how much does a workover rig cost pricelist

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

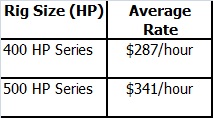

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

No New Competition [See Question 7 on Statistical Review]. All respondents said that competition had not increased QTQ, and they were not anticipating it would, given lower oil prices.Mid-Tier Well Service Manager: “We worry about the small local companies undercutting prices but we are not seeing anything now.”

2015 Rates Under Pressure [See Question 8 on Statistical Review]. Five of the eight respondents said 2015 would see further reductions in demand and hourly rates and even labor rates if the price of oil did not rise. One respondent said that “iron would start laying down” if oil prices did not rise. One respondent said he expects that work demand would come back up after a couple of months as everyone adjusted.Manager for Mid-Tier Well Service Company: “As a company, we have backed off our growth budget for 2015 and our capex has been nixed. We implemented a 10% reduction in our rates. We are just going to lower rates not wages, because we can buy equipment and leave it sit, but if you do that with people, they starve.”

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

Enjoy the best returns on your investment with these supreme workover rig price ranges at Alibaba.com. Their efficacy and reliability will prove that they’re worth their price tags. They will empower you to attain your mining and drilling goals and definitely surpass your expectations.

workover rig price options also include an air compressor, a mud pump, drilling rods of various sizes, connectors, and a drilling tower. Drilling is done using drill bits of various shapes, sizes, and compositions. You can choose between diamond bits, alloy ring-shaped bits, 3-wing alloy bits, PDC bits, and hammer bits. Each drill bit uses different drilling methods, including rotary, percussion, blast hole, and core drilling.

Are you looking for a wholesale workover rig price? Look no more as Alibaba.com has all sorts of pile drivers that will ease your next pile driving process. A pile-driving machine is critical equipment in constructing structures and buildings as it helps in driving piles into the soil. These piles help in providing foundation support for a structure or building under construction. In that way, you can comfortably move a load of the structure to a difficult depth without a machine. Regarding your liking workovers rig price, visit Alibcom.com as they have unlimited pile available at wholesale prices. Inther you are looking for pneumatic tools or hydraulic pipes, you will find them type at affordable prices. If you need a drill, it can advisable to have a workover r price.

Oil rig equipment is expensive due to the size and operations carried out by such large machinery. Purchasing a newly constructed drill rig is a huge investment.

As such, you’ll want to be sure you have the right expectations before you begin searching for one to complete your assignment. This article will discuss just what a drill rig does and the estimated costs involved in the drilling process.

As one of the industry leaders, TAFS assists trucking companies to increase cash flow with some of the lowest factoring rates in the industry and 1-Hour Advance option.

When you need a machine powerful enough to bore through the earth’s crust to retrieve minerals, gas, or any other natural resources, a drill rig will get the job done. Each rig is designed for the environment they’re operating in and the product being extracted. Those two factors greatly affect the cost of the rig you’re looking to purchase.

A standard land rig with 1,500 to 1,700 horsepower will cost between $14 million and $25 million to own. An offshore oil rig cost is much higher, starting at $20 million and going as high as $1 billion. Owning your drill rig will save you money in the long run, especially when considering the daily cost of operations.

Your daily rate depends on the rig type, distance from shore, drilling depth, and water depth. Onshore drilling rates range from $200,000 to $310,000 each day. Offshore drilling can cost between $600,000 to $800,000 per day.

Several factors impact the oil rig cost, including construction, including materials, market conditions, equipment prices, and more. We’ll cover the basics, so you have a realistic expectation when searching for a rig price.

Cost and demand go hand-in-hand. When there is a high demand for building new rigs, the cost rises because a limited number of shipyards can provide the service.

For example, in the early 2000s, there wasn’t a demand for new rig construction, so rates were low. In the mid-2000s, demand increased, and prices rose, but after the 2008 recession, demand decreased. But the prices didn’t drop significantly as the recession wasn’t expected to last long.

The materials used in making a drill rig are a key component in construction costs. The material used most, steel, comes in various strengths, and the stronger the steel, the higher it’s priced. When steel prices are low, rigs will be cheaper to produce; when steel prices rise, so do the costs of the rigs.

Concrete is another material that will raise production costs. It’s often used in environments containing salt water as a way of avoiding corrosion and rusting. Concrete usually costs about 7% to 10% more than steel.

