rongsheng heavy industries co ltd for sale

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

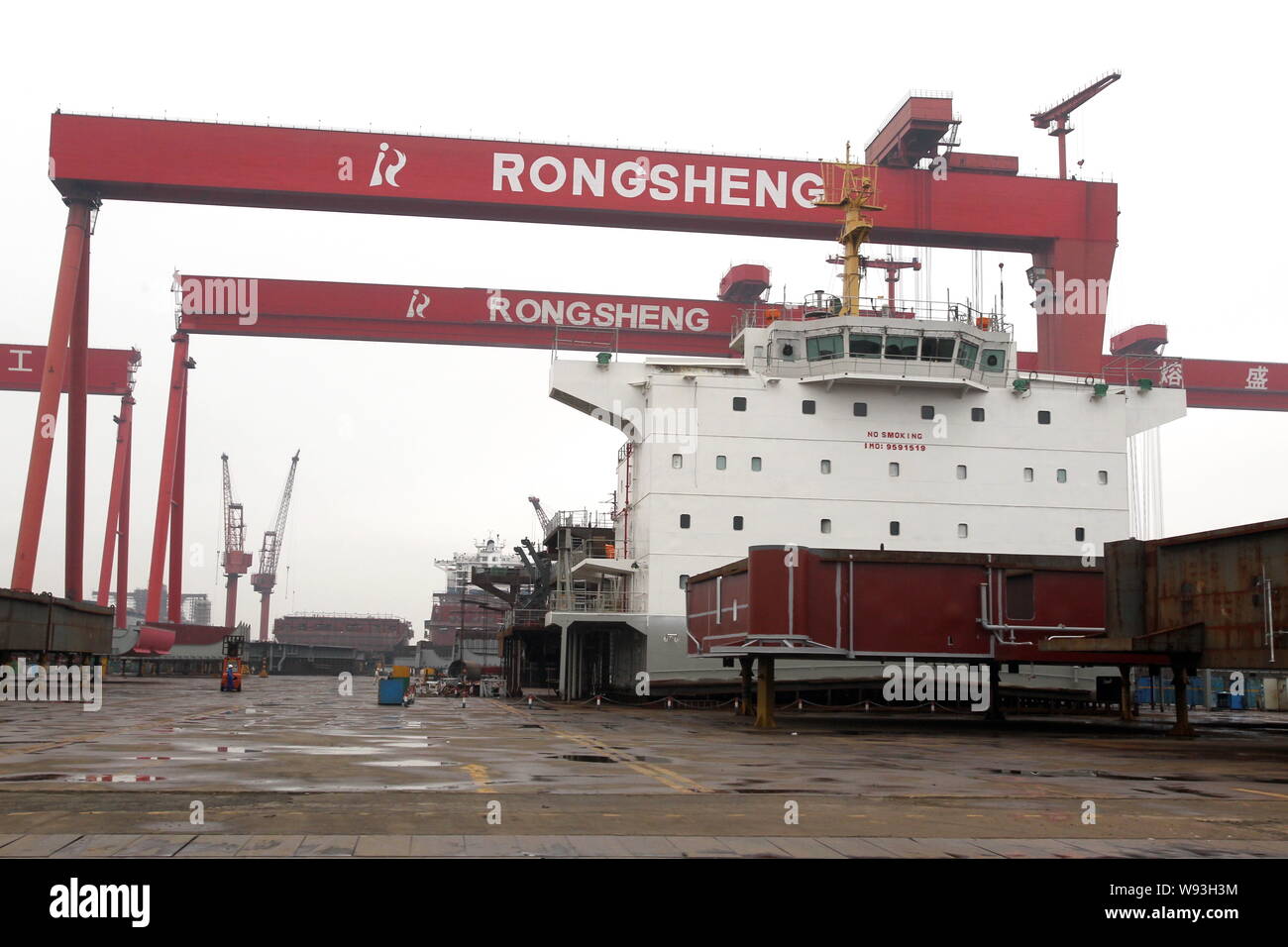

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Huarong Energy is of the view that the shipbuilding and engineering business is unlikely to see a turnaround in the foreseeable future and it is in the best interests of the company to dispose of the business and focus its resources on energy.

