rongsheng shipyard china pricelist

HONG KONG (Reuters) - Jiangsu Rongsheng Heavy Industries Co Ltd has appointed Morgan Stanleyand JP Morganto finalize plans for its long-awaited IPO in Hong Kong, aiming to raise up to $1.5 billion in the fourth quarter, sources told Reuters on Tuesday.

This is Rongsheng’s latest bid to go public after it failed to raise more than $2 billion from a planned IPO in Hong Kong in 2008, mainly as a result of the global financial crisis.

Rongsheng"s early main shareholders included an Asia investment arm of Goldman Sachs, U.S. hedge fund D.E. Shaw and New Horizon, a China fund founded by the son of Chinese Premier Wen Jiabao.

The three investors sold off their stakes in Rongsheng for a profit early this year, said the sources familiar with the situation. Representatives for the banks, funds and Rongsheng all declined to comment.

Rongsheng’s revived IPO plan comes at a challenging time. Smaller domestic rival, New Century Shipbuilding, slashed its Singapore IPO in half last week, planning to raise up to $560 million from the originally planned $1.24 billion due to weak market conditions.

Given uncertainty in the global shipbuilding business environment as well as growing concerns over a huge flow of fund-raising events in Hong Kong, investment bankers suggest the potential size for Rongsheng could be $1 billion to $1.5 billion, according to the sources.

Rongsheng is seeking to tap capital markets to fund fast growth and aims to catch up with bigger state-owned rivals such as Guangzhou Shipyard International Co Ltd.

Rongsheng won a $484 million deal to build four ships for Oman Shipping Co last year. The vessels would carry exports from an iron ore pellet plant in northern Oman which is expected to begin production in the second half of 2010.

(Bloomberg) — China Rongsheng Heavy Industries Group Holdings Ltd., which hasn’t announced any 2012 ship orders, may find winning deals even harder as a company owned by its billionaire chairman faces an insider-trading probe.

China’s biggest shipbuilder outside state control tumbled 16 percent yesterday in Hong Kong after the U.S. Securities and Exchange Commission said traders including Chairman Zhang Zhi Rong’s Well Advantage Ltd. made more than $13 million of illegal profits buying shares of Nexen Inc. ahead of a takeover announcement by CNOOC Ltd. The SEC also won a court order freezing about $38 million of the traders’ assets.

Rongsheng, based in Shanghai, has tumbled 87 percent since a November 2010 initial public offering because of concerns about delivery delays and a global slump in ship orders caused by a glut of vessels. The shipbuilder, which operates facilities in Jiangsu and Anhui provinces, also said yesterday that first- half profit probably dropped “significantly” because of falling prices and slowing orders.

The demand slump has pushed new-ship prices to an eight- year low, according to shipbroker Clarkson Plc. Chinese shipyard orders plunged 49 percent in the first half.

The probe won’t affect day-to-day operations run by Chief Executive Officer Chen Qiang, as Chairman Zhang only has a non- executive role, Rongsheng said in a statement yesterday. Zhang wasn’t available for comment yesterday, according to Doris Chung, public relations manager at Glorious Property Holdings Ltd., a developer he controls.

Chen isn’t aware of Zhang’s personal business dealings and he has no plans to leave Rongsheng, he said yesterday by text message in reply to Bloomberg News questions. The CEO may help reassure potential customers as he is well-known among shipowners, said Lawrence Li, an analyst at UOB Kay Hian Holdings Ltd.

Zhang owns 46 percent of Rongsheng and 64 percent of Glorious Property, according to data compiled by Bloomberg. The developer dropped 1.7 percent to close at HK$1.16 in Hong Kong today after falling 11 percent yesterday. Zhang’s listed holdings are worth about $1.2 billion, according to data compiled by Bloomberg.

Zhang, who holds a Master’s of Business Administration degree from Asia Macau International Open University, started in building materials and construction subcontracting before getting into real estate. Construction of his first project, in Shanghai, began in 1996, according to Glorious Property’s IPO prospectus. He got into shipbuilding after discussing the idea with Chen at a Shanghai Young Entrepreneurs’ Association event in 2001, according to Rongsheng’s sale document. He formed the company that grew into Rongsheng three years later.

“People in his hometown think Zhang is a legend as he expanded two companies in different sectors so quickly,” said Ji Fenghua, chairman of Nantong Mingde Group, a shipyard located next to Rongsheng’s facility in Nantong city, Jiangsu province. The billionaire maintains a low profile, said Ji, who has never seen him at meetings organized by the local government.