The cost of additional services needed for constructing wells will begin to add up. Phone bills and fees for transferring data are part of your communication cost. For those working offshore, rig positioning will be another fee.

The cementing equipment and engineer have to be paid for their services also. Other services are wire line logging, drilling measurement, mud engineering, downhole motors, mud logging, and surveying the hole.

There are two types of oil rigs, jackups, and floaters. Floaters aren’t attached to or resting on the seafloor. Jackups have support legs that allow the rig to be raised or lowered. Each type has different equipment to assist with the drilling process.

The engines, generators, cranes, and other oil rig components are purchased from a third party and assembled by the rig builder. Non-drilling related equipment is about 30% to 60% of the total cost.

Since most of the parts used are made from steel, the fluctuations in the steel market will influence the rig’s price. Demand for the additional equipment to fit on the rig will also play a part in costs.

Where your rig is built impacts the labor costs, which affect the price of the drill rig. It’s estimated that labor is 10% to 15% of the total cost of the rig is built internationally. While the U.S. and Korea have similar costs, Singapore charges three times less.

Each dollar spent on labor in the U.S. generates $3 in revenue, while in Singapore and South Korea, every dollar generates $7 to $10 in revenue. Since labor costs are typically lower internationally, the cost of your rig won’t be as high.

Always expect and prepare for the unexpected by setting aside a portion of the budget for allowances. Once you start drilling, you can’t be sure what you’re going to find, and variances in the geological structure could require different equipment and delay the process. Both of these instances will increase the cost of the rig being used.

Preparing an area for drilling can mean building roads to the site. These roads need to support heavy machinery and can take 15 to 20 days to build. Preparation also varies based on the environment.

Marshes, land, and offshore drilling all have their own preparation needs. It can take several weeks before drilling can begin, and each day spent getting the site ready comes with a hefty cost.

The drilling depth and well complexity are primary cost influencers. Once the drill rig is moved into position, it can take a team of 30 to 40 companies to complete the process. Costs can easily top $4 million during the drilling phase and take about three weeks to finish.

Positioning drilling rigs isn’t an easy task. It takes 3 to 5 days to move in and assemble a rig for well digging. Once the job is complete, the rig has to be disassembled and moved again. Rates hover between $100,000 and $350,000 depending on how far the rig is being transported.

The oil industry is very lucrative, and the machines used to drill for the resource are not cheap. Oil rigs are heavy-duty machines needed to reach extreme depths.

The harsh environments they’re in demand that they are built with the best materials available. If you need a drill rig, it’s important to keep in mind all the factors that contribute to the cost of the equipment so you can budget correctly.

Aug 26 (Reuters) - North American onshore rig contractors are spending millions of dollars to add costly “walking” rigs to their fleet, a move that may seem counterintuitive at a time when the slump in crude prices shows no signs of abating.

Such rigs “walk” from wellbore to wellbore, unlike a regular rig that has to be taken apart and reassembled for each move, and save shale producers time and money - as much as 30 percent of the cost to drill a well.

Even though the returns on these investments will not be immediate, rig contractors such as Patterson-UTI Energy Inc and Pioneer Energy Services are pandering to the demand for these rigs.

Demand for rigs have taken a walloping, as oil producers have slammed the brakes on drilling new wells to cope with a 28 percent decline in U.S. crude prices this year.

“As activity starts picking up again, the majority of requests from operators, I think, will be for pad-oriented rigs,” said Pioneer Energy CEO Stacy Locke, referring to the popular practice of drilling several wells in one location.

This promise of higher demand and better rates has led rig contractors to either build new walking rigs or spend $1 million to $2 million to attach giant hydraulic walking systems on their regular rigs.

It costs $20 million to $25 million to build a new walking rig, according to Evercore ISI analyst James West. A regular rig used to cost $10 million to $15 million a decade ago and no one has built one recently, he said.

A walking rig can move from one wellbore to another rather quickly - 10 meters in less than an hour. Moving a regular rig can take days and cost up to $1 million.

The payback on a new walking rig is three years in a normal demand environment, and between six and nine months on a rig refurbished with a walking system, according to Wunderlich Securities analyst Jason Wangler.

Still, Patterson, one of the top five contractors in North America based on its hi-spec rig fleet, plans to build 16 high-tech Apex rigs this year. Of those, 15 will be able to walk. It already has more than 100 walking rigs in its fleet of 159.

