jiangsu rongsheng heavy industries co ltd china price

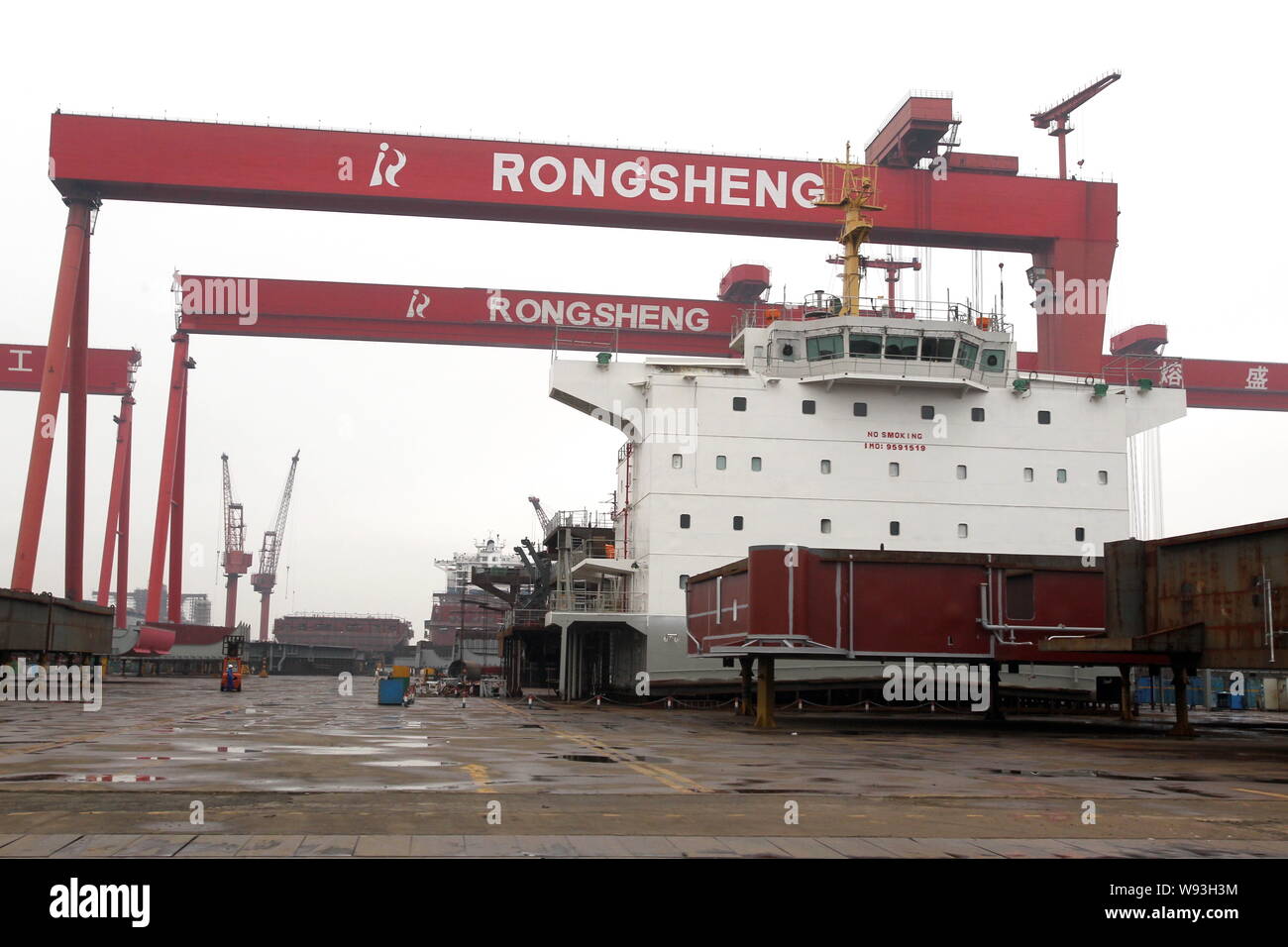

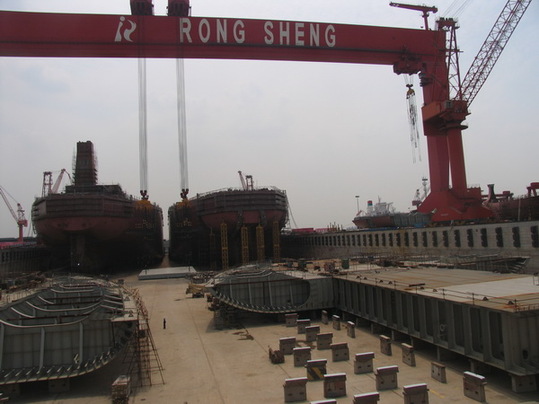

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

Brazil sank a decommissioned aircraft carrier in the Atlantic Ocean off its northeast coast, the Brazilian Navy said, despite warnings from environmentalists that the rusting 1960s French-built ship would pollute the sea and the marine food chain.The 32,000-tonne carrier had been floating offshore for three months since Turkey refused it entry to be scrapped there because it was an environmental hazard and the ship was towed back to Brazil.The carrier was scuttled in a "planned and controlled sinking" late on Friday, the Navy said in a statement, that would "avoid logistical, operational, environmental and economic losses to the Brazilian state," it said.

