rongsheng cease shipbuilding made in china

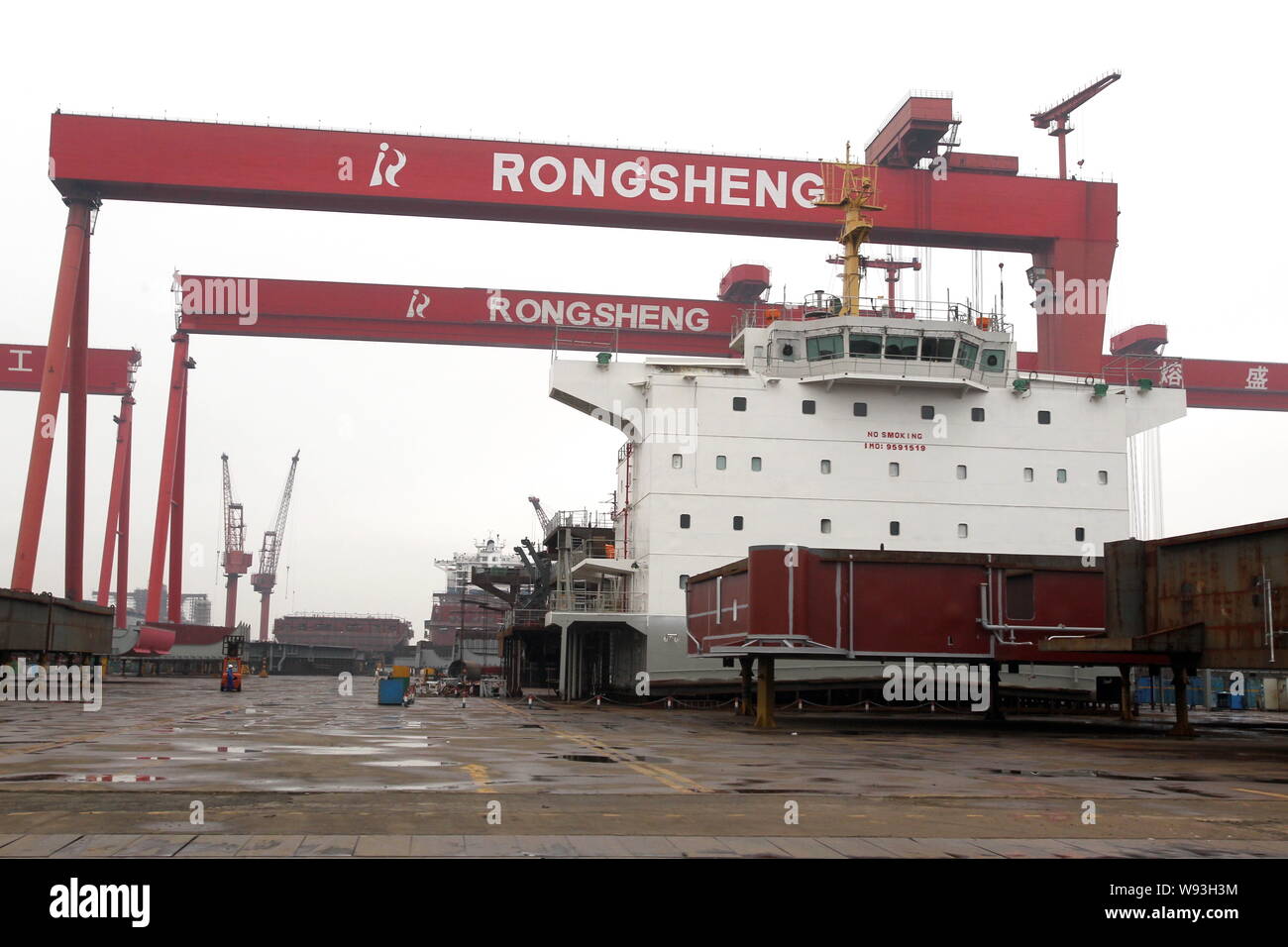

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

HONG KONG, July 5 (Reuters) - China Rongsheng Heavy Industries Group, China’s largest private shipbuilder, appealed for financial help from the Chinese government and big shareholders on Friday after cutting its workforce and delaying payments to suppliers.

Analysts said the company could be the biggest casualty of a local shipbuilding industry suffering from overcapacity and shrinking orders amid a global shipping downturn. New ship orders for Chinese builders fell by about half last year.

