rongsheng petrochemical singapore pte ltd bloomberg price

With assistance from Javier Blas. To contact the reporters on this story: Serene Cheong in Singapore at scheong20@bloomberg.net; Alfred Cang in Singapore at acang@bloomberg.net. To contact the editors responsible for this story: Pratish Narayanan at pnarayanan9@bloomberg.net Anna Kitanaka.

(Bloomberg) -- As the OPEC+ alliance sticks to its guns in trying to curb oil output to shore up prices, Asian buyers are increasingly looking to the U.S. for a cheaper source of supply.

“It’s difficult for refiners to cope with such volatility,” said John Driscoll, chief strategist at JTD Energy Services Pte in Singapore. “On the other hand, U.S. oil is looking more attractive with lower prices and freight rates.”

The volume of U.S. oil flowing to Asia is already rising. About 49 million barrels are scheduled to arrive next month, compared with 27 million barrels each in May and June, figures from Vortexa Ltd. show. Deeper discounts for American crude relative to other benchmark crudes such as Brent are spurring interest from China, said Serena Huang, a senior analyst at the market analytics firm.

China’s Rongsheng Petrochemical Co. bought at least 2 million barrels of the WTI Midland grade for August-September arrival, while South Korean processors including GS Caltex Corp. and SK Innovation Co. purchased U.S. varieties including WTI Midland and Eagle Ford for September. Indian Oil Corp. also snapped up 12 million barrels of American crude this month including Domestic Sweet, Eagle Ford and WTI Midland for delivery early next year.

The spot premium to purchase WTI Midland against its benchmark has risen by about $2 a barrel from a month earlier, while that for Murban has increased by $4 a barrel because of an increase in its official selling price, according to data compiled by Bloomberg.

Anton Wolfsberger is the Vice President, Global Marketing, Packaging & Circular Economy based in Singapore. He is responsible for developing and commercialising new solutions for Borouge’s packaging business, defining and implementing a long-term strategy and developing strategic partnerships across the value chain. He is also the key strategic driver of Borouge’s overall circular economy ambition.

Anoop joined Braemar ACM in 2016 and is based in Singapore. He is responsible for global tanker modelling, forecasting and bespoke research and consultancy work. He is regular presenter at industry conferences, focusing particularly on developments in the oil and tanker sectors. Prior to joining Braemar ACM, Anoop headed the strategy development and performance management team for AET.

Rakhi Rastogi serves as the global head of market research and analysis for Cargill’s Ocean transportation business and Energy activities, based in Singapore.

Rakhi started her career with Cargill as a credit risk analyst in Geneva, Switzerland and later became a global commodity analyst in ferrous markets, moving to Singapore to set up the analytics function for Cargill’s Metals business. She moved in 2017 to lead analytics for Cargill Ocean transportation in APAC and then globally. Last year, she was given the additional portfolio on energy analytics.

Joonas Rauramo is CEO of the transformational technology company Coolbrook, which is on a mission to de-carbonise major industrial sectors such as petrochemicals and chemicals, iron and steel, and cement.

Ashutosh Deshpande works at Essar as Vice President and is responsible for managing commodity risks for Essar’s Stanlow refinery in the UK. He has more than 22 years of experience in trading physical and paper energy markets covering traditional Crude Oil, Petroleum products, Freight, Coal, LNG, as well as, new age Petrochemicals, Biofuels, Renewable Transport Fuel Certificates and Carbon markets.

Sanjay has held various positions in the private and public sector across his career. Prior to joining GCMD, he was the Executive Director of the Singapore Maritime Institute which is responsible for funding maritime research projects with industry and building local capabilities in the maritime sector, an appointment in 2018 after more than 2 years as a Programme Director/Senior Scientist at the Energy Research Institute at the Nanyang Technological University ([email protected]) managing the NRF funded Smart Multi Energy System project.

He is currently a council member of the Sustainable Energy Association of Singapore (2011) and a member of MTI’s Pro-Enterprise Panel (2019). In 2020, he was also appointed to the Management Committee of Ecolabs, The Centre of Innovation for Energy, Advisory Board for Qi Square and District Councillor for the Central Singapore Community Development Council.

Since joining UOP in 1990, Keith has held numerous domestic and international positions across a broad range of manufacturing, technical and business management roles. Keith holds 31 patents and 20 industry publications. He has a strong background in both Refining and Petrochemicals and is driving UOP’s thought leadership for the Refinery of the Future.

