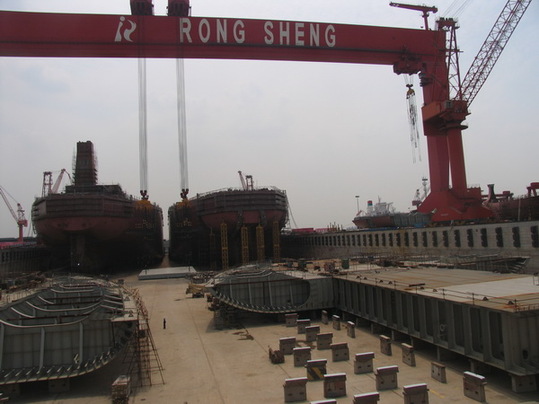

jiangsu rongsheng heavy industries co ltd factory

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

The shipyard, located in the Yangtze River Delta, was founded in 2006, and became the largest private shipbuilder in China, churning out giant valemaxes at its four large dry-docks, before a massive financial collapse forced it to cease operations in 2014.

Broking sources in China tell Splash that the yard’s former chief operating officer David Luan is now preparing to officially reopen the yard, to be known as SPS Shipyard, a reference to ShipParts.com, a business he created in 2015 after quitting Rongsheng.

Luan has tapped an old client, George Economou’s TMS Dry, to come in with the first orders at the reopened yard with the Greek owner signing a letter of intent for six firm 82,000 dwt kamsarmaxes and four 180,000 dwt capes. The deal comes with options for four more kamsarmaxes and pricing is understood to be a bargain – at $33m per kamsarmax and $62m per cape. The first ship will deliver in Q3 2024.

RM2CY8K6W–Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS CONSTRUCTION COMMODITIES)

RM2CXEFJ0–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96H39–--File--View of an exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 November 2010.

RM2HMPEWX–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW92M88–--FILE--The stand of Rongsheng Heavy Industries is seen during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Heavy Industries, whose

RMW95J26–--FILE--Zhang Zhirong, Chairman of Glorious Property Holdings Limited and Chairman of Rongsheng Heavy Industries Group Holdings Ltd., attends a ground

RMW961RD–--FILE--View of the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongsheng Heavy Industries

RMW95HXC–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RM2CWMP5X–A vacant dormitory is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HMPDMD–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China passes the finish line during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HKYKWJ–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (C) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW95J09–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RMW96KRG–--File--Visitors are seen in the exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 N

RM2D0PB6A–A closed police station is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY CRIME LAW)

RM2HKYJWB–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (R) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW96KTG–--FILE--People visit the headquarters of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 2010. Shipbuilder Chin

RMW92M7G–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Hea

RM2CYH4T9–Workers ride a motorcycle past closed restaurants at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYWMC–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW961KH–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongshe

RMW8CJA6–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east China"s Shandong province, 3 July 2013. Chinese

RMW8YJ5G–--FILE--A ship is being built at the shipyard of Rongsheng Heavy Industries in Rugao, Nantong city, east Chinas Jiangsu province, 12 December 2013.

RM2D01WH0–A worker rides a bicycle inside of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYH9T–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RMW8WYE1–--FILE--A signboard of Rongsheng is pictured at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 12 December 2013

RM2CXAAER–Workers ride motorcycles and bicycle after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96KPW–--FILE--Chinese workers are building a ship at the shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 20

RMW91GDK–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH4D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Guo Cheng/Xinhua/Alamy Live News

RM2CY7A2X–A worker rides a motorcycle on an empty street at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2CXP561–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW91GEJ–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH7D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW8YE7M–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industrie

RM2HN07XA–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2CXEBAD–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H43–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G5E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR4–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H40–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN20KG–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2CXCXJB–VIP guests visit a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H3M–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G8E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR2–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H6B–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN2122–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW8YE7R–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 23 May 2012. A heavily indebted Chinese shi

RM2HMMKN4–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HN211R–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng pf China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CWKEG9–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW96MJM–--FILE--A shipbuilding plant of China Rongsheng Heavy Industries Group Holdings Ltd is seen in Nantong city, east Chinas Jiangsu province, 23 May 2012

RMW96KT6–--FILE--Chinese workers walk past the logo of China Rongsheng Heavy Industries Group Holdings Ltd in an office building in Nantong city, east Chinas A

