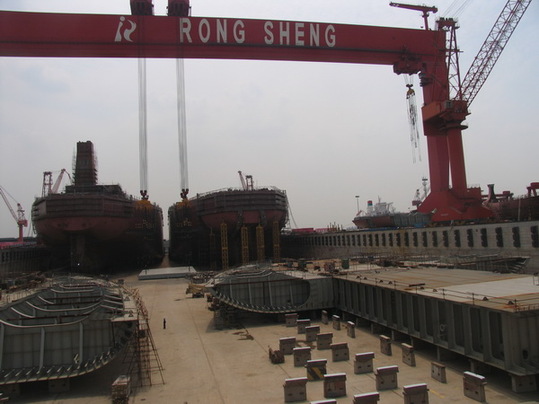

jiangsu rongsheng heavy industries factory

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country’s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

“The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company’s conservative sales strategy under the current trough stage of the shipbuilding market,” China Rongsheng said in a statement to the Hong Kong stock exchange.

Workers at Rongsheng’s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company’s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: “The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders.”

RM2CY8K6W–Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS CONSTRUCTION COMMODITIES)

RM2CXEFJ0–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96H39–--File--View of an exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 November 2010.

RM2HMPEWX–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW92M88–--FILE--The stand of Rongsheng Heavy Industries is seen during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Heavy Industries, whose

RMW95J26–--FILE--Zhang Zhirong, Chairman of Glorious Property Holdings Limited and Chairman of Rongsheng Heavy Industries Group Holdings Ltd., attends a ground

RMW961RD–--FILE--View of the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongsheng Heavy Industries

RMW95HXC–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RM2CWMP5X–A vacant dormitory is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HMPDMD–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China passes the finish line during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HKYKWJ–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (C) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW95J09–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RMW96KRG–--File--Visitors are seen in the exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 N

RM2D0PB6A–A closed police station is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY CRIME LAW)

RM2HKYJWB–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (R) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW96KTG–--FILE--People visit the headquarters of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 2010. Shipbuilder Chin

RMW92M7G–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Hea

RM2CYH4T9–Workers ride a motorcycle past closed restaurants at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYWMC–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW961KH–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongshe

RMW8CJA6–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east China"s Shandong province, 3 July 2013. Chinese

RMW8YJ5G–--FILE--A ship is being built at the shipyard of Rongsheng Heavy Industries in Rugao, Nantong city, east Chinas Jiangsu province, 12 December 2013.

RM2D01WH0–A worker rides a bicycle inside of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYH9T–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RMW8WYE1–--FILE--A signboard of Rongsheng is pictured at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 12 December 2013

RM2CXAAER–Workers ride motorcycles and bicycle after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96KPW–--FILE--Chinese workers are building a ship at the shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 20

RMW91GDK–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH4D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Guo Cheng/Xinhua/Alamy Live News

RM2CY7A2X–A worker rides a motorcycle on an empty street at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2CXP561–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW91GEJ–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH7D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW8YE7M–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industrie

RM2HN07XA–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2CXEBAD–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H43–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G5E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR4–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H40–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN20KG–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2CXCXJB–VIP guests visit a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H3M–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G8E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR2–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H6B–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN2122–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW8YE7R–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 23 May 2012. A heavily indebted Chinese shi

RM2HMMKN4–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HN211R–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng pf China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CWKEG9–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW96MJM–--FILE--A shipbuilding plant of China Rongsheng Heavy Industries Group Holdings Ltd is seen in Nantong city, east Chinas Jiangsu province, 23 May 2012

RMW96KT6–--FILE--Chinese workers walk past the logo of China Rongsheng Heavy Industries Group Holdings Ltd in an office building in Nantong city, east Chinas A

RM2HN1YFX–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW93F2K–--FILE--Chinese workers queue up to board a bus at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 23 August 201

RMW93H3T–--FILE--Chinese employees work at a shipbuilding plant of Jiangsu Rongsheng Heavy Industries Group Co. ,Ltd. in Nantong, east Chinas Jiangsu province,

RMW98F60–53-year old Hang Rongsheng measures the model of the Yellow Crane Tower, made from toothpicks, in Shanghai, China, 22 August 2011. Hang Rongsheng, c

RM2CWXTEK–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW92M4W–--FILE--Staff are seen at the stand of Jinhai Heavy Industry Co., during Marintec China in Shanghai, China, 29 November 2012. With orders for new

