pup joint oil and gas pricelist

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Find parts you need to repair or maintain your machines. At Alibaba.com, you can shop for pup joint drill pipe at affordable rates to tackle new obstacles and challenges. In the ever-changing industry, you can find what you need and speak to the supplier directly. Thanks to Alibaba’s collection of wholesale pup joint drill pipe you also get to buy these parts at lower prices, which means you can explore new levels every day more comfortably. From bulldozers to dragline excavators, wheel tractor scrapers to shotcrete machines, any part you need for a heavy-duty mining machinery; you can find it at Alibaba.com.

Looking for purpose-built machine parts? Find them at Alibaba.com. From new components to used parts straight from the manufacturers. Plus, if you need custom-made pieces, you can chat with the supplier, give specifications and wait on delivery. From stone crushers to excavator undercarriage parts, buckets, and even drill bits to get you through the rocks, the pup joint drill pipe from Alibaba offers you the chance to continue operating without a hitch. Whether you are looking to introduce concrete into the rock walls for more consistency and safety during mining, then pup joint drill pipe that goes at wholesale prices at Alibaba will be an excellent addition to your machinery.

Before buying a component, you’d want the equipment to suit your application and offer value. The list of pup joint drill pipe at Alibaba.com lets you dig into earth deposits, and the compare tool checks out other similar parts to give you the information you need to make a purchasing decision. You’ll get wholesale pup joint drill pipe that specializes in mining, with reinforced chassis, and run on more powerful engines. Whether you want to transport minerals or the workers to the mining site, introduce explosives or arms to help you remove materials from your mine pits, Alibaba.com has it all.

Whether your business operates in the manufacturing, construction, automobile, engineering, aerospace, or another industry, access to a ready source of timely steel pup joint products is essential to fulfil customer orders. Discover experienced Chinese wholesalers that sell a wide range of pup joint products at Alibaba.com and buy with ease online with us. Alibaba.com makes it easy to find the wholesalers you need, with ready reviews, clear pricing, and fast customer service on hand to give you access to the products your business needs.

When you need a motivated supplier of pup joint products and other steel pipes, tubes, plates, and custom materials for your business operation, Alibaba.com is your first choice for convenience and rapid access to customer-reviewed Chinese wholesale businesses. Search our immediate listings to see which wholesalers have the steel pup joint products you need, and access clear pricing.

See what other customers thought of different Chinese steel wholesalers and find out more about different wholesale companies" markets, product ranges, and lead times. Customer service is made easy with online chat, email, and 24/7 communication via the Alibaba.com website. With steel products often challenging to find in domestic Western markets, it makes sense to find a new and experienced supplier of ready steel materials and pup joint products in China, with quick delivery and streamlined fulfilment processes. Search now to find instant Chinese wholesale suppliers who are keen to serve your business and set up to do so, quickly and efficiently, whatever your business needs and volumes may be.

A premium provider of oil field equipment and service parts, Parveen Industries Pvt. Ltd is focused on high-quality manufacturing of premium-grade oil and gas field equipment that exceeds international standards. At its eight large-scale facilities, Parveen manufactures products that not only support the existing oil and gas industry but drive forward industry-wide innovation.

Transparency Market Research delivers key insights on the global pup joint market. In terms of revenue, the global pup joint market is estimated to expand at a CAGR of ~7%during the forecast period, owing to numerous factors regarding which TMR offers thorough insights and forecasts in the global pup joint market report.

In the report, TMR predicts that the global pup joint market would be largely driven by factors such as increase in demand for oil & gas and increase in number of explorations. Rise in demand for high-grade pup joints, use of advanced drilling technology, and penetration in developing nations are set to drive the global pup joint market during the forecast period.

According to the pup joint market report, the product type segment includes crossover pup joint, drill pipe pup joint, and tubing pup joint; the technology segment includes hot rolled and cold rolled; the end use segment includes oil & gas, chemical industry, mining, construction, and others. Based on product type, drill pipe pup joint accounts for major share. Increase in drilling activities in various countries contributes maximum to this segment. The segment is projected to expand at a significant rate in the near future.

The oil & gas segment holds maximum share in the global pup joint market. Economic growth and high demand for electricity has increased the demand for offshore exploration and production activities worldwide.

Volatility in raw material prices has an obvious impact on pup joint manufacturers. Fluctuating prices of raw materials have impact on the production of pup joints.

Geopolitical situations such as the ongoing troubles in Iran, and Venezuela and Qatar’s exit from OPEC is likely to influence oil and gas supply. Renewable and alternative energy coupled with government pressure and environmental legislation is another threat to traditional oil & gas companies. Government and private companies are showing keen interest in exploring new oil reserves to meet future demands.

Rising demand for oil & gas is set to increase drilling activities. New drilling technologies such as horizontal drilling and hydraulic fracturing is expected to have a positive impact on the oil & gas market. These factors are expected to drive the demand for pup joints during the forecast period.

Middle East & Africa holds a major share of the global pup Joint market followed by Europe. Key players largely depend on geographical expansion, promotions, and technological advancements to cater to customer demand and gain a competitive edge in the global pup joint market.

Middle East & Africa accounted for approximately 30% share of the global pup joint market in 2018, followed by North America and Europe. It is anticipated to maintain its dominance in the market during the forecast period. Domestic production capacity is increasing in several countries; exploring undeveloped sites and exploring new sites for drilling is projected to generate more options for business growth.

Key players operating in the global pup joint market include Anvil International, AZZ Inc., Dmh United Steel Industry Co., Ltd, Forum Energy Technologies, Inc., National Oilwell Varco, Oil Country Tubular Limited, Sledgehammer Oil Tools Pvt. Ltd, Stewart Tubular Products, Texas Pipe Works Inc., and TPS-Technitube Röhrenwerke GmbH.

Transparency Market Research registered at Wilmington, Delaware, United States, is a global market research firm that offers Market Analysis Reports and business consulting. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyze information.

Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports.

Pup Joint Inc. is a machine shop that sells down hole tubular and casing accessories and equipment. We are a leading supplier of pup joints & accessories with API5CT & premium threads at very competitive prices. Our machine shop is a threading facility for all your threading & precision machining needs. PJI commenced operations in Houma, LA in July of 1997. Our staff has over 65 years of combined experience supplying quality products & services to the oil & gas industry.

