rongsheng refinery start for sale

SINGAPORE, Oct 14 (Reuters) - Rongsheng Petrochemical, the trading arm of Chinese private refiner Zhejiang Petrochemical, has bought at least 5 million barrels of crude for delivery in December and January next year in preparation for starting a new crude unit by year-end, five trade sources said on Wednesday.

Rongsheng bought at least 3.5 million barrels of Upper Zakum crude from the United Arab Emirates and 1.5 million barrels of al-Shaheen crude from Qatar via a tender that closed on Tuesday, the sources said.

Rongsheng’s purchase helped absorbed some of the unsold supplies from last month as the company did not purchase any spot crude in past two months, the sources said.

Zhejiang Petrochemical plans to start trial runs at one of two new crude distillation units (CDUs) in the second phase of its refinery-petrochemical complex in east China’s Zhoushan by the end of this year, a company official told Reuters. Each CDU has a capacity of 200,000 barrels per day (bpd).

Zhejiang Petrochemical started up the first phase of its complex which includes a 400,000-bpd refinery and a 1.2 million tonne-per-year ethylene plant at the end of 2019. (Reporting by Florence Tan and Chen Aizhu, editing by Louise Heavens and Christian Schmollinger)

BEIJING (Reuters) - Rongsheng Petrochemical , the listed arm of a major shareholder in one of China"s biggest private oil refineries, expects demand for energy and chemical products to return to normal in the country in the second half of this year.

Rongsheng expects to start trial operations of the second phase of the refining project, adding another 400,000 bpd of refining capacity and 1.4 million tonnes of ethylene production capacity in the fourth quarter of 2020.

"We expect the effects of the coronavirus pandemic on energy and chemicals to have basically faded in spite of the possibility of new waves of outbreak," said Quan Weiying, board secretary of Rongsheng, in response to Reuters questions in an online briefing.

But Li Shuirong, president of Rongsheng, told the briefing that it was still in the process of applying for an export quota and would adjust production based on market demand. (Reporting by Muyu Xu and Chen Aizhu; Editing by Jacqueline Wong)

China"s private refiner Zhejiang Petroleum & Chemical is set to start trial runs at its second 200,000 b/d crude distillation unit at the 400,000 b/d phase 2 refinery by the end of March, a source with close knowledge about the matter told S&P Global Platts March 9.

ZPC cracked 23 million mt of crude in 2020, according the the source. Platts data showed that the utilization rate of its phase 1 refinery hit as high as 130% in a few months last year.

Started construction in the second half of 2019, units of the Yuan 82.9 billion ($12.74 billion) phase 2 refinery almost mirror those in phase 1, which has two CDUs of 200,000 b/d each. But phase 1 has one 1.4 million mt/year ethylene unit while phase 2 plans to double the capacity with two ethylene units.

With the entire phase 2 project online, ZPC expects to lift its combined petrochemicals product yield to 71% from 65% for the phase 1 refinery, according to the source.

Zhejiang Petroleum, a joint venture between ZPC"s parent company Rongsheng Petrochemical and Zhejiang Energy Group, planned to build 700 gas stations in Zhejiang province by end-2022 as domestic retail outlets of ZPC.

Established in 2015, ZPC is a JV between textile companies Rongsheng Petrochemical, which owns 51%, Tongkun Group, at 20%, as well as chemicals company Juhua Group, also 20%. The rest 9% stake was reported to have transferred to Saudi Aramco from the Zhejiang provincial government. But there has been no update since the agreement was signed in October 2018.

The construction works started recently. The volumes from the additional capacity are expected to be available from the end of 2021 and are dedicated to mainly serve European customers as well as the rapidly growing Asian market.

As MRC wrote previously, BASF, the world"s petrochemical major, restarted its No. 1 steam cracker on September 30, 2019, following a maintenance turnaorund. The plant was shut for maintenance in mid-August, 2019. Located at Ludwigshafen in Germany, the No. 1 cracker has an ethylene production capacity of 235,000 mt/year and a propylene production capacity of 125,000 mt/year.