Hours after China Rongsheng made its appeal in a filing to the Hong Kong stock exchange, where the company is listed, Beijing vowed to bring about the orderly closure of some factories in industries plagued by overcapacity.

The statement by the State Council, or cabinet, laid out broad plans to ensure banks support the kind of economic rebalancing Beijing wants as it looks to focus more on high-end manufacturing. It did not mention any specific industries or companies and there was no suggestion it was referring to Rongsheng.

China Rongsheng said it was expecting a net loss for the six months that ended June 30 from a year earlier, according to the filing. It gave no figures.

Rongsheng shares plunged 16 percent to a record low in heavy turnover on Friday, leaving its market capitalisation at just under $1 billion. The Hang Seng Index climbed 1.9 percent. China Rongsheng is down 28.2 percent on the year.

In its filing, China Rongsheng said some workers had been made redundant, although it gave no numbers or timeframe for the losses. The company did not immediately respond to requests for more information.

China Rongsheng has said it won only two shipbuilding orders worth $55.6 million last year when its target was $1.8 billion worth of contracts. This year, it received orders to build two drilling rigs used in oil exploration, worth $360 million.

By contrast, another Chinese shipbuilder, Singapore-listed Yangzijiang Shipbuilding (Holdings) Ltd, has secured total orders of $1 billion in the first half, Barclays said.

While the Chinese shipbuilding industry faced “unprecedented challenges”, China Rongsheng’s board was confident management could ease pressure on working capital in the near future and maintain normal operations, the company said in the filing.

According to its December 2012 annual report, issued on March 26, China Rongsheng’s cash and cash equivalents fell to 2.1 billion yuan from 6.3 billion yuan a year ago.

“The group is ... actively seeking financial support from the government and the substantial shareholders of the company, and increasing its efforts in negotiations with its customers to maximise the collection of receivables,” China Rongsheng said in the filing.

A note from Macquarie Equities research said the statement highlighted the “severity” of China Rongsheng’s liquidity problems, adding this was not necessarily representative of the wider sector.

It said other listed Chinese shipyards were not as leveraged as China Rongsheng. The loan from Zhang was a surprise, it said, showing how badly the company needed cash.

“Rongsheng will need to address the problems immediately to reassure the market,” said Martin Rowe, managing director of Clarkson Asia Limited, a global shipping services provider.

The Chinese government has been trying to support the domestic shipping industry since the 2008 financial crisis, and local media reports said this week Beijing was considering policies to revive the shipbuilding business.

The holding orders of Chinese shipyards dropped 23 percent in the first five months of this year compared with a year earlier, according to the China Association of the National Shipbuilding Industry. New orders dropped to a seven-year low in 2012. ($1=6.1258 yuan) (Additional reporting by Yimou Lee and Twinnie Siu in Hong Kong and Keith Wallis in Singapore; Editing by Dean Yates)

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

As orders for new ships began to dry up, China in 2013 issued a three-year plan urging financial institutions to support the shipbuilding industry. Ship owners placing orders for China-made vessels, engines and some parts should get better funding, the State Council said. A third of the more than 1,600 shipyards in China could shut down in the next five years, an industry association predicted earlier.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

Dalian: Rongsheng Heavy Industries, once the largest private shipbuilder in China, now on the verge of bankruptcy, has found salvation. A deal to save Rongsheng is expected to be hammered out early next week. Splash understands that Yangzijiang Shipbuilding and a trio of banks will step in as white knights to keep the huge yard going. The news follows the cancellation of an RMB510m investment deal for the yard as the main investor Wang Ping, was arrested by authorities last week.

According to an industry source, Yangzijiang Shipbuilding will acquire 20% equity in the financially troubled shipyard, three banks coordinated by the Jiangsu government, namely Minsheng Bank, China Everbright Bank and China Development Bank, will together acquire 40% equity, Rongsheng’s founder Zhang Zhirong and some major shareholders of the yard will occupy 20% equity, and the remaining shares will be taken by smaller investors.

In a release on Tuesday, Yangzijiang Shipbuilding admitted in relation to Rongsheng: “Yangzijiang has been approached by relevant government agencies and companies to explore the possibilities for Yangzijiang to consider an acquisition of some stake in the said company.” The following day Rongsheng announced, via the Hong Kong Stock Exchange, plans for an imminent “substantial disposal”.

“Given the current market situation, seeking help from the government seems to be the only viable solution for Rongsheng,” an official from the China Association of the National Shipbuilding Industry (CANSI) told Splash.

