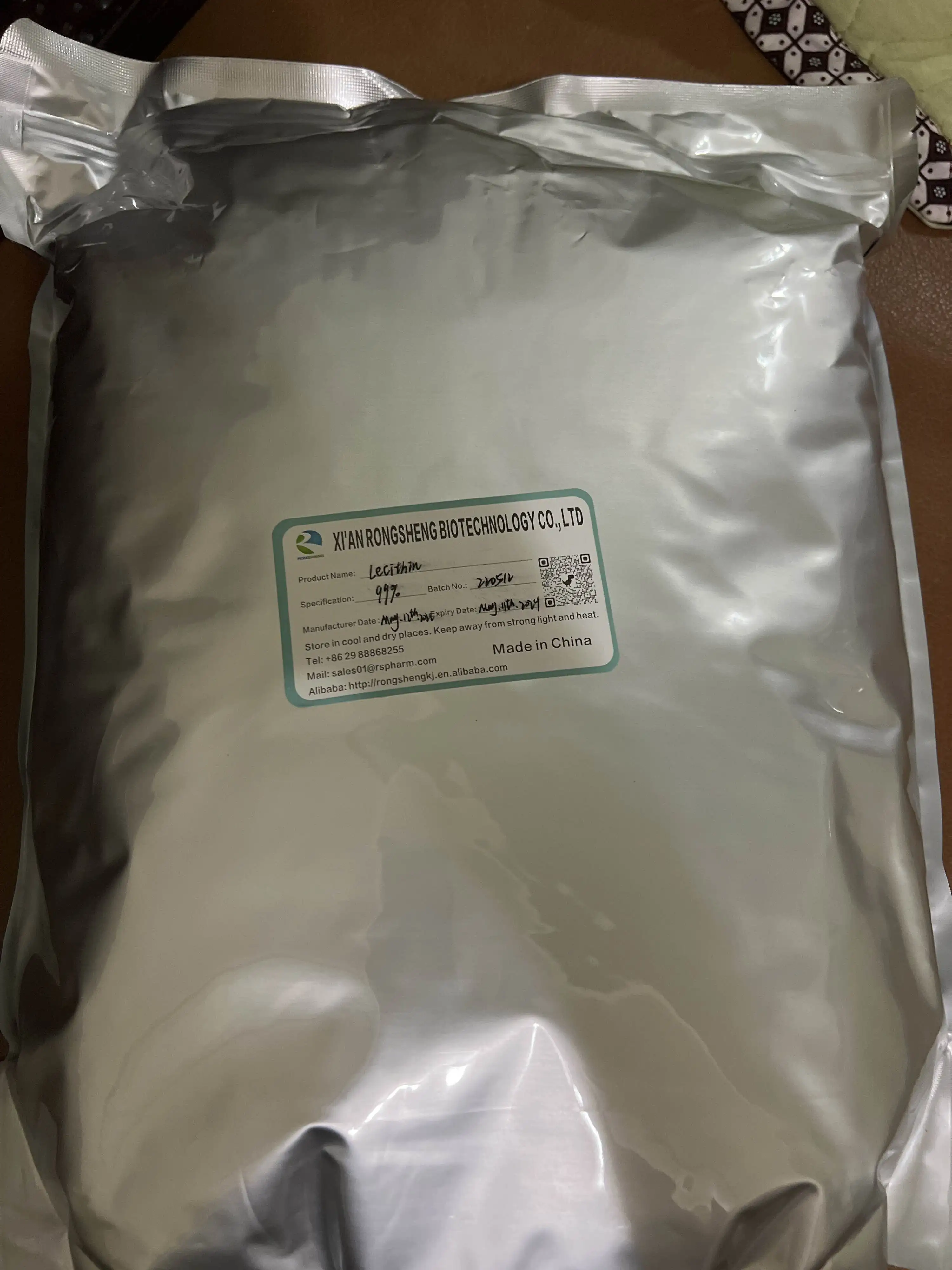

xi'an rongsheng biotechnolog made in china

Xi" an Rongsheng Biotechnology Co, Ltd. is specialized in research and development of natural plant extract and fine chemicals, which are used in food, cosmetic and health care industries. We cooperate closely with a number of research institutes and universities, take full advantages of natural resources that grow in Qinling Mountain and develop different kinds of quality products to meet the market demands.

Being a leading manufacturer of natural ingredients and nutrition supplements in China, HSF focuses on the R&D, production, and marketing of Natural Vitamin E and Phytosterol, Ferulic acid and Gamma Oryzanol throughout the worldwide market, with its headquarter located in the city of Xi"an, Shaanxi province, southwest China.

Xi"an Haoze Biotechnology Co., Ltd was established in 2015, and located in Hi-Tech Industrial Zone in Xi"an, Shaanxi, China. We are the leading supplier and researcher for plant extract, natural fruit extract, vegetable extract powder and many more. These are widely used in food supplement, beverage, cosmetics, medicines, health products and also part of chemical industries. It is mainly sold to health care company and medication company worldwide, such as China, Europe, USA, Japan and MENA countries. Our company has perfect quality assurance system of enterprises, the implementation of strict quality control standards, the aim is to provide users high quality product, reasonable prices and good service, this is also our consistent pursuit. Company has a strong team of experienced engineers and promising young management team, with more than 6 years experience in this industry, we can provide you the best service.

Rongsheng development announced that it significantly revised down the performance forecast for 2021, with an expected net loss of 4.5 billion yuan to 6 billion yuan and an expected profit of 100 million yuan to 150 million yuan; The company reassessed the expected sales price and its impact on inventory, and made a supplementary provision for inventory depreciation at the end of 2021.

SHANGHAI, Oct 30 (Reuters) - China Rongsheng, the country’s largest private shipbuilder, has secured a cash lifeline that could be worth up to HK$3.23 billion dollars and is looking to change its name to reflect its shift into oil exploration.

Shares in heavily indebted Rongsheng, which were suspended on Aug. 29 after the company said it was in the process of restructuring, surged almost 17 percent higher after trading resumed on Thursday. They reversed gains, and were down 3.7 pct by 0217 GMT.

Rongsheng said late on Wednesday it would issue warrants worth HK$510 million to a Cayman Islands-incorporated investment firm wholly owned by private equity investor Wang Ping, which would entitle subscribers to buy up to 1.7 billion new shares at HK$1.60 each.

This would raise about HK$3.23 billion for Rongsheng, it said. A warrant entitles the holder to buy stock from the issuer at a specific price within a time frame.

The price of the new shares is at a 17.65 percent premium to Rongsheng’s closing price of HK$1.36 per share on Aug. 28, when it last previously traded. It said the subscription shares represent 19.36 percent of the firm’s issued share capital.

Rongsheng, which builds Brazilian miner’s Vale mega-iron ore carriers, came close to insolvency last year before clinching an agreement with banks to extend its loans until end-2015.

As one of the Jiangsu region’s largest employers, the firm has received copious support from the government, which is currently helping Rongsheng with its restructuring.

Rongsheng also said it had signed a debt agreement with a syndicate of domestic banks in Anhui province that would extend its debt payments to the end of 2015.

Rongsheng has been one of the most prolific casualties of the global shipping slump. The industry is still trying to shake off a glut of ships ordered before the crisis which has sunk freight rates and caused many shipbuilding orders to be delayed or cancelled. ($1 = 7.7552 Hong Kong dollar) ($1 = 6.1136 Chinese yuan) (Reporting by Brenda Goh; Editing by Miral Fahmy)

8613371530291

8613371530291