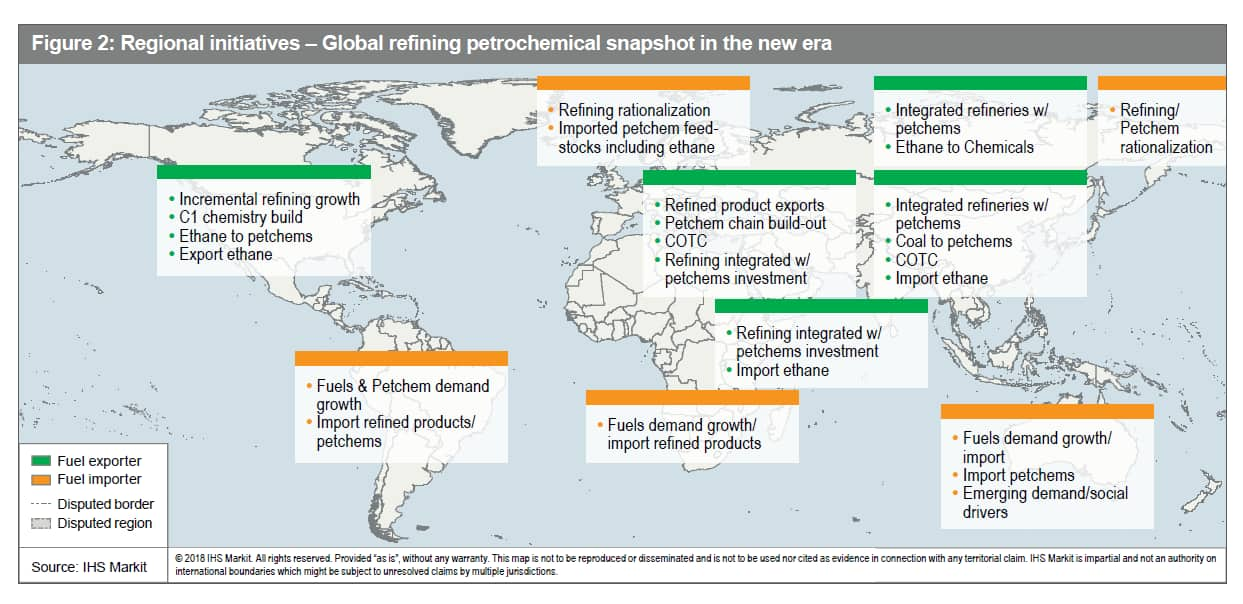

2021 marked the start of the central government’s latest effort to consolidate and tighten supervision over the refining sector and to cap China’s overall refining capacity.[14] Besides imposing a hefty tax on imports of blending fuels, Beijing has instituted stricter tax and environmental enforcement[15] measures including: performing refinery audits and inspections;[16] conducting investigations of alleged irregular activities such as tax evasion and illegal resale of crude oil imports;[17] and imposing tighter quotas for oil product exports as China’s decarbonization efforts advance.[18]

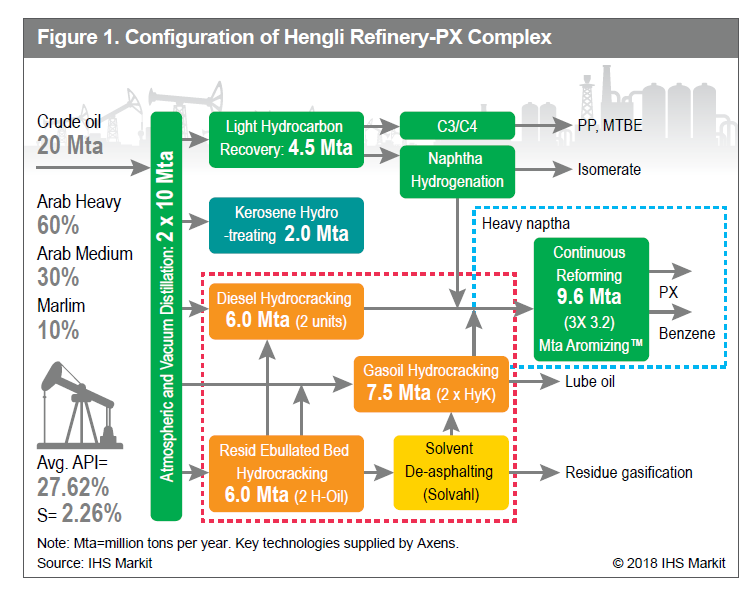

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

As China’s independent oil refining hub, Shandong is the bellwether for the rationalization of the country’s refinery sector. Over the years, Shandong’s teapots benefited from favorable policies such as access to cheap land and support from a local government that grew reliant on the industry for jobs and contributions to economic growth.[22] For this reason, Shandong officials had resisted strictly implementing Beijing’s directives to cull teapot refiners and turned a blind eye to practices that ensured their survival.

But with the start-up of advanced liquids-to-chemicals complexes in neighboring provinces, Shandong’s competitiveness has diminished.[23] And with pressure mounting to find new drivers for the provincial economy, Shandong officials have put in play a plan aimed at shuttering smaller capacity plants and thus clearing the way for a large-scale private sector-led refining and petrochemical complex on Yulong Island, whose construction is well underway.[24] They have also been developing compensation and worker relocation packages to cushion the impact of planned plant closures, while obtaining letters of guarantee from independent refiners pledging that they will neither resell their crude import quotas nor try to purchase such allocations.[25]

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

Saudi Aramco today signed three Memoranda of Understanding (MoUs) aimed at expanding its downstream presence in the Zhejiang province, one of the most developed regions in China. The company aims to acquire a 9% stake in Zhejiang Petrochemical’s 800,000 barrels per day integrated refinery and petrochemical complex, located in the city of Zhoushan.

The first agreement was signed with the Zhoushan government to acquire its 9% stake in the project. The second agreement was signed with Rongsheng Petrochemical, Juhua Group, and Tongkun Group, who are the other shareholders of Zhejiang Petrochemical. Saudi Aramco’s involvement in the project will come with a long-term crude supply agreement and the ability to utilize Zhejiang Petrochemical’s large crude oil storage facility to serve its customers in the Asian region.

