nantong rongsheng shipyard brands

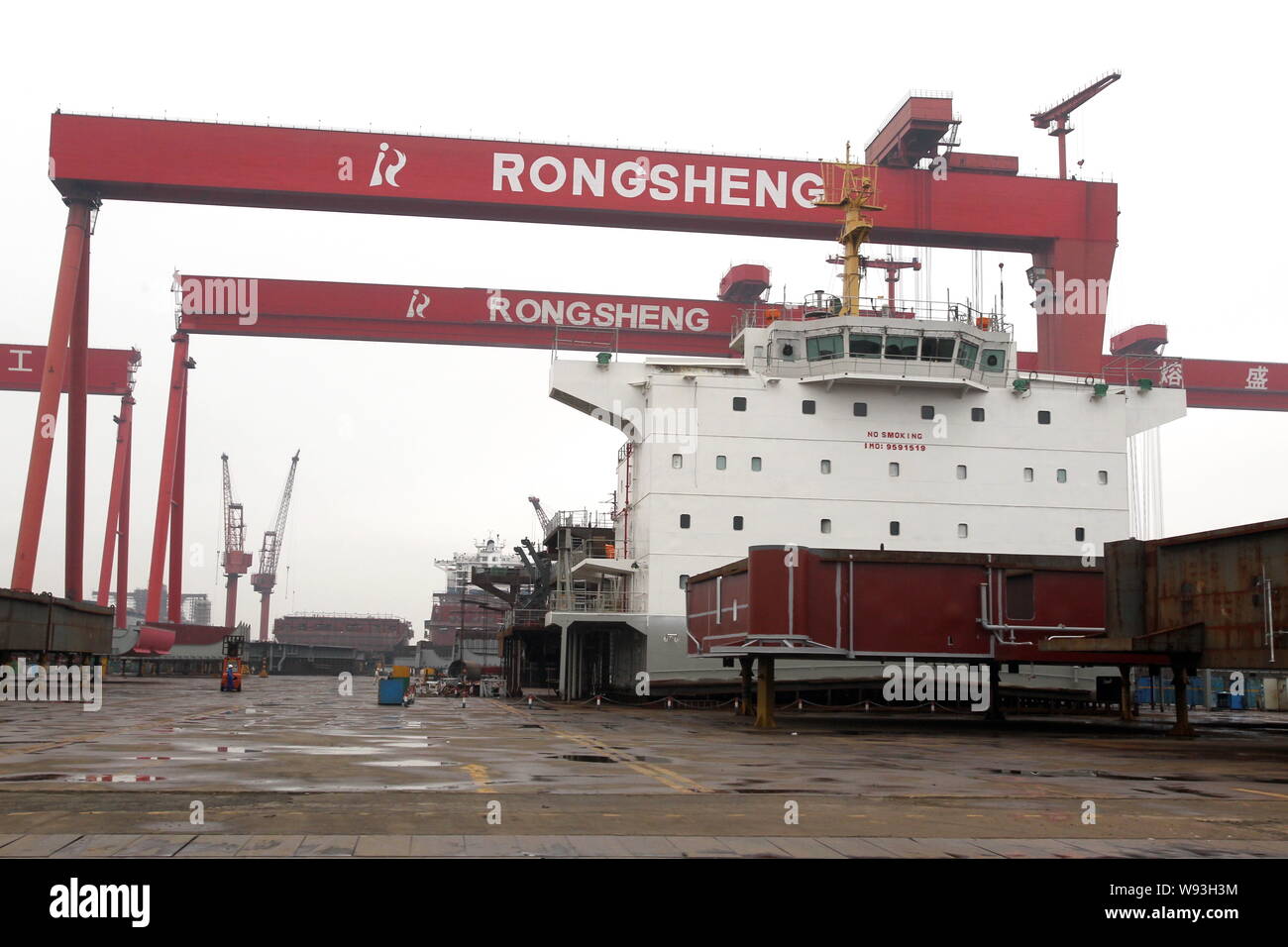

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

"Chinese shipyards of all sizes have been hit hard in the past two years, and they often lack the technology and bank loans needed to produce the sophisticated vessels sought in many new orders," Li said.

A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. Credit: Reuters/Aly Song/Files

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group (1101.HK).

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China (3988.HK) starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.”

As hard times continue in the shipbuilding industry, former giant Rongsheng is in deep financial trouble. The company hopes a move into the energy sector can change its fortunes, but analysts are skeptical.

Amid dark times in the global shipbuilding industry, another of China"s major players appears to be on the verge of bankruptcy. China Rongsheng Heavy Industries Group used to be the largest private shipbuilder in the country, but is now seeking potential buyers to help get it out of deep financial problems.

In the past few months, many workers have left Rongsheng"s plant in Nantong, East China"s Jiangsu Province, which stopped production after it delivered a ship to Brazilian iron ore giant Vale in January, Caixin magazine reported on March 9.

