rongsheng heavy industries co ltd manufacturer

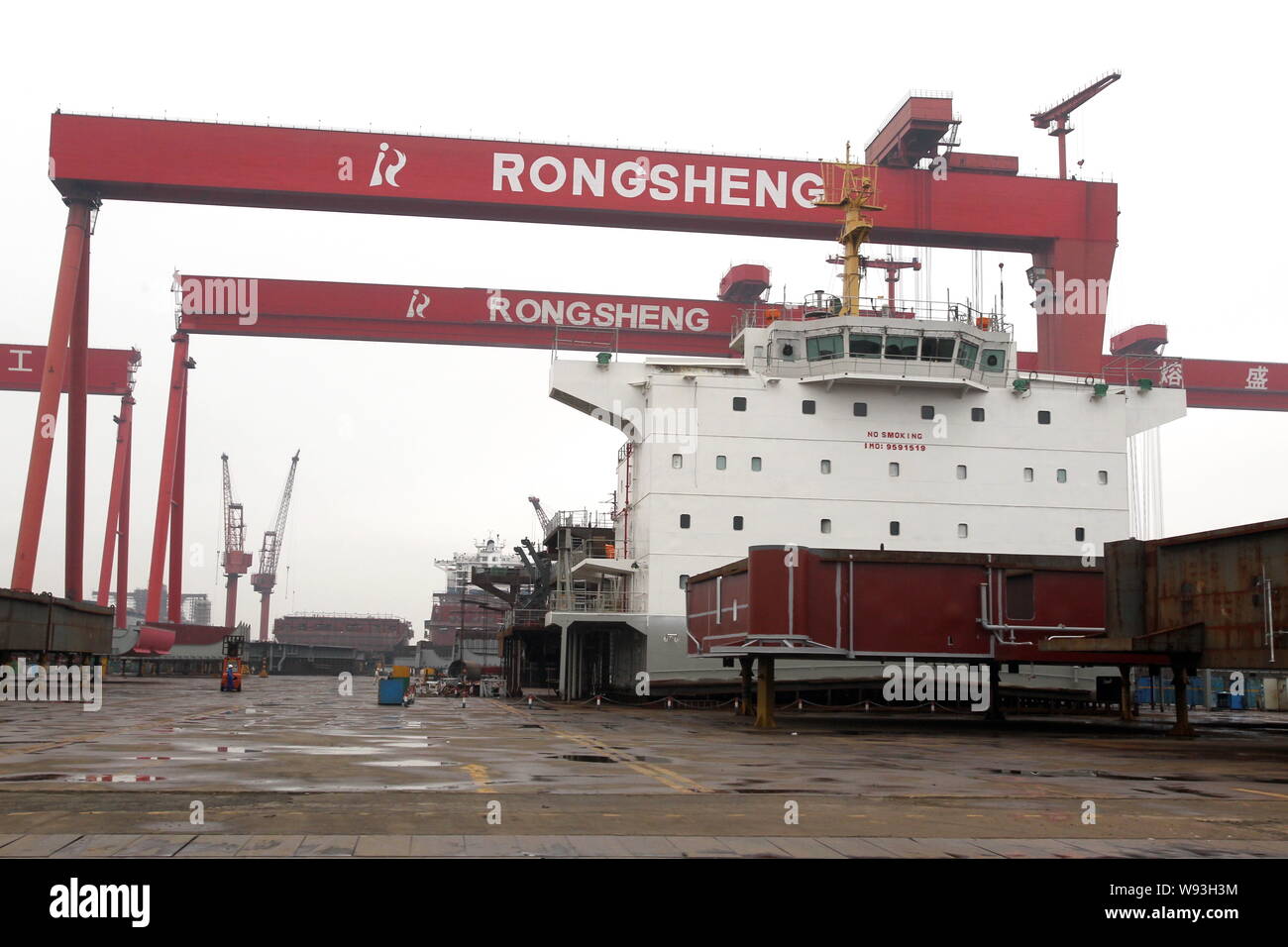

Manufacturer of marine equipment with a focus on oil and gas related customers and markets. The company"s business spans four segments, shipbuilding, offshore engineering, marine engine building, and engineering machinery. The products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines, and small to mid-size excavators and cranes for construction and mining uses. The company has been approved to build four drydocks which are capable of construction of vessels of over 100,000 deadweight tonnage, including the fourth drydock that will be primarily for use by offshore engineering projects.

