jiangsu rongsheng heavy industries group co ltd in stock

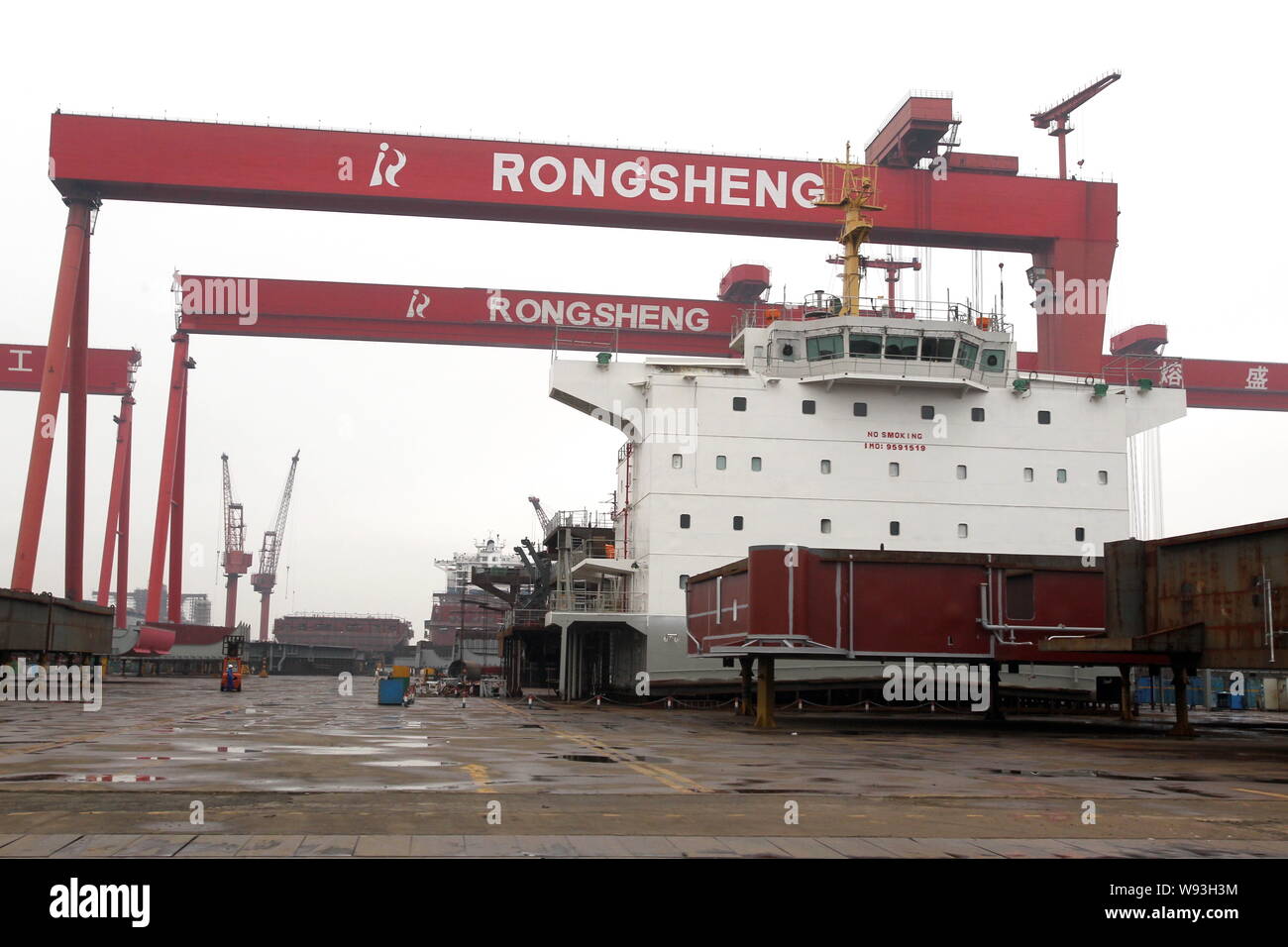

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

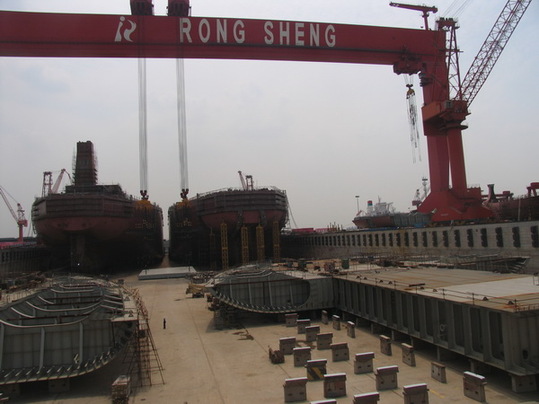

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

Hong Kong Exchanges and Clearing Limited and The Stock Exchange of Hong Kong Limited take no responsibility for the contents of this announcement, make no representation as to its accuracy or completeness and expressly disclaim any liability whatsoever for any loss howsoever arising from or in reliance upon the whole or any part of the contents of this announcement.

This announcement is issued by China Rongsheng Heavy Industries Group Holdings Limited (the "Company") in accordance with Rules 13.09 and 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong).

Reference is made to the announcement of the Company dated 21 March 2012 in respect of the issue of medium-term notes by its subsidiary, Jiangsu Rongsheng Heavy Industries Co., Ltd. (江 蘇熔盛重工有限公司) ("Jiangsu Rongsheng Heavy Industries"), in the People"s Republic of

Pursuant to the relevant rules and regulations in the PRC, the unaudited financial information (the "Unaudited Quarterly Financial Information") of Jiangsu Rongsheng Heavy Industries, which is indirectly owned by the Company as to approximately 96.38%, and its subsidiaries for the nine months ended 30 September 2014 was published on http://www.chinabond.com.cn/www.chinabond.com.cn and www.chinamoney.com.cn on 17 October 2014.

Set out below are the key unaudited financial figures of Jiangsu Rongsheng Heavy Industries and its subsidiaries for the nine months ended 30 September 2014 as included in the Unaudited Quarterly Financial Information, which have been prepared in accordance with the PRC Generally Accepted Accounting Principles and have not been audited:

of www.chinabond.com.cn and www.chinamoney.com.cn to provide further information with respect to its unaudited financial information for the nine months ended 30 September 2014, the key contents of which is set out below in this announcement.