Last year, it was reported that state run shipbuilding group CSSC had intentions to take over the yard, however, the potential deal has since gone quiet.

Among the three banks, Minsheng Bank has the most business involvement with Rongsheng. Its financial leasing arm, Mingsheng Leasing, had ordered more than 30 vessels in total at Rongsheng. Jiangsu Rongsheng Investment also purchased 500m shares in Minsheng Bank for RMB2.28bn in 2011.

CDB has been providing financial support to Rongsheng in the past few years. It granted a credit facility of RMB35bn to Rongsheng in 2011 and it was in the group of banks that signed an agreement with Rongsheng in 2014 to extend the debt repayment and renewal terms to the end of 2015.

News that Rongsheng is to be kept going as a functioning shipyard has not been met with universal approval from owners desperate to see China’s excessive yard capacity cut back. One owner implored Splash earlier this week, “Please can they close Rongsheng once and for all.”

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

Beijing has made its naval forces the cornerstone of its military modernization. China is actively pursuing the role of a global military power able to project its force to any corner of the earth, and the US may not have the sheer industrial capacity to compete. "It is easier for China to increase its fleet numbers as it is the world"s biggest shipbuilder. They have immense shipyard capacities, which the US lacks, as its commercial shipbuilding has been thrown into disarray over the past decades," says Vasily Kashin, Far East researcher at the Russian Academy of Sciences.

The 2016 Annual Report to Congress: Military and Security Developments Involving the People�s Republic of China reported that "Shipyard expansion and modernization has increased China�s shipbuilding capacity and capability for all types of military projects, including submarines, surface combatants, naval aviation, and sealift assets. China�s two largest state-owned shipbuilders�the China State Shipbuilding Corporation and the China Shipbuilding Industry Corporation�collaborate in shared ship designs and construction information to increase shipbuilding efficiency. China continues to invest in foreign suppliers for some propulsion units, but is becoming increasingly self-sufficient. China is the top ship-producing nation in the world... "

China is the leading shipbuilding country in the world. As of the end October 2010, China"s production completion of shipbuilding was 50.90 million deadweight tons (dwt), an increase of 58.4%, and new orders of the industry were 54.62 million dwt or 2.9 times that of the same period last year, respectively. China�s �White List� of shipbuilders, first released in September 2014 as a guide to the yards which the Chinese government wished to support, listed 71 builders which together delivered 90% of Chinese output. The first "white list" included 51 shipyards that it deems worthy of favourable policy support.

In the previous two years, China"s shipbuilding industry was severely affected by the 2008 financial crisis. Prior to 2008, when the global trade grew at a premium over the global GDP, the outlook in the shipping sector was encouraging and this pushed the expansion of shipbuilding capacity

China"s shipbuilding industry experienced significant slowdown in production completion, cancellation of existing orders, and huge drop in new orders in late 2008 and 2009. In helping the industry overcome its difficulties the State Council passed the "The Plan on the Adjustment and Revitalization of the Shipbuilding Industry" in February 2009 with three critical targets: 1) Stalling the declining demand; 2) Promoting mergers and acquisitions (M&A), and restructuring; and 3) Encouraging indigenous innovation and R&D.

The State-Owned Shipbuilders include two main group: CSSC & CSIC. These two Groups are both large and under supervision of the State Council. There are also other group such as CSC group, AVIC group and etc� The Private Shipbuilders include some big shipbuilders which are listed in the stock exchange such as Yangzijiang Shipbuilding Group, RongSheng Heavy Industry and some others such as New Times, MingDe, HanTong and etc�

China overtakes Korea as the world"s top shipbuilder in the first half of 2010 and kept ahead in terms of three major industry indicators, including new orders, order backlogs and delivery. China�s shipbuilding industry is expected to be left with a handful of 30 shipbuilding enterprises with demand for yard facilities not exceeding 60m dwt by end-2015. At its peak, China�s shipbuilding sector witnessed more than 3,000 shipyards at the start of 2010, leading to a severe yard capacity glut and sending thousands of yards out of business as newbuilding orders plunged.

As at end-2015, China�s total shipyard capacity was estimated at 65m dwt, down from around 80m dwt in 2012. But the current capacity is still too excessive, and China�s shipbuilding industry needs to �slim down� further by removing another 30% or more of capacity. The 30% reduction in yard capacity from 65m dwt would translate to around 19.5m dwt. Since 2015, more than 20 large to medium sized Chinese shipbuilders had either declared bankrupt or stopped production altogether.

