nantong rongsheng shipyard price

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

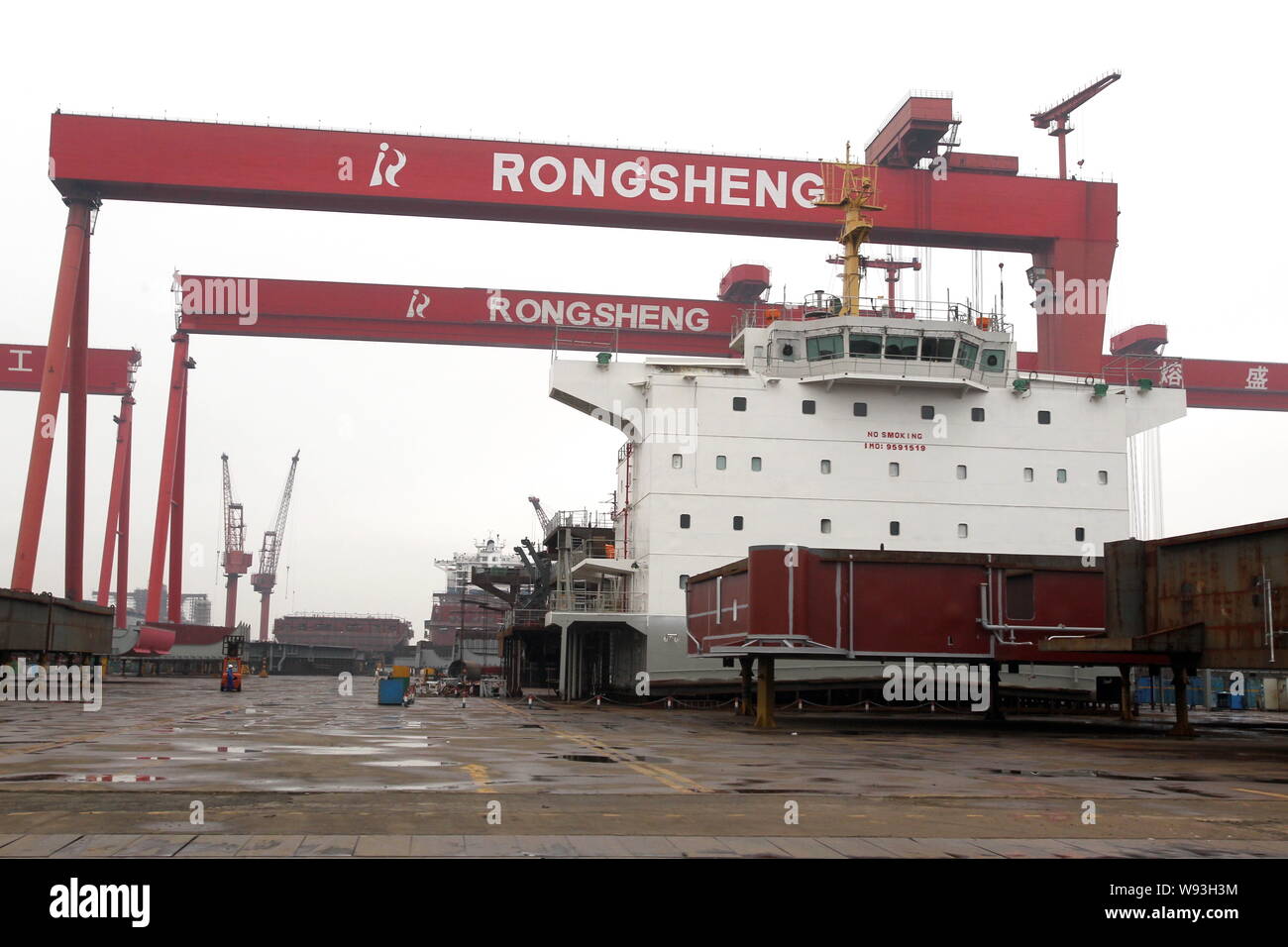

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country’s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

“The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company’s conservative sales strategy under the current trough stage of the shipbuilding market,” China Rongsheng said in a statement to the Hong Kong stock exchange.

