north america safety valve free sample

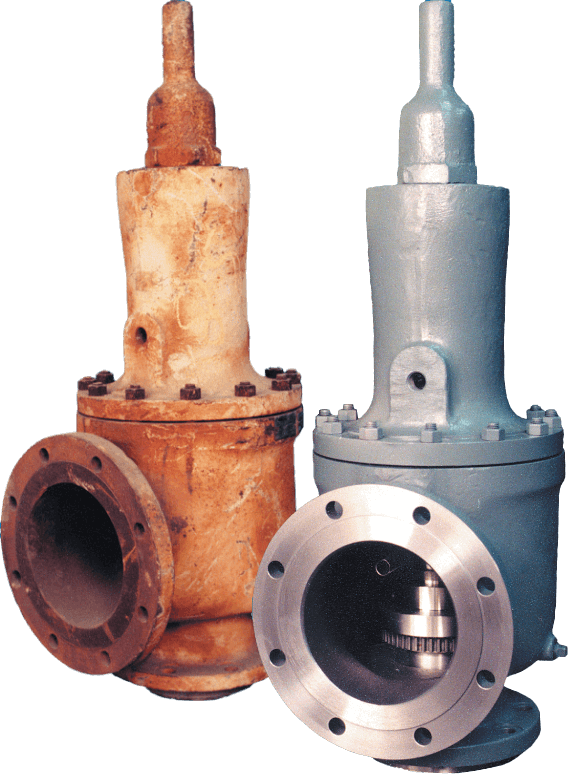

Of all the challenges you face keeping your customers’ plants operating at full capacity, safety and relief valves shouldn’t be one of them. NASVI’s job is to give you the confidence that your valve supply chain is rock solid regardless the pressure it’s under.

A little product education can make you look super smart to customers, which usually means more orders for everything you sell. Here’s a few things to keep in mind about safety valves, so your customers will think you’re a genius.

A safety valve is required on anything that has pressure on it. It can be a boiler (high- or low-pressure), a compressor, heat exchanger, economizer, any pressure vessel, deaerator tank, sterilizer, after a reducing valve, etc.

There are four main types of safety valves: conventional, bellows, pilot-operated, and temperature and pressure. For this column, we will deal with conventional valves.

A safety valve is a simple but delicate device. It’s just two pieces of metal squeezed together by a spring. It is passive because it just sits there waiting for system pressure to rise. If everything else in the system works correctly, then the safety valve will never go off.

A safety valve is NOT 100% tight up to the set pressure. This is VERY important. A safety valve functions a little like a tea kettle. As the temperature rises in the kettle, it starts to hiss and spit when the water is almost at a boil. A safety valve functions the same way but with pressure not temperature. The set pressure must be at least 10% above the operating pressure or 5 psig, whichever is greater. So, if a system is operating at 25 psig, then the minimum set pressure of the safety valve would be 30 psig.

Most valve manufacturers prefer a 10 psig differential just so the customer has fewer problems. If a valve is positioned after a reducing valve, find out the max pressure that the equipment downstream can handle. If it can handle 40 psig, then set the valve at 40. If the customer is operating at 100 psig, then 110 would be the minimum. If the max pressure in this case is 150, then set it at 150. The equipment is still protected and they won’t have as many problems with the safety valve.

Here’s another reason the safety valve is set higher than the operating pressure: When it relieves, it needs room to shut off. This is called BLOWDOWN. In a steam and air valve there is at least one if not two adjusting rings to help control blowdown. They are adjusted to shut the valve off when the pressure subsides to 6% below the set pressure. There are variations to 6% but for our purposes it is good enough. So, if you operate a boiler at 100 psig and you set the safety valve at 105, it will probably leak. But if it didn’t, the blowdown would be set at 99, and the valve would never shut off because the operating pressure would be greater than the blowdown.

All safety valves that are on steam or air are required by code to have a test lever. It can be a plain open lever or a completely enclosed packed lever.

Safety valves are sized by flow rate not by pipe size. If a customer wants a 12″ safety valve, ask them the flow rate and the pressure setting. It will probably turn out that they need an 8×10 instead of a 12×16. Safety valves are not like gate valves. If you have a 12″ line, you put in a 12″ gate valve. If safety valves are sized too large, they will not function correctly. They will chatter and beat themselves to death.

