rongsheng singapore pricelist

SINGAPORE, Dec 17 (Reuters) - Indian and Chinese oil buyers are snapping up Middle East crude after spot premiums for February-loading cargoes slumped by more than half to three-month lows on improved supplies to Asia.

In China, Rongsheng Petrochemical (002493.SZ), the trading arm of top private refiner Zhejiang Petrochemical, bought 8 million barrels of Abu Dhabi and Oman crude for February-March loading, on top of 1 million barrels of February-loading Abu Dhabi"s Upper Zakum last week. The refiner also purchased at least 2 million barrels of Emirati and Iraqi crude for delivery between February or March and December. [nL1N2T20C5]

"Premiums last month were too crazy and not sustainable," a Singapore-based trader said, adding that prices had to correct after refining margins slumped late last month.

Complex refining margins in Singapore, a bellwether for Asian refiners" profitability, hit a four-month low of $2.15 a barrel in late November on fears about Omicron"s impact.

The moomoo app is an online trading platform offered by Moomoo Technologies Inc. Securities, brokerage products and related services available through the moomoo app are offered by including but not limited to the following brokerage firms: Moomoo Financial Inc. regulated by the U.S. Securities and Exchange Commission (SEC), Moomoo Financial Singapore Pte. Ltd. regulated by the Monetary Authority of Singapore (MAS), Futu Securities International (Hong Kong) Limited regulated by the Securities and Futures Commission of Hong Kong (SFC) and Futu Securities (Australia) Ltd regulated by the Australian Securities and Investments Commission (ASIC).

Registered with the Monetary Authority of Singapore (MAS), moomoo SG is a Capital Markets Services Licence (Licence No. CMS101000) holder with the Exempt Financial Adviser Status. Moomoo SG has been admitted as Clearing Member of The Central Depository (Pte) Ltd (CDP) , Trading Member of Singapore Exchange Securities Trading Limited (“SGX-ST”), Trading and Clearing Member of Singapore Exchange Derivatives Trading Limited (“SGX-DT”), and Depository Agent of CDP.

At 10:37 am Singapore time (0237 GMT), the ICE Brent October crude futures were up 16 cents/b (0.36%) from the Aug. 20 settle at SUD45.07/b, while the new front-month NYMEX October light sweet crude contract was up by 9 cents/b (0.21%) at USD42.91/b.

Most straight-run fuel oil consumed in the Middle East is sourced locally, Iraq in particular, brought to Singapore to be blended to the refiner"s desired specification before being sold to the final destination. Other sources of supply are Russia"s M100 blend as well, usually sold directly to China.

Price for straight-run fuel oil with sulfur content below 1% was around $65-$70/mt against the Mean of Platts Singapore 380 CST assessment for a July-delivery cargo, according to traders and refiners.

However, Ningbo Zhongjin Petrochemical, a regular straight run fuel oil buyer for petrochemical production, has been on the sideline amid sufficient feedstock since getting its latest arrival in mid-May, a Singapore-based source with its parent company Rongsheng said.

