rongsheng shipyard china brands

RUGAO, China/SINGAPORE (Reuters) - Deserted flats and boarded-up shops in the Yangtze river town of Changqingcun serve as a blunt reminder of the area"s reliance on China Rongsheng Heavy Industries Group, the country"s biggest private shipbuilder.A view of the Rongsheng Heavy Industries shipyard is seen in Nantong, Jiangsu province December 4, 2013. REUTERS/Aly Song

The shipbuilder this week predicted a substantial annual loss, just months after appealing to the government for financial help as it reeled from industry overcapacity and shrinking orders. Rongsheng lost an annual record 572.6 million yuan ($92 million) last year, and lost 1.3 billion yuan in the first half of this year.

While Beijing seems intent to promote a shift away from an investment-heavy model, with companies reliant on government cash injections, some analysts say Rongsheng is too big for China to let fail.

Local media reported in July that Rongsheng had laid off as many as 8,000 workers as demand slowed. Three years ago, the company had about 20,000 staff and contract employees. This week, the shipbuilder said an unspecified number of workers had been made redundant this year.

A purpose-built town near the shipyard’s main gate, with thousands of flats, supermarkets and restaurants, is largely deserted. Nine of every 10 shops are boarded up; the police station and hospital are locked.

“In this area we’re only really selling to workers from the shipyard. If they’re not here who do we sell to?” said one of the few remaining shopkeepers, surnamed Sui, playing a videogame at his work-wear store. “I know people with salaries held back and they can’t pay for things. I can’t continue if things stay the same.”

In the shadow of the shipyard gate, workers told Reuters the facility was still operating but morale was low, activity was slowing with the lack of new orders and some payments to workers had been delayed.

“Without new orders it’s hard to see how operations can continue,” said one worker wearing oil-spattered overalls and a Rongsheng hardhat, adding he was still waiting to be paid for September. He didn’t want to give his name as he feared he could lose his job.

“Morale in the office is quite low, since we don’t know what is the plan,” said a Rongsheng executive, who declined to be named as he is not authorized to speak to the media. “We have been getting orders but can’t seem to get construction loans from banks to build these projects.”

