rongsheng cease shipbuilding in stock

HONG KONG (Reuters) - Shares in China Rongsheng Heavy Industries Group Holdings Ltdtumbled 16 percent on Monday after the U.S. securities regulator accused a company controlled by the shipbuilder"s chairman of insider trading ahead of China"s CNOOC Ltd"sbid for Canadian oil company Nexen Inc.Labourers work at a Rongsheng Heavy Industries shipyard in Nantong, Jiangsu province May 21, 2012. REUTERS/Aly Song

The U.S. Securities and Exchange Commission filed a complaint in a U.S. court on Friday against a company controlled by Rongsheng Chairman Zhang Zhirong, and other traders, accusing them of making more than $13 million (8.2 million pounds) from insider trading ahead of CNOOC’s $15.1 billion bid for Nexen.

“The news around the chairman comes on the back of other operational and credibility issues,” Barclays said in a note to clients. “We think China Rongsheng presents significant company-specific risk.”

Before Monday’s tumble, the stock had lost more than 73 percent in the past 12 months as a downturn in the global shipbuilding industry clouded its business outlook.

In a filing with the Hong Kong stock exchange, Rongsheng - which entered a strategic cooperation agreement with CNOOC in 2010 - said it did not expect the U.S. investigation to affect its operations. It said Zhang did not have an executive role in the company.

Rongsheng, controlled by Zhang, also issued a profit warning on Monday, saying first-half earnings would fall sharply as a result of the shipbuilding downturn.

Zhang was ranked the 22th richest Chinese person by Forbes Magazine in September 2011. But his net worth fell by more than half in the past year to $2.6 billion in March 2012 as shares of Rongsheng tumbled.

HONG KONG, July 5 (Reuters) - China Rongsheng Heavy Industries Group, China’s largest private shipbuilder, appealed for financial help from the Chinese government and big shareholders on Friday after cutting its workforce and delaying payments to suppliers.

Analysts said the company could be the biggest casualty of a local shipbuilding industry suffering from overcapacity and shrinking orders amid a global shipping downturn. New ship orders for Chinese builders fell by about half last year.

Hours after China Rongsheng made its appeal in a filing to the Hong Kong stock exchange, where the company is listed, Beijing vowed to bring about the orderly closure of some factories in industries plagued by overcapacity.

The statement by the State Council, or cabinet, laid out broad plans to ensure banks support the kind of economic rebalancing Beijing wants as it looks to focus more on high-end manufacturing. It did not mention any specific industries or companies and there was no suggestion it was referring to Rongsheng.

China Rongsheng said it was expecting a net loss for the six months that ended June 30 from a year earlier, according to the filing. It gave no figures.

Rongsheng shares plunged 16 percent to a record low in heavy turnover on Friday, leaving its market capitalisation at just under $1 billion. The Hang Seng Index climbed 1.9 percent. China Rongsheng is down 28.2 percent on the year.

In its filing, China Rongsheng said some workers had been made redundant, although it gave no numbers or timeframe for the losses. The company did not immediately respond to requests for more information.

China Rongsheng has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts. This year, it received orders to build two drilling rigs used in oil exploration, worth $360 million.

By contrast, another Chinese shipbuilder, Singapore-listed Yangzijiang Shipbuilding (Holdings) Ltd, has secured total orders of $1 billion in the first half, Barclays said.

While the Chinese shipbuilding industry faced “unprecedented challenges”, China Rongsheng’s board was confident management could ease pressure on working capital in the near future and maintain normal operations, the company said in the filing.

According to its December 2012 annual report, issued on March 26, China Rongsheng’s cash and cash equivalents fell to 2.1 billion yuan from 6.3 billion yuan a year ago.

“The group is ... actively seeking financial support from the government and the substantial shareholders of the company, and increasing its efforts in negotiations with its customers to maximise the collection of receivables,” China Rongsheng said in the filing.

A note from Macquarie Equities research said the statement highlighted the “severity” of China Rongsheng’s liquidity problems, adding this was not necessarily representative of the wider sector.

It said other listed Chinese shipyards were not as leveraged as China Rongsheng. The loan from Zhang was a surprise, it said, showing how badly the company needed cash.

“Rongsheng will need to address the problems immediately to reassure the market,” said Martin Rowe, managing director of Clarkson Asia Limited, a global shipping services provider.

The Chinese government has been trying to support the domestic shipping industry since the 2008 financial crisis, and local media reports said this week Beijing was considering policies to revive the shipbuilding business.

