dc rongsheng llc free sample

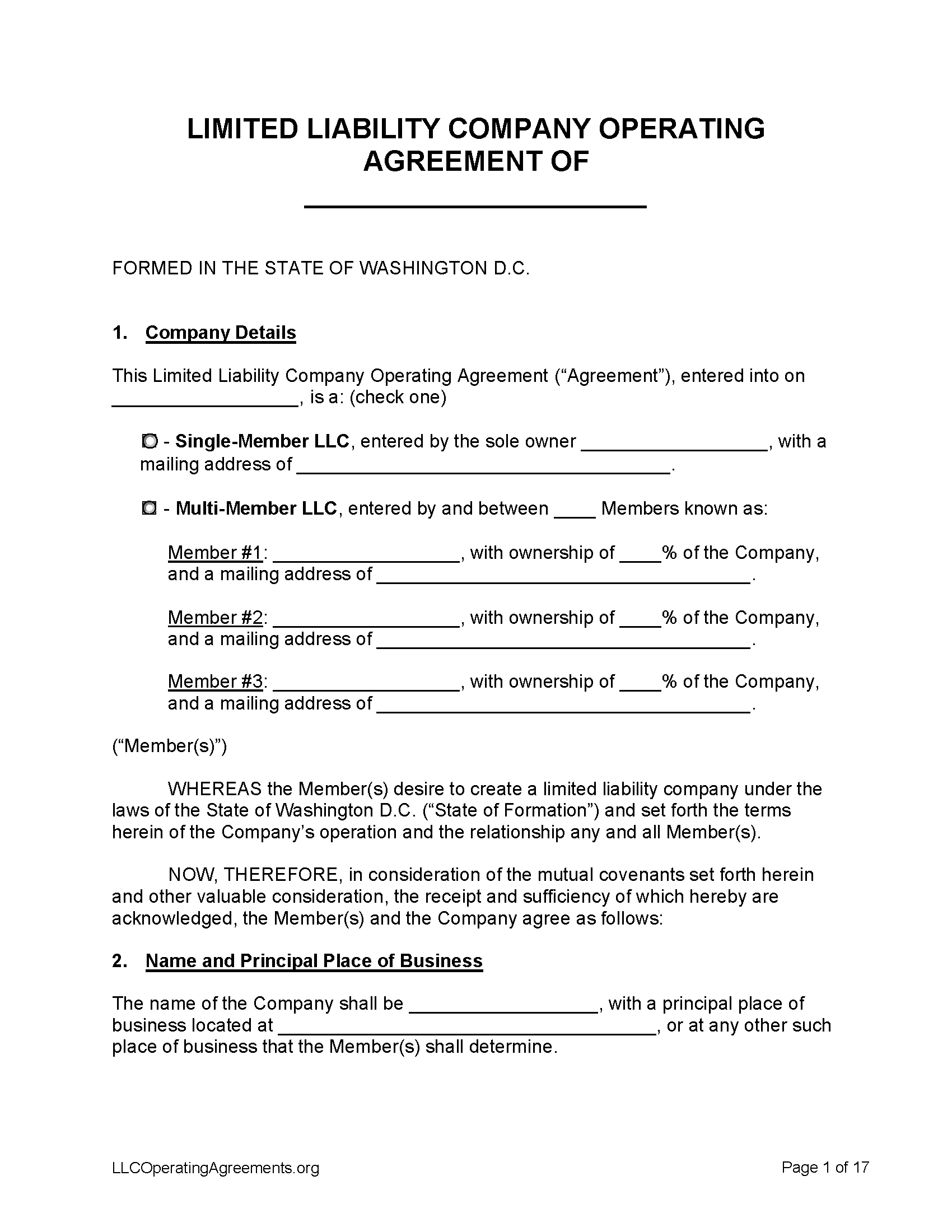

A Washington D.C. LLC operating agreement is written among the members of a company that establishes how it will be run and the relationship between the members. It should include the officers, voting rights (of members), and the company’s ownership. An operating agreement is the only document that records the ownership of the company and is recommended for a copy to be held by each member. It is not filed with the District of Consumer and Regulatory Affairs.

All LLCs must have an official legal name. Once possible names are chosen, before filling out any paperwork, it’s a good idea to make sure that another business entity is not already using that. Consult the Washington D.C. Business Info database to assure that the name is available.

A Registered Agent, sometimes called a statutory agent, is a person who will receive official communications on behalf of the LLC. The registered agent may be a person, or another business entity. If the agent is to be a person, that person must be a resident of Washington D.C.; if the agent is to be a business entity, that entity must be registered in the District. There are companies specifically set up to help foreign LLCs meet this requirement.