In the oil and gas drilling industry, the tubing pup joint is a critical component for the completion of a well. The pup joint allows the driller to change out the drill pipe without having to pull out the entire string of pipe from the well. This is a common practice, especially when drilling deep wells. Because of this, the tubing pup joint is one of the most important joints in any well.

Tubing pup joints are small-diameter tubing that is used in conjunction with casing to complete a well. The pup joint is run in the hole and cemented to the casing, and then the production tubing is run over it and attached. This arrangement allows for the use of smaller-diameter production tubing, which results in less pressure drop and improved production. The pup joint is usually located in the last few feet of the tubing string.

When you need tubing pup joints, Action is the only source you need to know.Westcan Oilfieldhave awide selection of productsto meet your needs and we offer some of the best prices in the industry. You can trust that we’ll provide you with quality products that you can count on.

A pup joint is a casing or tubing of length shorter than Range 1 with the same thread connection, used to adjust the length of tubular strings to its exact requirement.

Pup Joints are manufactured from AISI 4145H or 4140H-modified alloy, heat-treated to a Brinell Hardness range of 285-341 with a Charpy “V” notch minimum impact strength of 40 ft/lb at 70° F and one inch below the surface. Pup Joints are heat-treated to 110,000 PSI minimum yield. All connections are phosphate coated to impede galling during initial make-up.

Integral Pup Joints dedicated to Sour Service applications are available. PJ -110 PUP S are Sour Service Pup Joint using ASCOWELL C material providing improved resistance to Sulfide Stress Cracking with high yield strength.

ATOM would like to acknowledge the Traditional Owners and their custodianship of the lands which we live and work on today, and pay our respect to their Ancestors and their Descendants

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

ADFO manufactures Pup Joints with Integral Hammer Union end connections.These Pup Joints are used on high pressure discharge lines, choke and kill lines, auxiliary flow and other applications.

Prithviraj Industries manufactures Pup Joints up to 20, 000 psi cold working pressure in sizes: 1, 11 /2, 2, 3, and 4-inch bore sizes, lengths to 20 feet.

Village Bhagwanpur, Roorkee, Dist. Haridwar Khasra No. 599 Nalhera Anantpur Roorkee Uttarakhand 247667, Village Bhagwanpur, Roorkee - 247667, Dist. Haridwar, Uttarakhand

Shreeraj Industries offers NPST (Non-pressure Seal Thread) Pups in size 1-3 Fig 602 and 1502. The NPST connection offers a light weight pup capable of 6000-15000 CWP with a connection that isolates the thread from fluid’s flowpath. This connection is permanent and is well suited to abrasive applications where a weldedread more...

- Grant Prideco pup joints are manufactured from the same material as our drill collars. Heat-treatment processes ensure a hardness range of 285-341 Brinell. Charpy V minimum impact strength of 40 ft-lb at 70° F are guaranteed one inch below the surface.

Windlass manufactures Pup Joints with integral hammer lug union end connections. This enables faster, easier make-up and break-out of temporary flow lines.

Blaze Sales & Service has been outfitting the oil and natural gas industry with top quality Oilfield and downhole equipment supply and services. Offering sales, rental, replacement and repair services, we cater to a broad range of customer needs. From downhole equipment, 1502 plug valve, flow iron, pup joint, plug valve and trash catcher manifold, plug and gate valve, ridge plug, hydraulic packers, cement retainers, 1502 swivel joint, 1502 Chiksan, 10K needle valve, 15k needle valve, pressure gauge, Needle valves, Auto clave fitting, High pressure adapters and Changeover and crossover adapters, flowback and frac to coil tubing, workover rigs and supply stores, we deliver leading equipment that exceeds industry standards and regulations.

[1] On July 22, 2011, the Canada Border Services Agency (CBSA) received a written complaint from Alberta Oil Tool (AOT), a division of Dover Corporation (Canada) Limited of Edmonton, Alberta, (hereafter, "the Complainant") alleging that imports of certain pup joints originating in or exported from the People"s Republic of China (China) are being dumped and subsidized and causing injury to the Canadian industry.

[2] On August 12, 2011, pursuant to paragraph 32(1)(a) of the Special Import Measures Act (SIMA), the CBSA informed the Complainant that the complaint was properly documented. The CBSA also notified the government of China (GOC) that a properly documented complaint had been received and provided the GOC with the non-confidential version of the subsidy portion of the complaint, which excluded sections dealing with normal value, export price and margin of dumping.

[3] On September 9, 2011 consultations were held with the GOC in Ottawa pursuant to Article 13.1 of the Agreement on Subsidies and Countervailing Measures. During these consultations, China made representations with respect to its views on the evidence presented in the non-confidential version of the subsidy portion of the complaint.

[4] On September 12, 2011, pursuant to subsection 31(1) of SIMA, the President of the CBSA (President) initiated investigations respecting the dumping and subsidizing of certain pup joints from China.

[5] On September 13, 2011, the Canadian International Trade Tribunal (Tribunal) commenced a preliminary injury inquiry, pursuant to subsection 34(2) of SIMA, into whether the evidence discloses a reasonable indication that the alleged dumping and subsidizing of certain pup joints from China have caused injury or retardation or are threatening to cause injury to the Canadian industry producing the goods. On November 14, 2011, pursuant to subsection 37.1(1) of SIMA, the Tribunal determined that there is evidence that discloses a reasonable indication that the alleged dumping and subsidizing of certain pup joints have caused injury or retardation or are threatening to cause injury to the domestic industry.

[6] On December 12, 2011, the CBSA made preliminary determinations of dumping and subsidizing with respect to certain pup joints originating in or exported from China pursuant to subsection 38(1) of SIMA, and began imposing provisional duties on imports of the subject goods pursuant to subsection 8(1) of SIMA.

[7] On December 13, 2011, the Tribunal initiated a full inquiry pursuant to section 42 of SIMA to determine whether the dumping and subsidizing of the above mentioned goods have caused injury or retardation or are threatening to cause injury to the Canadian industry.

[8] The CBSA continued its investigations and, on the basis of the evidence, the President is satisfied that certain pup joints originating in or exported from China have been dumped and subsidized and that the margins of dumping and the amounts of subsidy are not insignificant. Consequently, on March 12, 2012, the President made final determinations of dumping and subsidizing pursuant to paragraph 41(1)(a) of SIMA.

