jiangsu rongsheng heavy industries group co ltd brands

Brazil sank a decommissioned aircraft carrier in the Atlantic Ocean off its northeast coast, the Brazilian Navy said, despite warnings from environmentalists that the rusting 1960s French-built ship would pollute the sea and the marine food chain.The 32,000-tonne carrier had been floating offshore for three months since Turkey refused it entry to be scrapped there because it was an environmental hazard and the ship was towed back to Brazil.The carrier was scuttled in a "planned and controlled sinking" late on Friday, the Navy said in a statement, that would "avoid logistical, operational, environmental and economic losses to the Brazilian state," it said.

Finnish cargo handling machinery manufacturer Cargotec on Monday announced its board of directors has appointed Casimir Lindholm to succeed Mika Vehviläinen as the company"s president and CEO, effective April 1, 2023.A member of Cargotec"s board since 2021, Lindholm has held CEO positions both in Eltel and Lemminkäinen and many board memberships.“I’m honored and excited to be leading Cargotec at such a pivotal moment in the company’s history, with a strong foundation and a clear vision into its next development phase of growth as we have communicated before.

The Baltic Exchange"s main sea freight index, tracking rates for ships carrying dry bulk commodities, fell to the lowest in nearly three years, pressured by weaker rates across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, fell 13 points, or about 2.1%, to 608, its lowest since early-June 2020.The capesize index lost 10 points, or about 2.3%, to over a five-month low of 419.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $86 at $3,475.

ABB has unveiled its Baldor-Reliance HydroCool XT motor product line, a new generation of water-cooled motors for extreme marine duty and other applications.According to the manufacturer, HydroCool XT is quiet and versatile, and offers reduced maintenance and high performance in some of the toughest environments. Water-jacket cooling offers higher thermal conductivity than air cooling, helping to extend the motor life while eliminating the need for fans or air filters. Available with induction or permanent magnet rotor technology, the motor can achieve the highest level (IE5) efficiency rating for energy savings

The Italian trade union USB filed a legal complaint against a plan by gas grid operator Snam to set up a new liquefied natural gas (LNG) terminal in the Tuscan port of Piombino, it said in a press release on Friday.USB alleged Snam had committed serious "environmental crimes" while performing works to build the terminal.USB criticised in the statement the choice to set up the terminal in an area already polluted by an old steel plant, saying regasification processes would increase pollution levels even further and cause "serious and irreparable injuries."Snam declined to comment on the issue.

Brazil sank a decommissioned aircraft carrier in the Atlantic Ocean off its northeast coast, the Brazilian Navy said, despite warnings from environmentalists that the rusting 1960s French-built ship would pollute the sea and the marine food chain.The 32,000-tonne carrier had been floating offshore for three months since Turkey refused it entry to be scrapped there because it was an environmental hazard and the ship was towed back to Brazil.The carrier was scuttled in a "planned and controlled sinking" late on Friday, the Navy said in a statement, that would "avoid logistical, operational, environmental and economic losses to the Brazilian state," it said.

Finnish cargo handling machinery manufacturer Cargotec on Monday announced its board of directors has appointed Casimir Lindholm to succeed Mika Vehviläinen as the company"s president and CEO, effective April 1, 2023.A member of Cargotec"s board since 2021, Lindholm has held CEO positions both in Eltel and Lemminkäinen and many board memberships.“I’m honored and excited to be leading Cargotec at such a pivotal moment in the company’s history, with a strong foundation and a clear vision into its next development phase of growth as we have communicated before.

The Baltic Exchange"s main sea freight index, tracking rates for ships carrying dry bulk commodities, fell to the lowest in nearly three years, pressured by weaker rates across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, fell 13 points, or about 2.1%, to 608, its lowest since early-June 2020.The capesize index lost 10 points, or about 2.3%, to over a five-month low of 419.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $86 at $3,475.

ABB has unveiled its Baldor-Reliance HydroCool XT motor product line, a new generation of water-cooled motors for extreme marine duty and other applications.According to the manufacturer, HydroCool XT is quiet and versatile, and offers reduced maintenance and high performance in some of the toughest environments. Water-jacket cooling offers higher thermal conductivity than air cooling, helping to extend the motor life while eliminating the need for fans or air filters. Available with induction or permanent magnet rotor technology, the motor can achieve the highest level (IE5) efficiency rating for energy savings

The Italian trade union USB filed a legal complaint against a plan by gas grid operator Snam to set up a new liquefied natural gas (LNG) terminal in the Tuscan port of Piombino, it said in a press release on Friday.USB alleged Snam had committed serious "environmental crimes" while performing works to build the terminal.USB criticised in the statement the choice to set up the terminal in an area already polluted by an old steel plant, saying regasification processes would increase pollution levels even further and cause "serious and irreparable injuries."Snam declined to comment on the issue.

