rongsheng petrochemical annual report 2018 pricelist

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright © FactSet Research Systems Inc. All rights reserved. Source: FactSet

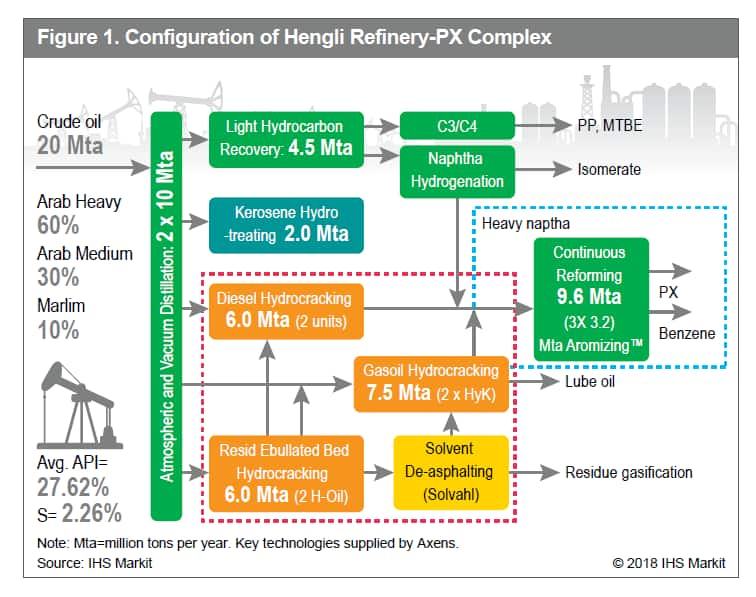

The newly-built highly-integrated mega Chinese refinery-cum-petrochemical complexes are immensely more efficient than the 50-60 year-old clunkers that they are replacing across the globe spanning from the U.S. west coast to the Philippines, bringing a new paradigm to the oil market, they said.

Even though Chinese refineries are built primarily to cater to the domestic market, the export market is a safety valve whenever there is an imbalance in fuel or petrochemical demand, which easily amounts to 1 million b/d in an average month. Such volumes weigh heavily on inefficient, standalone sites that are increasingly exposed and consequently shuttered.

The new sites coming onstream in China typically have processing capacities of 300,000 b/d or more and are integrated with petrochemical units that allow them to swing from a so-called petrochemical to an oil-product mode as the economics dictate.

One of the export quota recipient, Zhejiang Petrochemical Corp. (ZPC) was given 1 million mt. The company, which is majority owned by Rongsheng Petrochemical Co., is in the final stages of getting the second phase of its 800,000 b/d refinery up and running.

In the petrochemical sector, demand for polyester, derived from purified terephthalic acid (PTA), paraxylene and mixed xylene (MX), could improve as a life returns to normal, a petrochemical producer said.

A bumper 10 million-barrel spot crude oil purchase by Rongsheng Petrochemical suggests it is keen to get the second phase of its massive 40 million mt/yr, or 800,000 b/d, refinery and chemical project at subsidiary Zhejiang Petrochemical Co. Ltd (ZPC) running in the coming months, trading sources said.

Rongsheng announced in August plans to begin trial runs at the second 400,000 b/d tranche of the project in the fourth quarter of 2020 and looks set to achieve this aim despite COVID-19-related construction delays due to social distancing restrictions earlier in the year.

Market participants said Rongsheng was absent from the spot market for a couple of months and returned this week to buy the medium-sour Middle East cargoes, which led some to believe it was restocking but added that the scale of the purchase does point to some use in the new facility.

The petrochemical units include a 1.4 million mt/year ethylene and a 4 million mt/year paraxylene plants as well as related downstream polymer and polyester units. It also has a 600,000 mt/year propane dehydrogenation (PDH) unit.

Phase II is centered around a similar 400,000 b/d CDU as the first phase, placing ZPC in conjunction with Hengli Petrochemical as operators of the largest independent refining-cum-petrochemical complexes in China. Once completed there will be two such 800,000 b/d sites in the country.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Any improvement in kerosene demand this winter would be a welcome change for sellers compared with last year when milder temperatures weighed on the country’s buying appetite for the heating fuel.Japanese kerosene imports in December 2019 to February 2020 dropped to an average of 3.66 million bbls per month, down by 6.4% from 3.91 million bbls over the same period in 2018-19, data from the Petroleum Association of Japan (PAJ) showed.

With the largest oil product market in Africa, Egyptian total inland product demand has grown at an annual average rate of 2.4% since 2012, reaching an estimated 916,000 b/d in 2019, reports IHS Markit, the parent company of OPIS." Before the COVID-19 crisis, the net gasoil import balance in Egypt was around 150,000 b/d on average; our base case scenario estimates the gasoil deficit to decrease to at least 100,000 b/d in 2020," Boularas said.

On Wednesday, Hanwha Total Petrochemical (HTC) bought HFRN for H1 Nov. to Daesan at a discount of $5/mt or larger to Japan prices, said sources. An HTC company source declined to comment.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

The U.K.-based Grangemouth petrochemicals plant operated by Ineos will shut down at the beginning of October, according to sources with links to the plant Tuesday.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility. Tell Me More

However, the unrelenting spread of COVID-19 cases has cast a cloud over the upcoming festivities and some are questioning if expectations of exuberance and the accompanying surge in fuel consumption may be over stated especially as attendances at newly re-opened schools were poor, according to a Press Trust of India report.

India now has the second-largest COVID-19 case load at 5.56 million and daily new infections appear to be slowing down with 75,000 reported in the past 24 hours to Tuesday morning, government and John Hopkins data show. Almost 90,000 people have died from the pandemic.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

Abu Dhabi National Oil Co. (Adnoc), the biggest oil producer in the UAE, informed term customers of a 25% cut to November loadings on Wednesday after surprising the market early this month with a 30% reduction to all four of its export grades. The UAE pumped 3.11 million b/d in August or 520,000 b/d above its compliance target, the International Energy Agency (IEA) said in its monthly oil report published on Tuesday.