The holding orders of Chinese shipyards dropped 23 percent in the first five months of this year compared with a year earlier, according to the China Association of the National Shipbuilding Industry. New orders dropped to a seven-year low in 2012. ($1=6.1258 yuan) (Additional reporting by Yimou Lee and Twinnie Siu in Hong Kong and Keith Wallis in Singapore; Editing by Dean Yates)

Trading of shares and all structured products related to the company was suspended pending clarification of “news articles and possible inside information,” Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported yesterday, citing Lei Dong, secretary to the Shanghai- based company’s president, that more than half of the employees laid off were subcontractors and the rest full-time workers.

Rongsheng shares slumped 10 percent yesterday after the company said some idled contract workers had engaged in “disruptive” activities by surrounding the entrance of its factory in east China’s Jiangsu province. China’s shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongsheng’s 2012 revenue.

“Rongsheng’s move reflects the bad market,” said Lawrence Li, an analyst at UOB-Kay Hian Holdings Ltd. in Shanghai. “More small-to-medium sized shipyards, especially those that lack government support, may take the same actions or even close down.”

Rongsheng spokesman William Li declined to comment on the Journal report. Four calls to Lei’s office at Rongsheng went unanswered. Rongsheng Chairman Chen Qiang also declined to comment today.

Rongsheng had as many as 38,000 workers including its own employees and contract staff at the peak of the industry boom a few years ago, UOB-Kay Hian’s Li said.

The order book at China’s shipbuilders fell 23 percent at the end of May from a year earlier, according to data from the China Association of the National Shipbuilding Industry. Yards have reduced down-payment requirements, with some slashing their rates to as little as 2.5 percent of contract value compared with 20 percent before 2010, according to UOB-Kay Hian.

China Rongsheng posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, according to data compiled by Bloomberg. It had short-term debt of 19.3 billion yuan as of the end of 2012, the data show.