Shanghai: Hong Kong-listed Chinese shipyard Rongsheng Heavy Industries, which has officially changed its name to China Huarong Energy, has announced that it is in advanced talks with a listed company in China regarding the sale of the shipyard’s assets.

Rongsheng said the negotiations are currently under good progress and the group has already obtained letters of consent from various major creditor banks, according to which the major creditor banks have conditionally agreed to various matters in relation to the disposal of assets and liabilities of the yard.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

The company is trying to complete a restructuring by June and has proposed to change its name to China Huarong Energy Co. to more accurately reflect its expansion and new business scope.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

As orders for new ships began to dry up, China in 2013 issued a three-year plan urging financial institutions to support the shipbuilding industry. Ship owners placing orders for China-made vessels, engines and some parts should get better funding, the State Council said. A third of the more than 1,600 shipyards in China could shut down in the next five years, an industry association predicted earlier.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Investors have turned cautious on the industry after it was dealt a heavy blow by the economic downturn, with orders shrinking last year and the sector yet to fully recover.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

SHANGHAI, Aug 21 (Reuters) - Shipbuilder China Rongsheng Heavy Industries has snapped up a majority interest in a company searching for oil in Kyrgyzstan, marking a move into oil exploration amid headwinds in its core shipbuilding business.

Rongsheng said on Thursday it had, through a subsidiary, bought a 60 percent share in New Continental Oil & Gas Co. Ltd for HK$ 2.184 billion ($281.82 million). New Continental, together with Kyrgyzstan’s national oil company, operates four oilfields in the country.

In the announcement, which came after Hong Kong markets shut, Rongsheng said it will finance the deal by issuing 1.4 billion shares at a premium of 12.23 percent to its Thursday closing share price of HK$ 1.39 per share.

“Given the relatively adverse market conditions for shipbuilding industry for the time being, the acquisition can assist the group in diversifying operations and broadening its source of revenue,” Rongsheng said in the statement.

“The company expects to realise a dramatic increase of oil output through upgrade and consolidation of the existing exploration technology and thereby to generate steady operating cash flows,” it said.

The oilfields, in the Central Asian country of Kyrgyzstan that borders China, sit adjacent to the Fergana Valley where Rongsheng said a recent third-party reserve survey had found abundant oil and gas resources. The geological reserve of crude oil in such oilfields amounted to 276 million tons in aggregate, the firm said.

Rongsheng last year appealed to the government for financial help. In March it agreed with banks to extend loans and other financing. (1 US dollar = 7.7496 Hong Kong dollar) (Reporting by Brenda Goh; Editing by Muralikumar Anantharaman)

China Rongsheng Heavy Industries (RSHI) has entered into a memorandum of understanding (MoU) with an undisclosed third party Chinese investor to sell its onshore shipbuilding and offshore engineering business.

Both parties will further negotiate details of the deal, including the scope and list of related assets and liabilities, a stock filing of RSHI said. The MOU will remain in effect until 30 June and is likely to be extended by both parties.

China Rongsheng, which is also involved in marine engine building, engineering machinery and energy exploration, has been struggling with a heavy debt burden amid a slowdown in China"s economic growth. Earlier this month, Singapore-listed Yangzijiang Shipbuilding said it had been asked by Chinese government agencies to consider taking a stake in the group.

Shanghai-based Rongsheng, which is China’s largest shipbuilder outside government control, has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans.

Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

The decision has been triggered by a depressed shipbuilding market that has incurred considerable losses for the group’s shipbuilding operations further affecting its energy service business.