Rongsheng raised HK$14 billion in its 2010 IPO, selling shares at HK$8 each. The company’s market value has fallen by about $6.1 billion to $1 billion, based on data compiled by Bloomberg.

Rongsheng, which also makes engines and excavators, had outstanding orders for 98 ships as of June 2012, according to Clarkson. It employed 7,046 people at the end of last year, according to its annual report. The shipbuilder has built a pipe-laying vessel for Cnooc and it has a strategic cooperation agreement with the energy company.

With orders for new ships plunging to an eight-year low in 2012, China Rongsheng Heavy Industries Group Holdings Ltd. and its local rivals are foraying into the offshore business, lured by a market that will reach about $328 billion in 2017. The new entrants are lowering prices to grab contracts, hurting margins at Singapore-based Keppel Corp. and Sembcorp Marine Ltd., the world’s two-biggest rig makers.

“It’s like moving from one bottomless pit to another,” said Park Moo Hyun, an analyst at E*Trade Securities Co. in Seoul. “Chinese shipyards are competitively trying to get into what they see as a lucrative business. But the consequence of that is they could end up distorting the whole market.”

China Rongsheng, the nation’s biggest yard outside state control, announced in October its first order to make a tender barge and rival Yangzijiang Shipbuilding Holdings Ltd. got its first rig contract last month. Shanghai-based China Rongsheng warned in December of posting a loss in 2012 after three straight years of profits.

Shipyards are boosting offshore equipment business as Petroleo Brasileiro SA, Exxon Mobil and other energy companies develop new fields amid depleting oil reserves at existing wells.

About 464 shipyards in China won 18.7 million deadweight tons of orders worth $14.3 billion last year, the lowest since 2004, according to Clarkson. That compares with contracts for 14.6 million tons worth $29.6 billion received by 88 yards in South Korea, the world’s second-biggest shipbuilding nation.

Thirty-eight percent of yards in China didn’t get contracts for new vessels in 2012, and 10 percent had no deliveries scheduled beyond that year-end, the London-based shipbroking unit of ICAP Plc said in a report sent by e-mail on Dec. 24.

China Rongsheng said it has set up an offshore unit in Singapore, where the company has hired engineers with more than 20 years of experience. That “will help compensate Rongsheng China’s lack of experience in building rigs and drill ships and shorten the company’s learning curve,” it said in an e-mail.

Yangzijiang, based in Jiangyin, China, announced last month it got a $170 million order for a jack-up rig, lower than the $205 million contract Keppel got in April for a similar product. It’s an indicator of lower margins in the future, Keppel Chief Executive Officer Choo Chiau Beng said in a December interview. Yangzijiang said in an e-mail it doesn’t expect prices to drop because of the competition.

Cosco Corp. Singapore Ltd., the shipbuilding unit of China’s biggest shipping company, said in August it expects to incur higher costs as it worked on offshore projects it had never done before. That includes a contract to build a semi- submersible accommodation rig.

Shipyards in China are the world’s biggest builders of bulk ships, used to haul iron ore, grain and coal. Only a handful of companies in the country have built more complex vessels such as liquefied natural gas carriers and container ships that are longer than the Eiffel Tower.