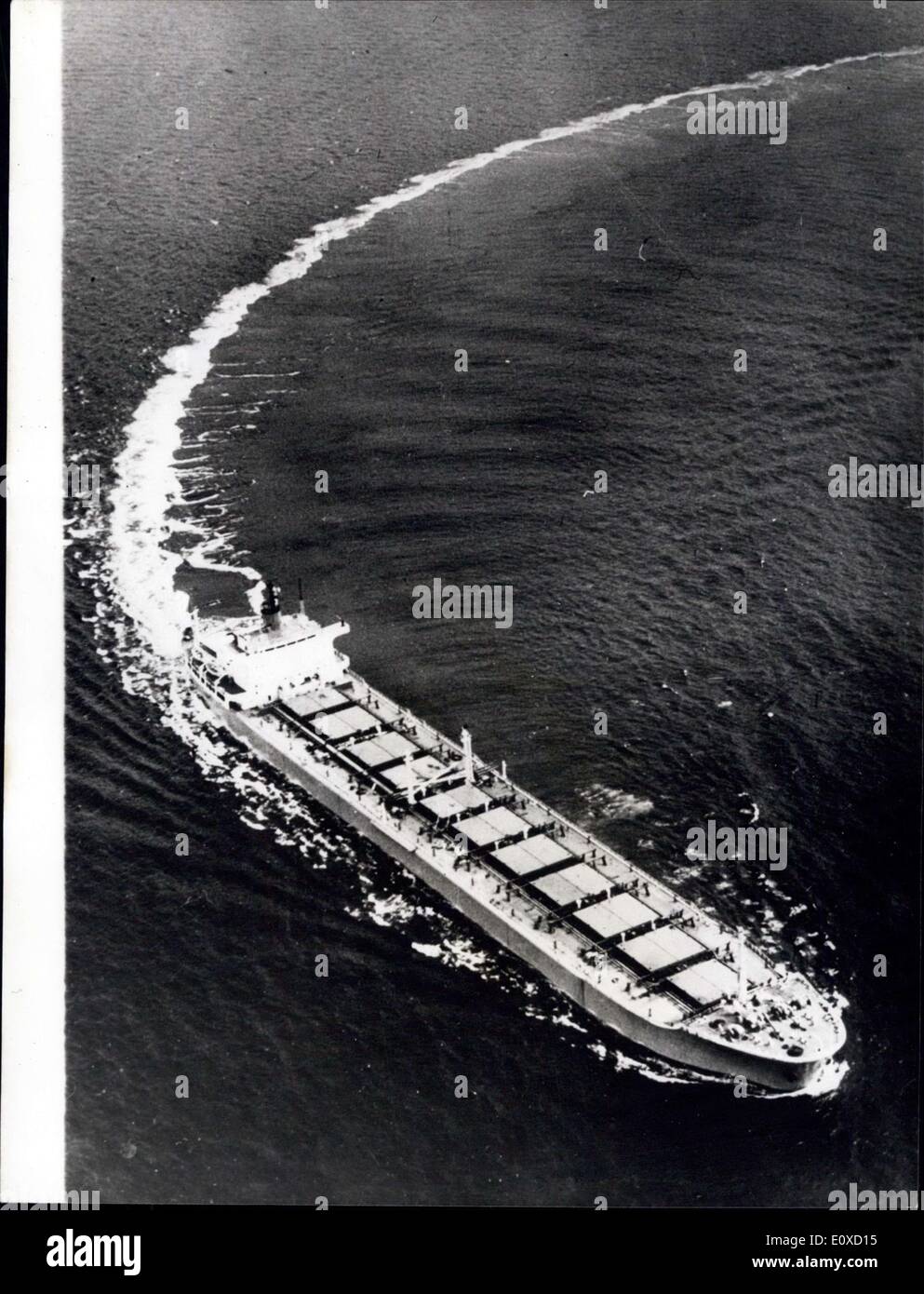

Rongsheng received orders to build a total of 16 Valemax vessels from Brazilian miner Vale SA and Oman Shipping Co. and had delivered 10 as of April. The commodity ships, among the biggest afloat, are about twice the size of the capesize vessels that have traditionally hauled iron ore from Brazil to China.

The company’s cash conversion cycle, a gauge of days required to convert resources into cash, more than doubled to 582 last year from 224 in 2011, the data show. China Rongsheng shares have fallen 15 percent this year in Hong Kong, compared with a 11 percent decline for the benchmark Hang Seng Index.

Shanghai: Founder and former chairman of Jiangsu Rongsheng Heavy Industries Group, Zhang Zhirong, has said the shipyard’s failure is down to its hasty expansion and a lack of direction.

Yesterday, trading of the yard’s shares on the Hong Kong Stock Exchange was suspendedahead of an announcement regarding a “substantial disposal”, which many suspect could be a substantial share in Rongsheng’s assets. No further details have yet been released and trading has not resumed.

“When shipbuilding was encouraged [by the government], banks were enthusiastic about lending and making advanced payment guarantees, but they suddenly turned their heads when the policy changed,” Zhang told Caixin in an interview earlier this week.

The yard is unable take new orders right now because it is unable to secure credit for outsourcing parts. Shipping companies pay only a 5% deposit to validate a contract. Rongsheng will only be revived with banks are willing to issue new credit, Zhang said.

The Chinese government is coordinating the yard’s restructuring, and creditor banks have formed a syndicate led by the Bank of China. Zhang says Rongsheng needs to win new major investors in order to restore banks’ confidence.

Dalian: Rongsheng Heavy Industries, once the largest private shipbuilder in China, now on the verge of bankruptcy, has found salvation. A deal to save Rongsheng is expected to be hammered out early next week. Splash understands that Yangzijiang Shipbuilding and a trio of banks will step in as white knights to keep the huge yard going. The news follows the cancellation of an RMB510m investment deal for the yard as the main investor Wang Ping, was arrested by authorities last week.

According to an industry source, Yangzijiang Shipbuilding will acquire 20% equity in the financially troubled shipyard, three banks coordinated by the Jiangsu government, namely Minsheng Bank, China Everbright Bank and China Development Bank, will together acquire 40% equity, Rongsheng’s founder Zhang Zhirong and some major shareholders of the yard will occupy 20% equity, and the remaining shares will be taken by smaller investors.

In a release on Tuesday, Yangzijiang Shipbuilding admitted in relation to Rongsheng: “Yangzijiang has been approached by relevant government agencies and companies to explore the possibilities for Yangzijiang to consider an acquisition of some stake in the said company.” The following day Rongsheng announced, via the Hong Kong Stock Exchange, plans for an imminent “substantial disposal”.

“Given the current market situation, seeking help from the government seems to be the only viable solution for Rongsheng,” an official from the China Association of the National Shipbuilding Industry (CANSI) told Splash.

Last year, it was reported that state run shipbuilding group CSSC had intentions to take over the yard, however, the potential deal has since gone quiet.

