rongsheng refinery in stock

China"s economy is recovering from a trough hit in the second quarter, with oil demand expected to rebound next year as Beijing eases COVID-19 restrictions, senior Chinese refining executives said on Wednesday. The recovery will come on the back of an expected contraction in oil demand in the world"s biggest energy consumer in 2022, the first in two decades, as China"s zero-COVID policy ravaged its economy and restricted movements. "This year we have seen the decline of imports of crude oil, first time in many, many years in China," Chen Hongbing, deputy general manager at Rongsheng Petrochemical, told a forum at the 38th Annual Asia Pacific Petroleum Conference (APPEC).

Rongsheng Petro Chemical Co, Ltd. specialises in the production and marketing of petrochemical and chemical fibres. Products include PTA yarns, fully drawn polyester yarns (FDY), pre-oriented polyester yarns (POY), polyester textured drawn yarns (DTY), polyester filaments and polyethylene terephthalate (PET) slivers.

Refinery based crude oil-to-chemicals (COTC) technology involves configuring a refinery to produce maximum chemicals instead of traditional transportation fuels. COTC complexes elevate petrochemical production to an unprecedented refinery scale. Due to the huge scale as well as the amount of target chemicals each COTC complex produces, COTC technology is expected to be disruptive, in terms of abrupt supply increase and price fluctuation, to the global petrochemical industry when each project starts. COTC is happening now with three refinery-PX projects, Hengli (Dalian, China), Zhejiang Phase 1(Zhejiang China), and Hengyi (Brunei) starting in 2019.

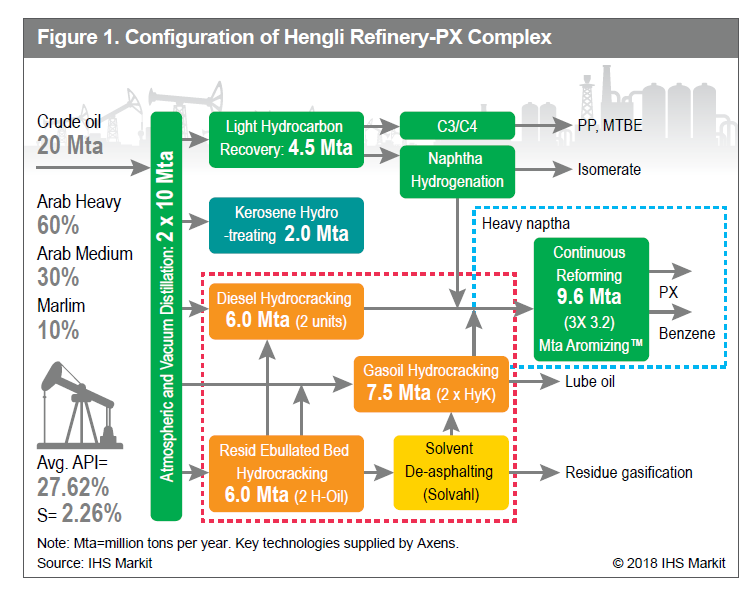

Hengli announced on May 17, 2019 that its COTC refinery-PX complex had achieved full line trial production. The complex is expected to produce 4.34 million tons of PX (paraxylene) per year, in addition to 3.9 million tons of other chemicals. The total chemical conversion per barrel of oil is estimated to be 42%. Hengli’s configuraton is mainly based on hydrocracking of diesel, gas oil, and vacuum residue with technologies licensed from Axens. PEP Report 303, published in December 2018, analyzed Hengli Petrochemical’s refinery-PX complex, provided PEP’s independent analysis of the process configuration and production economics.

Zhejiang Petroleum and Chemical (ZPC) Co.’s COTC refinery-PX project has two phases. Phase 1 is close to completion with several units in the intial trial operation. During the recent visit by S&P Global on May 23, 2019 to Rongsheng, the majority share holder of ZPC, said that full operation is expected in the third quarter of 2019. When completed, Phase 1 is expected to produce 4.0 million tons of PX, 1.5 million tons of benzene, 1.4 million tons of ethylene, and other downstream petrochemicals. The total chemical conversion per barrel of oil is about 45%.

ZPC’s configuration is mainly based on diesel hydrocracking with technology licensed from Chevron and gasoil hydrocracking with technology licensed from UOP. For vacuum residue upgradation, ZPC uses Delayed Coking (open art) and Residue Desulfurization followed by Residue Fluid Catalytic Cracking (RFCC) licensed from UOP. The Phase 2 project construction has also started, and when completed it will have a similar scale to Phase 1. However, the Phase 2 refinery configuration will be further enhanced by UOP to produce more mixed feeds to support two word-scale steam crackers as compared to one cracker for Phase 1. The total chemical conversion has been announced to increase to 50%, up from 45% in Phase 1. The number of downstream petrochemical units is also expected to differ from Phase 1.