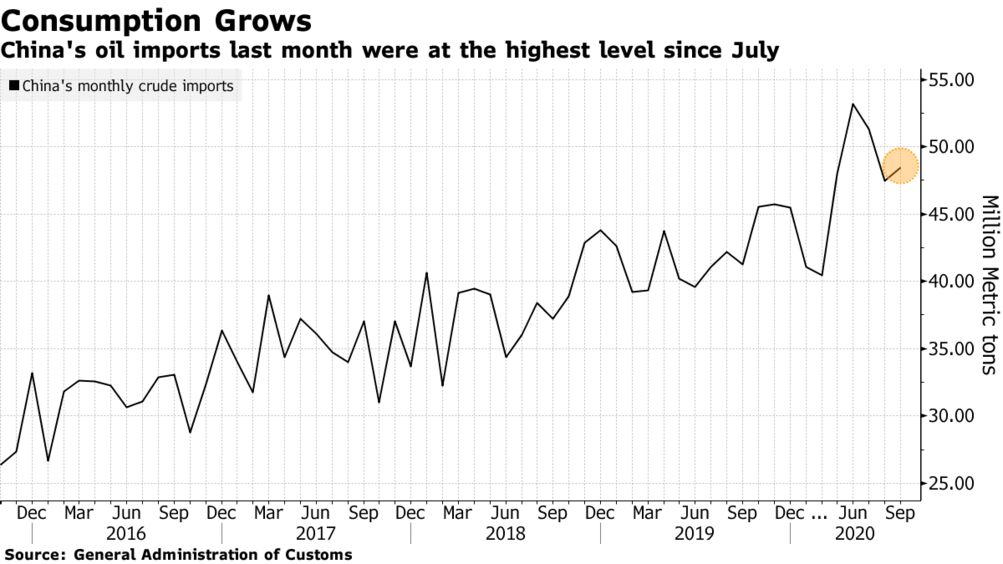

China"s refiners are optimistic about the likelihood of economic recovery in Asia"s top consuming country in the fourth quarter and into 2023 as pandemic control measures ease, helping to boost domestic oil product demand, according to the China-focused panel discussion at the S&P Global Commodity Insights Asia Pacific Petroleum Conference in Singapore Sept. 28.

"We have seen some green shoots already in China"s economy. Especially in September, we see more congestion in terms of transportation. We see a better run rate at the refineries," said Chen Hongbin, deputy GM of Rongsheng Petrochemical (Singapore).

Rongsheng is a trading arm of the privately-held refining complex Zhejiang Petroleum & Chemical, which restarted its 200,000 b/d No.4 CDU in last week after operations were suspended for seven months, and lifted run rates to around 95% of its nameplate capacity of 800,000 b/d from 83% in August, S&P Global data showed.

Hong Kong: China Rongsheng Heavy Industries, China’s largest private yard, posted its first loss since 2007 yesterday, announcing it was RMB572.6m in the red, a stark fall from 2011’s RMB1.7bn profit. Revenues slid by around 50% to RMB7.96bn.

This move has seen Rongsheng become more focused on offshore, establishing a Singapore subsidiary to chase offshore business, something that has borne fruit in the past week with a debut pair of rig orders as exclusively reported by this site. [27/03/13]

The U.S. Securities and Exchange Commission (SEC) said today in a statement it filed a complaint in Manhattan on July 27, 2012 against a company controlled by shipbuilder China Rongsheng Heavy Industries Group Holdings Ltd (Rongsheng) [HKG:1101] Chairman Zhang Zhirong, and other traders alleging they profited more than USD $13 million from insider trading in Nexen Group ahead of China"s state owned CNOOC Ltd."s $15.1 billion bid for Canadian oil company Nexen.

While not alleging any wrongdoing by Mr. Zhang, the SEC stated he "controls another company that has a "strategic cooperation agreement" with CNOOC," which is wording used on Rongsheng"s website to describe its relationship with CNOOC.

The SEC complaint states that unnamed Singapore traders used accounts in the names of Philllip Securities and Citibank C.N., and a company owned and controlled by Zhang Zhirong Well Advantage, made trades in accounts at UBS Securities and Citigroup Global Markets ahead of the CNOOC/Nexen merger and made trading profits of $7 million in the instance of the Singapore traders and $6 million in the case of Well Advantage.

Rongsheng said in a Hong Kong Exchange filingtoday it did not expect the U.S. investigation to have an effect on its operations, and that Mr. Zhang did not have an executive role in the company, nor was he a member of the management team responsible for the day-to-day business activities and operation of the Group.

As the trough of the shipbuilding cycle has now passed, China Rongsheng is expected to perform better financially during the second half of 2013, and 2014 will be an even better year, Chen said at a recent shareholders meeting.

Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square is located at 101 Kaiyuan Avenue, Floor 1, Yunhe in Yunhe, 3 miles from the center of Cangzhou. Cangzhou Confucian Temple is the closest landmark to Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square.

Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square is 64.6 miles from Tianjin. Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square is 86.7 miles from Beijing Daxing Intl.

KAYAK scours the web for all room deals available at Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square in Cangzhou and lets you compare them to find the best rate for your stay. Many different travel sites will offer discounts or deals at different times for rooms at Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square and KAYAK will provide you with prices from a huge range of travel sites. That means that you can always find a great deal for Jinjiang Inn Cangzhou West High Speed Railway Station Rongsheng Square.

Established in 2002 and with offices in London and Singapore, Exporta Publishing & Events Ltd is the world’s leading trade and trade finance media company, offering information, news, events and services for companies and individuals involved in global trade.

8613371530291

8613371530291