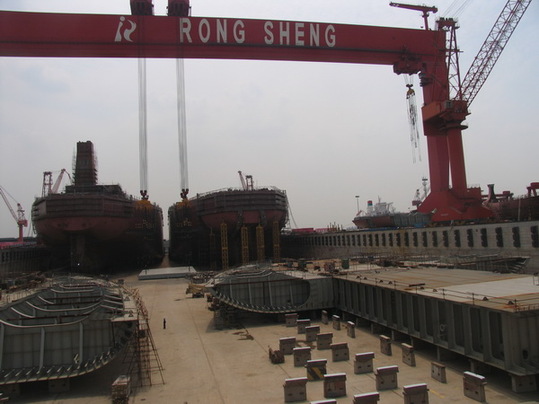

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

The shipbuilder’s net debt to equity, a measure of indebtedness, climbed to 134 percent in January-June from 119 percent in 2012 and 85 percent in 2011. Talks with its banking syndicate are ongoing, with no indication when a deal could be struck, a person at one of the banks told Reuters this week.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China’s economic growth began to slow and credit tightened at a time when global shipping, too, turned down.

“The lottery has become increasingly popular,” said a girl working the till. “I’m not sure why really, but perhaps people are hoping they can win something here.”

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

The investigation may deter customers from placing orders, Jon Windham, an analyst at Barclays Plc., said yesterday by phone. “It’s obviously very bad for the overall image of the company.” He downgraded the stock to underweight from equalweight and cut its target price to HK$1.06 from HK$2.40.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

The shipbuilder has had delays as it builds 16 of the world’s biggest commodity ships for Vale SA and Oman Shipping Co. It was supposed to hand over eight of the ships last year, according to its IPO prospectus. Instead, it only delivered one. It had handed over two more to Vale by May 20. The same month, it christened two for Oman Shipping, Xinhua reported.

The company’s cash reserves have also declined. It had 6.3 billion yuan of cash and cash equivalents at the end of December down from 10.4 billion yuan a year earlier. Its short-term borrowings rose to 18.2 billion yuan from 10.1 billion yuan, according to data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

Well Advantage and other unknown traders stockpiled shares of Nexen before Cnooc announced plans to buy the Calgary-based energy company for $15.1 billion, according to the SEC. The regulator acted to freeze accounts less than 24 hours after Well Advantage placed an order to liquidate its position, it said. The investigation continues, it said July 27.

The traders may have to pay multiples of the profit they made from illegal deals to settle the case, based on previous incidents, said David Webb, the founder of corporate-governance website Webb-site.com. The frozen accounts may make a settlement more probable as the traders won’t be able to access cash, he said. Still, there may be a long-term impact on reputations.

“Cases such as this bring the integrity of the persons involved into question,” Webb said. “And, if they are running a bank or a listed company, then it tends to tarnish the firm too.”

. All rights reserved. The content (including but not limited to text, photo, multimedia information, etc) published in this site belongs to China Daily Information Co (CDIC). Without written authorization from CDIC, such content shall not be republished or used in any form. Note: Browsers with 1024*768 or higher resolution are suggested for this site.

HONG KONG, May 24, 2011 /PRNewswire-Asia/ -- China Rongsheng Heavy Industries Group Holdings Limited ("China Rongsheng Heavy Industries" or the "Group"; stock code: 01101.HK), a large heavy industries group in China, has collaborated with China National Offshore Oil Corporation ("CNOOC") to construct the world"s first-ever 3,000-meter deepwater pipe laying crane vessel ("DPV") "Ocean Pec 201". A national major science and technology project conference and a christening ceremony to celebrate the completion of the vessel were held in Rugao City, Jiangsu today.

The DPV "Ocean Pec 201" was the culmination of the first joint offshore engineering project of CNOOC and China Rongsheng Heavy Industries. The project started in May 2005 and construction of the vessel commenced in September 2008. Offshore Oil Engineering Co., Ltd. ("COOEC"), a listed company held by CNOOC, was responsible for all construction cost as well as the operation upon completion. The christening ceremony today symbolised that the construction of the DPV has completed the outfitting and testing stages and is at the final stage of trial voyage and delivery.

