rongsheng petrochemical singapore pricelist

The moomoo app is an online trading platform offered by Moomoo Technologies Inc. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: Moomoo Financial Inc. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS), Futu Securities International (Hong Kong) Limited regulated by the Securities and Futures Commission of Hong Kong (SFC) and Futu Securities (Australia) Ltd regulated by the Australian Securities and Investments Commission (ASIC).

Registered with the Monetary Authority of Singapore (MAS), moomoo SG is a Capital Markets Services Licence (Licence No. CMS101000) holder with the Exempt Financial Adviser Status. Moomoo SG has been admitted as Clearing Member of The Central Depository (Pte) Ltd (CDP) , Trading Member of Singapore Exchange Securities Trading Limited (“SGX-ST”), Trading and Clearing Member of Singapore Exchange Derivatives Trading Limited (“SGX-DT”), and Depository Agent of CDP.

SINGAPORE, Dec 17 (Reuters) - Indian and Chinese oil buyers are snapping up Middle East crude after spot premiums for February-loading cargoes slumped by more than half to three-month lows on improved supplies to Asia.

In China, Rongsheng Petrochemical (002493.SZ), the trading arm of top private refiner Zhejiang Petrochemical, bought 8 million barrels of Abu Dhabi and Oman crude for February-March loading, on top of 1 million barrels of February-loading Abu Dhabi"s Upper Zakum last week. The refiner also purchased at least 2 million barrels of Emirati and Iraqi crude for delivery between February or March and December. [nL1N2T20C5]

Another mega Chinese refiner, Hengli Petrochemical (600346.SS), took three of four Qatari al-Shaheen crude cargoes in Qatar Energy"s tender while the remaining cargo went to Japan"s top refiner ENEOS Holdings (5020.T). read more

"Premiums last month were too crazy and not sustainable," a Singapore-based trader said, adding that prices had to correct after refining margins slumped late last month.

Complex refining margins in Singapore, a bellwether for Asian refiners" profitability, hit a four-month low of $2.15 a barrel in late November on fears about Omicron"s impact.

China"s refiners are optimistic about the likelihood of economic recovery in Asia"s top consuming country in the fourth quarter and into 2023 as pandemic control measures ease, helping to boost domestic oil product demand, according to the China-focused panel discussion at the S&P Global Commodity Insights Asia Pacific Petroleum Conference in Singapore Sept. 28.

"The toughest moment has passed. Restoring consumers" confidence is what the government needs to do and is doing," said Sun Xin, a director with Shenghong Petrochemical International, a trading desk of the greenfield Shenghong Petrochemical refinery complex in Jiangsu province.

"We have seen some green shoots already in China"s economy. Especially in September, we see more congestion in terms of transportation. We see a better run rate at the refineries," said Chen Hongbin, deputy GM of Rongsheng Petrochemical (Singapore).

Rongsheng is a trading arm of the privately-held refining complex Zhejiang Petroleum & Chemical, which restarted its 200,000 b/d No.4 CDU in last week after operations were suspended for seven months, and lifted run rates to around 95% of its nameplate capacity of 800,000 b/d from 83% in August, S&P Global data showed.

Petrochemical-oriented refineries with integrated value chains and economies of scale are expected to survive the intensive competition amid capacity surplus, the panelists said.

Wu said China"s new refineries were integrated with high yields of petrochemical products to replace imports when oil product demand growth slows, ruling out the small and simple refineries.

Beijing has set a target of capping China"s refining capacity at 20 million b/d in 2025. PetroChina"s 400,000 b/d Guangdong Petrochemical and the 320,000 b/d Shenghong Petrochemical refineries are scheduled to commission in 2022, while around 149,000 b/d of independent refining capacity was set to be phased out, S&P Global data showed.

Sun noted that refining and petrochemical bases help to lower transaction and logistics costs and maximize scale, while expanding the business chain to renewable energy, CCUS projects and new materials will help the company to compete in the future.

Asia"s petrochemical producers are scrambling to cut operating rates and switch to alternative feedstock to cope with over decade-high naphtha costs aggravated by volatile crude prices sparked by the Russia-Ukraine war, which have sent margins teetering near negative value.