He handles responsibility in the role of Head- Crude Oil and Products trading at HMEL (Refinery and Petrochemical company in India). He holds a B Tech degree in electrical engineering with further training in Marketing management at IIM Bangalore. An accomplished professional in area of international oil trading with 25+ years of industry experience. Prior to joining HMEL, he has worked at Reliance in their refinery, marketing and supply and trading departments.

Mathew George is General Manager (Corporate Planning & Economic Studies) at Indian Oil Corporation in New Delhi. An Indian Oil veteran of 35 years, Mathew has held a number of key assignments at Indian Oil, including heading the polymer marketing group, petrochemical exports group besides heading the lubricants group at subsidiary company Lanka IOC in Colombo, and assignments spread across many locations in the lubricants and aviation departments. In the field of petrochemicals he has handled polymers, PX, PTA, benzene, LAB, glycols and butadiene business. A well-known supply chain and ERP/CRM expert and analyst, he also has core experience in ship chartering for chemicals and petroleum. Mathew has been a regular speaker at international conferences in the areas of petrochemical feedstocks, polymers, ERP, CRM, detergents and benzene. He has also been a guest faculty at the Indian Institute of Management in Bangalore, taking the course Business in a World Without Borders –Bridging the Cultural and Linguistic Divide.

Michael joined OMV in 2007 in the Corporate Strategy department after 6 years with Accenture in the strategy consulting practice. In his career at OMV he was so far Counselor to the CEO, Head of Business Development Refining & Petrochemicals and Vice President for Crude & Risk Management.

She has 36 years’ experience across varied segments of oil & gas Industry encompassing operating, regulatory, and policy aspects of upstream and downstream industry. Prior to joining as Director (Finance)-ONGC, Ms. Jaspal was serving as Director (Finance) since October 2019 in Mangalore Refinery and Petrochemicals Ltd (MRPL)- Schedule ‘A’ CPSE and subsidiary of ONGC. She was the First ever woman Functional Director on the Board of MRPL. She was instrumental in the merger of OMPL with MRPL, paving the way for synergy and integration benefits for the ONGC Group.

She is also a Director on the Board of Mangalore Refinery and Petrochemicals Limited (MRPL), ONGC Tripura Power Company Limited (OTPC), Petronet Mangalore Hassan Bangalore Limited (PMHBL), ONGC Petro additions Limited(OPaL) and Mangalore SEZ Limited.

Qiunan Wu is the Chief Economist at PetroChina International Co., Ltd, covering market analysis and strategy research. He is also the Deputy General Manager of PetroChina International (Singapore) Pte Ltd in Research and Information Technology.

He was the General Manager of PetroChina International (Middle East) Company Limited, in charge of developing and maintaining the business relation with producers in the region. Before this, he was working as Deputy General Manager with Saudi Petroleum Beijing Ltd, a subsidiary of Saudi Aramco in China. He has worked in China University of Petroleum, Beijing, as a Professor and Deputy Head in Faculty of Business Administration.

Chua Sok Peng is the lead petrochemical analyst at Refinitiv Oil Research in Asia. She has been in the petrochemical price reporting industry since 2008 and had worked at Platts, The Petrochemical Standard and IHS Markit.

As associate director at IHS Markit, from 2016-2021. Sok Peng revamped the Asia aromatics spot price assessment methodology to align it with current market practices. With Refinitiv since 2022, Sok Peng leads the team in providing fundamental assessments of cargo flows and forward curves for petrochemicals and LPG.

With more than 28 years of experience in Petroleum Refinery and Petrochemical industry, Rajesh has been involved in various functions in Project Design Engineering & Execution, Operations and Acquisitions.

He has been with Reliance Industries for over 21 years initially at Jamnagar Refinery in its Fluidised Catalytic Cracker (FCC) Unit during the commissioning & operation stage. Subsequently he moved to Petrochemical Businesses in Mono Ethylene Glycol (MEG) and is currently heading the (Olefins) Cracker Business. He also has brief exposure to upstream energy business and execution of Merger and Acquisition deals in Oil & Gas and Mining Business in Latin America.

Cracker Business involves feedstock and plant optimisation across Crackers in Reliance - Naphtha, Gas & now Refinery Offgas Crackers and integrating its operation with upstream Refinery & Gas and downstream Petrochemical business.

Expertise in building industrial plants in Indonesia and Southeast Asia. Experienced in Project development and implementation of Fertilizer plants, Petrochemical plants, Power plants, Oil & Gas facilities, and Refineries.

He has held various senior positions in oil trading in Sinochem and ChinaOil (Petrochina Internation). Before Rongsheng, he was an associate director with Macquarie and has acquired more than 20 years of experiences in oil industry.