Guests including top management of China Rongsheng Heavy Industries and its partners together with leading officials of the local Government presided over the occasion and officiated at the ribbon-cutting ceremony. Business executives included Mr. Zhou Shouwei, Vice President of CNOOC and academician at the Chinese Academy of Engineering; Mr. Zhou Xuezhong, President of COOEC; Mr. Zhang Dehuang, Chairman of Jiangsu Rongsheng Investment Group Co. Ltd; Mr. Chen Qiang, Chief Executive Officer of China Rongsheng Heavy Industries and Mr. Chen Guorong, President of Jiangsu Rongsheng Heavy Industries Co., Ltd. Local officials included Mr. Qinyan from the Jiangsu Economic and Information Technology Commission and Ms. Chen Huijuan, Deputy Mayor of Nantong & Secretary of Rugao Municipal Committee of the Communist Party of China.

Mr. Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, ""Ocean Pec 201" is an important part of the demonstration engineering projects. It includes major equipment and ancillary engineering technology for offshore deepwater engineering projects among the major national science and technology programmes under China"s Eleventh Five-Year Plan. The entry of CNOOC in deep water exploitation creates opportunities for the offshore engineering sector in China and enhances the overall capability of the related manufacturing and metallurgy industries in China. The christening and impending trial voyage of the semi-submersible drilling rig "Ocean Pec 981" and DVP "Ocean Pec 201" highlights China"s ability to develop sophisticated equipment in the offshore engineering sector and its competitiveness in the international market."

"Ocean Pec 201" is the world"s first deepwater pipe laying crane vessel featuring 3,000-meter deepwater pipe-laying, 4,000 tonnes of lifting capacity and DP-3(1) dynamic positioning capability(2). The vessel is able to operate in any navigable area globally except for the Arctic regions. It is equipped with a series of advanced equipment including electric propulsion, VF electric drive, DP-3 dynamic positioning, "S" type deepwater dual node pipe-laying system as well as a 4,000-tonne heavy offshore crane. The vessel was designed and built in China. With a crew of 380, it is the first offshore engineering vessel in Asia and China capable of laying pipes at a water depth of 3,000 meters. The overall technology and capacity are also superior to similar vessels overseas.

The offshore oil development in China has long been hindered by its backward offshore oil technology and equipment, with operations confined to within 500 meters from the shore. However, CNOOC initiated its offshore development after the launch of the Eleventh Five-Year Plan through a significant investment in large deepwater development equipment including DPV and semi-submersible drilling rig. The completion of "Ocean Pec 201" fills a shortcoming in deepwater development of China. Together with other deepwater apparatus built by CNOOC, the DPV extends China"s development capability to a water depth of 3,000 meters.

Mr. Chen added, "Offshore engineering has been the major focus of the Group. We now own China"s largest offshore engineering dock equipped with China"s largest gantry crane with a lifting capacity of 1,600 tonnes. The DPV is the first collaborative project between CNOOC and China Rongsheng Heavy Industries. In the future, we expect to further strategically cooperate with CNOOC in the offshore engineering field. Upon completion of the "Ocean Pec 201", China Rongsheng Heavy Industries intends to further strengthen its design and construction capabilities, and lay a solid foundation to expand its offshore engineering business."

Mr. Chen concluded, "Looking ahead, the Group will continue to gradually expand our operating scale as stated in the prospectus and focus on high-end manufacturing and the development of large containerships to maintain our leadership in the shipbuilding engineering sector. We will also make marine engine building and offshore engineering our new growth drivers. Our aim is to develop the Group into a leading global heavy industries group and take the heavy industries in China onto the international stage."

DP-3: Vessels equipped with dynamic positioning system. In case of any fault (including total loss of a compartment resulting from fire or leakage), the system can automatically maintain the vessels" position and navigate into the designated operation area under specified environmental conditions. DP-3 is the highest class notation granted by the classification societies. Vessels equipped with DP-3 dynamic positioning systems also mean that these systems feature maximum capacity and reliability in their system deployment, thruster systems, electrical systems, controllers and measurement systems.

Dynamic positioning system: a complete system capabilities needed by vessels to automatically maintain a vessel"s position and heading by using its own propellers and thrusters. It includes the following subsystems: a dynamic system, thrusters, dynamic positioning control system and a measurement system.