RM2HN1YFX–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW93F2K–--FILE--Chinese workers queue up to board a bus at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 23 August 201

RMW93H3T–--FILE--Chinese employees work at a shipbuilding plant of Jiangsu Rongsheng Heavy Industries Group Co. ,Ltd. in Nantong, east Chinas Jiangsu province,

RMW98F60–53-year old Hang Rongsheng measures the model of the Yellow Crane Tower, made from toothpicks, in Shanghai, China, 22 August 2011. Hang Rongsheng, c

RM2CWXTEK–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW92M4W–--FILE--Staff are seen at the stand of Jinhai Heavy Industry Co., during Marintec China in Shanghai, China, 29 November 2012. With orders for new

RM2CYTC7F–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RMW91T3D–--FILE--A ship being built is seen at the shipyard of Jinhai Heavy Industry Co., on an island of Zhoushan Archipelago, southeast chinas Zhejiang provi

RM2HN0DAN–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2HMN1WC–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2E65YM2–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2HMN27W–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D0R611–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in a office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2CWWX07–A company logo is seen at the entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2HMN1W5–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CXHEMX–Workers ride motorcycles and bicycles after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2CXAP7K–Labourers stand on a new ship at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINABUSINESS MARITI

RM2HMN21C–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D07154–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HMN3MK–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HM9EFM–Zhangjiakou, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the men"s cross-country skiing sprint free qualification of the Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HN20G7–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) and Wang Qiang of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2E68M95–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HKXK7X–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km + 15km Skiathlon - National Cross-Country Centre, Zhangjiakou, China - February 6, 2022. Liu Rongsheng of China in action. REUTERS/Hannah Mckay

RM2HMMB79–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN20T2–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Shang Jincai (L) and Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HMMAPC–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HMYH8D–2022 Beijing Olympics - Cross-Country Skiing - Men"s 4 x 10km Relay - National Cross-Country Centre, Zhangjiakou, China - February 13, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN0D6W–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China and Antoine Cyr of Canada compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HN214K–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Antoine Cyr (L) of Canada and Liu Rongsheng of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HM92R3–Beijing, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s sprint free qulification match of Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2FMJX8F–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Liu Rongsheng of National Cross-Country Skiing Team competes during the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Hou Zhaokang/Xinhua/Alamy Live News

RM2FMJX8B–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Shang Jincai (L) and Liu Rongsheng of National Cross-Country Skiing Team celebrate after finishing the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Zanghaer Bolati/Xinhua/Alamy Live News

RM2HP7A4F–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP6R28–Beijing, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP7GR8–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HP79RK–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP799D–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Hadesi Badelihan (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP6W5G–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China passes the finish line during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP79F3–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP71XE–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (L) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

The shipbuilder’s net debt to equity, a measure of indebtedness, climbed to 134 percent in January-June from 119 percent in 2012 and 85 percent in 2011. Talks with its banking syndicate are ongoing, with no indication when a deal could be struck, a person at one of the banks told Reuters this week.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China’s economic growth began to slow and credit tightened at a time when global shipping, too, turned down.

“The lottery has become increasingly popular,” said a girl working the till. “I’m not sure why really, but perhaps people are hoping they can win something here.”

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country’s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

“The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company’s conservative sales strategy under the current trough stage of the shipbuilding market,” China Rongsheng said in a statement to the Hong Kong stock exchange.

Analysts have said the company could be the biggest casualty of a local shipbuilding industry suffering from overcapacity and shrinking orders amid a global shipping downturn.

Workers at Rongsheng’s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company’s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: “The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders.”

A company spokesman told Reuters late on Wednesday that the shipyard had no confirmed new orders so far in the second half of the year. He declined to elaborate.

The spokesman said the company had delivered 7 vessels, with a total of 1.5 million dead weight tonnes (DWT), in the first half of 2013, and had delivered at least two 380,000-DWT class very large ore carriers in the second half of the year.

Back in 2008, Rongsheng Heavy Industries Co failed in its bid to raise more than $2 billion from a planned IPO in Hong Kong, mainly due to the global financial crisis. But things are looking up again for the company as it is looking to list in the city this week.

Meanwhile, China"s biggest private shipbuilder Jiangsu Rongsheng Heavy Industries Co, which last year won a $484 million order to build four vessels for Oman Shipping Company, is also gaining significant exposure to the engineering machinery market via its expansion company, Rong"an Heavy Industries.

