china rongsheng heavy industries group holdings limited price

China Rongsheng Heavy Industries Group Holdings Limited (SEHK:1101) announced a private placement of 1,000, 7% convertible bonds due 2016 at a price of HKD 1,000,000 per bond for gross proceeds of HKD 1,000,000,000 on December 23, 2013. The transaction will include participation from Partners Kingwin Fund and Kingwin Victory Investment Limited, entity managed by Wang Ping which will invest HKD 500,000,000 each. The bonds will bear interest at a rate of 7% per annum payable annually in arrears. The bonds will be issued at 100% of the principal amount. The bonds will mature on date falling 30 months after closing. Both of the investors will nominate one candidate, each as non-executive Director on the company"s board of directors. The bonds will be convertible into 952,380,952 shares at a conversion price of HKD 1.05 per share, representing 11.98% stake in the company. The conversion period will start on issuance and will end on maturity date. The company will receive net proceeds of HKD 992,500,000 after deduction of commissions and expenses. The subscription and conversion of bonds is not subject to shareholders" approval.

On December 27, 2013, the company announced that Kingwin Victory Investment Limited has transferred its rights and obligation to Partners Kingwin Fund.

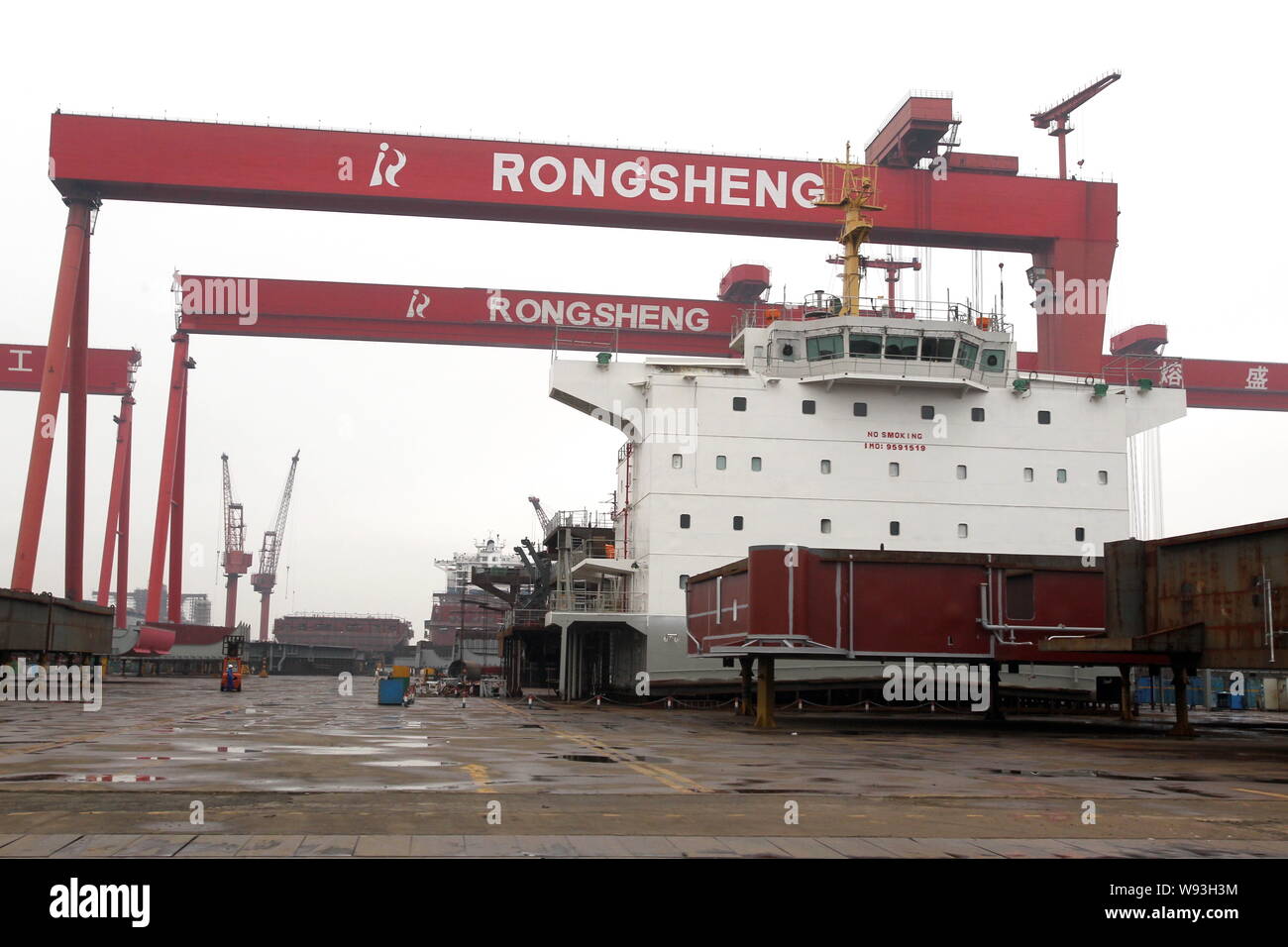

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

Shares of Glorious Property Holdings Ltd, a Chinese real-estate developer controlled by Zhang Zhirong, also fell sharply. The stock was down 12.9 percent as of 0304 GMT.