China is the world’s largest shipbuilder in terms of both the gross tonnage produced and the size of its order book, according to data from consultancy IHS Maritime.

Manufacturer of marine equipment with a focus on oil and gas related customers and markets. The company"s business spans four segments, shipbuilding, offshore engineering, marine engine building, and engineering machinery. The products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines, and small to mid-size excavators and cranes for construction and mining uses. The company has been approved to build four drydocks which are capable of construction of vessels of over 100,000 deadweight tonnage, including the fourth drydock that will be primarily for use by offshore engineering projects.

If you represent Jiangsu Rongsheng Heavy Industries Group Co Ltd and would like to update this information then use this link: update Jiangsu Rongsheng Heavy Industries Group Co Ltd information.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Chinese shipbuilder Jiangsu Rongsheng Heavy Industries has raised about HKD$14bn ($1.8bn) in its initial public offering on the Hong Kong stock exchange.

Rongsheng will use part of the sale proceeds to fund its shipbuilding and offshore engineering businesses, and to repay loans, according to lloydslist.com.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

HONG KONG - Jiangsu Rongsheng Heavy Industries is seeking $2.3 billion in what may be Hong Kong"s third-largest initial public offering (IPO) this year, according to terms sent to investors.

The company plans to sell 1.75 billion shares at HK$7.30 (94 cents) to HK$10.10, the terms show. China National Offshore Oil Corp, China Life Insurance (Group) Co, China Southern Fund Management Co and Atlantis Investment Management Ltd have agreed to buy a combined $155 million of shares, according to the terms.

Rongsheng intends to use the sale proceeds for projects that include building a fourth drydock, as a rebound in world trade following last year"s global recession revives demand for ships. The company, which raised $300 million from investors including Goldman Sachs Group Inc in 2007, planned to sell shares in 2008 before the failure of Lehman Brothers Holdings Inc and the credit crunch triggered a collapse in global stock markets.

"Orders for shipbuilding are improving and the industry is on a rebound," said Steven Leung, Hong Kong-based director for institutional sales at UOB-Kay Hian Ltd. Still, demand for the IPO will depend on the valuations, which are yet to be announced, he said.

BOC International Holdings Ltd is arranging the sale, along with CCB International (Holdings) Ltd, JPMorgan Chase & Co and Morgan Stanley, according to the terms sheet.

Guangzhou Shipyard International Co, the largest shipyard listed in Hong Kong, has gained 28 percent this year. It trades at about 11 times estimated earnings.

China Shipbuilding Industry Co, the nation"s largest maker of vessel equipment, raised 14.7 billion yuan ($2.2 billion) in a Shanghai IPO in December. It gained 34 percent this year.

Shipping lines have begun to resume ordering new vessels after a plunge in demand during the global recession. Evergreen Group and Neptune Orient Lines Ltd, Asia"s two biggest container lines, have ordered 32 new ships between them from South Korean shipyards since June.

Valemax ships are a fleet of very large ore carriers (VLOC) owned or chartered by the Brazilian mining company Vale S.A. to carry iron ore from Brazil to European and Asian ports. With a capacity ranging from 380,000 to 400,000 tons deadweight, the vessels meet the Chinamax standard of ship measurements for limits on draft and beam. Valemax ships are the largest bulk carriers ever constructed, when measuring deadweight tonnage or length overall, and are amongst the longest ships of any type currently in service.

The first Valemax vessel, Vale Brasil, was delivered in 2011. Initially, all 35 ships of the first series were expected to be in service by 2013, but the last ship was not delivered until September 2016. In late 2015 and early 2016, Chinese shipping companies ordered 30 more ships with deliveries in 2018–2020. Three additional vessels were ordered by a Japanese shipping company, bringing the total number of Valemax vessels to 68 as of 2020

In 2008, Vale placed orders for twelve 400,000-ton Valemax ships to be constructed by Jiangsu Rongsheng Heavy Industries (RSHI) in China and ordered seven more ships from South Korean Daewoo Shipbuilding & Marine Engineering (DSME) in 2009. In addition sixteen more ships of similar size were ordered from Chinese and South Korean shipyards for other shipping companies, and chartered to Vale under long-term contracts. The first vessel was delivered in 2011 and the last in 2016.

