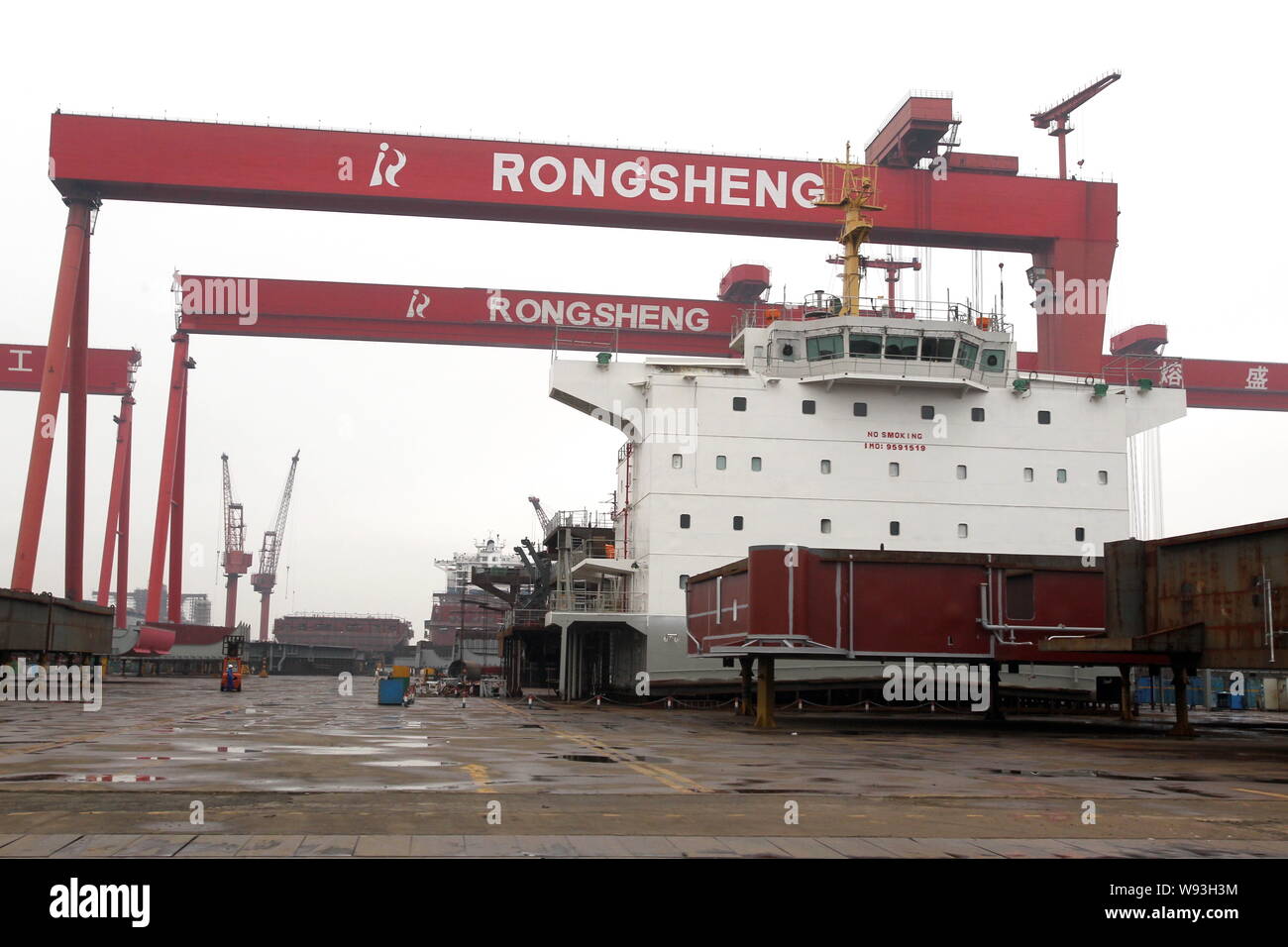

nantong rongsheng shipyard for sale

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

As orders for new ships began to dry up, China in 2013 issued a three-year plan urging financial institutions to support the shipbuilding industry. Ship owners placing orders for China-made vessels, engines and some parts should get better funding, the State Council said. A third of the more than 1,600 shipyards in China could shut down in the next five years, an industry association predicted earlier.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

HONG KONG, Dec 4 (Reuters) - China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just months after it appealed to the government for financial help.