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries" business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. China Rongsheng Heavy Industries" products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Group"s products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

The company said that trading of its shares and all structured products related to it was suspended pending clarification of "news articles and possible inside information", according to a filing with the exchange.

The company"s shares dropped 10 percent on Wednesday after it told the Wall Street Journal that some of its contract workers had engaged in "disruptive" activities and had surrounded the entrance of its factory in Jiangsu province.

And despite the global downturn, it managed to complete projects worth 3.9 million deadweight tons in 2012. Brazil and Greece accounted for more than half of the company"s 2012 revenue.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

However, Meng Lingru, an industrial analyst with Shanxi Securities, said that the product upgrade might not help the company that much as weak market demand is the fundamental reason behind the job losses.

The company posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, and it had short-term debt of 19.3 billion yuan as of the end of 2012. It also laid off 3,000 employees last year, as it aims to return to profit this year.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

A Moody"s Investors Service outlook report released in June said that the serious problem of the excess capacity in the next 18 months will continue to lower international shipping prices.

Declining US crude oil imports and lackluster commodity demand in Europe will also lead to a slowdown of maritime shipments, with dry bulk ships and crude oil tankers bearing the brunt first, which indicates that Chinese shipbuilders will see disappointing market conditions.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

China Huarong Energy Company Limited, formerly known as China Rongsheng Heavy Industries, has identified a Chinese company listed on a stock exchange in China as a potential buyer of its Jiangsu Rongsheng Heavy Industries shipyard.

The undisclosed buyer is further negotiating with the China Huarong regarding the list and scope of the relevant assets and liabilities, and the terms of the potential transaction.

The group has already obtained letters of consent from various major creditor banks which agreed to various matters in relation to, amongst other things, the disposal of assets and liabilities of Jiangsu Rongsheng.

However, China Huarong warned that the transaction is subject to certain provisions, including the signing of a formal transaction agreement, the final terms and conditions of which are still under further negotiations by the parties.

The celebrations were brief for China’s shipbuilders. Last year, they became the largest shipbuilding nation in the world, overtaking Korea for the first time. 2011, however, has been a harsh time of realisation for these yards: staying on top amid a jittery global economy is no easy task. As a result many have had to look for different lines of business; this has seen some yards go into ship recycling, others into repair, while quite a few have sought to increase their offerings in equipment, not least in engines.

A trend among Chinese shipbuilders over the past 24 months has been to grow their engine capabilities either organically or via acquisitions. New lines of business are vital as the trickle of new ship orders seen in China this year risks becoming a fully blown drought in years to come.

The China National Shipbuilding Association (CANSI) has repeatedly voiced concerns about the difficulties facing Chinese yards this year. CANSI noted how demand for large container ships, offshore vessels, LNG carriers and greener ships had dominated orders in 2011 to date. China’s major focus, however, is on bulk carriers, tankers and small and mid-sized container vessels. Moreover, CANSI has noted how many bulker newbuild contracts had been rescinded this year as the sector faces huge overcapacity.

According to CANSI, in the first half of 2011 the completed shipbuilding volume in China stood at 30.92 million dwt, a slight increase of 4.4 per cent. Newly received orders were, however, down by 9.2 per cent at 21.6 million dwt, giving a total orderbook of 181.76 million dwt, down 1.4 per cent year-on-year.

CANSI’s first-half report noted that nearly 50 per cent of researched companies had not received a single order in the first six months of this year. CANSI predicts that some shipbuilders will have no ships to build in the first half of next year, and some might even dry up by the final quarter of 2011.

CANSI reckons consolidation among China’s vast yard empire is inevitable. Ben Zhang, an independent shipbuilding analyst in Shanghai, told Marine Propulsion that of the current 400 facilities building ocean-going ships in China, there will be no more than 50 in the coming years.

In the first half of this year it has been difficult for shipbuilding companies to receive new orders, but the worst period for the sector is likely to be between 2013 and 2014, according to Xu Cai, general manger of one of China’s fastest growing private shipbuilders, Zhenghe Shipbuilding.

Wärtsilä’s operations in China continue to expand. Wärtsilä has been present in China for years, through its fully owned subsidiary and long-term licensing agreements. CSSC and Wärtsilä have been working together for 33 years, going back to 17 July 1978, according to Guo Xiwen, chief economist of CSSC.