The first Valemax vessels were ordered on 3 August 2008 when Vale signed a contract with the Chinese shipbuilder Jiangsu Rongsheng Heavy Industries (RSHI) for the construction of twelve 400,000-ton ore carriers. The development had reportedly started in 2007.

The second RSHI-built Valemax ship for Vale (Vale Dongjiakou) was delivered on 9 April 2012,Vale Dalian) on 20 May,Vale Hebei) on 28 September,Vale Shandong) on 7 December 2012,Vale Jiangsu) on 23 March 2013,Vale Caofeidian) on 22 July 2013,Vale Lianyungang) on 22 November 2013,Ore Majishan; renamed before delivery) on 11 July 2014,Ore Tianjin; renamed before delivery) on 18 October 2014,Ore Rizhao; renamed before delivery) on 15 December 2014.Valemax vessel of the original order by Vale, Ore Ningbo (renamed before delivery), was delivered on 23 January 2015.

On 2 November 2008, Oman Shipping Company signed a framework agreement with RSHI for the construction of four 400,000-ton vessels to transport iron ore from Brazil to the Port of Sohar in Oman, where Vale is expected to open a steel plant in near future.Jazer, Yanqul, Al Kamil and Wafi,Vale Liwa, Vale Sohar, Vale Shinas and Vale Saham. The steel cutting ceremony for the first two vessels was held on 8 July 2010 and they were launched on 19 March 2012.Vale Liwa entered service in August 2012, followed by Vale Sohar in September 2012, Vale Saham in January 2013, and Vale Shinas in March 2013. The ships reportedly received additional strengthening due to the Vale Beijing incident.classification societies such as American Bureau of Shipping and Lloyd"s Register.

The Chinese shipbuilder"s ability to deliver any of the very large ore carriers ordered by Vale in time was doubted already before the first ship was built.Valemax vessels will be delivered from the Chinese shipyard in 2011 instead of the planned six due to delays in construction.Vale China) was delivered before the end of the year. Furthermore, later reports claimed that the ships ordered by Vale had a capacity of only 380,000 tons even though according to the Det Norske Veritas database entries all Chinese-built ships have a deadweight tonnage in excess of 400,000 tons and in the past Vale has referred to the ships ordered from Rongsheng as "400,000-ton" vessels. The reduction in cargo capacity, at least on paper, may have been due to the reluctance of Chinese officials to accept the 400,000-ton ships to Chinese ports.

In April 2012, it was reported that Vale had refused delivery for three Valemax ships recently completed by Jiangsu Rongsheng Heavy Industries. This was seen as a move against the Chinese officials who have not allowed the 400,000-ton ships to dock in Chinese ports.

In addition to the ships Vale ordered for itself, more ships of similar size were to be built for other shipping companies and chartered to Vale under exclusive long-term contracts. Eight very large ore carriers were ordered from the South Korean shipbuilder STX Offshore & Shipbuilding in Jinhae, South Korea (STX Jinhae), and Dalian, China (STX Dalian). The shipping company, STX Pan Ocean, signed a 25-year contract with Vale in 2009.Valemax vessels built by STX, 374,400 tons, is slightly smaller than that of the similar ships built by DSME and RSHI.

The first STX-built Valemax vessel, Vale Beijing, was delivered by STX Jinhae on 27 September 2011. Although another vessel was expected to take delivery later that year, only one ship was delivered. The second ship, Vale Qingdao, was delivered also by STX Jinhae on 13 April 2012,Vale Espirito Santo and Vale Indonesia, were built by STX Dalian and delivered on 17 September 2012 and 30 October 2012, respectively.Vale Fujiyama, was again built by STX Jinhae and delivered on 26 November 2012.Vale Tubarao, was delivered by STX Dalian on 30 January 2013.Vale Maranhao entered service on 29 August.