Safety valves need to be selected for the worst possible scenario. If you are sizing a pressure reducing station that has 150 psig steam being reduced to 10 psig, you need a safety valve that is rated for 150 psig even though it is set at 15. You can’t put a 15 psig low-pressure boiler valve after the reducing valve because the body of the valve must to be able to handle the 150 psig of steam in case the reducing valve fails.

The seating surface in a safety valve is surprisingly small. In a 3×4 valve, the seating surface is 1/8″ wide and 5″ around. All it takes is one pop with a piece of debris going through and it can leak. Here’s an example: Folgers had a plant in downtown Kansas City that had a 6×8 DISCONTINUED Consolidated 1411Q set at 15 psig. The valve was probably 70 years old. We repaired it, but it leaked when plant maintenance put it back on. It was after a reducing valve, and I asked him if he played with the reducing valve and brought the pressure up to pop the safety valve. He said no, but I didn’t believe him. I told him the valve didn’t leak when it left our shop and to send it back.

If there is a problem with a safety valve, 99% of the time it is not the safety valve or the company that set it. There may be other reasons that the pressure is rising in the system before the safety valve. Some ethanol plants have a problem on starting up their boilers. The valves are set at 150 and they operate at 120 but at startup the pressure gets away from them and there is a spike, which creates enough pressure to cause a leak until things get under control.

If your customer is complaining that the valve is leaking, ask questions before a replacement is sent out. What is the operating pressure below the safety valve? If it is too close to the set pressure then they have to lower their operating pressure or raise the set pressure on the safety valve.

Is the valve installed in a vertical position? If it is on a 45-degree angle, horizontal, or upside down then it needs to be corrected. I have heard of two valves that were upside down in my 47 years. One was on a steam tractor and the other one was on a high-pressure compressor station in the New Mexico desert. He bought a 1/4″ valve set at 5,000 psig. On the outlet side, he left the end cap in the outlet and put a pin hole in it so he could hear if it was leaking or not. He hit the switch and when it got up to 3,500 psig the end cap came flying out like a missile past his nose. I told him to turn that sucker in the right direction and he shouldn’t have any problems. I never heard from him so I guess it worked.

If the set pressure is correct, and the valve is vertical, ask if the outlet piping is supported by something other than the safety valve. If they don’t have pipe hangers or a wall or something to keep the stress off the safety valve, it will leak.

There was a plant in Springfield, Mo. that couldn’t start up because a 2″ valve was leaking on a tank. It was set at 750 psig, and the factory replaced it 5 times. We are not going to replace any valves until certain questions are answered. I was called to solve the problem. The operating pressure was 450 so that wasn’t the problem. It was in a vertical position so we moved on to the piping. You could tell the guy was on his cell phone when I asked if there was any piping on the outlet. He said while looking at the installation that he had a 2″ line coming out into a 2×3 connection going up a story into a 3×4 connection and going up another story. I asked him if there was any support for this mess, and he hung up the phone. He didn’t say thank you, goodbye, or send me a Christmas present.

As one of the leading manufacturers of cavity free plug valves and special valves, AZ supplies to production plants in the chemical, petrochemical, pharmaceutical, paper, food industries as well as for nuclear power plants and many other areas. Special valves for highest demands in areas with high operating pressures and aggressive, toxic or abrasive media are designed and developed together with our customers. In the 50 years of the company’s existence, AZ has continuously developed to meet the increasing requirements of customers active around the world and today AZ manufactures internationally on four continents.

Besides the P/T value of the sleeve the limitations of the valve bodies also have to be considered. Please refer to the EN 12516-1 resp. ASME B16.34 in order to choose a proper pressure rating (PN/class). The shown values refer to austenitic stainless steel 1.4408 (A351 Gr. CF8M).