RM2CYTC7F–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RMW91T3D–--FILE--A ship being built is seen at the shipyard of Jinhai Heavy Industry Co., on an island of Zhoushan Archipelago, southeast chinas Zhejiang provi

RM2HN0DAN–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2HMN1WC–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2E65YM2–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2HMN27W–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D0R611–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in a office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2CWWX07–A company logo is seen at the entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2HMN1W5–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CXHEMX–Workers ride motorcycles and bicycles after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2CXAP7K–Labourers stand on a new ship at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINABUSINESS MARITI

RM2HMN21C–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D07154–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HMN3MK–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HM9EFM–Zhangjiakou, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the men"s cross-country skiing sprint free qualification of the Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HN20G7–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) and Wang Qiang of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2E68M95–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HKXK7X–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km + 15km Skiathlon - National Cross-Country Centre, Zhangjiakou, China - February 6, 2022. Liu Rongsheng of China in action. REUTERS/Hannah Mckay

RM2HMMB79–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN20T2–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Shang Jincai (L) and Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HMMAPC–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HMYH8D–2022 Beijing Olympics - Cross-Country Skiing - Men"s 4 x 10km Relay - National Cross-Country Centre, Zhangjiakou, China - February 13, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN0D6W–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China and Antoine Cyr of Canada compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HN214K–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Antoine Cyr (L) of Canada and Liu Rongsheng of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HM92R3–Beijing, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s sprint free qulification match of Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2FMJX8F–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Liu Rongsheng of National Cross-Country Skiing Team competes during the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Hou Zhaokang/Xinhua/Alamy Live News

RM2FMJX8B–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Shang Jincai (L) and Liu Rongsheng of National Cross-Country Skiing Team celebrate after finishing the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Zanghaer Bolati/Xinhua/Alamy Live News

RM2HP7A4F–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP6R28–Beijing, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP7GR8–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HP79RK–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP799D–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Hadesi Badelihan (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP6W5G–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China passes the finish line during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP79F3–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP71XE–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (L) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

--FILE--A shipbuilding plant of China Rongsheng Heavy Industries Group Holdings Ltd is seen in Nantong city, east Chinas Jiangsu province, 23 May 2012. China Rongsheng Heavy Industries Group Holdings Ltd may report its first annual loss in four years amid a slump in the shipbuilding market. The decline in demand has led to the sharp decrease in orders and prices of vessels compared with the same period last year, Rongsheng Chinas largest private shipbuilder, said in a filing to the Hong Kong stock exchange yesterday (24 December 2012), without giving figures. The shipbuilder in August reported an 82 percent plunge in first-half earnings as a global economic slowdown and overcapacity sank demand for vessels.

Back in 2008, Rongsheng Heavy Industries Co failed in its bid to raise more than $2 billion from a planned IPO in Hong Kong, mainly due to the global financial crisis. But things are looking up again for the company as it is looking to list in the city this week.

Meanwhile, China"s biggest private shipbuilder Jiangsu Rongsheng Heavy Industries Co, which last year won a $484 million order to build four vessels for Oman Shipping Company, is also gaining significant exposure to the engineering machinery market via its expansion company, Rong"an Heavy Industries.

Founded by Rongsheng, Rong"an Heavy Industries was established in March of this year at the Hefei hi-tech industrial area in Anhui province. With a total investment of 60 million yuan, the new firm plans an annual output of 3 million hydraulic excavators, 1,000 crawler cranes, 5,000 tower cranes, 17,860 truck cranes and 500 rotary drilling rigs. The output is worth some 300 billion yuan. And from previously being one of the lower-ranking engineering machinery production bases in China, Hefei is now one of the largest.

"We are planning to begin operations in June next year," said Deng Hui, president of Rong"an Power Machinery Co Ltd, another Rongsheng engineering machinery market investment.

Rongsheng Heavy Industries is a large-scale heavy industry enterprise group that possesses manufacturing bases for shipbuilding and offshore engineering in Nantong, Jiangsu province. It also manufactures diesel engines in Hefei.

Trading of shares and all structured products related to the company was suspended pending clarification of “news articles and possible inside information,” Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported yesterday, citing Lei Dong, secretary to the Shanghai- based company’s president, that more than half of the employees laid off were subcontractors and the rest full-time workers.

Rongsheng shares slumped 10 percent yesterday after the company said some idled contract workers had engaged in “disruptive” activities by surrounding the entrance of its factory in east China’s Jiangsu province. China’s shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongsheng’s 2012 revenue.

