jiangsu rongsheng shipyard price

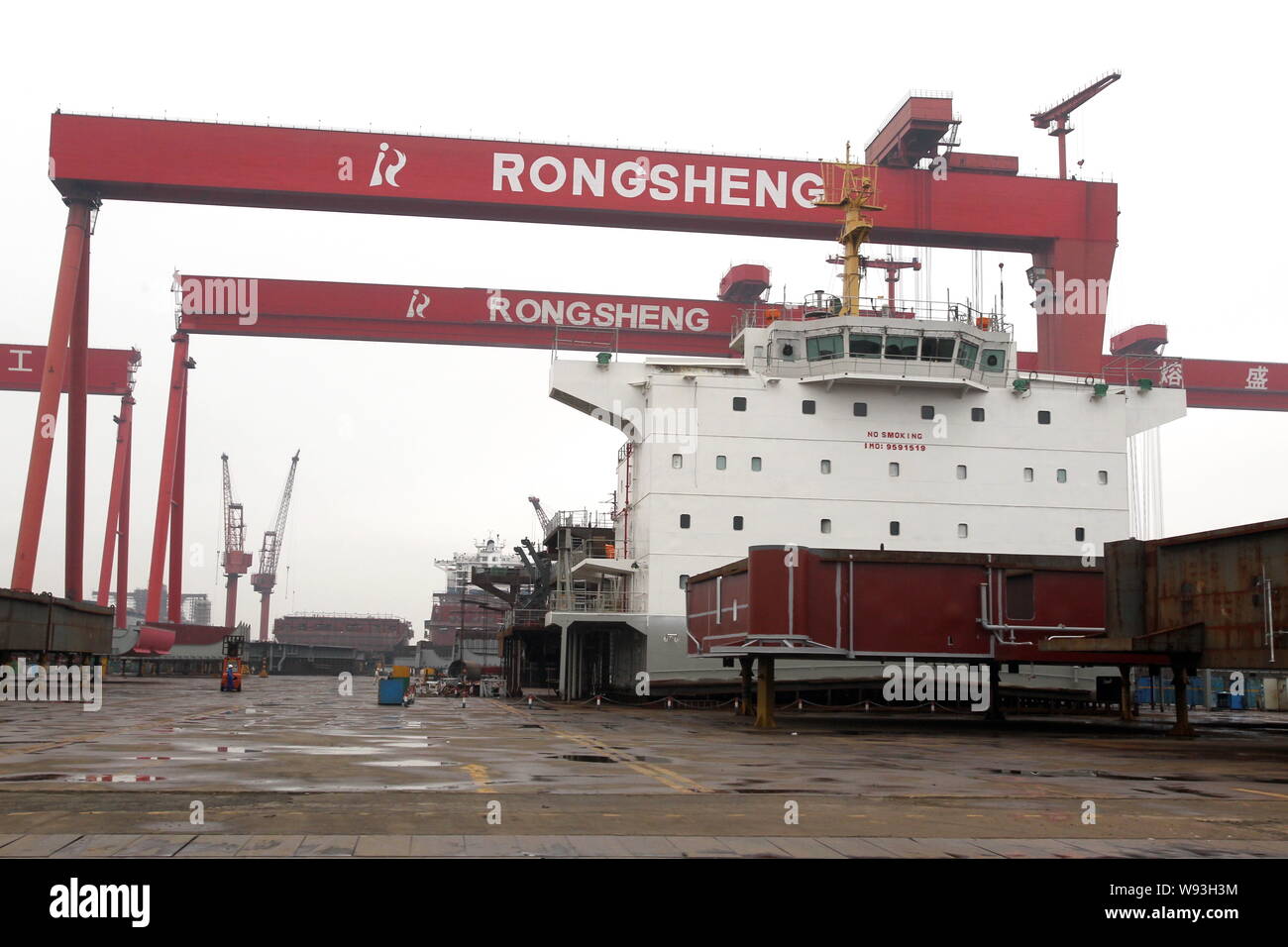

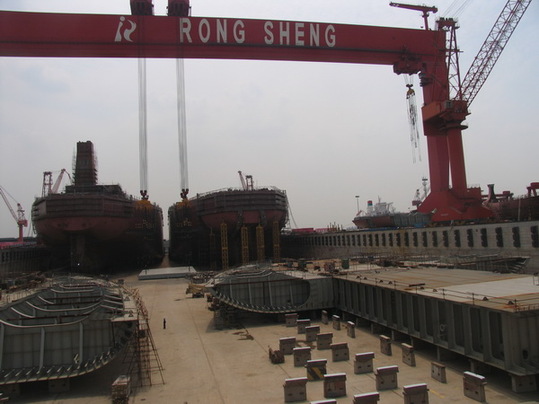

The shipyard, located in the Yangtze River Delta, was founded in 2006, and became the largest private shipbuilder in China, churning out giant valemaxes at its four large dry-docks, before a massive financial collapse forced it to cease operations in 2014.

