rongsheng petrochemical annual report brands

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright © FactSet Research Systems Inc. All rights reserved. Source: FactSet

Rongsheng Petrochemical (brand value up 43% to US$2.3 billion) achieved very strong growth this year, rising two places in the chemicals ranking and jumpingfrom 10th to 8th place amongst global chemicals brands. The Chinese brand owns various globally significant facilities, including an integrated refining-petrochemical complex with the refining capacity of 40 million tons per annum.

Rongsheng Petro Chemical Co, Ltd. specialises in the production and marketing of petrochemical and chemical fibres. Products include PTA yarns, fully drawn polyester yarns (FDY), pre-oriented polyester yarns (POY), polyester textured drawn yarns (DTY), polyester filaments and polyethylene terephthalate (PET) slivers.

A coalescing of factors has led to arrested growth across the chemicals sector this year, with the brand value of the top 25 most valuable chemicals brands contracting by 8% on average, according to the latest report by Brand Finance - the world"s leading independent brand valuation consultancy.

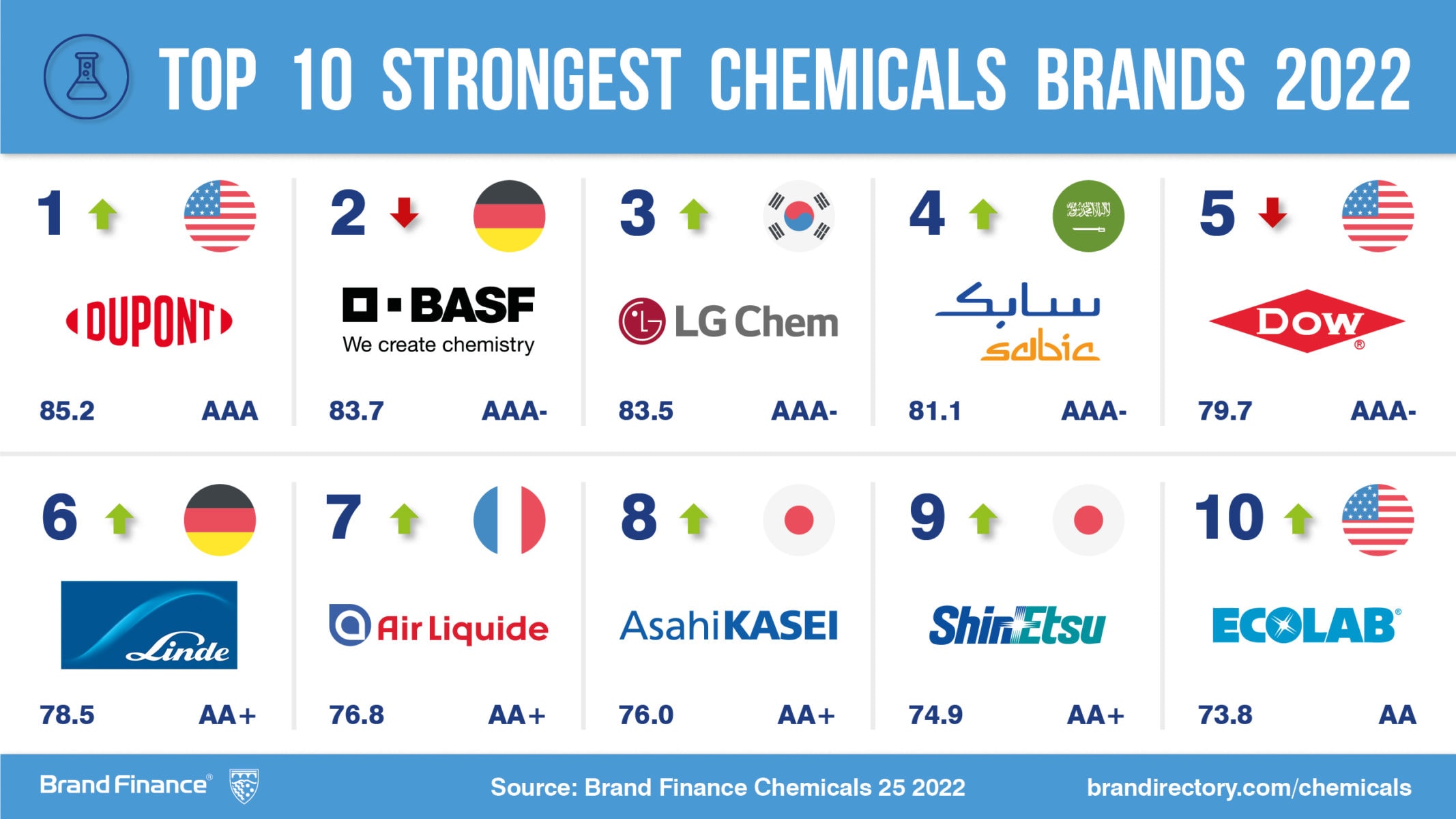

SABIC (down 7% to US$4.0 billion) is committed to its vision of becoming the world’s largest petrochemical company by 2030, undertaking several strategic partnerships over the last year and aligning with the chemical arm of oil and gas leader Saudi Aramco. The brand has strategically aligned with the UN’s Sustainable Development Goals (SDG) and developed more open and creative collaborations with other companies, NGOs, academia, and governments to better meet the expectations of customers and stakeholders.

Zhejiang-based Rongsheng Petrochemical (up 14% to US$1.6 billion) is the sector’s fastest growing brand after seeing profits more than triple in the past year, bolstered by the launch of its 400,000 barrel-per-day Zhejiang Petrochemical Co (ZPC).

BASF (brand value up 15% to US$8.3 billion) is leading the chemicals industry as chemicals brands across the world return to growth after the widespread disruption of the COVID-19 pandemic, according to a new report from brand valuation consultancy, Brand Finance.

