rongsheng investment for sale

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

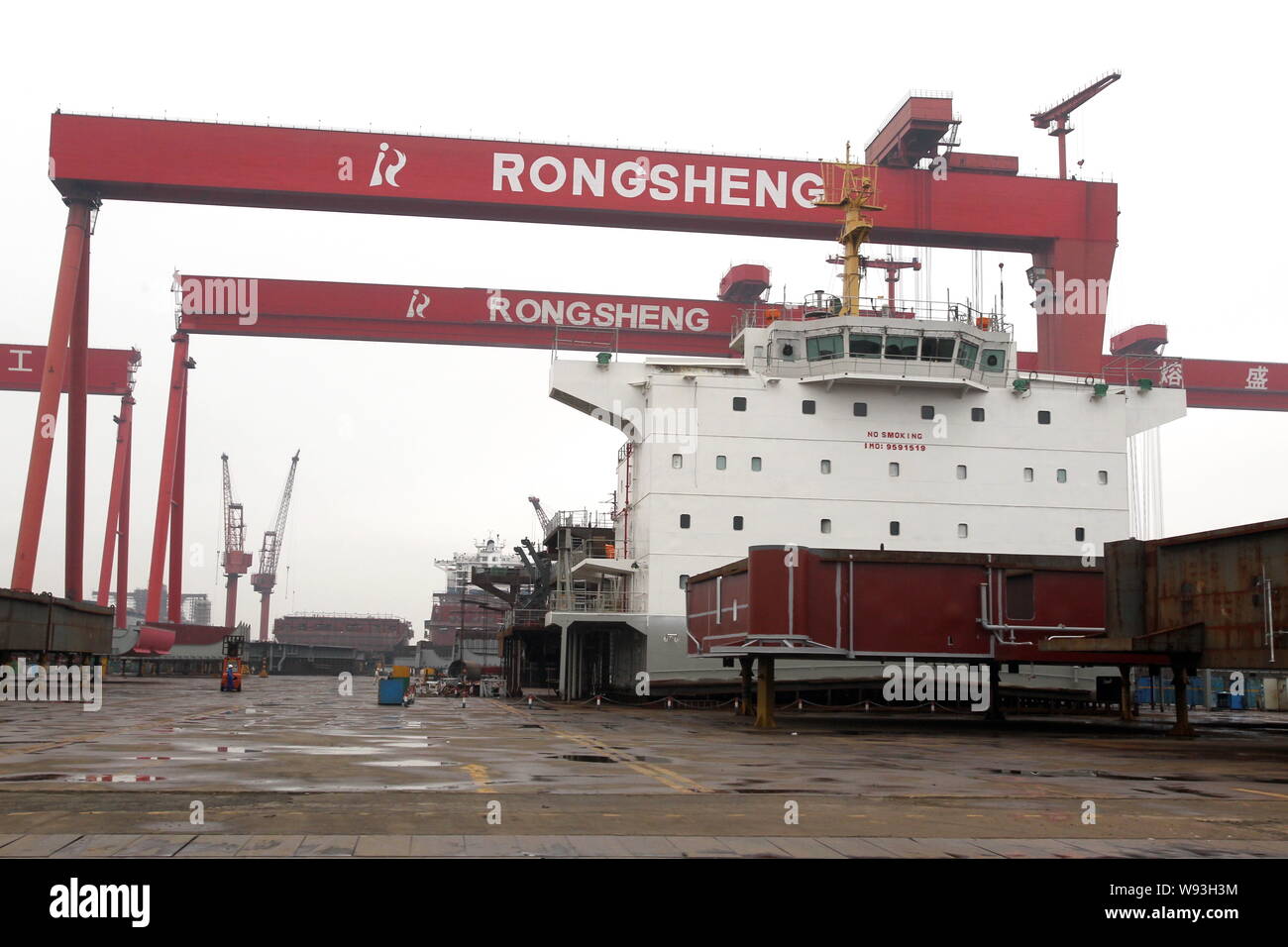

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., the shipbuilder whose woes made it a symbol of the country’s credit binge, said it planned to sell assets to an unidentified Chinese acquirer.

The company intends to sell the core assets and liabilities of its onshore shipbuilding and offshore engineering businesses, according to a statement to the Hong Kong exchange Monday. Rongsheng’s shares, which were halted March 11, will resume trading on March 17.