Please choose...AlbaniaAlgeriaAndorraAngolaAnguillaAntigua BarbudaArgentinaArmeniaArubaAustraliaAustriaAzerbaijanBahamasBahrainBangladeshBarbadosBelarusBelgiumBelizeBeninBermudaBhutanBoliviaBosnia and HerzegovinaBotswanaBrazilBruneiBulgariaBurkina FasoBurundiCambodiaCameroonCanadaCape VerdeCayman IslandsCentral African RepublicChadChileChinaChristmas IslandCocos (Keeling) IslandsColombiaComorosCongo-BrazzavilleCook IslandsCosta RicaCroatiaCyprusCzech RepublicDenmarkDjiboutiDominicaDominican RepublicEcuadorEgyptEl SalvadorEquatorial GuineaEritreaEstoniaEthiopiaFalkland Islands (Malvinas)Faroe IslandsFijiFinlandFranceFrench GuianaFrench PolynesiaGabonGambiaGeorgiaGermanyGhanaGibraltarGreeceGreenlandGrenadaGuadeloupeGuatemalaGuineaGuinea-BissauGuyanaHaitiHeard and McDonald IslandsHoly See (Vatican City State)Honduras(China) Hong KongHungaryIcelandIndiaIndonesiaIraqIreland (Republic only)IsraelItalyIvory CoastJamaicaJapanJordanKazakhstanKenyaKiribatiCongo-KinshasaKosovoKuwaitKyrgyzstanLao Peoples Democratic RepublicLatviaLebanonLesothoLiberiaLiechtensteinLithuaniaLuxembourg(China) MacaoMacedoniaMadagascarMalawiMalaysiaMaldivesMaliMaltaMarshall IslandsMartiniqueMauritaniaMauritiusMayotteMexicoMicronesiaMoldovaMonacoMongoliaMontenegroMontserratMoroccoMozambiqueMyanmarNamibiaNauruNepalNetherlandsNew CaledoniaNew ZealandNicaraguaNigerNigeriaNiueNorfolk IslandNorwayOmanPakistanPalauPalestinian TerritoryPanamaPapua New GuineaParaguayPeruPhilippinesPitcairnPolandPortugalQatarReunionRomaniaRussiaRwandaSaint Kitts and NevisSaint LuciaSaint Vincent and the GrenadinesSaint-Martin (FR)SamoaSan MarinoSao Tome and PrincipeSaudi ArabiaSenegalSerbiaSeychellesSierra LeoneSingaporeSlovakiaSloveniaSolomon IslandsSomaliaSouth AfricaSouth KoreaSpainSri LankaSurinameSwazilandSwedenSwitzerland (deutsch)Switzerland (francais)(China) TaiwanTajikistanTanzaniaThailandTimor-LesteTogoTokelauTongaTrinidad and TobagoTunisiaTurkeyTurkmenistanTurks and Caicos IslandsTuvaluUgandaUkraineUnited Arab EmiratesUnited KingdomUnited States of AmericaUruguayUzbekistanVanuatuVenezuelaVietnamWallis and FutunaWestern SaharaYemenZambiaZimbabweCuraçaoSint MaartenLibyaSaint BarthélemyVirgin Islands, British

As leaders in sampling valve technology, our zero-defect inline valves can be configured for the most difficult applications where grabbing hazardous chemicals in liquid and gas states, including Hydrofluoric Acid, Fuming Acid and Liquid Chlorine is required. These robust valves, along with our adapters and receptacles, are easy to use and may be customized to your specific needs. We help to maximize operator safety by designing maintenance-free valves that don’t require flushing or purging, thus providing adirectly representative sample, the first time, every time!

Expansion in the oil and gas industry, rise in demand for cleaner fuel, technological advancements in manufacturing lines have resulted in boosting Safety valves market.

NEW YORK, June 11, 2019 (GLOBE NEWSWIRE) -- The Global Safety valves market is forecast to reach USD 6.30 Billion by 2026, according to a new report by Reports and Data.

Safety values have become an integral part of the operation for different industries in contemporary times. The expansion of these industries is promoting the growth of the market. Another essential driving factor for the market is stringent government policies regulating workplace health and safety. It is because of these government regulations; it has become necessary for different industries to comply with these safety norms and incorporate safety valves in their operation. Such a rise in safety valves application in various sectors encourages the growth of this sector.

In addition to these factors, with a rise in global population, there has been a rise in demand for oil and gas. For catering to this present demand for oil and gas, the industry is focusing on various developments. One such recent event in the oil and gas industry is the discovery of shale gas. Such developments in the industry, along with its expansion, is positively impacting the growth of the safety valves market. Expansion of global population has also resulted in increased demand for energy. In order to cater to the rise in demand for energy, alternative sources of energy generation like nuclear energy generation are being tapped. In the operation of nuclear energy generation, safety valves are essential in preventing radioactive elements from getting disseminated. Hence, the growth of nuclear energy generation also results in the growth of safety valves market.

Further key findings from the report suggest The Safety valves market held a market share of USD 4.70 Billion in the year 2018. It is forecasted to grow at a rate of 3.7% during the forecast period.