Finnish cargo handling machinery manufacturer Cargotec on Monday announced its board of directors has appointed Casimir Lindholm to succeed Mika Vehviläinen as the company"s president and CEO, effective April 1, 2023.A member of Cargotec"s board since 2021, Lindholm has held CEO positions both in Eltel and Lemminkäinen and many board memberships.“I’m honored and excited to be leading Cargotec at such a pivotal moment in the company’s history, with a strong foundation and a clear vision into its next development phase of growth as we have communicated before.

The Baltic Exchange"s main sea freight index, tracking rates for ships carrying dry bulk commodities, fell to the lowest in nearly three years, pressured by weaker rates across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, fell 13 points, or about 2.1%, to 608, its lowest since early-June 2020.The capesize index lost 10 points, or about 2.3%, to over a five-month low of 419.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $86 at $3,475.

ABB has unveiled its Baldor-Reliance HydroCool XT motor product line, a new generation of water-cooled motors for extreme marine duty and other applications.According to the manufacturer, HydroCool XT is quiet and versatile, and offers reduced maintenance and high performance in some of the toughest environments. Water-jacket cooling offers higher thermal conductivity than air cooling, helping to extend the motor life while eliminating the need for fans or air filters. Available with induction or permanent magnet rotor technology, the motor can achieve the highest level (IE5) efficiency rating for energy savings

The Italian trade union USB filed a legal complaint against a plan by gas grid operator Snam to set up a new liquefied natural gas (LNG) terminal in the Tuscan port of Piombino, it said in a press release on Friday.USB alleged Snam had committed serious "environmental crimes" while performing works to build the terminal.USB criticised in the statement the choice to set up the terminal in an area already polluted by an old steel plant, saying regasification processes would increase pollution levels even further and cause "serious and irreparable injuries."Snam declined to comment on the issue.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

The investigation may deter customers from placing orders, Jon Windham, an analyst at Barclays Plc., said yesterday by phone. “It’s obviously very bad for the overall image of the company.” He downgraded the stock to underweight from equalweight and cut its target price to HK$1.06 from HK$2.40.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

The shipbuilder has had delays as it builds 16 of the world’s biggest commodity ships for Vale SA and Oman Shipping Co. It was supposed to hand over eight of the ships last year, according to its IPO prospectus. Instead, it only delivered one. It had handed over two more to Vale by May 20. The same month, it christened two for Oman Shipping, Xinhua reported.

The company’s cash reserves have also declined. It had 6.3 billion yuan of cash and cash equivalents at the end of December down from 10.4 billion yuan a year earlier. Its short-term borrowings rose to 18.2 billion yuan from 10.1 billion yuan, according to data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

Well Advantage and other unknown traders stockpiled shares of Nexen before Cnooc announced plans to buy the Calgary-based energy company for $15.1 billion, according to the SEC. The regulator acted to freeze accounts less than 24 hours after Well Advantage placed an order to liquidate its position, it said. The investigation continues, it said July 27.

The traders may have to pay multiples of the profit they made from illegal deals to settle the case, based on previous incidents, said David Webb, the founder of corporate-governance website Webb-site.com. The frozen accounts may make a settlement more probable as the traders won’t be able to access cash, he said. Still, there may be a long-term impact on reputations.

“Cases such as this bring the integrity of the persons involved into question,” Webb said. “And, if they are running a bank or a listed company, then it tends to tarnish the firm too.”

Standard Digital includes access to a wealth of global news, analysis and expert opinion. Premium Digital includes access to our premier business column, Lex, as well as 15 curated newsletters covering key business themes with original, in-depth reporting. For a full comparison of Standard and Premium Digital, click here.

For cost savings, you can change your plan at any time online in the “Settings & Account” section. If you’d like to retain your premium access and save 20%, you can opt to pay annually at the end of the trial.

You may also opt to downgrade to Standard Digital, a robust journalistic offering that fulfils many user’s needs. Compare Standard and Premium Digital here.