For the nine months ended 30 September 2014, Jiangsu Rongsheng Heavy Industries and its subsidiaries recorded an operating loss and a total loss of approximately RMB2,778.6 million and RMB3,362.2 million respectively, and a net loss of approximately RMB3,362.2 million

The net loss incurred for the nine months ended 30 September 2014 was primarily due to the low prices of shipbuilding orders in depressed market conditions and the diminishing profitability of the conventional shipbuilding business. The net loss was also due to the decline of production activities of Jiangsu Rongsheng Heavy Industries despite considerable fixed production cost and the adjustment of the contract price of certain shipbuilding contracts. Such loss may lead to adverse effects on the production and operation, financial position and repayment capacity of Jiangsu Rongsheng Heavy Industries. Jiangsu Rongsheng Heavy Industries has been proactively adopting measures to improve operational performance and financial position, and to mitigate liquidity pressure. These measures include but are not limited to: actively negotiating with principal banks in the PRC on the terms and conditions of the extension and renewal of borrowings; obtaining financial support from a shareholder of its holding company; negotiating for better payment terms and revising up prices of certain existing shipbuilding orders; redesigning operation flow and controlling costs for existing shipbuilding orders; maximizing sales efforts and obtaining the appropriate project-based financing; establishing strategic cooperation with key suppliers with a view to reduce the costs of supplies.

The Unaudited Quarterly Financial Information and the key unaudited financial figures disclosed in this announcement have been prepared in accordance with the PRC Generally Accepted Accounting Principles and have not been audited. Shareholders and potential investors are cautioned not to unduly rely on such information, and should exercise caution when dealing in the shares of the Company.