Over the last 15 years with SGX, William has overseen the development of several commodity derivative products in the petrochemical, freight and electricity markets. As a product manager, he is responsible for the end-to-end product development process, from market research, product design and listing, to industry education, driving the products’ adoption and sustained growth. He was also part of several digital platform projects, such as the online electricity procurement platform as well as the OTC trade registration system. William holds degrees in electrical engineering and business.

Galid Lahdahda is a Dutch national who has been living and working in Asia for over 10 years. He started his career 2 decades ago with ABN AMRO Bank where he was working with its large European Energy and Commodity clients. After moving to Singapore to join Standard Chartered Bank’s regional Oil & Gas Group, he has been specializing in providing financial services to companies that operate in the oil and gas and wider energy sector.

Ganesh Gopalakrishnan is the Global Head for Petrochemicals Trading for TotalEnergies and oversees teams in Singapore, Shanghai, Geneva and Houston. He started as a Technical service Engineer in Singapore and after multiple roles, moved to the USA to manage Styrene and Aromatics businesses for the Americas. He later moved to Hong Kong to start up the Petrochemical marketing and trading activity for Asia in 2012. He has been with the company for 25 years and is now based in Singapore, managing the global trading activities and price risk management for Petrochemicals.

Vandana Hari is Founder & CEO of Vanda Insights, a Singapore-based provider of global oil markets macro-analysis. She has 25 years of experience providing intelligence on the global energy markets to stakeholders in the petroleum industry, policy-makers, and wealth managers.

Before launching Vanda Insights in 2016, Vandana served in leadership positions at S&P Global Platts, a leading information agency for global energy, petrochemicals, metals and agricultural markets.

Russel has over 30 years’ experience within the energy industry, joining Vitol in 1993 from BP. He has held a number of trading and management roles in Singapore and London.

For 2 years, Ching also supported The National Kidney Foundation in Singapore, where she led the implementation and growth of the corporate sponsorship department.

Dave Ernsberger is Head of Market Reporting & Trading Solutions for S&P Global Commodity Insights. Based in London, Dave assumed overall responsibility for Platts Western hemisphere energy news and pricing across oil, generating fuels and petrochemicals in November 2016 and is a member of the Platts Executive Committee.

Prior to this role, Dave was Global Head of Oil Content for two years. Before relocating to London in 2010, Dave was Senior Editorial Director for Asia, managing Platts’ editorial and analytical groups in Singapore, Japan, Australia, the Philippines, and China.

Garrie Li, Vice President, Industry Executive Advisory Asia, has 39 years of experience in the chemical industry. He began his career with Dow Chemical in Hong Kong and held marketing and management positions in Hong Kong, Canada, Singapore, and Thailand, managing products including membranes, epoxy resins, cracker feedstocks, olefins, and aromatics.

After leaving Dow in 2004, he conducted a strategic study for Methanex Corporation in China. Garrie joined CMAI in Singapore in 2005, launched and led the Asia Light Olefins market advisory service, then transited into consulting and was appointed Managing Director of CMAI Asia. He joined BASF in Singapore 2007 and held management positions in Singapore and then Hong Kong, managing products such as steam cracker products, isocyanates, and polyamides in Asia Pacific. Garrie retired from BASF as Vice President, Polyamides & Precursors Asia Pacific in 2018, and joined IHS Markit, now part of S&P Global, in his current position in 2020.

Jenny Yang, Senior Director, S&P Global Commodity Insights, leads the practice on Greater China’s natural gas and low-carbon gases. Based in Singapore, Ms. Yang focuses on China’s gas and power market fundamentals and policy analysis. Her recent research includes China’s hydrogen policies and market development progress, energy market reforms, air pollution control and environmental policies and the implications on energy demand, LNG procurement strategies, and the impacts of Chinese energy policies and demand on the global market. She also has extensive knowledge of electricity load forecast, peak demand management, pricing and structuring of electricity products, power retail operations, and electricity market deregulation.

JY Lim is currently Advisor of Asia-Pacific Oil Markets at Platts Analytics, a part of S&P Global Commodity Insights in Singapore. Part of his role is to develop Platts Analytics’ outlook for Asian crude and product markets. This includes analysis of refining capacity and margins, regional product pricing and cracks, regional crude and product flows and inventories, as well as various topics impacting product demand. He joined PIRA before it was acquired by Platts. JY held positions with other energy consulting firms, including FGE and KBC, with a similar focus on Asian oil markets.

Currently based in Singapore, Kang is in the S&P Global Commodity Insights leadership team and leading a team of global macro, demand and Asia analysts.