[10] Each of the two investigations has its own separate Period of Investigation (POI). The dumping POI includes shipments of subject pup joints released into Canada from July 1, 2010 to June 30, 2011, while the subsidy POI includes shipments of subject pup joints released into Canada from January 1, 2010 to June 30, 2011.

[13] Of the other producers certified to produce the like goods in Canada, only Tenaris Canada (Tenaris), of Sault Ste. Marie, Ontario, confirmed that they are manufacturing them. Tenaris produces like goods which are premium pup joints in relatively small quantities and provided a letter supporting the complaint.[1]

[14] At the initiation of the investigations, the CBSA identified 109 potential exporters and producers of the goods under investigation. The CBSA sent a Dumping Request for Information (RFI) to each potential exporter and section 20 and subsidy RFIs to each potential exporter and producer in China.

[15] The CBSA received two responses, but one company’s response was determined to involve only non-subject goods.[2] One exporter, Hengshui Weijia Petroleum Equipment Manufacturing Co., Ltd. (Hengshui Weijia), provided responses to the three RFIs (dumping, subsidy and section 20). This exporter also provided additional information to supplement and clarify their responses.[3]

[16] At the initiation of the investigations, the CBSA identified 17 potential importers of the subject goods from information provided by the Complainant and CBSA import documentation over the period of January 1, 2010 to June 30, 2011.

[19] At the initiation of the investigations, the CBSA sent subsidy and section 20 RFIs to the GOC. The GOC provided responses to both RFIs. The CBSA reviewed the responses and while some of the information requested was provided, some of the GOC’s responses were limited.

[21] The GOC’s section 20 RFI response, discussed in greater detail below, was also fundamentally insufficient as they provided limited responses to questions which required more detail. In short, the GOC indicated that their seminal macro-economic policies in respect of the Chinese steel industry, which are most notably the National Steel Policy (NSP) and 2009 Steel Revitalization/Rescue Plan[5] remain unchanged and, as a result, the status quo remains for the Chinese steel industry. Further details regarding the GOC’s section 20 submission is provided in the “Section 20 Inquiry” section of this document.

[22] As part of the section 20 inquiry, RFIs were sent to all known producers of pup joints in other countries (excluding China). This list of certified producers was obtained directly from the American Petroleum Institute (API). Although seven producers indicated their intention to provide a response, no complete response to the Surrogate RFI was ever received.

“Oil country tubular goods pup joints, made of carbon or alloy steel, welded or seamless, heat-treated or not heat-treated, regardless of end finish, having an outside diameter from 2 3/8 inches to 4 1/2 inches (60.3 mm to 114.3 mm), in all grades, in lengths from 2 feet to 12 feet (61 cm to 366 cm) originating in or exported from the People"s Republic of China.”

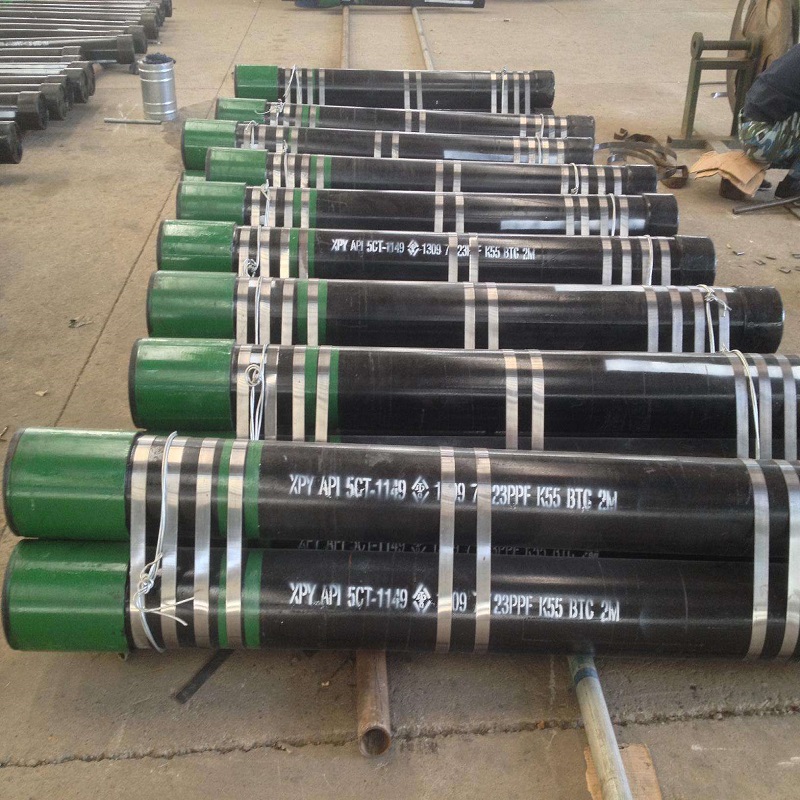

[24] Pup joints are oil country tubular goods (OCTG) made from carbon or alloy steel pipes used for the exploration and exploitation of oil and natural gas. These pipes may be made by the electric resistance welded (ERW) or seamless production method, and are supplied to meet API specification 5CT or equivalent standard.[6]

[25] Pup joints are primarily used for the purpose of adjusting the depth of strings or down hole tools, particularly where exact depth readings in a well are required for any given purpose, such as setting valves, packers, nipples or circulating sleeves. Pup joints are also used with down hole pumps. The number and lengths of pup joints may vary widely from well to well, depending on the various equipment and performance requirements established by engineers of the purchasing end users.

[26] Pup joints may range from 2 feet to 12 feet in length with a permitted tolerance of plus or minus three inches. The sizes are generally 2, 4, 6, 8, 10 and 12 feet in length.

[27] The pup joints subject to these investigations are, by virtue of the characteristics such as the outside diameter range, essentially short lengths of OCTG tubing.

[28] Pup joints are manufactured in Canada by the Complainant using plain end tube as an input. For J55 grade pup joints, a length of J55 OCTG tubing is employed. For L80 grade pup joints, the input is an A-519 mechanical tube with the appropriate steel chemistry for L80 OCTG. The L80 input tube does not qualify for the API 5CT designation until it has been tested in accordance with API requirements. The Complainant performs the testing required.

