rongsheng li factory

Connecting decision makers to a dynamic network of information, people and ideas, Bloomberg quickly and accurately delivers business and financial information, news and insight around the world

1. Lifebuoy self-igniting light (RSQD-2) use tilt switch.When the light is thrown into water with lifebuoy, it floats on the water,turning on tilt switch. The light can provide at least 2cd intensity and more than 2 hours of flashes, provide a strong guarantee for search and rescue at sea.

2. There were no signs of damage after ten cycles at -30 ° C and +65 ° C ambient temperature, such as shrinkage, cracking, swelling, decomposition or changes in mechanical properties. It can be used normally at an ambient temperature of -1 ° C to +65 ° C.

Li Shuirong (born 1956) is a Chinese billionaire and businessman, the chairman of the Zhejiang Rongsheng Holding Group[zh], which produces petrochemicals.

In 1989, Li Shuirong founded the Yinong Network Chemical Fiber Factory that produced polyester fiber cloth. After the polyester industry shifted upstream, he founded the Zhejiang Rongsheng Holding Group.

"It"s easy to steal things in Peking," reads the top headline in a recent issue of the local newspaper, the Peking Daily. The newspaper"s complaint is not so much about theft in general, although there is a fair amount of that. Rather it is about stealing from industrial and construction premises, and it takes to task not only the thieves themselves but also the lax accounting controls that either keep management blithely ignorant of losses or enable it to doctor accounts to cover up waste and thefts.

The Dec. 31 issue of the Peking Daily, for instnace, tells of Li Rongsheng, a worker at an electric tube factory who stole 1,132.5 grams of industrial gold and antimony worth a total of 23,415.5 yuan (about $15,610) from his workshop over a period of several months.

The factory had no idea the thefts were taking place until the police caught one of Li"s accomplices trying to sell the gold on busy Qianmen shopping street. In December 1979, Li had stolen the 500-gram lot of gold and antimony that had been registered on the company"s books as having arrived on the premises in September. The theft was not discovered even when the company closed its books at the end of the year, because they noted only incoming shipments. There was no record of how much gold and antimony was actually used, when it was used, or for what specific purpose.

In one case a worker at a forklift factory who lived on the premises took a walk to the toilet late at night. He came across a group of more than 10 thieves dragging away ingots of lead through a broker-down section of the factory wall. He rean to the gatekeeper to give the alarm, only to be told, "My duty is to guard the front gate. Go find the security section."

The most outrageous incident reported by the newspaper concerns a boiler factory from which thieves caught by the police confessed to having stolen 450 kilograms of heavy copper wire.

The police managed to confiscate 150 kilograms of the stolen wire, but when they went to the factory to ascertain how much the factory had lost, officials there obstinately refused to concede that they had lost any wire at all. "There is a lot of this kind of wire around, how can you prove that it was lost by our factory?" the officials asked.

The police were forced to get the thieves to reenact the crime, showing exactly how they had stolen the wire. STill the officials said, "Unless the thieves insist that the stolen wire was ours, we will not record it as having been lost by us."

BEIJING, April 29 (Reuters) - A private-led Chinese group is planning to build a $15 billion mega-petrochemical complex on an island near Shanghai, in what would be the country’s first and largest energy installation to be built by a non-state investor, industry sources said.

Zhejiang Petrochemical, 51 percent owned by textile giant Rongsheng Holding Group, last month awarded a key design contract for the project, which could compete head-to-head with state-owned firms such as Sinopec that dominate the market.

“The project was inspired by Premier Li Keqiang’s visit in 2014 that called for a pilot ‘mixed ownership’ project led by private companies,” said a senior industry source close to Rongsheng, referring to Li’s visit to the city of Zhoushan, where the project will be located.

Rongsheng has partnered with local firms, including a state-owned chemical producer, to build the complex, which would include a 400,000 barrels per day refinery and a 1.4 million tonnes a year ethylene plant.

The project, which needs Beijing’s approvals including environmental clearances, is likely to start up around 2020, according to two sources with knowledge of the plan.

