chen rongsheng manufacturer

HONG KONG, Nov 26 (Reuters) - China Rongsheng Heavy Industries Group, the country’s largest private shipbuilder, said its chairman had stepped down just three months after the company posted its sharpest fall in half-year net profit.

Zhang Zhirong quit to devote more time to his personal interests and will be replaced by the company’s chief executive officer, Chen Qiang, effective immediately, the company said on Monday in a statement to the Hong Kong stock exchange.

Listed in November 2010, Rongsheng was hit by an insider dealing scandal involving a firm owned by Zhang ahead of the $15.1 billion bid for Canadian oil firm Nexen Inc by China offshore oil and gas producer CNOOC.

Rongsheng said earlier this month that investment firm Well Advantage, controlled by Zhang, had agreed to pay $14 million as part of a settlement deal with the U.S. Securities and Exchange Commission (SEC).

In August, Rongsheng posted an 82 percent drop in half-year profit on a dearth of new orders and warned economic uncertainties would continue to weigh on the global shipping market.

As part of the changes at China Rongsheng, the company said that Zhang De Huang was retiring and had resigned as an executive director and as vice chairman of the board.

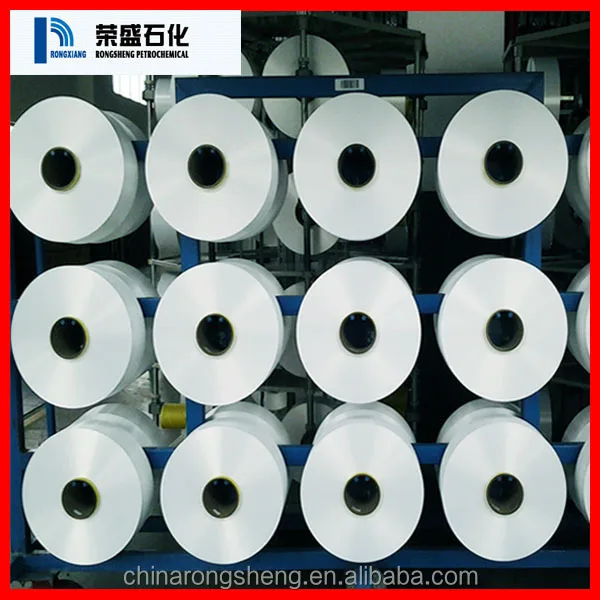

If you are exploring for a identified China polyester yarn, POY, FDY, DTY Manufacturer that has speciallized in Textiles, Yarn & Fabrics, then Rongsheng Holding Group is the right option. The factory of Rongsheng Holding Group is positioned in Beijing Beijing China. Rongsheng Holding Group right now processing with a manufacturing unit in China. Rongsheng Holding Group Details Name: kevin chen

(Reuters) - Private Chinese oil refiner and petrochemical manufacturers Hengli Petrochemical Corp and Rongsheng Petrochemical Corp have each hired a new executive for its Singapore trading desk, company officials said.

Separately, Zhu Yanyu, previously a veteran oil products trading manager at state-owned oil and gas company PetroChina , started in June at Rongsheng Petrochemical (Singapore) Pte Ltd as a deputy general manager in charge of refined products trading, said two company officials.

The Singapore operation is the international trading unit for Rongsheng Petrochemical Corp, which is a key stakeholder in Zhejiang Petrochemical Corp (ZPC), one of China"s largest private refiners which operates a 400,000 barrels per day refinery in east China"s Zhoushan.

China Rongsheng Heavy Industries Group, China"s largest private shipbuilder, issued a surprise warning that it expects to post an annual net loss for 2012 on sharp declines in orders and prices of new vessels after the shipping industry took a downward turn during the year.

Rongsheng was hit by an insider dealing scandal last year involving a company owned by its major shareholder, Zhang Zhirong, who stepped down as chairman last month and was replaced by chief executive officer, Chen Qiang.

Shares of Rongsheng ended down 1.5 percent on Monday and have lost 37 percent of their value this year, underperforming a 22 percent gain on the Hang Seng Index.

In August, Rongsheng reported its sharpest fall in half-year profit, down 82 percent, to 215.8 million yuan ($34.65 million)on a dearth of new orders, putting further pressure on its stretched balance sheet.

In an uncertain profit outlook, the shipbuilder"s estimated free cash flow in 2013-14 was unlikely to be enough to lower net debt, Citi said in a research report on Dec. 10. Rongsheng had net debt of about 17 billion yuan, it added.

8613371530291

8613371530291