[30] The production process of the input pipe itself is virtually identical to that employed for OCTG tubing and casing. There are, however, significant subsequent costs associated with transforming the input tubing into pup joints including: cutting to length, end finishing, threading, and testing to meet the certification required.

[31] For J55 grade pup joints, the Complainant produces an upset end by heating (upset forging) and butting to thicken the end of the pipe diameter for threading. J55 tubing is cut 8 inches longer than the required pup joint length to accommodate this process. In the case of L80 grade pup joints, the production process uses profiling rather than upset ends, and accordingly only 1/4 inch of additional length is needed to accommodate finishing. Profiling refers to machining the pipe towards the ends of the pipe so it is thicker at the far ends. This process is used instead of upsetting because upsetting a pipe with steel chemistry for an L80 grade would require the producer to heat-treat the pipe again.

[32] Testing includes drift testing which is an assessment of the straightness within the hollow part of the tube, to ensure no bends or kinks exist after the pup joint was forged, and hydrostatic testing which assesses the pup joint’s ability to withstand internal pressure.

[33] For further information on the production process of the input tubes, see the CBSA’s Initiation Statement of Reasons for Certain Oil Country Tubular Goods (September 8, 2009).[7]

[38] During the final phase of the investigations, the CBSA refined the total volume of imports based on data from its internal information system, CBSA import documentation and other information received from the cooperative exporter and importers.

[40] Regarding the dumping investigation, information was requested from known and potential exporters, vendors and importers, concerning shipments of subject pup joints released into Canada during the dumping POI of July 1, 2010 to June 30, 2011.

[41] Regarding the subsidy investigation, information related to potential actionable subsidies was requested from known and potential exporters and the GOC concerning financial contributions made to exporters or producers of subject pup joints released into Canada during the subsidy POI of January 1, 2010 to June 30, 2011.

[42] In addition, known and possible exporters and producers of pup joints, along with the GOC, were requested to respond to the section 20 RFI for the purposes of the section 20 Inquiry.

[47] In summary, 80 subsidy programs were reviewed and two of the subsidy programs were determined to be conferring benefits to the cooperative exporter during the subsidy POI.

[48] As part of the final stage of the investigations, case briefs were provided by the legal representatives of the Complainant, Hengshui Weijia and the GOC.[12] Reply submissions were provided by the legal representatives of the Complainant and the GOC.[13] Details of all representations can be found in Appendix 2 to this document.

[49] Section 20 is a provision under the Special Import Measures Act (SIMA) that is applied to determine the normal value of goods in a dumping investigation where certain conditions prevail in the domestic market of the exporting country. In the case of a prescribed country[14] under paragraph 20(1)(a) of SIMA, section 20 is applied where, in the opinion of the President, the government of that country substantially determines domestic prices and there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market. Where section 20 is applicable, the normal values of goods are not determined using domestic prices or costs in that country.

the government or a government body sets minimum and/or maximum (floor or ceiling) price levels in respect of certain goods which permits prices to be established no lower or no higher than the minimum or maximum price levels;

the government or a government body sets recommended or guidance pricing at which it is expected that sellers will adhere to within a certain range above and/or below that value;

there are government or regulatory bodies which are responsible for establishing the price levels and for regulating and enforcing these price levels;

there are government-owned or controlled enterprises that set the price of their goods in consultation with the government or as a result of government-mandated pricing policies and, because of their market share or dominance, become price-leaders in the domestic market.

[53] Governments can also indirectly determine domestic prices through a variety of mechanisms that can involve the supply or price of the inputs (goods and services) used in the production of the subject goods or by influencing the supply of the subject goods in order to affect their price. For example:

[54] The CBSA is also required to examine the price effect resulting from substantial government determination of domestic prices and whether there is sufficient information on the record for the President to have reason to believe that the resulting domestic prices are not substantially the same as they would be in a competitive market.

[55] The Complainant requested that section 20 be applied in the determination of normal values due to the alleged existence of the conditions set forth in paragraph 20(1)(a) of SIMA. In their complaint, the Complainant provided information to support these allegations concerning the steel industry in China including the OCTG sector, which includes pup joints.[15]

[56] At the initiation of the dumping investigation, the CBSA had sufficient information from the Complainant, the CBSA’s own research and previous CBSA section 20 opinions to support the initiation of a section 20 inquiry to examine the extent of GOC involvement in pricing in the OCTG sector, which includes pup joints. The information indicated that domestic prices in China have been influenced by various GOC industrial policies concerning the Chinese steel industry including the OCTG sector, which includes pup joints.

[59] In respect of the GOC’s section 20 submission, the GOC provided some of the information requested but some of the GOC’s responses were limited. As a result, the GOC’s submission is considered to be insufficient and incomplete.

[60] As part of the CBSA’s examination of the OCTG sector in China, which includes pup joints, the GOC was requested to provide information concerning the Chinese manufacturers of OCTG by region, the type of products produced (i.e. welded versus seamless) and their respective steel production capacities. In addition, the GOC was requested to indicate the ownership structure of each manufacturer along with information pertaining to OCTG manufacturers that are State-Owned Enterprises (SOE).

“The GOC does not have detailed official statistics of OCTG producers…Other information would presumably come from public sources and is available to the CBSA. The GOC cannot vouch for its accuracy.”[16]

[62] It is the CBSA’s understanding from previous verifications conducted with the GOC, that production figures and other statistics are submitted to the GOC through timely monthly submissions to the Chinese National Bureau of Statistics by the producers of OCTG.

[63] Furthermore, according to recent legislation passed by the GOC, through the Criterion for the Production and Operation of Steel Industry – GY [2010] No. 105,[17] there is an application process that requests this information from producers along with additional detailed information concerning output value, sales revenue, profits etc. At minimum, the GOC has the information available from its SOEs, which comprise a substantial proportion of the top OCTG producers in the sector. This indicates that the information requested by the CBSA is available to the GOC and current information from the GOC regarding the OCTG sector in China, which includes pup joints, would have been useful to the CBSA in its analysis.

[64] This is the same sector that was examined in the CBSA’s investigations of certain Seamless Steel Casing (2008) and certain OCTG (2010). Each of those section 20 inquiries concluded that domestic prices in the OCTG sector in China are substantially determined by the GOC and that there is sufficient reason to believe that the domestic prices are not substantially the same as they would be in a competitive market.

