china rongsheng heavy industries group holdings limited for sale

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

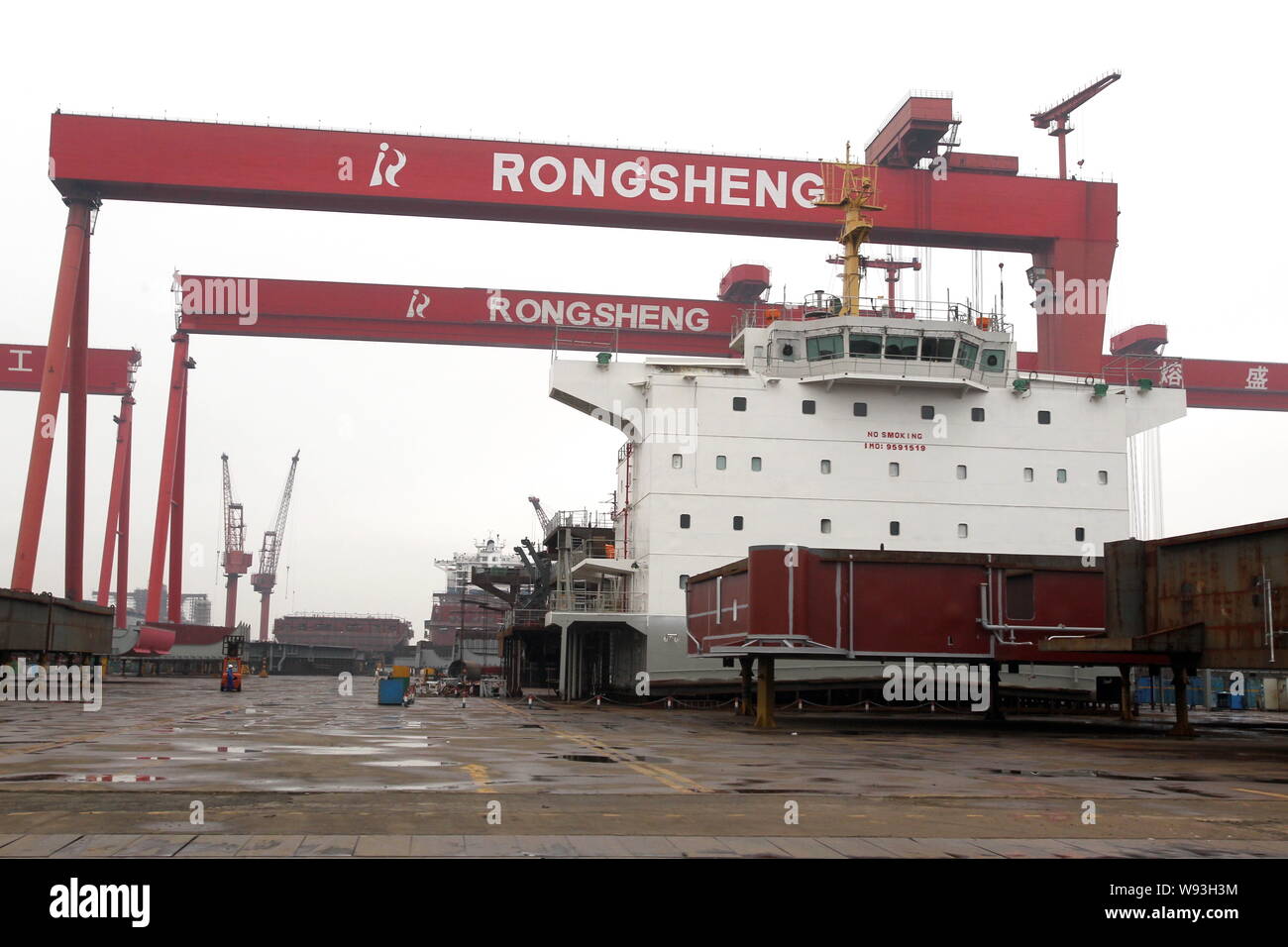

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

The company is trying to complete a restructuring by June and has proposed to change its name to China Huarong Energy Co. to more accurately reflect its expansion and new business scope.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

As orders for new ships began to dry up, China in 2013 issued a three-year plan urging financial institutions to support the shipbuilding industry. Ship owners placing orders for China-made vessels, engines and some parts should get better funding, the State Council said. A third of the more than 1,600 shipyards in China could shut down in the next five years, an industry association predicted earlier.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

Shares of Glorious Property Holdings Ltd, a Chinese real-estate developer controlled by Zhang Zhirong, also fell sharply. The stock was down 12.9 percent as of 0304 GMT.