To serve the world’s largest shipbuilding region, Wärtsilä has established joint ventures for propeller and auxiliary generating set production with leading Chinese shipbuilding groups and a joint venture for automation services. Wärtsilä also manufactures thrusters at its wholly owned company facilities, while low speed engines are produced by eight licencees and by a joint venture company.

At the end of June, Wärtsilä and Jiangsu CuiXing Marine Offshore Engineering agreed to establish a joint venture for manufacturing Wärtsilä 26 and Wärtsilä 32 medium speed marine engines in China. The following month Wärtsilä and CSSC Guangzhou Marine Diesel signed a licence agreement for the manufacture and sale of Wärtsilä two-stroke engines in China.

Wärtsilä has invested €16 million in the joint venture with Jiangsu CuiXing, which holds 51 per cent and Wärtsilä 49 per cent. Before the current investment Wärtsilä investments in China already exceeded €60 million.

The joint venture’s production facilities in Rugao city, just outside Nantong in Eastern China, will focus on the assembly and testing of engines. The facility is close to many shipyards, not least China’s largest, China Rongsheng Heavy Industries. Operations are planned to start in early 2013.

“This joint venture is a major step in our strategy to broaden our presence and production close to our marine customers in China,” said Ole Johansson, president and chief executive officer of Wärtsilä Corp, at the signing ceremony. “China has notably increased its market share in shipbuilding during recent years, and today has more than 40 per cent of the total global vessel orderbook. Through this joint venture, we will further improve our leading global position in the marine market

John Zhu, president of Wärtsilä China, said: “This joint venture will enable Wärtsilä to offer competitive products to its customers in the Chinese marine market. Wärtsilä expects to significantly increase its market share of medium speed engines. Our objective is to become one of the leading medium speed engine manufacturers in China.”

The agreement with CSSC Guangzhou Marine Diesel Co Ltd (GMD), a member of the state-owned China State Shipbuilding Corp (CSSC) Group, covers the entire engine portfolio with a power range of between 4,300kW and more than 80,000kW per engine.

Wärtsilä has recently been awarded orders to supply propulsion solutions for dredgers to be built in China (see also page 34). Nantong Gangzha ordered two Wärtsilä 16V32 engines, propulsion equipment and systems for a hopper dredger scheduled to be fully operational by the third quarter 2012. Nantong Gangzha said: "Wärtsilä has successfully supplied propulsion packages for a number of large hopper dredgers in the Chinese market, and we feel that the company’s products, backed by Wärtsilä’s professional service capabilities, will bring us the highest value and returns.”

Tianjin Dredging Co (TDC), part of the state-owned CCCC Group, has placed a propulsion package order with Wärtsilä for two dredgers being built at yards in China and scheduled to enter service during the beginning of 2012. TDC had previously ordered Wärtsilä engines for three other jumbo hopper dredgers. “We wish to ensure the vessel performance by choosing Wärtsilä, has proven to be a professional and reliable partner for the other ships in our current fleet,” the company said.

“The common theme in all these orders is that the companies trust Wärtsilä to provide reliable and cost-efficient solutions,” said Aaron Bresnahan, vice president, special vessels, Wärtsilä Ship Power. “Over the years, the Wärtsilä team has acquired considerable know-how on dredging solutions, and this experience is of tremendous importance to owners and operators across the world. Dredging is a complicated business, and the vessels require a very high degree of efficiency in order to work effectively in varying sea and weather conditions.”

In a busy year of design firsts for Wärtsilä in China, in July the company was contracted to supply the ship design for a series of 2,083 TEU state-of-the-art new generation container feeders. The UK-based Graig Group has ordered up to 26 fuel-efficient new generation Marlin 2000 Blue design container feeders to be built at Jin Hai Heavy Industries in Zhoushan. The first two vessels are scheduled for delivery in August and September 2013, with subsequent vessels to be delivered in pairs every two and half months (see page 153).

Wärtsilä Ship Design has been in close co-operation with Graig and classification society DNV to develop the Marlin series. The design marks a new era in the container industry"s standard for environmentally sustainable, competitively priced and fuel efficient feeder vessels, the companies say.

Another world leading diesel engine manufacturer, MAN, has added more than 10 licensee manufacturers in China over the past two years, almost accounting for half of its licensee manufacturers accrued over 30 years in China. It has been a hectic year for MAN in China, and sources in Shanghai say there is no let-up in enquiries.