[65] The following is the CBSA’s analysis of the relevant factors that prevail in the Chinese steel industry, which subsequently affect the OCTG sector, which includes pup joints.

[66] As cited in previous section 20 inquiries, The Development Policies for the Iron and Steel Industry – Order of the National Development and Reform Commission [No. 35], [18] (National Steel Policy - NSP) was promulgated on July 8, 2005 and outlines the GOC’s future plans for the Chinese domestic steel industry. The major objectives of the NSP are:

[67] On March 20, 2009, the GOC promulgated the Blueprint for the Adjustment and Revitalization of the Steel Industry issued by the General Office of the State Council (2009 Steel Revitalization/Rescue Plan).[19]

[68] This macro-economic policy was the GOC’s response to the global financial crisis and is also the action plan for the steel industry for the 2009 through 2011 period. This plan includes the following major tasks:

[69] There are common measures between these two GOC policies, as the 2009 Steel Revitalization/Rescue Plan is an acceleration of the major objectives of the NSP. In the 2009 plan, the GOC asserts its strict control over new or additional steel production capacity, promotes new GOC directed mergers and acquisitions to reform the Chinese steel industry into larger conglomerates, along with an increased emphasis on steel product quality.

[70] The 2009 Steel Revitalization/Rescue Plan also applies to the OCTG sector in China, which includes pup joints. There is evidence on the record confirming that the GOC specifically directed one of the cooperating exporters in the OCTG (2010) investigation, which was one of the largest SOE producers, and possibly the largest seamless OCTG manufacturer, to reorganize with another company.[20]

[71] In the CBSA’s supplemental section 20 RFI to the GOC, the CBSA requested the GOC to provide the 12th Five-Year Plan: Iron and Steel along with an English translation. The GOC subsequently provided this document.[21]

[72] On November 7, 2011, the GOC’s Ministry of Industry and Information Technology released the 12th Five-Year Plan: Iron and Steel (Development Plan for the Steel Industry). For the preliminary phase of the section 20 inquiry, the CBSA had a summary of the draft plan that had been published in May 2011 by KPMG, an international accounting firm. A review of the official 12th Five Year Development Plan for the Steel Industry indicates that the KPMG details in the draft were similar to the final official GOC document. The 12th Five-Year Development Plan for the Steel Industry serves as the guiding document for the development of the Chinese steel industry for the 2011-2015 period and its directives include:

[73] Also included in this plan are minimum requirements for steel production in order to eliminate smaller players in the market. Through this plan, the GOC is continuing its reform and restructuring of the Chinese steel industry. The GOC’s target is that by 2015, China’s top 10 steel producers will represent 60% of the country’s total steel output. According to the NSP (2005), the long-range GOC target for mergers and acquisitions is to have the top 10 Chinese steel producers account for 70% of total national steel production by 2020.[23] This plan is the next development stage of GOC directives aimed at achieving this long-range 2020 target.

[74] The 12th Five-Year Development Plan for the Steel Industry addresses existing issues in the steel industry with the directive to strictly control expansion of steel production capacity, accelerate the development of new material for steel and producer service and to continue to advance mergers and restructuring.[24]

[75] According to the plan, the more highly concentrated steel industry will reduce overcapacity, decrease pollution and will improve Chinese steel producers’ bargaining power when negotiating prices on iron ore imports. In addition, through the 12th Five-Year Development Plan for the Steel Industry, the GOC is progressing with its initiative in the 2009 Steel Revitalization/Rescue Plan to move Chinese steel production facilities to China’s coast. By the end of this GOC directed plan in 2015, 40% of China’s steel production will be relocated to the coast.[25]

Improve the industry management system. This would include the GOC’s Criterion for the Production and Operation of the Steel Industry (Steel Operations Standards) released in 2010;

Improve industry information flow, capital flow and material flow. Support enterprise groups to establish and improve the information system in different regions;

Improve planning by regional authorities of industries to develop the steel industry, combine the regional mergers and reconstruction and eliminate obsolete construction. Related enterprises should put forward the planning scheme corresponding to the foregoing plan. The China Iron and Steel Industry should assist and put forward advice on the policy.

“We would like to draw the attention of the CBSA to the fact all these three Five-Year Plans (National 12th Five-Year Plan, 12th Five-Year Plan for Hebei and 12th Five-Year Plan: Iron and Steel) we submitted above are only instructive and guiding rather than compulsory binding to the steel industry and companies.”[26]

[79] Only one of the Five-Year Plans referenced by the GOC in the above quote was provided in their entirety and this was the 12th Five-Year Plan: Iron and Steel. An examination of this document indicates that the “Basic Principles” include to:

“strictly control expansion of production capacity, accelerate the development of new material for steel and producer service, continue to advance merger and restructuring and further enhance industrial clustering.”[27]

[80] Together with the GOC’s recent legislation: Criterion for the Production and Operation of Steel Industry – GY [2010] No. 105[28] and Several Observations of the General Office of the State Council on Further Strengthening Energy-saving and Emission Reduction Efforts, as well as the Accelerating of Restructuring of Steel Industry – GBF (1010) No. 34,[29] these plans set out the detailed requirements for existing production and operations of steel enterprises in China. For construction and renovation projects in the steel industry, the GOC’s development policies for the steel industry apply (i.e. the 12th Five-Year Plan: Iron and Steel and 2009 Steel Revitalization/Rescue Plan).

[81] Should steel enterprises not acquiesce to the GOC’s requirements, laws and industrial policies, there are repercussions which include the withdrawal of steel production licenses and credit support. In respect of new construction or renovation of Chinese steel enterprises, the GOC’s steel development policies also apply.

[82] The above GOC statement that the Five-Year Plans are merely instructive and guiding are inconsistent with the reality of the GOC’s macro-economic policies/measures that support the GOC’s stated objectives. The GOC’s measures, notices and observations as addressed in this section 20 inquiry serve to illustrate the fact that the GOC is closely administering the steel industry in China.

[83] Based on the information on the record, the scope of the GOC’s macro-economic policies/measures provide a compelling factual basis that the GOC is influencing the Chinese steel industry including the OCTG sector, which includes the pup joints under investigation.