Jiangsu Rongsheng Heavy Industries Group Co. Ltd. made an offer to acquire 55.61% stake in Anhui Quanchai Engine Co., Ltd. (SHSE:600218) for CNY 2.6 billion on April 26, 2011. In a related transaction, Jiangsu Rongsheng Heavy Industries Group Co. Ltd. signed an agreement to acquire Anhui Quanchai Group Corp. from The People"s Government of Quanjiao County, Anhui Province for CNY 2.1 billion in cash on April 26, 2011. There are no conditions with respect to any minimum acceptance level in respect of the bid. The completion of this acquisition is subject to the approval of the relevant governmental regulators, including, without limitation, the State-owned Assets Supervision and Administration Commission of the State Council. The transaction was approved by the Ministry of Commerce and the State-owned Assets Supervision and Administration Commission on December 16, 2011 while Security Regulatory Commission"s consent is still pending.

Jiangsu Rongsheng Heavy Industries Group Co. Ltd. cancelled the acquisition of 55.61% stake in Anhui Quanchai Engine Co., Ltd. (SHSE:600218) on August 20, 2012. Jiangsu Rongsheng Heavy Industries will not conduct any acquisition of equity interest in Quanchai Engine within 12 months from August 21, 2012.

The 2023 Conference will take place from 21-23rd November in Hamburg, Germany and will offer a meeting place to learn, discuss and knowledge-share the latest developments in efficient power and propulsion technology plus alternative low flashpoint and low carbon fuels.

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

The SEC does not allege any wrongdoing by Zhang, but notes that he is the controlling shareholder of a company that engages in significant business activities with CNOOC. CNOOC in Beijing has declined comment on the matter.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

“Since weak earnings had been expected and the stock had already come down quite a bit, the early selling was mainly triggered by the insider trading probe,” said Steven Leung, a director at UOB Kay Hian.

“Investors are very sensitive to this kind of news and they simply unloaded their stakes on the worry that they will not be able to exit their investment if the company involved gets suspended,” he said.

The SEC said on Friday that a federal court in Manhattan had frozen assets worth more than $38 million belonging to Hong Kong-based Well Advantage, controlled by Zhang, and other unnamed traders who used accounts in Hong Kong and Singapore to trade in Nexen stock.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

Shares of Glorious Property Holdings Ltd, a Chinese real-estate developer controlled by Zhang Zhirong, also fell sharply. The stock was down 12.9 percent as of 0304 GMT.

The unnamed Singapore traders used accounts in the names of Phillip Securities and Citibank C.N, while Well Advantage made its trades through accounts held at UBS Securities and Citigroup Global Markets. Neither of the Well Advantage accounts had traded Nexen shares since January 2012, and the Citigroup account had been completely dormant for over six months, the SEC says.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

The investigation may deter customers from placing orders, Jon Windham, an analyst at Barclays Plc., said yesterday by phone. “It’s obviously very bad for the overall image of the company.” He downgraded the stock to underweight from equalweight and cut its target price to HK$1.06 from HK$2.40.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

The shipbuilder has had delays as it builds 16 of the world’s biggest commodity ships for Vale SA and Oman Shipping Co. It was supposed to hand over eight of the ships last year, according to its IPO prospectus. Instead, it only delivered one. It had handed over two more to Vale by May 20. The same month, it christened two for Oman Shipping, Xinhua reported.

The company’s cash reserves have also declined. It had 6.3 billion yuan of cash and cash equivalents at the end of December down from 10.4 billion yuan a year earlier. Its short-term borrowings rose to 18.2 billion yuan from 10.1 billion yuan, according to data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

Well Advantage and other unknown traders stockpiled shares of Nexen before Cnooc announced plans to buy the Calgary-based energy company for $15.1 billion, according to the SEC. The regulator acted to freeze accounts less than 24 hours after Well Advantage placed an order to liquidate its position, it said. The investigation continues, it said July 27.