This Summit is the only event with a focus on refining and petrochemicals in a comprehensive manner. Join us and learn how refining evolves in the new low-carbon world, where petrochemicals are moving even more to the forefront and traditional fuels are being pushed aside.

"The petrochemical markets are oversupplied for derivatives of C2 and C3. But recent run cuts are driven by soaring feedstock," the North Asian source said.

E1 Corp. was regularly buying LPG for South Korean petrochemical makers, though Taiwan"s Formosa Petrochemical, which plans to lower runs at three naphtha-fed steam crackers, withdrew its LPG import tender for H2 April, a source said.

At 10:37 am Singapore time (0237 GMT), the ICE Brent October crude futures were up 16 cents/b (0.36%) from the Aug. 20 settle at SUD45.07/b, while the new front-month NYMEX October light sweet crude contract was up by 9 cents/b (0.21%) at USD42.91/b.

And in September 2019, six world"s major petrochemical companies in Flanders, Belgium, North Rhine-Westphalia, Germany, and the Netherlands (Trilateral Region) announcedthe creation of a consortium to jointly investigate how naphtha or gas steam crackers could be operated using renewable electricity instead of fossil fuels. The Cracker of the Future consortium, which includes BASF, Borealis, BP, LyondellBasell, SABIC and Total, aims to produce base chemicals while also significantly reducing carbon emissions. The companies agreed to invest in R&D and knowledge sharing as they assess the possibility of transitioning their base chemical production to renewable electricity.

Rongsheng Petrochemical Co.’s Singapore unit has purchased at least 7 million barrels in the spot market so far this month for delivery in December and January, according to traders who asked not to be identified because the information is private. The company is buying up crude to feed a trial run operation of its expanded refinery in Zhejiang province this quarter.

Rongsheng’ Singapore unit purchased medium-sour grades from the Persian Gulf -- the baseload for its refinery -- such as Abu Dhabi’s Upper Zakum, Qatar’s Al-Shaheen and Iraq’s Basrah Light cargoes, according to the traders. The phase 2 expansion of its Zhoushan-based refinery is expected to double processing capacity to 800,000 barrels a day.

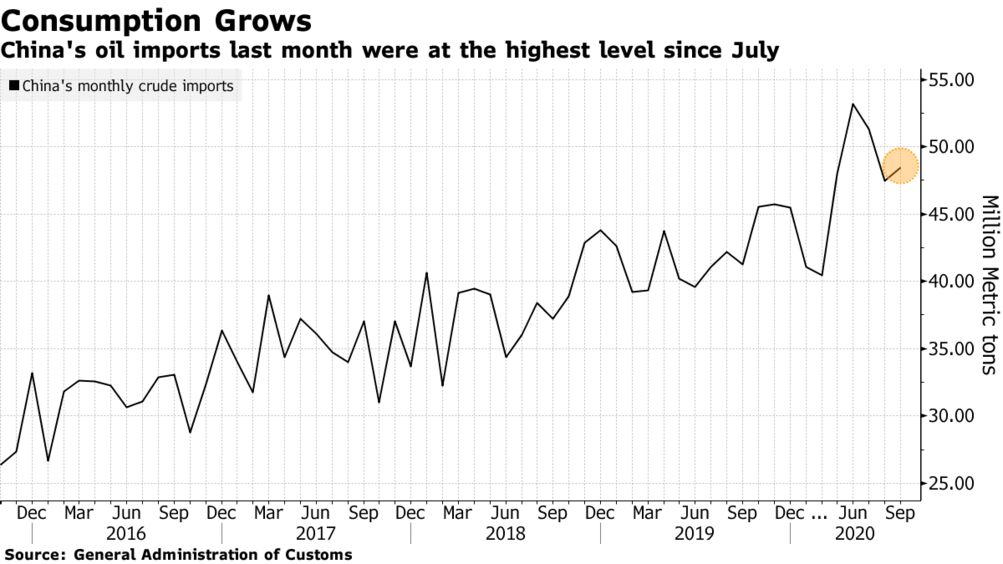

Expansions at state-owned refineries and the launch of new facilities by privately owned Zhejiang Petrochemical Corp further boosted China"s appetite for the fossil fuel.