Phase I of the project will include a newly built 400,000 barrels per day refinery with a 1.4 mmtpa ethylene cracker unit, and a 5.2 mmtpa Aromatics unit. Phase II will see a 400,000 barrels per day refinery expansion, which will include deeper chemical integration than Phase I.

The 400,000 barrels-per-day oil refinery will be accompanied by two ethylene plants. It will also include an oleflex propane dehydrogenation unit, which is expected to produce 600,000t of polymer-grade propylene.

The integrated refinery and petrochemical project is expected to produce more than 20 petrochemical products such as gasoline, diesel, jet coal, paraxylene, high-end polyolefin, and polycarbonate. Aromatics for plastic resins, films, and fibers will be produced in the first phase, using Honeywell"s UOP technology.

The refinery will utilize three UOP Unicracking process units to convert vacuum gas oil and distillate into petrochemical feedstock. The phase will also include production facilities for aromatics and blend stocks along with normal butane.

China’s Hengli Petrochemical Group will start test-running its new oil refinery in the northeastern city of Dalian on December 15, according to a company statement, slightly behind an earlier timeline of around the end of November.

Once operational, Hengli will become the country’s first privately owned refinery and chemical complex. With a refining capacity of 400,000 bpd of crude oil, the site will rival the largest oil refineries in China, the world’s biggest importer and second-largest consumer of oil.

“Hengli has completed building the 20 million ton per year refinery and chemical complex, with public utilities and auxiliary facilities also ripe for operations,” the firm said in a statement posted on its social media platform late on Wednesday.

Zhejiang Petrochemical Corp, controlled by private chemical group Rongsheng Holdings, is expected to start partial test operations at some units around end of this year and early 2019 at its similar-sized complex.

Chinese private-sector firm Rongsheng has started trial runs at a 400,000 b/d expansion of its ZPC refinery in Zhejiang, which will take total capacity to 800,000 b/d.

Rongsheng held a ceremony to mark the start of the refinery’s second phase this week. ZPC will add two 200,000 b/d crude distillation units (CDUs) in the second phase expansion, the second of which is scheduled to start trial runs in 2021.

The second-phase units are designed to produce 88,000 b/d of gasoline, 32,000 b/d of diesel and 63,000 b/d of jet fuel. The complex is geared towards producing feedstocks for Rongsheng’s petrochemical operations.

Saudi Aramco signed three Memoranda of Understanding (MoUs) on Friday to purchase a 9 percent stake in Chinese Zhejiang Petrochemical"s integrated refinery and petrochemical complex in the city of Zhoushan, and to invest in a retail fuel network in the eastern region of China, the Saudi state-run energy giant announced.

The first agreement was signed with the Zhoushan government to acquire its 9 percent share in the 800,000-barrels-per-day integrated refinery and petrochemical complex, according to the company"s statement.

According to the press release, phase I of the project will include a newly-built 400,000-barrels-per-day refinery with a 1.4 million-metric-tons-per-annum (mmtpa) ethylene cracker unit, and a 5.2 mmtpa aromatics unit. Phase II will see a 400,000-barrels-per-day refinery expansion, which will include deeper chemical integration than phase I, it said.

Abu Dhabi National Oil Company signed an agreement with Rongsheng Petrochemical of China to explore domestic and international opportunities as it seeks to sell more products to customers in East Asia.

"The strategic co-operation with Adnoc will ensure that our ZPC project, which will have a refining capacity of up to 1m barrels per day of crude, has adequate supplies of feedstock," Li Shuirong, chairman of the Rongsheng Group, said.

National oil companies such as Adnoc have started negotiating and signing long-term contracts for products with buyers in East Asia in a push to secure market share and pivot business strategies to focus more on high-value downstream products.

Rongsheng Petrochemical Co., Ltd. is a China-based company principally engaged in the research, development, manufacturing and distribution of refining products, petrochemicals and chemical fibers. Rongsheng has an annual production capability of 2 million tons of aromatic hydrocarbon, over 13 million tons of pure terephthalic acid (PTA), 2 million tons of PET, 1 million tons of POY and FDY, 0.45 millon tons of DTY. Rongsheng‘s total capability of PTA ranks the first of the world. Rongsheng persists in “Two-way of Vertical and Horizontal” development strategy and recently developed a green refining-petrochemical integrated project with a total capacity of 40 million tons per annum, via its subsidiary Zhejiang Petroleum and Chemicals Co., Ltd. (ZPC).

A refinery’s success relies on stable downstream demand, which for Chinese refineries usually comes from their shareholders. Hengli Petrochemical, which has 20 million tons of annual capacity, is majority owned by Hengli Group Co. Ltd., which specializes in producing chemical fibers for which refined oil is a key ingredient. Zhejiang Rongsheng Holding Group, which invests in petrochemical, logistics and real estate businesses, holds a 51% stake in Zhejiang Petrochemical, a refinery with 40 million tons of capacity.

8613371530291

8613371530291