Jiangsu Antai Power, ZGPT Diesel and Hefei Rongan Power (a Rongsheng subsidiary which will soon launch an IPO in Hong Kong) all entered the market through co-operating with MAN.

In April, Jiangsu Antai Power Machinery signed a co-operative agreement with Doosan Engine, a listed subsidiary of Doosan Infracore, one of the world’s top 500 enterprises from Korea. According to the agreement, both Antai and Doosan will develop co-operation on the manufacture, marketing and servicing of MAN low speed marine diesel engines. On the basis of the Antai Power’s manufacturing, Doosan will provide support in the fields of technology, quality control and manufacturing management with the two parties considering forming a joint venture according to the effectiveness of this initial co-operation.

Doosan Engine has co-operated with MAN for 27 years. As a leading enterprise in the field of marine diesel engines, Doosan Engine covers one fourth of the market with 14 million HP production capability. However, Doosan only produces 3 million HP in the increasingly important China market. In order to expand, Doosan had been looking for partners in China.

“Through this co-operation, we probably can achieve the technical improvement in three years which might have taken 10 years,” said Zhang Tong, vice president of Antai Power. On 31 May, Antai Power signed a contract with Jiangsu New Century Shipbuilding to supply six MAN 5S60MC diesel engines worth more than ¥100 million. The first of the six engines will be delivered in April 2012. Antai Power will also deliver the first of the four MAN 5S60MC diesel engines ordered earlier this year to Jiangsu East Heavy Industry in October.

“As the first private enterprise in China to enter the low speed diesel engine industry, Antai Power will firstly expand the local market in Jiangsu province which is a strategic location of China’s shipbuilding industry,” said Chen Guochong, president of Antai Power.

The first MAN 8L27/38 Tier E3 diesel engine in the world was completed in July and introduced by Zhejiang ZGPT Diesel Heavy Industry. The engine is environmentally sustainable which meets the latest standards of IMO’s Marpol commitments and it will be installed on a 6,650 dwt bulk cargo ship.

During the past two years, ZGPT diesel has successfully completed four engine series MAN16/24, MAN21/31, MAN27/38, MAN32/40 and MAN8L32/40 Tier C1 which is used on dredgers.

Also of note regarding this European machinery manufacturer, in May MAN Diesel & Turbo opened the second section of the construction work at its plant in Changzhou, China. At this plant turbomachinery and turbochargers for large-bore diesel engines will in future be produced under a single roof for the Chinese market. Until now, China"s production of the turbochargers has been based in Shanghai. By relocating its production facilities to Changzhou, MAN Diesel & Turbo is looking to harness further synergies from the merger of the two former sister companies MAN Diesel and MAN Turbo.

China Rongsheng Heavy Industries, China’s largest privately-owned shipbuilder, acquired Anhui Quanchai Group Corp for ¥2.15 billion at the end of April to enter the high speed diesel engine market. Quanchai Group, which was wholly owned by the government of Quanjiao County of Anhui Province, holds about 44.39 per cent of Shanghai-listed Anhui Quanchai Engine Co.

The transaction will allow Rongsheng to position itself as a diversified heavy industry enterprise through leveraging its capability in producing low speed diesel engines and enhancing its ability to enter into high speed diesel engine market, which is the prime business of Quanchai Engine.

Currently Rongsheng is mainly engaged in four business segments, comprising shipbuilding, offshore engineering, marine engines and engineering machinery.

The company plans to get 40 per cent of sales from shipbuilding by 2015, 20 per cent from marine engineering, as much as 25 per cent from machine engineering and the rest from making engines, its president Chen Qiang said earlier this year. Last year, about 94 per cent of the company’s ¥12.7 billion of sales came from shipbuilding. To help boost revenue, Rongsheng may buy engine makers and small shipbuilders, Chen said.

Rongsheng Heavy Industries and Brazilian company Vale SA held a naming and launching ceremony in July for Vale China, a 400,000 dwt very large ore carrier (VLOC). Vale is the world’s largest producer of iron ore, and has ordered 12 of the so-called ‘Valemax’ ships from Rongsheng, of which Vale China was the yard’s first delivery. Vale has also ordered seven Valemax ships from Daewoo Shipbuilding & Marine Engineering Co in South Korea, which were led into service by Vale Brasil in March. Vale plans to have another 16 ships with the same dimensions – a length of 360m and a 65m beam – and says that all 35 ships will be delivered between 2011 and 2013.