Wang Qi, director of Shanghai Waigaoqiao Shipbuilding (SWS), subsidiary of state-owned China State Shipbuilding Corp (CSSC), observed that China needed to prevent the emergence of speculative private yards, which he referred to them as �cancer cells� of the industry. �If the market starts to recover and you have this influx of speculative yards, they will throw the demand-supply equation off balance again,� Wang was reported saying. Ni Tao, deputy general manager of state-owned Cosco Shipyard Group, concurred that private yards can �open and close as they like�, unlike state-owned yards that carry national responsibility and are needed for any nation.

According to figures published in China, its Shipbuilding Industry developed rapidly during the period of the 10th-11th National 5 year Economic Plan (2000-2010). With the average annual growth of 29%, in 2010 Chinese Shipbuilding output reached 40 billion dollars, accounting for 43% of the global shipbuilding market. And takes the position of number one world�s shipbuilder. China�s largest shipbuilding cluster is located in the Yantze River Delta Region. Jiangsu Province is the biggest export province in China, accounting for 27% of the total amount. And Yangzijiang Shipbuilding Group was the biggest shipbuilder in JiangSu Province.

In October 2013 the State Council issued The Guidance on the Resolution of Seriously Excessive Capacity. The reform focused on the five industries with seriously excessive capacity such as the steel, cement, electrolytic aluminum, glass and shipbuildingindustries and the State Council designed the �road map� to resolve the problem of excess production capacity for the next five years. Brokerage researchers believed that with the implementation of the above guidance, the shipbuilding industry would usher into a profound adjustment, and a large number of companies with weak competitiveness and low value-added technology were expected to disappear. Theindustry agglomeration gradually increased. Meanwhile, the shipbuilding industry would develop into the marine engineering with high technology and high added value. Thus,China Shipbuilding Industry and other companies would clearly benefit.

The Guidance proposed to improve marine equipment level of shipbuilding industry, enhance the capacity building of maritime security, fully explore the potential ofdomestic demand for marine equipment in shipping, marine engineering, fisheries, law enforcement , emergency rescue and other areas, and adjust and optimize the product structure of ships. Meanwhile, raise the standards of industry access, conduct thedifferentiated policies on the enterprises with the failure of reaching access standardsand no orders of building new ships for more than one year, support the corporate mergers and acquisitions, and augmented the industrial concentration.

The Implementation Plan (2013-2015) on the Acceleration of Structural Adjustment and the Transformation and Upgrading in Shipbuilding Industry released in August 2013 clearly defined that in the next three years China would accelerate the development of marine engineering equipment and high-tech ships, strengthen the administrative law enforcement and the allotment of civil ships, promote the structural upgrading of ship industrial products. The industries related to shipbuilding were highly associated. Therefore, the resolution of high excessive capacity and the upgrading of industrial competitiveness would assist China to seize the historic opportunity of the shift of world shipbuilding center.

The Guidance also proposed to encourage the transformation of the existing shipbuilding capacity into the field of marine engineering equipment, support the conversion of SMEs, and upgraded the proportion of high-level production capacity. In the context of maritime strategy, maritime industry became the hot spot in a new round of the economic development. According to China Ocean Development Report (2013), Since the 1990s, the average annual GDP growth of the world marine economy was about 11 %, significantly higher than the global economic growth rate during the same period by 3% -4%; currently the marine economies contribute to more than 50% of GDP in the United States, Japan and other developed economies, while the marine economy in China"s 2012 GDP was about 5 trillion yuan, accounting for less than 10% of GDP.

China had seen rapid development of its marine industry. China has more than 3 million square kilometers of water territory, with more than 1,400 harbors and 210,000 cargo ships. According to the Ministry of Land and Resources of the PRC, the marine industry would gradually become one of the pillars of China"s economy. The success of the shipbuilding industry was based on decisions made in the early 1980s to corporatize the shipbuilding sector, to open the industry to foreign technology imports, and to compete on the global market.

The dual-use industrial base was a critical component of China"s strategic high-tech economic plans. Currently, its leading dual use sectors include shipbuilding, aviation, space, nuclear, electronics and IT infrastructures. The shipbuilding industry has made particular progress in modernizing its design and manufacturing capabilities and in transfering commercial shipbuilding practices to naval construction. Chinese shipbuilding was domestically and globally competitive, and seems to be profitable - indeed, it was the only sector in the defense industry that was adding productive capacity, i.e., new shipyards and more workers.