The Panama Maritime Authority (AMP) said it has recovered more than $15.7 million in wage payments owed to seafarers who sail on Panamanian-flagged vessels.Under its current administration, through the General Directorate of Seafarers (DGGM), the AMP said it has recovered $15,763,052.24 for vessel crewmembers, including $5,315,909.99 in 2022.The AMP said that during this span 1,248 maritime labor complaints were processed (including 451 in 2022) and that 1,864 crew members of various nationalities have been repatriated through the intervention of the AMP the shipowners

Damen Shipyards Group and Compagnie Maritime Monégasque (CMM) announced a two-year offshore support contract for Damen Fast Crew Supplier (FCS) 7011 Aqua Helix. The vessel will transport personnel to and from offshore platforms in support of an oil and gas decommissioning project. The 2022-built Aqua Helix arrived in Brazil on January 26 and is anticipated to commence work in the coming weeks.“During the design phase of the FCS 7011, we considered the Brazilian market a strong fit for this vessel, due to its geography and concentration of offshore assets,” Robin Segaar, Sales Manager at Damen.

Caledonian Maritime Assets Ltd (CMAL) confirmed the signing of the Bank Refund Guarantee (BRG) for two new vessels for the Little Minch routes between Uig, Lochmaddy and Tarbert (Harris).Work to build the ferries will now begin at Cemre Marin Endustri A.S shipyard in Turkey, with an expected delivery date for both in June and October 2025 respectively.They will be built to the same specification as the vessels for Islay, which are already under construction at Cemre. Both are currently ahead of schedule.Jim Anderson, director of vessels at CMAL, said, “Now that the BRG has been signed, construction of the two new vessels can begin at Cemre.

Wisconsin Gov. Tony Evers, together with the state"s Department of Transportation (WisDOT), announced grants totaling $5.3 million for seven harbor maintenance and improvement projects to promote waterborne freight and economic development.“From the Great Lakes to the Mississippi River, Wisconsin’s unique geography provides our state opportunities to grow our economy and help our businesses reach markets worldwide,” said Gov. Evers. “These grants will help maintain our harbors and ensure our ports are secure and reliable, all while strengthening our supply chains and our commitment to our port cities.

The Panama Maritime Authority (AMP) said it has recovered more than $15.7 million in wage payments owed to seafarers who sail on Panamanian-flagged vessels.Under its current administration, through the General Directorate of Seafarers (DGGM), the AMP said it has recovered $15,763,052.24 for vessel crewmembers, including $5,315,909.99 in 2022.The AMP said that during this span 1,248 maritime labor complaints were processed (including 451 in 2022) and that 1,864 crew members of various nationalities have been repatriated through the intervention of the AMP the shipowners

Damen Shipyards Group and Compagnie Maritime Monégasque (CMM) announced a two-year offshore support contract for Damen Fast Crew Supplier (FCS) 7011 Aqua Helix. The vessel will transport personnel to and from offshore platforms in support of an oil and gas decommissioning project. The 2022-built Aqua Helix arrived in Brazil on January 26 and is anticipated to commence work in the coming weeks.“During the design phase of the FCS 7011, we considered the Brazilian market a strong fit for this vessel, due to its geography and concentration of offshore assets,” Robin Segaar, Sales Manager at Damen.

Caledonian Maritime Assets Ltd (CMAL) confirmed the signing of the Bank Refund Guarantee (BRG) for two new vessels for the Little Minch routes between Uig, Lochmaddy and Tarbert (Harris).Work to build the ferries will now begin at Cemre Marin Endustri A.S shipyard in Turkey, with an expected delivery date for both in June and October 2025 respectively.They will be built to the same specification as the vessels for Islay, which are already under construction at Cemre. Both are currently ahead of schedule.Jim Anderson, director of vessels at CMAL, said, “Now that the BRG has been signed, construction of the two new vessels can begin at Cemre.

Wisconsin Gov. Tony Evers, together with the state"s Department of Transportation (WisDOT), announced grants totaling $5.3 million for seven harbor maintenance and improvement projects to promote waterborne freight and economic development.“From the Great Lakes to the Mississippi River, Wisconsin’s unique geography provides our state opportunities to grow our economy and help our businesses reach markets worldwide,” said Gov. Evers. “These grants will help maintain our harbors and ensure our ports are secure and reliable, all while strengthening our supply chains and our commitment to our port cities.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

The 2023 Conference will take place from 21-23rd November in Hamburg, Germany and will offer a meeting place to learn, discuss and knowledge-share the latest developments in efficient power and propulsion technology plus alternative low flashpoint and low carbon fuels.

The 2023 Conference will take place from 21-23rd November in Hamburg, Germany and will offer a meeting place to learn, discuss and knowledge-share the latest developments in efficient power and propulsion technology plus alternative low flashpoint and low carbon fuels.