"The company believes that the net loss is primarily attributable to the decrease in revenue as a result of the company"s conservative sales strategy under the current trough stage of the shipbuilding market," China Rongsheng said in a statement to the Hong Kong stock exchange.

Workers at Rongsheng"s Nantong shipyard in eastern China told Reuters on Wednesday that morale was low, with some employees complaining about a shortage of work.

Greek ship owner Dryships Inc has already questioned whether some of the ships on order at China Rongsheng will be delivered, which could hit its revenue and profitability next year. Dryships has four dry bulk carriers on order at the company"s shipbuilding subsidiary, Jiangsu Rongsheng Heavy Industries, that are due for delivery in 2014.

China Rongsheng, which sought financial help from the government in July, has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts.

A shipbuilding source said: "The shipyard has had no confirmed orders since June 30 because payment terms and contract prices were still unfavorable. But China Rongsheng has signed some letters of intent which have yet to be transformed into confirmed orders."

A company spokesman told Reuters late on Wednesday that the shipyard had no confirmed new orders so far in the second half of the year. He declined to elaborate.

By Pete Sweeney SHANGHAI (Reuters) - Chinese banks are stuck in a lose-lose legal battle between domestic shipyards and foreign buyers over billions of dollars in refund guarantees that are supposed to be paid out if shipbuilders fail to deliver on time. One in three ships ordered from Chinese builders was behind schedule in 2013, according to data from Clarksons Research, a UK-based shipping intelligence firm. Although that was an improvement from 36 percent a year earlier, it was well behind rival South Korea, where shipyards routinely delivered ahead of schedule the same year. That means Chinese banks may be on the hook to pay large sums to buyers if the yards can"t come through per contract, with little hope of recouping the cash from the yards. China is the world"s biggest shipbuilder, with $37 billion in new orders received last year alone. Buyers pay as much as 80 percent of the purchase price upfront. Chinese bankers rushed to finance shipbuilding after the 2008 global financial crisis as Beijing pushed easy credit and tax incentives to lift the industry and sustain industrial employment levels in the face of collapsing exports. Fees generated by offering such guarantees looked like easy money until massive oversupply and falling demand started taking a toll on the yards around 2010. Shipyards fell behind schedule and buyers demanded their money back. But behind or not, the builders, keen to keep orders on the books and prepaid money in their pockets, have submitted injunctions against banks in Chinese courts to prevent them from paying out. "China"s ambitions to take over South Korea as the top major shipbuilder meant that all the banks were encouraged to open up their wallets and lend money to the shipbuilders without making thorough due diligence," said AKM Ismail, former finance director for Dongfang Shipyard, the first Chinese shipyard to be listed on London"s AIM Stock Exchange in 2011. Since ships cost millions of dollars and can take years to deliver, a shipbuilder generally asks for part of the purchase price upfront to cover material and labor costs. Buyers normally obtain a refund guarantee from a bank to assure their money is returned if the yard defaults, and the yard pays the bank"s fee for the service. Lawyers say that in many cases, banks did not require shipyards to pledge any specific collateral, partly because these guarantees are like a form of insurance rather than a loan. That leaves banks stuck with the default bill. If banks obey local court injunctions and hold off from issuing refunds, they risk being taken to court by ship buyers in foreign jurisdictions. But if they pay out under the refund guarantee or seek compensation from the shipyard for the loss, bankers say they risk alienating local governments, which can damage the banks" business interests in the region. "The whole issue of refund guarantees has been a big headache," said a finance executive at China Minsheng Bank. "On the one hand, we know that our clients, the shipyards, will be saddled with huge debt that they will struggle to repay to us, if they can even pay back at all. But at the same time, our credibility is at risk, so we have to pay them out." He and other bankers interviewed for this article all spoke on condition of anonymity because of the legal sensitivities of the issue. Minsheng Bank did not respond to a request for comment. In one case, UK court records show that in November 2012, subsidiaries of German ship owner First Class Ship Invest GmbH took China Construction Bank Corp to court in London to enforce payment of more than $10 million under a refund guarantee after Zhejiang Zhenghe Shipbuilding Co Ltd allegedly failed to deliver on an order. CCB lawyers argued that an injunction served on it by Zhejiang Zhenghe in China would open up the bank to fines and the responsible banker could be arrested in China were it to pay out, but the judge rejected the argument. None of the parties in the suit responded to requests for comment from Reuters. Reuters was unable to find a single public example of a Chinese bank successfully fighting off a refund guarantee claimant in an overseas court; nearly all refund guarantee contracts stipulate litigation must be conducted in a