Every year, leading brand valuation consultancy Brand Finance puts 5,000 of the biggest brands to the test, and publishes around 100 reports, ranking brands across all sectors and countries. The world’s top 25 most valuable and strongest brands in the chemicals industry are included in the annual Brand Finance Chemicals 25 2022 ranking.

Rongsheng Petrochemical (brand value up 43% to US$2.3 billion) achieved very strong growth this year, rising two places in the chemicals ranking and jumping from 10th to eighth place amongst global chemicals brands. The Chinese brand owns various globally significant facilities, including an integrated refining-petrochemical complex with the capacity to produce 40 million tons of plastics per annum.

As the world’s largest producer of various plastics, Rongsheng Petrochemical faces both risks and opportunities from increasing global concerns about the usage of plastics and carbon emissions. The brand value of this giant Chinese brand is growing in connection with increased research and development of clean technologies, while its world-leading refining-petrochemical complex recovers and purifies carbon dioxide from the plants for use as feedstock to produce downstream chemical products (polycarbonates).

Oil prices tell some of the story. Early last year, as the economy froze up and people stayed home, crude prices crashed, dragging chemical prices down with them. Petrochemical volumes, however, were relatively strong because some products, such as polyethylene, saw an uptick in demand.

For instance, more than a dozen members of the Global Top 50 have major plastics recycling initiatives. A similar number of companies are looking to make ammonia and hydrogen via water electrolysis rather than from natural gas. Still others are overhauling basic petrochemical processes to make them more energy efficient. Dow, Shell, Sabic, and BASF, for example, are developing ethylene crackers that run on renewable electricity.

Despite the year’s volatility, the survey was marked by few changes. Companies heavily laden with petrochemical operations generally saw declines in sales and fell in the ranking. Companies that make industrial gases or agricultural chemicals tended to rise.