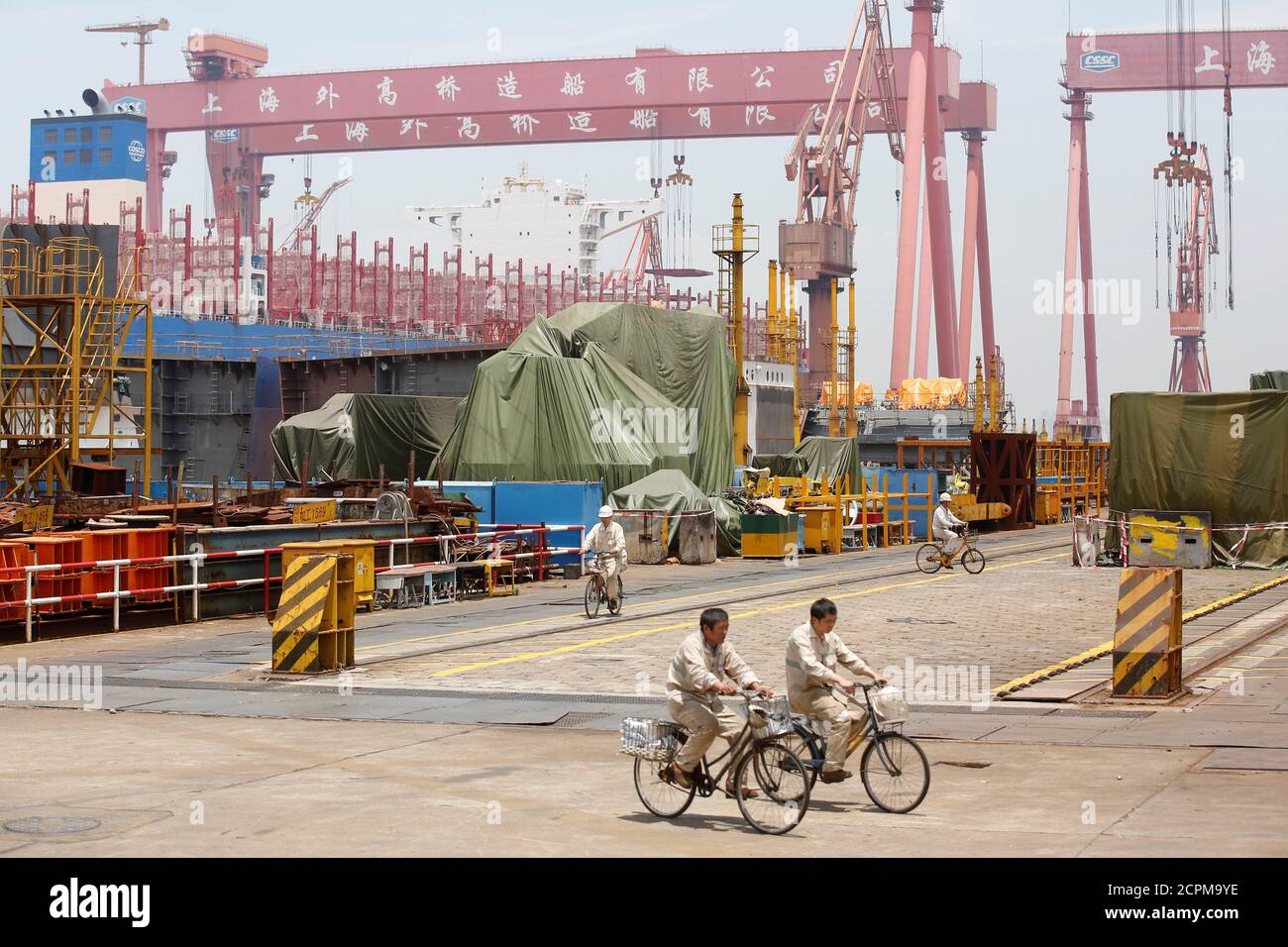

While Rongsheng has won just two orders this year, state-backed rival Shanghai Waigaoqiao Shipbuildinghas secured 50, according to shipbroker data. Singapore-listed Yangzijiang Shipbuildinghas won more than $1 billion in new orders and is moving into offshore jack-up rig construction, noted Jon Windham, head industrials analyst at Barclays in Hong Kong.

Frontline, a shipping company controlled by Norwegian business tycoon John Fredriksen, ordered two oil tankers from Rongsheng in 2010 for delivery earlier this year. It now expects to receive both of them in 2014, Frontline CEO Jens Martin Jensen told Reuters.

Greek shipowner DryShips Inchas also questioned whether other large tankers on order will be delivered. DryShips said Rongsheng is building 43 percent of the Suezmax vessels - tankers up to 200,000 deadweight tons - in the current global order book. That"s equivalent to 23 ships, according to Rongsheng data.

Speaking at a quarterly results briefing last month, DryShips Chief Financial Officer Ziad Nakhleh said Rongsheng was “a yard that, as we stated before, is facing difficulties and, as such, we believe there is a high probability they will not be delivered.” DryShips has four dry cargo vessels on order at the Chinese firm.

Rongsheng declined to comment on the Dryships order, citing client confidentiality. “For other orders on hand, our delivery plan is still ongoing,” a spokesman said.

At least two law firms in Shanghai and Singapore are acting for shipowners seeking compensation from Rongsheng for late or cancelled orders. “I’m now dealing with several cases against Rongsheng,” said Lawrence Chen, senior partner at law firm Wintell & Co in Shanghai.

Billionaire Zhang Zhirong, who founded Rongsheng in 2005 and is the shipyard"s biggest shareholder, last month announced plans to privatize Hong Kong-listed Glorious Property Holdingsin a HK$4.57 billion ($589.45 million) deal - a move analysts said could raise money to plug Rongsheng"s debts.

Meanwhile, Rongsheng’s shipyard woes have already pushed many people away from nearby centers, and others said they would have to go if things don’t pick up. Some said they hoped the local government might step in with financial support.