The traders may have to pay multiples of the profit they made from illegal deals to settle the case, based on previous incidents, said David Webb, the founder of corporate-governance website Webb-site.com. The frozen accounts may make a settlement more probable as the traders won’t be able to access cash, he said. Still, there may be a long-term impact on reputations.

“Cases such as this bring the integrity of the persons involved into question,” Webb said. “And, if they are running a bank or a listed company, then it tends to tarnish the firm too.”

Chinese shipbuilder Jiangsu Rongsheng Heavy Industries has raised about HKD$14bn ($1.8bn) in its initial public offering on the Hong Kong stock exchange.

Rongsheng will use part of the sale proceeds to fund its shipbuilding and offshore engineering businesses, and to repay loans, according to lloydslist.com.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Any Country Andorra Argentina Armenia Australia Austria Azerbaijan Bangladesh Belarus Belgium Bosnia and Herzegovina Brazil Bulgaria Canada China Colombia Croatia Cyprus Czech Republic Denmark Ecuador Egypt Estonia Finland France Georgia Germany Greece Hong Kong Hungary India Indonesia Ireland Israel Italy Japan Kazakstan Korea, Republic of Kyrgyzstan Latvia Lithuania Macedonia Malaysia Mexico Moldova Montenegro Morocco Netherlands New Zealand Norway Pakistan Peru Philippines Poland Portugal Romania Russian Federation Serbia Singapore Slovakia Slovenia South Africa Spain Sri Lanka Sweden Switzerland Taiwan Tajikistan Thailand Turkey Ukraine United Arab Emirates United Kingdom United States Uruguay Uzbekistan Vietnam

RM2CY8K6W–Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS CONSTRUCTION COMMODITIES)

RM2CXEFJ0–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96H39–--File--View of an exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 November 2010.

RM2HMPEWX–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW92M88–--FILE--The stand of Rongsheng Heavy Industries is seen during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Heavy Industries, whose

RMW95J26–--FILE--Zhang Zhirong, Chairman of Glorious Property Holdings Limited and Chairman of Rongsheng Heavy Industries Group Holdings Ltd., attends a ground

RMW961RD–--FILE--View of the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongsheng Heavy Industries

RMW95HXC–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RM2CWMP5X–A vacant dormitory is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HMPDMD–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China passes the finish line during cross-country skiing men"s 15km classic at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HKYKWJ–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (C) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RMW95J09–--FILE--Visitors look at the machines of Anhui Rongan Heavy Industry, the subsidiary of China Rongsheng Heavy Industries Group Holdings Ltd in an Expo

RMW96KRG–--File--Visitors are seen in the exhibition hall at the headquarters of Rongsheng Heavy Industries Group in Nantong, east Chinas Jiangsu province, 4 N

RM2D0PB6A–A closed police station is seen at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY CRIME LAW)

RM2HKYJWB–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (R) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW96KTG–--FILE--People visit the headquarters of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 2010. Shipbuilder Chin

RMW92M7G–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. Rongsheng Hea

RM2CYH4T9–Workers ride a motorcycle past closed restaurants at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYWMC–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW961KH–--FILE--A Chinese employee poses at the stand of Rongsheng Heavy Industries during an exhibition in Shanghai, China, 29 November 2011. China Rongshe

RMW8CJA6–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east China"s Shandong province, 3 July 2013. Chinese

RMW8YJ5G–--FILE--A ship is being built at the shipyard of Rongsheng Heavy Industries in Rugao, Nantong city, east Chinas Jiangsu province, 12 December 2013.

RM2D01WH0–A worker rides a bicycle inside of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2HKYH9T–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RMW8WYE1–--FILE--A signboard of Rongsheng is pictured at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 12 December 2013

RM2CXAAER–Workers ride motorcycles and bicycle after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RMW96KPW–--FILE--Chinese workers are building a ship at the shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 4 November 20

RMW91GDK–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH4D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng (front) of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Guo Cheng/Xinhua/Alamy Live News

RM2CY7A2X–A worker rides a motorcycle on an empty street at the Rongsheng community in Nantong, Jiangsu province December 4, 2013. Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS EMPLOYMENT SOCIETY)