On 30 April 2007 Berge Bulk signed a contract with the Chinese shipbuilding company Bohai Shipbuilding Heavy Industry for the construction of four 388,000-ton very large ore carriers. Although initially scheduled for delivery in 2010, the first vessel, Berge Everest, was delivered on 23 September 2011.Berge Aconcagua on 15 March 2012Berge Jaya on 12 June 2012.Berge Neblina, was initially also scheduled to be delivered in 2012, but entered service on 4 January 2013.

Had Vale not ordered the Valemax fleet in 2008, these ships would have become the largest bulk carriers in the world, surpassing Berge Bulk"s own Berge Stahl. The four ships have since been chartered by Vale and, despite slight differences in design and contract date predating that of the ships ordered by Vale, they are also referred to as Valemax vessels.

In March 2016, it was reported that three Chinese companies China Ocean Shipping (Group) Company (COSCO), China Merchants Energy Shipping and Industrial and Commercial Bank of China (ICBC) had ordered ten Valemax vessels each from four Chinese shipyards with a total price of US$2.5 billion.Valemax ships ordered by China Merchants Energy Shipping would be built by Shanghai Waigaoqiao Shipbuilding (4 ships), Qingdao Beihai Shipbuilding (4 ships), and China Merchants Group-controlled China Merchants Heavy Industry (Jiangsu) (2 ships).Yangzijian Shipbuilding while the remaining four would be awarded to Qingdao Beihai Shipbuilding.Valemax vessels, Yuan He Hai, was delivered on 11 January 2018

In December 2016, the Japanese shipping company NS United ordered a single 400,000DWT very large ore carrier from Japan Marine United after signing a 25-year contract with Vale. The vessel, which would become the first Valemax ship built in Japan, was delivered in December 2019 as

On 24 May 2011, Vale Brasil received her first cargo at the Brazilian port Terminal Marítimo de Ponta da Madeira, 391,000 tons of iron ore bound for Dalian in China.Atlantic Ocean in June after rounding the Cape of Good Hope and was rerouted to Taranto, Italy.Vale Brasil was not allowed to enter the Chinese port fully laden, but according to Vale the destination was changed due to commercial, not political reasons.Valemax vessels have unloaded at various ports, such as Dalian in China,Sohar in Oman,Rotterdam,Ōita in Japan,Dangjin in South Korea,Subic Bay in the Philippines.

On 31 January 2012, the Ministry of Commerce of the People"s Republic of China officially banned dry bulk carriers with capacity exceeding 300,000 tons from entering Chinese ports in order to protect the domestic freight industry. Prior to this, only one of the new very large ore carrier chartered by Vale, Berge Everest, had unloaded Brazilian iron ore at a Chinese port – the ship arrived at Dalian on 28 December 2011 – but this was assumed to be a bureaucratic fluke as no Chinese port has regulatory approval to receive dry bulk carriers of that size.

According to Vale, the discussions about allowing the Valemax ships to enter Chinese ports had been ongoing since the ban came into forceNingbo Port Company, the construction of the new port facilities would take two to three years, causing further delays for Vale which in the meantime is losing $2–3 per ton of ore due to the ban.Vale Malaysia became the first 400,000-ton Valemax vessel to call a Chinese port. The partially loaded ship docked at the port of Lianyungang en route from the Vale transshipment hub in Subic Bay, Philippines. However, at the time the Chinese officials had not yet lifted the ban for fully laden Valemax vessels.Valemax vessel to call a Chinese port since 2012, Shandong Da Ren, docked at the Dongjiakou port in Qingdao on 2 October 2014.

