rongsheng petrochemical bloomberg brands

Renewed emphasis on recycling and the spread of local bans on some kinds of plastic products could cut petrochemical demand growth to one-third of its historical pace, to about 1.5% a year, said Paul Bjacek, a principal director at consulting firm Accenture Plc.

“Oil companies are saying, no problem, we’ll invest in petrochemicals,” Bjacek said. “But petrochemicals, after the circular economy happens to the maximum extent, is likely to be a low-growth market.”

Projects by companies including Hengli Petrochemical Co. and Rongsheng Petrochemical Co. will devote as much as half their capacity to chemicals, mostly paraxylene, a material that China imports to make polyester and plastic bottles. That’s a sharp increase from the 10% chemical production at a typical refinery and as much as 20% at modern refineries integrated with chemical plants.

But consultants and analysts are sounding the alarm that petrochemical demand is heading south of earlier forecasts. Images of waste fouling the oceans are drawing government bans on single-use plastics from the European Union to India and California. Chemical makers are investing in recycling technologies and infrastructure. Coca Cola Co. is pledging to recycle one bottle for every one it sells by 2030 as consumer products companies come under pressure to reduce their use of plastics.

With more investment in waste recovery, recycled resins could replace almost a third of virgin plastic by 2030 and nearly 60% by 2050, slashing demand for petrochemicals, according to a McKinsey & Co. report. Christof Ruehl, the former head of research for the Abu Dhabi Investment Authority, estimates a 20% cut in oil demand from petrochemicals if current trends continue.

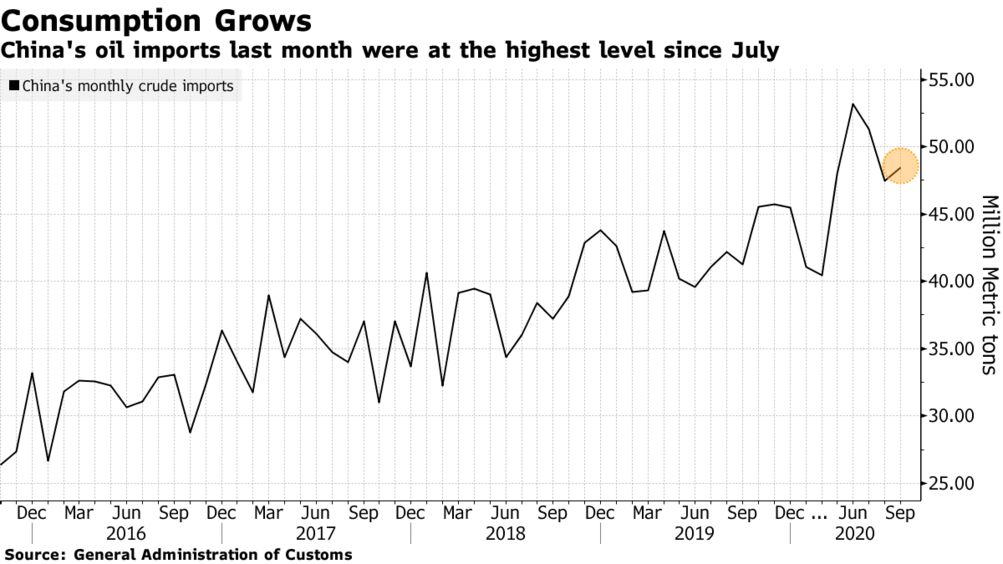

BEIJING, Aug 14 (Reuters) - Rongsheng Petrochemical , the listed arm of a major shareholder in one of China’s biggest private oil refineries, expects demand for energy and chemical products to return to normal in the country in the second half of this year.

The Zhejiang-based Chinese private refiner saw profit more than triple in the first half of 2020, bolstered by the launch of its 400,000 barrel-per-day Zhejiang Petrochemical Co (ZPC), according to a stock exchange filing earlier this week.

Rongsheng expects to start trial operations of the second phase of the refining project, adding another 400,000 bpd of refining capacity and 1.4 million tonnes of ethylene production capacity in the fourth quarter of 2020.

“We expect the effects of the coronavirus pandemic on energy and chemicals to have basically faded in spite of the possibility of new waves of outbreak,” said Quan Weiying, board secretary of Rongsheng, in response to Reuters questions in an online briefing.

But Li Shuirong, president of Rongsheng, told the briefing that it was still in the process of applying for an export quota and would adjust production based on market demand. (Reporting by Muyu Xu and Chen Aizhu; Editing by Jacqueline Wong)

Sanctions hold a sword of Damocles over what would remain of the business, too. The billions that ChemChina has been dedicating to capital investment is just a small part of the constellation of new chemical plants under construction in China in recent years, with vast complexes being planned or built by Hengli Petrochemical Co., Rongsheng Petro Chemical Co. and even BASF. Despite rapid increases in domestic demand, these plants need robust export markets to soak up their product — but that route would be closed off to SinoChemChina if Washington was to unleash its thunderbolt.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

Privately owned unaffiliated refineries, known as “teapots,”[3] mainly clustered in Shandong province, have been at the center of Beijing’s longtime struggle to rein in surplus refining capacity and, more recently, to cut carbon emissions. A year ago, Beijing launched its latest attempt to shutter outdated and inefficient teapots — an effort that coincides with the emergence of a new generation of independent players that are building and operating fully integrated mega-petrochemical complexes.[4]