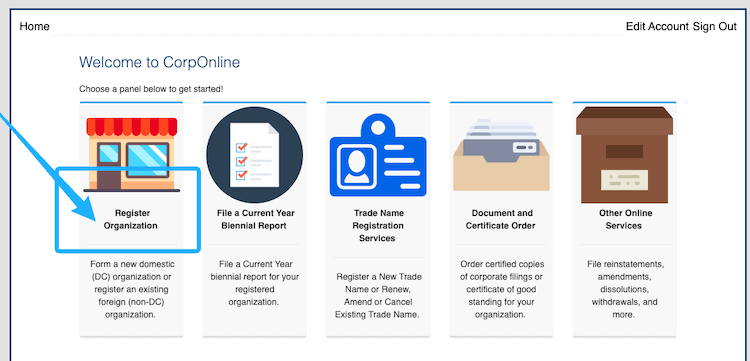

A “domestic” LLC is one that is formed in the District, while a foreign LLC is formed elsewhere. Both types are required to file Articles of Organization in order to transact business in the District, but they have distinct applications.

An Employer Identification Number (EIN) is a number assigned to a business entity by the Internal Revenue Service (IRS). An LLC should obtain one as soon as possible after formation. An EIN enables a business to make financial transactions in its name, and without one, it will be maintain bank accounts, pay employees or obtain lines of credit. Applying for an EIN may be done online or through the mail using Form SS-4.

A Washington DC LLC should have an operating agreement because a company cannot act for itself. In order to operate, LLCs require real humans (and other entities) to carry out company operations.

The ground rules for operating agreements in Washington DC are covered in DC Code § 29–801.07, but the statutes don’t actually state that a Washington DC LLC must have one. However, you will need an operating agreement to maintain your LLC. Here’s why:

After you file your Washington DC LLC Certificate of Formation, you’ll want to open a bank account for your business. Why? Your LLC only has limited liability if it can prove it’s a separate entity from its owners. Mixing personal and business spending erodes this separation, so it’s crucial to open a business bank account and keep your business finances separate. When you head to the bank, you’ll need to bring a copy of your operating agreement.

To benefit from limited liability status, business owners must be able to show that their company is its own legal entity, distinct from its owners. One way to do this is to open a business bank account and keep spending separate. Another way is to create (and follow) an LLC operating agreement.

Without an operating agreement, your LLC will automatically be governed by Washington DC’s default LLC statutes. The problem is that these default laws might not work for your business. Creating an operating agreement for your LLC ensures that you’re able to run your company (within the law) in the way you see fit.

“Consider the case of owingmoney to her firm following her notice of intent to withdraw. To the credit of the PLLC members, they did adopt and maintain an operating agreement, however a dispute about how to interpret a specific provision of the operating agreement ultimately emerged. Naturally, litigation ensued between the withdrawing member and the PLLC. Looking to the operating agreement of the PLLC, the DC Court of Appeals noted the importance of giving the literal interpretation to clear and unambiguous provisions within an LLC operating agreement.

According to DC Code § 29–801.02 (10), an operating agreement can be “oral, in a record, implied, or in any combination thereof.” But verbal agreements are flimsy and won’t hold-up in court. A written operating agreement is essential, and should include information about:

Limited Liability Company (LLC) is an unincorporated association, with one or more members, domestic or foreign. Owners risk only their investment and personal assets not at risk. Owners manage and control business that can be run by one person. LLCs are more complicated than partnership while it is easier to set up and maintain than corporation. LLCs are being taxed on earnings and owners can be taxed on business income.

A limited liability company (LLC) is a type of business structure that combines the benefits of a corporation with the tax benefits of a sole proprietorship or partnership. LLCs minimize the personal legal accountability of their members — especially in the event of litigation. It also protects the members’ personal assets from collection, creating a separate property from the LLC.

A business should have an LLC Operating Agreement to receive these benefits and protections. These agreements organize the LLC and set forth essential responsibilities and obligations. Legal Templates can help you create your free LLC Operating Agreement to get your business started correctly.

An LLC Operating Agreement is a critical legal document that outlines an LLC’s ownership and member duties. The agreement sets out the financial and working relations that suit the specific needs of the business owners. From daily operations to what would happen if a member needs to leave the business, an operating agreement is crucial to your company and should be created as soon as you form your LLC.

Most states do not specifically require an Operating Agreement to create an LLC. However, you are afforded fewer protections without one, and a court could find that your business is not a properly formed LLC. This could result in personal liability for the LLC’s members.

Individuals looking for more control over how their companies are operated day-to-day and managed on a long-term and strategic level should invest in an LLC Operating Agreement.

A written LLC Operating Agreement protects a company’s limited liability status by proving that the LLC is a separate legal entity. Without written documentation of an LLC Operating Agreement, a company may appear to be a sole proprietorship or partnership for tax and lawful purposes.