Three companies in the Global Top 50 a year ago didn’t make it this year. Ecolab fell off the list because it divested an oil-field chemical business. SK Innovation and PTT Global Chemical were both victims of declines in petrochemical sales.

Now that it is breaking out chemical sales again, Shell rejoins the Global Top 50 this year after a 5-year hiatus. Rongsheng Petrochemical, which makes polyester chemicals, debuts this year. The former DowDuPont agricultural chemical business, Corteva Agriscience, made the cut as well.

Tightening its belt in the face of the COVID pandemic, Dow launched a cost-cutting program last July. The firm said it was reducing its workforce by 6%—about 2,200 jobs—in an effort to save more than $300 million annually by the end of 2021. The program is also hitting manufacturing: the company is shutting down amine and solvent plants in the US and Europe and closing small polyurethane plants and coatings reactors. Dow also divested terminal and rail assets in 2020. Amid the cuts, the company is making investments. For example, Dow plans to build a $250 million specialty chemical plant in Zhanjiang, China. Initially, the plan will focus on new specialty polyurethane and alkoxylate facilities. Dow says it may launch additional projects at the site in the future.

Saudi Arabia’s state oil company, Saudi Aramco, completed its purchase of a 70% stake in the petrochemical maker Sabic in June 2020. The purchase was meant to diversify Aramco, which today depends heavily on oil and gas. But soon after the deal closed, the firms announced they were reevaluating the scope of a planned complex that was to convert 400,000 barrels per day of crude oil into 9 million metric tons (t) per year of petrochemicals. Their new, more modest plan is to build an ethylene cracker and derivatives units that will be integrated with existing Aramco refineries. In another instance of Sabic and Aramco working together, the companies shipped 40 t of ammonia to a power plant in Japan last September. The ammonia is considered “blue” because carbon dioxide emitted during its manufacture was captured and used for enhanced oil recovery and methanol production in Saudi Arabia. In another strategic move, Sabic carved out a stand-alone business that includes its polyphenylene oxide, polyetherimide, and compounding units. The company got the businesses with its purchase of GE Plastics in 2007. Sabic had sought to combine them with Clariant’s masterbatch business, but those talks broke down in 2019.

The $9.4 billion petrochemical complex that Formosa Plastics is planning in St. James Parish, Louisiana, is in hot water. It faces fierce opposition both locally from community organizations worried about pollution and nationally from environmental groups that wish to stop the mounting production of plastics. Sharon Lavigne, head of the local group Rise St. James, recently received the prestigious Goldman Environmental Prize for her efforts, a sign that the Formosa project has high-profile opposition. The project also faces practical hurdles. Notably, the US Army Corps of Engineers suspended a permit for the facility in November. Formosa Plastics had better luck in Point Comfort, Texas, where it started up an ethylene cracker and low-density polyethylene unit last year.

Most large chemical companies nowadays are plunging into plastics recycling to counter public backlash, and LyondellBasell Industries is at the front of the pack. CEO Bob Patel is one of the founders of the Alliance to End Plastic Waste, formed by industry to address the recycling problem. And Lyondell has its own initiatives. It and the waste management firm Suez bought the plastics recycler Tivaco and are combining it with Quality Circular Polymers, a recycling venture Lyondell and Suez started in 2018. Quality Circular has some high-profile clients. For example, Samsonite is using its resin for a line of sustainable suitcases. Meanwhile, Lyondell continues to grow its core petrochemical business, often on the cheap. In December, the firm bought, for the bargain price of $2 billion, a 50% interest in a new ethylene cracker and two polyethylene plants that the struggling Sasol had built. Similarly, it bought into an ethylene cracker joint venture already under construction in China.

PetroChina will bring a pair of unique petrochemical projects—which cost a total of $2.5 billion—on line later this year. The company is building ethylene crackers in Tarim and Changqing, China, that will use ethane sourced from domestic natural gas fields as their feedstock. These projects wouldn’t be unusual in the US or the Middle East, where oil and natural gas are cheap and plentiful, but ethylene crackers in resource-constrained China are mostly fed with naphtha derived from imported oil. The country also sources petrochemical feedstocks from coal. Both routes to ethylene are relatively expensive and put China at a competitive disadvantage.