In its statement on Thursday following a Joint Ministerial Monitoring Committee (JMMC) meeting under the leadership of the Saudi and Russia oil ministers, the group said that the monthly report prepared by its Joint Technical Committee (JTC) showed overall compliance by participating OPEC and non-OPEC countries at 102% in August 2020, including Mexico as per the secondary sources.

However, it said the group was looking closely at market developments particularly as new cases of COVID-19 spread in many countries affecting fuel demand. In its monthly report, OPEC downgraded global oil demand further by 400,000 b/d, now contracting by 9.5 million b/d to 90.2 million b/d.

The need for better compliance and compensation was driven hard by the Saudi oil minister who warned nations against over producing and then making up for their indiscretions in a news briefing after the meeting, according to several media reports.

"Anyone who thinks they will get a word from me on what we will do next, is absolutely living in a La La Land...I"m going to make sure whoever gambles on this market will be ouching like hell," Prince Abdulaziz bin Salman was quoted as saying in a Reuters report when asked about OPEC+ next steps.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

Aramco set in end-Aug. its September Contract Price (CP) for propane at $360/mt, unchanged from August and butane at $355/mt, up $10/mt on-month, as term discussions for next year got started. No cancellations of term cargoes were reported for September.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

According to shipping reports obtained by OPIS, 24 VLCCs have been booked on mostly three-six month TCs with one trading company having got the jump on others and managing to snap up at least four supertankers at below $30,000 per day with the cheapest at $25,000/day. The best deal on the list was for a 3+3-month booking delivered Singapore at $20,500/day, the list showed.

This compares with similar six-month TCs done in late April at as much as $130,000/day with many agreed at above the $80,000/day mark, according to past fixture reports.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

Naphtha usage as petrochemical feedstock was crimped by poor aromatics margins as downstream polyester and other derivative demand started to slow down in the face of the prolonged economic downturn wreaked by COVID-19. However, consumption in China for use in olefin production remains robust, a source said.

“We expect port congestion will be alleviated in September with less fresh arrivals coming in, and that China’s crude imports will begin to see a material step-down in October and beyond once the congested cargoes get fully cleared,” according to the report.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with the OPIS Asia Naphtha & LPG Report.

YNCC settled at a premium of around $7/mt to Japan naphtha price, two sources said. LG Chem concluded at plus $6-$7/mt while Korea Petrochemical Industry Co. settled at around plus $3/mt, according to several sources. Formosa Petrochemical Corp. (FPCC) bought cargoes for Oct. 2020-Sept. 2021 at plus $4-$5/mt.

Asia naphtha demand as a petrochemical feedstock will continue to grow as new crackers begin operations even as below-capacity refinery utilization rates in some countries squeeze supply further, they said.

Buyers currently in 2021 CFR term discussions include Hanwha Total Petrochemical for splitter grade, or heavy full range naphtha (HFRN), and Lotte Chemical Titan for light naphtha, sources said

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

In India, where authorities have re-imposed lockdown measures, Reliance Industries Ltd (RIL) and Indian Oil Corp (IOC) will shut crude distillation units (CDUs) for maintenance works, as reported earlier.

Sinopec restarted its 460,000 b/d Zhenhai Refining & Chemical Co. site after about a four-month maintenance and its 250,000 b/d Tianjin facility after a two-month turnaround, as reported previously.

The market is feeling the weight of slower regional demand since early July when resurgence of COVID-19 cases were reported in pockets of the region. The front-month time-spread in the first half of July averaged at $0.51/bbl in backwardation, but shrank significantly to $0.07/bbl in the second half, according to OPIS data.

U.S. refined product output capacity that has been chasing significantly weaker demand since April due to the economic fallout of coronavirus disease 2019 (COVID-19) is about to lose another refinery to temporary shutdown, market sources report.

Another market participant, citing a published report, attributed the idling to low product demand and suggested that restart of the plant would depend on an increase in that demand.

Other U.S. refineries shelved during the pandemic are Marathon Petroleum"s 166,000-b/d plant in Martinez, Calif., and its 28,000-b/d refinery in Gallup, N.M. (both in April). As reported by OPIS on June 16, restart of at least the Martinez refinery is not likely in 2020, according to some large unbranded wholesale customers who were privately informed by company sales executives.

Another U.S. refinery -- HollyFrontier"s 52,000-b/d refinery in Cheyenne, Wyo. -- is also soon to exit the petroleum-processing business. As previously reported, the refinery is expected to halt refining operations by Aug. 1 in order to begin the process of converting the facility to renewable diesel production by the first quarter of 2022.

Weekly growth in gasoline demand, as measured by the OPIS Demand Report survey of sales at more than 15,000 service stations across the country, has stalled at about 1%, and year-on-year deficits have held to a range of 15% to 19% since mid-June.

U.S. diesel demand has been inconsistent. The Energy Information Administration reported demand for the week ended July 17 as 24% lower compared to the same week last year and off by 9.8% on a four-week average basis. Consumption of jet fuel is still faltering compared to a year ago, only recently narrowing its year-on-year deficit to less than 50% on a four-week average basis.

Many of those concerns have faded inversely with rising coronavirus disease 2019 (COVID-19) numbers, but an assessment issued this month by the Environmental Protection Agency suggests there is still cause for concern. EPA released its tabulation for sulfur compliance in 2019, and the data showed that the average sulfur level in gasoline last year was still a relatively hefty 17.5 parts per million. That is down just 3 ppm from the 2018 assessment, and some 75% above the actual requirement of 10 ppm for 2020.

In 2018, for example, RBOB futures values lost 75cts/gal between final September settlements and late November. Other years have commonly seen drops of 20-40cts/gal tied to the easier task of manufacturing high-RVP winter gasoline.