As Richard A. Bitzinger, Associate Professor, Asia-Pacific Center for Security Studies, has noted "Following an initial period of basically low-end commercial shipbuilding - such as bulk carriers and container ships - China"s shipyards have since the mid-1990s progressed toward more sophisticated ship design and construction work. In particular, moving into commercial shipbuilding began to bear considerable fruit beginning in the late 1990s, as Chinese shipyards modernized and expanded operations, building huge new dry-docks, acquiring heavy-lift cranes and computerized cutting and welding tools, and more than doubling their shipbuilding capacity. At the same time, Chinese shipbuilders entered into a number of technical cooperation agreements and joint ventures with shipbuilding firms in Japan, South Korea, Germany, and other countries, which gave them access to advanced ship designs and manufacturing technologies - in particular, computer-assisted design and manufacturing, modular construction techniques, advanced ship propulsion systems, and numerically controlled processing and testing equipment. As a result, military shipbuilding programs collocated at Chinese shipyards have been able to leverage these considerable infrastructure and software improvements when it comes to design, development, and construction."

Three types of firms make up China"s shipbuilding industry: 1) large state owned enterprises [SOEs] with mega-size production and technology capacity; 2) small private shipbuilding enterprises in the coastal provinces; and 3) joint ventures of foreign and domestic companies. Two mega parenting conglomerates dominate China"s shipbuilding industry. CSSC (China State Shipbuilding Corporation) which has headquaters in Shanghai, controls about 30 shipyards in the east and the south including those in Anhui, Guangdong, Jiangxi and Shanghai. CSIC (China Shipbuilding Industry Corporation) which is based in Beijing controls about 48 shipyards in the north and the west with a focus on major ports in Liaoning and Tianjin as well as operating 28 science, design and research units.

To sustain demand, the government encouraged banks to provide more financial support and credit loans to both domestic and foreign enterprises, and to stimulate the domestic shipbuilding market through more investment on infrastructural ships and high-tech ships such as maritime engineering products. Toe promote indigenous innovation and R&D capability of domestic enterprises, apart from improving existing ship models, China would invest more on high-tech and high value-added technologies such as environment-saving and energy-efficient shipbuilding, maritime equipment projects, and critical internal equipment within ships. China was also developing its offshore drilling rig industry as a future alternative to traditional shipbuilding. Many large enterprises in China are starting their production of rigs for both domestic and foreign orders.

Chinese shipbuilding output and ship orders in hand have shown growth for six consecutive years and have been ranked the second in the world. The central government"s 11th five-year plan (2005 to 2010) pointed out that the key to strengthening the shipping industry lies in design capability, marine equipment supply, large-scale shipbuilding construction, and optimizing the three main ship types: bulk-carriers, oil tankers, and container vessels. Emphasis would be put on hi-tech ships, new ship designs and ocean engineering equipment, which have additional added value.

Chinese accomplished shipbuilding output and ship orders in hand have enjoyed fast growth for seven consecutive years and are ranked second in the world. According to statistics from the China Shipbuilding Industry Association, China"s shipbuilding output was 42.43 million deadweight tons (DWT) in 2009, rising 47% from 2008. According to statistics issued by Clarkson, a UK consultant, Chinese accomplished shipbuilding output was 56.76 million deadweight tonnages from January to November of 2010, with an increase of some 55.4% compared with the same period of 2009. New ship orders were 26 million deadweight tons in 2009, which was down 55% compared with the same period of 2008. The market share of Chinese accomplished shipbuilding output, new ship orders and ship orders in hand accounted for 34.8%, 61.6% and 38.5% respectively of the world"s totals in 2009.

Although the China shipbuilding industry has enjoyed remarkable growth, the impact of the international financial crisis has been transferred to the shipbuilding industry in which new building orders continue to decline in number and the currency appreciation and cost increase would impact the profits of the China"s shipbuilding companies in long term.

China was one of leading shipbuilding countries in the world. in 2009, Chinese shipbuilders built vessels with a total displacement capacity of 42.4 million dead weight tons (dwt), which was an increase of 47% from that of 2008. Owing to the global financial crisis, China"s shipbuilders received orders for a total of 26 million dwt in 2009 compared with 58.2 million dwt in 2008. China would deliver its first super-large crude tanker, which could carry up to 308,000 t of crude oil, to Saudi Arabia in 2010.