RM2CXP561–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW91GEJ–--FILE--A netizen browses the Chinese website of Rongsheng Heavy Industries in Liaocheng city, east Chinas Shandong province, 3 July 2013. China Ron

RM2HKYH7D–Zhangjiakou, China"s Hebei Province. 6th Feb, 2022. Liu Rongsheng of China competes during Cross-Country Skiing Men"s 15km 15km Skiathlon at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 6, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW8YE7M–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industrie

RM2HN07XA–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2CXEBAD–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H43–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G5E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR4–Claudio Alves, Global Marketing Director of Vale, World"s largest iron ore miner, attends the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province, May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: BUSINESS COMMODITIES MARITIME TRANSPORT)

RMW93H40–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN20KG–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2CXCXJB–VIP guests visit a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H3M–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN0G8E–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Zhang Hongxiang/Xinhua/Alamy Live News

RM2CY9JR2–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW93H6B–--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongshen

RM2HN2122–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RMW8YE7R–--FILE--View of a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 23 May 2012. A heavily indebted Chinese shi

RM2HMMKN4–Zhangjiakou, China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 11, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HN211R–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng pf China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CWKEG9–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW96MJM–--FILE--A shipbuilding plant of China Rongsheng Heavy Industries Group Holdings Ltd is seen in Nantong city, east Chinas Jiangsu province, 23 May 2012

RMW96KT6–--FILE--Chinese workers walk past the logo of China Rongsheng Heavy Industries Group Holdings Ltd in an office building in Nantong city, east Chinas A

RM2HN1YFX–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RMW93F2K–--FILE--Chinese workers queue up to board a bus at a shipyard of Rongsheng Heavy Industries in Rugao city, east Chinas Jiangsu province, 23 August 201

RMW93H3T–--FILE--Chinese employees work at a shipbuilding plant of Jiangsu Rongsheng Heavy Industries Group Co. ,Ltd. in Nantong, east Chinas Jiangsu province,

RMW98F60–53-year old Hang Rongsheng measures the model of the Yellow Crane Tower, made from toothpicks, in Shanghai, China, 22 August 2011. Hang Rongsheng, c

RMW933HF–--FILE--A sign board of China Citic Bank, subsidiary of China Citic Group is seen in Weifang, east Chinas Shandong province, 22 December 2012. Rongs

RMW938Y8–--FILE--A customer walks out of a branch of China Citic Bank, subsidiary of China Citic Group in Guangzhou city, southeast Chinas Guangdong province,

RM2CWXTEK–Workers stand in front of a 380,000 DWT class Very Large Ore Carrier (VLOC) during the naming ceremony of two Valemax ships built by Rongsheng Heavy Industries in Nantong, Jiangsu province May 21, 2012. The global shipping market, battered for the past few years by a severe downturn, will likely improve from the second half of this year, said an executive with major shipbuilder China Rongsheng Heavy Industries Group Holdings on Monday. REUTERS/Aly Song (CHINA - Tags: MARITIME BUSINESS COMMODITIES)

RMW92M4W–--FILE--Staff are seen at the stand of Jinhai Heavy Industry Co., during Marintec China in Shanghai, China, 29 November 2012. With orders for new

RM2CYTC7F–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RMW91T3D–--FILE--A ship being built is seen at the shipyard of Jinhai Heavy Industry Co., on an island of Zhoushan Archipelago, southeast chinas Zhejiang provi

RM2HN0DAN–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2HMN1WC–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2E65YM2–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in an office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2HMN27W–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D0R611–Chen Qiang, chief executive officer of China Rongsheng Heavy Industries, poses in a office after an interview with Reuters in Hong Kong July 19, 2011. China Rongsheng Heavy Industries Group Holdings Ltd, the country"s largest privately owned shipbuilder, will achieve or even exceed its $3 billion new order target in 2011, its chief executive officer, Qiang, said on Tuesday. To match interview RONGSHENG/ REUTERS/Tyrone Siu (CHINA - Tags: BUSINESS)