Broking sources in China tell Splash that the yard’s former chief operating officer David Luan is now preparing to officially reopen the yard, to be known as SPS Shipyard, a reference to ShipParts.com, a business he created in 2015 after quitting Rongsheng.

SPS Shipyard will start to market cape and kamsarmax slots from next week with next available slots being from Q3 2025 onwards. Luan has yet to reply to questions sent by Splash earlier today.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

SHANGHAI, July 10 (Reuters) - Jiangsu Rongsheng Heavy Industries Co, China’s biggest privately-owned shipbuilder, expects revenue and profit to double this year from last year, its president Chen Qiang said on Friday.

Rongsheng, backed by foreign funds including Goldman Sachsand U.S. fund D.E. Shaw, is seeking to tap capital markets via an initial public offering of up to $2 billion to fund growth and compete with bigger state-owned rivals including Guangzhou Shipyard International Co.

Rival Guangzhou Shipyardposted a near 50 percent drop in first-quarter net profit this year and called off a proposed $445 million acquisition of a shipyard from its state-owned parent in March as its share price had slumped.

Chinese shipbuilder Jiangsu Rongsheng Heavy Industries has raised about HKD$14bn ($1.8bn) in its initial public offering on the Hong Kong stock exchange.

Rongsheng will use part of the sale proceeds to fund its shipbuilding and offshore engineering businesses, and to repay loans, according to lloydslist.com.