Originally, Vale planned to own and manage a fleet of 19 Valemax vessels by itself in order to control the wildly fluctuating charter prices for large bulk carriers which had dropped from US$233,988 per day in June 2008 to as low as US$2,400 by December of the same year. However, because of the global economic downturn and the reluctance of Chinese ports to accept the fully laden ships, the new board of directors decided to focus capital allocation to mining. As a result, Vale decided to sell the ships and charter them back under long-term contracts.

In September 2014, Vale signed a framework agreement for strategic co-operation in iron ore shipping with the state-owned China Ocean Shipping (Group) Company (COSCO).Valemax vessels has been effectively lifted and fully laden ships have called Chinese ports.

In May 2015, four ships were sold China Ore Shipping Pte. Ltd, a joint venture between COSCO and China Shipping Development Company, for US$445 million.Valemax vessels to officially change ownership. Later, four more ships were sold to China Merchants Energy Shipping.Valemax ships owned by the mining company would be sold and leased back from the new owners.Valemax vessels were reportedly sold in December 2017.

The cause of the damage has not been published by STX, but design or construction flaws, material fatigue and incorrect loading have all been suspected.Vale Beijing remained anchored off Ponta da Madeira with a crawler crane on the deck and an oceangoing tug standing bySão Luís for Oman. After unloading at Sohar, the ship headed to South Korea for dry docking and arrived at STX shipyard in Jinhae, where it was delivered in September 2011, for inspection and repairs on 21 April 2012.Vale Beijing returned to service in July 2012.

Had Vale Beijing sunk at the pier instead of being moved to an anchorage area outside the port shortly after the leak was detected, the incident would have severely delayed the operations at the port which ships out about 10 percent of the world"s iron ore production.Vale Beijing delayed the loading of only 750,000 tons of iron ore,Trade Daring, a 145,000 DWT ore-bulk-oil carrier, broke in two at the same location due to incorrect loading, blocking the deepwater pier of Ponta da Madeira for more than six weeks before the wreck was removed and scuttled offshore.

After the incident, the China Shipowners" Association (CSA) questioned the safety of the 400,000-ton ore carriers commissioned by Vale. CSA was particularly concerned about the ability of the newly built ships to withstand various sea conditions and the pollution resulting from fuel oil leaks in case of structural damageValemax ship can carry around 10,000 tons of fuel oil.port of Lianyungang in the Jiangsu province.

All Valemax vessels, with the exception of those owned and operated by Berge Bulk, were initially given names consisting of the word Vale and a place name, either one related to the mining operations of Vale S.A. in Brazil or a potential destination for the new iron ore carriers. However, none of the original 35 Valemax vessels retains its original name.

When Vale signed a $500 million contract with the Chinese shipping company Shandong Shipping for the operation of four Valemax vessels, the ships were given new names beginning with Shandong.Valemax vessels were sold to China Ore Shipping, the vessels were given names beginning with Yuan and ending with Hai.Valemax vessels were given names starting with Pacific after Vale sold the ships to China Merchants Energy Shipping.

Additionally, a number of Valemax vessels have been renamed by replacing Vale with Ore or Sea but retaining the second part of the name. Vale Sohar, Vale Saham, Vale Liwa and Vale Shinas have also been renamed Sohar Max, Saham Max, Liwa Max and Shinas Max, respectively.

Vale Sohar, built by Jiangsu Rongsheng Heavy Industries (RSHI), awaiting delivery for Oman Shipping Company in Nantong, China, in September 2012. Note the minor differences to the South Korean-built Vale Rio de Janeiro.

Although similar in size, there are some differences in main dimensions, cargo capacity, machinery and external appearance between the Valemax ships built in South Korea, China and Japan. While the first series of 35 ships was more diverse, all 30 Chinese-built Valemax vessels of the second series are based on the same standard design, SDARI 400OC, by Shanghai Merchant Ship Design & Research Institute (SDARI).G400OC.