In 2008, the shipbuilding sector consumed about 12 Mt of steel products, of which 9.6 Mt was medium-thick plate.in 2008, China produced 20.4 Mt of medium-thick plate forshipbuilding and exported 8.97 Mt. The Republic of Korea, which received 6.31 Mt, was the leading destination for Chinese medium-thick plate; the remainder was shipped to Japan, Malaysia, Singapore, and Vietnam. At year end 2009, the country had medium-thick plate output capacity of 71.3 Mt, of which 27 Mt was for shipbuilding. Domestic analysts estimated that the shipbuilding sector would consume about 15.2 Mt in 2011. During the past several years, the quality of Chinese shipbuilding plate had improved; however, the quality of steel products remained as good as such countries as Japan and the Republic of Korea.

After more than 3 decades of development, the existing structure of most industries no longer met the requirementsof the modern business world. The Chinese enterprises wereconsidered to be weak in independent innovation; they had low measures of competitiveness and productivity, depended heavilyon external demand, and had undiversified product lines. The Government announced that 10 major industries in China - automobile manufacturing, electronic information, equipment manufacturing, iron and steel production, light industry, logistics, nonferrous metals production, petrochemicals, textile manufacturing and shipbuilding - were to be reformed and upgraded. These industries accounted for more than80% of the country"s total industrial output value and aboutone-third of the GDP.

In February 2009, China"s State Council approved the adjustment and revitalization plans of Chinese shipbuilding industry. According to the plan, the government would encourage financial institutions to expand financing to purchasers of ships and extend fiscal support for domestic buyers of long-range ships until 2012. The plan would also support the industry in stabilizing the production, enlarging the market demand, developing marine engineering equipment, supporting the merger and acquisition and technical innovations.

China Rongsheng Heavy Industries Group Holdings Ltd rose in Hong Kong trading after saying it applied to withdraw a plan to buy a diesel engine maker for 2.15 billion yuan ($338 million) because of the European debt crisis.

"If the withdrawal is successful, the investors will be happy and the cash pressure on Rongsheng will be relieved as there will be savings for Rongsheng," said UOB-Kay Hian Holdings Ltd analyst Lawrence Li.

China Rongsheng, which hasn"t announced new shipbuilding contracts this year and is releasing interim results on Tuesday, said it expects a significant drop in its first-half profit. The stock advance on Monday pared Rongsheng"s decline this year to 48 percent and the index gained 8.4 percent in the same period.

* Yangzijiang says only interested in Rongsheng * Yangzijiang expects decision on investment by end-June * Yangzijiang 1Q net profit falls 12 pct (Recasts, adds details, comments) SINGAPORE, April 30 (Reuters) - China"s Yangzijiang Shipbuilding Holdings Ltd is considering a possible investment in troubled peer China Huarong Energy Co Ltd , formerly known as China Rongsheng, its executive chairman said on Thursday. Ren Yuanlin said the company was still in early talks with stakeholders, and expected to make a decision on the investment by end-June. "The government, banks, and Rongsheng"s major shareholder all hope we can be part of the deal, but whether or not we will get in depends on the asset price," he told reporters at a post-earnings briefing in Singapore, where the company is listed. "We are not interested in anyone else but Rongsheng." Yangzijiang, in which Ren owns a 26 percent stake and is the biggest shareholder, is one of China"s biggest shipbuilders, and the country"s most profitable listed shipyard. Hong Kong-listed China Rongsheng recently changed its name to China Huarong after expanding into oil and gas development and production. It is one of China"s largest private shipbuilders, and has been struggling with high debt and a slowdown in the shipbuilding industry in recent years. Yangzijiang reported earlier in the day that its first quarter net profit dropped 12 percent, as investment income and shipbuilding revenue both weakened. ($1 = 6.1989 Chinese yuan) (Reporting by Aradhana Aravindan and Rujun Shen; Editing by Miral Fahmy)

Looking through our archives, Seatrade Global ran a story on China Ocean Shipbuilding Industry Group’s (Cosig) 2013 results exactly a year ago which almost reads like a carbon copy of this year’s results report, except that the loss figures have gotten bigger and the going concern issue is more pressing.

