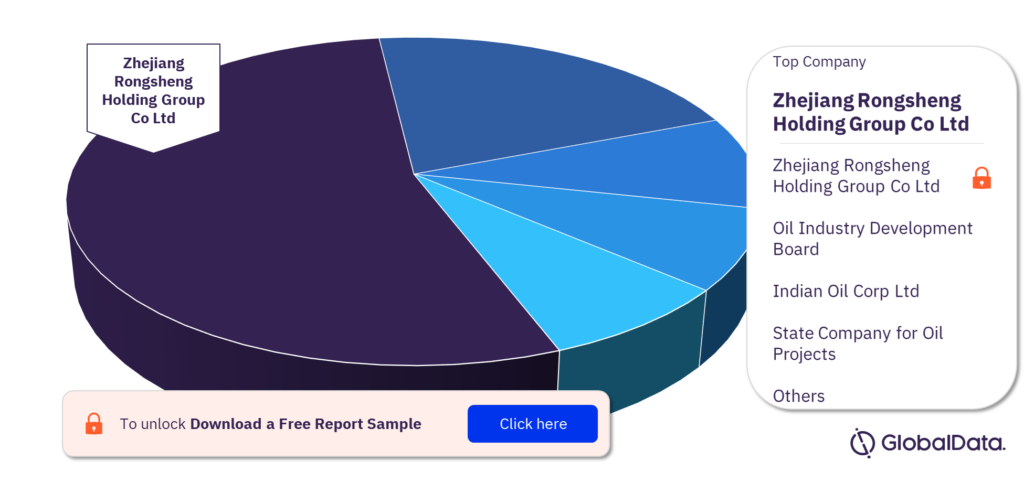

zhejiang rongsheng holding group co ltd quotation

Stocks: Real-time U.S. stock quotes reflect trades reported through Nasdaq only; comprehensive quotes and volume reflect trading in all markets and are delayed at least 15 minutes. International stock quotes are delayed as per exchange requirements. Fundamental company data and analyst estimates provided by FactSet. Copyright 2019© FactSet Research Systems Inc. All rights reserved. Source: FactSet

Stock Movers: Gainers, decliners and most actives market activity tables are a combination of NYSE, Nasdaq, NYSE American and NYSE Arca listings. Sources: FactSet, Dow Jones

Commodities & Futures: Futures prices are delayed at least 10 minutes as per exchange requirements. Change value during the period between open outcry settle and the commencement of the next day"s trading is calculated as the difference between the last trade and the prior day"s settle. Change value during other periods is calculated as the difference between the last trade and the most recent settle. Source: FactSet

Data are provided "as is" for informational purposes only and are not intended for trading purposes. FactSet (a) does not make any express or implied warranties of any kind regarding the data, including, without limitation, any warranty of merchantability or fitness for a particular purpose or use; and (b) shall not be liable for any errors, incompleteness, interruption or delay, action taken in reliance on any data, or for any damages resulting therefrom. Data may be intentionally delayed pursuant to supplier requirements.

Mutual Funds & ETFs: All of the mutual fund and ETF information contained in this display, with the exception of the current price and price history, was supplied by Lipper, A Refinitiv Company, subject to the following: Copyright 2019© Refinitiv. All rights reserved. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper. Lipper shall not be liable for any errors or delays in the content, or for any actions taken in reliance thereon.

Fair Value is the appropriate price for the shares of a company, based on its earnings and growth rate also interpreted as when P/E Ratio = Growth Rate. Estimated return represents the projected annual return you might expect after purchasing shares in the company and holding them over the default time horizon of 5 years, based on the EPS growth rate that we have projected.

This website uses cookies for convenience and personalization. Cookies store useful information on your computer so that we can improve the operational efficiency and accuracy of our website for you. In some cases, cookies are necessary for the proper operation of the website. By accessing this website, you consent to the use of cookies.

Rongsheng Petrochemical Co., Ltd. (SZSE:002493) signed an equity transfer agreement to acquire 70% stake in Zhejiang Yongsheng Film Technology Co., Ltd. and Zhejiang Juxing Chemical Fiber Co., Ltd from Zhejiang Rongsheng Holding Group Co., Ltd for approximately CNY 610 million on September 27, 2018. Under the terms, the consideration will be paid in 2 installments in which first installment of 30% of the total consideration payable within 7 days since approval from the board of directors and the second installment for the remaining consideration payable within 7 days since completion of delivery of underlying equity.