[85] In its second supplemental section 20 RFI response, the GOC provided the document, Several Observations of the General Office of the State Council on Further Strengthening Energy-saving and emission Reduction Efforts as well as Accelerating of Restructuring of Steel Industry- GBF (2010) No. 34.[31]

[86] The intent of this legislation is to further support and carry out the 2009 Steel Revitalization/Rescue Plan, to achieve the energy-saving and emission targets, in addition to the restructuring of the steel industry in China as approved by the State Council. One main objective of the State Council is to “resolutely suppress the excessive growth of steel production capacity” and “strictly implement the approval and review process of steel projects.”[32]

[87] In addition to the GOC’s actions to eliminate obsolete steel production and reduce energy-emissions, the GOC has clearly identified its plans for mergers and acquisitions. The GOC calls for provincial, autonomous regional and municipal governments to focus on formulating and reporting 2010-2011 iron and steel enterprise merger and restructuring plans to be organized, upon approval by the Ministry of Industry and Information Technology. The GOC directs that the implementation/improvement of policies for promoting mergers and restructuring be improved. These are compelling facts that the GOC is in charge of the reform of the Chinese steel industry.

[88] Information on the record further illustrates that GOC macro-economic policies/measures are compulsory and followed by local governments, with substantive impacts on the commercial decisions of producers of pup joints.[33]

[89] The “China Steel Pipe Industry 12th Five-Year Plan” was released by the Steel Pipe Branch of the China Steel Construction Society.[34] In its response to the section 20 RFI, the China Iron and Steel Association (CISA) stated that the Steel Pipe Branch is one of its member institutions.[35] The CBSA considers CISA to be “Government” as it is under the administration of SASAC as per its Articles of Association. This plan directs that the output of steel pipe should be controlled at 67-75 million metric tonnes (mmt). The scope of the GOC’s reform of the Chinese steel industry thus extends to the Chinese pipe sector, with the industry concentration targets through mergers and acquisitions to be attained by the end of 2015. Additional details of the China Steel Pipe Industry 12th Five-Plan were addressed in the Statement of Reasons for the preliminary determination.

[90] In respect of the OCTG sector, one of the GOC directives under this plan is to expand the development of OCTG products such as high collapse, anti-corrosion pipe.[36] These GOC objectives are likely to conflict with the commercial interests of OCTG producers, affecting production volumes and ultimately prices.

[91] Wuxi Forest Petroleum Technology Co., Ltd. (Wuxi Forest) had provided a response to the CBSA’s dumping RFI which had Chinese domestic sales of pup joints.[37] Wuxi Forest is a Chinese trading company and is not a manufacturer of pup joints. The company’s exports to Canada were subsequently found to be non-subject to the investigation. Wuxi Forest had purchased pup joints in China for re-sale during the POI. The acquisition cost of these pup joints represent actual Chinese domestic sales of pup joints. These Chinese domestic sales are all grade P110 pup joints which is a high-end API 5CT specification.[38] The CBSA used these Chinese domestic selling prices of pup joints for the following analysis.

[92] Firstly, the CBSA compared the overall average selling price of these P110 goods sold in China, with U.S. selling prices of High Collapse P110 (HCP) as reported by Pipe Logix during the POI.[39] Pipe Logix does not report U.S. domestic selling prices for ordinary P110 grade product, as it is not normally sold in the US domestic market. However, P110 is required for some applications in the Canadian oilfield where there are sour gas environments. HCP pipe is not an equivalent grade but a very comparable specification to the P110. A comparison of the HCP to the P110 grades based on like outside diameters (OD) and nominal weights of 11.6 pounds per foot (lbs/ft) for the Chinese and U.S. products indicates that the selling price of Chinese P110 pup joints was less than the selling prices of standard length HCP casing in the U.S. (likely about a 30 foot length), on a metric tonne basis.

[93] To put this in perspective, if the Chinese domestic pup joints were all of 10 foot lengths, there would be approximately 19 pup joints in a metric tonne with each end piece finished and tested according to the API 5CT specification. [40] In contrast, the reported U.S. Pipe Logix selling price, on a metric tonne basis, is comprised of average standard lengths of about 30 feet, meaning each tonne would comprise roughly six 30 foot lengths with finished and tested ends according to the API 5CT specification.[41] With the same OD and 11.6 lbs/ft nominal weight in each example, the Chinese domestic prices do not reflect the additional cost and resulting incremental value in selling price for the additional 13 finished end pieces of pup joints. This is a conservative example in respect of the Chinese selling price. One metric tonne of the Chinese goods could alternatively be comprised of 63 three foot pup joints, each with finished and tested ends according to the API 5CT specification.[42] This would illustrate an even greater cost and a substantial selling price differential.

United States to Canada during the POI.[43] In this comparison, the CBSA did not have sales of P110 in the same OD and lbs/ft as the Chinese goods but both were similar. The OD and nominal weight for the US selling prices were 3.5 inches and 9.3 lbs/ft compared to the Chinese product of 4.5 inches and 11.6 lbs/ft, which are sufficiently similar for comparison purposes. The lengths of the pup joints were the same at six feet. This comparison of selling prices indicates that the Chinese pup joints were 86% below that of the U.S. selling price. Consequently, in this comparison, the Chinese pup joint price is markedly lower than competitive market pricing for the same grade and same length of pup joint.

[95] In a third comparison, the CBSA compared the overall average domestic Chinese P110 pup joint selling price with the lowest U.S. selling prices of the lowest grade of API 5CT specification, J55, as per the Pipe Logix report over the POI.[44] The Chinese selling price was 34% lower than the U.S. J55 selling price.

[96] Each of the CBSA’s comparisons indicates that Chinese domestic pup joint selling prices are substantially below corresponding competitive market prices. Based on the CBSA’s price analysis, the evidence indicates that Chinese domestic OCTG pup joint prices are not substantially the same as they would be if they were determined in a competitive market.

[97] The wide range and material nature of the GOC measures have resulted in significant influence on the Chinese steel industry including the OCTG sector, which includes pup joints. The conditions described in paragraph 20(1)(a) of SIMA exist in this sector. Domestic prices are substantially determined by the GOC, and there is sufficient reason to believe that the domestic prices of pup joints are not substantially the same as they would be in a competitive market.