Among the three banks, Minsheng Bank has the most business involvement with Rongsheng. Its financial leasing arm, Mingsheng Leasing, had ordered more than 30 vessels in total at Rongsheng. Jiangsu Rongsheng Investment also purchased 500m shares in Minsheng Bank for RMB2.28bn in 2011.

CDB has been providing financial support to Rongsheng in the past few years. It granted a credit facility of RMB35bn to Rongsheng in 2011 and it was in the group of banks that signed an agreement with Rongsheng in 2014 to extend the debt repayment and renewal terms to the end of 2015.

News that Rongsheng is to be kept going as a functioning shipyard has not been met with universal approval from owners desperate to see China’s excessive yard capacity cut back. One owner implored Splash earlier this week, “Please can they close Rongsheng once and for all.”

Shares in China Rongsheng Heavy Industries Group Holdings, the largest private shipbuilder in China, fell by 8.6 percent in Hong Kong Tuesday, after the company issued a profit warning. The shares fell by 16.4 percent Monday.

"During the first half of 2012, affected by the decline of the shipbuilding market, the orders and prices of ships dropped sharply as compared with last year, which resulted in the decrease in profits," it noted.

China Rongsheng Heavy dropped by HK$0.1 ($0.01) to end at HK$1.07 a share Tuesday, down by 23.6 percent from its closing price of HK$1.4 a share Friday.

"China Rongsheng Heavy has been receiving a huge amount of local government subsidies since 2010. It received over 800 million yuan in 2010 and more than 1.2 billion yuan in 2011. Because its earnings are going to drop significantly this year, the government is expected to further increase its subsidies to the company, whose main business will face a loss without them," the news report said, citing an unnamed source.

China"s shipbuilding industry is facing bleak prospects because demand for the types of vessels it is good at producing has declined amid poor economic conditions, Hu Qianli, a manager at the Shanghai office of Norwegian vessel surveyor Det Norske Veritas, told the Global Times Tuesday.

[Press Release]China Rongsheng Heavy Industries Secures Shipbuilding Contracts from Three Ship Owners* * * *Enhances Functions of the Vessel Models and Captures the GreenTrend in the MarketStrong Capability to Secure New Orders with Immense GrowthPotential

(3 July 2011, Hong Kong) China Rongsheng Heavy Industries Group Holdings Limited (China Rongsheng Heavy Industries or the Group; stock code: 01101.HK), a large heavy industries group in China, is pleased to announce that it has secured large orders from three renowned shipowners in Europe recently, including four

6600-TEU containerships and ten 205,000-tonne bulk carriers.Mr Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, We have secured the highest number of new orders in the country and the worlds fifth highest number of orders in hand since the end of 2010. Following the order[s] valued at USD400 million secured in the first quarter this year, we have secured several additional large orders which have notably increased the total amount of our orders in hand. These orders are sufficient to support our development in the coming few years, forming a solid foundation for our future growth. The signing of the contracts has increased the amount of new orders of the Group in the first half of the year to more than USD1.3 billion and further rationalised our order structure.

At the same time, China Rongsheng Heavy Industries has signed contracts with two other European ship owners to provide each with two 6600-TEU containerships [respectively]. Adopting a new generation design, the 6600TEU containerships reduce the speed from 25 kn to 21 kn as well as [ballast capacity], thus saving oil consumption and lowering transportation cost.

Despite the slowdown in the global shipbuilding industry in the first half of the year, China Rongsheng Heavy Industries has stood out among its peers in the volume of new orders it has secured. This year, the Group has signed contracts with Golden Union, a well-known international shipowner, for provision of two Panamax bulk carriers in January, and 2+2 of these carriers in May. Founded in 1977, Golden Union is well-known for operating bulk carriers. Currently, Golden Union has more than 20 ships in its fleet, thus making it the leader in the dry bulk carrier transportation [industry] in Greece.

Mr Chen concluded, Our improvement was by no means due to luck. The new orders that we just secured included some established and world renowned shipowners. These new orders represented their recognition of our rapid growth and appreciation of the top quality of our finished products, as well as their support and trust of the brand. Although the global shipbuilding market remains slow, our business has not been affected and we are boosting sustained and stable income growth as planned. In the near future, our strong ability to secure new orders should lead the industry to grow and come on the international stage. We are moving forward to become a leading heavy industries group and generate more promising returns for our shareholders and investors.

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. Rongsheng products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Groups products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.For press enquiries:Strategic Financial Relations (China) LimitedMs. Anita CheungTel: (852) 2864 4827Email: anita.cheung@sprg.com.hk

Rongsheng said it had sought the suspension pending clarification of the news articles, according to a filing to the Hong Kong stock exchange. On Wednesday, its shares closed down 10% at HK$1.06.