Once China’s largest shipbuilder outside government control, Shanghai-based Rongsheng has been searching for funds after orders for new ships dried up and the company fell behind on principal and interest payments on 8.57 billion yuan ($1.4 billion) of bank loans. Rongsheng’s struggles illustrate the difficulties shipbuilders face in competing with state-owned yards that have government backing and easier access to funds.

Rongsheng and the proposed buyer have entered into an exclusivity period while assets and liabilities are valued, according to the statement. The agreement will expire on June 30, the company said.

Rongsheng said March 5 it wouldn’t proceed with a proposed warrant sale after Kingwin Victory Investment Ltd. owner Wang Ping — a potential investor who had pledged as much as HK$3.2 billion ($412 million) — was said to have been detained.

Yangzijiang Shipbuilding Holdings Ltd. said previously it had been approached by China’s government about buying a stake in Rongsheng, and that no decision had been made. Yangzijiang Chief Financial Officer Liu Hua said today that the company isn’t involved in the agreement announced by Rongsheng, according to the company’s external representative.

Rongsheng has sought help from the government to benefit from a rebound in China’s shipbuilding industry — the world’s second biggest — after cutting its workforce and running up debts amid a global downturn in orders.

In September, the government responded by listing Rongsheng’s Jiangsu shipyard unit among 51 shipbuilding facilities in China deemed worthy of policy support as the industry grapples with overcapacity.

Some of Rongsheng’s subsidiaries, including Hefei Rong An Power Machinery Co. and Rongsheng Machinery Co., signed agreements with domestic lenders, led by Shanghai Pudong Development Bank, to extend debt repayments to the end of 2015, the company said in October.

Abu Dhabi National Oil Co. said Tuesday it signed an agreement with China"s Rongsheng Petrochemicals Co. to explore local and international opportunities as the UAE"s national oil producer looks to bolster its presence in Asia.

Both companies will look into opportunities for ADNOC"s sale of refined products to Rongsheng, downstream investments in both China and the UAE and ADNOC"s supply and delivery of LNG to the Chinese company, ADNOC said in a statement.

"This framework agreement builds on the existing crude oil supply relationship between ADNOC and Rongsheng, which we are keen to enhance," ADNOC CEO Sultan al Jaber said in the statement. "The agreement covers domestic and international growth opportunities across a range of sectors, which have the potential to open new markets for our growing portfolio of products and attract investment to support our downstream and gas expansion plans."

Under the agreement, ADNOC may boost the volume and variety of refined product sales to Rongsheng, and explore the possibility of ADNOC becoming an active participant in the Chinese company"s refinery and petrochemical project opportunities, including in Rongsheng"s downstream complex.

In return, Rongsheng will look into potential investments in ADNOC"s downstream projects in the industrial hub of Ruwais such as its gasoline aromatics plant. ADNOC will also potentially supply and deliver LNG to Rongsheng"s facilities in China.

"The strategic cooperation with ADNOC will ensure that our ZPC project, which will have a refining capacity of up to 1 million barrels per day of crude, has adequate supplies of feedstock," Li Shuirong, chairman of Rongsheng Group, said in the statement.

The Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities which will support the delivery of its 2030 smart growth strategy

The agreement will see both companies explore opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the UAE, and the supply and delivery of LNG to Rongsheng.

Under the terms of the agreement, ADNOC and Rongsheng will explore opportunities for increasing the volume and variety of refined products sales to Rongsheng as well as ADNOC’s active participation as Rongsheng’s strategic partner in refinery and petrochemical opportunities, including investment in Rongsheng’s downstream complex.

In return, Rongsheng will also explore potential investments in ADNOC’s downstream industrial ecosystem in Ruwais, including the proposed Gasoline Aromatics Plant, GAP, and the potential for ADNOC to supply and deliver LNG for utilisation by Rongsheng within its production complexes in China.

Sultan Al Jaber, minister of State and ADNOC Group CEO, said, “The agreement covers domestic and international growth opportunities across a range of sectors, which have the potential to open new markets for our growing portfolio of products and attract investment to support our downstream and gas expansion plans.”

The framework agreement supports ADNOC’s downstream expansion plans, which will see it create an integrated refining and petrochemicals complex in Ruwais while pursuing integrated margins for its own hydrocarbons with in-market investments.

Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities in support of ADNOC’s 2030 growth strategy.

The companies will examine opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates (UAE) and the supply of liquified natural gas (LNG) to Rongsheng.

Under the terms of the deal, the companies will also study chances to increasing the volume and variety of refined product sales to Rongsheng as well as ADNOC’s participation as the China firm’s strategic partner in refinery and petrochemical projects. This could include an investment in Rongsheng’s downstream complex.