[98] Based on the above analysis, for the purposes of the final determination, the President affirmed the opinion rendered at the preliminary determination that the conditions described in paragraph 20(1)(a)apply in the OCTG sector in China, which includes pup joints.[45]

[99] Normal values of goods sold to importers in Canada are generally calculated based on the domestic selling prices of like goods in the country of export pursuant to section 15 of SIMA, or based on the aggregate of the cost of production of the goods, a reasonable amount for administrative, selling and all other costs, and a reasonable amount for profits pursuant to paragraph 19(b) of SIMA. Where, in the opinion of the President, sufficient information has not been furnished or is not available, normal values are determined pursuant to a ministerial specification under subsection 29(1) of SIMA.

[100] For purposes of the preliminary determination, normal values could not be calculated on the basis of domestic selling prices in China or on the full cost of goods plus profit, as the President formed the opinion that the conditions described in section 20 exist in the OCTG sector, which includes pup joints.

[102] Where section 20 conditions exist, the CBSA may determine normal values using the selling price, or the total cost and profit, of like goods sold by producers in a surrogate country designated by the President pursuant to paragraph 20(1)(c) of SIMA. However, sufficient surrogate country data on the necessary domestic pricing and costing information relating to the goods under investigation was not provided to the CBSA.

[105] While the CBSA does not have sufficient pricing, costing or import data available relating to a surrogate country, it does have pricing information for pup joints imported into Canada from, and originating in, the United States. This information was acquired from internal import data and from brokers representing the importers of these goods.[46] For the purposes of the final determination, normal values were determined on the basis of these prices.

[106] The normal values for each subject good exported to Canada by Hengshui Weijia over the period of investigation was based on the price of imported pup joints from the United States which matched the major characteristics used to identify these goods. Where such a match was not possible on a given transaction, the difference between the total normal value and the total export price for all other transactions for which matches were made, expressed as a percentage of this total export price, was used to establish the normal value.

[107] The export price of goods sold to importers in Canada is generally calculated pursuant to section 24 of SIMA based on the lesser of the adjusted exporter’s sale price for the goods or the adjusted importer’s purchase price. These prices are adjusted where necessary by deducting the costs, charges, expenses, duties and taxes resulting from the exportation of the goods as provided for in subparagraphs 24(a)(i) to 24(a)(iii) of SIMA. Where, in the opinion of the President, sufficient information has not been furnished or is not available, export prices are determined pursuant to a ministerial specification under subsection 29(1) of SIMA.

[108] For purposes of the final determination, export prices for the cooperative exporter were determined using their reported export price of the goods. For all other exporters, import pricing information available from the CBSA’s internal information systems and, where applicable, importer RFI responses, were used for the purposes of determining export prices.

[114] Under paragraph 41(1)(a) of SIMA, the President shall make a final determination of dumping when he is satisfied that the goods have been dumped and that the margin of dumping of the goods of a country is not insignificant. Pursuant to subsection 2(1) of SIMA, a margin of dumping of less than 2% is defined as insignificant. The margin of dumping of certain pup joints from China is not less than 2% and is, therefore, not insignificant.

[115] For purposes of a preliminary determination of dumping, the President has responsibility for determining whether the actual and potential volumes of dumped goods are negligible. After a preliminary determination of dumping, the Tribunal assumes this responsibility. In accordance with subsection 42(4.1) of SIMA, the Tribunal is required to terminate its injury inquiry in respect of any goods if the Tribunal determines that the volume of dumped goods is negligible.

[117] The company’s response to the exporter and section 20 RFIs were received by the October 19, 2011 deadline.[47] The company also cooperated in responding to several supplemental RFIs.[48]

[119] A review of the information submitted by Hengshui Weijia revealed that the company had no domestic sales during the POI. All Hengshui Weijia production is for export and all products are pup joints.

[120] Normal values for Hengshui Weijia were determined pursuant to a ministerial specification under subsection 29(1) of SIMA. The normal values for each subject good exported to Canada by Hengshui Weijia over the period of investigation was based on the price of imported pup joints from the United States which matched the major characteristics used to identify these goods. Where such a match was not possible on a given transaction, the difference between the total normal value and the total export price for all other transactions for which matches were made, expressed as a percentage of this total export price, was used to establish the normal value.

[121] Hengshui Weijia exported the subject goods to its related importer in Canada, and consequently the exporter and importer are considered associated persons in accordance with subsection 2(2) of SIMA. As such, a reliability test is conducted in order to determine whether the export price under section 24 (the lesser of the importer"s purchase price or exporter"s selling price) is reliable within the context of SIMA. This test is conducted by comparing the section 24 export price with the section 25 “deductive” export price based on the importer"s resale price of the imported goods in Canada to unrelated purchasers, less deductions for all costs incurred in preparing, shipping and exporting the goods to Canada, all costs incurred in reselling the goods (including duties and taxes), and an amount representative of the average industry profit in Canada.

[126] For all other exporters, import pricing information available from the CBSA’s internal information systems was used for the purposes of calculating the export price. The normal value and related margin of dumping was determined by advancing export prices by the highest amount by which the normal value exceeded the export price on an individual transaction (173.4%) for the cooperating exporter in accordance with the ministerial specification.

[128] Following the January 26, 2012 close of the record, a series of case briefs and reply submissions were received from counsel for the Complainant, the exporter Hengshui Weijia and the GOC.

[129] Issues raised by participants through case arguments and reply submissions pertaining to the dumping investigation and the CBSA’s response to these issues are provided in Appendix 2.

[130] In accordance with section 2 of SIMA, a subsidy exists if there is a financial contribution by a government of a country other than Canada that confers a benefit on persons engaged in the production, manufacture, growth, processing, purchase, distribution, transportation, sale, export or import of goods. A subsidy also exists in respect of any form of income or price support within the meaning of Article XVI of the General Agreement on Tariffs and Trade, 1994, being part of Annex 1A to the World Trade Organization (WTO) Agreement that confers a benefit.

amounts that would otherwise be owing and due to the government are exempted or deducted or amounts that are owing and due to the government are forgiven or not collected;

the government permits or directs a non-governmental body to do anything referred to in any of paragraphs (a) to (c) where the right or obligation to do the thing is normally vested in the government and the manner in which the non-governmental body does the thing does not differ in a meaningful way from the manner in which the government would do it.