“The entry of private firms into the refining business was a fruit of the sector reform, but the capacity surplus is a reality to face,” said Li Shousheng, chairman of China Petroleum and Chemical Industry Federation.

Rongsheng, founded in 1989 as a small textile firm, has grown into a conglomerate that is also involved in property and logistics with more than 50 billion yuan ($7.7 billion) worth of assets.

Rongsheng is among a group of independent petrochemical manufacturers long interested in expanding into the oil refining business that provides the industry’s feedstocks.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Ginsenoside Rh_2 is a rare active ingredient in precious Chinese medicinal materials such as Ginseng Radix et Rhizoma, Notoginseng Radix et Rhizoma, and Panacis Quinquefolii Radix. It has important pharmacological activities such as anti-cancer and improving human immunity. However, due to the extremely low content of ginsenoside Rh_2 in the source plants, the traditional way of obtaining it has limitations. This study intended to apply synthetic biological technology to develop a cell factory of Saccharomyces cerevisiae to produce Rh_2 by low-cost fermentation. First, we used the high protopanaxadiol(PPD)-yielding strain LPTA as the chassis strain, and inserted the Panax notoginseng enzyme gene Pn1-31, together with yeast UDP-glucose supply module genes[phosphoglucose mutase 1(PGM1), α-phosphoglucose mutase(PGM2), and uridine diphosphate glucose pyrophosphorylase(UGP1)], into the EGH1 locus of yeast chromosome. The engineered strain LPTA-RH2 produced 17.10 mg·g~(-1) ginsenoside Rh_2. This strain had low yield of Rh_2 while accumulated much precursor PPD, which severely restricted the application of this strain. In order to further improve the production of ginsenoside Rh_2, we strengthened the UDP glucose supply module and ginsenoside Rh_2 synthesis module by engineered strain LPTA-RH2-T. The shaking flask yield of ginsenoside Rh_2 was increased to 36.26 mg·g~(-1), which accounted for 3.63% of the dry weight of yeast cells. Compared with those of the original strain LPTA-RH2, the final production and the conversion efficiency of Rh_2 increased by 112.11% and 65.14%, respectively. This study provides an important basis for further obtaining the industrial-grade cell factory for the production of ginsenoside Rh_2.

UDP-glycosyltransferase (UGT)-mediated glycosylation is a widespread modification of plant natural products (PNPs), which exhibit a wide range of bioactivities, and are of great pharmaceutical, ecological and agricultural significance. However, functional annotation is available for less than 2% of the family 1 UGTs, which currently has 20,000 members that are known to glycosylate several classes of PNPs. This low percentage illustrates the difficulty of experimental study and accurate prediction of their function. Here, a synthetic biology platform for elucidating the UGT-mediated glycosylation process of PNPs was established, including glycosyltransferases dependent on UDP-glucose and UDP-xylose. This platform is based on reconstructing the specific PNPs biosynthetic pathways in dedicated microbial yeast chassis by the simple method of plug-and-play. Five UGT enzymes were identified as responsible for the biosynthesis of the main glycosylation products of triterpenes in Panax notoginseng, including a novel UDP-xylose dependent glycosyltransferase enzyme for notoginsenoside R1 biosynthesis. Additionally, we constructed a yeast cell factory that yields >1 g/L of ginsenoside compound K. This platform for functional gene identification and strain engineering can serve as the basis for creating alternative sources of important natural products and thereby protecting natural plant resources.