Oil prices tell some of the story. Early last year, as the economy froze up and people stayed home, crude prices crashed, dragging chemical prices down with them. Petrochemical volumes, however, were relatively strong because some products, such as polyethylene, saw an uptick in demand.

For instance, more than a dozen members of the Global Top 50 have major plastics recycling initiatives. A similar number of companies are looking to make ammonia and hydrogen via water electrolysis rather than from natural gas. Still others are overhauling basic petrochemical processes to make them more energy efficient. Dow, Shell, Sabic, and BASF, for example, are developing ethylene crackers that run on renewable electricity.

Despite the year’s volatility, the survey was marked by few changes. Companies heavily laden with petrochemical operations generally saw declines in sales and fell in the ranking. Companies that make industrial gases or agricultural chemicals tended to rise.

Three companies in the Global Top 50 a year ago didn’t make it this year. Ecolab fell off the list because it divested an oil-field chemical business. SK Innovation and PTT Global Chemical were both victims of declines in petrochemical sales.

Now that it is breaking out chemical sales again, Shell rejoins the Global Top 50 this year after a 5-year hiatus. Rongsheng Petrochemical, which makes polyester chemicals, debuts this year. The former DowDuPont agricultural chemical business, Corteva Agriscience, made the cut as well.

Saudi Arabia’s state oil company, Saudi Aramco, completed its purchase of a 70% stake in the petrochemical maker Sabic in June 2020. The purchase was meant to diversify Aramco, which today depends heavily on oil and gas. But soon after the deal closed, the firms announced they were reevaluating the scope of a planned complex that was to convert 400,000 barrels per day of crude oil into 9 million metric tons (t) per year of petrochemicals. Their new, more modest plan is to build an ethylene cracker and derivatives units that will be integrated with existing Aramco refineries. In another instance of Sabic and Aramco working together, the companies shipped 40 t of ammonia to a power plant in Japan last September. The ammonia is considered “blue” because carbon dioxide emitted during its manufacture was captured and used for enhanced oil recovery and methanol production in Saudi Arabia. In another strategic move, Sabic carved out a stand-alone business that includes its polyphenylene oxide, polyetherimide, and compounding units. The company got the businesses with its purchase of GE Plastics in 2007. Sabic had sought to combine them with Clariant’s masterbatch business, but those talks broke down in 2019.

The $9.4 billion petrochemical complex that Formosa Plastics is planning in St. James Parish, Louisiana, is in hot water. It faces fierce opposition both locally from community organizations worried about pollution and nationally from environmental groups that wish to stop the mounting production of plastics. Sharon Lavigne, head of the local group Rise St. James, recently received the prestigious Goldman Environmental Prize for her efforts, a sign that the Formosa project has high-profile opposition. The project also faces practical hurdles. Notably, the US Army Corps of Engineers suspended a permit for the facility in November. Formosa Plastics had better luck in Point Comfort, Texas, where it started up an ethylene cracker and low-density polyethylene unit last year.

Most large chemical companies nowadays are plunging into plastics recycling to counter public backlash, and LyondellBasell Industries is at the front of the pack. CEO Bob Patel is one of the founders of the Alliance to End Plastic Waste, formed by industry to address the recycling problem. And Lyondell has its own initiatives. It and the waste management firm Suez bought the plastics recycler Tivaco and are combining it with Quality Circular Polymers, a recycling venture Lyondell and Suez started in 2018. Quality Circular has some high-profile clients. For example, Samsonite is using its resin for a line of sustainable suitcases. Meanwhile, Lyondell continues to grow its core petrochemical business, often on the cheap. In December, the firm bought, for the bargain price of $2 billion, a 50% interest in a new ethylene cracker and two polyethylene plants that the struggling Sasol had built. Similarly, it bought into an ethylene cracker joint venture already under construction in China.

PetroChina will bring a pair of unique petrochemical projects—which cost a total of $2.5 billion—on line later this year. The company is building ethylene crackers in Tarim and Changqing, China, that will use ethane sourced from domestic natural gas fields as their feedstock. These projects wouldn’t be unusual in the US or the Middle East, where oil and natural gas are cheap and plentiful, but ethylene crackers in resource-constrained China are mostly fed with naphtha derived from imported oil. The country also sources petrochemical feedstocks from coal. Both routes to ethylene are relatively expensive and put China at a competitive disadvantage.