Any changes made can be done at any time and will become effective at the end of the trial period, allowing you to retain full access for 4 weeks, even if you downgrade or cancel.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Investors have turned cautious on the industry after it was dealt a heavy blow by the economic downturn, with orders shrinking last year and the sector yet to fully recover.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

The SEC does not allege any wrongdoing by Zhang, but notes that he is the controlling shareholder of a company that engages in significant business activities with CNOOC. CNOOC in Beijing has declined comment on the matter.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

“Since weak earnings had been expected and the stock had already come down quite a bit, the early selling was mainly triggered by the insider trading probe,” said Steven Leung, a director at UOB Kay Hian.

“Investors are very sensitive to this kind of news and they simply unloaded their stakes on the worry that they will not be able to exit their investment if the company involved gets suspended,” he said.

The SEC said on Friday that a federal court in Manhattan had frozen assets worth more than $38 million belonging to Hong Kong-based Well Advantage, controlled by Zhang, and other unnamed traders who used accounts in Hong Kong and Singapore to trade in Nexen stock.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

Shares of Glorious Property Holdings Ltd, a Chinese real-estate developer controlled by Zhang Zhirong, also fell sharply. The stock was down 12.9 percent as of 0304 GMT.

CNOOC said on July 23 it had agreed to acquire Nexen for $15.1 billion, China’s biggest foreign takeover bid. Shares of Nexen jumped almost 52 percent that day.

The unnamed Singapore traders used accounts in the names of Phillip Securities and Citibank C.N, while Well Advantage made its trades through accounts held at UBS Securities and Citigroup Global Markets. Neither of the Well Advantage accounts had traded Nexen shares since January 2012, and the Citigroup account had been completely dormant for over six months, the SEC says.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

The company said that the struggles of its shipbuilding arm, Jiangsu Rongsheng Heavy Industries, had been hampering efforts to expand in energy services

China Rongsheng Heavy Industries Group Holdings Limited [1101.HK] has announced that it has signed a memorandum of understanding that will see its shipbuilding business, Jiangsu Rongsheng Heavy Industries, sold to an undisclosed potential purchaser.

The deal involves the core assets and liabilities of both its onshore shipbuilding and offshore engineering business, though the company stressed that a formal transaction agreement is still pending.

According to the company, the depressed shipbuilding market had led to operational difficulties at Jiangsu Rongsheng Heavy Industries, while its highly-leveraged state was also interfering with the company"s efforts to expand in oil and gas exploration elsewhere.

"The Potential Transaction shall adjust and optimize the assets and business of the Group, and divest the relevant assets and liabilities of the shipbuilding business and offshore engineering business, which shall help to ease the debt burden of the Group, enhance the flexibility of fund utilization, better implement the strategy of business transformation and transformation into an energy service provider focusing in the oil and natural gas market," said the company.

It was reported in 2012 that in the face of market difficulties, China Rongsheng Heavy Industries had turned its focus to building containerships with a "green design" as one its key products.

However, a year later, the company was reported as saying that the Chinese shipbuilding industry was still experiencing "unprecedented challenges" as demand waned and ship prices failed to increase.

In September 2010, Vale Mining Company was provided a $1.229 billion USD export buyer"s credit loan by a syndicate composed of the Bank of China and the Export Import Bank of China. This line of credit was to be used to finance 80% of the cost of building of 12 very large ore carriers (VLOC) from Jiangsu Rongsheng Heavy Industries Co., Ltd. ordered in 2008. The ships estimated total cost is $1.6 billion.Vale began shipping ore to China in 2011 and 2012. The last one of the 12 ships was finished and started its trial trip in January 2015. The loan is payable over 13 years and is disbursed over three years.According to Vale Mining Company, as of December 2016, Vale sold the 12 very large ore carriers for US$445 million from China Ocean Shipping Company in June 2015, US$448 million from China Merchants Energy Shipping Co. Ltd. in September 2015, and US$423 million from a consortium led by ICBC Financial Leasing in December 2015. Vale used part of the proceeds to repay debt to the Export-Import Bank of China and the Bank of China Limited, reducing the total debt by US$284 million.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

"The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company"s conservative sales strategy under the current trough stage of the shipbuilding market," China Rongsheng said in a statement to the Hong Kong stock exchange.

Analysts have said the company could be the biggest casualty of a local shipbuilding industry suffering from overcapacity and shrinking orders amid a global shipping downturn.

Workers at Rongsheng"s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company"s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: "The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders."

A company spokesman told Reuters late on Wednesday that the shipyard had no confirmed new orders so far in the second half of the year. He declined to elaborate.

The spokesman said the company had delivered 7 vessels, with a total of 1.5 million dead weight tonnes (DWT), in the first half of 2013, and had delivered at least two 380,000-DWT class very large ore carriers in the second half of the year.

8613371530291

8613371530291