By Pete Sweeney SHANGHAI (Reuters) - Chinese banks are stuck in a lose-lose legal battle between domestic shipyards and foreign buyers over billions of dollars in refund guarantees that are supposed to be paid out if shipbuilders fail to deliver on time. One in three ships ordered from Chinese builders was behind schedule in 2013, according to data from Clarksons Research, a UK-based shipping intelligence firm. Although that was an improvement from 36 percent a year earlier, it was well behind rival South Korea, where shipyards routinely delivered ahead of schedule the same year. That means Chinese banks may be on the hook to pay large sums to buyers if the yards can"t come through per contract, with little hope of recouping the cash from the yards. China is the world"s biggest shipbuilder, with $37 billion in new orders received last year alone. Buyers pay as much as 80 percent of the purchase price upfront. Chinese bankers rushed to finance shipbuilding after the 2008 global financial crisis as Beijing pushed easy credit and tax incentives to lift the industry and sustain industrial employment levels in the face of collapsing exports. Fees generated by offering such guarantees looked like easy money until massive oversupply and falling demand started taking a toll on the yards around 2010. Shipyards fell behind schedule and buyers demanded their money back. But behind or not, the builders, keen to keep orders on the books and prepaid money in their pockets, have submitted injunctions against banks in Chinese courts to prevent them from paying out. "China"s ambitions to take over South Korea as the top major shipbuilder meant that all the banks were encouraged to open up their wallets and lend money to the shipbuilders without making thorough due diligence," said AKM Ismail, former finance director for Dongfang Shipyard, the first Chinese shipyard to be listed on London"s AIM Stock Exchange in 2011. Since ships cost millions of dollars and can take years to deliver, a shipbuilder generally asks for part of the purchase price upfront to cover material and labor costs. Buyers normally obtain a refund guarantee from a bank to assure their money is returned if the yard defaults, and the yard pays the bank"s fee for the service. Lawyers say that in many cases, banks did not require shipyards to pledge any specific collateral, partly because these guarantees are like a form of insurance rather than a loan. That leaves banks stuck with the default bill. If banks obey local court injunctions and hold off from issuing refunds, they risk being taken to court by ship buyers in foreign jurisdictions. But if they pay out under the refund guarantee or seek compensation from the shipyard for the loss, bankers say they risk alienating local governments, which can damage the banks" business interests in the region. "The whole issue of refund guarantees has been a big headache," said a finance executive at China Minsheng Bank. "On the one hand, we know that our clients, the shipyards, will be saddled with huge debt that they will struggle to repay to us, if they can even pay back at all. But at the same time, our credibility is at risk, so we have to pay them out." He and other bankers interviewed for this article all spoke on condition of anonymity because of the legal sensitivities of the issue. Minsheng Bank did not respond to a request for comment. In one case, UK court records show that in November 2012, subsidiaries of German ship owner First Class Ship Invest GmbH took China Construction Bank Corp to court in London to enforce payment of more than $10 million under a refund guarantee after Zhejiang Zhenghe Shipbuilding Co Ltd allegedly failed to deliver on an order. CCB lawyers argued that an injunction served on it by Zhejiang Zhenghe in China would open up the bank to fines and the responsible banker could be arrested in China were it to pay out, but the judge rejected the argument. None of the parties in the suit responded to requests for comment from Reuters. Reuters was unable to find a single public example of a Chinese bank successfully fighting off a refund guarantee claimant in an overseas court; nearly all refund guarantee contracts stipulate litigation must be conducted in a foreign court. Jim James, a partner at Norton Rose Fulbright in Hong Kong, said that he has been involved in several cases in which yards repeatedly obtained injunctions from different Chinese courts to drag out the refund process. James, who has represented buyers, shipyards and banks in different cases, said the problem had become so serious that China"s supreme court planned to issue guidance to lower courts on the handling of injunction applications. LOBBYING WAR Most customer suits are settled in arbitration and domestic court records are usually not published, so there is little hard data on the number or value of contracts under dispute. But loan officers at China Export Import Bank, Bank of Communications, Bank of China and Shanghai Pudong Development Bank told Reuters that they had seen refund claims rising rapidly in 2012 and 2013. The problem was widespread enough for the China Behavior Law Association Training Cooperative Center, an organization registered with the Ministry of Civil Affairs, to hold a three-day conference for Chinese banks last July on the risks of refund guarantees. On the other side, the Shanghai Shipbrokers" Association published advice for shipyards on how to keep banks from paying out refund guarantees on its website, saying Chinese banks should be more cooperative. Shanghai Pudong Development Bank said it largely disbanded its shipping finance team in 2012, due to the sudden rise in refund guarantee claims and worsening market conditions. An executive at another Chinese municipal bank told Reuters his company was interested in getting into the refund guarantee business "but we"ve been warned by regulators to be careful." Jonathan Silver, shipping finance partner at Howse Williams Bowers, said banks have been taking steps to reduce their exposure, including asking shipyards to put up the partially built vessel as collateral for the guarantee. SHARING BLAME But lawyers also said that the Chinese shipyards are not always to blame, nor are their injunctions always frivolous. Ismail of Dongfang Shipyard said his experience at the yard showed many foreign investors had exploited the weakness of Chinese shipyards - and inexperience of Chinese banks - to drive very hard bargains vis a vis refund guarantees. Some buyers would gamble that prices would rise by the time the ship was completed and they could sell for an immediate profit. If prices didn"t rise, they would reject the ship and cash in the guarantee. In one instance, he said Dongfang had an agreement to deliver two or three ships that were behind schedule but 90 percent completed. The buyers pulled the plug and sought a refund, even though Dongfang was willing to renegotiate and sell the ship at a lower price, he said. BIG FISH Clarkson Research data shows that the Chinese shipbuilding industry won $37 billion in new ship orders in 2013, up 92 percent year-on-year. But this rising tide is not lifting all boats: Chinese state media reported that 80 percent of new ship orders went to just 20 yards. Investors are concerned that the debt-sodden Chinese shipping industry is set for a wave of defaults if Beijing doesn"t bail it out. China Rongsheng, the country"s largest private shipyard, reported a $1.4 billion loss for 2013 and some customers are worried about Rongsheng"s $4.6 billion worth outstanding orders. Greek ship operator Dryships Inc has already put down a $11.56 million downpayment, 8.5 percent of the total cost, toward four cargo ships scheduled to be delivered in 2014, but Dryships executives said they aren"t sure Rongsheng has even started cutting steel. "We don"t want to make any more payments to Rongsheng," Dryships CFO Ziad Nakhleh told Reuters in February. "Things are getting worse not better." Rongsheng said in an emailed statement to Reuters that thanks to recent refinancing, it is optimistic it can make delivery, but would not otherwise comment on other refund guarantee cases. Regardless, Dryships executives also said they expect Bank of China, the guarantor, to refund their money plus 8 percent interest if Rongsheng fails. Bank of China did not respond to a request for comment. By paying up, Chinese banks can reassure foreign customers doing business in China, protect their overseas assets and preserve their reputations. And the amounts, while large, are manageable, said Silver of Howse Williams Bowers. "If there is any collection of banks anywhere in the world able to disperse those sums of money... it"s going to be Chinese banks." (Additional reporting by the Shanghai Newsroom, Fayen Wong, and Keith Wallis in SINGAPORE; Editing by Emily Kaiser)