Hengli Petrochemical’s growth has been amazing. Last year, the company came out of nowhere to debut at 26 in the Global Top 50. In 2020, and despite the COVID-19 pandemic, the Chinese petrochemical maker’s chemical sales grew by a whopping 46%. Construction at an almost unbelievable pace is responsible for this growth. In 2020 alone, Hengli started two large production lines for purified terephthalic acid (PTA), a polyester raw material, in Dalian, China. The lines, which use technology from Invista, bring Hengli’s PTA capacity to 12 million metric tons (t) per year. In November, Hengli signed a licensing agreement, also with Invista, for two more PTA lines at its site in Huizhou, China. In addition, the company plans to build a plant in Dalian to make a biodegradable plastic from PTA, adipic acid, and 1,4-butanediol. Hengli says the plant will have 450,000 t of annual capacity, a large figure for a biodegradable plastic.

The Japanese chemical maker has emphasized green projects of late. In June, it signed an agreement to use Ginkgo Bioworks’ synthetic biology capabilities to improve the production of an undisclosed biobased chemical and to make other Sumitomo Chemical products. Sumitomo’s similar relationship with Zymergen resulted in a biobased film for displays and touch screens. Sumitomo is also building a pilot plant in Chiba, Japan, that will make ethylene from ethanol supplied by Sekisui Chemical. In addition, Sumitomo is planning a facility in Singapore that will make methanol from carbon dioxide and hydrogen. To investigate even more technologies with low environmental impact, Sumitomo is building a research facility in Chiba.

Many people would think of Dow and BASF as the technology giants in industrial chemistry. But Braskem, a Brazilian petrochemical maker, is a technological heavy hitter too. It is partnering with the University of Illinois Chicago on a route to ethylene based on the electrochemical reduction of carbon dioxide from flue gas. At its chlor-alkali complex in Maceió, Brazil, Braskem will host a pilot plant to make ethylene dichloride using a novel process developed by the start-up Chemetry. In this energy-saving process, called eShuttle, chloride ions react with cuprous chloride (CuCl) to form cupric chloride (CuCl2), which reacts with ethylene to form the polyvinyl chloride raw material. In Pittsburgh, Braskem recently completed a $10 million expansion of its technology and innovation center to allow work on recycling, 3D printing, and catalysis.

Recent years have seen Chinese petrochemical producers, often involved in the polyester supply chain, join the Global Top 50. Hengli Petrochemical is one of those firms. And now Rongsheng Petrochemical is another. The company is one of the largest producers of purified terephthalic acid in the world, with 13 million metric tons of capacity at plants in Dalian, Ningbo, and Hainan, China. It also makes polyester resin and fiber. It is an investor in Zhejiang Petrochemical, a large oil refinery and petrochemical complex that is currently starting up.

Sustainability continues to be a focus for the Austrian petrochemical maker. In June, the company signed an agreement to buy oil from Renasci Oostende Recycling, which uses a thermal process to break down postconsumer plastic. Borealis will turn this feedstock into plastics again at its complex in Porvoo, Finland. Borealis also started up a demonstration unit at its polyethylene plant in Antwerp, Belgium, to test a heat-recovery technology developed by the start-up Qpinch. The technology is modeled on the adenosine triphosphate–adenosine diphosphate cycle in biology. Separately, Borealis put its fertilizer business up for sale in February.

Sasol ended a saga in November when it started up a low-density polyethylene plant in Lake Charles, Louisiana. The unit was the last of the plants the South African company built as part of a $12.8 billion petrochemical complex. The project went $4 billion over budget, leading to the ouster of its co-CEOs. To strengthen its balance sheet, Sasol aims to divest $6 billion in assets. To that end, the company formed a joint venture with LyondellBasell Industries to run the ethylene cracker and two polyethylene plants it built in Lake Charles, essentially selling half these operations for $2 billion. Sasol is keeping alcohols, ethylene oxide and ethylene glycol, and ethoxylation plants at the site. Separately, Sasol sold its 50% interest in the Gemini HDPE high-density polyethylene joint venture with Ineos for $400 million.

8613371530291

8613371530291