As of December 31, 2017, Zhejiang Yongsheng Film Technology and Zhejiang Juxing Chemical Fiber Co., Ltd reported total assets of CNY 967.8 million, total common equity of CNY 138.5 million, operating revenue of CNY 1.5 billion and net profit of CNY 22 million. The transaction has been approved by the Board of Directors of Rongsheng Petrochemical at 19th meeting of the 4th directorate held on September 27, 2018.

Rongsheng Petrochemical Co., Ltd. (SZSE:002493) cancelled the acquisition of 70% stake in Zhejiang Yongsheng Film Technology Co., Ltd. and Zhejiang Juxing Chemical Fiber Co., Ltd from Zhejiang Rongsheng Holding Group Co., Ltd on September 27, 2019.

© 2023 Fortune Media IP Limited. All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use and Privacy Policy | CA Notice at Collection and Privacy Notice | Do Not Sell/Share My Personal Information | Ad Choices

FORTUNE is a trademark of Fortune Media IP Limited, registered in the U.S. and other countries. FORTUNE may receive compensation for some links to products and services on this website. Offers may be subject to change without notice.

S&P Index data is the property of Chicago Mercantile Exchange Inc. and its licensors. All rights reserved. Terms & Conditions. Powered and implemented by Interactive Data Managed Solutions.

Li Shuirong (born 1956) is a Chinese billionaire and businessman, the chairman of the Zhejiang Rongsheng Holding Group[zh], which produces petrochemicals.

In 1989, Li Shuirong founded the Yinong Network Chemical Fiber Factory that produced polyester fiber cloth. After the polyester industry shifted upstream, he founded the Zhejiang Rongsheng Holding Group.

SINGAPORE/DUBAI/BEIJING, Feb 21 (Reuters) - Saudi Aramco plans to sign preliminary deals to invest in two oil refining and petrochemical complexes in China during Saudi Arabian Crown Prince Mohammed bin Salman’s state visit to Beijing this week, according to sources familiar with the plans.

Saudi Aramco, the world’s top oil exporter, will sign a memorandum of understanding (MOU) to build a refinery and petrochemical project in the northeastern Chinese province of Liaoning in a joint venture with China’s defence conglomerate Norinco, said three sources with knowledge of the matter.

Aramco is also expected to formalise an earlier plan to take a minority stake in Zhejiang Petrochemical, controlled by private Chinese chemical group Zhejiang Rongsheng Holding Group , said two sources with knowledge of this particular deal. Zhejiang Petrochemical is building a refinery and petrochemical complex in eastern Chinese province of Zhejiang.

The investments could help Saudi Arabia regain its place as the top oil exporter to China, which it has relinquished to Russia for the past three years. Saudi Aramco is poised to bolster its market share by signing supply agreements with non-state Chinese refiners.

It is not clear what new details will be in the MOU with Norinco expected during the visit, as the two companies first announced an alliance in May 2017 during Saudi ruler King Salman’s visit to Beijing.

Under that earlier MOU, the companies agreed to build a refinery capable of processing 300,000 barrels per day of crude and a facility that would make 1 million tonnes per year of ethylene, a building block for petrochemicals, at an estimated cost of over $10 billion.

A senior Aramco executive said last June he expected the front-end engineering for the Norinco project to be finished by mid-2019, following which the company will take a final investment decision.

The agreement follows an earlier MOU that Aramco signed in October to invest in Zhejiang’s project, which is planned as a refinery to process 400,000 bpd of crude and associated petrochemical facilities in the city of Zhoushan, south of Shanghai.

Reuters was not able to immediately reach Zhoushan Ocean Development and Investment Co Ltd, which holds the 9 percent stake in Zhejiang Petrochemical for the provincial government, for a comment.

The Saudi delegation, including top executives from Aramco, arrived in Beijing on Thursday for a two-day visit, part of the crown prince’s Asia tour, during which the kingdom has pledged $20 billion of investment in Pakistan and sought additional investment in India’s refining industry.

Chinese private petrochemical group Zhejiang Rongsheng Holding has signed a framework agreement with state-run shipping conglomerate Cosco Shipping Group to form a strategic partnership.