foreign court. Jim James, a partner at Norton Rose Fulbright in Hong Kong, said that he has been involved in several cases in which yards repeatedly obtained injunctions from different Chinese courts to drag out the refund process. James, who has represented buyers, shipyards and banks in different cases, said the problem had become so serious that China"s supreme court planned to issue guidance to lower courts on the handling of injunction applications. LOBBYING WAR Most customer suits are settled in arbitration and domestic court records are usually not published, so there is little hard data on the number or value of contracts under dispute. But loan officers at China Export Import Bank, Bank of Communications, Bank of China and Shanghai Pudong Development Bank told Reuters that they had seen refund claims rising rapidly in 2012 and 2013. The problem was widespread enough for the China Behavior Law Association Training Cooperative Center, an organization registered with the Ministry of Civil Affairs, to hold a three-day conference for Chinese banks last July on the risks of refund guarantees. On the other side, the Shanghai Shipbrokers" Association published advice for shipyards on how to keep banks from paying out refund guarantees on its website, saying Chinese banks should be more cooperative. Shanghai Pudong Development Bank said it largely disbanded its shipping finance team in 2012, due to the sudden rise in refund guarantee claims and worsening market conditions. An executive at another Chinese municipal bank told Reuters his company was interested in getting into the refund guarantee business "but we"ve been warned by regulators to be careful." Jonathan Silver, shipping finance partner at Howse Williams Bowers, said banks have been taking steps to reduce their exposure, including asking shipyards to put up the partially built vessel as collateral for the guarantee. SHARING BLAME But lawyers also said that the Chinese shipyards are not always to blame, nor are their injunctions always frivolous. Ismail of Dongfang Shipyard said his experience at the yard showed many foreign investors had exploited the weakness of Chinese shipyards - and inexperience of Chinese banks - to drive very hard bargains vis a vis refund guarantees. Some buyers would gamble that prices would rise by the time the ship was completed and they could sell for an immediate profit. If prices didn"t rise, they would reject the ship and cash in the guarantee. In one instance, he said Dongfang had an agreement to deliver two or three ships that were behind schedule but 90 percent completed. The buyers pulled the plug and sought a refund, even though Dongfang was willing to renegotiate and sell the ship at a lower price, he said. BIG FISH Clarkson Research data shows that the Chinese shipbuilding industry won $37 billion in new ship orders in 2013, up 92 percent year-on-year. But this rising tide is not lifting all boats: Chinese state media reported that 80 percent of new ship orders went to just 20 yards. Investors are concerned that the debt-sodden Chinese shipping industry is set for a wave of defaults if Beijing doesn"t bail it out. China Rongsheng, the country"s largest private shipyard, reported a $1.4 billion loss for 2013 and some customers are worried about Rongsheng"s $4.6 billion worth outstanding orders. Greek ship operator Dryships Inc has already put down a $11.56 million downpayment, 8.5 percent of the total cost, toward four cargo ships scheduled to be delivered in 2014, but Dryships executives said they aren"t sure Rongsheng has even started cutting steel. "We don"t want to make any more payments to Rongsheng," Dryships CFO Ziad Nakhleh told Reuters in February. "Things are getting worse not better." Rongsheng said in an emailed statement to Reuters that thanks to recent refinancing, it is optimistic it can make delivery, but would not otherwise comment on other refund guarantee cases. Regardless, Dryships executives also said they expect Bank of China, the guarantor, to refund their money plus 8 percent interest if Rongsheng fails. Bank of China did not respond to a request for comment. By paying up, Chinese banks can reassure foreign customers doing business in China, protect their overseas assets and preserve their reputations. And the amounts, while large, are manageable, said Silver of Howse Williams Bowers. "If there is any collection of banks anywhere in the world able to disperse those sums of money... it"s going to be Chinese banks." (Additional reporting by the Shanghai Newsroom, Fayen Wong, and Keith Wallis in SINGAPORE; Editing by Emily Kaiser)

--FILE--Ships are being built at a shipyard of Rongsheng Heavy Industries in Nantong city, east Chinas Jiangsu province, 24 May 2012. China Rongsheng Heavy Industries Group Holdings Ltd., the Chinese shipyard seeking financial assistance from the government, agreed to issue convertible bonds to a member of VMS Investment Group to raise capital. Estimated net proceeds from the sale to Action Phoenix Ltd. will be HK$1.38 billion (US$178 million), according to a company statement to the Hong Kong stock exchange. The initial conversion price is HK$1 a share, about 22 percent more than the closing price on Wednesday (31 July 2013), it said. Rongsheng, the countrys largest shipyard outside state control, said on July 5 it was seeking help from the government after a plunge in orders forced it to reduce production and restructure its workforce. Chinese shipmakers are struggling as a global vessel glut makes orders more difficult to win and pushes down prices.