The objective of this report (PEP 303A) is to analyze ZPC’s Phase 1 refinery-PX complex. Although Zhejiang Phase 1 project, as announced, includes a steam cracker and fifteen downstream petrochemical units, PEP 303A analysis will draw a boundary before steam cracker to focus on PX production economics to be compared to that of Hengli’s complex.

Section 1 introduces various crude oil-to-chemicals (COTC) approaches including directly feeding a light crude to steam cracker and configuring a refinery to produce maximum chemicals. In this section, we have discussed the merits and impacts of each approach, and why COTC is different from the conventional state-of-art refinery-petrochemical integration. We have elaborated the potential impact and implications of COTC on global petrochemical production.

Section 2 summarizes the overall PX production economics of Zhejiang Phase 1 refinery-PX complex. The economics are evaluated under a wide range of oil price scenarios and compared with Hengli’s project.

"The toughest moment has passed. Restoring consumers" confidence is what the government needs to do and is doing," said Sun Xin, a director with Shenghong Petrochemical International, a trading desk of the greenfield Shenghong Petrochemical refinery complex in Jiangsu province.

"We have seen some green shoots already in China"s economy. Especially in September, we see more congestion in terms of transportation. We see a better run rate at the refineries," said Chen Hongbin, deputy GM of Rongsheng Petrochemical (Singapore).

Rongsheng is a trading arm of the privately-held refining complex Zhejiang Petroleum & Chemical, which restarted its 200,000 b/d No.4 CDU in last week after operations were suspended for seven months, and lifted run rates to around 95% of its nameplate capacity of 800,000 b/d from 83% in August, S&P Global data showed.

He added that ZPC always takes economics as the most important factor in deciding when and which product to export. The refinery holds 2.36 million mt of gasoline, gasoil and jet fuel export quotas, and was expected to gain a further 600,000 mt in the potential new allocation.

BEIJING (Reuters) - Rongsheng Petrochemical , the listed arm of a major shareholder in one of China"s biggest private oil refineries, expects demand for energy and chemical products to return to normal in the country in the second half of this year.

Rongsheng expects to start trial operations of the second phase of the refining project, adding another 400,000 bpd of refining capacity and 1.4 million tonnes of ethylene production capacity in the fourth quarter of 2020.

"We expect the effects of the coronavirus pandemic on energy and chemicals to have basically faded in spite of the possibility of new waves of outbreak," said Quan Weiying, board secretary of Rongsheng, in response to Reuters questions in an online briefing.

But Li Shuirong, president of Rongsheng, told the briefing that it was still in the process of applying for an export quota and would adjust production based on market demand. (Reporting by Muyu Xu and Chen Aizhu; Editing by Jacqueline Wong)

Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities in support of ADNOC’s 2030 growth strategy.

The companies will examine opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates (UAE) and the supply of liquified natural gas (LNG) to Rongsheng.

Under the terms of the deal, the companies will also study chances to increasing the volume and variety of refined product sales to Rongsheng as well as ADNOC’s participation as the China firm’s strategic partner in refinery and petrochemical projects. This could include an investment in Rongsheng’s downstream complex.

In return, Rongsheng will also look at investing in ADNOC’s downstream industrial ecosystem in Ruwais, UAE, including a proposed gasoline-to-aromatics plant as well as reviewing the potential for ADNOC to supply LNG to Rongsheng for use within its own complexes in China.

Rongsheng’s chairman Li Shuirong added that the cooperation will ensure that its project, which will have a refining capacity of up to 1 million bbl/day of crude oil, has adequate supplies of feedstock.

2021 marked the start of the central government’s latest effort to consolidate and tighten supervision over the refining sector and to cap China’s overall refining capacity.[14] Besides imposing a hefty tax on imports of blending fuels, Beijing has instituted stricter tax and environmental enforcement[15] measures including: performing refinery audits and inspections;[16] conducting investigations of alleged irregular activities such as tax evasion and illegal resale of crude oil imports;[17] and imposing tighter quotas for oil product exports as China’s decarbonization efforts advance.[18]

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

As China’s independent oil refining hub, Shandong is the bellwether for the rationalization of the country’s refinery sector. Over the years, Shandong’s teapots benefited from favorable policies such as access to cheap land and support from a local government that grew reliant on the industry for jobs and contributions to economic growth.[22] For this reason, Shandong officials had resisted strictly implementing Beijing’s directives to cull teapot refiners and turned a blind eye to practices that ensured their survival.