The Rugao government did not respond to requests for comment on whether it would lend financial or other support to Rongsheng. Annual reports show Rongsheng has received state subsidies in the past three years.

The exodus has left row upon row of deserted apartments, with just a few old garments strewn on the floor and empty name tags to show for what was a bustling community before China’s economic growth began to slow and credit tightened at a time when global shipping, too, turned down.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Chinese private petrochemical group Zhejiang Rongsheng Holding has entered into a framework of agreement with China Shipbuilding Group to build a VLCC fleet.

Under the agreement, Rongsheng will set up a joint venture with CSSC Shipping and order VLCCs with China Shipbuilding Group. The ships will be used for oil transportation from the Middle East to Zhoushan to support the development of Rongsheng’s new petrochemical plant.

While the details of the newbuilding order have not been disclosed, local shipbroking sources tell Splash that the first batch of the order will probably see 10 VLCCs contracted and the whole project could eventually total 30 ships. The ships will be most likely built at Waigaoqiao Shipbuilding, Dalian Shipbuilding Industry and Guangzhou Shipyard International.

HONG KONG/BEIJING, July 8 (Reuters) – An appeal for government financial support from China’s biggest private shipbuilder presents authorities with some stark choices between protecting a big employer and its jobs or letting the firm go under to ease pressure on a sector suffering from overcapacity and sharply falling new orders.

Since Beijing appears intent on telling investors it is serious about changing the investment-led growth model of the world’s second-biggest economy and controlling a credit splurge, it may seem like the writing is on the wall for China Rongsheng Heavy Industries Group.

Yet analysts say the government is more likely than not to judge that Rongsheng, which employs around 20,000 workers and has received state patronage, is too big and well connected to fail.

Supporting Rongsheng will not mean China’s economic reform plans are derailed, they say. Instead, it will mean reforms will be gradual and the government will cherry-pick firms it wants to support, which will exclude the small, private shipbuilders that have been folding in waves.

“Rongsheng is a flagship in the industry,” said Lawrence Li, an analyst with UOB Kay Hian in Shanghai. “The government will definitely provide assistance if companies like this are in trouble.”

Analysts say Rongsheng is possibly the largest casualty of a sector that has grown over the past decade into the world’s biggest shipbuilding industry by construction capacity. Amid a global shipping downturn, new orders for Chinese builders fell by half last year. In Rongsheng’s case, it won orders worth $55.6 million last year, compared with a target of $1.8 billion.

Rongsheng appealed for government aid on Friday, saying it was cutting its workforce and delaying payments to suppliers to deal with tightened cash flow.

In the prospectus for its initial public offer, Rongsheng said it received 520 million yuan of subsidies from the Rugao city government in the southern province of Jiangsu, where the company is based.

The state funds paid for research and development of new types of vessels, and were based in part on the “essential role we play in the local economy”, Rongsheng said.

China’s shipbuilding woes are partly of its own making. A global downturn in demand has hammered the sector since 2008, but a national obsession for global dominance in some industries led China to declare in the early 2000s that it wanted to be the world’s top shipbuilding nation by 2015.

As the world’s largest shipbuilder, it had 1,647 shipyards in 2012, data from China Association of the National Shipbuilding Industry showed. Over 60 percent of its shipbuilders are based in Rongsheng’s province of Jiangsu.

The rapid increase in capacity combined with a global shipping downturn is now taking its toll. A fifth of China’s shipbuilders lost money in 2012, data from the association of shipbuilders showed, nearly doubling from 2011.

Despite this, the government is providing support for the industry, a sign it will also support Rongsheng given its prominence in the sector, analysts said.

Export-Import Bank of China, which lends in support of government policy goals, said in January it will increase lending for the buying or leasing of ships by around $3 billion this year to support Chinese shipbuilders.

Beijing also devised a plan last year to subsidise early disposal of ships in use for over 15 years, with the state paying for 20 percent of the cost incurred, the Economics Information Daily, a newspaper run by state news agency Xinhua, said this month. The paper said the plan had not been announced due to conflicting views. It was not clear if China’s new government had vetoed the plan designed by their predecessors.