Market players say Nantong-based Rongsheng has accumulated as much as CNY 20bn ($3.1bn) of debt and that no one will be willing to take over the troubled yard owner if that amount is not drastically reduced.

The administrator of Nantong Dongxin Shipbuilding will hold a fourth online auction for the assets of the bankrupt shipyard on September 26, after the first three auctions failed due to no bidders.

Dongxin Shipbuilding was established in 2008 and mainly builds bulk carriers. A local court in Nantong ruled to liquidate yard in 2015, at the request of a major creditor.

Nantong, a major shipbuilding base in China, has seen a large number of local shipyards going into bankruptcy in the past few years including famous names like Rongsheng Heavy Industries, Mingde Heavy Industry and Sinopacific Shipbuilding.

Rugao - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area’s reliance on China Rongsheng Heavy Industries Group, the country’s biggest private shipbuilder. Like Rongsheng’s shipyards, the area is struggling to survive. The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

The company has become a test of China’s market reforms. While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail. As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

The local community, on the outskirts of the eastern Chinese city of Nantong, has mirrored Rongsheng’s fall. A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked. “In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.” In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed. “Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job. The uncertainty isn’t only at the yard. “Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorised to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.” A company spokesman said the shipyard had no confirmed new orders in the second half of the year.

A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province, in this file photo taken May 21, 2012. Credit: Reuters/Aly Song/Files

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group (1101.HK).

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China (3988.HK) starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.”

Meanwhile, five privately owned shipbuilders - Jiangsu Rongsheng Heavy Industries, Sinopacific, Mingde Nantong, Yantai Raffles Shipbuilding and JES International - are also looking to sell equity in order to fund their expansion, according to people familiar with the situation. Sinopacific and Mingde confirmed they have IPO plans but declined to give details.

JES will begin its roadshow next week and is set to float in Singapore as early as the end of November, trying to raise as much as $300m from a share sale managed by ABN Amro. Sinopacific is hoping to raise about $660m next year in an IPO managed by Citic. Meanwhile, Rongsheng is reportedly planning to sell as much as 25 per cent of its equity in an IPO. However, Rongsheng is now in talks with private investors about selling a stake ahead of a IPO. Finally, Mingde has selected Deutsche Bank and Morgan Stanley to manage a listing in either Singapore or Hong Kong. The banks involved in the plans would not comment.

Rongsheng Heavy Industries Group Holdings Ltd, China"s largest private shipyard, said on Friday it predicted net losses in the first half of this year amid media reports that suppliers and subcontractors were taking matters into their own hands.

Some media reports said that suppliers removed equipment from its Nantong production base to use for collateral security, and subcontractors absconded without paying wages.

The No 4 dock at Jiangsu Rongsheng Heavy Industries Co Ltd"s Nantong shipbuilding base on May 26, 2012. With a dimension of 139.5*580m,the dock is equipped with a 1600-T gantry crane, the world"s largest. [Photo/chinadaily.com.cn]

China Rongsheng Heavy Industries Group Holdings Ltd, the nation"s largest private shipbuilder, may seek "cooperation with one or two ship builders" in 2013 or 2014, grasping the opportunity emerging from an industry recession, according to Xu Yifei, assistant president of Jiangsu Rongsheng.

In response to this round of recession, Rongsheng has been actively upgrading technology and design. It has also put more focus on the offshore engineering sector to further diversify its business.

Rongsheng is setting up its offshore engineering company in Singapore, aiming to take advantage of Singapore"s technology and existing market to deepen its penetration in the global offshore engineering market, according to Xu.

The company entered the marine engineering sector years ago. China"s first deepwater pipe-laying crane vessel, known as Hai Yang Shi You 201, was built by Rongsheng. The vessel can lay pipes at depths of 3000 meters and lift 4000 metric tons and will operate at the South China Sea"s Liwan 3-1 gas field.

Rongsheng"s president, Chen Qiang, said in an earlier interview that he hoped orders from marine engineering will make up about 40 percent of the company"s new orders this year.

8613371530291

8613371530291