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

Saudi Aramco today signed three Memoranda of Understanding (MoUs) aimed at expanding its downstream presence in the Zhejiang province, one of the most developed regions in China. The company aims to acquire a 9% stake in Zhejiang Petrochemical’s 800,000 barrels per day integrated refinery and petrochemical complex, located in the city of Zhoushan.

The first agreement was signed with the Zhoushan government to acquire its 9% stake in the project. The second agreement was signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, who are the other shareholders of Zhejiang Petrochemical. Saudi Aramco’s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical’s large crude oil storage facility to serve its customers in the Asian region.

Phase I of the project will include a newly built 400,000 barrels per day refinery with a 1.4 mmtpa ethylene cracker unit, and a 5.2 mmtpa Aromatics unit. Phase II will see a 400,000 barrels per day refinery expansion, which will include deeper chemical integration than Phase I.

In Asia and the Middle East, at least nine refinery projects are beginning operations or are scheduled to come online before the end of 2023. At their current planned capacities, they will add 2.9 million barrels per day (b/d) of global refinery capacity once fully operational.

The scheduled expansions follow a period of reduced global refining capacity. Net global capacity declined in 2021 for the first time in 30 years, according to the IEA. The new refinery projects would increase production of refined products, such as gasoline and diesel, and in turn, they might reduce the current high prices for these products.

China’s refinery capacity is scheduled to increase significantly this year. The Shenghong Petrochemical facility in Lianyungang has an estimated capacity of 320,000 b/d, and they report that trial crude oil-processing operations began in May 2022. In addition, PetroChina’s 400,000 b/d Jieyang refinery is expected to come online in the third quarter of 2022. A planned 400,000 b/d Phase II capacity expansion also began operations earlier this year at Zhejiang Petrochemical Corporation’s (ZPC) Rongsheng facility. More information on these expansions is available in our Country Analysis Executive Summary: China.

Outside of China, the 300,000 b/d Malaysian Pengerang refinery (also known as the RAPID refinery) restarted in May 2022 after a fire forced the refinery to shut down in March 2020. In India, the Visakha Refinery is undergoing a major expansion, scheduled to add 135,000 b/d by 2023.

New projects in the Middle East are also likely to be an important source of new refining capacity. The 400,000 b/d Jizan refinery in Saudi Arabia reportedly came online in late 2021 and began exporting petroleum products earlier this year. More recently, the 615,000 b/d Al Zour refinery in Kuwait—the largest in the country when it becomes fully operational—began initial operations earlier this year. A new 140,000 b/d refinery is scheduled to come online in Karbala, Iraq, this September, targeting fully operational status by 2023. A new 230,000 b/d refinery is set to come online in Duqm, Oman, likely in early 2023.

These estimates do not necessarily include all ongoing refinery capacity expansions. Moreover, many of these projects have already been subject to major delays, and the possibility of partial starts or continued delays related to logistics, construction, labor, finances, political complications, or other factors may cause these projects to come online later than estimated. Although the potential for project complications and cancellations is always a significant risk, these projects could otherwise account for an increase of nearly 3.0 million b/d of new refining capacity by the end of 2023.

Abu Dhabi National Oil Company (ADNOC) has signed a broad framework agreement with China’s Rongsheng Petrochemical to explore domestic and international growth opportunities in support of ADNOC’s 2030 growth strategy.

The companies will examine opportunities in the sale of refined products from ADNOC to Rongsheng, downstream investment opportunities in both China and the United Arab Emirates (UAE) and the supply of liquified natural gas (LNG) to Rongsheng.

Under the terms of the deal, the companies will also study chances to increasing the volume and variety of refined product sales to Rongsheng as well as ADNOC’s participation as the China firm’s strategic partner in refinery and petrochemical projects. This could include an investment in Rongsheng’s downstream complex.

In return, Rongsheng will also look at investing in ADNOC’s downstream industrial ecosystem in Ruwais, UAE, including a proposed gasoline-to-aromatics plant as well as reviewing the potential for ADNOC to supply LNG to Rongsheng for use within its own complexes in China.

Rongsheng’s chairman Li Shuirong added that the cooperation will ensure that its project, which will have a refining capacity of up to 1 million bbl/day of crude oil, has adequate supplies of feedstock.

Rongsheng Petrochemical (brand value up 43% to US$2.3 billion) achieved very strong growth this year, rising two places in the chemicals ranking and jumpingfrom 10th to 8th place amongst global chemicals brands. The Chinese brand owns various globally significant facilities, including an integrated refining-petrochemical complex with the refining capacity of 40 million tons per annum.

8613371530291

8613371530291