But the biggest question mark is likely to be gasoline demand. Coming in to 2020, most predictions called for annual demand of about 9.3 million b/d, which would essentially match consumption trends witnessed in 2017, 2018 and 2019.

Most recent EIA reports suggest annual gasoline demand of less than 7.9 million b/d, or a drop of 15% from last year. OPIS demand assessments suggest that the drops have been understated, and are more severe, and a consensus view has formed which holds that "normal" demand won"t return until COVID-19 vaccines are available.

Incidents of piracy reported to the International Maritime Bureau (IMB) totalled 47 in the first three months of 2020, up from 38 in the same period last year,global insurance carrier Allianz Global Corporate and Specialty

(AGCS) said Wednesday in its Safety and Shipping Review 2020. Most pirate attacks targeted oil tankers, but included container ships and bulk carriers, the report said.

In a bid to curb the spreading COVID-19 pandemic earlier this year, governments restricted population movement. The resulting economic slump and declining oil demand prompted the funnelling of crude and refined products into onshore storage facilities. As these tank farms rapidly filled up, there was a surge in the number of tankers chartered for storing excess volumes of oil. Many such tankers were anchored off the coast of major oil ports in West Africa, the U.S. and Europe, with the Gulf of Guinea becoming a hotspot for pirate attacks, according to the AGCS report.

"Piracy remains an ongoing issue. We thought we had a handle on it but it has manifested yet again," said global head of Marine Risk Consulting at AGCS Captain Rahul Khanna in the report. "Incidents have been increasing in West Africa and parts of Asia, where we see a worrying pattern of violent attacks against crew, as well as kidnappings."

The Gulf of Guinea region, which borders some 3,700 miles of the coastline of West Africa, accounted for 90% of global kidnappings reported at sea in 2019, with the number of crew taken increasing by more than 50% to 121, according to data from the IMB.

Get accurate, up-to-the minute news, pricing and analysis for buying and supplying ethanol-blended fuel and biodiesel withOPIS Ethanol & Biodiesel Information Service.This service includes real-time news alerts, end-of-day pricing assessments, and a weekly newsletter and rack pricing report.

Over the same period, U.S. jet fuel stocks have risen by a net 1.5 million bbl to 40.4 million, well below the highest level seen in the last five years, 47.4 million bbl in early October 2018. Meanwhile, total gasoline stocks have fallen by nearly 8.8 million bbl to 248.5 million since early April.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Transportation mobility was back to January levels in many Asian economies by early July, and up considerably from April and May, according to the International Energy Agency in its July Oil Market Report, in which it cited Google data.

"European countries applied some of the strictest containment measures in the world with the vast majority of the continent"s citizens told to stay home during the month," said the IEA in the July report. "The decline in fuels demand reflected the region"s product mix and was therefore more weighed towards gasoil/diesel than gasoline."

OPIS developed the pricing in ourEurope LPG & Naphtha Reportto reflect the market’s desire for an unbiased methodology and accurate spot price benchmark in northwest Europe and the Mediterranean.

However, shipments have picked in July as seen in recent shipping fixture reports but are still well short of typical levels due to COVID-19, which may lead to reduced refinery runs resulting in a longer period of lower imports, trading sources said.

Marketers interviewed by OPIS this week are acknowledging an alarming midsummer slide in sales this week, and preliminary data suggests that demand reports may show numbers last witnessed in May.

But EIA has always been honest about the flaws of "implied demand" and has consistently stressed that it does not measure gasoline sales. It simply looks at inventory changes, production, imports and exports, and comes up with a "product supplied" number that can often represent product moving from reportable (bulk terminals) to non-reportable (station tanks) storage.

Asian petrochemical makers plan to use more liquefied petroleum gas (LPG) in August for a second straight month as gas cracking economics improved following a jump in naphtha prices due to strong downstream and gasoline demand.

The petrochemical manufacturers had planned to crack 310,000 mt in July, according to the previous poll published on June 5. They used 306,000 mt in June.

Hanwha Total Petrochemical Corp. (HTC) bought one 22:22 lot for end-July delivery to Daesan via a tender with propane at a single-digit discount to the Far East quotes and butane at a discount of $30s/mt to the Japan naphtha quotes, according to sources.

Mitsubishi Chemical, Maruzen Petrochemical and Mitsui Chemicals are on track to restart their crackers over the next two weeks after completing scheduled maintenance works, as reported earlier.

Mitsubishi Chemical will crank-up its 539,000 mt/year plant in Kashima this week, while Maruzen Petrochemical will resume its 525,000 mt/year unit in Ichihara next week. Mitsui is also on track to complete maintenance at the 500,000 mt/year Osaka facility on July 20.

Asian naphtha markets strengthened with the CFR Japan price on Monday reaching a four-month high of $406.500/mt, according to OPIS data, supported by healthy petrochemical demand, tight supply and increased gasoline consumption following relaxations of lockdowns over the coronavirus disease 2019 (COVID-19).

Ethylene production costs and margins from LPG were better than naphtha, according to IHS Markit Asia Light Olefins Weekly report published on July 3.

The cash cost of steam cracking in Northeast Asia using LPG was estimated at $401/mt on June 25, generating a margin of $404/mt, the report showed. The costs of cracking naphtha was at $517/mt and the margin was $288/mt.

Ethylene market sentiment in Asia also held firm on increasing demand and tight supply, while caution emerged given large quantities of U.S.-origin cargoes bound for Northeast Asia, according to the IHS Market report.

Methodology: OPIS collects Asian petrochemical companies" plans for the current month and the next month, as well as actual cracking volume in the previous month. OPIS, a unit of IHS Markit, checks if any manufacturers revise their plans for the current month and if any manufacturers crack more or less than initial plans in the previous month. OPIS contacts feedstock procurement officers of each companies for the survey by phone, email or messengers in the last week of previous month or the first week of the current month. OPIS surveys 16-20 companies a month.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

Supply of all naphtha grades tightened as refiners worldwide operated at below capacity to counter the loss in fuel demand stemming from coronavirus disease 2019 (COVID-19) mobility restrictions. At the same time, resilient petrochemical demand kept Asia cracker run rates at more than 85%, widening the supply shortfall, they said.