CNOOC said on July 23 it had agreed to acquire Nexen for $15.1 billion, China’s biggest foreign takeover bid. Shares of Nexen jumped almost 52 percent that day.

The unnamed Singapore traders used accounts in the names of Phillip Securities and Citibank C.N, while Well Advantage made its trades through accounts held at UBS Securities and Citigroup Global Markets. Neither of the Well Advantage accounts had traded Nexen shares since January 2012, and the Citigroup account had been completely dormant for over six months, the SEC says.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China’s economic growth began to slow and credit tightened at a time when global shipping, too, turned down.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. [Provided to China Daily]

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. [Provided to China Daily]

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

China Rongsheng Heavy Industries Group Holdings Limited has denied rumors that it"s planning of a private placement of new shares in Rongsheng to one or a group of new investors to raise $200 million.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. (Li Junfeng / China Daily)

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

Some of Rongsheng"s subsidiaries, including Hefei Rong An Power Machinery Co and Rongsheng Machinery Co, signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015.

The Shanghai-based company said on Aug 21 that it is entering the energy business by buying 60 percent in a Kyrgyzstan oilfield by issuing new shares. It said on Oct 15 that it is seeking to identify new investment opportunities outside of China including in Central Asia.

Shares in the maker of bulk carriers and oil tankers had been suspended from trading since Aug 29 in Hong Kong, pending the restructuring details. Rongsheng had first-half net losses of 3.06 billion yuan ($501 million), more than double last year"s.

Rongsheng was overdue on principal and interest payments on 8.57 billion yuan of bank loans on June 30, according to a Hong Kong Stock Exchange filing on Aug 29.

China Rongsheng Heavy Industries Group Holdings Limited announced today its breakthrough in offshore engineering market by securing two CJ46 jack-up rigs EPC contracts, with a total contract value of exceeding USD 360 million.

It also marked the first jack-up rig orders received by the Group. With sound developments made in its transformation and advancement strategy, China Rongsheng Heavy Industries is accelerating its growth into the high-end offshore equipment manufacturing field as a world-class offshore engineering service provider.

The two 1+1 jack-up rigs contracts are separately signed with two Singaporean customers. Each of them includes one confirmed order and one option of same product. These orders were signed in an EPC contract (covering Engineering, Procurement, and Construction), with Rongsheng Offshore & Marine Private Limited (Rongsheng Offshore & Marine) and Jiangsu Rongsheng Heavy Industries Company Limited.

China Rongsheng Heavy Industries is one of the few shipbuilders in China capable of undertaking an EPC project, and the winning of these orders highlight the technological and manufacturing strength of the Group in the offshore engineering field. China Rongsheng Heavy Industries has targeted 2013 as a breakthrough year of its offshore engineering business, and is striving to secure more offshore engineering orders.

Since the establishment of Rongsheng Offshore & Marine in October 2012, the company has accumulated confirmed orders of two jack-up rigs and one deep-water tender barge, with several options of related products. These orders demonstrate the recognition received by the Group in the international shipbuilding and offshore engineering market.

China Rongsheng Heavy Industries Group Holdings Limited, a leading heavy industries group in China, yesterday announced its audited annual results for the twelve months ended 31 December 2011.

During 2011, the Group’s revenue was approximately RMB 15.9 billion, a surge of 25.6% from RMB 12.7 billion during the same period last year. Earnings attributable to equity holders of the Company slightly increased by 0.1% to RMB 1.7 billion compared with 2010.

Mr. Chen Qiang, Chief Executive Officer and Executive Director, said, “The Group continued to present outstanding results in 2011 and demonstrated immense growth potential under adverse market conditions. Affected by sluggish economic growth caused by volatile world markets, new shipbuilding orders globally declined about 54.6% and China’s new orders declined 58.3% compared with 2010. However, amidst these challenges, China Rongsheng Heavy Industries demonstrated strong marketing capability. The Group ranked first in China and third in the world in terms of new shipbuilding orders measured by DWT as at the end of 2011, demonstrating our strong capabilities and shipowners’ recognition of the Group.”

“The two flagship products of the Group have also achieved remarkable progress. The first very large ore carrier (“VLOC”) has been delivered in November 2011. The 3,000-meter deepwater pipe-laying crane vessel (“DPV”) has also been completed within the year. Besides, the steadily emerging contribution from the marine engine building and the engineering machinery business segments helped to increase the proportion of RMB revenue from 20% in 2010 to 35% in 2011, which has enabled the Group to deliver promising returns to our shareholders.”