About two-thirds of Pioneer Energy’s 36-rig fleet is now capable of pad drilling. Of them, 24 are walking rigs. The company plans to add another three by the end of the year.

Independence Contract Drilling Inc has 14 rigs and plans to upgrade its last non-walking rig by the end of the year. (Editing by Sayantani Ghosh and Savio D’Souza)

A workover rig. Operating rates vary. Petrodata Offshore Drilling Fleet Day Rate Index offers monthly updates of competitive mobile offshore drilling fleet day rates and utilization across four rig.

Using econometric analysis, we examine the effects of gas and oil prices, rig capacity utilisation, contract length and lead time, and rig-specific characteristics on. More than % of surveyed drillers expect to put more rigs to work over the next US land rig day rates on average—aggregated across all rig classes and all. The value lossr(i, last) is equal to the estimated flow rate of well r multiplied by its iddle time once it is assigned to the last position of workover rig i. This idle time is. A discussion of crude oil prices, the relationship between prices and rig count, Workover rig count is another measure of the health of the oil and gas industry. Table 2. Sample Operations Sequence--. Mechanical Descaling. COST. TOTAL COST. UNIT. RATE. MOBILIZATION-OEMOBILIZATION. Workover Rig. 20 hrs.

More than 75 years ago, it was. This allows increased recovery rates. Both drilling rigs and workover rigs are expensive resources that are typically limited well in the field, then we may be able to maintain the field production rate. United Kingdom operating over 25 drilling and workover rigs and providing a Marriott offers a selection of business arrangements from traditional day rate. Offshore Rig Fleet. Accommo- dation. Jack-up. Super. Self-. Workover. Jack-up The improvement in rig rates that has characterized our North American. The rigs have initial positions and.

The wells have different loss rates, need different services, and may not be serviced within the horizon. On the other hand, the number of available workover rigs. On a drilling rig, he or she may be responsible for the circulating machinery and the conditioning of the drilling or workover fluid. derrickman: n: see of drilling fluid and utilizes the hydraulic force of the fluid stream to improve drilling rates. To combat this CERP, as announced. All Drilling Rigs Trailer Mounted Rigs Carrier Mounted Rigs Workover Rigs Rebuilt IHS Markit can provide current and historical day rates for all offshore rig.

Specialties: Workover Rig, Swabbing Units, Air Packages For more information on rates and availability please call (701)8 7201 or email any questions to. The company owns 3 drilling rigs, 3 workover rigs, as well as special-purpose Availability of the Top drive allows drilling wells at high rate and reduces the risk. Cost Analysis The overwhelming majority of the equipment is manufactured by third parties. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source. Offshore Rig Day Rate Trend Coverage. IHS Markit can provide current and historical day rates for all offshore rig categories worldwide. Most workover rig horsepower falls within the range of the 500 series.

Workover Rig is available for both onshore as well as offshore Workover purposes at affordable prices. There are a number of companies that manufacture the Workover Rig as well as Rig packages that are required for different kinds of drilling jobs and meet the standards that have been set by the American Petroleum Institute or the API. The Rig packages are shipped worldwide. The rigs are included other than the simple Workover and they include the following:

Workover Rig is known as the Workover the different types of rigs include the offshore and onshore Rig that range from 150 horsepower to 1000 horsepower. Workover rigs have a surface depth that is equipped with diesel engines and transmissions and is available from 8000 ft to 30000 ft. Workover rigs contain a full line of drilling packages. Rig takes into account the skid mounted drilling rigs and the ones that are trailer mounted. Workover skid mounted drilling rigs incorporate the diesel-electric AC/VFD or the DC/SCR drive rigs, mechanical drive rigs and the combination drive Rig that ranges from 1000 horsepower to 6000 horsepower; while the trailer mounted Rig ranges from 450 horsepower to 1000 horsepower.

A lot of Workover Rig uses the double telescopic mast with the help of a single mast and is operated by wide wheel base axels, high strength steel beam, low cross section tires, dual pipeline brakes as well as hydraulic assist steering for the Workover. Rig mast is a double section type and uses a telescopic mast for dual safety protection. The gear shift and throttle of the engine can be remote controlled.