Ethylene operating rates in July are projected to be 89% for Northeast Asia and 88% for Southeast Asia, according to the latest IHS Markit Asia Light Olefins Weekly Market Report, up from 86% and 87% last month, respectively.

Spot production cash margins for Northeast Asian crackers using naphtha dropped to $288/mt as of June 25, down 17.7% from the preceding week, according to the Asia Light Olefins report.

Growing buyer resistance to the naphtha price escalation is seen in the recent withdrawal of H1 and H2 Aug. purchase tenders by Hanwha Total Petrochemical, Yeochun NCC and LG Chem.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

The Rome-based company revised its long-term price assumptions for Brent crude oil to $60/bbl from 2023 onwards compared to $70/bbl previously. Brent prices are expected to average $40/bbl, $48/bbl and $55/bbl each year for the period 2020 to 2022. That"s compared to previous assumption of annual averages at $45/bbl, $55/bbl and $70/bbl for the same period.

Similarly, BP is writing off up to $17.5 billion of assets in the second quarter, according to a company statement in June. BP reduced its Brent crude long-term assumption to an annual average of $55/bbl until 2050, down from its previous forecast of $70/bbl, due the increasing likelihood of COVID-19 having an "enduring impact" on the economy and demand, the company said.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Prices of naphtha and gasoline rose on the back of easing coronavirus disease 2019 (COVID-19) lockdown measures that rekindled road transportation fuel demand, with naphtha buoyed by both stable intake as a petrochemical feedstock and its diversion into the gasoline pool as a blendstock, they said.

"The steps to destroy unwanted jet stream is to first blend it into diesel up to the upper limit, blend it into cracker (petrochemical) feedstock, switch to dumbbell-like crude slate...if these are not enough then a refiner may need to lower runs as a last resort," she said.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

There have been reports of operational problems at the Enterprise storage facility, which may be causing some distressed sales. However, there has been no confirmation. Enterprise does not typically provide operational information related to specific assets or market dynamics. Enterprise does not "have any kind of comment or details to share at this time," Rick Rainey, Enterprise"s vice president of public relations, told OPIS.

IHS Markit"s U.S. NGL Markets Weekly report stated that Enterprise"s TEPPCO pipeline and terminal, which supplies natural gasoline to Canadian markets, may be getting backed up as a result. IHS Markit is the parent company of OPIS.

Additionally, the report cited the shutdown of a BASF cracker on June 12 as potential source of price pressure, as the cracker can run natural gasoline as a feedstock.

Ethane prices will be driven higher by increasing outright natural gas prices due to the loss of associated gas production and the need to drill for gas from drier fields. Demand will be flattish in 2020 before recovering through to 2025 on growing US petrochemical consumption and boosted by new export capacity to start up at the end of the year.

As crude oil prices recover, the favourability of ethane over LPG and naphtha as a petrochemical feedstock to produce ethylene will exist for US Gulf Coast crackers even with the increases in ethane prices, said Mehta. Still, there will be some periods, especially during the summer months, when LPG prices become more favourable.

Energy Transfer"s Orbit ethane export facility in the US Gulf Coast, the group"s joint venture with China"s Satellite Petrochemicals, will be in service in the fourth quarter. The export terminal will have the capacity to export 180,000 b/d alongside 800,000 bbl of refrigerated ethane storage, the group said at the conference.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

The tender came as CPC Corp. shut the RFCC at its 200,000 b/d Taoyuan refinery on May 7 for maintenance works that are expected to last until around Aug. 20, as reported earlier.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

With China"s domestic oil demand not expected to recover to pre-outbreak levels until the third quarter and with state-owned refineries expected to lose a large chunk of their export demand compared with last year, independents will face more intense domestic competition, IHS Markit said a report on the sector issued on May 29.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Supply of all naphtha grades tightened because of lower global refinery runs due to fuel demand loss stemming from coronavirus disease 2019 (COVID-19) mobility restrictions. At the same time, resilient petrochemical demand has kept Asia cracker run rates at more than 85% in recent months, widening the supply shortfall, they said.

European naphtha has strengthened on the back of decreased imports, particularly from Russia, and strong demand from crackers as well as gasoline blending, as reported by OPIS.

For H1 August delivery, Hanwha Total Petrochemical (HTC) and GS Caltex bought HFRN at premiums of $11-$13/mt while Korea Petrochemical Industry Co. Ltd. (KPIC) paid $13-14/mt for light naphtha with minimum 70% paraffin, as reported.

Ethylene operating rates in June were estimated at 86% for Northeast Asia and 87% for Southeast Asia, according to the latest IHS Markit Asia Light Olefins Weekly Market Report, little changed from 86% for both regions in May.

LPG"s competitiveness as a cracker feedstock has increased although the gas can only replace up to 20% of naphtha, according to the latest Asian Petrochemical Feedstock Market Outlook weekly report.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

On June 20, Pakistan authorities approved measures by its petroleum division to ensure adequate supplies of HSFO to meet power requirements, as reported by the national Associated Press of Pakistan news agency.

PSO imported 79,800 b/d of residual fuel oil in 2018 and 20,000 b/d in 2019, according to IHS Markit data. Over the past three years, Islamabad has been trying to replace fuel oil with the cleaner-burning LNG, partly through bans on fuel oil imports that were implemented intermittently.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

The restart of the 300,000 b/d Petronas-Saudi Aramco joint venture Pengerang Refining and Petrochemical (PRefChem) facility after an explosion was pushed back due to manpower issues leading to the sale of several million barrels of crude oil that were in floating storage, trading sources said.

Consequently, the refinery as a whole, and the RFCC in particular, was running at very low rates, market sources said. The fire-hit ARDS was due to restart in the middle of this year, Petronas said in a quarterly report.