Founded by Rongsheng, Rong"an Heavy Industries was established in March of this year at the Hefei hi-tech industrial area in Anhui province. With a total investment of 60 million yuan, the new firm plans an annual output of 3 million hydraulic excavators, 1,000 crawler cranes, 5,000 tower cranes, 17,860 truck cranes and 500 rotary drilling rigs. The output is worth some 300 billion yuan. And from previously being one of the lower-ranking engineering machinery production bases in China, Hefei is now one of the largest.

"We are planning to begin operations in June next year," said Deng Hui, president of Rong"an Power Machinery Co Ltd, another Rongsheng engineering machinery market investment.

Rongsheng Heavy Industries is a large-scale heavy industry enterprise group that possesses manufacturing bases for shipbuilding and offshore engineering in Nantong, Jiangsu province. It also manufactures diesel engines in Hefei.

Trading of shares and all structured products related to the company was suspended pending clarification of “news articles and possible inside information,” Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported yesterday, citing Lei Dong, secretary to the Shanghai- based company’s president, that more than half of the employees laid off were subcontractors and the rest full-time workers.

Rongsheng shares slumped 10 percent yesterday after the company said some idled contract workers had engaged in “disruptive” activities by surrounding the entrance of its factory in east China’s Jiangsu province. China’s shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongsheng’s 2012 revenue.

“Rongsheng’s move reflects the bad market,” said Lawrence Li, an analyst at UOB-Kay Hian Holdings Ltd. in Shanghai. “More small-to-medium sized shipyards, especially those that lack government support, may take the same actions or even close down.”

Rongsheng spokesman William Li declined to comment on the Journal report. Four calls to Lei’s office at Rongsheng went unanswered. Rongsheng Chairman Chen Qiang also declined to comment today.

Rongsheng had as many as 38,000 workers including its own employees and contract staff at the peak of the industry boom a few years ago, UOB-Kay Hian’s Li said.

The order book at China’s shipbuilders fell 23 percent at the end of May from a year earlier, according to data from the China Association of the National Shipbuilding Industry. Yards have reduced down-payment requirements, with some slashing their rates to as little as 2.5 percent of contract value compared with 20 percent before 2010, according to UOB-Kay Hian.

Economic growth in China has held below 8 percent for the past four quarters, the first time that has happened in at least 20 years. The nation’s clampdown on excessive short-term borrowing sent the overnight repurchase rate to a record 13.91 percent last month, forcing at least 22 companies including China Development Bank Corp., a backer of the shipping industry, to cancel or delay bond sales.

China Rongsheng posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, according to data compiled by Bloomberg. It had short-term debt of 19.3 billion yuan as of the end of 2012, the data show.

Rongsheng received orders to build a total of 16 Valemax vessels from Brazilian miner Vale SA and Oman Shipping Co. and had delivered 10 as of April. The commodity ships, among the biggest afloat, are about twice the size of the capesize vessels that have traditionally hauled iron ore from Brazil to China.

The company’s cash conversion cycle, a gauge of days required to convert resources into cash, more than doubled to 582 last year from 224 in 2011, the data show. China Rongsheng shares have fallen 15 percent this year in Hong Kong, compared with a 11 percent decline for the benchmark Hang Seng Index.

Ten of the 14 analysts tracked by Bloomberg recommend selling the stock with the rest rating it hold. The company raised HK$14 billion in its initial public offer in 2010.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

On August 10, 2011, a delegation of 19 people visited rongan power headed by president Chen Guorong, vice president Chang Jianhua and Zhang Hongyun of Jiangsu Rongsheng Heavy Industries Co., Ltd.. enterprise leaders Zou Zhiming, Yu Zheng, Wang Zhiliang, Xu Baoan, Ling Li, Chen Guangqing, Feng Jianjun, Xu Wenyou, Chen Shaozhong warmly welcomed the delegation. After successive visit to big parts processing workshop, preassembly workshop, assembly workshop and Rongan Basin, a business exchange meeting was held. Rongan Power assistant president Mr. Xu Wenyou made a detailed introduction to the guests on enterprise development history, planning, equipment, production capacity and situation. On the meeting, both sides also went deep into frontier technology share, future development direction and how to strengthen bilateral cooperation.

After the meeting, Related department responsible persons in charge of technology, quality, auditing, H.R., procurement, security, finance etc. had a heated group discussion with their counterparts.