Banks, lenders, investors, and professionals will often ask for an LLC Operating Agreement before allowing a company to open a business checking account, secure financing, receive investment money, or obtain proper legal and tax help.

Your state’s default LLC rules will apply if you do not have an Operating Agreement. For example, suppose you do not detail what happens when a company member leaves or passes away. In that case, the state may automatically dissolve your limited liability company based on its laws.

If you want something different than your state’s de facto laws, an LLC Operating Agreement allows you to retain control and flexibility on how the company should operate. LLC members own a percentage of the company, not shares of a corporation. However, state default rules often assume that each owner has an equal share of the company, even though they may have contributed different amounts of money, property, or time.

Most joint ventures established in the US are formed as LLCs for tax purposes. [1] If you want to create your LLC as a joint venture, you might also need a joint venture agreement.

An LLC Operating Agreement should detail the name of each member of the LLC. It should include their legal name, not informal designations or “nicknames.” This legally identifies who is an owner of the LLC, so a proper legal assignment of the parties is essential.

The introductory provisions set forth important summary details of the LLC Operating Agreement. It includes the company’s name, principal place of business, and purpose. It will also include information on the company’s registered agent and that person’s address. This section should also include information on the following:

a) List the legal name that you will be operating and filing taxes under. This may or may not be the name you use for marketing or other purposes. However, this should be the name you used to legally file the LLC in your state. Be aware that states have specific requirements for how you name your LLC. This varies by state so be sure to check with your Secretary of State or the equivalent business formation office in your state for the naming requirements of your LLC.

b) List the legal name that you will be operating and filing taxes under. This may or may not be the name you use for marketing or other purposes. However, this should be the name you used to legally file the LLC in your state. Be aware that states have specific requirements for how you name your LLC. This varies by state so be sure to check with your Secretary of State or the equivalent business formation office in your state for the naming requirements of your LLC.

d) The registered agent is the designated individual or company physically located within the state who can receive service of process or other correspondence on behalf of the LLC. A member located in the state can be appointed to serve as a registered agent for the LLC. The registered office is the full physical address of the registered agent, where service of process or other legal or official correspondence can be delivered or served upon the company. This cannot be a PO Box.

f) This is the timeframe that the LLC will follow to establish a full year. Most businesses choose to follow the calendar year, which runs from January 1 through December 31; however, you can choose a different time frame as long as it is a full year. For example, your fiscal year can run from April 1 through March 31.

LLCs can structure ownership rights and voting rights together or separately. This depends on how you want voting rights to work within your new company.

b) If there is more than one class of membership units that will be issued then you can input the number of Class B units that the LLC may issue to its members here.

If the LLC is manager-managed, this section should detail which LLC member is the manager, the manager’s term, and how a manager is voted into their position. It should also outline the manager’s duties and their rights to enter into an agreement on behalf of the LLC. If applicable, it should also include any additional compensation for being a manager.

a) Manager-managed LLCs are granted authority to manage day-to-day operations but aren’t given all member authorities. If the members would rather take a passive investor role in the business, a manager-management structure is preferable. This structure may also be better if the members are not skilled in management, or if the LLC is large enough to the point where it’s no longer practical to have all members involved in every decision.

Capital contributions are the amount of property, services, or money that each member gives in the formation of the LLC and what they may be asked to give in the future. The LLC Operating Agreement should outline the members’ contributions and how they relate to their respective ownership interests. Certain agreements may grant ownership interests without a monetary capital contribution. When this is the case, the value of the member’s contribution should be clearly stated in the agreement.

Lastly, the section should include information on if and when the return of capital contributions may occur. Outlining this information now is key to properly forming your new LLC.

The LLC Operating Agreement should account for how net profits or net losses will be determined and how they will be distributed between the members. This is typically based on ownership percentage or different ownership brackets. An LLC Operating Agreement template provides you the flexibility to create an allocation scheme that fits your company’s needs. It will also discuss when distributions will be made and any prerequisite conditions necessary before distributions will occur.

This section outlines how and when the LLC will cease to operate. It outlines who decides to dissolve the LLC, voting rights, and any automatic dissolution conditions like death or bankruptcy. It will also detail the specific procedures for liquidating company assets, payment of obligations, and full accounting related to winding up the business. A well-drafted form agreement then outlines how remaining liabilities or assets are distributed to members of the LLC.

Indemnification sections also typically include insurance information. This section permits the LLC to purchase and maintain insurance for the company, its members, employees, and property.

This sample LLC Operating Agreement details an agreement between two members of the LLC. The two members, “Kenneth A Wenger” and “Hattie J Stamps,” agree on how the LLC will be run. Topics included are membership rights, allocation of profits and losses, what to do with salaries and expenses, and others.