Mr. Barrow is responsible for Platts and IHS Markit’s research of crude oil, NGLs, refining, biofuels and petrochemical feedstocks. He also has responsible for joint mobility research offerings with S&P Mobility. Kurt oversees a global team of experts providing forecast views on market fundamentals and transition scenarios. He writes on a range of topics and supports executive and corporate boards with views on downstream markets and strategy and how to navigate the energy transition. Mr. Barrow began his career as a refining engineer at Exxon and was a partner at Purvin & Gertz. He holds a Bachelor of Science in mechanical engineering from Kansas State University and an MBA from the University of Houston.

Mr. Larry Tan heads S&P Chemicals Insight APAC Team. He is based in Singapore. Larry has been in the oil and petrochemical industry for over 38 years. His current role is to help downstream companies shape their strategic growth options in the chemicals sector through providing data, analytics and insights.

He past work has been in downstream refinery to chemicals like olefins and aromatics petrochemicals, polymers, and derivatives. He has extensive experience in the development and strategic review of business plans, competitor analysis, feedstock supply strategy, development of sales & marketing strategies, identification of new product opportunities, price forecast and strategies, technical and financial assessment of new ventures/ technologies, and bespoke commercial competency skills equipping training workshops. He is frequently invited to speak at both international and regional conferences.

Pradeep Rajan leads the team of editors based in Singapore who are responsible for Platts coverage of the Asia Pacific shipping markets. He was the first tanker market editor to join the team, and was closely involved in the launch of the Dry Freight Wire – Platts’ first publication covering Capesize, Panamaz, Supramax, Handymax and Handysize segments.

Premasish Das leads S&P Global oil market downstream research activities for Asia, the Middle East, and Africa. He is responsible for the regional short-term and long-term crude oil and refined product supply, demand, price and margin outlooks, and detailed downstream market research. In addition, Mr. Das is leading the global and regional petrochemical feedstock research activities. Das is actively involved in consulting as well and advises clients on strategic studies, market studies, and commercial and technical assessments.

Before joining the firm, Mr. Das worked for ExxonMobil, Singapore, and NOCIL, India in various technical, commercial, and leadership assignments. The roles include refining/ petrochemical technical support, site-level utility and energy management, and regional market advisory. Mr. Das was responsible for analyzing business opportunities and developing and implementing strategies to improve business line profitability.

Most recently, he was at Bloomberg Intelligence and earlier headed Drewry Financial Research Services Ltd. He has also worked as senior equities analyst at RS Platou Markets and Nomura.

He joined Purvin & Gertz in 2005, which was acquired by IHS Markit in 2011, and in turn acquired by S&P Global in 2022 and is based at their Singapore office. Mr. Narayanaswamy has more than 30 years of diverse oil industry experience spanning both refining and petrochemicals.

He previously had Lube basestock Operations and Process Engineering, Production Planning, Asia Pacific Petrochemical Feedstocks Economics and Optimization, and Manufacturing Advisor for Aromatic facilities globally with increasing responsibilities at ExxonMobil, Singapore where he worked for 11 years. Prior to that, he worked at Hindustan Petroleum at their Mumbai refinery, India.

Samar Niazi is the Managing Editor for aromatics with the Asia Petrochemicals team, based out of Singapore for S&P Global Platts, a leader in commodities benchmarks worldwide. She leads a team that covers aromatics benchmark markets including paraxylene, benzene, mixed xylenes, etc. She was previously handling multiple agriculture markets in Asia. She has worked at a major commodities trading firm handling oil markets.

Vanessa joined S&P Global Platts in 2004 working as an oil reporter in London moving to Singapore in 2012 joining the Platts’ Price Group as an oil and shipping methodology and operations specialist.

Vanessa moved to her role as Editorial Director, Petrochemicals Asia in November 2017. Prior to joining S&P Global Platts Vanessa was an oil broker, broking bunker fuel and jet fuel in Europe for 8 years.