The company said that the struggles of its shipbuilding arm, Jiangsu Rongsheng Heavy Industries, had been hampering efforts to expand in energy services

China Rongsheng Heavy Industries Group Holdings Limited [1101.HK] has announced that it has signed a memorandum of understanding that will see its shipbuilding business, Jiangsu Rongsheng Heavy Industries, sold to an undisclosed potential purchaser.

According to the company, the depressed shipbuilding market had led to operational difficulties at Jiangsu Rongsheng Heavy Industries, while its highly-leveraged state was also interfering with the company"s efforts to expand in oil and gas exploration elsewhere.

It was reported in 2012 that in the face of market difficulties, China Rongsheng Heavy Industries had turned its focus to building containerships with a "green design" as one its key products.

This announcement is issued by China Rongsheng Heavy Industries Group Holdings Limited (the "Company") in accordance with Rules 13.09 and 13.10B of the Rules Governing the Listing of Securities on The Stock Exchange of Hong Kong Limited and Part XIVA of the Securities and Futures Ordinance (Chapter 571 of the Laws of Hong Kong).

Reference is made to the announcement of the Company dated 21 March 2012 in respect of the issue of medium-term notes by its subsidiary, Jiangsu Rongsheng Heavy Industries Co., Ltd. (江 蘇熔盛重工有限公司) ("Jiangsu Rongsheng Heavy Industries"), in the People"s Republic of

Pursuant to the relevant rules and regulations in the PRC, the unaudited financial information (the "Unaudited Quarterly Financial Information") of Jiangsu Rongsheng Heavy Industries, which is indirectly owned by the Company as to approximately 96.38%, and its subsidiaries for the nine months ended 30 September 2014 was published on http://www.chinabond.com.cn/www.chinabond.com.cn and www.chinamoney.com.cn on 17 October 2014.

Set out below are the key unaudited financial figures of Jiangsu Rongsheng Heavy Industries and its subsidiaries for the nine months ended 30 September 2014 as included in the Unaudited Quarterly Financial Information, which have been prepared in accordance with the PRC Generally Accepted Accounting Principles and have not been audited:

For the nine months ended 30 September 2014, Jiangsu Rongsheng Heavy Industries and its subsidiaries recorded an operating loss and a total loss of approximately RMB2,778.6 million and RMB3,362.2 million respectively, and a net loss of approximately RMB3,362.2 million

The net loss incurred for the nine months ended 30 September 2014 was primarily due to the low prices of shipbuilding orders in depressed market conditions and the diminishing profitability of the conventional shipbuilding business. The net loss was also due to the decline of production activities of Jiangsu Rongsheng Heavy Industries despite considerable fixed production cost and the adjustment of the contract price of certain shipbuilding contracts. Such loss may lead to adverse effects on the production and operation, financial position and repayment capacity of Jiangsu Rongsheng Heavy Industries. Jiangsu Rongsheng Heavy Industries has been proactively adopting measures to improve operational performance and financial position, and to mitigate liquidity pressure. These measures include but are not limited to: actively negotiating with principal banks in the PRC on the terms and conditions of the extension and renewal of borrowings; obtaining financial support from a shareholder of its holding company; negotiating for better payment terms and revising up prices of certain existing shipbuilding orders; redesigning operation flow and controlling costs for existing shipbuilding orders; maximizing sales efforts and obtaining the appropriate project-based financing; establishing strategic cooperation with key suppliers with a view to reduce the costs of supplies.

(Beijing) – Piles of rusty steel bars and old ship parts are virtually all that"s left of a sprawling shipyard in the eastern city of Rugao, where Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people.

Once China"s largest shipbuilder, Rongsheng is on the verge of bankruptcy. Orders have dried up and banks are refusing credit. Questions have been raised about the shipyard"s business practices, including allegations of padded order books. And Rongsheng is apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms, sources told Caixin.

8613371530291

8613371530291