Analysts say what separates Rongsheng from many other companies are its connections with the government and state banks. Rongsheng’s Chief Executive Chen Qiang, for example, enjoys “special government allowances” granted by China’s cabinet, the firm’s annual reports say.

Rongsheng also said in its IPO prospectus that it has two five-year financing deals with Export-Import Bank of China that end in 2014 and in 2015, and a 10-year agreement with Bank of China starting from 2009.

After all, local government coffers will suffer the biggest blow if Rongsheng goes bust. The firm had 168 million yuan of deferred income taxes in 2012.

“Do people expect one of the largest shipyards in the world is going to stop building ships completely with state-of-the-art, brand new facilities?” said Martin Rowe, managing director of global shipping services provider Clarkson Asia Ltd. “I think it’s highly unlikely.” (Reporting by Yimou Lee in HONG KONG and Koh Gui Qing in BEIJING; Editing by Neil Fullick)

China Huarong Energy Company Limited, formerly known as China Rongsheng Heavy Industries, has identified a Chinese company listed on a stock exchange in China as a potential buyer of its Jiangsu Rongsheng Heavy Industries shipyard.

The undisclosed buyer is further negotiating with the China Huarong regarding the list and scope of the relevant assets and liabilities, and the terms of the potential transaction.

The group has already obtained letters of consent from various major creditor banks which agreed to various matters in relation to, amongst other things, the disposal of assets and liabilities of Jiangsu Rongsheng.

However, China Huarong warned that the transaction is subject to certain provisions, including the signing of a formal transaction agreement, the final terms and conditions of which are still under further negotiations by the parties.

Earlier this year we had the opportunity to visit China Rongsheng Heavy Industries, one of China’s leading shipbuilding companies. Rhongsheng was founded in 2005 and floated in November 2010 on the back of winning an enormous order from Vale to build twelve ore carrier vessels each 360 metres long, 65 metres wide and 30.4 metres deep with a deadweight tonnage of 400,000. The ambitious founder, 46% shareholder and Chairman, Zhang Zhi Rong, was desperate to challenge the global leaders, South Korean based, Hyundai Heavy Industries and Daewoo Shipbuilding & Marine.

Back in 2008, Rongsheng represented all that is good and bad in China. With Government support, Chinese corporate support, recently announced offshore diversification and the cost of shipping dry goods such as grain, coal and iron-ore at US$55,000 per day, the outlook was superb.

Let’s fast forward to July 2012 and the price of Rhongsheng’ shares have declined from HK$8 to HK$1. For the six months to June 2012, China’s 1,536 shipyards have announced a combined 50% decline in orders. The cost of shipping dry goods has crashed to sub US$10,000 per day (-82%), and Rhongsheng is experiencing a number of operational and credibility issues.

With the global slump in ship orders caused by a glut of vessels, Rongsheng is trying to diversify from shipbuilding and earlier this year they won a contract to build an offshore support vessel for CNOOC, one of China’s largest government controlled oil production and exploration companies.

The development of China has seen some extraordinary national champions in industries like ship building, however we wonder how many of these companies will ultimately become global champions. With several front page newspaper disasters associated with misfeasance, we continue to be wary of China’s corporate governance record.

[Press Release]China Rongsheng Heavy Industries Secures Shipbuilding Contracts from Three Ship Owners* * * *Enhances Functions of the Vessel Models and Captures the GreenTrend in the MarketStrong Capability to Secure New Orders with Immense GrowthPotential

(3 July 2011, Hong Kong) China Rongsheng Heavy Industries Group Holdings Limited (China Rongsheng Heavy Industries or the Group; stock code: 01101.HK), a large heavy industries group in China, is pleased to announce that it has secured large orders from three renowned shipowners in Europe recently, including four

6600-TEU containerships and ten 205,000-tonne bulk carriers.Mr Chen Qiang, Chief Executive Officer and Executive Director of China Rongsheng Heavy Industries, said, We have secured the highest number of new orders in the country and the worlds fifth highest number of orders in hand since the end of 2010. Following the order[s] valued at USD400 million secured in the first quarter this year, we have secured several additional large orders which have notably increased the total amount of our orders in hand. These orders are sufficient to support our development in the coming few years, forming a solid foundation for our future growth. The signing of the contracts has increased the amount of new orders of the Group in the first half of the year to more than USD1.3 billion and further rationalised our order structure.

