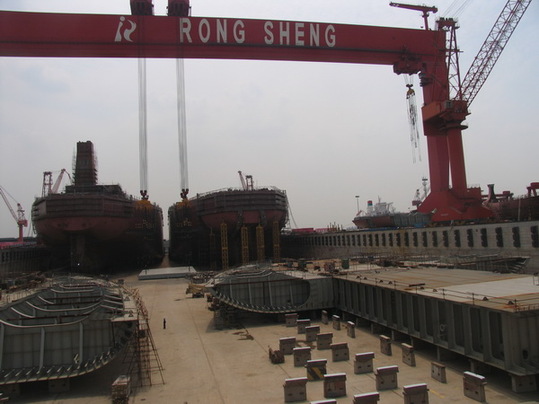

jiangsu rongsheng heavy industries co ltd china supplier

Brazil sank a decommissioned aircraft carrier in the Atlantic Ocean off its northeast coast, the Brazilian Navy said, despite warnings from environmentalists that the rusting 1960s French-built ship would pollute the sea and the marine food chain.The 32,000-tonne carrier had been floating offshore for three months since Turkey refused it entry to be scrapped there because it was an environmental hazard and the ship was towed back to Brazil.The carrier was scuttled in a "planned and controlled sinking" late on Friday, the Navy said in a statement, that would "avoid logistical, operational, environmental and economic losses to the Brazilian state," it said.

Finnish cargo handling machinery manufacturer Cargotec on Monday announced its board of directors has appointed Casimir Lindholm to succeed Mika Vehviläinen as the company"s president and CEO, effective April 1, 2023.A member of Cargotec"s board since 2021, Lindholm has held CEO positions both in Eltel and Lemminkäinen and many board memberships.“I’m honored and excited to be leading Cargotec at such a pivotal moment in the company’s history, with a strong foundation and a clear vision into its next development phase of growth as we have communicated before.

The Baltic Exchange"s main sea freight index, tracking rates for ships carrying dry bulk commodities, fell to the lowest in nearly three years, pressured by weaker rates across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, fell 13 points, or about 2.1%, to 608, its lowest since early-June 2020.The capesize index lost 10 points, or about 2.3%, to over a five-month low of 419.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $86 at $3,475.

ABB has unveiled its Baldor-Reliance HydroCool XT motor product line, a new generation of water-cooled motors for extreme marine duty and other applications.According to the manufacturer, HydroCool XT is quiet and versatile, and offers reduced maintenance and high performance in some of the toughest environments. Water-jacket cooling offers higher thermal conductivity than air cooling, helping to extend the motor life while eliminating the need for fans or air filters. Available with induction or permanent magnet rotor technology, the motor can achieve the highest level (IE5) efficiency rating for energy savings

The Italian trade union USB filed a legal complaint against a plan by gas grid operator Snam to set up a new liquefied natural gas (LNG) terminal in the Tuscan port of Piombino, it said in a press release on Friday.USB alleged Snam had committed serious "environmental crimes" while performing works to build the terminal.USB criticised in the statement the choice to set up the terminal in an area already polluted by an old steel plant, saying regasification processes would increase pollution levels even further and cause "serious and irreparable injuries."Snam declined to comment on the issue.

The 2023 Conference will take place from 21-23rd November in Hamburg, Germany and will offer a meeting place to learn, discuss and knowledge-share the latest developments in efficient power and propulsion technology plus alternative low flashpoint and low carbon fuels.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

This announcement is issued by China Rongsheng Heavy Industries Group Holdings Limited (the "Company") in accordance with Rules 13.09 and 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong).

Reference is made to the announcement of the Company dated 21 March 2012 in respect of the issue of medium-term notes by its subsidiary, Jiangsu Rongsheng Heavy Industries Co., Ltd. (江 蘇熔盛重工有限公司) ("Jiangsu Rongsheng Heavy Industries"), in the People"s Republic of

Pursuant to the relevant rules and regulations in the PRC, the unaudited financial information (the "Unaudited Quarterly Financial Information") of Jiangsu Rongsheng Heavy Industries, which is indirectly owned by the Company as to approximately 96.38%, and its subsidiaries for the nine months ended 30 September 2014 was published on http://www.chinabond.com.cn/www.chinabond.com.cn and www.chinamoney.com.cn on 17 October 2014.

Set out below are the key unaudited financial figures of Jiangsu Rongsheng Heavy Industries and its subsidiaries for the nine months ended 30 September 2014 as included in the Unaudited Quarterly Financial Information, which have been prepared in accordance with the PRC Generally Accepted Accounting Principles and have not been audited:

of www.chinabond.com.cn and www.chinamoney.com.cn to provide further information with respect to its unaudited financial information for the nine months ended 30 September 2014, the key contents of which is set out below in this announcement.