With this free sample LLC Operating Agreement, you can build your operating agreement by filling in the blank sections. This template allows you to create an agreement that fits your company’s unique needs.

The purpose of an LLC is to protect the individual members from liability by protecting their assets. If the LLC is sued, the individual members and their assets should not be directly liable.

You can create your Operating Agreement for your LLC. Using a template form builder, you can quickly create an LLC Operating Agreement to create a binding legal document. While most states do not specifically require these agreements, they are an essential asset in protecting each member’s rights and the health of the LLC.

In most states, you do not have to have an LLC Operating Agreement at all. The LLC can still exist and still protects from individual liability. In the few states that do require Operating Agreements, it is typically required to form or maintain the entity and is used when a court scrutinizes how to treat the entity in a dispute or by the IRS in an audit. Certain states, like Delaware or New York, require an Operating Agreement.

Even for states that don’t require one, Operating Agreements are key evidence that an LLC is formed and the company is not a sole proprietorship or partnership in disguise. Without one, disputes between members will be subject to a state’s de facto LLC laws, which may not operate in your favor.

Yes, all members of an LLC have to sign the Operating Agreement. Members must sign the agreement to be bound to it. If a member doesn’t sign, they may not be legally obligated to follow the same rules as the rest. A dedicated section for each member’s signature is included in the above template.

An LLC agreement is the same as an LLC Operating Agreement, and they are often used as interchangeable terms. Some people, instead, say LLC agreement when referring to the Articles of Organization. The Articles of Organization are a separate but important part of forming the LLC with the state — making it a recognized legal entity.

Although you may not need a Business Plan, LLC Operating Agreements and Business Plans are important legal documents. There are some overlaps between the two documents, but they have different uses. A Business Plan lays out how a business will achieve its goals and objectives and is a useful internal document and vital for securing investment and funding. An LLC Operating Agreement, on the other hand, outlines how the business will be run, such as daily operations and member duties.

You can usually choose to form your company in any state; however, check your state laws and/or professional requirements to determine if the state you have chosen to form your business in or the specific type of business you are operating has a bona fide office requirement or other condition for doing business in the state that you have chosen. You do not need to make an LLC Operating Agreement for every state that you do business in.

A Limited Liability Company (LLC) Operating Agreement, also known as an LLC Company Agreement, is a legal document that establishes the rights and responsibilities of each LLC member and provides details such as:

To be an LLC member, an individual or corporation provides capital contributions in exchange for a percentage of ownership interest in the company. Use LawDepot’s LLC Operating Agreement template to describe each member’s contributions to your company and their role in internal management.

If you form an LLC inDelaware,Maine,Missouri, orNew York, state laws require you to create an Operating Agreement(though you don’t need to file the document with the government). If your state does not require a written company agreement, you should keep in mind that this document is crucial to your company’s internal operations.

As such, multi-member LLCs can use this agreement to reduce the chances of disputes between members. Single-member LLCs may also benefit from an Operating Agreement, especially if the sole member relies on a manager to conduct company business.

Without an LLC Operating Agreement, any legal actions against your company will rely on the provisions established by your state’s LLC code.Creating a company agreement allows you to exert more control over the rules that govern your company’s management.

To protect the interests of individual members, a company may require unanimous consent for certain actions—especially when a business decision has a significant impact on the success of the LLC. For example, members may require unanimous consent on critical issues, such as:

Expansion of the LLC may require significant financial investment with a large debt load. To limit the risk to individual members, they may set a dollar amount for acceptable levels of liability. Any liability over that amount would require the consent of all members.

Your LLC’s tax classification affects how you file federal income tax for your business. Contact a tax lawyer or a qualified accountant for help deciding which tax system works best for your business.

The unified tax audit rules (facilitated by the IRS) automatically apply to any business entity that is taxed as a partnership. These rules do not apply to single-member LLCs or to those that elect to be taxed as corporations.

Generally, an LLC that has at least two members is treated as a partnership for tax purposes. In this case, the business does not pay income tax but does pay employment and excise taxes. Each partner reports their earnings from the LLC on their personal tax return.

A single-member LLC is treated as a disregarded entity (also known as a sole proprietorship). In this case, the owner reports the company’s income and expenses on their personal tax return. However, a single-member LLC can elect to be taxed as a corporation instead.

You can change the terms of an LLC Operating Agreement only if the changes are documented in writing and signed by all the members of the LLC. Use LawDepot’s Contract Addendum to make changes to your existing Operating Agreement.

Although a few states require LLC members to create an Operating Agreement, you don’t need to file this internal document with the government. Instead, states require you to file your company’s Articles of Organization and annual reports.

8613371530291

8613371530291