The Group signed a contract with a renowned shipowner in Europe on 26 June in relation to ten 205,000-tonne bulk carriers. The contract is one of the few large orders in China in the first half and enhances the confidence of the international market in the countrys shipping enterprises. This order is for a new vessel model developed by the Group to be built to the specifications of the shipowner. The shallow draft vessel model is able to stop at many other ports including ports in Australia and Brazil in the world. It also boasts the low oil consumption of less than 60 tonnes of heavy oil per day which helps to save transportation costs.

At the same time, China Rongsheng Heavy Industries has signed contracts with two other European ship owners to provide each with two 6600-TEU containerships [respectively]. Adopting a new generation design, the 6600TEU containerships reduce the speed from 25 kn to 21 kn as well as [ballast capacity], thus saving oil consumption and lowering transportation cost.

Despite the slowdown in the global shipbuilding industry in the first half of the year, China Rongsheng Heavy Industries has stood out among its peers in the volume of new orders it has secured. This year, the Group has signed contracts with Golden Union, a well-known international shipowner, for provision of two Panamax bulk carriers in January, and 2+2 of these carriers in May. Founded in 1977, Golden Union is well-known for operating bulk carriers. Currently, Golden Union has more than 20 ships in its fleet, thus making it the leader in the dry bulk carrier transportation [industry] in Greece.

Panamax bulk carriers from Minsheng Financial Leasing (MSFL), the largest financing leasing company in China. It is worth noting that MSFL has granted 28 orders with

of bulk carriers will be used to deliver coal in the coastal waters of China by several domestic large coal-fired power plants such as Huadian and Guodian. The first vessel will be christened and delivered in July this year.

In recent years, the Group has placed equal attention on domestic and overseas markets, so as to consolidate its leading presence both in the global market and China. Besides, to meet the requirements of markets, the Group has also enhanced its R&D capability and undertook appropriate preparation for containership, which explains why it has grown into a strong competitor in this field.

Established in 2005, China Rongsheng Heavy Industries advanced to become a market leader in the Chinese shipbuilding industry within five years. According to Clarkson Research, China Rongsheng Heavy Industries was the second largest shipbuilder and the largest privately-owned shipbuilder in the PRC in terms of total order book measured by DWT as of end of 2010, and had the largest shipyard in the PRC. China Rongsheng Heavy Industries was also a global leader in manufacture of VLOCs of over 400,000 DWT. Headquartered in Hong Kong and Shanghai, China Rongsheng Heavy Industries has production facilities in Nantong of Jiangsu Province and Hefei of Anhui Province. Currently, China Rongsheng Heavy Industries business spans four segments: shipbuilding, offshore engineering, marine engine building and engineering machinery. Rongsheng products include bulk carriers, crude oil tankers, containerships, offshore engineering products, low-speed marine diesel engines and small to mid-size excavators for construction and mining uses. It has established strategic cooperations with renowned international classification societies including DNV, ABS, LR, GL and CCS, and has built a customer base including enterprises such as CNOOC, Vale, Geden Line, Cardiff Marine Inc., MSFL and Frontline Ltd. The Groups products have been sold to 11 countries and regions including Turkey, Norway, Germany, Brazil, Singapore and China.For press enquiries:Strategic Financial Relations (China) LimitedMs. Anita CheungTel: (852) 2864 4827Email: anita.cheung@sprg.com.hk

RUGAO, China—An anxious shipyard worker named Li and the deserted shops around him offer a glimpse of the tough choices that many of China"s most bloated industries present to Beijing.

The 46-year-old Mr. Li, who gave only his surname, said he works for China Rongsheng Heavy Industries Group Holdings Ltd. The company Friday said it is struggling to pay employees and suppliers and is in talks with its bankers for more credit. Rongsheng also is seeking financial help from the government and shareholders amid a prolonged industry slump.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

"Chinese shipyards of all sizes have been hit hard in the past two years, and they often lack the technology and bank loans needed to produce the sophisticated vessels sought in many new orders," Li said.

