rongsheng heavy industries co ltd brands

The Panama Maritime Authority (AMP) said it has recovered more than $15.7 million in wage payments owed to seafarers who sail on Panamanian-flagged vessels.Under its current administration, through the General Directorate of Seafarers (DGGM), the AMP said it has recovered $15,763,052.24 for vessel crewmembers, including $5,315,909.99 in 2022.The AMP said that during this span 1,248 maritime labor complaints were processed (including 451 in 2022) and that 1,864 crew members of various nationalities have been repatriated through the intervention of the AMP the shipowners

Damen Shipyards Group and Compagnie Maritime Monégasque (CMM) announced a two-year offshore support contract for Damen Fast Crew Supplier (FCS) 7011 Aqua Helix. The vessel will transport personnel to and from offshore platforms in support of an oil and gas decommissioning project. The 2022-built Aqua Helix arrived in Brazil on January 26 and is anticipated to commence work in the coming weeks.“During the design phase of the FCS 7011, we considered the Brazilian market a strong fit for this vessel, due to its geography and concentration of offshore assets,” Robin Segaar, Sales Manager at Damen.

Caledonian Maritime Assets Ltd (CMAL) confirmed the signing of the Bank Refund Guarantee (BRG) for two new vessels for the Little Minch routes between Uig, Lochmaddy and Tarbert (Harris).Work to build the ferries will now begin at Cemre Marin Endustri A.S shipyard in Turkey, with an expected delivery date for both in June and October 2025 respectively.They will be built to the same specification as the vessels for Islay, which are already under construction at Cemre. Both are currently ahead of schedule.Jim Anderson, director of vessels at CMAL, said, “Now that the BRG has been signed, construction of the two new vessels can begin at Cemre.

Wisconsin Gov. Tony Evers, together with the state"s Department of Transportation (WisDOT), announced grants totaling $5.3 million for seven harbor maintenance and improvement projects to promote waterborne freight and economic development.“From the Great Lakes to the Mississippi River, Wisconsin’s unique geography provides our state opportunities to grow our economy and help our businesses reach markets worldwide,” said Gov. Evers. “These grants will help maintain our harbors and ensure our ports are secure and reliable, all while strengthening our supply chains and our commitment to our port cities.

The Panama Maritime Authority (AMP) said it has recovered more than $15.7 million in wage payments owed to seafarers who sail on Panamanian-flagged vessels.Under its current administration, through the General Directorate of Seafarers (DGGM), the AMP said it has recovered $15,763,052.24 for vessel crewmembers, including $5,315,909.99 in 2022.The AMP said that during this span 1,248 maritime labor complaints were processed (including 451 in 2022) and that 1,864 crew members of various nationalities have been repatriated through the intervention of the AMP the shipowners

Damen Shipyards Group and Compagnie Maritime Monégasque (CMM) announced a two-year offshore support contract for Damen Fast Crew Supplier (FCS) 7011 Aqua Helix. The vessel will transport personnel to and from offshore platforms in support of an oil and gas decommissioning project. The 2022-built Aqua Helix arrived in Brazil on January 26 and is anticipated to commence work in the coming weeks.“During the design phase of the FCS 7011, we considered the Brazilian market a strong fit for this vessel, due to its geography and concentration of offshore assets,” Robin Segaar, Sales Manager at Damen.

Caledonian Maritime Assets Ltd (CMAL) confirmed the signing of the Bank Refund Guarantee (BRG) for two new vessels for the Little Minch routes between Uig, Lochmaddy and Tarbert (Harris).Work to build the ferries will now begin at Cemre Marin Endustri A.S shipyard in Turkey, with an expected delivery date for both in June and October 2025 respectively.They will be built to the same specification as the vessels for Islay, which are already under construction at Cemre. Both are currently ahead of schedule.Jim Anderson, director of vessels at CMAL, said, “Now that the BRG has been signed, construction of the two new vessels can begin at Cemre.

Wisconsin Gov. Tony Evers, together with the state"s Department of Transportation (WisDOT), announced grants totaling $5.3 million for seven harbor maintenance and improvement projects to promote waterborne freight and economic development.“From the Great Lakes to the Mississippi River, Wisconsin’s unique geography provides our state opportunities to grow our economy and help our businesses reach markets worldwide,” said Gov. Evers. “These grants will help maintain our harbors and ensure our ports are secure and reliable, all while strengthening our supply chains and our commitment to our port cities.