The Hong Kong-listed shipbuilder said in a statement it on Friday submitted an application to the nation’s securities regulator for approval of its plan to withdraw a bid to buy Anhui Quanchai Group Corp., a diesel engine maker, from the local government of Anhui Province’s Quanjiao County. Anhui Quanchai Group’s unit Anhui Quanchai Engine Co. is listed on the Shanghai Stock Exchange.

The company said the decision to withdraw its bid is due to worsening global economic conditions as a result of the eurozone debt woes and other unforeseeable developments.

The planned withdrawal comes as the Shanghai-based shipbuilder in July warned investors that its first-half net profit, scheduled for Tuesday, is expected to fall “significantly” from a year earlier because of a decline in orders and prices of ships.

In the same month, the company’s non-executive chairman and co-founder Zhang Zhirong was accused by the U.S. Securities and Exchange Commission for insider trading ahead of a public disclosure that Chinese state-owned oil company Cnooc Ltd. plans to acquire U.S.-listed Canadian energy producer Nexen Inc. for $15.1 billion. China Rongsheng subsequently issued a statement on July 30 to state that the U.S. regulator’s investigation against Mr. Zhang has no impact on its operations.

China Rongsheng Heavy Industries Group Holdings Ltd., the shipyard that has become symbolic of a credit glut gone wrong, said a spate of canceled orders led to

China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell

China Rongsheng Heavy Industries Group Holdings Ltd., once the country’s largest private shipyard, said it will not proceed with a proposed warrant sale

NASDAQ-listed DryShips Inc. (DRYS) says it has pulled the trigger on the cancellation of newbuilding contracts for four four ice-class panamax bulker vessels

China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said its first-half net loss widened more than ten times as shipowners

Private-sector shipyards such as Rongsheng Heavy Industries and China Ocean Shipbuilding Industry Group Ltd report another very tough year of losses in 2013

China Rongsheng Heavy Industries Group, the country"s largest private shipbuilder, said on Wednesday it expects to report a substantial full-year loss just

Rongsheng Heavy Industries announced in a stock filing today their plan to issue HK$1,400,000,000 (USD $180 million) in convertible bonds in an effort to help

HONG KONG/SINGAPORE, July 11 (Reuters) – A court has granted a unit of China Rongsheng Heavy Industries approval to proceed with legal action to reclaim

China Rongsheng Heavy Industries Group, China"s largest private shipbuilder, appealed for financial help from the Chinese government and big shareholders on

As forewarned in December, Chinese shipbuilder Rongsheng Heavy Industries, posted a 2012 loss of USD $92 million, the opposite of the $90 million profit they

HONG KONG, March 25 (Reuters) – China Rongsheng Heavy Industries Group Holdings Ltd won its first orders to build two jack-up rigs worth more than $360

Rongsheng Heavy Industries Group Holdings Limited is pleased to announce the establishment of Rongsheng Offshore & Marine Private Limited (“Rongsheng Offshore & Marine”), the Group’s new offshore engineering base, in Singapore. The company will focus on research and development, marketing and “Engineering, Procurement and Construction” (“EPC”) projects in offshore engineering, drawing on Singapore’s superior industry advances and human resources. On the same day, Rongsheng Offshore & Marine also officially announces that it has secured an EPC contract for a 2,000-meter deepwater tender barge. With sound developments made in the high-end offshore equipment manufacturing field, the Group will seek to accelerate its all-round transformation into an offshore engineering service provider.

Rongsheng Offshore & Marine, a wholly-owned subsidiary of China Rongsheng Heavy Industries and registered in Singapore, is set to become a light asset, high technology and first class offshore engineering talent base. It will play an important role in the Group’s offshore engineering strategy; the sales team is positioned to help the Group to gain market share in the international offshore engineering market, and the operational team will help the Group to achieve greater breakthroughs by engaging in high-end operational activities such as research and development, EPC project management and international procurement.

Mr. Chen Qiang, Executive Director and Chief Executive Officer of China Rongsheng Heavy Industries, said: “The opening of Rongsheng Offshore & Marine marks an important milestone towards the Group’s goal to upgrade and transform into an offshore engineering service provider. Combined with the company’s new, innovative operating model and technological platform and Jiangsu Rongsheng Heavy Industries Company Limited’s (“Jiangsu Rongsheng”) strong manufacturing base, China Rongsheng Heavy Industries has gained access to the global market and can now make their presence felt in the high-end marine equipment manufacturing field. By improving efficiency and lowering cost through synergizing the Group’s various business areas, we are confident that we can build Rongsheng into a world-class offshore engineering brand.”

The tender barge, ordered by a Norwegian customer, is currently one of the largest of its kind in the world, complete with a high-tech, high value-added deepwater engineering apparatus that boasts a wide scope of applications and excellent cost performance. With a maximum working depth and drilling depth of 2,000 meters and 6,000 meters, respectively, it meets the global requirements of oil drilling operations in mild-temperature waters.