RM2CWWX07–A company logo is seen at the entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2HMN1W5–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2CXHEMX–Workers ride motorcycles and bicycles after their shifts at an entrance of the Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province December 4, 2013. China"s biggest private shipbuilder, China Rongsheng Heavy Industries Group, posted a second straight annual loss on March 31, 2014, as new orders were less than half its target, and is in talks with banks about loan repayments. Picture taken December 4, 2013. REUTERS/Aly Song (CHINA - Tags: BUSINESS MARITIME)

RM2CXAP7K–Labourers stand on a new ship at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINABUSINESS MARITI

RM2HMN21C–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2D07154–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HMN3MK–Zhangjiakou, North China"s Hebei Province. 11th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 15km classic of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, North China"s Hebei Province, Feb. 11, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HM9EFM–Zhangjiakou, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the men"s cross-country skiing sprint free qualification of the Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HN20G7–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (L) and Wang Qiang of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2E68M95–A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, posted its sharpest fall in half-year profit - down 82 percent - on a dearth of new orders, putting further pressure on its stretched balance sheet. Rongsheng warned on August 21, 2012, that economic uncertainties such as the euro zone debt crisis would continue to weigh on the global shipping market. Picture taken May 21, 2012. REUTERS/Aly Song/Files (CHINA - Tags: BUSINESS MARITIME)

RM2HKXK7X–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km + 15km Skiathlon - National Cross-Country Centre, Zhangjiakou, China - February 6, 2022. Liu Rongsheng of China in action. REUTERS/Hannah Mckay

RM2HMMB79–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN20T2–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Shang Jincai (L) and Liu Rongsheng of China competes during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HMMAPC–2022 Beijing Olympics - Cross-Country Skiing - Men"s 15km Classic - National Cross-Country Centre, Zhangjiakou, China - February 11, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HMYH8D–2022 Beijing Olympics - Cross-Country Skiing - Men"s 4 x 10km Relay - National Cross-Country Centre, Zhangjiakou, China - February 13, 2022. Liu Rongsheng of China in action. REUTERS/Lindsey Wasson

RM2HN0D6W–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Liu Rongsheng (R) of China and Antoine Cyr of Canada compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HN214K–Zhangjiakou, China"s Hebei Province. 13th Feb, 2022. Antoine Cyr (L) of Canada and Liu Rongsheng of China compete during the cross-country skiing men"s 4x10 km relay of the Beijing Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 13, 2022. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HM92R3–Beijing, China"s Hebei Province. 8th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s sprint free qulification match of Beijing 2022 Winter Olympics at Zhangjiakou National Cross-country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 8, 2022. Credit: Wang Song/Xinhua/Alamy Live News

RM2FMJX8F–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Liu Rongsheng of National Cross-Country Skiing Team competes during the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Hou Zhaokang/Xinhua/Alamy Live News

RM2FMJX8B–Altay, China"s Xinjiang Uygur Autonomous Region. 10th May, 2021. Shang Jincai (L) and Liu Rongsheng of National Cross-Country Skiing Team celebrate after finishing the men"s 15km mass start classic event at the FIS Cross-Country Skiing China City Tour in Sarkobu Cross-Country Ski Track, Altay City, northwest China"s Xinjiang Uygur Autonomous Region, May 10, 2021. Credit: Zanghaer Bolati/Xinhua/Alamy Live News

RM2HP7A4F–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP6R28–Beijing, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP7GR8–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

RM2HP79RK–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China competes during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Hu Huhu/Xinhua/Alamy Live News

RM2HP799D–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Hadesi Badelihan (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Liu Chan/Xinhua/Alamy Live News

RM2HP6W5G–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Liu Rongsheng of China passes the finish line during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP79F3–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (R) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Deng Hua/Xinhua/Alamy Live News

RM2HP71XE–Zhangjiakou, China"s Hebei Province. 19th Feb, 2022. Wang Qiang (L) and Liu Rongsheng of China compete during the cross-country skiing men"s 50km mass start free of Beijing 2022 Winter Olympics at National Cross-Country Skiing Centre in Zhangjiakou, north China"s Hebei Province, Feb. 19, 2022. The men"s 50km cross-country mass start race on Saturday has been delayed by an hour to 1500 local time (0700 GMT) and shortened to 30km due to high winds at the National Cross-Country Skiing Centre. Credit: Mu Yu/Xinhua/Alamy Live News

(Beijing) – Piles of rusty steel bars and old ship parts are virtually all that"s left of a sprawling shipyard in the eastern city of Rugao, where Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people.

