the pup joint (usually 3/8 inch though they may have holes or slots of various sizes in the body). The product is produced with API 5CT tubing, though once perforated the product no longer conforms to an API 5CT specification, since it no longer meets the yield strength requirements. Perforated pup joints are employed to allow fluids to enter the production tubing. They can also be used to create a mud anchor. Perforated pup joints are included as goods subject to these investigations.

On March 23, 2010, the Canadian International Trade Tribunal (Tribunal) excluded ‘pup joints" as part of its finding in Inquiry No. NQ-2009-004 on Certain Oil Country Tubular Goods. In that finding, the Tribunal stated:

“The Tribunal hereby excludes pup joints, seamless or welded, heat-treated or not heat-treated, in lengths of up to 3.66 m (12 feet), from its injury finding.”3

Pup joints are manufactured in Canada by the Complainant using plain end tube as an input. For J55 grade pup joints, a length of J55 OCTG tubing is employed. For L80 grade pup joints, the input is an A-519 mechanical tube with the appropriate steel chemistry for L80 OCTG. The L80 input tube does not qualify for the API 5CT designation until it has been tested in accordance with API requirements. The Complainant performs the testing required.

The production process of the input pipe itself is virtually identical to that employed for OCTG tubing and casing. There are, however, significant subsequent costs associated with transforming the input tubing into pup joints including: cutting to length, end finishing, threading, and testing to meet the certification required.

For J55 pup joints, the Complainant produces an upset end by heating (upset forging) and butting to thicken the end of the pipe diameter for threading. J55 tubing is cut 8 inches longer than the required pup joint length to accommodate this process. In the case of L80 pup joints, the production process uses profiling rather than upset ends, and accordingly only 1/4 inch of additional length is needed to accommodate finishing. Profiling refers to machining the pipe towards the ends of the pipe so it is thicker at the far ends. This process is used instead of upsetting because upsetting a pipe with steel chemistry for an L80 grade would require the producer to heat-treat the pipe again.

Testing includes drift testing which is an assessment of the straightness within the hollow part of the tube, to ensure no bends or kinks exist after the pup joint was forged, and hydrostatic testing which assesses the pup joint"s ability to withstand internal pressure.4

Pup joints produced by the domestic industry compete directly with and have the same end uses as the subject goods imported from China. The goods produced in Canada and China are completely substitutable. Therefore, the CBSA has concluded that the pup joints produced by the Canadian industry constitute like goods to the subject goods. Pup joints can be considered as a single class of goods notwithstanding that the subject goods may be further differentiated in terms of seamless or welded.

All pup joints sold by the Complainant are sold to oilfield supply distributors who in turn sell the products to end users. The Complainant makes some sales directly to large volume end users and specialty manufacturing companies that require the product in conjunction with their own manufactured products (i.e. down hole pumps and wellheads).6

The Complainant estimated the import portion of the Canadian market using the best information available to them, recognizing that there is no publicly available information which segregates pup joints from the larger category of products which are oil country tubular goods.

The Complainant"s commercial intelligence indicates that China and the United States are the only countries that export commercially significant quantities of pup joints to Canada.

The Complainant provided estimates respecting the Canadian market for pup joints. These figures are based on their own domestic sales reports and on publicly available import data.

Detailed information regarding the volume of subject imports and domestic production cannot be divulged for confidentiality reasons. The CBSA has, however, prepared the following table to show the estimated import share of certain pup joints in Canada.

The Complainant alleged that subject goods from China have been injuriously dumped into Canada. Dumping occurs when the normal value of the goods exceeds the export price to importers in Canada. The Complainant provided information to support the allegation that the OCTG sector in China, which includes pup joints, may not be operating under competitive market conditions and as such, normal values should be determined under section 20 of SIMA. This included reference to the CBSA"s previous section 20 determinations in respect of its Certain Seamless Steel Casing and Certain Oil Country Tubular Goods final determinations on February 7, 2008 and February 22, 2010 respectively.

The Complainant provided information supporting a request that a section 20 inquiry be initiated in investigating their allegation of injurious dumping of the subject goods. Due to the lack of available information and because they believe that the conditions of section 20 exist, the Complainant did not provide any analysis regarding the domestic selling price of pup joints in China.

Estimated normal values were provided for models of pup joints that represent a major proportion of goods normally sold in Canada by the Complainant. The CBSA also noted that these products represented just over 50% of the specific products (i.e. matching grade, outside diameter and length) imported during the POI on a value basis.