The refinery also provides feedstock to an integrated petrochemical complex with a nameplate capacity of 3.3 million mt/year. The cracker has a capacity to produce 1.26 million mt/year of ethylene, 600,000 mt/year of propylene and 180,000 mt/year of butadiene, according to IHS Markit data.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Propane"s discount to CIF NWE naphtha deepened for July, ending at minus $46/t mid-week, from minus $8/t at the start of June, according to the data in the OPIS Europe LPG & Naphtha Report. Early-June bidding for CIF ARA propane by a petrochemical major in NW Europe had continually pitched buyside levels between $10 and $15/mt deeper when compared to propane/naphtha spreads at the time.

OPIS developed the pricing in ourEurope LPG & Naphtha Reportto reflect the market’s desire for an unbiased methodology and accurate spot price benchmark in northwest Europe and the Mediterranean.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Northwest Europe naphtha values strengthened against the refinery complex in April and May, with support coming from higher arbitrage flows to Asia alongside burgeoning petrochemical feedstock demand, while other refined products in Europe saw demand crumple due to the confinement measures brought about by the coronavirus 2019 disease (COVID-19).

Long Range 2 (LR2) freight rates for the Mediterranean to Japan route surged to around $4 million lumpsum compared to a more typical $1 million-$1.5 million lumpsum, according to shipping reports seen by OPIS, and subsequently, many of the arbitrage cargoes were later fixed on Medium Range (40,000 tons) vessels.

Naphtha market length in northwest Europe was prevalent and one market source noted that at one point in May, over 10 parcels were looking for homes with one cargo reportedly sitting outside Amsterdam-Rotterdam-Antwerp (ARA) since early April.

According to shipping reports compiled by OPIS, naphtha loadings in the region covering northern and northwest Europe, the Baltic, Mediterranean, Black Sea and Algeria dropped 0.23 million tons to 3.12 million tons from April to May.

Naphtha did not experience the same demand crushing effect COVID-19 lockdown measures had on transport fuels in April and first-half May as support came from the petrochemical sector amid discounted prices to rival gas liquids feedstocks.

Paraffinic naphtha sank to discounts of minus $18/t to parity with the flat price in April before partially recovering to the minus $7.50/t to plus $2/t band in May, with more buying interest from the petrochemical sector compared to OSN due to its higher paraffin content.

OPIS developed the pricing in ourEurope LPG & Naphtha Reportto reflect the market’s desire for an unbiased methodology and accurate spot price benchmark in northwest Europe and the Mediterranean.

Demand in Asia was expected to contract by about 4.5 million b/d in the first quarter and by 4.9 million b/d in the second quarter, according to an IHS Markit report on the region published on May 19.

“Although we expect the trough to have been over in April on a monthly basis as regional countries start to ease their containment measures, recovery will be gradual amid change in consumption patterns and fears over a second wave of infections,” it said in the report.

China, for example, ramped up crude oil imports in the first half of this year with purchases soaring to a record 11.34 million b/d in May and there are expectations that it could reduce purchases for delivery in the second half, something it did over the course of 2018.

“By how much 2H 2020 imports will pull back depends on refinery runs (which in turn depends on oil demand recovery in domestic and overseas markets) and availability of storage capacity. All these factors are 2020 specific and may not be directly comparable to 2018,” said Feng Xiaonan, IHS Markit analyst in Beijing.

The IDI was chartered by BP and loaded 37,000 metric tons of jet fuel from the Mediterranean port of Augusta in Italy on June 4, according to a shipbroker report. The tanker is due to arrive in New York around June 27, according to data from IHS Markit"s Maritime Intelligence Network.

Using a live trading platform, theOPIS450 Europe Jet Tickerconverts bids, offers and deals in the barge jet fuel market into a price mark for each minute between 9:00 a.m. and 4:30 p.m. London time. The average of those 450 prices creates a value for the entire trading day, providing carriers and suppliers with an accurate and impartial market assessment. Combine the all-day visibility of the Ticker with the expert market commentary found in theOPIS450 Europe Jet Fuel Reportand you have a complete and transparent picture of each day"s entire activity.

Indian Oil Corp. (IOC) in May raised utilization rates to 75-80% from 39% in April, as reported earlier. Bharat Petroleum Corp. Ltd. (BPCL) said it will resume full operation where possible after raising throughput to 77% of capacity as of May 31 from 63% in April.

Chinese refinery runs in May were estimated to see more month-on-month improvement to 70% from 55 % in February, according to the IHS Markit China Refining and Marketing Short-Term Outlook report published on May 29.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

MEXICO CITY -- Mexico"s driving levels for the first week of June reached 60% of the activity reported at the beginning of the year, almost twice the level reported by Apple for mid-April.

Driving activity has slowly recovered since the week ended April 12, when driving levels were 35% of the baseline driving levels reported by Apple for the third week of January.

Pemex CEO Octavio Romero Oropeza reported on Friday that his company sold up to 620,000 b/d of gasoline during the first week of April, a year-over-year (YOY) increase of 3%.

Multiple states reported driving activity levels at over 70% of baseline levels during the first week of June: Aguascalientes, Baja California, Campeche, Chihuahua, Coahuila, Colima, Durango, San Luis Potosi, Sinaloa, Sonora, Tamaulipas, Tlaxcala and Zacatecas.

Mexico has had the lowest number of tests positive for COVID-19 among countries in the Organization for Economic Co-operation and Development makes, which makes market observers think the outbreak is worse than reported by the government.

According to an investigative report by Mexico City-based magazine Nexos, found that Mexico City released 20,900 death certificates during April and May, of which 7,196 mention COVID-19 as the cause of death, 5,900 as respiratory insufficiency, and 5,540 as atypical or viral pneumonia.

The death rate related to COVID-19, pneumonia, and respiratory issues is three times higher than the figure reported by health authorities for Mexico City.