Wärtsilä engines power the 12 VLOCs being built in China, and the order was the biggest for Wärtsilä RT-flex82T low speed engines when it was placed in October 2008. Each vessel features a 7-cylinder Wärtsilä RT-flex82T low-speed engine with a contracted maximum continuous power of 29,400kW at 76 rpm. Each of the seven VLOCs on order in Korea is powered by an MAN B&W 7S80ME-C8 engine with an output of 29,260kW.

The 12 engines for the Rongsheng ships are being built by Hefei RongAn Power Machinery Co Ltd (RPM) of Hefei, Anhui, China under licence from Wärtsilä. Both Rongsheng Shipbuilding & Heavy Industries and Hefei RongAn Power Machinery Co Ltd are members of Jiangsu Rongsheng Heavy Industries Group Co Ltd (RSHI). The licence agreement between Wärtsilä and RSHI for the manufacture of Wärtsilä low-speed engines dates back to March 2008.

Yuchai Power’s first low speed and high power marine engine manufacturing base in south China officially started operations from 13 July in Zhuhai, Guangdong Province. The ¥2.5 billion project is targeting the domestic shipbuilding market in Jiangsu, Zhejiang and Fujian, and then the Southeast Asia market. Wärtsilä will provide full technical and service support for the products which will enhance Yuchai’s overall technology level and market competiveness.

“The Zhuhai Yuchai diesel engine base is one of Yuchai’s most important projects,” said Yan Ping, chairman of Yuchai Group. “Yuchai will still focus on the development of medium speed and low speed diesel engines. Especially the low speed diesel engine market has been monopolised by overseas brands for years and that has constrained the development of domestic manufacturers. This year, our objective is not the quantity but the quality. We hope we can be the leading domestic manufacturer of low-speed diesel engines in China in 2013-2015 and we are confident about that.”

At its most recent quarterly results, announced in early August, the company gave an idea of where cash might come from in the coming months. “Given the PRC government’s current anti-inflationary policies and measures, interest rates have continued to rise and are expected to increase further,” it said in a statement. “The group continues to explore financing options such as the issuance of short-term financing bonds to improve our profitability, financial flexibility and to meet our working capital requirements.”

As well as signing low speed engine license agreements with MAN and Wärtsilä in June and July respectively, state-owned engine maker CSSC Guangzhou Marine Diesel (GMD) has had a busy year expanding. In July GMD accelerated the construction of its low speed engine manufacturing base project. The total investment of the Phase 1 project is now projected to reach ¥6.5 billion. Occupying 1,250,000m2, this giant facility will offer a production capacity of three million HP upon completion by the end of this year.

Lu Xiaoyan, vice general manager of CSSC, said: “The Guangzhou low speed engine manufacturing base project is strategic to complete the marine engine system in south China. The base will mainly produce 6RT-Flex68 and 6S70MC-C engines.”

The Wärtsilä deal covers its entire engine portfolio with a power range of between 4,300kW and over 80,000kW per engine. Wärtsilä expects the first engines to be produced at the end of this year.

“China’s burgeoning growth in shipbuilding capacity during recent years has stimulated the rapid development of the marine diesel engine market,” said Dr Martin Wernli, president, Wärtsilä Switzerland Ltd. “We are, therefore, delighted to have formed this partnership with [GMD] and have every confidence that this agreement will enhance Wärtsilä’s presence in this region.”

GMD is a subsidiary of China State Shipbuilding Co (CSSC), the state-run umbrella organisation for all state yards and marine equipment firms from Shanghai to the south of the country. Another CSSC subsidiary is stepping up its engine production facilities too. CSSC Anqing (Anchai)’s marine diesel engine plant Phase 2 is in progress. The facility which includes assembly plant, experiment plant and production line, will be completed by the end of year.

Anchai has a record delivery of 471 marine engines by the end of 2010, a growth of 16.3 per cent. Its new product, 8DK-36, has been approved by Daihatsu and will be promoted on the market this year. Anchai now has yearly production capacity of 600-700 marine diesel engines.

While China is producing far more engines than it did a decade ago, it is still not enough to satisfy Beijing’s drive across key industries for greater self-sufficiency. As it stands fewer than one in two engines for ships built in China is made in China. Given the future predicted turmoil of China’s shipbuilding industry, central government has recently issued a restructuring and revitalisation plan for the shipbuilding industry. This optimistically calls for 80 per cent of all low and medium speed marine diesel engines for ships being built in China to be built domestically.