Workover types of Rig are available in the form of the single drum as well as the double drum. The groove ensures the alignment of in place as well as for long life. The optional Workover accessories for the auxiliary brakes include air thrust disc type clutch, brakes for the braking of the main drum, forced water circulating cooling with the brake rims as well as the optional brakes. Workover rigs are centrally controlled with electricity. The other kinds of drilling equipment include drilling equipment, triplex mud pumps, well control equipment; solids control equipment, oil control tubular goods and quality equipment. Work over rigs run casing tools and clean outs inside and outside a hole already drilled.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time d94a2288d76f819e65e1cc71545d07c7 63.210.148.230 10/27/2022 01:40 PM UTC

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time 406b4f95116c28dca247da206ca234ea 63.210.148.230 10/27/2022 01:40 PM UTC

The Drilling Productivity Report (DPR) rig productivity metric new-well oil/natural gas production per rig can become unstable during periods of rapid decreases or increases in the number of active rigs and well completions. The metric uses a fixed ratio of estimated total production from new wells divided by the region"s monthly rig count, lagged by two months. The metric does not represent new-well oil/natural gas production per newly completed well.

The DPR metric legacy oil/natural gas production change can become unstable during periods of rapid decreases or increases in the volume of well production curtailments or shut-ins. This effect has been observed during winter weather freeze-offs, extreme flooding events, and the 2020 global oil demand contraction. The DPR methodology involves applying smoothing techniques to most of the data series because of inherent noise in the data.

September 2020 Supplement: With low rig counts, the inventory of drilled but uncompleted (DUC) wells provides short-term reserve for completions of new wells.

Workover Rig is available for both onshore as well as offshore Workover purposes at affordable prices. There are a number of companies that manufacture the Workover Rig as well as Rig packages that are required for different kinds of drilling jobs and meet the standards that have been set by the American Petroleum Institute or the API. The Rig packages are shipped worldwide. The rigs are included other than the simple Workover and they include the following:

Workover Rig is known as the Workover the different types of rigs include the offshore and onshore Rig that range from 150 horsepower to 1000 horsepower. Workover rigs have a surface depth that is equipped with diesel engines and transmissions and is available from 8000 ft to 30000 ft. Workover rigs contain a full line of drilling packages. Rig takes into account the skid mounted drilling rigs and the ones that are trailer mounted. Workover skid mounted drilling rigs incorporate the diesel-electric AC/VFD or the DC/SCR drive rigs, mechanical drive rigs and the combination drive Rig that ranges from 1000 horsepower to 6000 horsepower; while the trailer mounted Rig ranges from 450 horsepower to 1000 horsepower.

A lot of Workover Rig uses the double telescopic mast with the help of a single mast and is operated by wide wheel base axels, high strength steel beam, low cross section tires, dual pipeline brakes as well as hydraulic assist steering for the Workover. Rig mast is a double section type and uses a telescopic mast for dual safety protection. The gear shift and throttle of the engine can be remote controlled.

Workover types of Rig are available in the form of the single drum as well as the double drum. The groove ensures the alignment of in place as well as for long life. The optional Workover accessories for the auxiliary brakes include air thrust disc type clutch, brakes for the braking of the main drum, forced water circulating cooling with the brake rims as well as the optional brakes. Workover rigs are centrally controlled with electricity. The other kinds of drilling equipment include drilling equipment, triplex mud pumps, well control equipment; solids control equipment, oil control tubular goods and quality equipment. Work over rigs run casing tools and clean outs inside and outside a hole already drilled.

Tulsa-based drilling expert Helmerich & Payne (H&P) is getting more bang for its buck, as North American pricing improves for the super-spec FlexRig fleet.

In the North American Solutions segment, efforts earlier this year to “achieve more sustainable contract economics continue and will accumulate further as pricing improves” for the high-tech FlexRigs, Lindsay said. “Our scale and technology enhance profitability in the U.S., and these advantages are also providing a pathway to grow internationally, both of which will ultimately lead to improved economic returns for all our stakeholders over time.”

As expected, H&P ended June with 175 rigs operating in North America, which represented modest growth, he said. However, the company brought in more revenue per rig.

“Fiscal discipline, together with additional contractual churn, allowed us to re-contract rigs without incurring additional reactivation costs and redeploy them at significantly higher rates,” he noted. “Our rapidly improving contract economics are primarily driven by H&P’s value proposition to customers in a tight market for readily available super-spec rigs…

“Capital discipline by many among the land drillers, combined with supply chain and labor constraints, are governing the drilling industry’s cadence of reactivating idle super-spec rigs at scale,” the CEO said. “This will likely perpetuate the supply-demand tightness for super-spec rigs, leading to further improvements in our contract economics.”