The petrochemical sector in northwest Europe continued to cut its intake of LPG feedstock in May as propane values maintained significant premiums to rival feedstock naphtha, leading to a slash in LPG import flows from the U.S.

CIF ARA propane prices extended its two-month run holding a premium to CIF NWE naphtha, with propane/naphtha trading at +$53/mt at the start of May, down from a high of +$131/mt recorded on April 21, but still atypical going into the summer months when propane usually trades at a discount due to the lack of heating demand. By comparison, the propane/naphtha spread was minus $139/t in May 2019. A petrochemical producer with feed-flexible coastal facilities in the Netherlands and Spain made repeated propane cargo resale attempts last month.

Demand attrition for finished goods in the petrochemical chain due to coronavirus disease 2019 (COVID-19) gathered pace in May, with Dow Chemical among other producers announcing the idling of some downstream chemical units (see OPIS alert April 30, 2020).

Petrochemical operators relied more on local North Sea supply, with 81% of their May LPG intake from North Sea countries Norway and the U.K., while 11% came from the Russian Baltic region and 8% from the U.S. East Coast.

Looking ahead, LPG has come back into favor as a petrochemical feedstock as naphtha prices have rebounded harder on rising Brent crude oil values. The propane/naphtha spread tipped negative for the first time in two months to minus $6/t on May 26, and has since deepened to minus $24/t at last look, spurring a petrochemical producer to resurface seeking propane cargoes.

OPIS developed the pricing in ourEurope LPG & Naphtha Reportto reflect the market’s desire for an unbiased methodology and accurate spot price benchmark in northwest Europe and the Mediterranean.

Asian petrochemical producers plan a modest increase of liquefied petroleum gas (LPG)cracking in July from the lower levels intended this month, while gas usage will grow further in August when demand for heating fuels in the northern hemisphere eases, according to a poll.

The petrochemical manufacturers had planned to crack 350,000 mt in June, according to the previous survey published on May 13. They used 321,000 mt in May, lower than initial plans of 357,000 mt.

Ethylene production costs and margins from naphtha were better than LPG, according to IHS Markit Asia Light Olefins Weekly report published on May 29.

The cash cost of steam cracking in Northeast Asia using naphtha was estimated at $264/mt as of May 21, generating a margin of $366/mt, the report showed.The costs of cracking LPG was almost double at $413/mt and the margin was $217/mt.

Ethylene market sentiment in Asia strengthened on limited offers and increasing demand in the key polyethylene sector, according to the IHS Markit report.

A petrochemical producer in Northeast Asia raised cracker runs to full in June from around 90%, given the strong market, an official at the company said.

Methodology: OPIS collects Asian petrochemical companies" plans for the current month and the next month, as well as actual cracking volume in the previous month. OPIS, a unit of IHS Markit, checks if any manufacturers revise their plans for the current month and if any manufacturers crack more or less than initial plans in the previous month. OPIS contacts feedstock procurement officers of each companies for the survey by phone, email or messengers in the last week of previous month or the first week of the current month. OPIS surveys 16-20 companies a month.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

Last month, Petron closed a tender to buy 200,000 bbls of 87 RON and/or 100,000 bbls of 92 RON for loading on June 5-10, as reported earlier, although its results were not known.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

Plans by the Chinese provincial Shandong government to build a mega refining-cum-petrochemical complex is unlikely to lead to a glut of oil products due to its high integration and the probable closure of several teapot plants as part of a consolidation exercise, analysts and trading sources said.

The authorities began a second public review of its environmental impact assessment (EIA) as of March 31, 2020, IHS Markit reported in their April short-term outlook on the China Crude Oil Markets.

The Yulong project will be the most sophisticated yet in the string of mega refineries that have come onstream in the past year including the 400,000 b/d each of Hengli Petrochemical and Zhejiang Petrochemical (ZPC), according to IHS Markit.

"The combined yield of transport fuels of Yulong can be as low as 17%," said Feng Xiaonan, IHS Markit analyst in Beijing and one of the authors of the report, adding, "If enough teapots are closed down, there will be very limited incremental supply of transport fuels since these teapots mostly produce fuels and very limited chemicals."

Ten independent refineries, with a combined 560,000 b/d capacity, have so far signed up to swap their existing refining assets into equivalent equity shares in the newly proposed refinery, according to the IHS Markit report.

The provincial government announced on Feb. 11 that it will start work to close down four of the participating refineries in 2020, namely Zhonghai Fine Chemical, Yuhuang Shengshi, Binyang Gasificaiton and Kinshi Bitumen, which have a combined 254,000 b/d processing capacity, the IHS Markit report showed.

"Considering that the COVID-19 outbreak has already put mounting pressure on employment and local economic growth, we believe it is probable for the government to postpone refinery closures in order to maintain stability," they said in the report.

On Tuesday, Reuters news agency reported that the National Development & Reform Commission (NDRC) gave initial approval for the $20 billion project, allowing Shandong province to start planning for construction for around an end 2024 start, citing sources with knowledge of the approval.

The Yulong complex is designed to convert over 60 % of a barrel of crude into petrochemical products and feedstocks through a combination of hydrocracking and intensive catalytic cracking technologies, IHS Markit said.

"If such design is carried through, China will be able to take its crude-oil-to-chemicals (COTC) achievements one big step forward from where the operating Hengli and ZPC currently stand, consolidating the country"s world leading position in the realm of refining and petrochemical integration," it said in the report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

A 2018 study by IHS Markit suggested that the Alaska North Slope could re-emerge as a major source of U.S. energy production, with crude oil output potentially increasing as much as 40% in eight years, due to new discoveries and higher investment by majors.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Domestic flights last month increased with visitors to Jeju island, a major domestic tourist spot, increasing by 32%, local media reported. The air route between Seoul and the resort island is the busiest in the country.

Last month, SK Energy, the nation"s largest refiner idled its 260,000 b/d No. 5 CDU and other facilities including the 57,000 b/d No.1 residue fluidized catalytic cracker (RFCC) at the 840,000 b/d Ulsan refinery for scheduled turnaround, as reported earlier.