Turning attention to another beleaguered Chinese shipbuilder, China Rongsheng Heavy Industries also faced a second year of going concern issues. While it has managed to reduce 2014 losses to RMB7.8bn ($1.3bn) from RMB8.7bn previously, it has come at a tremendous cost with revenue negative to the tune of RMB3.9bn in contrast to revenue of RMB1.34bn in 2013, due to the decrease of revenue from shipbuilding and other contracts and the reversal of revenue from cancellation of shipbuilding contracts as the group moved to restructure its shipbuilding business.

Rongsheng’s liabilities situation would appear to be even worse. As at 31 December 2014 current liabilities exceeded current assets by RMB20.7bn. Total borrowings and finance lease liabilities of the group were RMB22.6bn, of which RMB20.8bn is due within 12 months. Of this, RMB528.0m is overdue and has not been renewed or repaid subsequent to year-end.

Rongsheng management reassured however that “a series of plans and measures to mitigate liquidity pressure have been taken to improve the financial and liquidity positions of the group (and) the group has also been actively negotiating with the banks regarding the current and non-current borrowings”.

It should be noted that management has made similar statements at the past full-year results as well. To be fair this has proven reliable and the banks have been stayed thus far. The next critical stage in Rongsheng’s rehabilitation must be the divestment of the shipbuilding business and the restoration of credit.

This is proving to be quite an endeavour however. Rongsheng has announced it is in talks with a bigger player, believed to be a Chinese state-owned shipyard group, and has until the end of June to seal a deal but the state of its finances and operations may prove an impediment.

According to local reports, as far back as last May, provincial officials tried to help by sponsoring a meeting between Rongsheng and state-owned China State Shipbuilding Corp (CSSC) aimed at securing a possible bailout for Rongsheng.

Talks ended without an agreement, with CSSC sources quoted as saying the complexity of Rongsheng"s asset structure and heavy debt worked against CSSC against pursuing a tie-up. Factors included an estimated RMB5bn in costs to restart full production in addition to the massive debt load.

Looking to the future, Rongsheng has its sights firmly set on getting out of the shipbuilding business and focusing on its new energy business. “We sorted and optimised our order book by reducing the number of vessels under construction and cancelling some shipbuilding orders. In the period, we negotiated proactively with ship owners and reached agreement with them on certain orders on hand, resulting in the cancellation, revision and variation of a number of shipbuilding contracts,” the company said.

It added: “We believe that this action will reduce our burden on working capital and effectively reduce the credit risk of our order book.” Provided the divestment plan manages to be well-executed, Rongsheng should emerge from the dark days into a relatively brighter future.

Cosig is also looking to diversify into the energy business but is maintaining its stronghold in shipbuilding and relying on consolidation and other government aid measures to weather the storm.

Troubled China shipbuilders are working hard to rehabilitate themselves. While some have restructured, in the case of Guangzhou Shipyard International and its parent CSSC, others such as Cosig and Rongsheng are making extraordinary efforts to diversify to remain viable.

China’s Rongsheng Heavy Industries—the largest private shipbuilder in the world’s number one shipbuilding country—is in a bad shape. Struggling with plummeting orders and soaring debts, on Friday the company

Rongsheng reported a net loss of $93.5 million in 2012 and said—with no details provided—that it expects a further loss in the first half of this year. Its orders last year numbered just two, compared to 24 in 2011 and it recently

China’s shipbuilding industry body said on Thursday that a third of the country’s yards could close within five years if the global economy does not pick up. “Because of the overall market, there’s no way out for the companies, so only the strongest will survive,” an analyst at Masterlink Securities in Shanghai

Rongsheng has borrowed billions of dollars in debt since its launch in 2005, fueling a rapid expansion that has made it one of China"s biggest three shipbuilders. But a global slowdown in demand for new vessels over the past few years has hit the firm hard.

In July Rongsheng, which is owned by private investors, said it was in discussions with a number of banks about "renewing existing credit facilities." The company also said it has reached an accord with a company controlled by key shareholder

said in a written statement that a recovery in the shipbuilding industry is likely to be slow due to an imbalance between supply and demand. "Although the [shipbuilding] industry has recently showed positive signs that point to a rebound, neither new order price nor volume confirms a recovery," he said. "Shipbuilding companies still encounter difficulty in earning profits on orders."