While production capacity across China’s marine diesel engine industry has accelerated, there is still a big gap in technical expertise for domestic manufacturers to overcome. Wang Jinlian, general secretary of CANSI, details the progress and pitfalls: “The domestic medium speed diesel engine industry is developing fast. There might be a breakthrough development this year, but domestic manufacturers still need time to develop the brands, and that is even harder for low speed diesel engines which doesn’t seem likely to have any big breakthroughs soon.”

Seaspan Corp has placed a landmark order this year for 7 + 18 newbuildings of 10,000 TEU container ships at Jiangsu Yangzijiang Shipbuilding. The largest container ships to be built in the mainland thus far, These will be powered by the new super long-stroke engine type MAN B&W 10S90ME-C9, which will be built by the Chinese engine builder CSSC-MES Diesel (CMD).

Traditionally, MAN Diesel & Turbo K98-type engines have been used as prime movers by 8,000-10,000 TEU capacity container vessels. Following efficiency optimisation trends in the market, where container ships have increasingly adopted lower ship speeds, the engine designer evaluated the possibility of using even larger propellers with a view to using engines with even lower speeds for propulsion. Investigations revealed that container ships are indeed compatible with larger propeller diameters than current designs, and the high efficiencies that follow an adaptation of the aft-hull design to accommodate the larger propeller.

The new, higher-powered, super long-stroke S90ME-C9 engine type meets this trend in the market. MAN Diesel & Turbo investigations indicate an overall efficiency increase of about 7 per cent when using the S90ME-C9, compared with existing main engines, depending on the propeller diameter used.

Canada-based Seaspan Ship Management entered a close dialogue with MAN Diesel & Turbo to decide upon main engines for its expanding fleet of newbuilding container ships. The owner initially considered the MAN B&W K98ME-C engine, but ultimately settled for the super long-stroke 10S90ME-C9 type on account of its superior fuel savings, a choice that required a redesign of the newbuildings’ aft-ship to accommodate the lower engine rpm and larger propeller diameter. The yard and its design partner changed the design accordingly. Seaspan has previously built ships at Yangzijiang Shipbuilding with 6K80MC-C engines built by CMD in China.

Ole Grøne, MAN Diesel & Turbo’s senior vice president, Promotion & Sales, said: “We continuously keep a close eye on developments and trends within the shipping sector and have watched with interest the increasing demand for lower engine speeds and larger propeller diameters within the container segment. While our portfolio of engines already matches a broad reach of requirements, we have specifically introduced the super long-stroke S90ME-C9 to market to satisfy current trends and are very happy with its immediate adoption in the major shipbuilding markets.”

In April, Guangzhou Diesel Engine Factory and the Norwegian maritime research institute Marintek signed a co-operation agreement for the development of an innovative LNG ship engine for the Chinese market. Based on a test model of an LNG ship engine created at Marintek, Guangzhou Diesel Engine Factory has built a corresponding engine for the Chinese market. LNG eliminates sulphur emissions, significantly reduces NOx emissions and cuts CO2 emissions by at least 20 per cent.

The engine is expected to become popular in China for several reasons. First, using LNG as fuel does not reduce the power of the engine compared with conventional diesel engines, something which is a common problem for other engines run on LNG. This Norwegian-Chinese 6230SG LNG engine will perform as well as a diesel engine.

Second, ships need to meet new IMO emission standards that will come into effect by 2016. These entail, among other things, that NOx emissions cannot be larger than 2g per kW/h. The 6230SG LNG engine meets these requirements, and gives a 20 per cent reduction in CO2 emissions compared to a diesel engine with the same effect.

Third, even though an LNG fueled engine is more expensive than a conventional engine, LNG is less expensive than diesel, so choosing LNG engines is an investment which pays back over time.

Shipping’s carbon footprint is under ever greater scrutiny and Norway has positioned itself as a nation with strong green maritime credentials. “As a significant shipping nation with a clear position on climate change, Norway has made reduction of CO2 emissions from maritime transport a priority,” said Tormod Endresen, Norway’s consul general based in Guangzhou. “The co-operation between Marintek and Guangzhou Diesel makes for a concrete contribution to this aim. It also illustrates the potential in Sino-Norwegian co-operation in the maritime sector.” MP

8613371530291

8613371530291