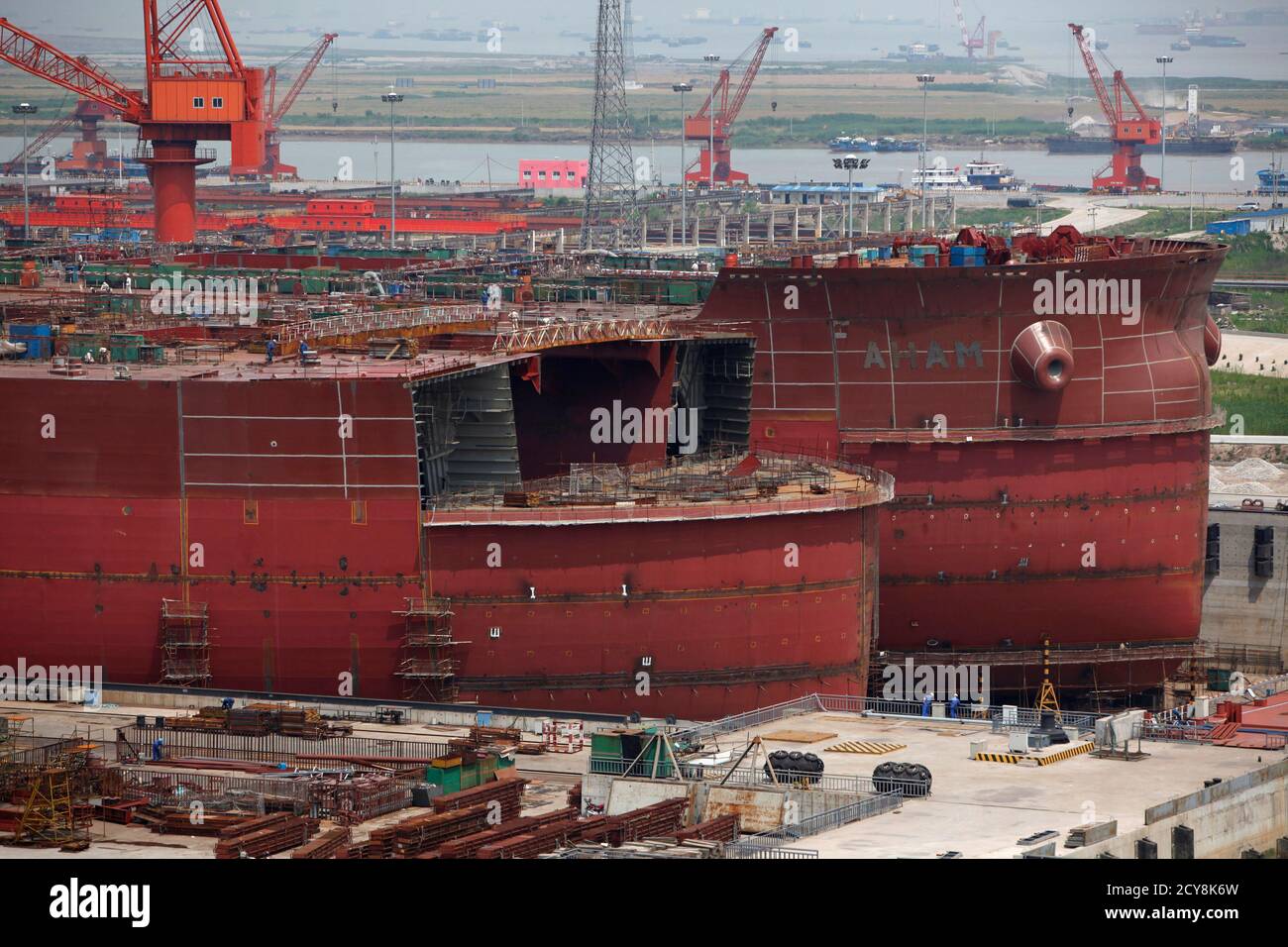

The shipyard, located in the Yangtze River Delta, was founded in 2006, and became the largest private shipbuilder in China, churning out giant valemaxes at its four large dry-docks, before a massive financial collapse forced it to cease operations in 2014.

Broking sources in China tell Splash that the yard’s former chief operating officer David Luan is now preparing to officially reopen the yard, to be known as SPS Shipyard, a reference to ShipParts.com, a business he created in 2015 after quitting Rongsheng.

SPS Shipyard will start to market cape and kamsarmax slots from next week with next available slots being from Q3 2025 onwards. Luan has yet to reply to questions sent by Splash earlier today.

Last October, the company entered into an agreementto sell 98.5% equity interest of Rongsheng Heavy Industries, the entire interest in Rongsheng Engineering Machinery, Rongsheng Power Machinery and Rongsheng Marine Engineering Petroleum Services, to Unique Orient, an investment holding company owned by Wang Mingqing, a creditor of Huarong Energy, for a nominal price of HK$1.

Once the largest private shipyard in China, Rongsheng ceased shipbuilding operations in 2014 after it was hit by a major financial crisis and the shipyard rebranded into Huarong Energy in 2015.

Rongsheng Heavy Industries Group Holdings Ltd"s shares have been suspended on the Hong Kong Stock Exchange after a media report said that the company cut 8,000 jobs in recent months.

The Jiangsu-based company - China"s largest private shipyard - has been hit by a slowdown in the global shipping industry as well as sluggish domestic demand for new ships.

Last year, Rongsheng Offshore & Marine was established in Singapore to seek new market growth points. Its business segments include shipbuilding, offshore engineering, marine engine building and engineering machinery.