China has released its first "white list" of 51 shipyards that it deems worthy of favourable policy support, as the world"s largest shipbuilder strives to tackle over-capacity that has slammed the global shipping market.

Fifteen yards affiliated with State-owned China State Shipbuilding Corporation and China Shipbuilding Industry Corporation, four related to China Ocean Shipping (Group) Co, two controlled by Sinotrans & CSC Holdings and one owned by China Shipping Group Co were also listed.

China has more than 1,600 shipyards and analysts predict that about a third will shut as the industry struggles to emerge out of a capacity glut that has hit freight rates. Rongsheng, the largest private shipbuilder, came close to insolvency last year before it agreed with banks to extend its debt payments.

China last year laid out a detailed three-year plan to restructure its massive shipbuilding industry, urging local governments to halt approvals of new projects and firms to build higher quality vessels.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

HONG KONG — China grew into the world"s leading shipbuilder over the last decade as hundreds of private yards opened to compete with state-run companies. Now, the government is poised to regain control as the industry heads for consolidation.

The number of shipyards in China has swollen to 1,647, contributing to a global capacity glut. To stabilize the industry, one third to a half of the yards will probably have to disappear through acquisitions and closings, according to executives and analysts.

State-run companies are at an advantage because they have easier access to credit to pay workers, buy raw materials and provide financing for clients. China State Shipbuilding Corp., China Shipbuilding Industry Corp. and other government-backed companies won three-quarters of all orders in the first half of this year. Though state companies may buy some private yards, many will likely have to close since their capacity isn"t needed.

"It"s a lost cause for most of the private shipyards," said Park Moo-hyun, an analyst at E*Trade Securities Korea in Seoul. "The government and even the banks seem to have given up on trying to save some of the troubled private shipyards. What innovations can they come up with when they can"t pay to keep their workers?"

China"s State Council announced Aug. 4 a three-year plan for the industry that included control of capacity. Ship owners ordering China-made vessels, engines and some main parts should get better access to funds from financial institutions and some key companies will be allowed to issue corporate bonds, according to the State Council statement.

Last month, China Rongsheng Heavy Industries Group Holdings Ltd., the country"s biggest private shipyard, sought financial assistance after failing to win a single vessel order this year.

"China has realized it"s better to have a few big yards under its control and help them become more competitive than have too many," said Park at E*Trade Securities. "The government is looking for quality now, not quantity."

More than half of China"s yards will have to be wound down to cut capacity, according to Ren Yuanlin, chairman of Yangzijiang Shipbuilding Holdings Ltd., the country"s second- largest private vessel maker. Of the remainder, only 20 percent will be profitable, he said. China Association of the National Shipbuilding Industry said last month a third of the nation"s yards face the danger of closure in about five years after failing to win orders.

The State Council stepped in with its plan a month after Rongsheng said it had a first-half loss and sought government support. Some idled contract workers surrounded the entrance of its main factory in Jiangsu province, the company said July 3.

The yield on a Rongsheng unit"s 2015 onshore bonds rose to 6.9 percent on Aug. 9 even after the State Council"s pledge. Rongsheng on July 31 sold three-year offshore convertible notes at 7 percent to help repay borrowings. By comparison, bonds due 2015 for South Korea"s Hyundai Heavy Industries Co., the world"s largest builder of vessels, yielded at 2.91 percent.

"Compared with shutting down of companies, mergers and acquisitions will less likely cause social unrest," said Xu Minle, an analyst at Bank of China International Ltd.

Consolidation may help the government achieve a target that the nation"s top 10 yards should account for 70 percent of the total output by 2015. China also aims to have more than 50 brands of different types of ships in that period, according to a five-year plan released last year.

"The Chinese government wants to support its big state- owned shipyards because they are strategically important," said Kim Hong-gyun, an analyst at Dongbu Securities Co. in Seoul. "That means less hope for private yards."

Global ship orders reached a peak in 2007, helped by China"s demand for raw materials. To support the yards, the government also provided low-cost financing for new vessels.