[133] The following terms are defined in section 2 of SIMA. A “prohibited subsidy” is either an export subsidy or a subsidy or portion of subsidy that is contingent, in whole or in part, on the use of goods that are produced or that originate in the country of export. An export subsidy is a subsidy or portion of a subsidy contingent, in whole or in part, on export performance. An “enterprise” is defined as also including a group of enterprises, an industry and a group of industries.

[134] Notwithstanding that a subsidy is not specific in law pursuant to subsection 2.7(2) of SIMA, a subsidy may also be considered specific having regard as to whether:

[143] Consequently, on the basis of the available information, Programs 1 and 32 constitute financial contributions pursuant to subsection 2(1.6) of SIMA.

[144] During the preliminary phase of the investigation, the CBSA reviewed documents submitted for the record and determined that Hengshui Weijia had received benefits under Program 1: Preferential Tax Policies for Enterprises with Foreign Investment (FIEs) Established in Special Economic Zones (excluding Shanghai Pudong Area).

[145] After the preliminary determination, Hengshui Weijia made a submission contesting that they are not established in any Special Economic Zones (SEZ) and as such are not a recipient of Preferential Tax Policies for Enterprises with Foreign Investment in any SEZ.[52]

[148] In the final phase of the investigation, the CBSA requested that the exporter provide information about the law which determined its taxable income as a percentage of its total revenue. In response, the company provided a copy of The issue of the circular of the state administration of taxation on the procedures for verification and collection of enterprise income tax (trial implementation), which states the following: [54]

[149] The circular further states that “the taxable income rate shall be determined in accordance with the standards at ranges in the following table:”

[150] Hengshui Weijia pays income tax at the applicable rate of 25% and its taxable income rate, as evidenced from its income tax forms, is substantially less. Given the range in the manufacturing sector of 5% - 15%, the CBSA sent supplemental RFIs to Hengshui Weijia requesting that they explain why its taxable income rate was a comparatively lower rate.[55] In the absence of a satisfactory answer, the highest taxable income rate of 15% was used to calculate the subsidy benefit.

[153] Hengshui Weijia and the GOC each acknowledged that Hengshui Weijia received benefits from the government in the form of a grant for market promotion and trade development.

[156] As previously stated, the CBSA did not include Program 74: Exemption of VAT on Purchases of Equipment as part of its subsidy calculations for the final determination. In response to the supplemental RFI, the exporter explained that the VAT refund was due to the difference in the input VAT rate of 17% and the export VAT rate of 13%. The VAT tax return form provided by Hengshui Weijia demonstrated that the refund was lower then the amount the company paid for input VAT and thus, the refund did not constitute a benefit.[56] After reviewing the responses provided by Hengshui Weijia to the supplemental RFIs, the CBSA excluded the program from its subsidy calculations.

the subsidy amount per metric tonne for the actionable subsidy program in (1) above which was identified by both the GOC and the cooperative exporter, applied to each of the remaining 78 potentially actionable subsidy programs for which information is not available or has not been provided.

[162] In making a final determination of subsidizing under subsection 41(1) of SIMA, the President must be satisfied that the subject goods have been subsidized and that the amount of subsidy on the goods of a country is not insignificant. According to subsection 2(1) of SIMA, an amount of subsidy that is less than 1% of the export price of the goods is considered insignificant.

[163] However, according to section 41.2 of SIMA, the President is required to take into account Article 27.10 of the WTO Agreement on Subsidies and Countervailing Measures when conducting a subsidy investigation. This provision stipulates that a countervailing duty investigation involving a product from a developing country should be terminated as soon as the authorities determine that the overall level of subsidies granted upon the product in question does not exceed 2% of its value calculated on a per unit basis.

[164] SIMA does not define or provide any guidance regarding the determination of a “developing country” for purposes of Article 27.10 of the WTO Agreement on Subsidies and Countervailing Measures. As an administrative alternative, the CBSA refers to the Development Assistance Committee List of Official Development Assistance Recipients (DAC List of ODA Recipients) for guidance.[57] As China is included in the listing, the CBSA will extend developing country status to China for purposes of this investigation. As the preceding table illustrates, the amount of subsidy found during this investigation is not insignificant.

[166] Following the January 26, 2012 close of the record, a series of case briefs and reply submissions were also received from counsel for the Complainant, the exporter Hengshui Weijia and the GOC.

[167] Issues raised by participants through case arguments and reply submissions pertaining to the subsidy investigation and the CBSA’s response to these issues are provided in Appendix 2.

[168] On the basis of the results of the investigation, the President is satisfied that certain pup joints originating in or exported from the People’s Republic China, have been dumped and that the margin of dumping is not insignificant. Consequently, on March 12, 2012, the President made a final determination of dumping pursuant to paragraph 41(1)(a) of SIMA respecting the subject goods.

[169] Similarly, on the basis of the results of the investigation, the President is satisfied that certain pup joints originating in or exported from the People’s Republic of China have been subsidized and that the amount of subsidy is not insignificant. As a result, the President also made a final determination of subsidizing pursuant to paragraph 41(1)(a) of SIMA respecting the subject goods on this same date.

[171] The provisional period began on December 12, 2011, and will end on the date the Tribunal issues its finding. The Tribunal is expected to issue its decision by April 10, 2012. Subject goods imported during the provisional period will continue to be assessed provisional duties as determined at the time of the preliminary determinations. For further details on the application of provisional duties, refer to the Statement of Reasons issued for the preliminary determinations, which is available on the CBSA Web site at: www.cbsa-asfc.gc.ca/sima-lmsi/menu-eng.html

[172] If the Tribunal finds that the dumped and subsidized goods have not caused injury and do not threaten to cause injury, all proceedings relating to these investigations will be terminated. In this situation, all provisional duties paid or security posted by importers will be returned.

[173] If the Tribunal finds that the dumped and subsidized goods have caused injury, the anti-dumping and/or countervailing duties payable on subject goods released by the CBSA during the provisional period will be finalized pursuant to section 55 of SIMA. Imports released by the CBSA after the date of the Tribunal’s finding will be subject to anti-dumping duty equal to the margin of dumping and countervailing duty equal to the amount of subsidy.

[175] Normal values and the amount of subsidy have been provided to the cooperating exporter for future shipments to Canada in the event of an injury finding by the Tribunal. The normal values and amount of subsidy will come into effect the day after the date of the injury finding, if there is one. Information regarding normal values of the subject goods should be obtained from the exporter.

8613371530291

8613371530291