By using this site, you are agreeing to security monitoring and auditing. For security purposes, and to ensure that the public service remains available to users, this government computer system employs programs to monitor network traffic to identify unauthorized attempts to upload or change information or to otherwise cause damage, including attempts to deny service to users.

Unauthorized attempts to upload information and/or change information on any portion of this site are strictly prohibited and are subject to prosecution under the Computer Fraud and Abuse Act of 1986 and the National Information Infrastructure Protection Act of 1996 (see Title 18 U.S.C. §§ 1001 and 1030).

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

State oil giant Saudi Aramco signed an agreement on Thursday to invest in a refinery-petrochemical project in eastern China, part of its strategy to expand in downstream operations globally.

The memorandum of understanding between the company and Zhejiang province included plans to invest in a new refinery and co-operate in crude oil supply, storage and trading, according to details released by the Zhoushan government after a signing ceremony in the city south of Shanghai.

Zhejiang Petrochemical, 51 percent owned by textile giant Zhejiang Rongsheng Holding Group, is building a 400,000-barrels-per-day refinery and associated petrochemical facilities that was expected to start operations by the end of this year.

This is the third such project in China that Saudi Aramco has set its sight on as it seeks to lock in long-term outlets for its crude oil and produce fuel and petrochemicals to meet rising demand in Asia and cushion the risk of a slowdown in oil consumption.

The oil giant had not yet finalised the size of its stake in the project and still needed to complete due diligence, Aramco’s Senior Vice President of Downstream, Abdulaziz al-Judaimi, told Reuters on the sidelines of the event.

Aramco also owns part of the Fujian refinery-petrochemical plant with Sinopec and Exxon Mobil Corp, and has plans to build a 300,000-bpd refinery with China’s Norinco. It is also in talks with PetroChina to invest in a refinery in Yunnan.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

The China Petroleum and Chemical Industry Federation (CPEC) and the China Chemical Industry Association (CCEA) have jointly released the “2021 List of Top 100 Petroleum and Chemical Companies in China”. The list is ranked according to the main business revenue of major petroleum and petrochemical companies in 2020 and the public data of listed companies, among which China National Petroleum Corporation(CNPC), China Petroleum & Chemical Corporation(SINOPEC), and Hengli Group are the top three on the list.

On September 13, 2021, Chemical Weekly released its latest “Billion Dollar Club of Global Chemical Company” ranking. The ranking is based on each company’s 2020 chemical sales, and the threshold for this year’s Billion Dollar Club ranking is $2.8 billion, with BASF, Sinopec, and Dow Chemical occupying the top three spots. German chemical giant BASF continues to hold the top spot, having topped the list 10 times in the past 13 years.

The top ten chemical companies are not much different from 2020, among which three Chinese companies entered the top ten of the list, namely Sinopec, Formosa Plastics Group, and China National Chemical Corporation, withFormosa Plastics Groupand China National Chemical Corporation ranking No. 4 and No. 7 respectively, both up one position from the 2020 ranking.

In terms of country distribution, chemical companies from the U.S., Japan, China, and Germany predominate, with 28, 16, 13, and 9 companies from the four countries on the list, respectively. Among the 13 Chinese finalists, Hengli Petrochemicals and Rongsheng Petrochemicals rose significantly in ranking, with Hengli Petrochemicals rising from 27th to 14th last year and Rongsheng Petrochemicals rising from 51st to 24th last year. 2021 Ranking2020 RankingCompany(Headquarters)Chemicals Sales in 2020(Billion Dollar)

Due to the impact of the new global crown epidemic in 2020, 78 chemical companies on the list saw their revenues decline, while the remaining 22 companies saw their revenues increase year on year, with the average sales of $11.8 billion for the companies on the list.

Sales revenue is mainly concentrated between $10-20 billion, with 42 companies in that revenue range and only 14 companies above $20 billion, with BASF and Sinopec breaking the $50 billion mark, and Dow Chemical, Formosa Plastics Group, ExxonMobil, Hercules, and ChemChina with sales revenue of $30-40 billion.

The following is a rough introduction to the 4 domestic companies Sinopec, Hengli Petrochemical, Rongsheng Petrochemical, and Wanhua Chemical 2021 quarter 1 and 2 results.