Hengli Petrochemical’s growth has been amazing. Last year, the company came out of nowhere to debut at 26 in the Global Top 50. In 2020, and despite the COVID-19 pandemic, the Chinese petrochemical maker’s chemical sales grew by a whopping 46%. Construction at an almost unbelievable pace is responsible for this growth. In 2020 alone, Hengli started two large production lines for purified terephthalic acid (PTA), a polyester raw material, in Dalian, China. The lines, which use technology from Invista, bring Hengli’s PTA capacity to 12 million metric tons (t) per year. In November, Hengli signed a licensing agreement, also with Invista, for two more PTA lines at its site in Huizhou, China. In addition, the company plans to build a plant in Dalian to make a biodegradable plastic from PTA, adipic acid, and 1,4-butanediol. Hengli says the plant will have 450,000 t of annual capacity, a large figure for a biodegradable plastic.

Many people would think of Dow and BASF as the technology giants in industrial chemistry. But Braskem, a Brazilian petrochemical maker, is a technological heavy hitter too. It is partnering with the University of Illinois Chicago on a route to ethylene based on the electrochemical reduction of carbon dioxide from flue gas. At its chlor-alkali complex in Maceió, Brazil, Braskem will host a pilot plant to make ethylene dichloride using a novel process developed by the start-up Chemetry. In this energy-saving process, called eShuttle, chloride ions react with cuprous chloride (CuCl) to form cupric chloride (CuCl2), which reacts with ethylene to form the polyvinyl chloride raw material. In Pittsburgh, Braskem recently completed a $10 million expansion of its technology and innovation center to allow work on recycling, 3D printing, and catalysis.

One again, Syngenta is involved in merger and acquisition activity. ChemChina, which already owned the Israeli generic crop protection chemical maker Adama, bought Syngenta in 2017 for $43 billion. Now ChemChina is merging with another Chinese firm, Sinochem, to form a conglomerate with about $160 billion in annual revenue. Chinese authorities approved the deal earlier this year. But the impact on Syngenta will likely be minimal. ChemChina and Sinochem had already combined their agricultural operations into an organization called Syngenta Group.

Solvay has been trimming its portfolio to focus on specialty chemicals. In a major recent move along these lines, the company is carving out its soda ash unit into a separate business, a possible precursor to divesting the operation, which generates about $1.75 billion in annual sales. The business is Solvay’s oldest, dating back to 1863, when Ernest Solvay developed a process to make soda ash out of brine and limestone. Now the mineral is also extracted from trona, which Solvay mines in Green River, Wyoming. In addition, the company completed the sale of a basket of businesses to the private equity firm Latour Capital in March. Those businesses include a barium and strontium carbonate unit, a sodium percarbonate business, and a barium chemical joint venture with Chemical Products. In 2020, Solvay sold its nylon 6,6 business to BASF.

The Chinese polyurethane raw materials supplier bucked the general trend of sales decline in 2020 with a nearly 8% increase in chemical sales and a 10% rise in profits. After a weak first half of the year, demand bounced back in the second half, the company says. The COVID-19 “pandemic in China was rapidly and effectively controlled,” Wanhua Chemical says in its annual report. “Domestic market demands and the downstream export overseas were resumed rapidly, and growth of prices of chemical products was recovered.” Wanhua sought to build a beachhead in the US with a $1.25 billion project to build a methylene diphenyl diisocyanate plant in Louisiana. But US-China trade friction and a jump in construction costs appear to have prompted the firm to shelve the initiative.