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

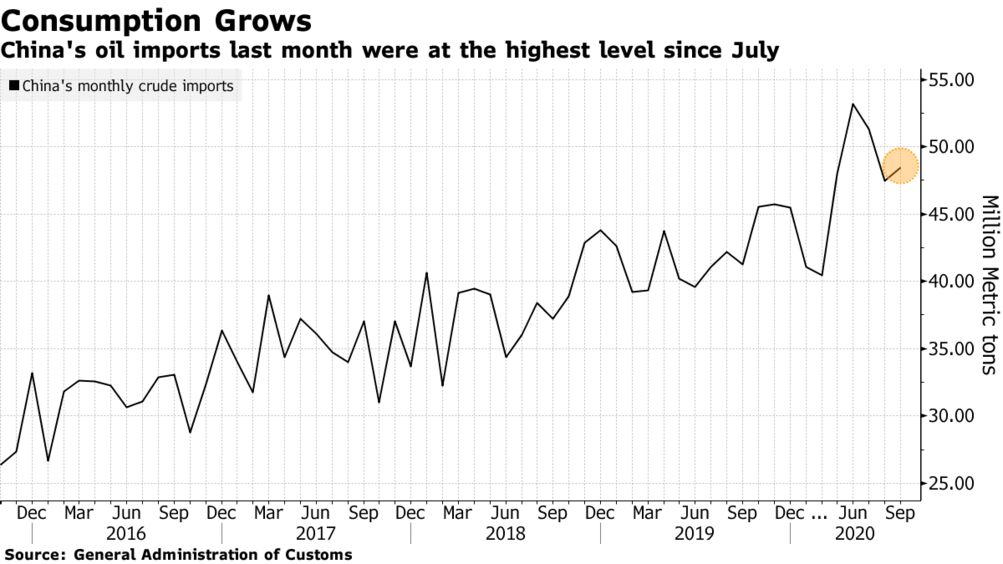

(Bloomberg) — China’s independent refiners burst onto the international oil market scene only a couple of years ago and lifted the nation past the U.S. as the world’s No. 1 crude buyer. Now, a new generation of firms building some of the globe’s biggest plants are threatening to eclipse them.

The original set of private processors, known as teapots, is clustered in the eastern Shandong province, and operate relatively small refineries that pump out fuels such as gasoline and diesel. By contrast, the budding giants supported by the regional governments in Zhejiang and Liaoning will focus on making petrochemicals — the building blocks of everything from sportswear to soda cans and Star Wars figures.

At last week’s Asia Pacific Petroleum Conference in Singapore, one of the industry’s largest gatherings, traders and company executives were speculating about how the upcoming Chinese mega refineries would shake up oil markets worldwide just as the smaller plants did. Saudi Arabia, OPEC’s largest producer, broke with tradition to sell a test cargo to one of the teapots, and the world’s top oil traders such as Trafigura Group have also sought to supply the companies. The refiners bought U.S. crude as well.

“Independent refiners in Shandong think of themselves as wolves, alongside tigers that are the national oil companies,” said Zhang Liucheng, vice president of Dongming Petrochemical Group, one of the largest teapot refiners. “But with the emergence of other bigger independents that will soon bring new capacity online, they will become the wolves, while the tigers remain, and we will be the sheep in their presence.”

The facility’s operator, Rongsheng Petrochemical Co., plans to double its capacity by 2020, a move that would make it bigger than energy giant Royal Dutch Shell Plc’s Singapore refinery, the company’s largest, as well as Exxon Mobil Corp.’s Baytown refinery in Texas. It would also rival plants run by India’s Reliance Industries Ltd. and South Korea’s SK Innovation Co.

At full capacity, the mega-complex will be able to produce 10.4 million tons a year of aromatics including paraxylene and 2.8 million tons of ethylene. Gasoline produced at the refinery will be marketed at pump stations operated by Rongsheng’s unit, Zhejiang Petroleum Co.

Hengli Group, another Chinese petrochemical giant, is planning a facility that aims to process 20 million tons in the northern Chinese city of Dalian in Liaoning province. The plan is supported by the country’s economic planner, according to a statement posted on the company’s official website earlier this month.

“The market is closely watching Rongsheng and Hengli as they’re able to accommodate larger vessels, which means it could be more viable to supply long-haul crudes in addition to regional barrels,” said Nevyn Nah, a Singapore-based analyst at industry consultant Energy Aspects Ltd. “The units come at a time when other refineries like Saudi Arabia’s Jazan, Malaysia’s Rapid and Brunei’s Hengyi are expected to be completed, adding to the list of new refinery builds that we’ll see in 2019.”

Rongsheng plans to import crude feedstock via purpose-built wharfs capable of receiving vessels that are of the very large crude carrier class or larger, while Hengli’s terminal will be able to handle VLCCs. The ability to receive bigger tankers will add to the ease and affordability of purchasing oil from farther-away sources such as the Middle East, Europe or the Americas.

Brent crude, the benchmark for more than half the world’s oil, traded at $56.58 a barrel on the London-based ICE Futures Europe Exchange at 1:20 p.m. in Singapore. Prices were at more than $115 a barrel in mid-2014.

8613371530291

8613371530291