Like most modern bulk carriers, Valemax vessels are powered by a single two-stroke low-speed crosshead diesel engine directly coupled to a fixed-pitch propeller. The ships built by DSME and STX in South Korea are powered by 7-cylinder MAN B&W 7S80ME-C8 and 7S80ME-C engines, respectively, and the ships built by RSHI and Bohai Shipbuilding Heavy Industry have Wärtsilä 7RT-flex82T and 7RT-flex84T engines, respectively.maximum continuous rating of around 29,000 kW (39,000 hp) when turning the 10-metre (33 ft) propeller at 76–78 rpm, giving the ships a service speed of around 15 knots (28 km/h; 17 mph) while burning almost 100 tons of heavy fuel oil per day.cargo ton-mile are very low and thus the Valemax vessels are in fact among the most efficient long-distance dry bulk carriers in service – Vale has reported a 35% drop in emissions per ton of cargo carried in comparison to older ships.

The new ships are considerably larger than the previous record holder, 364,767-ton Berge Stahl, which had been the largest bulk carrier in the world since it was built in 1986. While the draft of the old vessel is the same as that of the Valemax vessels — 23 metres (75 ft) — the new ships are 20 metres (66 ft) longer and 1.5 metres (4.9 ft) wider than the old freighter, and can carry about 10% more cargo.

The Valemax vessels are also the second largest ships in service by deadweight tonnage, second only to the TI-class supertankers that have a deadweight tonnage of over 440,000 tons.Knock Nevis in the adjacent image), built in 1979 and broken up in 2009, was 458.46 metres (1,504.1 ft) long and had a deadweight tonnage of 564,650 tonscontainer ship

Vale"s decision to construct a fleet of 400,000-ton ore carriers was widely criticized by other shipping companies. The new Valemax ships, expected to cut the company"s transportation costs by 20–25%,financial crisis. The freight rates, down 80% from 2008, were expected to drop further down to the levels of 1977.BIMCO, the Valemax vessels could displace up to 168 150,000–180,000-ton capesize bulk carriers, around 15% of the existing fleet, from the long haul voyages and force them to less profitable shorter routes.

Vale also faced opposition from the China Shipowners" Association which claimed that the Brazilian mining company is seeking to control the freight market as it has already done with the iron ore prices. In the past, the Chinese ports were not allowed to increase their capacity to more than 300,000 tons for dry bulk carriers due to safety and environmental concerns. If the 400,000-ton Valemax vessels are allowed to Chinese ports, Vale"s monopoly on the route may result in losses for other shipping companies operating capesize ore carriers.Vale Brasil was diverted to Italy on her maiden voyage, there was speculation that the domestic steel industry of China had urged the authorities to protect their commercial interests.

As a precaution against prolonged ban of Valemax vessels from the Chinese ports, Vale started constructing both land- and offshore-based transshipment hubs where iron ore can be loaded to smaller ships for final delivery. Ore Fabrica, a 280,000 DWT crude oil tanker converted in China, arrived at Subic Bay, Philippines, in late January 2012.Ore Sossego, entered service in 2013.Zhang Shouguo, who called it "waste of resource" and questioned Vale"s ability to run the fleet as properly as professional shipping companies.Ore Fabrica and Ore Sossego were sold for scrap.

In May 2012, the largest Chinese operator of dry bulk carriers, state-owned China Ocean Shipping (Group) Company (COSCO), claimed that Vale had refused to use the company"s ships since March as a protest against banning the Valemax vessels from Chinese ports. Vale has refused to give comments on the issue.

Luiz Inácio Lula da Silva, the former president of Brazil, also publicly criticized Vale"s former CEO Roger Agnelli for the decision of ordering ships from Asian shipyards instead of building them in Brazil, where Lula da Silva has been trying to revitalize the shipbuilding industry to create more jobs and increase local demand for steel and other products. Agnelli, who later left his position following continued criticism, replied that the Brazilian shipyards did not have the capacity to build such ships and stated that during the past few years Vale had commissioned 51 vessels from Brazilian shipyards.