Longtime Chevron Phillips Chemical CEO Mark Lashier retired as president and CEO in April. Bruce Chinn, formerly the head of Chevron Chemicals, replaced him as CEO. B. J. Hebert, who joined Chevron Phillips in 2020 after 3 years as president of Occidental Chemical, is taking on the roles of president and chief operating officer. In October, Chevron Phillips launched Marlex Anew Circular polyethylene, which incorporates recycled content. That content includes a synthetic crude oil from Atlanta-based Nexus Fuels, which uses pyrolysis to break down postconsumer plastic. Chevron Phillips aims to produce 450,000 metric tons of the polymer annually by the end of the decade. Separately, the company has broken ground on a 1-hexene plant in Old Ocean, Texas, that is scheduled to open in 2023. The product is a comonomer for linear low-density polyethylene.

Recent years have seen Chinese petrochemical producers, often involved in the polyester supply chain, join the Global Top 50. Hengli Petrochemical is one of those firms. And now Rongsheng Petrochemical is another. The company is one of the largest producers of purified terephthalic acid in the world, with 13 million metric tons of capacity at plants in Dalian, Ningbo, and Hainan, China. It also makes polyester resin and fiber. It is an investor in Zhejiang Petrochemical, a large oil refinery and petrochemical complex that is currently starting up.

Sustainability continues to be a focus for the Austrian petrochemical maker. In June, the company signed an agreement to buy oil from Renasci Oostende Recycling, which uses a thermal process to break down postconsumer plastic. Borealis will turn this feedstock into plastics again at its complex in Porvoo, Finland. Borealis also started up a demonstration unit at its polyethylene plant in Antwerp, Belgium, to test a heat-recovery technology developed by the start-up Qpinch. The technology is modeled on the adenosine triphosphate–adenosine diphosphate cycle in biology. Separately, Borealis put its fertilizer business up for sale in February.

The Houston-based chemical maker has the second-largest polyvinyl chloride (PVC) business in the world, behind Japan’s Shin-Etsu Chemical. Westlake is now integrating this business further downstream—a common move for PVC makers—with the purchase of the North American building product business of Australia’s Boral for $2.15 billion. The business makes about $1 billion per year worth of roofing, siding, trim, shutters, windows, and decorative stone per year. Westlake already has about $1.4 billion in annual sales of building products such as PVC pipe. Much of that business came with the company’s 2016 purchase of PVC rival Axiall.

Sasol ended a saga in November when it started up a low-density polyethylene plant in Lake Charles, Louisiana. The unit was the last of the plants the South African company built as part of a $12.8 billion petrochemical complex. The project went $4 billion over budget, leading to the ouster of its co-CEOs. To strengthen its balance sheet, Sasol aims to divest $6 billion in assets. To that end, the company formed a joint venture with LyondellBasell Industries to run the ethylene cracker and two polyethylene plants it built in Lake Charles, essentially selling half these operations for $2 billion. Sasol is keeping alcohols, ethylene oxide and ethylene glycol, and ethoxylation plants at the site. Separately, Sasol sold its 50% interest in the Gemini HDPE high-density polyethylene joint venture with Ineos for $400 million.

Nutrien got a new CEO in May when Mayo Schmidt replaced Chuck Magro. Schmidt had been chair of the Canadian fertilizer maker’s board since 2019 and before that was CEO of the Canadian agribusiness Viterra. Magro had led Nutrien and its predecessor Agrium since 2014. Because of tight supplies of potash, Nutrien pledged in June to raise production at its six potash mines. Like a few other big fertilizer makers, Nutrien is developing low-carbon ammonia as a fuel. It is one of 15 partners, led by the nonprofit RTI International, working with the US Department of Energy to develop a demonstration facility for low- and zero-carbon ammonia. Nutrien already produces about 1 million metric tons of low-carbon ammonia annually in the US and Canada.

Financial Associated Press, December 29 - Rongsheng Petrochemical announced that Zhejiang Petrochemical Co., Ltd. had an annual output of 300000 tons of EVA plant put into operation.

8613371530291

8613371530291