jiangsu rongsheng heavy industries free sample

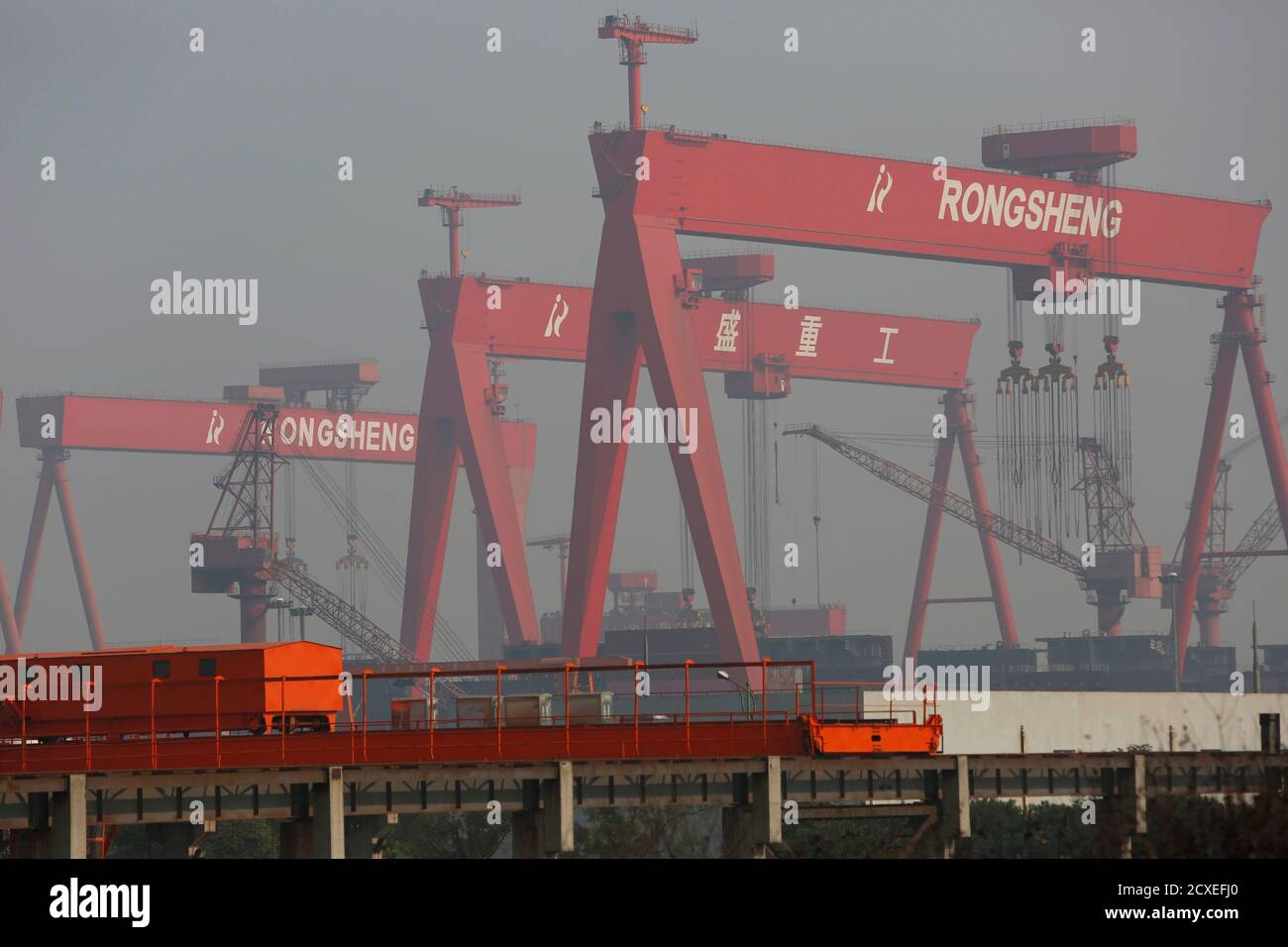

You can use this royalty-free editorial photo "Ship is being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east China"s Jiangsu province, 12 October 2012" for personal and non-commercial purposes according to the Standard License. This stock image may be used to illustrate stories in newspaper and magazine articles and blog posts. Please note that editorial stock photos may not be used in advertising or promotional material.

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 18 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

On Monday, Rongsheng shares dropped as much as 18 percent to HK$1.15, a record low, leaving the company with a market capitalization of just over $1 billion. The company also issued a profit warning, saying first-half earnings would fall sharply as a result of a global shipbuilding downturn, a factor that has already pushed its shares down more than 75 percent in the past year.

Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said in a Hong Kong filing that it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

NHST Media Group is the leading news provider in the shipping, seafood, and energy industries, with a number of English- and Norwegian-language news publications across a variety of sectors. Read more about NHST Media Group here.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

In the 1940s the world moved on from Colonial System to Globalisation. This movement was accompanied by rapidly growing trade and the need for effective means of transport and its systems. Shipping industry has explored every chance and anchored in the world trade. Over the 50 years, seaborne trade grew by 64 per cent faster than GDP (Stopford, 2007). The growth was not stable: 1960-1975 seaborne trade was driven well above GDP trend due to increased consumption of raw materials by industries of Europe and Japan; in 1980-1996, sea trade was below GDP trend because of two oil crises of 1973 and 1979; 1997-2005 seaborne trade was above world GDP due to the growth of Asian countries. In 2008, before the crisis, maritime nations imported 2.7 billion tons of energy commodities (oil, coal and gas); 500 million tons of agricultural product (grain, fertilizer sugars, etc); 1 billion tons of raw materials (Stopford, 2007). The development of new technologies for communication (telephone, telex, fax, email, and world wide web), fast travelling (air transport), globalized materials and market supply (opening new energy sources, reducing transport costs by developing special types of ships, mechanized cargo handling, containerization), and business models (newly-developed flags, long-term time charters) assisted successful growth of the seaborne trade. In this context, the development of shipbuilding industry also wasn’t monotonous. Let follow briefly what caused changes.

The demographic status of the world"s population is shown in the Figure 8. World population as that of July 2010 was approximately 6.83 billion (Geohive, 2011) and is going to grow up: the mid-range estimate is 9.08 billion people by 2050 (DSD, 2008). Due to the fact that the main countries of growing population are India, Nigeria, North America, Pakistan, Indonesia, and China, main trade directions servicing the development of regional industries and international companies have to be clear. If China add extra billion tons of the trade in the nearest future the foreign shipping companies will not win much because of Chinese policy to enlarge its own fleet for servicing its own internal and external trade.

A noteworthy growth in the use of polyester in textile industry including apparel & home furnishing, rising demand for polyester filament in manufacturing of automotive textile, expansion of technical textile industry, favourable government policies, positive movement in international prices of the raw materials are the factors fuelling the polyester filament market. Polyester filament is versatile and relatively applicable in large areas. (from consumer apparel to heavy industrial applications)

The major players in global polyester filament market include Tongkun Group, Reliance, Zhejiang Hengyi Group, Shenghong, Xin Feng Ming Group, Hengli Group, Million Industrial, Jiangsu Sanfangxiang Group, Nanya, Rongsheng PetroChemical, Sinopec Yizheng Chemical Fibre, Zhejiang GuXianDao Industrial Fiber, Far Eastern New Century, DAK Americas, Advansa and Lealea Group among others. Leaders are providing better opportunities and continuously focused on new product developments and venture capital investments to capture market share. For instance, there was a joint acquisition of German polyester producer Trevira by Indorama of Thailand and Sinterama of Italy so as to face significant competitors.

The application segment includes recycle polyester, performance and functional wear fabrics, home textiles and other. The demand for recycled polyester filament is growing in apparel, fashion, and retail industries moving towards development and production of new products. Developed countries around the world are supporting the idea of using recycled polyester in various industries. Brands are increasingly incorporating recycled polyester filament yarns made from plastic bottles in the apparel products.

The regions analysed for the market include North America, Europe, South America, Asia Pacific, and Middle East and Africa. Asia Pacific region dominated the global polyester filament market in 2017 where as the North America region is growing rapidly in the market. The Asia Pacific region is a major consuming region globally, where the fast-growing textile Industries (weaving, garment manufacturing, dyeing and finishing) have been consuming increasing amounts of polyester fibres. By far, China holds major proportion of overall polyester consumption in Asia region, followed by India and Southeast Asia. North America is the fastest growing region as there is a substantial growth and improvements in technology which may channelize the growth of the market.

Fior Markets is a futuristic market intelligence company, helping customers flourish their business strategies and make better decisions using actionable intelligence. With transparent information pool, we meet clients’ objectives, commitments on high standard and targeting possible prospects for SWOT analysis and market research reports. Fior Markets deploys a wide range of regional and global market intelligence research reports including industries like technology, pharmaceutical, consumer goods, food and beverages, chemicals, media, materials and many others. Our Strategic Intelligence capabilities are purposely planned to boost your business extension and elucidate the vigor of diverse industry. We hold distinguished units of highly expert analysts and consultants according to their respective domains. The global market research reports we provide involve both qualitative and quantitative analysis of current market scenario as per the geographical regions segregated and comprehensive performance in different regions with global approach. In addition, our syndicated research reports offer a packaged guide to keep companies abreast of the upcoming major restyle in their domains. Fior Markets facilitates clients with research analysis that are customized to their exact requirements, specifications and challenges, whether it is comprehensive desk research, survey work, composition of multiple methods, in-detailed interviewing or competitive intelligence. Our research experts are experienced in matching the exact personnel and methodology to your business need.

8613371530291

8613371530291