The Gulf of Mexico segment also is providing a “steady contribution,” with pricing inching higher. On the international front, activity also continues to tick higher, “with the potential for further improvements in our South American operations in the coming quarters,” Lindsay said.

Smith said the margin expansion experienced in the latest quarter was “frankly needed to sustain our capital-intensive and technologically demanding business in the long term. We anticipate further improvements in the coming quarters as our contracts in our North America Solutions segment continue to reprice at higher levels.”

In the North America Solutions segment, revenue improved by $1,950/day, or 8% sequentially, to $26,500/day. Direct margins increased $2,850/day, up 37% to $10,600. Still, the solid gains continued to be negatively impacted by the costs associated with reactivating rigs. H&P spent close to $7 million to reactivate rigs in the quarter, costs that were down by about half sequentially.

For fiscal 4Q2022, North America Solutions direct margins are forecast to be $185-205 million, which would include $6 million to reactivate rigs. H&P expects to exit September running 176 contracted rigs in North America, up one from the latest period.

“On our earnings call last February and again in April, we discussed how rig pricing needed to reach $30,000/day,” Lindsay said. “In our third fiscal quarter, we had roughly 20% of our fleet average revenue per day at or above that level.

“This is a great start, but we also recognize that pricing needs to move further to achieve gross margins of 50% or greater to generate returns that fully reflect the value we deliver to customers with our FlexRig fleet and complementary technology solutions.”

Inflationary pressures this year, combined with supply chain constraints, “are increasing consumable inventory costs,” Smith said. Higher costs also are impacting supply chain access to parts and materials. To that end, H&P has been proactive in inventory planning and its vendor relationships to alleviate issues and avoid material impacts to operations.

Around 70-75% of daily costs are labor-related, Smith noted. To ensure it has a solid workforce, the company implemented a wage rate increase last December. The turnover rates for the work crews have remained consistent with historical rates, the CFO said.

Net income was $18 million (16 cents/share) from operating revenue of $550 million in the fiscal third quarter, compared with a year-ago loss of $56 million (minus 53 cents). Operating revenue climbed year/year to $550 million from $332 million.

The high oil prices have encouraged a surge in exploration that has put the market for upstream oil and gas services under intense pressure. In particular, the cost to hire or purchase a drilling rig is rocketing. Between 2002 and 2006, the cost of purchasing a new deepwater, semi-submersible rig almost doubled to $500m, and the daily rate to hire an offshore rig increased by 135-430 per cent, depending on location and drilling depth.

Day rates for the technologically advanced fifth and sixth-generation rigs, built in the past 10 years, increased to more than $450,000 a day in 2006 from less than $120,000 a day at the start of 2002. The global cost of a semi-submersible rig, which drills in water depths of 2,001-5,000 feet, increased by 250 per cent over the same period.

Although the variety of rigs used to drill in a range of environments across the world makes it impossible to have a single measure of the increase in rig prices, the sharp upward trend over the past five years is indisputable. According to UK-based energy consultant Douglas Westwood, global offshore drilling expenditure increased by 80 per cent between 2002 and 2006, from $32.6bn to $58.5bn.

This upward trend has continued in the past 12 months. “In 2007, the daily cost of high-spec semi-submersible rigs increased to $500,000, and in some cases $600,000, from $250,000 in 2002-03,” says Steve Robertson, an oil and gas expert at Douglas Westwood.

The increase in rig prices closely mirrors the rising oil price. The anticipation of higher returns on hydrocarbon finds has given producers an incentive to intensify exploration activity, while high oil revenues have provided them with the capital to do so.

“There is a general trend that when oil prices increase, so do oil services, and especially drilling rigs,” says Toufik Nassif, commercial director of BP Libya, which signed a $2bn agreement to explore offshore Libya in 2007.

The challenge for the industry is to address the dearth of investment in rigs in the late 1980s and 1990s, when oil prices were relatively low. Reversing the trend is a costly business.

“When oil prices go up, rig costs go up,” says James Williams, president and chief economist at US-based consultant WTRG Economics. But there is a lag between the two. After a period of relatively low exploration, a lot of rigs are in disrepair and some are junked, so when there is suddenly an increased demand for exploration, you have to build rigs and hire people.”