Given the greater accuracy of the CBSA"s estimate of export prices using actual import data, the CBSA"s margin of dumping estimate incorporated export price estimates using this data.

The Complainant alleged that the conditions described in section 20 prevail in the OCTG sector in China, which includes pup joints. That is, the Complainant alleges that this industry sector in China does not operate under competitive market conditions and consequently, prices established in the Chinese domestic market for pup joints are not reliable for determining normal values.

With respect to the OCTG sector, which includes pup joints, the CBSA has information which demonstrates that the prices of OCTG products may be significantly affected by the GOC"s actions and as a result, prices of OCTG in China may not be substantially the same as they would be if they were determined in a competitive market.

Consequently, on September 12, 2011, the CBSA initiated a section 20 inquiry based on the information available in order to determine whether the conditions set forth in paragraph 20(1)(a) of SIMA prevail in the OCTG sector, which includes pup joints, in China. A section 20 inquiry refers to the process whereby the CBSA collects information from various sources so that the President may, on the basis of this information, form an opinion regarding the presence of the conditions described under section 20 of SIMA, in the sector under investigation.

As part of this section 20 inquiry, the CBSA sent section 20 questionnaires to all known exporters and producers of OCTG in China, as well as to the GOC requesting detailed information related to the OCTG sector which includes pup joints in China. In addition, the CBSA requested that producers in other countries, who are not subject to the present investigation, provide domestic pricing and costing information concerning pup joints.

In the event that the President forms the opinion that domestic prices of pup joints in China are substantially determined by the GOC and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be if they were determined in a competitive market, the normal values of the goods under investigation will be determined, where such information is available, on the basis of the domestic price or cost of the like goods sold by producers in any country designated by the President and adjusted for price comparability; or the selling price in Canada of like goods imported from a designated country and adjusted for price comparability.

The following 11 grant programs, which were identified by the Complainant and previously investigated by the CBSA, were found to not be relevant to the pup joints investigation. The reason for their lack of relevance is that none of the exporters identified for this investigation are located in regions that would allow them to qualify for these subsidies. The affected programs are as follows:

The above-mentioned programs will not be investigated by the CBSA unless sufficient information is provided to justify their investigation. In this respect, the CBSA may further examine location-specific subsidy programs in the event that such programs are found in the areas where the identified pup joints producers are located.

SIMA refers to material injury caused to the domestic producers of like goods in Canada. The CBSA has accepted that the pup joints produced by the Complainant are like goods to those imported from China. The CBSA"s analysis primarily included information on the Complainant"s domestic sales, with a focus on the impact of the allegedly dumped and subsidized goods on their production and sale of like goods in Canada.

The Complainant alleged that the subject goods have been dumped and subsidized and that such dumping and subsidizing has caused and is threatening to cause material injury to the pup joint industry in Canada. In support of its allegations, the Complainant provided evidence of increased volumes of dumped and subsidized goods, lost sales, price erosion, price suppression, lost revenues, reduced gross margins, reduced profitability, loss of market share, loss of employment, reduced returns on investment, and underutilization of capacity.

The complaint cited the increase in subject welded casing/tubing immediately following the Tribunal finding onCertain Seamless Steel Casing, which subsequently resulted in measures against those products under the Certain Oil Country Tubular Goods finding, as evidence that in the absence of protection, the threat of injury on accessory products like pup joints will persist.

The import volumes were difficult for the Complainant to estimate, given that the subject goods would normally be imported under the same HS codes as other OCTG products. Consequently, there is no way for the Complainant to take the publicly available information which is segregated by HS code and accurately assess the value and quantity of certain pup joints imported into Canada. However, given that the Complainant knows the volume of sales they typically made to customers who now buy from Chinese sources, they were able to estimate the volume of Chinese imports.

Import data generated by the CBSA made use of ACROSS statements, which typically specify when OCTG tubing are pup joints and is thus more accurate, indicating comparable trends to those provided by the Complainant in terms of the relationship of subject imports to the total share of imports and to the overall Canadian market.

The CBSA"s analysis of Chinese pup joint imports in Q1 and Q2-2011 supports the Complainant"s position that subject goods are taking an increasing share of the Canadian market, as subject import volumes in that period increased to more than what was imported for the entire 2010 period.

The increase in Chinese imports is particularly noticeable in Q4-2010, where according to the data from FIRM,26 the two most significant lost customers identified by the Complainant began importing Chinese pup joints in substantial volumes. These two parties are in fact two of the three largest importers of Chinese origin pup joints during the July 1, 2010 to June 30, 2011 POI, accounting for over half of the value of subject imports.