[Press Release]China Rongsheng Heavy Industries Secures Shipbuilding Contracts from Three Ship Owners* * * *Enhances Functions of the Vessel Models and Captures the GreenTrend in the MarketStrong Capability to Secure New Orders with Immense GrowthPotential

(3 July 2011, Hong Kong) China Rongsheng Heavy Industries Group Holdings Limited (China Rongsheng Heavy Industries or the Group; stock code: 01101.HK), a large heavy industries group in China, is pleased to announce that it has secured large orders from three renowned shipowners in Europe recently, including four

6600-TEU containerships and ten 205,000-tonne bulk carriers.Mr Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, We have secured the highest number of new orders in the country and the worlds fifth highest number of orders in hand since the end of 2010. Following the order[s] valued at USD400 million secured in the first quarter this year, we have secured several additional large orders which have notably increased the total amount of our orders in hand. These orders are sufficient to support our development in the coming few years, forming a solid foundation for our future growth. The signing of the contracts has increased the amount of new orders of the Group in the first half of the year to more than USD1.3 billion and further rationalised our order structure.

At the same time, China Rongsheng Heavy Industries has signed contracts with two other European ship owners to provide each with two 6600-TEU containerships [respectively]. Adopting a new generation design, the 6600TEU containerships reduce the speed from 25 kn to 21 kn as well as [ballast capacity], thus saving oil consumption and lowering transportation cost.

Despite the slowdown in the global shipbuilding industry in the first half of the year, China Rongsheng Heavy Industries has stood out among its peers in the volume of new orders it has secured. This year, the Group has signed contracts with Golden Union, a well-known international shipowner, for provision of two Panamax bulk carriers in January, and 2+2 of these carriers in May. Founded in 1977, Golden Union is well-known for operating bulk carriers. Currently, Golden Union has more than 20 ships in its fleet, thus making it the leader in the dry bulk carrier transportation [industry] in Greece.

Mr Chen concluded, Our improvement was by no means due to luck. The new orders that we just secured included some established and world renowned shipowners. These new orders represented their recognition of our rapid growth and appreciation of the top quality of our finished products, as well as their support and trust of the brand. Although the global shipbuilding market remains slow, our business has not been affected and we are boosting sustained and stable income growth as planned. In the near future, our strong ability to secure new orders should lead the industry to grow and come on the international stage. We are moving forward to become a leading heavy industries group and generate more promising returns for our shareholders and investors.

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. Rongsheng products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Groups products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.For press enquiries:Strategic Financial Relations (China) LimitedMs. Anita CheungTel: (852) 2864 4827Email: anita.cheung@sprg.com.hk

China"s Yangzijiang Shipbuilding Holdings Ltd is considering a possible investment in troubled peer China Huarong Energy Co Ltd , formerly known as China Rongsheng, its executive chairman said on Thursday.

"The government, banks, and Rongsheng"s major shareholder all hope we can be part of the deal, but whether or not we will get in depends on the asset price," he told reporters at a post-earnings briefing in Singapore, where the company is listed.

Hong Kong-listed China Rongsheng recently changed its name to China Huarong after expanding into oil and gas development and production. It is one of China"s largest private shipbuilders, and has been struggling with high debt and a slowdown in the shipbuilding industry in recent years.

Yangzijiang reported earlier in the day that its first quarter net profit dropped 12 percent, as investment income and shipbuilding revenue both weakened.

The company said that the struggles of its shipbuilding arm, Jiangsu Rongsheng Heavy Industries, had been hampering efforts to expand in energy services

China Rongsheng Heavy Industries Group Holdings Limited [1101.HK] has announced that it has signed a memorandum of understanding that will see its shipbuilding business, Jiangsu Rongsheng Heavy Industries, sold to an undisclosed potential purchaser.

The deal involves the core assets and liabilities of both its onshore shipbuilding and offshore engineering business, though the company stressed that a formal transaction agreement is still pending.

According to the company, the depressed shipbuilding market had led to operational difficulties at Jiangsu Rongsheng Heavy Industries, while its highly-leveraged state was also interfering with the company"s efforts to expand in oil and gas exploration elsewhere.

"The Potential Transaction shall adjust and optimize the assets and business of the Group, and divest the relevant assets and liabilities of the shipbuilding business and offshore engineering business, which shall help to ease the debt burden of the Group, enhance the flexibility of fund utilization, better implement the strategy of business transformation and transformation into an energy service provider focusing in the oil and natural gas market," said the company.

It was reported in 2012 that in the face of market difficulties, China Rongsheng Heavy Industries had turned its focus to building containerships with a "green design" as one its key products.

However, a year later, the company was reported as saying that the Chinese shipbuilding industry was still experiencing "unprecedented challenges" as demand waned and ship prices failed to increase.

8613371530291

8613371530291