The refinery"s financial viability, an issue that has dogged Grangemouth in the past, reared its head again earlier this month, when Petroineos was widely reported by the British media to have applied for an emergency government loan of up to £500 million.

"With people following government advice to stay at home, demand for road and jet fuel has dropped significantly," the company said in a statement reported by IHS Markit, the parent company of OPIS. "As a responsible operator of Scotland"s only refinery, Petroineos is in regular discussion with the Scottish and U.K. governments on a variety of matters."

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

It bought 13.17 million kl, or 2.76 million barrels a day (b/d), the smallest since June 2018, according to data from Ministry of Economy Trade and Industry (METI) on Friday. The April imports were down 9% from a year earlier.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Product stockpile in the latest week totaled 63.528 million bbls, not far from a three-month high of 64.408 million bbls reported for the week ended May 9.

Idemitsu Kosan expects jet fuel and gasoline sales in the 2020/21 fiscal year to drop 50% and 12%, respectively, amid travel restrictions and declining economic activity caused by the COVID-19, as previously reported.

Tsutomu Sugimori, who is also JXTG Holdings" president, said the reductions were likely to be enough to meet the lower local refining demand, although he did not reveal the extent of the supply cut, according to the reports.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

IOC brought back online crude units at refineries in Panipat, 150,000 b/d after a near two-month maintenance and refurbishment program earlier this month, in Paradip, 160,000 b/d after about 10 days works in late April, and in Paradip, 120,000 b/d following an almost month-long turnaround that finished this week, according to the reports and a trading source.

Nayara Energy restarted a 110,000 b/d unit at Vadinar in late April after a over two-week closure, Bharat Petroleum Corp. Ltd resumed operations at its 100,000 b/d crude unit in Kochi this week following a three-week shutdown, while Mangalore Refinery & Petrochemicals Ltd also did the same after works at a 144,000 b/d unit for about a month, the report showed.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Chinese fuel demand recovery is likely to taper off in the second half of this year after a spectacular V-shaped rebound from the coronavirus disease 2019 (COVID-19), which is also taking shape in countries that have relaxed lockdown measures, according to an IHS Markit report and trading sources.

Overall oil consumption in China is forecast to contract by more than 1 million b/d in 2020 from a year ago due mainly to the drag in transport fuels while demand for petrochemical feedstocks, including naphtha and liquefied petroleum gas (LPG), are expected to post modest growth, the IHS report showed.

“When you look at oil demand over February, March and April, there was a very definite V-shape recovery, except for jet fuel. Looking into the second-half, we believe the right leg of the V will be lower than the left,” said Feng Xiaonan, IHS Markit downstream analyst in Beijing, one of the authors of the report published on May 20.

The spike in demand growth was matched by an equally impressive rebound in refinery run rates with independents raising output sharply took take advantage of local fuel floor prices that raised margins significantly, according to the report.

“Imports will shore up in the second quarter ahead of a full recovery of downstream demand. We also expect the pace of stock build to ease in second half 2020 as tanks get filled up and as storage economics become less attractive with crude oil prices expected to trend higher in our base case scenario,” IHS Markit said in the report.

Turning to each transportation fuel, in its best-case scenario gasoline demand was forecast to drop by 454,000 b/d, diesel by 228,000 b/d and jet fuel by 360,000 b/d, according to the report.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

Hubbs pointed out that ethanol production has increased in recent weeks, citing recent data from the U.S. Energy Information Administration (EIA). "We saw ethanol plants shutter and reduce production, and we got down to 537,000 b/d a few weeks ago. It picked up to 617,000 b/d in last week"s report. I expect it to go up again this week."

The agency on Wednesday reported that ethanol output rose by 46,000 b/d, or 7.5%, in the week ended Friday to 663,000 b/d, a six-week high. Production, however, is 38.1% below the same week of last year.

The panelists" comments come after Geoff Cooper, president and CEO of the Renewable Fuels Association (RFA), an ethanol industry trade group, told reporters on Friday that "the worst may be behind us. We"re beginning to see some signs of recovery as states begin to ease stay-at-home restrictions and people begin to return to public spaces and get back out on the roads."

Get accurate, up-to-the minute news, pricing and analysis for buying and supplying ethanol-blended fuel and biodiesel withOPIS Ethanol & Biodiesel Information Service.This service includes real-time news alerts, end-of-day pricing assessments, and a weekly newsletter and rack pricing report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Nghi Son Refinery and Petrochemical (NSRP), for example, will not export any spot diesel cargoes in May and June, according to sources with knowledge of the matter.

That"s one of the frictionless payment initiatives Alimentation Couche-Tard Inc. has rolled out in response to the coronavirus disease 2019 (COVID-19) crisis. And there are more ways the convenience store giant is adapting to the "new normal" in the wake of the virus, according to a status report released today.

As OPIS has reported, convenience store operators are expanding delivery service and online ordering for pick up, as well as adopting technology such as scan-and-go to reduce the need for social interaction and to speed transactions.

And in its report, Couche-Tard said it also has "pulled forward" technologies that could become "key to serving customers beyond the current pandemic." Among the initiatives are: adopting a "frictionless" payment technology in Norway to accept fuel payments using license plate recognition; expanding home delivery in North America to more than 620 stores; and offering click-and-collect and curbside delivery in Europe and North America with preordering and payment through the Circle K app.

Couche-Tard and other convenience store chains have reported higher demand for alcohol and tobacco products, as well as basic staples, canned and dry goods and cleaning and sanitation products. The company said the demand for those products has helped offset lower demand in the prepared food category.

"Couche-Tard"s teams in Europe recommended adjustments to the in-store assortment, which allowed stores in North America to better anticipate the changes in shopping behavior and the items that could see greater demand," the report said.