In regards to the product types, Spring-loaded Pressure-relief Valves segment generated the highest revenue of USD 2.03 Billion in 2018 with a CAGR of 3.9% during the forecast period. This type of safety valve is one of the most commonly used safety valves due to the presence of traits like no impact of pressure release on back pressure and effectiveness in dealing with higher built-up backpressure. The high rate of application of this type of safety valve, contributes to the revenue yielded by this segment.

In context to material, Stainless Steel segment generated the highest revenue of USD 1.69 Billion in 2018 with a growth rate of 4.0% during the forecast period. The revenue generated by the segment has been the result of the rise in demand for a high-quality and effective safety valve for mitigating the issue of contamination that is prevalent in industries like food and beverage industry.

In regards to size, Less than 6-inch segment generated the highest revenue of USD 1.65 Billion in 2018 with a CAGR of 4.0% during the forecast period. The revenue generated by this segment has been the result of the rise in demand for power-based and energy application, in which, safety valve finds a significant application.

In regards to application, the Agriculture segment is forecasted to generate USD 1.32 Billion by 2026 with the highest CAGR of 5.0% during the forecast period. The growth rate of the segment has been the consequence of the effectiveness of safety valve in precision farming and irrigation, which are integral parts of agriculture.

Key participants include Alfa Laval, Bosch Rexroth, Aquatrol Valve Company, ARI-Armaturen, Forbes Marshall, Baker Hughes (A GE Company), Emerson, Danfoss, IMI PLC, Curtiss-Wright Corporation.

For the purpose of this report, Reports and Data have segmented the global Safety valves market according to Product types, Material, Size, Application areas, and Region:

According to a comprehensive research report by Market Research Future (MRFR), “Global Safety Valve Market information by Material, Size, End-use and Region – forecast to 2027” the market is projected to reach USD 5.12 billion by 2025, with 5.02% CAGR.

Safety valves, put simply, are preventive and precautionary valves which actuate automatically when the temperature and preset safety valve pressure is exceeded. These valves safeguard critical equipment from damage via releasing the excess pressure sans any electrical support. Along with protecting the equipment, safety valves are also essential to protect the employees around the plants as well as the environment around it. Safety valves are made of different materials such as cryogenic, cast iron, alloy, steel, and others that have wide applications in water and wastewater treatment, food and beverage, chemicals, energy and power, oil and gas, and others.

According to the MRFR report, there are numerous factors that are propelling the global safety valve market share. Some of these entail the growing need for safety valves from oil and gas industry, growing nuclear energy generation, the integration of safety valves into the IoT, rising demand for oil and gas, associated development of the market, growth in the construction of downstream, midstream, and upstream infrastructure, and growing construction industry. The additional factors adding market growth include the growing nuclear energy generation, constant need for safety valve replacement, the use of 3D printers in manufacturing lines, booming oil and gas industry, technological advances, and growing need for cleaner fuel.

By material, the global safety valve market is segmented into cryogenic, cast iron, alloy, steel, and others. Of these, the steel segment will lead the market over the forecast period as these valves are durable as well as do not leak in cold or hot temperatures.

By size, the global safety valve market is segmented into 20” and above, 11 to 20”, 1 to 10”, and less than 1”. Of these, the 1 to 10” segment will dominate the market over the forecast period as this size range of safety valves are utilized for controlling the pressure and flow of slurries, gases, and liquids with different end-use industries.

By end use, the global safety valve market is segmented into water and wastewater treatment, food and beverage, chemicals, energy and power, oil and gas, and others. Of these, the oil and gas segment will spearhead the market over the forecast period as the oil & gas industry is amid the most significant revenue generating industries that needs almost every form of valve such as butterfly, ball, check, globe, and gate.

Geographically, the global safety valve market is bifurcated into Europe, North America, South America, the Asia Pacific, & the Middle East and Africa (MEA). Of these, the APAC region will remain domineer in the market over the forecast period. Growing industrialization, rapid urbanization, structural and regulatory changes needed to make infrastructure more competitive for private investors, build a public-private partnership projects, used for controlling liquid flow in piping systems, firefighting systems, and water supply systems, increasing construction industry, numerous opportunities for market players in the safety valve sector, population growth, and the presence of developing economies such as India and China are adding to the global safety valve market growth in the region. Besides, speedy development in the region, growing demand from several industries like oil and gas, pharmaceuticals, chemicals, construction, water and wastewater treatment, and energy and power, infrastructural developments, increasing investments in various sectors, and increased application of safety valves are also adding market growth.