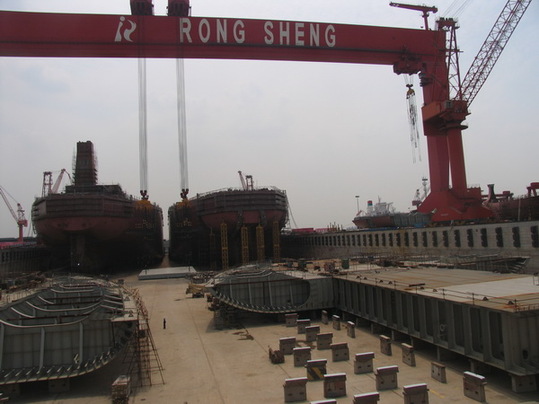

Trading of shares and all structured products related to the company was suspended pending clarification of “news articles and possible inside information,” Rongsheng said in filings to the Hong Kong stock exchange. The Wall Street Journal reported yesterday, citing Lei Dong, secretary to the Shanghai- based company’s president, that more than half of the employees laid off were subcontractors and the rest full-time workers.

Rongsheng shares slumped 10 percent yesterday after the company said some idled contract workers had engaged in “disruptive” activities by surrounding the entrance of its factory in east China’s Jiangsu province. China’s shipyards are suffering from a global slump in orders as a glut of vessels and slowing economic growth sap demand. Brazil and Greece accounted for more than half of Rongsheng’s 2012 revenue.

“Rongsheng’s move reflects the bad market,” said Lawrence Li, an analyst at UOB-Kay Hian Holdings Ltd. in Shanghai. “More small-to-medium sized shipyards, especially those that lack government support, may take the same actions or even close down.”

Rongsheng spokesman William Li declined to comment on the Journal report. Four calls to Lei’s office at Rongsheng went unanswered. Rongsheng Chairman Chen Qiang also declined to comment today.

Rongsheng had as many as 38,000 workers including its own employees and contract staff at the peak of the industry boom a few years ago, UOB-Kay Hian’s Li said.

The order book at China’s shipbuilders fell 23 percent at the end of May from a year earlier, according to data from the China Association of the National Shipbuilding Industry. Yards have reduced down-payment requirements, with some slashing their rates to as little as 2.5 percent of contract value compared with 20 percent before 2010, according to UOB-Kay Hian.

China Rongsheng posted a loss of 572.6 million yuan ($93 million) last year, after three consecutive years of profits, according to data compiled by Bloomberg. It had short-term debt of 19.3 billion yuan as of the end of 2012, the data show.

The shipbuilder targets new ship and offshore orders worth more than $2.3 billion this year, Chen said in Hong Kong in March. The shipbuilder pared about 3,000 employees last year as it aims to return to profit this year, he said at the time.

Rongsheng received orders to build a total of 16 Valemax vessels from Brazilian miner Vale SA and Oman Shipping Co. and had delivered 10 as of April. The commodity ships, among the biggest afloat, are about twice the size of the capesize vessels that have traditionally hauled iron ore from Brazil to China.

The company’s cash conversion cycle, a gauge of days required to convert resources into cash, more than doubled to 582 last year from 224 in 2011, the data show. China Rongsheng shares have fallen 15 percent this year in Hong Kong, compared with a 11 percent decline for the benchmark Hang Seng Index.

Ten of the 14 analysts tracked by Bloomberg recommend selling the stock with the rest rating it hold. The company raised HK$14 billion in its initial public offer in 2010.

Ship prices have plunged because of the overcapacity and industrywide losses, hurting margins at shipbuilders. Prices for a vessel that can carry as many as 13,500 boxes fell to $106 million in April, which was then the

Oxford Academic is home to a wide variety of products. The institutional subscription may not cover the content that you are trying to access. If you believe you should have access to that content, please contact your librarian.

For librarians and administrators, your personal account also provides access to institutional account management. Here you will find options to view and activate subscriptions, manage institutional settings and access options, access usage statistics, and more.

The team of ZHANG Xueli at CAS Tianjin Institute of Industrial Biotechnology has applied metabolic engineering to introduce rose essential oil pathways into baker"s yeast, Saccharomyces cerevisiae. To this end, they integrated a geraniol-rose alcohol synthesis module and nerol synthesis module into the same chassis strain and through optimization obtained a "rose yeast" with essential oil yields of up to 5 g/L in a 5 L fermenter. The group also studies the microbial synthesis of other plant volatile terpenes such as sandalwood oil.

8613371530291

8613371530291