Workers at Rongsheng’s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company’s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: “The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders.”

A company spokesman told Reuters late on Wednesday that the shipyard had no confirmed new orders so far in the second half of the year. He declined to elaborate.

COSCO Shipping Heavy Industry, China"s third-largest shipbuilder by output, plans to reduce the number of its offshore construction shipyards from five to two by 2020.

Under the plan, shipyards in Nantong, Zhoushan and Dongguan will be closed. Shipyards in Qidong and Dalian will remain open as they also build polar ships, drilling platforms and cattle carriers, reports China Daily.

Declining international oil and shipbuilding prices, growing costs for materials and labor have become factors squeezing shipyards" earning ability globally," a COSCO spokesman said.

Established in December 2016, the company was formed out of the previous COSCO Shipyard Group, COSCO Shipbuilding Industry and China Shipping Industry. COSCO Shipyard and China Shipping Industry all reported financial losses last year. http://maritime-executive.com/article/cosco-to-close-three-shipyards

Wison Offshore & Marine today announced that the world’s first barge-based Floating Storage and Regasification Unit (FSRU), for which the company provided EPC services for Exmar, has undocked from Wison’s dry-dock in Nantong, China, marking another major milestone for this project. Upon the undocking, topside installation has been completed, which paves the way for successful delivery.

Rugao port is adding infrastructure whereby it will be able to handle up to 800,000 teu a year. The river port in Jiangsu province near Rongsheng shipyard is building four 5,000 dwt terminals, two 10,000 dwt terminals and one 20,000 dwt terminal. There will also be a 400,000 sq m container yard with all work likely to be finished by the end of 2014. [SinoShipNews 24/07/13]Upload News

Shares in China Rongsheng Heavy Industries Group Holdings, the largest private shipbuilder in China, fell by 8.6 percent in Hong Kong Tuesday, after the company issued a profit warning. The shares fell by 16.4 percent Monday.

China Rongsheng Heavy dropped by HK$0.1 ($0.01) to end at HK$1.07 a share Tuesday, down by 23.6 percent from its closing price of HK$1.4 a share Friday.

"China Rongsheng Heavy has been receiving a huge amount of local government subsidies since 2010. It received over 800 million yuan in 2010 and more than 1.2 billion yuan in 2011. Because its earnings are going to drop significantly this year, the government is expected to further increase its subsidies to the company, whose main business will face a loss without them," the news report said, citing an unnamed source.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

"Chinese shipyards of all sizes have been hit hard in the past two years, and they often lack the technology and bank loans needed to produce the sophisticated vessels sought in many new orders," Li said.

--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industries Group Holdings Ltd., the Chinese shipyard seeking financial assistance from the government, agreed to issue convertible bonds to a member of VMS Investment Group to raise capital. Estimated net proceeds from the sale to Action Phoenix Ltd. will be HK$1.38 billion (US$178 million), according to a company statement to the Hong Kong stock exchange. The initial conversion price is HK$1 a share, about 22 percent more than the closing price on Wednesday (31 July 2013), it said. Rongsheng, the countrys largest shipyard outside state control, said on July 5 it was seeking help from the government after a plunge in orders forced it to reduce production and restructure its workforce. Chinese shipmakers are struggling as a global vessel glut makes orders more difficult to win and pushes down prices.

Rongsheng Heavy Industries Group Holdings Ltd, China"s largest private shipyard, said on Friday it predicted net losses in the first half of this year amid media reports that suppliers and subcontractors were taking matters into their own hands.

Some media reports said that suppliers removed equipment from its Nantong production base to use for collateral security, and subcontractors absconded without paying wages.

8613371530291

8613371530291