Regardless of the decline in prepared food business, Couche-Tard said in its report that it still plans to have its "Food at Scale" food service initiative in 1,500 locations by this fall. "This continues to be an important area of focus and capital expenditures for this initiative remain in the budget for fiscal 2021," the company said.

The company said it is moving to "preserve its cash position and financial flexibility, including a pause to share repurchases." As previously reported, it also put its acquisition of Caltex Australia on hold. As of Feb. 2, 2020, Couche-Tard said it had $1.8 billion in cash and equivalents on its balance sheet and another $2.5 billion available on its revolving credit facility. CFO Claude Tessier said the company went into the crisis in a "strong position" and is taking steps to "be ready to reinvest in our business and in the economy when the time comes to exit this crisis."

Crude throughput in April jumped to 53.85 million mt or about 13.1 million b/d, data from the National Bureau of Statistics (NBS) showed. This volume processed is 0.8% more than March, according to the NBS data show. However, NBS gets its data from refiners which at times are under or over reported and often leads to revisions, sources said.

The increases in travel came as many states around the nation began lifting stay-at-home orders and opening some businesses last week. But even as life in the United States slowly begins to head back toward normal, AAA is saying anecdotal reports suggest fewer people will be traveling for the Memorial Day weekend this week than in past years.

AAA said that because COVID-19 has made economic data unreliable this year, it will not issue a formal Memorial Day travel forecast of the number of people it expects to be on the road -- the first time in 20 years that it hasn"t issued such a report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Global Marine Fuels Reportdelivers daily assessments of marine bulk and bunker fuel prices in key global ports, including calculated prices for the new 0.5% VLSFO, a new fuel created in anticipation for IMO 2020. Easily track cargo and bulk fuel prices for Asia, Mideast, Europe and the Americas with this concise report filled with at-a-glance tables and charts.

In a 36-page report for clients issued Tuesday, they see twists and turns for Brent and WTI but conclude with much higher price forecasts than current forward curves imply.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

While many petrochemical markets have been affected by demand that dropped rapidly amid quarantines around the world related to the coronavirus disease 2019 (COVID-19), toluene has been hit particularly hard.

OPIS Global Marine Fuels Reportdelivers daily assessments of marine bulk and bunker fuel prices in key global ports, including calculated prices for the new 0.5% VLSFO, a new fuel created in anticipation for IMO 2020. Easily track cargo and bulk fuel prices for Asia, Mideast, Europe and the Americas with this concise report filled with at-a-glance tables and charts.

LPG usage for petrochemical production in June is set to decline 2% on-month to 350,000 mt, according to an OPIS poll completed on May 11. Revised figures show that in May, gas cracking volume is to fall to 357,000 mt from 436,000 mt in April, according to the survey.

Ethylene production costs and margins from naphtha were better than LPG, according to the IHS Markit Asia Light Olefins Weekly report published on May 8.

The cash cost of steam cracking in Northeast Asia using naphtha was estimated at $116/mt as of April 30, generating a margin of $239/mt, the report showed.

Ethylene market sentiment in Northeast Asia strengthened on tighter supply amid cracker turnarounds and bullish energy prices with some governments relaxing curbs against the COVID-19, the report said. Propylene market sentiment also firmed up, according to the report.

Maruzen Petrochemical also idled its 525,000 mt/year cracker in Ichihara on May 11 for scheduled turnaround expected to last two months, according to a company source.

Some petrochemical makers in Asia maintained lowered runs on expectations that downstream demand may weaken again with the COVID-19 hurting the global economy. The Asian Manufacturing PMI, compiled by IHS Markit, fell to 43.9 in April, the lowest since March 2009, from 48.3 in March, indicating a deterioration in regional business conditions.

"We are considering further run cut, even probably to around 80%," said the buyer at a petrochemical manufacturer in Northeast Asia, adding their cracker has been operating at around 90%.

Methodology: IHS Markit OPIS collects Asian petrochemical companies" plans for the current month and the next month, as well as actual cracking volume in the previous month. IHS Markit OPIS checks if any manufacturers revise their plans for the current month and if any manufacturers crack more or less than initial plans in the previous month. IHS Markit OPIS contacts feedstock procurement officers of each companies for the survey by phone, email or messengers in the last week of previous month or the first week of the current month. IHS Markit OPIS surveys 16-20 companies a month.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

Domestic margins in China were supported as authorities in March decided not to cut local product prices further after global crude prices fell below $40/bbl, the floor for the nation"s product pricing system, as reported earlier.

China released two batches of oil product export quotas for this year so far, allocating a total of 49.19 million mt, compared to 56 million mt in the whole of 2019, as reported earlier.

Gain greater transparency into Asia-Pacific markets for more strategic buy and sell decisions on refinery feedstocks, LPG and gasoline with theOPIS Asia Naphtha & LPG Report.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

Even without mandates, cuts are being made, according to longtime oil economist Phil Verleger. In his Notes at the Margin report this week, Verleger said U.S. production might already be down by 2.7 million b/d, to about 10 million b/d, as producers shut in wells that are uneconomical to operate or because they couldn"t find oil buyers in this time of record-low demand.

Recent weeks have seen announcements of large cuts in United States, with much of those cuts in shale fields, where production costs are generally higher than those at conventional wells. ConocoPhillips is slashing production 265,000 b/d in May and planning cuts of 460,000 b/d in North American production starting in June. ExxonMobil has said it will shut in about 100,000 b/d of oil equivalent in the Permian Basin. Chevron will curtail 200,300 b/d of oil equivalent in May and continue that through June. Continental Resources has shut most of its wells in North Dakota"s Bakken play, according to reports.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

OPIS Mobile News Alertsprovides instant access to real-time petroleum industry news from veteran OPIS reporters. For over 35 years, OPIS has guided jobbers, retailers, suppliers, refiners, traders, brokers, end users, and other industry professionals through a sea of volatility.

The most recent four-week average for domestic gasoline supplied from the U.S. Energy Information Administration (EIA) is just 5.329 mil

8613371530291

8613371530291