Sinopec achieved oil and gas equivalent production of 235.29 million barrels in the first half of the year, up 4.2% year-on-year, and natural gas production of 582.6 billion cubic feet, up 13.7% year-on-year. Upstream segment profitability improved significantly, achieving an operating income of 6.2 billion RMB.

In the refining segment, 126 million tons of crude oil were processed in the first half of the year, up 13.7% year-on-year, and 72.19 million tons of refined oil products were produced, up 7.4% year-on-year. The refining segment’s profit rebounded strongly, achieving an operating income of 39.4 billion RMB.

In the chemical segment, Sinopec achieved ethylene production of 6.46 million tons in the first half of the year, an increase of 11.9% year on year. The total operating volume of chemical products was 40 million tons. The chemical segment maintained a good level of profitability, achieving an operating income of 13 billion RMB.

In addition, in the first half of the year, Sinopec completed four sets of hydrogen purification production units in Yanshan Petrochemical, Guangzhou Petrochemical, Gaoqiao Petrochemical, and Hainan Refinery respectively.

In the first half of 2021, with the nationwide New Crown Pneumonia epidemic under effective control, Sinopec’s sales of refined oil products recovered rapidly, achieving a total distribution volume of 109 million tons of refined oil products. As for the non-oil business, Sinopec achieved a 13.2% year-on-year increase in profit in the first half of the year. In the 2021 China Brand Value Evaluation, the brand value of “EJ” reached 18.4 billion RMB, an increase of 2.3 billion RMB. The profitability of the refined oil sales segment improved significantly, with an operating income of RMB 16.1 billion.

In addition, under the promotion of “one base, two wings, and three new” industry patterns, Sinopec accelerated the construction of “oil, gas, hydrogen, electricity, and service” integrated energy refueling stations, and the first carbon-neutral gas station and photovoltaic building-integrated gas station were completed and put into operation, and 20 hydrogen refueling stations, 570 charging and exchanging stations and distributed power stations were completed in China. The company has completed 20 hydrogen refueling stations, 570 charging and exchange stations, and 205 distributed photovoltaic power generation stations in China.

In terms of capital expenditure, Sinopec spent nearly RMB 58 billion on capital expenditure in the first half of the year. The chemical sector spent 19 billion yuan, mainly on Zhenhai and Hainan ethylene projects, Jiujiang aromatics, Yizheng PTA, and other projects. In this regard, Sinopec said that the company pays more attention to quality and efficiency. In terms of investment, it continues to optimize the investment management system and focus on improving the quality and efficiency of investment.

As the earliest and fastest leader in the development of the whole industry chain strategy of polyester new materials, Hengli Petrochemical has been vigorously expanding the upstream and downstream high-end production capacity in recent years to build a world-class integrated platform development of “crude oil – aromatics, olefins – PTA, glycol – polyester – civil yarn, industrial yarn, film, plastic”. model.

On the evening of August 12, 2021, Rongsheng Petrochemical released its 2021 semi-annual report, during which the listed company achieved operating revenue of 84.416 billion yuan, up 67.88% year-on-year, and a net profit of 6.566 billion yuan, up 104.69% year-on-year, with basic earnings per share of 0.65 yuan.

For the reasons for the change in performance, Rongsheng Petrochemical said that the overall production of refining and chemical projects is steadily climbing, contributing to the incremental performance of the company; the spread of raw material products has expanded, and the profitability space is significantly improved. In addition, since this year, the global economic resonance recovery, downstream demand rebounded significantly, crude oil-PX-PTA-polyester and crude-chemical industry chain boom continued to recover, so the company’s industry chain product costs and product spreads have expanded, and profitability increased significantly.

The company reported that in the first half of the year, the Yantai MDI plant completed 1.1 million tons/year of technical reform and expansion, the company’s MDI production capacity to further enhance, and one million tons of ethylene and other new devices were put into operation, the production and sales of major products increased year-on-year. In addition, with the easing of the global new crown epidemic, the downstream market demand improved; some overseas chemical plants were affected by extreme weather and other factors, resulting in global supply tension and rising prices of chemical raw materials. The company’s main products increased in volume and price compared to the same period last year, and the operating results in the first half of the year increased significantly.

In Conclusion, As a professional valve manufacturer, THINKTANK have been served many famous chemical companies around the world, we have rich project experience and standardized processes of production. So if you have a related project in the chemical industry, we are pleased to provide a free consultation.

8613371530291

8613371530291