The project in question is an EPC project, covering Engineering, Procurement, Construction. Rongsheng Offshore & Marine is the general contractor, and Jiangsu Rongsheng is the manufacturer. China Rongsheng Heavy Industries is one of the few shipbuilders in China capable of undertaking an EPC project, and the winning of this tender highlights the technological and manufacturing strength of China Rongsheng Heavy Industries in the marine engineering field. It also demonstrates the recognition received by the Group in the international shipbuilding and offshore engineering industries.

Mr. Don Lee, Director and Chief Executive Officer of Rongsheng Offshore & Marine, has made great achievements in offshore engineering and commands a considerable reputation, having established extensive contacts and close cooperation with offshore rig owners and petroleum companies over the course of 40 years in the field. Prior to his appointment at Rongsheng, Mr. Lee served as an Senior General Manager at Sembcorp Marine’s subsidiary Jurong Shipyard, Senior Vice President of the Marketing of Sembcorp Marine,Director of Jurong Brazil, Director of Brazil Netherlands BV, and Director of PPL Shipyard.

China Rongsheng Heavy Industries Group Holdings Limited (“China Rongsheng Heavy Industries” or the “Group”; stock code: 01101.HK), a large heavy industries group in China, announced that it has delivered its first 380,000 DWT Very Large Ore Carrier (VLOC) to Vale S.A. (“Vale”). The 380,000 DWT VLOC is a high-tech vessel self-developed by the Group. It is not only the world’s largest dry bulk carrier with the largest cargo capacity, but also incorporates the Group’s most advanced shipbuilding technology in very large bulk carrier. Successful delivery of the new vessel marked an innovative breakthrough for the shipbuilding industry in China.

Mr. Zhang Zhi Rong, Chairman of the Board and Non-executive Director of China Rongsheng Heavy Industries, said, “The successful delivery of the VLOC not only has extraordinary significance for the development of the shipbuilding industry in China, it also marks an important breakthrough of China Rongsheng Heavy Industries in moving towards its goal of developing into one of the world’s top diversified heavy industries group. The Group wishes to pave the way forward for private enterprises within China’s heavy industry to wield greater influence in the global market.”

Mr. Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, “‘VALE CHINA’ represents the most advanced bulk carrier in the world. The technologies needed for building the vessel are far more challenging than those for building the typical 200,000 DWT VLOCs. Far more advanced technologies are required to meet more demanding specifications on its structure, pressure endurance and fluid dynamic design. The delivery of the new vessel demonstrates the Group’s leadership in the global VLOC shipbuilding market.

The sea trial voyage of ‘VALE CHINA’ has been successful, with an outstanding performance in cargo loading capability and speed. While the second and third 380,000 DWT VLOCs have also been launched, the Group expects smoother delivery of other VLOCs. We are well prepared for the coming peak of delivery period.”

Mr. Marcus Moura, General Manager of Shipbuilding and Conversions of Vale China, said, “‘VALE CHINA’ is professionally designed and built by China Rongsheng Heavy Industries, and is tailored to address VALE’s trade pattern and terminals requirements in Brazil. This fantastic vessel certainly will enhance our competitiveness in the iron ore market, also help our company to cope with our ambitious iron ore export plan to Asia. We would like to thank China Rongsheng Heavy Industries for its hard and dedicated work and for keeping the commitment to deliver this vessel to our fleet within the required quality standards.”

The main engine of “VALE CHINA”, the 7RT-flex 82T, is self-built by China Rongsheng Heavy Industries and produced by Hefei Rongan Power Machinery Co. Ltd., the Group’s marine engine building division. The engine has not only gained a high degree of recognition from shipowners, but is also the first Warsila low-speed diesel engine with maximum power manufactured by a Chinese enterprise independently.

The new engine boasts the advantages of huge power output, low oil consumption, compact structure, and reduced emission of SOx and NOx. All these features demonstrate the Group’s all-round shipbuilding ability while addressing the operational and environmental protection concerns of shipowners. In August 2008, the Group signed shipbuilding contracts for twelve 380,000 DWT VLOCs with Vale, having a total contract value as high as US$1.6 billion. The work under the contracts attracted wide attention at the time as it set three world records in the contract value of a single shipbuilding order, carrying deadweight tonnage of single bulk carriers and total deadweight tonnage of orders. “VALE CHINA” delivered today is the first vessel for the VLOC series. In 2009, Vale also announced that it would rent four VLOCs of the same type from Oman Shipping Company which were also to be built by China Rongsheng Heavy Industries.

8613371530291

8613371530291