"In 2011, the market was so-so, but 2012 was bad and the situation this year is cruel," said Li Aidong, president of Daoda Heavy Industry Group, an 8,000-worker shipyard in Jiangsu.

"Chinese shipyards of all sizes have been hit hard in the past two years, and they often lack the technology and bank loans needed to produce the sophisticated vessels sought in many new orders," Li said.

Amidst the current problems, Shipyards in China compete with Korean ones for orders for container carriers. Hapag-Lloyd intends to place a USD 1.2 billion order for six 23,000 TEU ultra-large container vessels. Ocean Network Express (ONE) also plans to place a similar order. Chinese shipyards such as Jiangnan Shipbuilding, Dalian Shipbuilding Industry, China Hudong Zhonghua, Nantong COSCO KHI Ship Engineering and Yangzijiang Shipbuilding are all in the race. The winner’s financial situation will, for sure, improve. It is expected that thanks to the Chinese government’s financing policy, Chinese shipbuilders will win over technologically superior Korean competitors.

Another once-leading privately-owned yard China Huarong Energy Company, previously and better known as China Rongsheng Heavy Industries, continues to struggle with debts and ongoing talks with its creditors. The shipbuilder with huge yard facilities is now literally a �ghost yard�, where operations have ceased as funds dried up.

Jiangsu Rongsheng Heavy Industries Group Co. used to employ more than 30,000 people in the eastern city of Rugao. Once China�s largest shipbuilder, by 2015 Rongsheng was on the verge of bankruptcy. Orders had dried up and banks are refusing credit. Questions have been raised about the shipyard�s business practices, including allegations of padded order books. And Rongsheng was apparently behind on repaying some of the 20.4 billion yuan in combined debt owed to 14 banks, three trusts and three leasing firms.

Rongsheng is on the ropes now that it had completed a multi-year order for so-called Valemax ships for the Brazilian iron ore mining giant Companhia Vale do Rio Doce. The last of these 16 bulk carriers, the Ore Ningbo, was delivered in January 2015. With a carrying capacity of up to 400,000 tons, Valemaxes are the world�s largest ore carriers. Vale hired Rongsheng to build the ships starting in 2008, and has tolerated the shipyard�s slow pace: The Ore Ningbo was delivered three years late. Rongsheng employees said the Ore Ningbo may have been the shipyard�s last product because no new ship orders are expected and all contracts for unfinished ships have either been canceled or are in jeopardy.

Founder and former chairman Zhang Zhirong started the company in 2005 with money made when he worked as a property developer in the 1990s. The new shipyard stunned the industry by clinching major vessel orders from the start, even at a time when most of the world�s shipyards were slumping. Rongsheng�s success attracted investors and banks to the company�s side, fueling its expansion.

The shipyard, a sprawling facility spread across one-third of Changqingsha Island in the middle of the Yangtze River, suffered from a lack of capacity and management problems. As a result, the company had trouble meeting its contract obligations, including delivery timetables. Rongsheng�s problems were tied to difficulties with delivering ships. Many of Rongsheng�s order cancellations were due to its own delivery delays.

After the global financial crisis of 2008, many ship owners could no longer afford paying in advance for new vessels. So builders such as Rongsheng started arranging up-front financing with Chinese banks that got projects off the ground.

Rongsheng built ships with a combined capacity of 8 million tons in 2010 and was preparing to begin filling US$ 3 billion in new orders the following year. But the company�s 2011 orders wound up totaling only US$ 1.8 billion. That same year, Rongsheng�s customers canceled contracts for 23 new vessels.

In 2012, Rongsheng received orders for only two ships. Layoffs ensued, with some 20,000 workers getting the axe. The company closed the year with a net loss of 573 million yuan, down from a 1.7 billion yuan net profit in 2011 and despite 1.27 billion yuan in government subsidies. The bleeding worsened in 2013, with 8.7 billion yuan in reported losses. Despite a recovery of the Chinese shipbuilding industry in 2014, Rongsheng saw no relief, as its clients canceled orders for 59 vessels that year.

Roxen Shipping, a company controlled by Chinese businessman Guan Xiong, reportedly stepped in to rescue some US$ 2 billion worth of ship contracts that were canceled by Rongsheng�s other customers. Without these orders, Rongsheng never would have maintained its status as the No. 1 shipbuilder in China from 2009 to 2013.