The once-busy plant in Nantong used to have as many as 30,000 workers, but now "only several thousand of them are still there," a Rongsheng employee who declined to be named told the Global Times on Tuesday.

The employee has been working at Rongsheng for more than five years, but said he will also be leaving the company soon. Having watched the ups and downs of Rongsheng, he said he will not be staying in the shipbuilding industry either. "It has been such a sad story for the industry," he said.

No more plain sailingRongsheng was founded by entrepreneur Zhang Zhirong in 2005, when the shipbuilding industry was booming. The initial designed annual capacity of the plant in Nantong was as much as 3.5 million dead weight tons, nearly the same as the total annual capacity of State-owned China State Shipbuilding Corp at that time, according to the Caixin report.

But the global shipbuilding industry found itself in a severe recession when the world economy was hit by the financial crisis in 2008. Many private shipbuilders went bankrupt in the ensuing years, but even then few people thought the same fate would befall Rongsheng.

Many shipbuilders became very cautious about accepting new orders under these circumstances, given the huge amounts of capital needed to build a ship. But Rongsheng did the opposite and increased its orders. The Caixin report said that Rongsheng gained the most orders among all shipbuilders in China from 2010 to 2012.

"Good order figures may have helped the financing, but Rongsheng should have been more cautious about expanding during an overall industry downturn," Wang Danqing, a partner at Beijing-based ACME Consultancy, told the Global Times on Tuesday.

The Rongsheng employee said that poor management has also been a major factor behind Rongsheng"s predicament. Deliveries of many of the orders have been delayed, giving ship buyers the option of abandoning the order and claiming compensation.

Seeking a way outRongsheng has been trying to diversify in order to get over the current difficulties, and is now preparing for a move into the energy sector. The company announced on Friday that its board of directors had agreed to change its name to China Huarong Energy Co, according to a filing with the Hong Kong bourse.

Wang Shaojian, Rongsheng"s chief financial officer, told the media he was "confident" in the prospects for Rongsheng in the energy sector. The company has already started making moves in this regard. In August 2014, it announced that it had acquired a 60 percent stake in a subsidiary of New Continental Oil & Gas (HK) Co in Kyrgyzstan, giving Rongsheng equity in an oil field in the country.

Wu noted that Rongsheng may lack the expertise and talent required for the oil industry, adding that it will have to compete with even bigger rivals in the sector.

Rongsheng is also trying to streamline its business. It said in a filing on Tuesday that it has signed a memorandum with a potential buyer for it to acquire Rongsheng"s shipbuilding and ocean engineering business, as well as its debts.

Yangzijiang Shipbuilding declined to comment on the matter when contacted by the Global Times on Wednesday. Rongsheng also declined to comment, saying that it is now in a "quiet period," prior to further announcements.

The No 4 dock at Jiangsu Rongsheng Heavy Industries Co Ltd"s Nantong shipbuilding base on May 26, 2012. With a dimension of 139.5*580m,the dock is equipped with a 1600-T gantry crane, the world"s largest. [Photo/chinadaily.com.cn]

China Rongsheng Heavy Industries Group Holdings Ltd, the nation"s largest private shipbuilder, may seek "cooperation with one or two ship builders" in 2013 or 2014, grasping the opportunity emerging from an industry recession, according to Xu Yifei, assistant president of Jiangsu Rongsheng.

In response to this round of recession, Rongsheng has been actively upgrading technology and design. It has also put more focus on the offshore engineering sector to further diversify its business.

Rongsheng is setting up its offshore engineering company in Singapore, aiming to take advantage of Singapore"s technology and existing market to deepen its penetration in the global offshore engineering market, according to Xu.

The company entered the marine engineering sector years ago. China"s first deepwater pipe-laying crane vessel, known as Hai Yang Shi You 201, was built by Rongsheng. The vessel can lay pipes at depths of 3000 meters and lift 4000 metric tons and will operate at the South China Sea"s Liwan 3-1 gas field.

Rongsheng"s president, Chen Qiang, said in an earlier interview that he hoped orders from marine engineering will make up about 40 percent of the company"s new orders this year.

Jiangsu-based Nantong Mingde Heavy Industries, which focused on building high-end vessels such as stainless-steel chemical tankers and pure car/truck carriers (PCTCs), was officially declared bankrupt by Nantong Tongzhou District Court in July. A dearth of orders and tight cash flow were said to be behind the closure.

Rugao - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area’s reliance on China Rongsheng Heavy Industries Group, the country’s biggest private shipbuilder. Like Rongsheng’s shipyards, the area is struggling to survive. The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

The company has become a test of China’s market reforms. While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail. As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

The local community, on the outskirts of the eastern Chinese city of Nantong, has mirrored Rongsheng’s fall. A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked. “In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.” In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed. “Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job. The uncertainty isn’t only at the yard. “Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorised to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.” A company spokesman said the shipyard had no confirmed new orders in the second half of the year.

China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, warned of a net loss in the first half and has appealed for financial help from the Chinese government and big shareholders to cope with slumping orders and high debt.

8613371530291

8613371530291