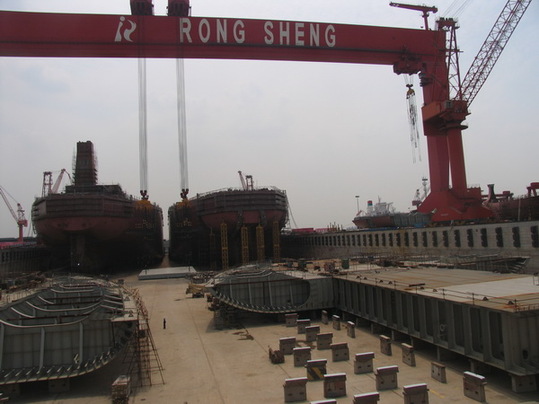

China Rongsheng Heavy Industries Group Holdings Limited is an investment holding company. The Company has four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. The Company commenced the construction of its shipyard in Nantong, Jiangsu Province. As of December 31, 2009, the Company鈥檚 shipyard covers approximately four million square meters and occupies 3,058 meters of Yangtze River shoreline. The Company operates its marine engine building business through Rong An Power Machinery. In October 2009, Rong An Power Machinery delivered its marine engine product, a Wartsila 6RT-flex68D low-speed marine diesel engine. The Company through Zhenyu Machinery offers 16 varieties of hydraulic excavators and two varieties of hydraulic crawler cranes. Its products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators and cranes for construction and mining.

Ch Rongsheng isa leadinglarge-scaleheavy industry enterprisegroup.It possesses of two manufacturing bases of shipbuilding and offshore engineering in Nantong of Jiangsu Province and diesel engine in Hefei of Anhui Province both approved by NDRC, coveringwide services ranging from shipbuilding, offshoreengineering,power engineering, engineering machineryandetc. Until Dec.With thevision of “cultivate world first-class employees and create world first-class enterprise”,the spirit of “integrity-based, the pursuit of excellence”, and the responsibility ofrevitalizingnational industry, it runs fast toward the great goal of world first-class diversified heavy industry group.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

The investigation may deter customers from placing orders, Jon Windham, an analyst at Barclays Plc., said yesterday by phone. “It’s obviously very bad for the overall image of the company.” He downgraded the stock to underweight from equalweight and cut its target price to HK$1.06 from HK$2.40.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

The shipbuilder has had delays as it builds 16 of the world’s biggest commodity ships for Vale SA and Oman Shipping Co. It was supposed to hand over eight of the ships last year, according to its IPO prospectus. Instead, it only delivered one. It had handed over two more to Vale by May 20. The same month, it christened two for Oman Shipping, Xinhua reported.

The company’s cash reserves have also declined. It had 6.3 billion yuan of cash and cash equivalents at the end of December down from 10.4 billion yuan a year earlier. Its short-term borrowings rose to 18.2 billion yuan from 10.1 billion yuan, according to data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

Well Advantage and other unknown traders stockpiled shares of Nexen before Cnooc announced plans to buy the Calgary-based energy company for $15.1 billion, according to the SEC. The regulator acted to freeze accounts less than 24 hours after Well Advantage placed an order to liquidate its position, it said. The investigation continues, it said July 27.

The traders may have to pay multiples of the profit they made from illegal deals to settle the case, based on previous incidents, said David Webb, the founder of corporate-governance website Webb-site.com. The frozen accounts may make a settlement more probable as the traders won’t be able to access cash, he said. Still, there may be a long-term impact on reputations.

“Cases such as this bring the integrity of the persons involved into question,” Webb said. “And, if they are running a bank or a listed company, then it tends to tarnish the firm too.”

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

. All rights reserved. The content (including but not limited to text, photo, multimedia information, etc) published in this site belongs to China Daily Information Co (CDIC). Without written authorization from CDIC, such content shall not be republished or used in any form. Note: Browsers with 1024*768 or higher resolution are suggested for this site.

The country’s largest shipyard outside state control is in discussions with the cities of Rugao and Nantong and some ministry-level departments related to the shipping industry, Rongsheng spokesman William Li said by phone today. The company said July 5 it was seeking financial assistance from the government after a plunge in orders forced it to reduce production and “restructure” its workforce. Li declined to elaborate.

“It will be difficult to see an obvious recovery before the end of next year” in demand for ships, Zhang Shouguo, vice president of the China Shipowner’s Association, said in a telephone interview today. “The shipping industry has been in a downturn for at least three years.”

Rongsheng and other Chinese shipmakers are struggling as a global vessel glut makes orders more difficult to win and pushes down prices. China has also identified shipbuilding as an industry with overcapacity, for which authorities won’t approve new projects and will limit financing as part of Premier Li Keqiang’s campaign to reduce the economy’s reliance on exports and investment for growth.