Rongsheng�s capital crunch worsened since February 2014, when the China Development Bank (CDB) demanded more collateral after the company failed to make a scheduled payment on a 710 million yuan loan. When Rongsheng refused, the CDB called the loan. Other banks that issued loans to the shipbuilder had taken similar steps.

Rongsheng�s weak financial position was highlighted by a third-quarter 2014 financial report in which the company posted a net loss of 2.4 billion yuan. It also reported 31.3 billion yuan in liabilities, including 7.6 billion yuan worth of outstanding short-term debt.

It would cost at least 5 billion yuan to restart operations at Rongsheng�s facility, plus they have a huge amount of debt. Buying Rongsheng would not be a good deal.

ChinaRongsheng Heavy Industry Group announced that the asset evaluation of the affiliated Jiangsu Rongsheng has gained a stage achievement. The related parties has reached consensus on potential recombination scope and assessment standard which will be regarded as the recombination basement.

In 2013, Rongsheng was announced that its working capital under huge pressure.Factors causing increased pressure on its working capital include1) weakening demand in the shipbuilding market and low prices for new orders,2) banks tightening credit facilities to shipbuilders, 3) shipowners delaying ordefaulting on payments to shipbuilders. As a result, Rongsheng has tightened cash outflows by delaying payments to its suppliers and workers.

In the first nine months of 2014, Rongsheng"s Jiangsu unit continues to bleed.Struggling Chinese shipyard group China Rongsheng Heavy Industries Group continues to be stuck in the mire, announcing that its majority-owned subsidiary Jiangsu Rongsheng Heavy Industries posted net loss of about RMB3.36bn ($548.6m) for the nine months ended 30 September 2014.

What does it actually cost Chinese naval shipyards to build major warships? Chinese sources do not disclose actual or estimated warship and submarine production costs, so it falls on external analysts to generate this important dataset. Quantifying warship production costs bolsters our understanding of how China’s defense budget actually translates into hardware and capabilities.

This analysis focuses on the Type 054A (NATO codename: Jiangkai-II) frigate, for three primary reasons. First, it is China’s most prolifically produced large, modern major surface combatant. Second, it has been series produced for several years. Third, it is the cornerstone of the PLAN’s surface warfare capabilities at present and has actually seen sustained (and ongoing) operational deployments.

Readers should note that this is a “Beta Version” estimate of the Type 054A’s production costs. It is well-developed, but will almost certainly evolve as more participants contribute their insights. I share my core calculations and assumptions in order to provide a springboard for other analysts and hopefully catalyze a broader discussion that advances our knowledge of China’s naval-industrial complex.

This author estimates that the Type 054A currently costs a total of approximately $348 million per vessel to build and fit out (Exhibit 1). This estimate derives from breaking the ship down by its main systems categories (hull and equipment, propulsion/power transmission, weapons, and electronics) and calculating their respective costs, as well as the cost of the labor needed to assemble the ship into a finished product. The estimate relies heavily on valuation by analogy in many cases because Chinese sources simply do not disclose cost information on the vast majority of the inputs used in warships being built in China. As such, the figure as stands is conservative and may overestimate the construction and equipment costs.

Labor: $75 million, 22 percent. While data is somewhat scarce, building and commissioning a frigate-sized warship of between 3,000 and 4,000 tons displacement appears to require between 2.5 million man hours (U.S. FFG-7) and 10.8 million man hours (India Godavari-class) of labor. The author estimates that at present, Chinese military shipyards, which can afford a higher degree of labor intensity than Western yards due to a large labor force, but which are also almost certainly substantially more efficient than Indian yards, require around 3.2 million man hours to build and commission a Type 054A frigate. Chinese yards’ average labor cost is based on the 2013 labor expenditures of Jiangsu Rongsheng, a top private shipbuilder, which are then increased by 25 percent to reflect the premium paid for special skill sets required for shipbuilding work done to naval specifications.

The $348 million unit cost estimate dovetails reasonably well with the price at which China offered Type 054 frigates to Thailand in early 2013. Thailand’s Navy sought to spend $1 billion on new frigates and China reportedly offered three Type 054s at that price. China’s offer of ships at an effective price of $333 million each suggests that with higher international-level profit margins built in, the actual delivered ship cost is likely between $350 million and $375 million per vessel. In addition, the imported ships would likely cost less to build given that they are not as comprehensively capable as the Type 054As delivered to the PLAN.