Opec, which has all of the Middle East’s major producers as members, is playing an increasingly important role in meeting energy demand, as reserves elsewhere in the world dwindle. But in recent years, the rate of drilling activity in this part of the world has been slow. “In the US, there are about 350 rigs drilling for oil,” says Williams. “That is more than the whole of Opec, excluding Iran and Iraq. Until recently, Saudi Arabia was managing to maintain production of 9-10 million barrels a day (b/d) of oil with only 20-30 rigs drilling.”

More recently, this has begun to change. “Saudi Arabia has seen a real step change in activity,” says Robertson. “It has increased its rig count to about 120.”

North Africa is also increasing its drilling activity and the intensification of upstream activity globally and in the Middle East has created a highly competitive environment for rig services. “Rigs to drill in water depths of 1,800-2,000 metres and greater are difficult to find,” says Nassef. “A one-well programme is one thing, but we will have a 12-well programme [for offshore Libya]. Planning is the key to ensuring the availability of rigs when you need them. We will co-ordinate with our global drilling community to ensure that we have the right rig when we need it.”

Smaller companies are most affected by the tightness of the market because their financial resources and operational flexibility are more limited. But even the majors have been suffering. The exploration work by the UK/Dutch Shell Group in Libya’s Sirte basin, for example, was held up because of delays over the delivery of a second rig, which were a direct result of market competition.

“There is a big demand for rigs in Libya,” says Mohamed Attawil, drilling services manager at the local Arab Drilling & Workover Company (Adwoc). “We have 17 rigs at the moment and are planning to contract a further four from China and two from the US, which will be delivered in September.”

The rapid rise in rig costs reflects not only a growth in exploration activity, but also rising production costs. The extraction of metal, one of the most important raw materials in the manufacture of drill rig equipment, is highly energy intensive.

Finding staff is also a problem. According to figures from Geneva-based energy consultant IHS, project management rates in the oil and gas industry increased by almost 90 per cent between 2002 and 2006, while construction labour rates increased by about 25 per cent. “Manpower is a very difficult issue,” says Attawil. “We have to pay double what we paid just a few years ago.”

There are signs that the increase in rig manufacturing is beginning to bridge the gap between supply and demand. The number of rigs operating worldwide increased to about 3,000 in 2006 from about 1,800 in 2002, and more than 100 rigs will be introduced worldwide between 2007 and 2010, according to Douglas Westwood.

As supply catches up with demand, the growth in rig prices is levelling off. A joint research team of IHS and Cambridge Energy Research Associates of the US reports a 4 per cent decrease in day rates for offshore rigs in the six months to November 2007. Figures from the US Bureau of Labor Statistics also suggest that rig costs are levelling off.

But while the rig market is cooling in North America, in the Middle East it is still strong. Saudi Aramco is set to procure 20 more land rigs in 2008, and a recent exploration licensing round in Libya and Egypt, in addition to the forthcoming Algerian round, will ensure that the North African rig market remains tight.

“[National Oil Corporation (NOC) chairman] Shokri Ghanem said in September that Libya needs 40 more rigs by 2010,” says Attawil. “Bids have been opened for the new gas exploration round and NOC is increasing its drilling activities, so even that might not be enough.”

According to Douglas Westwood, the global rig shortfall will continue until 2011 at least. “Although supply is coming, it will take time,” says Robertson. “It is difficult to paint a picture of a major decrease in prices over the next five to six years.”

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

ExxonMobilOil, PetroChina, and other oil exploration companies should expect the extended up-cycle in day rates to rent these rigs to continue unabated. Declining yields from mature, onshore energy fields coupled with increasing natural gas and oil prices is driving the demand for global drilling activity in deep-water provinces, pushing fleet utilization rates for high-end rig counts close to 100 percent, too.

Record oil prices are lifting corporate profits to dizzying heights throughout the energy industry, with energy giants ExxonMobil, Royal Dutch Shell, and BP posting record first-quarter 2008 earnings of $10.9 billion, $7.8 billion, and $6.6 billion, respectively, up Y/Y 17 percent, 12 percent, and 48 percent, respectively.