Valemax ships are a fleet of very large ore carriers (VLOC) owned or chartered by the Brazilian mining company Vale S.A. to carry iron ore from Brazil to European and Asian ports. With a capacity ranging from 380,000 to 400,000 tons deadweight, the vessels meet the Chinamax standard of ship measurements for limits on draft and beam. Valemax ships are the largest bulk carriers ever constructed, when measuring deadweight tonnage or length overall, and are amongst the longest ships of any type currently in service.

The first Valemax vessel, Vale Brasil, was delivered in 2011. Initially, all 35 ships of the first series were expected to be in service by 2013, but the last ship was not delivered until September 2016. In late 2015 and early 2016, Chinese shipping companies ordered 30 more ships with deliveries in 2018–2020. Three additional vessels were ordered by a Japanese shipping company, bringing the total number of Valemax vessels to 68 as of 2020

In 2008, Vale placed orders for twelve 400,000-ton Valemax ships to be constructed by Jiangsu Rongsheng Heavy Industries (RSHI) in China and ordered seven more ships from South Korean Daewoo Shipbuilding & Marine Engineering (DSME) in 2009. In addition sixteen more ships of similar size were ordered from Chinese and South Korean shipyards for other shipping companies, and chartered to Vale under long-term contracts. The first vessel was delivered in 2011 and the last in 2016.

The first Valemax vessels were ordered on 3 August 2008 when Vale signed a contract with the Chinese shipbuilder Jiangsu Rongsheng Heavy Industries (RSHI) for the construction of twelve 400,000-ton ore carriers. The development had reportedly started in 2007.

The second RSHI-built Valemax ship for Vale (Vale Dongjiakou) was delivered on 9 April 2012,Vale Dalian) on 20 May,Vale Hebei) on 28 September,Vale Shandong) on 7 December 2012,Vale Jiangsu) on 23 March 2013,Vale Caofeidian) on 22 July 2013,Vale Lianyungang) on 22 November 2013,Ore Majishan; renamed before delivery) on 11 July 2014,Ore Tianjin; renamed before delivery) on 18 October 2014,Ore Rizhao; renamed before delivery) on 15 December 2014.Valemax vessel of the original order by Vale, Ore Ningbo (renamed before delivery), was delivered on 23 January 2015.

On 2 November 2008, Oman Shipping Company signed a framework agreement with RSHI for the construction of four 400,000-ton vessels to transport iron ore from Brazil to the Port of Sohar in Oman, where Vale is expected to open a steel plant in near future.Jazer, Yanqul, Al Kamil and Wafi,Vale Liwa, Vale Sohar, Vale Shinas and Vale Saham. The steel cutting ceremony for the first two vessels was held on 8 July 2010 and they were launched on 19 March 2012.Vale Liwa entered service in August 2012, followed by Vale Sohar in September 2012, Vale Saham in January 2013, and Vale Shinas in March 2013. The ships reportedly received additional strengthening due to the Vale Beijing incident.classification societies such as American Bureau of Shipping and Lloyd"s Register.

The Chinese shipbuilder"s ability to deliver any of the very large ore carriers ordered by Vale in time was doubted already before the first ship was built.Valemax vessels will be delivered from the Chinese shipyard in 2011 instead of the planned six due to delays in construction.Vale China) was delivered before the end of the year. Furthermore, later reports claimed that the ships ordered by Vale had a capacity of only 380,000 tons even though according to the Det Norske Veritas database entries all Chinese-built ships have a deadweight tonnage in excess of 400,000 tons and in the past Vale has referred to the ships ordered from Rongsheng as "400,000-ton" vessels. The reduction in cargo capacity, at least on paper, may have been due to the reluctance of Chinese officials to accept the 400,000-ton ships to Chinese ports.

In April 2012, it was reported that Vale had refused delivery for three Valemax ships recently completed by Jiangsu Rongsheng Heavy Industries. This was seen as a move against the Chinese officials who have not allowed the 400,000-ton ships to dock in Chinese ports.

In addition to the ships Vale ordered for itself, more ships of similar size were to be built for other shipping companies and chartered to Vale under exclusive long-term contracts. Eight very large ore carriers were ordered from the South Korean shipbuilder STX Offshore & Shipbuilding in Jinhae, South Korea (STX Jinhae), and Dalian, China (STX Dalian). The shipping company, STX Pan Ocean, signed a 25-year contract with Vale in 2009.Valemax vessels built by STX, 374,400 tons, is slightly smaller than that of the similar ships built by DSME and RSHI.