Military hardware spending always incurs an opportunity cost, since even a large and growing economy like China’s still has a finite amount of resources that can realistically be devoted to military expenditures. To put the cost of purchasing one Type 054A at $365 million into perspective, consider that the ship uses funds equal to each of the following alternative expenditures, all of which are in demand in various branches of the PLA:

* 177.5 million gallons of jet fuel for training – enough fuel to allow each of China’s 97 SU-30 fighters to be fully loaded with fuel 600 times apiece.

A navy ultimately sails on the strength of the national treasury. In that respect, the PLAN increasingly gets a significant “bang for its buck” with ship acquisition costs that are much lower than those of other major Asia-Pacific naval powers. The analytical community now has the opportunity to create a unique warship cost dataset that will unlock powerful new avenues of inquiry into China’s naval modernization and defense spending.

Gabe Collins is the co-founder of China SignPost and a former commodity investment analyst and research fellow in the US Naval War College’s Maritime Studies Institute.

All these cost more than those that will be made in the Philippines.The Philippines should have shipyards to produce modern, high tech navy,coastguard ships and boats.

Tanin (Crocodile ), the first of the three subs, and the fourth one that Israel has purchased from Germany since 1998, was formally accepted by the Israeli navy at a ceremony at the Kiel shipyard in Hamburg last Thursday, where the subs are being built. The $500 million boat, the most expensive vessel ever commissioned by the Israeli Navy, will arrive in Israel and go into service in 2013, after trials.”

“More than anything else this ceremony represents the strong and unique link between Germany and Israel, especially in light of the intensifying regional situation and challenges,” Udi Shani, Defense Ministry director general, said at the ceremony, which took place at the shipyard of the Howaldtswerke-Deutsche Werft shipbuilding company, headquartered in Kiel. HDW developed and built the Dolphin class diesel-electric submarines for Israel.

Our Government has just recently announced a new 30 year, 35 billion dollar ship building program mainly for the military. There is 20 billion dollars for 15 new wide area, anti-ballistic missle, capable destroyers which will be build in Canada, so about 1.3 billion each, which can be done. We will likely license an existing design to be built in Canada. We are also getting new ice breakers, supply ships, coastal patrol vessels, and some new coast guard ships. The bids to select two canadian shipyards are already in and the two yards will be announced later this year, they will begin cutting steel in about 2 years. Other than subs, this will completely rebuild our existing navy.

“The shipyard Royal Schelde and Thales recently signed several contracts for the delivery of a wide range of products that are to be installed on the two corvettes that Royal Schelde will build for the Indonesian Navy. Thales will supply the ship’s above-water defence system, the communication equipment and the sonar system. The value of the contracts amounts to approximately 60 million euros. The first ship is expected to be commissioned mid 2007.

PASCAGOULA, Miss. – Officials laid the keel on a new missile-range instrumentation ship for the Navy on Wednesday, marking the start of construction on the $199 million vessel at VT Halter Marine’s Pascagoula shipyard. Halter Marine in September 2006 won the contract to build the T-AGM 25 vessel, a 700-foot ship. Halter Marine expects to launch the ship next year, with delivery in 2010.

The three GP / ASW / AAW frigates of the Danish Iver Huitfeldt (notice that I use the correct & proper Danish spelling of Iver, not ‘Ivar’) were priced at $997 million in 2008 USD. That means each was $332 million apiece in 2008 dollars. What their price might be in 2010 dollars is unknown to me. Of course, those prices were for the basic ship, minus certain weapons systems, minus the missile load-out, and anything else the Danes decided to acquire separately and install with minimal handling charges from the shipyard. Clever bunch of Vikings, those Danes – concealing the true costs of their warships that way…

The giant bulk carrier will be used to transport iron ore from Brazil to Sohar, Oman. OSC has one more vessel of its class under construction at Jiangsu Rongsheng Heavy Industries Company in Nantong in China.

Vale Saham, the new Rongsheng-built VLOC delivered to OSC adopts an environmentally friendly design to lower oil consumption and reduce the emission of CO2, while its operating efficiency exceeds that of most existing ore carriers. With Energy Efficiency Design Index recorded at approximately 1.99 during sea trials, Rongsheng-built VLOCs are in line with low-carbon green product initiative and meets the benchmark requirements on emission reduction set by the International Maritime Organization, which came into effect on 1 January 2013.

8613371530291

8613371530291