zhejiang rongsheng refinery quotation

In a move to encourage higher refinery production to help a struggling economy, authorities earlier this month issued a small portion of the first-batch crude oil import quotas for 2023, months ahead of the usual timeline.

SINGAPORE, Oct 14 (Reuters) - Rongsheng Petrochemical, the trading arm of Chinese private refiner Zhejiang Petrochemical, has bought at least 5 million barrels of crude for delivery in December and January next year in preparation for starting a new crude unit by year-end, five trade sources said on Wednesday.

Rongsheng bought at least 3.5 million barrels of Upper Zakum crude from the United Arab Emirates and 1.5 million barrels of al-Shaheen crude from Qatar via a tender that closed on Tuesday, the sources said.

Rongsheng’s purchase helped absorbed some of the unsold supplies from last month as the company did not purchase any spot crude in past two months, the sources said.

Zhejiang Petrochemical plans to start trial runs at one of two new crude distillation units (CDUs) in the second phase of its refinery-petrochemical complex in east China’s Zhoushan by the end of this year, a company official told Reuters. Each CDU has a capacity of 200,000 barrels per day (bpd).

Zhejiang Petrochemical started up the first phase of its complex which includes a 400,000-bpd refinery and a 1.2 million tonne-per-year ethylene plant at the end of 2019. (Reporting by Florence Tan and Chen Aizhu, editing by Louise Heavens and Christian Schmollinger)

2021 marked the start of the central government’s latest effort to consolidate and tighten supervision over the refining sector and to cap China’s overall refining capacity.[14] Besides imposing a hefty tax on imports of blending fuels, Beijing has instituted stricter tax and environmental enforcement[15] measures including: performing refinery audits and inspections;[16] conducting investigations of alleged irregular activities such as tax evasion and illegal resale of crude oil imports;[17] and imposing tighter quotas for oil product exports as China’s decarbonization efforts advance.[18]

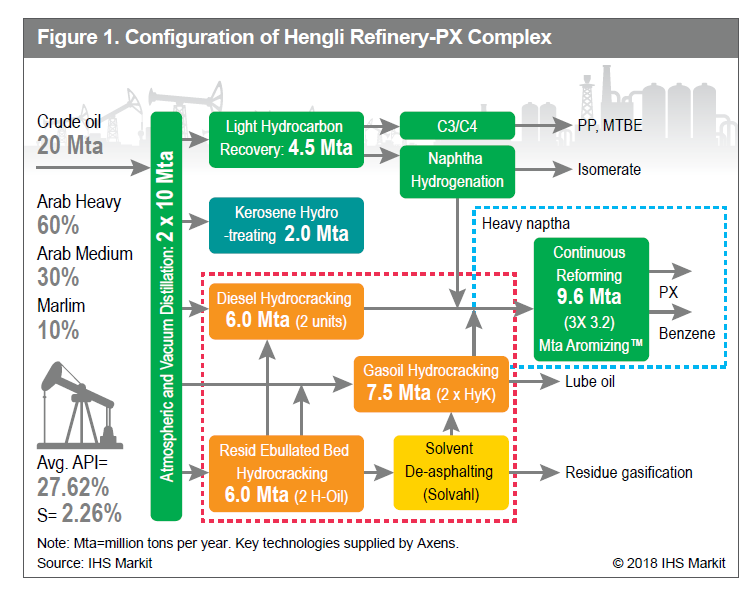

Yet, of the three most recent major additions to China’s greenfield refinery landscape, none are in Shandong province, home to a little over half the country’s independent refining capacity. Hengli’s Changxing integrated petrochemical complex is situated in Liaoning, Zhejiang’s (ZPC) Zhoushan facility in Zhejiang, and Shenghong’s Lianyungang plant in Jiangsu.[21]

As China’s independent oil refining hub, Shandong is the bellwether for the rationalization of the country’s refinery sector. Over the years, Shandong’s teapots benefited from favorable policies such as access to cheap land and support from a local government that grew reliant on the industry for jobs and contributions to economic growth.[22] For this reason, Shandong officials had resisted strictly implementing Beijing’s directives to cull teapot refiners and turned a blind eye to practices that ensured their survival.