The job cuts at Rongsheng, China’s biggest privately-owned shipbuilder, represent some 40% of the company’s workforce, according to the Wall Street Journal, and sparked protests by workers earlier this week.

Lei Dong, secretary to the president of Rongsheng, is reported to have said that more than half of the workers affected by the cuts are subcontracted with the remainder full-time employees.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

Rather than building cheap bulk carriers, many Chinese shipbuilders are keen to upgrade their product focus from shipbuilding to offshore engineering products, such as offshore drilling rigs, wind turbine installation vessels and offshore pipe-laying vessels.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"Due to the low pre-payment rates and delayed deliveries, many shipbuilding companies in Shanghai, Nantong and Zhoushan are experiencing a shortage of capital. Banks are not willing to lend to shipbuilding companies because they"re fully aware of how sluggish the business is. Shipbuilding is listed as a high-risk industry by banks," Meng said.

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

Some of Rongsheng"s subsidiaries, including Hefei Rong An Power Machinery Co and Rongsheng Machinery Co, signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015.

Shares in the maker of bulk carriers and oil tankers had been suspended from trading since Aug 29 in Hong Kong, pending the restructuring details. Rongsheng had first-half net losses of 3.06 billion yuan ($501 million), more than double last year"s.

Rongsheng was overdue on principal and interest payments on 8.57 billion yuan of bank loans on June 30, according to a Hong Kong Stock Exchange filing on Aug 29.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. Li Junfeng / China Daily

Rongsheng has borrowed billions of dollars in debt since its launch in 2005, fueling a rapid expansion that has made it one of China"s biggest three shipbuilders. But a global slowdown in demand for new vessels over the past few years has hit the firm hard.

In July Rongsheng, which is owned by private investors, said it was in discussions with a number of banks about "renewing existing credit facilities." The company also said it has reached an accord with a company controlled by key shareholder

said in a written statement that a recovery in the shipbuilding industry is likely to be slow due to an imbalance between supply and demand. "Although the [shipbuilding] industry has recently showed positive signs that point to a rebound, neither new order price nor volume confirms a recovery," he said. "Shipbuilding companies still encounter difficulty in earning profits on orders."

Rongsheng admitted to Xinhua that it had terminated the contracts of those workers on low production utility rate due to a lack of new orders this year. But it denied withholding their wages.

Meanwhile, the China Shipbuilding Industry Corp (CSIC) has signalled an interest in taking over Rongsheng, subject to an attractive offer, according to a report by Chinese business newspaper 21st Century Business Herald, which quoted a source at CSIC.

Rongsheng was cast into the limelight in 2008 after it won a $1.6 billion order from Brazilian iron ore miner Vale for a dozen 400,000-deadweight-tonne very large ore carriers.

The shipyard of China Rongsheng Heavy Industries Group Holdings Ltd in Rugao, Jiangsu province. The company will generate HK$2.55 billion ($326.4 million) in a share sale in the next six months and HK$3.23 billion thereafter. (Li Junfeng / China Daily)

China Rongsheng Heavy Industries Group Holdings Ltd, the private-sector shipbuilder that had sought financial assistance, has secured cash for restructuring and announced changing the company"s name as it shifts focus to energy.

Shifting its focus to oil will need a lot more funds, which Rongsheng already struggled to get as a shipbuilder, said Francis Lun, chief executive officer of Geo Securities Ltd.

The company had sought help from the government to benefit from a rebound in China"s shipbuilding industry after cutting its workforce and running up huge debts amid a global downturn in orders.

In September the Jiangsu shipyard unit was listed among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Rongsheng said it has now received the results of an appraisal by an independent assessor, which will be used as the basis for the restructuring in which it also plans to change its name to China Huarong Energy Co to more accurately reflect its expansion and new business scope.

Some of Rongsheng"s subsidiaries, including Hefei Rong An Power Machinery Co and Rongsheng Machinery Co, signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015.

Shares in the maker of bulk carriers and oil tankers had been suspended from trading since Aug 29 in Hong Kong, pending the restructuring details. Rongsheng had first-half net losses of 3.06 billion yuan ($501 million), more than double last year"s.

Rongsheng was overdue on principal and interest payments on 8.57 billion yuan of bank loans on June 30, according to a Hong Kong Stock Exchange filing on Aug 29.

8613371530291

8613371530291