Once China"s largest shipbuilder, Rongsheng is on the verge of bankruptcy. Orders have dried up and banks are refusing credit. Questions have been raised about the shipyard"s business practices, including allegations of padded order books. And Rongsheng is apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms, sources told Caixin.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

"The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company"s conservative sales strategy under the current trough stage of the shipbuilding market," China Rongsheng said in a statement to the Hong Kong stock exchange.

Analysts have said the company could be the biggest casualty of a local shipbuilding industry suffering from overcapacity and shrinking orders amid a global shipping downturn.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year.

Dryships has four dry bulk carriers on order at the company"s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

The company told Reuters on Wednesday it had delivered 7 vessels (1.5 million DWT) in the first half of 2013, and had delivered at least two 380,000-DWT class very large ore carriers in the second half of the year.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

The company said that trading of its shares and all structured products related to it was suspended pending clarification of "news articles and possible inside information", according to a filing with the exchange.

The company"s shares dropped 10 percent on Wednesday after it told the Wall Street Journal that some of its contract workers had engaged in "disruptive" activities and had surrounded the entrance of its factory in Jiangsu province.

And despite the global downturn, it managed to complete projects worth 3.9 million deadweight tons in 2012. Brazil and Greece accounted for more than half of the company"s 2012 revenue.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

However, Meng Lingru, an industrial analyst with Shanxi Securities, said that the product upgrade might not help the company that much as weak market demand is the fundamental reason behind the job losses.

The company posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, and it had short-term debt of 19.3 billion yuan as of the end of 2012. It also laid off 3,000 employees last year, as it aims to return to profit this year.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

A Moody"s Investors Service outlook report released in June said that the serious problem of the excess capacity in the next 18 months will continue to lower international shipping prices.

Declining US crude oil imports and lackluster commodity demand in Europe will also lead to a slowdown of maritime shipments, with dry bulk ships and crude oil tankers bearing the brunt first, which indicates that Chinese shipbuilders will see disappointing market conditions.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

China Huarong Energy Co. Ltd. is an investment holding company, which engages in the energy exploration and production business. It operates through the following segments: Energy Exploration & Production and Oil Storage. The Energy Exploration & Production segment includes sale of crude oil in Kyrgyzstan and trading the relevant commodities in China. The Oil Storage segment derives income through renting its capacity in the provision of oil storage services. The company was founded on February 3, 2010 and is headquartered in Hong Kong.

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

The country"s second-largest private vessel maker has been given a HK$3.23 billion ($417 million) cash injection, the company said in Hong Kong Stock Exchange filings.

The company"s struggles illustrate the difficulties shipbuilders face in competing with State-owned yards that have government backing and easier access to financing.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

"They are already having funding problems. Their gamble has backfired. Some people might be concerned they might need a lot of funding in future because oil exploration is a very capital-intensive business," said Hong Kong-based Lun.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

Some of Rongsheng"s subsidiaries, including Hefei Rong An Power Machinery Co and Rongsheng Machinery Co, signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015.

The Shanghai-based company said on Aug 21 that it is entering the energy business by buying 60 percent in a Kyrgyzstan oilfield by issuing new shares. It said on Oct 15 that it is seeking to identify new investment opportunities outside of China including in Central Asia.

Shares in the maker of bulk carriers and oil tankers had been suspended from trading since Aug 29 in Hong Kong, pending the restructuring details. Rongsheng had first-half net losses of 3.06 billion yuan ($501 million), more than double last year"s.

Rongsheng was overdue on principal and interest payments

8613371530291

8613371530291