The loss of sales to its largest customers in addition to other smaller customers, which cumulatively accounted for substantial portions of the Complainant"s pup joint revenue, has resulted in reduced revenues which have failed to reach those achieved in 2008.

To illustrate the downward trend in their pup joints business, the Complainant offered a comparison between the pup joints segment and the overall business of the division, to demonstrate that the pup joints segment"s decline in gross margins is not a reflection of their overall business.

In 2008, the Complainant"s pup joints business segment outperformed their total operations. Overall gross margins dipped in 2009 due to the recession but in 2010 and Q1-2011, overall gross margins have grown substantially, such that they exceed margins achieved on pup joints. Pup joint margins have conversely dropped over this same period.

The Complainant used a similar comparison of its relatively higher profitability in other oilfield products as evidence that dumped and subsidized Chinese pup joints have reduced profitability of their pup joint sales.

In contrast, the Complainant"s pup joints business reported a substantial drop in profits as a percentage of sales revenues from 2008 to 2009, with only a modest recovery in 2010 and Q1-2011, largely underperforming the division as a whole.

The Complainant alleged that their market share has steadily diminished since the emergence of Chinese pup joints in Canada after 2008. In fact, according to the CBSA"s estimate, the Complainant"s share of the Canadian market has decreased substantially since 2008.

With Q1 and Q2-2011 imports of subject goods already eclipsing the total volume of subject goods estimated by the CBSA to have been imported in all of 2010, the most recent evidence indicates that the Complainant is continuing to lose market share to alleged dumped and subsidized pup joints.

The Complainant stated that with a decline in orders for their like goods, which is attributable to the alleged dumped and subsidized imports of subject goods from China, their employment directly associated with the production of pup joints dropped considerably from 2008 to 2010.28

The Complainant is particularly concerned with its recent investment in paint and threading systems for pup joints, which was required with the transfer of certain production from facilities from its affiliate in the United States. The injury caused by the alleged dumped and subsidized pup joints will make it more difficult to recoup on this investment, given the total cost of the project.

The Complainant stated that they have the available capacity to meet considerably more Canadian demand were they not having to compete with dumped and subsidized Chinese pup joints. The Complainant reported capacity utilization declined considerably from 2008 to 2010.

The Complainant alleges that the current growing trend of lost customers in Canada through the first half of 2011 is an indication that these customers are increasingly sourcing pup joints from China.

Based on information provided in the complaint, other available information, and the CBSA"s internal data on imports, there is evidence that certain pup joints originating in or exported from China have been dumped and subsidized, and there is a reasonable indication that such dumping and subsidizing has caused or is threatening to cause injury to the Canadian industry. As a result, based on the CBSA"s examination of the evidence and its own analysis, dumping and countervailing investigations were initiated on September 12, 2011.

The CBSA has also requested costing and sales information from producers of pup joints in multiple countries. Where sufficiently available, this information may be used to determine normal values of the goods in the event that the President of the CBSA forms an opinion that the evidence in this investigation demonstrates that section 20 conditions apply in the OCTG sector, which includes pup joints, in China.

This included a review of US, Indian and European OCTG producers, segregated to examine only financial results related to OCTG tubing where available. OCTG tubing is the product segment most closely related to the pup joints subject to these investigations. Segregated financial reporting at the more specific ‘pup joint" level was not found.

Pup Joints were subject to the Certain Oil Country Tubular Goods investigation prior to their exclusion at the Tribunal. The provisional period for that investigation began November 23, 2009, so that year was largely unaffected by the investigation.

The perfect complement to our diets. Our Veterinary formulated line of health supplements for puppies and adult dogs are made with 100% human-edible ingredients and are designed for allergy care, gastrointestinal health, and skin and coat health. We also offer calming supplements for dogs to help them feel more relaxed and comfortable.

A pup joint is a casing or tubing of length shorter than Range 1 with the same thread connection, used to adjust the length of tubular strings to its exact requirement.

Pup Joints are manufactured from AISI 4145H or 4140H-modified alloy, heat-treated to a Brinell Hardness range of 285-341 with a Charpy “V” notch minimum impact strength of 40 ft/lb at 70° F and one inch below the surface. Pup Joints are heat-treated to 110,000 PSI minimum yield. All connections are phosphate coated to impede galling during initial make-up.

Integral Pup Joints dedicated to Sour Service applications are available. PJ -110 PUP S are Sour Service Pup Joint using ASCOWELL C material providing improved resistance to Sulfide Stress Cracking with high yield strength.

8613371530291

8613371530291