Yards in China won orders to make vessels with a capacity to carry 27.8 million deadweight tons, or 47 percent of global contracts, in the seven months through July, according to Clarkson, the world"s largest shipbroker. State-backed builders won almost three-quarters of those deals, helping the nation gain a 7.8 million-ton lead over South Korea.

Chinese shipyards and related companies employed about 671,564 people in the country in 2012, down from 681,339 in the previous year, according to data provider Beijing Compass-info Consulting Co. Most of the builders are based in Yangtze River Delta, Pearl River Delta and northeastern China. South Korea has 138,248 people working at 65 shipyards, according to its Ministry of Trade, Industry & Energy.

China"s government hasn"t had much success in its efforts to encourage mergers and acquisitions in the steel industry, Wang at Masterlink said. Benxi Iron & Steel Group, owned by a provincial government, and Anshan Iron & Steel Group, controlled by the central government, failed in their bid to merge in 2010, at least five years after authorities initiated the process.

"Shutting down yards is a hard landing, while mergers and acquisitions is a soft landing," said Li Yanqing, president of Shipbuilding Information Center of China.

A large number of shipyards in China are suffering at the moment, as the global maritime industry has been hit hard by a drastic decline in new ship orders amid the ongoing economic crisis.

China Rongsheng Heavy Industries Group, one of the leading shipyards in China, warned of a net loss for 2012, due to a sharp decline in orders and new vessel prices, according to a company filing with the Hong Kong Stock Exchange on December 24.

The number of Rongsheng"s employees has dropped to around 10,000 from nearly 50,000 at the peak time for the industry several years ago, according to a report from Guangzhou-based 21st Century Business Herald on December 27, citing workers from Rongsheng.

Wu Jiawei, a 20-year-old electrician who works at a Rongsheng shipyard in Nantong, East China"s Jiangsu Province, said he is planning to leave his current position after the Spring Festival in February, after he gets the year-end bonus.

A PR employee at Rongsheng"s Shanghai headquarters, who declined to be named, admitted that some employees have left the firm amid the gloomy industry prospects.

He told the Global Times that the company"s number of employees was now stable. "The total number of employees at Rongsheng was 25,000 during the peak time several years ago, not 50,000 as reported, and at present Rongsheng still has a total of around 20,000 employees."

Lu Jian, a former co-worker of Wu"s at Rongsheng"s Nantong shipyard, told the Global Times that the reason he left the company in February 2012 was because he "basically had nothing to do every day."

Rongsheng received only two new orders in the first half of 2012, and the prices of the orders were substantially lower than before, according to the PR employee.

Rongsheng is not the only shipbuilding company to be hit by the industry downturn. Media reports have said that many privately owned small shipyards in Jiangsu and Zhejiang provinces have partly halted production amid the downturn.

Jiangsu-based Dongfang Shipyard, a privately owned company, has defaulted on employee salaries for half a year, and the total amount of unpaid salaries is more than 170 million yuan, according to a report by news portal 21cbh.com on December 18.

China CSSC Holding, a State-owned shipbuilding company, also reported on October 30 an 87.34 percent drop in third-quarter net profit to 70.49 million yuan.

"It is likely that 50 percent of the smaller privately owned shipyards in China will go bankrupt or be acquired by larger firms during the current downturn," Zhou Liwei, an expert at the China Classification Society, a testing agency for industry standards, told the Global Times on December 28.

He also noted that ship buyers have started to push down prices amid the sluggish demand, and Rongsheng is responding by turning to marine engineering, such as producing equipment for offshore oil exploration.

Rongsheng Offshore & Marine, a subsidiary dedicated to the marine engineering business, was established in Singapore in October 2012, and it announced that it had already secured an order from a Singaporean client.

Other shipbuilding companies such as COSCO Shipyard Group and Jiangsu-based Mingde Heavy Industry also announced similar strategies over the past two years.

In the first 11 months of 2012, China"s 1,647 shipyards reported combined profits of 23.4 billion yuan, down 37 percent year-on-year, the latest data from the China Association of the National Shipbuilding Industry (CANSI) showed.

8613371530291

8613371530291