The first STX-built Valemax vessel, Vale Beijing, was delivered by STX Jinhae on 27 September 2011. Although another vessel was expected to take delivery later that year, only one ship was delivered. The second ship, Vale Qingdao, was delivered also by STX Jinhae on 13 April 2012,Vale Espirito Santo and Vale Indonesia, were built by STX Dalian and delivered on 17 September 2012 and 30 October 2012, respectively.Vale Fujiyama, was again built by STX Jinhae and delivered on 26 November 2012.Vale Tubarao, was delivered by STX Dalian on 30 January 2013.Vale Maranhao entered service on 29 August.

On 30 April 2007 Berge Bulk signed a contract with the Chinese shipbuilding company Bohai Shipbuilding Heavy Industry for the construction of four 388,000-ton very large ore carriers. Although initially scheduled for delivery in 2010, the first vessel, Berge Everest, was delivered on 23 September 2011.Berge Aconcagua on 15 March 2012Berge Jaya on 12 June 2012.Berge Neblina, was initially also scheduled to be delivered in 2012, but entered service on 4 January 2013.

Had Vale not ordered the Valemax fleet in 2008, these ships would have become the largest bulk carriers in the world, surpassing Berge Bulk"s own Berge Stahl. The four ships have since been chartered by Vale and, despite slight differences in design and contract date predating that of the ships ordered by Vale, they are also referred to as Valemax vessels.

In March 2016, it was reported that three Chinese companies China Ocean Shipping (Group) Company (COSCO), China Merchants Energy Shipping and Industrial and Commercial Bank of China (ICBC) had ordered ten Valemax vessels each from four Chinese shipyards with a total price of US$2.5 billion.Valemax ships ordered by China Merchants Energy Shipping would be built by Shanghai Waigaoqiao Shipbuilding (4 ships), Qingdao Beihai Shipbuilding (4 ships), and China Merchants Group-controlled China Merchants Heavy Industry (Jiangsu) (2 ships).Yangzijian Shipbuilding while the remaining four would be awarded to Qingdao Beihai Shipbuilding.Valemax vessels, Yuan He Hai, was delivered on 11 January 2018

In December 2016, the Japanese shipping company NS United ordered a single 400,000DWT very large ore carrier from Japan Marine United after signing a 25-year contract with Vale. The vessel, which would become the first Valemax ship built in Japan, was delivered in December 2019 as

On 24 May 2011, Vale Brasil received her first cargo at the Brazilian port Terminal Marítimo de Ponta da Madeira, 391,000 tons of iron ore bound for Dalian in China.Atlantic Ocean in June after rounding the Cape of Good Hope and was rerouted to Taranto, Italy.Vale Brasil was not allowed to enter the Chinese port fully laden, but according to Vale the destination was changed due to commercial, not political reasons.Valemax vessels have unloaded at various ports, such as Dalian in China,Sohar in Oman,Rotterdam,Ōita in Japan,Dangjin in South Korea,Subic Bay in the Philippines.

On 31 January 2012, the Ministry of Commerce of the People"s Republic of China officially banned dry bulk carriers with capacity exceeding 300,000 tons from entering Chinese ports in order to protect the domestic freight industry. Prior to this, only one of the new very large ore carrier chartered by Vale, Berge Everest, had unloaded Brazilian iron ore at a Chinese port – the ship arrived at Dalian on 28 December 2011 – but this was assumed to be a bureaucratic fluke as no Chinese port has regulatory approval to receive dry bulk carriers of that size.

According to Vale, the discussions about allowing the Valemax ships to enter Chinese ports had been ongoing since the ban came into forceNingbo Port Company, the construction of the new port facilities would take two to three years, causing further delays for Vale which in the meantime is losing $2–3 per ton of ore due to the ban.Vale Malaysia became the first 400,000-ton Valemax vessel to call a Chinese port. The partially loaded ship docked at the port of Lianyungang en route from the Vale transshipment hub in Subic Bay, Philippines. However, at the time the Chinese officials had not yet lifted the ban for fully laden Valemax vessels.Valemax vessel to call a Chinese port since 2012, Shandong Da Ren, docked at the Dongjiakou port in Qingdao on 2 October 2014.