“Rongsheng’s move reflects the bad market,” said Lawrence Li, an analyst at UOB-Kay Hian Holdings Ltd. in Shanghai. “More small-to-medium sized shipyards, especially those that lack government support, may take the same actions or even close down.”

Rongsheng spokesman William Li declined to comment on the Journal report. Four calls to Lei’s office at Rongsheng went unanswered. Rongsheng Chairman Chen Qiang also declined to comment today.

Rongsheng had as many as 38,000 workers including its own employees and contract staff at the peak of the industry boom a few years ago, UOB-Kay Hian’s Li said.

China Rongsheng posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, according to data compiled by Bloomberg. It had short-term debt of 19.3 billion yuan as of the end of 2012, the data show.

Rongsheng received orders to build a total of 16 Valemax vessels from Brazilian miner Vale SA and Oman Shipping Co. and had delivered 10 as of April. The commodity ships, among the biggest afloat, are about twice the size of the capesize vessels that have traditionally hauled iron ore from Brazil to China.

The company’s cash conversion cycle, a gauge of days required to convert resources into cash, more than doubled to 582 last year from 224 in 2011, the data show. China Rongsheng shares have fallen 15 percent this year in Hong Kong, compared with a 11 percent decline for the benchmark Hang Seng Index.

HONG KONG, May 24, 2011 /PRNewswire-Asia/ -- China Rongsheng Heavy Industries Group Holdings Limited ("China Rongsheng Heavy Industries" or the "Group"; stock code: 01101.HK), a large heavy industries group in China, has collaborated with China National Offshore Oil Corporation ("CNOOC") to construct the world"s first-ever 3,000-meter deepwater pipe laying crane vessel ("DPV") "Ocean Pec 201". A national major science and technology project conference and a christening ceremony to celebrate the completion of the vessel were held in Rugao City, Jiangsu today.

The DPV "Ocean Pec 201" was the culmination of the first joint offshore engineering project of CNOOC and China Rongsheng Heavy Industries. The project started in May 2005 and construction of the vessel commenced in September 2008. Offshore Oil Engineering Co., Ltd. ("COOEC"), a listed company held by CNOOC, was responsible for all construction cost as well as the operation upon completion. The christening ceremony today symbolised that the construction of the DPV has completed the outfitting and testing stages and is at the final stage of trial voyage and delivery.

Guests including top management of China Rongsheng Heavy Industries and its partners together with leading officials of the local Government presided over the occasion and officiated at the ribbon-cutting ceremony. Business executives included Mr. Zhou Shouwei, Vice President of CNOOC and academician at the Chinese Academy of Engineering; Mr. Zhou Xuezhong, President of COOEC; Mr. Zhang Dehuang, Chairman of Jiangsu Rongsheng Investment Group Co. Ltd; Mr. Chen Qiang, Chief Executive Officer of China Rongsheng Heavy Industries and Mr. Chen Guorong, President of Jiangsu Rongsheng Heavy Industries Co., Ltd. Local officials included Mr. Qinyan from the Jiangsu Economic and Information Technology Commission and Ms. Chen Huijuan, Deputy Mayor of Nantong & Secretary of Rugao Municipal Committee of the Communist Party of China.

Mr. Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, ""Ocean Pec 201" is an important part of the demonstration engineering projects. It includes major equipment and ancillary engineering technology for offshore deepwater engineering projects among the major national science and technology programmes under China"s Eleventh Five-Year Plan. The entry of CNOOC in deep water exploitation creates opportunities for the offshore engineering sector in China and enhances the overall capability of the related manufacturing and metallurgy industries in China. The christening and impending trial voyage of the semi-submersible drilling rig "Ocean Pec 981" and DVP "Ocean Pec 201" highlights China"s ability to develop sophisticated equipment in the offshore engineering sector and its competitiveness in the international market."

"Ocean Pec 201" is the world"s first deepwater pipe laying crane vessel featuring 3,000-meter deepwater pipe-laying, 4,000 tonnes of lifting capacity and DP-3(1) dynamic positioning capability(2). The vessel is able to operate in any navigable area globally except for the Arctic regions. It is equipped with a series of advanced equipment including electric propulsion, VF electric drive, DP-3 dynamic positioning, "S" type deepwater dual node pipe-laying system as well as a 4,000-tonne heavy offshore crane. The vessel was designed and built in China. With a crew of 380, it is the first offshore engineering vessel in Asia and China capable of laying pipes at a water depth of 3,000 meters. The overall technology and capacity are also superior to similar vessels overseas.