Two calls each to Rugao and Nantong local governments’ media offices seeking comment went unanswered today. Rongsheng has a production base in Nantong, a prefecture-level city that has administrative jurisdiction over Rugao.

“We expect shipyard failures could become a reality in China if current conditions persist,” Barclays Plc analysts Jon Windham and Esme Pau wrote in a report to clients yesterday. “Those yards not facing such harsh financial difficulties could increase their market and pricing power.” The Hong Kong-based analysts lowered their rating on Rongsheng’s shares to “underweight” from “equalweight.”

A third of the shipyards in China, the world’s biggest shipbuilding nation, may be shut in about five years, the China Association of National Shipbuilding Industry said last week. The order book of Chinese shipbuilders fell 23 percent at the end of May from a year earlier, according to data from the shipbuilders’ group.

Rongsheng said last week it may post a net loss for the first half. The Shanghai-based company reported an annual loss of 573 million yuan ($93.5 million) last year and a 50 percent drop in revenue. The Wall Street Journal reported on July 3 that the shipbuilder had laid off about 8,000 workers.

Shares of Rongsheng rose 3.8 percent to 82 Hong Kong cents at close of trading in the city. The stock has plunged 34 percent this year, compared with a 9 percent decline for the benchmark Hang Seng Index.

Overcapacity is at the “core” of the plunge in profits for China’s shipbuilders, the shipowner association’s Zhang said. The group’s membership is made of the nation’s largest shipping companies, including China Ocean Shipping Group, China Shipping Group Co. and Sinotrans Ltd.

A.P. Moeller-Maersk A/S, the world’s largest container line, said last month it would pool vessels with it two biggest competitors in an effort to manage overcapacity and raise unprofitable freight rates. Maersk Line, Mediterranean Shipping Co. and CMA CGM SA agreed to cooperate on the world’s three largest trade lanes after seeing “virtually no growth” since the financial crisis in 2008, Maersk Line Chief Trading and Marketing Officer Vincent Clerc said.

Vice Premier Zhang Gaoli said in May that China must “strictly forbid” approvals of projects in industries with overcapacity, including those in the ship-building sector, state broadcaster China Central Television reported. The Economic Information Daily reported today that China will implement “strict” financial policies to curb overcapacity.

“There is a saying in Chinese: ‘Save the one that needs it the most, not the poorest,’” Zhang said. “If Rongsheng’s troubles are temporary, and the company’s other management controls are good, and the company still has a promising future, then yes, the government can step in and give it a helping hand.”

The largest private shipbuilding enterprise in China has so far delivered six 156,000dwt suezmax tankers and will hand over up to 20 new builds this year, according to Asiasis.

Rongsheng has recently signed a contract with Oman Shipping to build four 400,000dwt very large ore carriers, following an order from Companhia Vale do Rio Doce in 2008 to build 12 400,000dwt large ore carriers.

SHANGHAI, Aug 21 (Reuters) - Shipbuilder China Rongsheng Heavy Industries has snapped up a majority interest in a company searching for oil in Kyrgyzstan, marking a move into oil exploration amid headwinds in its core shipbuilding business.

Rongsheng said on Thursday it had, through a subsidiary, bought a 60 percent share in New Continental Oil & Gas Co. Ltd for HK$ 2.184 billion ($281.82 million). New Continental, together with Kyrgyzstan’s national oil company, operates four oilfields in the country.

In the announcement, which came after Hong Kong markets shut, Rongsheng said it will finance the deal by issuing 1.4 billion shares at a premium of 12.23 percent to its Thursday closing share price of HK$ 1.39 per share.

“Given the relatively adverse market conditions for shipbuilding industry for the time being, the acquisition can assist the group in diversifying operations and broadening its source of revenue,” Rongsheng said in the statement.

“The company expects to realise a dramatic increase of oil output through upgrade and consolidation of the existing exploration technology and thereby to generate steady operating cash flows,” it said.

The oilfields, in the Central Asian country of Kyrgyzstan that borders China, sit adjacent to the Fergana Valley where Rongsheng said a recent third-party reserve survey had found abundant oil and gas resources. The geological reserve of crude oil in such oilfields amounted to 276 million tons in aggregate, the firm said.

Rongsheng last year appealed to the government for financial help. In March it agreed with banks to extend loans and other financing. (1 US dollar = 7.7496 Hong Kong dollar) (Reporting by Brenda Goh; Editing by Muralikumar Anantharaman)

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

company profile with verification of existence, current status, initial subscriber (if available), share capital, nature of business (if available), type of company, registered address and office, date and place of incorporation

8613371530291

8613371530291