Originally, Vale planned to own and manage a fleet of 19 Valemax vessels by itself in order to control the wildly fluctuating charter prices for large bulk carriers which had dropped from US$233,988 per day in June 2008 to as low as US$2,400 by December of the same year. However, because of the global economic downturn and the reluctance of Chinese ports to accept the fully laden ships, the new board of directors decided to focus capital allocation to mining. As a result, Vale decided to sell the ships and charter them back under long-term contracts.

In September 2014, Vale signed a framework agreement for strategic co-operation in iron ore shipping with the state-owned China Ocean Shipping (Group) Company (COSCO).Valemax vessels has been effectively lifted and fully laden ships have called Chinese ports.

In May 2015, four ships were sold China Ore Shipping Pte. Ltd, a joint venture between COSCO and China Shipping Development Company, for US$445 million.Valemax vessels to officially change ownership. Later, four more ships were sold to China Merchants Energy Shipping.Valemax ships owned by the mining company would be sold and leased back from the new owners.Valemax vessels were reportedly sold in December 2017.

The cause of the damage has not been published by STX, but design or construction flaws, material fatigue and incorrect loading have all been suspected.Vale Beijing remained anchored off Ponta da Madeira with a crawler crane on the deck and an oceangoing tug standing bySão Luís for Oman. After unloading at Sohar, the ship headed to South Korea for dry docking and arrived at STX shipyard in Jinhae, where it was delivered in September 2011, for inspection and repairs on 21 April 2012.Vale Beijing returned to service in July 2012.

Had Vale Beijing sunk at the pier instead of being moved to an anchorage area outside the port shortly after the leak was detected, the incident would have severely delayed the operations at the port which ships out about 10 percent of the world"s iron ore production.Vale Beijing delayed the loading of only 750,000 tons of iron ore,Trade Daring, a 145,000 DWT ore-bulk-oil carrier, broke in two at the same location due to incorrect loading, blocking the deepwater pier of Ponta da Madeira for more than six weeks before the wreck was removed and scuttled offshore.

After the incident, the China Shipowners" Association (CSA) questioned the safety of the 400,000-ton ore carriers commissioned by Vale. CSA was particularly concerned about the ability of the newly built ships to withstand various sea conditions and the pollution resulting from fuel oil leaks in case of structural damageValemax ship can carry around 10,000 tons of fuel oil.port of Lianyungang in the Jiangsu province.

All Valemax vessels, with the exception of those owned and operated by Berge Bulk, were initially given names consisting of the word Vale and a place name, either one related to the mining operations of Vale S.A. in Brazil or a potential destination for the new iron ore carriers. However, none of the original 35 Valemax vessels retains its original name.

When Vale signed a $500 million contract with the Chinese shipping company Shandong Shipping for the operation of four Valemax vessels, the ships were given new names beginning with Shandong.Valemax vessels were sold to China Ore Shipping, the vessels were given names beginning with Yuan and ending with Hai.Valemax vessels were given names starting with Pacific after Vale sold the ships to China Merchants Energy Shipping.

Additionally, a number of Valemax vessels have been renamed by replacing Vale with Ore or Sea but retaining the second part of the name. Vale Sohar, Vale Saham, Vale Liwa and Vale Shinas have also been renamed Sohar Max, Saham Max, Liwa Max and Shinas Max, respectively.

Vale Sohar, built by Jiangsu Rongsheng Heavy Industries (RSHI), awaiting delivery for Oman Shipping Company in Nantong, China, in September 2012. Note the minor differences to the South Korean-built Vale Rio de Janeiro.

Although similar in size, there are some differences in main dimensions, cargo capacity, machinery and external appearance between the Valemax ships built in South Korea, China and Japan. While the first series of 35 ships was more diverse, all 30 Chinese-built Valemax vessels of the second series are based on the same standard design, SDARI 400OC, by Shanghai Merchant Ship Design & Research Institute (SDARI).G400OC.

Like most modern bulk carriers, Valemax vessels are powered by a single two-stroke low-speed crosshead diesel engine directly coupled to a fixed-pitch propeller. The ships built by DSME and STX in South Korea are powered by 7-cylinder MAN B&W 7S80ME-C8 and 7S80ME-C engines, respectively, and the ships built by RSHI and Bohai Shipbuilding Heavy Industry have Wärtsilä 7RT-flex82T and 7RT-flex84T engines, respectively.maximum continuous rating of around 29,000 kW (39,000 hp) when turning the 10-metre (33 ft)

8613371530291

8613371530291