Sultanate and Brazil, Agreement to Lease four ships for Steel Ore. Oman Shipping Company News Press Releases, 2 November 2008. Retrieved 5 September 2011

By Adam Jourdan and Keith Wallis RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group <1101.HK>, the country"s biggest private shipbuilder. Like Rongsheng"s shipyards, the area is struggling to survive. The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year. The company has become a test of China"s market reforms. While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail. As ship orders and funding have dried up, the firm has delayed deliveries and now faces legal disputes, shipping and legal sources said. The company - whose market value has slumped more than 90 percent to around $1 billion since its Hong Kong listing in late 2010 - is in talks with bankers to restructure its debt. Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year. GHOST TOWN The local community, on the outskirts of the eastern Chinese city of Nantong, has mirrored Rongsheng"s fall. A purpose-built town near the shipyard"s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked. "In this area we"re only really selling to workers from the shipyard. If they"re not here who do we sell to?" said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. "I know people with salaries held back and they can"t pay for things. I can"t continue if things stay the same." In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed. "Without new orders it"s hard to see how operations can continue," said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn"t want to give his name as he feared he could lose his job. The uncertainty isn"t only at the yard. "Morale in the office is quite low, since we don"t know what is the plan," said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. "We have been getting orders but can"t seem to get construction loans from banks to build these projects." A company spokesman said the shipyard had no confirmed new orders in the second half of the year. RIVALS DOING BETTER While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuilding <600648.SS> has secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuilding has won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong. Some Rongsheng customers say the company is behind schedule in delivering ships. Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters. Greek shipowner DryShips Inc has also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data. Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was "a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered." DryShips has four dry cargo vessels on order at the Chinese firm. Rongsheng declined to comment on the Dryships order, citing client confidentiality. "For other orders on hand, our delivery plan is still ongoing," a spokesman said. At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. "I"m now dealing with several cases against Rongsheng," said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai. RISING DEBT Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdings <0845.HK> in a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts. The shipbuilder"s net debt to equity, a measure of indebtedness, climbed to 134 percent in January-June from 119 percent in 2012 and 85 percent in 2011. Talks with its banking syndicate are ongoing, with no indication when a deal could be struck, a person at one of the banks told Reuters this week. Meanwhile, Rongsheng"s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don"t pick up. Some said they hoped the local government might step in with financial support. The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years. "We have no further elaboration on government assistance and bank negotiations," a Rongsheng spokesman said on Friday. The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China"s economic growth began to slow and credit tightened at a time when global shipping, too, turned down. In a local lottery shop, workers sat around smoking as they waited to see if their luck was in. "The lottery has become increasingly popular," said a girl working the till. "I"m not sure why really, but perhaps people are hoping they can win something here." ($1 = 7.7529 Hong Kong dollars) (Editing by Emily Kaiser and Ian Geoghegan)

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

Established in 2014, Advantage Tankers LLC (Advantage) acts as a holding company for eighteen single-purpose vessel owing entities; its majority shareholder is Mrs Nazli Williams. Advantage is incorporated in the Republic of the Marshall Islands with executive offices in Geneva and London. Advantage is ideally positioned for future growth; it currently owns and operates a modern and dynamic fleet comprising eighteen crude carriers, five aframaxes, seven suezmaxes, two very large crude carriers (VLCC), four DF VLCC and five chemical and product tankers – see our fleet list for details.

Our vision is to become a world leader in the oil tanker shipping industry by focusing on sustainable growth, innovation, quality and flawless performance.

Our mission is to make a difference through our commitment to providing our customers with a world-class service meeting the strictest environmental and safety requirements,

safeguarding both the environment and human health. Respect, Professionalism, Continuous Improvement, Ambition, Perseverance; these are the core values that define our corporate culture,

8613371530291

8613371530291