Shipbuilding, our major business segment, remained as our major revenue source. During the year, revenue from our shipbuilding segment was RMB 15.4 billion, an increase of 29.8% compared with 2010. During the year, the Group received orders for a total of 39 new vessels of approximately 4.6 million DWT with a total contract value of USD 1.8 billion.

According to Clarkson Research, the Group represented 15.6% of China’s and 7.2% of the world’s new shipbuilding orders in terms of DWT in 2011, increases of 7.5 percentage points and 3.1 percentage points respectively. As at the end of 2011, the Group ranked first in China and third in the world in terms of new shipbuilding orders measured by DWT.

The Group endeavored to move upwards along the industry value chain, expanding its customer base of domestic shipowners and enriching our product variety to include more high-value vessels in its order book. In 2011, vigorous efforts were made to develop the containership market, which accounted for 14.6% of the total new orders secured during the year. The Group also continued to develop advanced vessel types with eco-friendly features, in full appreciation of current market requirements regarding fuel efficiency and low emission standards.

During the year, revenue from the offshore engineering segment, which arose from the construction of the 3,000-meter DPV, was approximately RMB 31.3 million. The DPV has contributed revenue since 2008 and was completed in June 2011. With China’s growing demand for offshore oil and gas, offshore engineering is positioned as a strategic emerging industry supported by the Government. The Group is enhancing its R&D capability in complex vessel types such as drilling rigs and liquefied natural gas (“LNG”) carriers, and preparing for LNG carrier containment systems and mock-up installation.

The Group’s revenue from the marine engine building segment during 2011 was RMB 1.1 billion, an increase of 257.6% from the previous year. After excluding the inter-segmental sales, the marine engine building segment contributed RMB 93 million, an increase of 201.6% from the comparable period last year. The Group secured new orders for 37 low-speed marine diesel engines during the year, a total capacity of 683,663 horsepower with a total contract value of RMB 1.2 billion, of which 14 were external orders. The Group’s total orders on hand as at 31 December 2011 were 56 engines, with a total capacity of 1,145,868 horsepower and a total contract value of RMB 1.9 billion, of which 26 were external orders.

During 2011, the Group’s revenue from the engineering machinery segment was RMB 681 million, an increase of 108.1% compared with 2010. After excluding inter-segmental sales, this segment contributed revenue of approximately RMB 410 million, an increase of 24.2% compared with 2010. Following the official commissioning of Phase One of our new plant, which is to focus on the production of 16 types of hydraulic excavators and two types of crawler cranes, on 28 June 2011, our production capacity of engineering machinery has been further enhanced. This project has been included in the “861 Action Plan” of Anhui Province and designated as a key implementation project under the “Twelfth Five-Year Plan” of the Hefei Municipal Government.

Due to economic uncertainty and seasonal pressures, the recovery of the shipping market in 2012 may encounter a possible delay. The Group expects the global shipbuilding industry will remain weak for the year of 2012 with the imbalance between supply and demand unlikely to be resolved shortly. It will be difficult to secure new orders of traditional vessel types. However, orders for high-value vessels such as very large containerships are expected to remain steady. The current market situation will guide the shipbuilding industry into a period of restructuring and polarization. This tendency will inevitably further broaden the gap between leading shipyards and Greenfield shipyards. In the long-run, adjustment and restructuring will relieve oversupply and help restore market equilibrium.

In the time of uncertainty, China Rongsheng Heavy Industries will enhance strategic cooperation with shipowners and rely on the strong three-year order backlog to push through the current downturn. Meanwhile, the Group will actively seek upgrading and restructuring of our product offerings, with a focus on high-value vessels and cost-efficient eco-friendly vessels. To take advantage of falling steel price, the Group will reinforce cost management while enhancing production efficiency and profitability.

Driven by the ever-increasing global demand for offshore energy resources, offshore equipment manufacturing is entering into a boom period. During the “Twelfth Five-Year Plan” period, China plans to develop an offshore production capacity of 50 million tonnes and total investment in this sector will reach RMB 250 to 300 billion.

Mr. Chen Qiang concluded, “Looking ahead into 2012, the Group will reinforce execution of our measures to address risks after cautious evaluation of the market situation and closely tracking market trends. The Group will enhance our strategic cooperation with financial institutions and optimise cash flow management. To mitigate risks, the Group will regulate capital expenditure by controlling both the extent and speed of implementing new projects. Moreover, our primary target is to boost overall corporate competitiveness by enhancing management with a focus on cost efficiency and production efficiency. The current downturn offers us an opportunity to promote transformation, restructuring and upgrading. Setting 2012 as a new start, the Group will strive to ensure that it steadily progresses along the road to become a world-class competitive heavy industries conglomerate, and to generate promising returns for our shareholders.”

8613371530291

8613371530291