In 2016, during the period of frenzied post-licensing crude oil importing by Chinese independents, Saudi Arabia began targeting teapots on the spot market, as did Kuwait. Iran also joined the fray, with the National Iranian Oil Company (NIOC) operating through an independent trader Trafigura to sell cargoes to Chinese independents.[27] Since then, the coming online of major new greenfield refineries such as Rongsheng ZPC and Hengli Changxing, and Shenghong, which are designed to operate using medium-sour crude, have led Middle East producers to pursue long-term supply contracts with private Chinese refiners. In 2021, the combined share of crude shipments from Saudi Arabia, UAE, Oman, and Kuwait to China’s independent refiners accounted for 32.5%, an increase of more than 8% over the previous year.[28] This is a trend that Beijing seems intent on supporting, as some bigger, more sophisticated private refiners whose business strategy aligns with President Xi’s vision have started to receive tax benefits or permissions to import larger volumes of crude directly from major producers such as Saudi Arabia.[29]

The shift in Saudi Aramco’s market strategy to focus on customer diversification has paid off in the form of valuable supply relationships with Chinese independents. And Aramco’s efforts to expand its presence in the Chinese refining market and lock in demand have dovetailed neatly with the development of China’s new greenfield refineries.[30] Over the past several years, Aramco has collaborated with both state-owned and independent refiners to develop integrated liquids-to-chemicals complexes in China. In 2018, following on the heels of an oil supply agreement, Aramco purchased a 9% stake in ZPC’s Zhoushan integrated refinery. In March of this year, Saudi Aramco and its joint venture partners, NORINCO Group and Panjin Sincen, made a final investment decision (FID) to develop a major liquids-to-chemicals facility in northeast China.[31] Also in March, Aramco and state-owned Sinopec agreed to conduct a feasibility study aimed at assessing capacity expansion of the Fujian Refining and Petrochemical Co. Ltd.’s integrated refining and chemical production complex.[32]

State oil giant Saudi Aramco signed an agreement on Thursday to invest in a refinery-petrochemical project in eastern China, part of its strategy to expand in downstream operations globally.

The memorandum of understanding between the company and Zhejiang province included plans to invest in a new refinery and co-operate in crude oil supply, storage and trading, according to details released by the Zhoushan government after a signing ceremony in the city south of Shanghai.

Zhejiang Petrochemical, 51 percent owned by textile giant Zhejiang Rongsheng Holding Group, is building a 400,000-barrels-per-day refinery and associated petrochemical facilities that was expected to start operations by the end of this year.

Aramco also owns part of the Fujian refinery-petrochemical plant with Sinopec and Exxon Mobil Corp, and has plans to build a 300,000-bpd refinery with China’s Norinco. It is also in talks with PetroChina to invest in a refinery in Yunnan.

Miserable Chinese refinery margins will constrain runs among integrated refineries, incl major firms like Hengli & Rongsheng, whose profits fell by 90% y/y in Q3 22.expects low margins to persist into Q2 2023 -> cautious crude purchases.

(Reuters) Chinese conglomerate Zhejiang Rongsheng Holding Group plans to double capacity of a joint venture refining project to 800 Mbpd in 2020, two years after the first phase starts up, senior company officials said Thursday.

The project, a venture among private companies led by Rongsheng, is planning to start up the 400 Mbpd first phase in 2018, aiming to meet the group"s requirements for petrochemical feedstocks.

Chinese private petrochemical group Zhejiang Rongsheng Holding has signed a framework agreement with state-run shipping conglomerate Cosco Shipping Group to form a strategic partnership.

Hengli Petchem and Zhejiang Rongsheng"s new 400,000 bpd refinery each in Dalian and Zhoushan, respectively, are expected to come on stream in the last quarter of this year. In the same quarter, CNPC"s 100,000 bpd and Sinopec"s 200,000 bpd incremental capacity in Huabei and Zhanjiang, respectively, are also expected to become operational, they said.

China"s private refiner Zhejiang Petroleum & Chemical is set to start trial runs at its second 200,000 b/d crude distillation unit at the 400,000 b/d phase 2 refinery by the end of March, a source with close knowledge about the matter told S&P Global Platts March 9.

ZPC cracked 23 million mt of crude in 2020, according the the source. Platts data showed that the utilization rate of its phase 1 refinery hit as high as 130% in a few months last year.

Started construction in the second half of 2019, units of the Yuan 82.9 billion ($12.74 billion) phase 2 refinery almost mirror those in phase 1, which has two CDUs of 200,000 b/d each. But phase 1 has one 1.4 million mt/year ethylene unit while phase 2 plans to double the capacity with two ethylene units.

With the entire phase 2 project online, ZPC expects to lift its combined petrochemicals product yield to 71% from 65% for the phase 1 refinery, according to the source.

Zhejiang Petroleum, a joint venture between ZPC"s parent company Rongsheng Petrochemical and Zhejiang Energy Group, planned to build 700 gas stations in Zhejiang province by end-2022 as domestic retail outlets of ZPC.

Established in 2015, ZPC is a JV between textile companies Rongsheng Petrochemical, which owns 51%, Tongkun Group, at 20%, as well as chemicals company Juhua Group, also 20%. The rest 9% stake was reported to have transferred to Saudi Aramco from the Zhejiang provincial government. But there has been no update since the agreement was signed in October 2018.

8613371530291

8613371530291