Mr. Chen added, "Offshore engineering has been the major focus of the Group. We now own China"s largest offshore engineering dock equipped with China"s largest gantry crane with a lifting capacity of 1,600 tonnes. The DPV is the first collaborative project between CNOOC and China Rongsheng Heavy Industries. In the future, we expect to further strategically cooperate with CNOOC in the offshore engineering field. Upon completion of the "Ocean Pec 201", China Rongsheng Heavy Industries intends to further strengthen its design and construction capabilities, and lay a solid foundation to expand its offshore engineering business."

Mr. Chen concluded, "Looking ahead, the Group will continue to gradually expand our operating scale as stated in the prospectus and focus on high-end manufacturing and the development of large containerships to maintain our leadership in the shipbuilding engineering sector. We will also make marine engine building and offshore engineering our new growth drivers. Our aim is to develop the Group into a leading global heavy industries group and take the heavy industries in China onto the international stage."

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries" business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. China Rongsheng Heavy Industries" products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Group"s products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.

As hard times continue in the shipbuilding industry, former giant Rongsheng is in deep financial trouble. The company hopes a move into the energy sector can change its fortunes, but analysts are skeptical.

Amid dark times in the global shipbuilding industry, another of China"s major players appears to be on the verge of bankruptcy. China Rongsheng Heavy Industries Group used to be the largest private shipbuilder in the country, but is now seeking potential buyers to help get it out of deep financial problems.

In the past few months, many workers have left Rongsheng"s plant in Nantong, East China"s Jiangsu Province, which stopped production after it delivered a ship to Brazilian iron ore giant Vale in January, Caixin magazine reported on March 9.

The once-busy plant in Nantong used to have as many as 30,000 workers, but now "only several thousand of them are still there," a Rongsheng employee who declined to be named told the Global Times on Tuesday.

The employee has been working at Rongsheng for more than five years, but said he will also be leaving the company soon. Having watched the ups and downs of Rongsheng, he said he will not be staying in the shipbuilding industry either. "It has been such a sad story for the industry," he said.

No more plain sailingRongsheng was founded by entrepreneur Zhang Zhirong in 2005, when the shipbuilding industry was booming. The initial designed annual capacity of the plant in Nantong was as much as 3.5 million dead weight tons, nearly the same as the total annual capacity of State-owned China State Shipbuilding Corp at that time, according to the Caixin report.

But the global shipbuilding industry found itself in a severe recession when the world economy was hit by the financial crisis in 2008. Many private shipbuilders went bankrupt in the ensuing years, but even then few people thought the same fate would befall Rongsheng.

Many shipbuilders became very cautious about accepting new orders under these circumstances, given the huge amounts of capital needed to build a ship. But Rongsheng did the opposite and increased its orders. The Caixin report said that Rongsheng gained the most orders among all shipbuilders in China from 2010 to 2012.

"Good order figures may have helped the financing, but Rongsheng should have been more cautious about expanding during an overall industry downturn," Wang Danqing, a partner at Beijing-based ACME Consultancy, told the Global Times on Tuesday.

The Rongsheng employee said that poor management has also been a major factor behind Rongsheng"s predicament. Deliveries of many of the orders have been delayed, giving ship buyers the option of abandoning the order and claiming compensation.

Seeking a way outRongsheng has been trying to diversify in order to get over the current difficulties, and is now preparing for a move into the energy sector. The company announced on Friday that its board of directors had agreed to change its name to China Huarong Energy Co, according to a filing with the Hong Kong bourse.

Wang Shaojian, Rongsheng"s chief financial officer, told the media he was "confident" in the prospects for Rongsheng in the energy sector. The company has already started making moves in this regard. In August 2014, it announced that it had acquired a 60 percent stake in a subsidiary of New Continental Oil & Gas (HK) Co in Kyrgyzstan, giving Rongsheng equity in an oil field in the country.

"It [the transition] is a risky move, and the prospects are not that optimistic given that they are two quite different industries," Shanghai-based independent industry expert Wu Minghua told the Global Times on Tuesday.

Wu noted that Rongsheng may lack the expertise and talent required for the oil industry, adding that it will have to compete with even bigger rivals in the sector.

Rongsheng is also trying to streamline its business. It said in a filing on Tuesday that it has signed a memorandum with a potential buyer for it to acquire Rongsheng"s shipbuilding and ocean engineering business, as well as its debts.

Yangzijiang Shipbuilding declined to comment on the matter when contacted by the Global Times on Wednesday. Rongsheng also declined to comment, saying that it is now in a "quiet period," prior to further announcements.

8613371530291

8613371530291