For the nine months ended 30 September 2014, Jiangsu Rongsheng Heavy Industries and its subsidiaries recorded an operating loss and a total loss of approximately RMB2,778.6 million and RMB3,362.2 million respectively, and a net loss of approximately RMB3,362.2 million

The net loss incurred for the nine months ended 30 September 2014 was primarily due to the low prices of shipbuilding orders in depressed market conditions and the diminishing profitability of the conventional shipbuilding business. The net loss was also due to the decline of production activities of Jiangsu Rongsheng Heavy Industries despite considerable fixed production cost and the adjustment of the contract price of certain shipbuilding contracts. Such loss may lead to adverse effects on the production and operation, financial position and repayment capacity of Jiangsu Rongsheng Heavy Industries. Jiangsu Rongsheng Heavy Industries has been proactively adopting measures to improve operational performance and financial position, and to mitigate liquidity pressure. These measures include but are not limited to: actively negotiating with principal banks in the PRC on the terms and conditions of the extension and renewal of borrowings; obtaining financial support from a shareholder of its holding company; negotiating for better payment terms and revising up prices of certain existing shipbuilding orders; redesigning operation flow and controlling costs for existing shipbuilding orders; maximizing sales efforts and obtaining the appropriate project-based financing; establishing strategic cooperation with key suppliers with a view to reduce the costs of supplies.

The Unaudited Quarterly Financial Information and the key unaudited financial figures disclosed in this announcement have been prepared in accordance with the PRC Generally Accepted Accounting Principles and have not been audited. Shareholders and potential investors are cautioned not to unduly rely on such information, and should exercise caution when dealing in the shares of the Company.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

The shipbuilder’s net debt to equity, a measure of indebtedness, climbed to 134 percent in January-June from 119 percent in 2012 and 85 percent in 2011. Talks with its banking syndicate are ongoing, with no indication when a deal could be struck, a person at one of the banks told Reuters this week.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China’s economic growth began to slow and credit tightened at a time when global shipping, too, turned down.

“The lottery has become increasingly popular,” said a girl working the till. “I’m not sure why really, but perhaps people are hoping they can win something here.”

* Zhang Yaqin, the man who helped build Microsoft"s biggest technology research operation outside of the United States, is leaving the software giant to join Chinese online search powerhouse Baidu. Sources close to Baidu said Zhang would report directly to Robin Li Yanhong, the co-founder of Baidu. (bit.ly/1w5CkMd)

* The gutter oil scare deepened in Hong Kong and Macau after it emerged that another importer in the city and 21 businesses in the former Portuguese enclave had purchased oil from the Taiwanese supplier at the centre of the scandal. The Hong Kong importers include Dah Chong Hong Holdings Ltd. (bit.ly/1wdzF0i)

* Sun Hung Kai Properties Ltd is likely to become Hong Kong"s biggest supplier of small flats once its application to convert four luxury residential projects in the northeast New Territories into 4,000 tiny apartments wins approval, according to industry observers. (bit.ly/1ogDgVY)

* China Auto Rental opens the retail book for its HK$3.62 billion ($467 million) initial public offering in Hong Kong, with 426 million new shares in a range of HK$7.50-HK$8.50 each. Shares of the country"s largest auto rental firm, which aims to double the size of its fleet, start to trade on September 19. (bit.ly/1uFpdgU)

* A much-hyped idea to link bourses in Hong Kong and Shenzhen is not in the pipeline, China"s securities watchdog said, saying one of its current priorities is to hammer out taxation issues for the upcoming Shanghai-Hong Kong Stock Connect program. (bit.ly/1tjjuwd)

* Chinese shipbuilder China Rongsheng Heavy Industries Group said an independent third party is considering to initiate a potential restructuring involving its unit Jiangsu Rongsheng Heavy Industries Co Ltd. The unit contributed a respective 89 percent and 91.4 percent of China Rongsheng’s total revenue for 2013 and for six months ended in June 2014.

* Yuzhou Properties Co Ltd has earmarked 3 billion yuan ($488 million) to replenish landbank in China in the second half of 2014, according to chairman Lam Lungon.

For Chinese newspapers, see............... ($1 = 7.7503 Hong Kong dollar) ($1 = 6.1400 Chinese yuan) (Compiled by Donny Kwok in Hong Kong; Editing by Anand Basu)

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

The shipyard, located in the Yangtze River Delta, was founded in 2006, and became the largest private shipbuilder in China, churning out giant valemaxes at its four large dry-docks, before a massive financial collapse forced it to cease operations in 2014.

Broking sources in China tell Splash that the yard’s former chief operating officer David Luan is now preparing to officially reopen the yard, to be known as SPS Shipyard, a reference to ShipParts.com, a business he created in 2015 after quitting Rongsheng.

Luan has tapped an old client, George Economou’s TMS Dry, to come in with the first orders at the reopened yard with the Greek owner signing a letter of intent for six firm 82,000 dwt kamsarmaxes and four 180,000 dwt capes. The deal comes with options for four more kamsarmaxes and pricing is understood to be a bargain – at $33m per kamsarmax and $62m per cape. The first ship will deliver in Q3 2024.

China Rongsheng said in a statement to the Hong Kong Stock Exchange late on Thursday that Jiangsu Rongsheng Heavy Industries had placed the deposit while bidding for a stake in the Anhui Province Property Rights Exchange.

China Rongsheng asked the government and its biggest shareholders for financial help last week after cutting its workforce and delaying payments to suppliers, while warning of a net loss for the first half of 2013.

Analysts said the company could be the biggest casualty of a local shipping industry suffering from overcapacity and shrinking orders amid a global shipping downturn.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

8613371530291

8613371530291