The politics surrounding this new class of greenfield mega-refineries is important, as is their geographical distribution. Beijing’s reform strategy is focused on reducing the country’s petrochemical imports and growing its high value-added chemical business while capping crude processing capacity. The push by Beijing in this direction has been conducive to the development of privately-led mega refining and petrochemical projects, which local officials have welcomed and staunchly supported.[20]

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

But with the start-up of advanced liquids-to-chemicals complexes in neighboring provinces, Shandong’s competitiveness has diminished.[23] And with pressure mounting to find new drivers for the provincial economy, Shandong officials have put in play a plan aimed at shuttering smaller capacity plants and thus clearing the way for a large-scale private sector-led refining and petrochemical complex on Yulong Island, whose construction is well underway.[24] They have also been developing compensation and worker relocation packages to cushion the impact of planned plant closures, while obtaining letters of guarantee from independent refiners pledging that they will neither resell their crude import quotas nor try to purchase such allocations.[25]

To be sure, the number of Shandong’s independent refiners is shrinking and their composition within the province and across the country is changing — with some smaller-scale units facing closure and others (e.g., Shandong Haike Group, Shandong Shouguang Luqing Petrochemical Corp, and Shandong Chambroad Group) pursuing efforts to diversify their sources of revenue by moving up the value chain. But make no mistake: China’s teapots still account for a third of China’s total refining capacity and a fifth of the country’s crude oil imports. They continue to employ creative defensive measures in the face of government and market pressures, have partnered with state-owned companies, and are deeply integrated with crucial industries downstream.[26] They are consummate survivors in a key sector that continues to evolve — and they remain too important to be driven out of the domestic market or allowed to fail.

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

Commenting on the rationale for these undertakings, Mohammed Al Qahtani, Aramco’s Senior Vice-President of Downstream, stated: “China is a cornerstone of our downstream expansion strategy in Asia and an increasingly significant driver of global chemical demand.”[33] But what Al Qahtani did notsay is that the ties forged between Aramco and Chinese leading teapots (e.g., Shandong Chambroad Petrochemicals) and new liquids-to-chemicals complexes have been instrumental in Saudi Arabia regaining its position as China’s top crude oil supplier in the battle for market share with Russia.[34] Just a few short years ago, independents’ crude purchases had helped Russia gain market share at the expense of Saudi Arabia, accelerating the two exporters’ diverging fortunes in China. In fact, between 2010 and 2015, independent refiners’ imports of Eastern Siberia Pacific Ocean (ESPO) blend accounted for 92% of the growth in Russian crude deliveries to China.[35] But since then, China’s new generation of independents have played a significant role in Saudi Arabia clawing back market share and, with Beijing’s assent, have fortified their supply relationship with the Kingdom.

Vertical integration along the value chain has become a global trend in the petrochemical industry, specifically in refining and chemical operations. China’s drive to self-sufficiency in chemicals is a key factor powering this worldwide trend.[42] And it is the emergent “second generation” of independent refiners that it is helping make China the frontrunner in developing massive liquids-to-chemicals complexes. Following Beijing’s lead, Shandong officials appear determined to follow this trend rather than risk being left in its wake.

As Chinese private refiners’ number, size, and level of sophistication has changed, so too have their roles not just in the domestic petroleum market but in their relations with Middle East suppliers. Beijing’s import licensing and quota policies have enabled some teapot refiners to maintain profitability and others to thrive by sourcing crude oil from the Middle East. For their part, Gulf producers have found Chinese teapots to be valuable customers in the spot market in the battle for market share and, especially in the case of Aramco, in the effort to capture the growth of the Chinese domestic petrochemicals market as it expands.

Rongsheng Petro Chemical Company Limited manufactures and sales purified terephthalic acid (PTA) and polyester drawn yarn related products. The Company"s main products are PTA and polyester full drawn yarn (FDY), polyester pre-oriented yarn (POY), polyester drawn textured yarn (DTY), various polyester filament and polyethylene terephthalate (PET) slices.

With assistance from Javier Blas. To contact the reporters on this story: Serene Cheong in Singapore at scheong20@bloomberg.net; Alfred Cang in Singapore at acang@bloomberg.net. To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net Anna Kitanaka.

PVTIME– Rongsheng Petrochemical Co., Ltd., (002493.SZ) (hereinafter referred to as Rongsheng) announced that the 300,000MT EVA device was successfully put into operation on December 28, 2021, and its photovoltaic products have been successfully produced with 28% VA content.

These products were produced by the ‘40 Million MT/Year Integrated Refining and Chemical Project (Phase II)’, which invested by Zhejiang petroleum & chemical Co., Ltd., a holding subsidiary of Rongsheng. The project based in Green Petrochemical Base, Zhoushan City, China, with an annual output of 300,000MT PV products.

Furthermore, as early July this year, Rongsheng revealed in its interaction with investors that Zhejiang project (Phase II) is undergoing. The EVA device can produce all photovoltaic products, and it may make an expansion of EVA production capacity in the future.

8613371530291

8613371530291