In return, Rongsheng will also look at investing in ADNOC’s downstream industrial ecosystem in Ruwais, UAE, including a proposed gasoline-to-aromatics plant as well as reviewing the potential for ADNOC to supply LNG to Rongsheng for use within its own complexes in China.

Sultan Al Jaber, the UAE’s minister of state, who is also CEO of ADNOC, said the agreement has the potential to open new markets for its growing portfolio of products and attract investment to support our downstream and gas expansion plans.

Rongsheng’s chairman Li Shuirong added that the cooperation will ensure that its project, which will have a refining capacity of up to 1 million bbl/day of crude oil, has adequate supplies of feedstock.

Frontline Ltd. (“Frontline”) announces that on 14th August 2006 it has sold its entire holding of 3,860,000 shares in General Maritime Corporation (“General Maritime”) for USD $40 per share. The shares were sold to World Wide Shipping. Frontline will record a gain of approximately USD $ 9.7 million in the third quarter as a result of this sale. Frontline has, during the holding period, also recorded dividend income on the same investment of approximately USD $13.3 million.

At the same time Frontline is pleased to announce that it intends to firmly declare four further newbuilding Suezmaxes orders from Jiangsu Rongsheng Heavy Industries Group Co. Ltd. (“Rongsheng”) in China. The vessels which are 156,000 dead weight tons will be delivered in 2009. Two of these Suezmaxes will be offered as an investment to Frontline’s affiliated company, Ship Finance International Limited. The four Suezmax newbuildings are in addition to the two newbuildings already declared. Frontline is also in the process of discussing a further two fixed priced options for similar vessels. The payment terms and contract price are considered favourable to other alternative ways to renew and grow the Frontline Suezmax fleet.

The decision to sell the General Maritime investment and order the Suezmaxes included a comparison between the Rongsheng 2009 newbuildings and the implicit pricing of an existing General Maritime newbuilding. With a price differential of more than USD $20 million, the Frontline Board feels that significant discount is given for a later delivery.

The re-organisational cost of General Maritime and the large Aframax exposure further prevented Frontline from pursuing further action in the General Maritime investment. Frontline, as General Maritime’s largest shareholder, had a constructive dialogue with General Maritime regarding its investment.

The Board of Frontline hopes that the sale of the General Maritime investment to another industry player will still have a positive consolidation effect on the tanker market. The proceeds from the sale will be allocated to repayment of debt, equity financing of the Rongsheng investments as well as increased dividend capacity.

Image: The agreement was signed by His Excellency Dr. Sultan Al Jaber, UAE Minister of State and ADNOC Group CEO, and Li Shuirong, Chairman of Rongsheng Group. Photo: courtesy of Abu Dhabi National Oil Company.

The Abu Dhabi National Oil Company (ADNOC) has entered into a framework agreement with China-based Rongsheng Petrochemical to look out for domestic and international expansion opportunities.

The deal will see ADNOC and Rongsheng explore opportunities in the sales of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the UAE, and the supply and delivery of LNG to Rongsheng.

Under the terms of the agreement, both the companies will look out for opportunities to expand the volume and range of refined products sales to Rongsheng in addition to ADNOC’s participation as Rongsheng’s strategic partner in refinery and petrochemical opportunities, including funding in Rongsheng’s downstream complex.

On the other hand, the China-based company will also explore possible investments in ADNOC’s downstream industrial ecosystem in Ruwais, including the proposed Gasoline Aromatics Plant, GAP, and the possibility for ADNOC to supply and deliver LNG for utilisation by Rongsheng within its production factories in China.

UAE Minister of State and ADNOC Group CEO Al Jaber said: “The agreement covers domestic and international growth opportunities across a range of sectors, which have the potential to open new markets for our growing portfolio of products and attract investment to support our downstream and gas expansion plans.

The deal will help in ADNOC’s downstream development plans, which will see it create an integrated refining and petrochemicals complex in Ruwais while pursuing integrated margins for its own hydrocarbons with in-market investments.

Rongsheng Group chairman Li Shuirong said: “The strategic cooperation with ADNOC will ensure that our ZPC project, which will have a refining capacity of up to 1 million barrels per day (mbpd) of crude, has adequate supplies of feedstock.

“Our valued partnership will enable Rongsheng Petrochemical to continue its expansion into the international oil market and we are confident Rongsheng Petrochemical will achieve enhanced market share and recognition in the global marketplace.”

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investor’s point of view. We also respect individual opinions––they represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

8613371530291

8613371530291