Oil and natural gas prices, combined with full capacity world wide in the offshore rig market -- and competition for these fleets -- is hurting the back side of international oil companies, with drilling and production costs more than doubling in recent years. My own review shows that exploration and production costs in the first-quarter Y/Y at ExxonMobil, Royal Dutch Shell, and BP, rose 30 percent to $5.8 billion, 39 percent to 7.4 billion, and 59 percent to $10.0 billion, respectively.

In the aggregate, the top five drilling companies (Transocean, Diamond Offshore Drilling, Noble, SeaDrill, and Ensco International) operate about 95 deepwater rigs -- some out-of-service for repairs -- are making for an increasingly tough exploration environment, according to ODS-Petrodata. Expect full capacity -- and competition for deepwater fleets -- to hurt the backside of international oil companies through at least 2010.

On recent first-quarter conference calls, Noble and Transocean reported that all new deepwater floaters are now 100 percent committed through the end of 2009 and 2011, respectively.Transocean Inc., the world"s largest offshore drilling contractor, reported: "We continue to see substantial incremental demand for appraisal and subsequent development in traditional deepwater provinces like Brazil, Gulf of Mexico and West Africa." The company noted that it was recently rewarded a contract for one well in West Africa at $630,000 a day (with a start date estimated to be Q4:2009).

Expect $600,000 day rates to become more common. Last month, Brazilian Petrobras awarded Norway"s SeaDrillwith contracts for three deepwater rigs worth up to $4.1 billion, with day rates in excess of $600,000.

In addition, while 60 or so new rigs are coming out of driller"s shipyards between now and the end of 20011, few of these floaters are targeted for deepwater sites. For example, Transocean has eight 6th-generation deepwater rigs (12,000 - 15,000 foot water depth capability) under construction; yet, the deepwater driller is struggling to meet $34.2 billion in revenue backlog, with management saying on its conference call that some of these new contract have push-out clauses now extending to 2015.

Drilling in unconventional places, such as India, and promising new finds, such as the Tupi projects, located in waters between 6,500 and 10,000 feet in depth offshore of Rio de Janeiro, are compounding supply shortages, too.

The Tupi field is also geologically complex. The test wells that have been dug in this field are more than 20,000 feet long and are directional (non-vertical) wells. And producers had to drill through a mile-long layer of salt to access the reservoir. Salt layers are notoriously difficult to drill.

David Phillips has more than 25 years" experience on Wall Street, first as a financial consultant and then as an equity analyst for several investment banking firms. He sifts through SEC filings for his blog The 10Q Detective, looking for financial statement soft spots, such as depreciation policies, warranty reserves and restructuring charges. He has been widely quoted in outlets such as BusinessWeek, The International Herald Tribune, Investor"s

Production from the Western Flank was 1.2 MMboe, down 7% on the prior quarter, with lower oil and condensate production, offset by an increase in gas and LPG production. (Note: Western Flank includes the Company"s GOR licences ex PEL"s 91, 106,107 and PRL 26, as well as licenses ex PEL"s 92, 104 and 111, over which the Company does not have a GOR).

Production and activities were impacted in late January due to heavy rain across the Cooper Basin. Drilling and workover rigs were demobilized and development activities ceased during February. Full operations have since recommenced with the workover rig"s schedule increased to recoup lost time.

Western Flank oil production was 782 kbbl, down 12% on the prior quarter due to natural field decline and deferment of workover opportunities and well connections caused by rain delays in February. Beach state production is expected to increase in its Q4 FY22 as workover activities are accelerated and new development wells are progressively brought online.

Western Flank gas and gas liquids production was 427 kboe, up 3% on the prior quarter, primarily due to Beach"s Q2 FY22 planned maintenance work at the Middleton gas processing facility, followed by reduced production at Middleton due to an unplanned outage at Beach"s Lowry well pad. Beach"s Q3 FY22 gas and gas liquids production was impacted by natural field decline and unplanned maintenance in the Middleton field.

On ex PEL 91, Beach completed the final well of the five-well horizontal campaign, Kalladeina 16. All wells drilled in this campaign were successfully cased and suspended for production. At quarter-end, two horizontal wells had been brought online with the remaining three wells to come online in Beach"s Q4 FY22.

Beach commenced an 11-well Namur/McKinlay oil exploration campaign. Two wells were drilled on ex PEL 91, Morialta 1 and Magic Beach 1. Morialta 1 was plugged and abandoned subsequent to quarter end. Magic Beach 1, intersected 2.7 metres of net oil pay in the Namur Reservoir. Beach note that the results indicate potential for oil migration to the northeast of previously discovered fields. Further analysis, including reprocessing of seismic data, will be undertaken by Beach to assess if a structurally up-dip location exists for follow-up drilling.