CNOOC said on July 23 it had agreed to acquire Nexen for $15.1 billion, China’s biggest foreign takeover bid. Shares of Nexen jumped almost 52 percent that day.

The unnamed Singapore traders used accounts in the names of Phillip Securities and Citibank C.N, while Well Advantage made its trades through accounts held at UBS Securities and Citigroup Global Markets. Neither of the Well Advantage accounts had traded Nexen shares since January 2012, and the Citigroup account had been completely dormant for over six months, the SEC says.

China Huarong Energy Company Limited, an investment holding company, engages in the energy exploration and production businesses. It explores for, produces, and sells crude oil. The company operates five oilfields in the Fergana Valley of the Republic of Kyrgyzstan; and sells petroleum products. It is also involved in commodity trading business; and oil and gas wholesale and distribution activities. The company was formerly known as China Rongsheng Heavy Industries Group Holdings Limited and changed its name to China Huarong Energy Company Limited in April 2015. China Huarong Energy Company Limited was founded in 2004 and is headquartered in Wan Chai, Hong Kong.

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

Some of Rongsheng"s subsidiaries, including Hefei Rong An Power Machinery Co and Rongsheng Machinery Co, signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015.

The Shanghai-based company said on Aug 21 that it is entering the energy business by buying 60 percent in a Kyrgyzstan oilfield by issuing new shares. It said on Oct 15 that it is seeking to identify new investment opportunities outside of China including in Central Asia.

Shares in the maker of bulk carriers and oil tankers had been suspended from trading since Aug 29 in Hong Kong, pending the restructuring details. Rongsheng had first-half net losses of 3.06 billion yuan ($501 million), more than double last year"s.

Rongsheng was overdue on principal and interest payments on 8.57 billion yuan of bank loans on June 30, according to a Hong Kong Stock Exchange filing on Aug 29.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. Li Junfeng / China Daily

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

The company said that the struggles of its shipbuilding arm, Jiangsu Rongsheng Heavy Industries, had been hampering efforts to expand in energy services

China Rongsheng Heavy Industries Group Holdings Limited [1101.HK] has announced that it has signed a memorandum of understanding that will see its shipbuilding business, Jiangsu Rongsheng Heavy Industries, sold to an undisclosed potential purchaser.

According to the company, the depressed shipbuilding market had led to operational difficulties at Jiangsu Rongsheng Heavy Industries, while its highly-leveraged state was also interfering with the company"s efforts to expand in oil and gas exploration elsewhere.

"The Potential Transaction shall adjust and optimize the assets and business of the Group, and divest the relevant assets and liabilities of the shipbuilding business and offshore engineering business, which shall help to ease the debt burden of the Group, enhance the flexibility of fund utilization, better implement the strategy of business transformation and transformation into an energy service provider focusing in the oil and natural gas market," said the company.

It was reported in 2012 that in the face of market difficulties, China Rongsheng Heavy Industries had turned its focus to building containerships with a "green design" as one its key products.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Rongsheng has borrowed billions of dollars in debt since its launch in 2005, fueling a rapid expansion that has made it one of China"s biggest three shipbuilders. But a global slowdown in demand for new vessels over the past few years has hit the firm hard.

In July Rongsheng, which is owned by private investors, said it was in discussions with a number of banks about "renewing existing credit facilities." The company also said it has reached an accord with a company controlled by key shareholder

During the year ended 31, December 2013 China Rongsheng, the largest non-state-owned shipbuilder in the PRC, reports that revenue of the Company was RmB1,343.6 million, a decrease of 83.1% from RmB7,956.3 million for the year ended 31 december 2012. Excerpts from the report follow:

China Rongsheng Heavy Industries Group Holdings Limited explain that In 2013, the unfavourable operating environment for ship owners persisted amid the unsatisfying performance of the global shipping market in spite of the tepid recovery from 2012. As a result, ship owners requested shipyards to postpone the delivery of new vessels.

Delays in constructions and deliveries of the Company’s orders on hand in the core shipbuilding segment led to a significant decline of the group"s revenue. In addition, the results of the period were directly dented by

Shipbuilding was the group"s major business and also its primary revenue source. Revenue from the shipbuilding segment decreased 84.2% year-on-year to RmB1,195.7 million for the period, representing 89.0% of the total revenue. the significant decrease in revenue was primarily attributable to the downturn in the shipbuilding industry.

In 2013, the overcapacity in the global shipping market was not curbed, with shipping enterprises stuck in the loss-making position, exacerbating the overcapacity in shipbuilding industry and leaving the prices for new vessels low. In response to the adverse market environment, Rongsheng adopted a defensive sales strategy and abandoned some extremely low price orders.

Rongsheng anticipates that the elimination of outdated overcapacity and lifted market entry barriers will result in an increase in market concentration and thus benefit leading large-scale shipbuilders in the long term. leveraging on the government policies. They say they will carry on implementation of established strategy of “Transformation and advancement” to further strengthen and expand the company for the long-term development.

China Rongsheng Heavy Industries Group Holdings Limited and its subsidiaries are a leading diversified large heavy industries group in China. Business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

8613371530291

8613371530291