In North America, the global safety valve market is predicted to have promising growth over the forecast period. Growing investments in the construction sector, booming construction sector in the US, extensive installation of safety valves in the construction industry, rapid industrialization, rapid use of high-end technology, flourishing oil and gas industry, and rapid establishment of several market players are adding to the global safety valve market growth in the region.

In Europe, the global safety valve market is predicted to have admirable growth over the forecast period. Germany holds the utmost market share for the rise in power produced from renewable energy sources.

The global safety valve market has unfortunately faced the brunt of the ongoing COVID-19 crisis. This is due to disruptions in supply chain, fluctuations in demand share, the economic consequences of the outbreak, and the immediate as well as future impact of the global crisis owing to social distancing trends and government imposed lockdowns all across the globe have all impacted the growth of the market negatively. However following relaxation of the lockdown in some parts the market is likely to get back to normalcy soon.

Solenoid directional valves and cartridges with inductive sensors to monitor the spool/poppet position, certified to Machine Directive 2006/42/EC. Pressure relief valves certified to PED 2014/68/EU.

A pressure relief valve is a safety device designed to protect an overpressurized vessel or piping system by venting fluids back to the system to the low-pressure side during an overpressure event.

Industrial accidents potentially bring down the top-notch industrial players to rock bottom. The demand for technologies that can ensure the safety of the plant is rising among the facility owners. Moreover, several regulatory such as pipeline and hazardous materials safety administration have put up various regulations, that is compelling the facility owners to install technologies that will enhance and ensure the safety of the plants.

The continuously rising population has impelled the growth of the various market across the globe. Thus, to meet these demands, industrialists are scaling-up their production by setting up new plants across the globe, especially in emerging economies. Additionally, as the industrialization of the country reflects in its economic growth, the government of various countries taking several initiatives to boost the industrial sector of their country. For Instances, According to India Brand Equity Foundation (IBEF), the Government of India unveiled "Pharma Vision 2020" under which it has reduced the approval time for new facilities to boost investments of the pharmaceutical sector, the aiming to make India a global leader in end-to-end drug manufacture market. Such initiatives and expansion are expected to push up the demand for high-pressure relief valves in the upcoming years.

Pressure relief valves are used in the oil & gas industry to provide overpressure protection for fracturing & treating lines, pressure vessels, cementing/fracturing pumps, and other equipment. Oil and gas lines, high-pressure well-servicing lines, acidizing & fracturing lines, manifolds and pipelines, and vessels are some of the significant applications where high-pressure relief valves are used across the oil & gas industry.

To meet the rising demand, energy is one major driver fueling the growth of the oil & gas Industry. Thus, further leading to the consumption of high-pressure relief valves for the safety of the pipelines. According to the B.P. statistical review of world energy 2019, the global oil consumption went up from 96,737 TBPD in 2016 to 99,843 TBPD in 2018, in which the U.S. itself accounted for 20.4% in 2018. It is expected that this consumption will rise in the upcoming years.

In the energy sector, pressure safety valves are used across various industries such as thermal power plants, hydroelectric plants, and nuclear plants. In these industries, high-pressure relief valves are used to provide overpressure protection of pressurized systems. These valves are majorly used in steam, gas, and vapor services.

In the chemical and petrochemical industry, high-pressure relief valves are used in the pipelines to transfer industrial gases, and for cooling and oxygen transfer applications in chemical reactors. These valves help to optimize processes and assist in ensuring the safety of plants and workers.

Moreover, the chemical industry is underway rapid expansion and scaling up its manufacturing process through mergers and acquisitions. As the industry is thriving, the complexity of the plants is also rising and increasing the risk associated with it. Thus, to guarantee the safety of the plants and workers, the manufacturers are spending a significant amount on the installation of these pressure valves.

In the food & beverage industry, high-pressure relief valves are used to control the flow performance and shut-off protection for food safety. Some of the major application areas of these valves are the distilleries, fermenters, dairy processing, steam control, and others.

The key players in the High-Pressure Relief Valves Market are LESER GmbH & Co. KG Emerson Electric Co. Baker Hughes, a GE company LLC Velan Inc. Groth Corporation Schlumberger Limited Bosch Rexroth AG Watts Water Technologies, Inc. The Weir Group PLC Pentair plc Goetze KG Armaturen Curtiss-Wright PARKER HANNIFIN CORP IMI Precision Engineering Limited Afva Laval Flow Safe, Inc. Mercury Manufacturing Company Forbes Marshall AGF Manufacturing Inc.

8613371530291

8613371530291