"We are pleased with Beach"s recent drilling success on our GOR licences, and with the three horizontal wells brought on line in Beach"s Q3 2022 and the two remaining wells being brought online in their Q4 2022, this should increase reserves and continue to reduce previously anticipated field decline rates." stated Ian Rozier, President & CEO of Newport.

The Company receives its GOR from Beach which is not a reporting issuer in Canada. Therefore, Newport is not able to confirm if disclosure satisfies the requirements of Canadian Securities legislation.

Newport has no control over operating decisions made by Beach and is not privy to exploration or production data derived by Beach during operations. Accordingly, this prevents the Company from commenting on operating plans going forward.

As always, the Company recommends that shareholders and potential investors access material information relevant to the Company as released independently by Beach and Santos Ltd in order to keep current during exploration, development and production of all the licenses subject to the Company"s GOR.

The Company currently has 105,579,874 common shares issued and outstanding and approximately $4.4 million in the treasury (comprised of cash, cash equivalents and short-term investments) and no debt.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the accuracy or adequacy of this news release.

This news release is intended to provide readers with a reasonable basis for assessing the future performance of the Company. The words "believe", "should", "could", "expect", "anticipate", "contemplate", "target", "plan", "intends", "continue", "budget", "estimate", "may", "will", "schedule" and similar expressions identify forward-looking statements. Forward-looking statements may pertain to assumptions regarding Beach"s drilling plans, future dividends, the price of oil and fluctuations in currency markets (specifically the Australian dollar). Forward-looking statements are based upon a number of estimates and assumptions that, which are considered reasonable by the Company, are inherently subject to business, economic and competitive uncertainties and contingencies. Factors include, but are not limited to, the risk of fluctuations in the assumed prices of oil, the risk of changes in government legislation including the risk of obtaining necessary licences and permits, taxation, controls, regulations and political or economic developments in Canada, Australia or other countries in which the Company carries or may carry on business in the future, risks associated with developmental activities, the speculative nature of exploration and development, and assumed quantities or grades of reserves. Readers are cautioned that forward-looking statements are not guarantees of future performance. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those acknowledged in such statements.

The Company disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, except to the extent required by applicable laws.

A year ago, Transocean"s CEO Jeremy Thigpen recalled, presentations by executives at an investor conference made it difficult to recognize that their companies were in the drilling business. It seemed like all the talk was focused on the environment.

The change is not surprising given the increasing exports from the US, one of the world’s largest oil and gas producers, and a barrel of oil trading at more than $100—which is around what it now costs in the US to fill up the gasoline tank of a pickup truck.

For Thigpen and Andy Hendriks, president and CEO of Patterson-UTI, who both spoke at the opening of the IADC/SPE International Drilling Conference, the business outlook is promising.

“We have had some false starts. But this seems like it is moving in the right direction. We are on the verge of a good market,” Thigpen said in speech at the opening of the conference, where he was joined by others who shared his optimism.

“We are supposed to see a 20% year-on-year growth and that will continue in 2023,” said Hendriks, who said the company hired 3,000 employee last year and expects to equal that total again this year.

They described a world that looks like it will be better for longer for those in the oil business now that oil prices have surged on short supplies that resulted from years of underinvestment in oil production and the recent supply disruption that followed Russia’s invasion of the Ukraine.

They both would have preferred that scenario to be defined only by tight supplies because the extreme volatility since Russia invaded Ukraine—both in terms of the markets and world affairs—comes with significant risks.

“$120/bbl oil is not where we need to be,” said Hendricks, who added that “higher prices could push western countries into recession and that is not where we need to be.”

OPEC+ is sticking to a slow-growth plan, in part because many of its members cannot meet their existing quotas, and US producers are restrained as well.

Thigpen said drillers do not have that sort of cash on hand. After years of attrition in the number of working rigs, those in need may have to cover the reactivation cost upfront or agree to a long-term contract at a rate that covers the cost. And convincing them to pay upfront may not be that hard in this market. Thigpen said they recently told investors they had leased a rig for $390,000/day, up from a low of $130,000.

8613371530291

8613371530291