workover rig companies in colorado price

2+ years previous oilfield and/or workover rig experience preferred. Work on floors or derricks on the rig as needed. May offer relocation package DOE.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

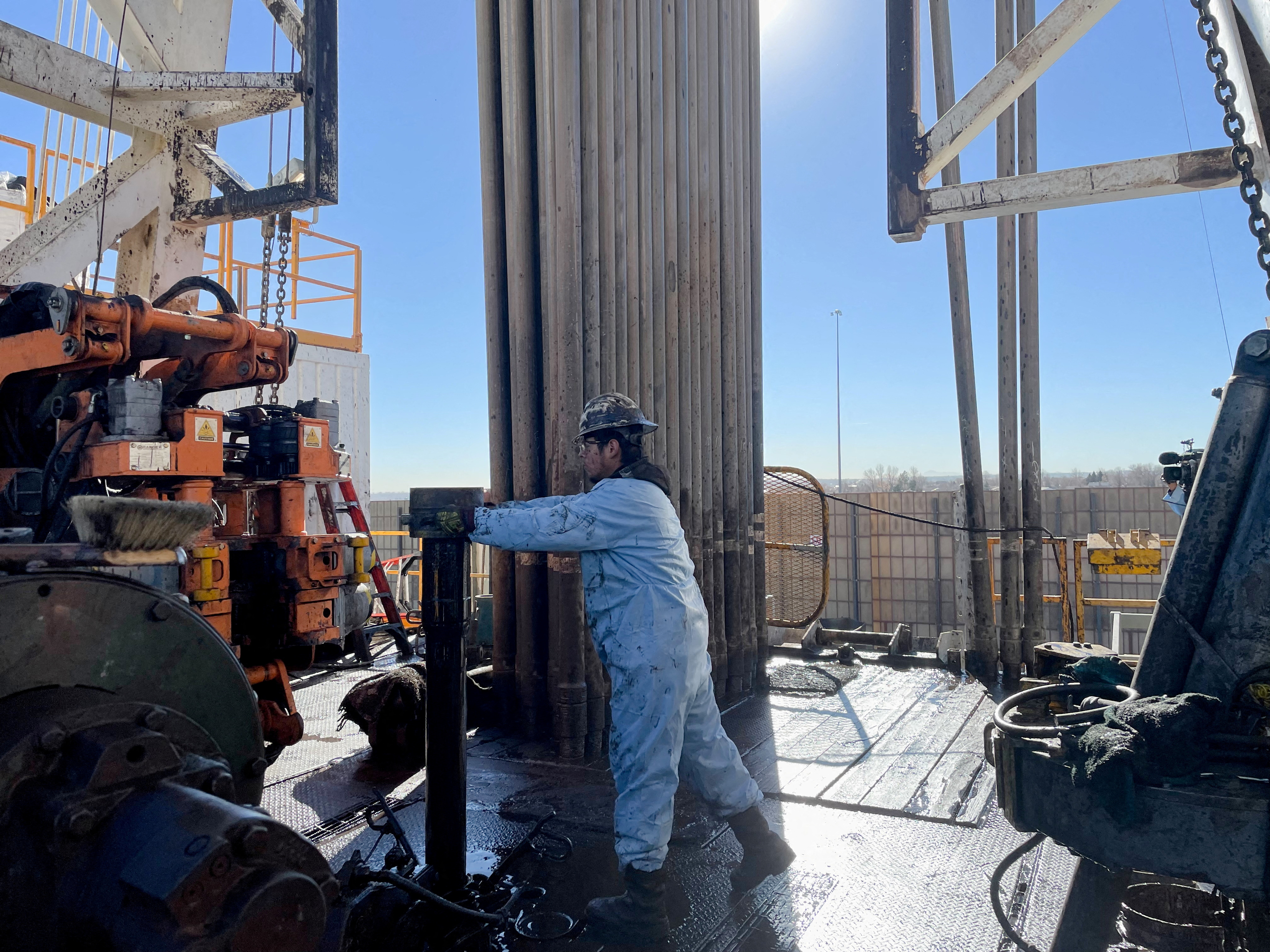

The Floorhand performs the duties of general manual labor on the rig and supports and assists other members of the drilling crew during all rig operations.

Assists the Rig Operator in performing job activities associated with the rig-up and rig-down of the workover rig, picking up/laying down and standing back rods…

Performing rig up and down procedures, nipple up and down and care of the B.O.P. Ensuring safe and efficient rig operations to meet the company’s goals and…

2 years minimum experience as a rig hand on a production rig working floors and derricks. Starting pay is $23.00 per hour with an increase to $26.00 per hours…

Crew Member positions include Rig Trainee (no experience required), and Floor hand, Derrick hand, Relief Crew Chief, and Crew Chief, which are experience…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

You will perform advanced hydraulic fracturing operations and assist in various aspects of the job including pre-job preparation, mobilization, rig up, on site…

Must have years of experience working multiple positions on an oil and gas drilling rig. General maintenance of drilling rig. Must be at least 18 years of age.

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

Reliable means of transportation to and from rig site. The Floorhand is responsible for safely and efficiently performing a variety of physically demanding…

Assist in rig moves: help with rig-up / rig-down, nipple up and down blowout preventers, assist with general assembly and maintenance and help prepare new…

*Floor Hands - *minimum experience required 6 months. *Derrick Hands - *minimum experience required 1 year. Job Requirements: *Job requirements include but are…

The Leasehand also provides assistance to rig personnel as required. The Leasehand is responsible for keeping the rig clean, performing general maintenance and…

Previous experience as a carpenter, general laborer, roofer, landscaper, heavy equipment operator, construction, pipefitting, oil and gas, energy services,…

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

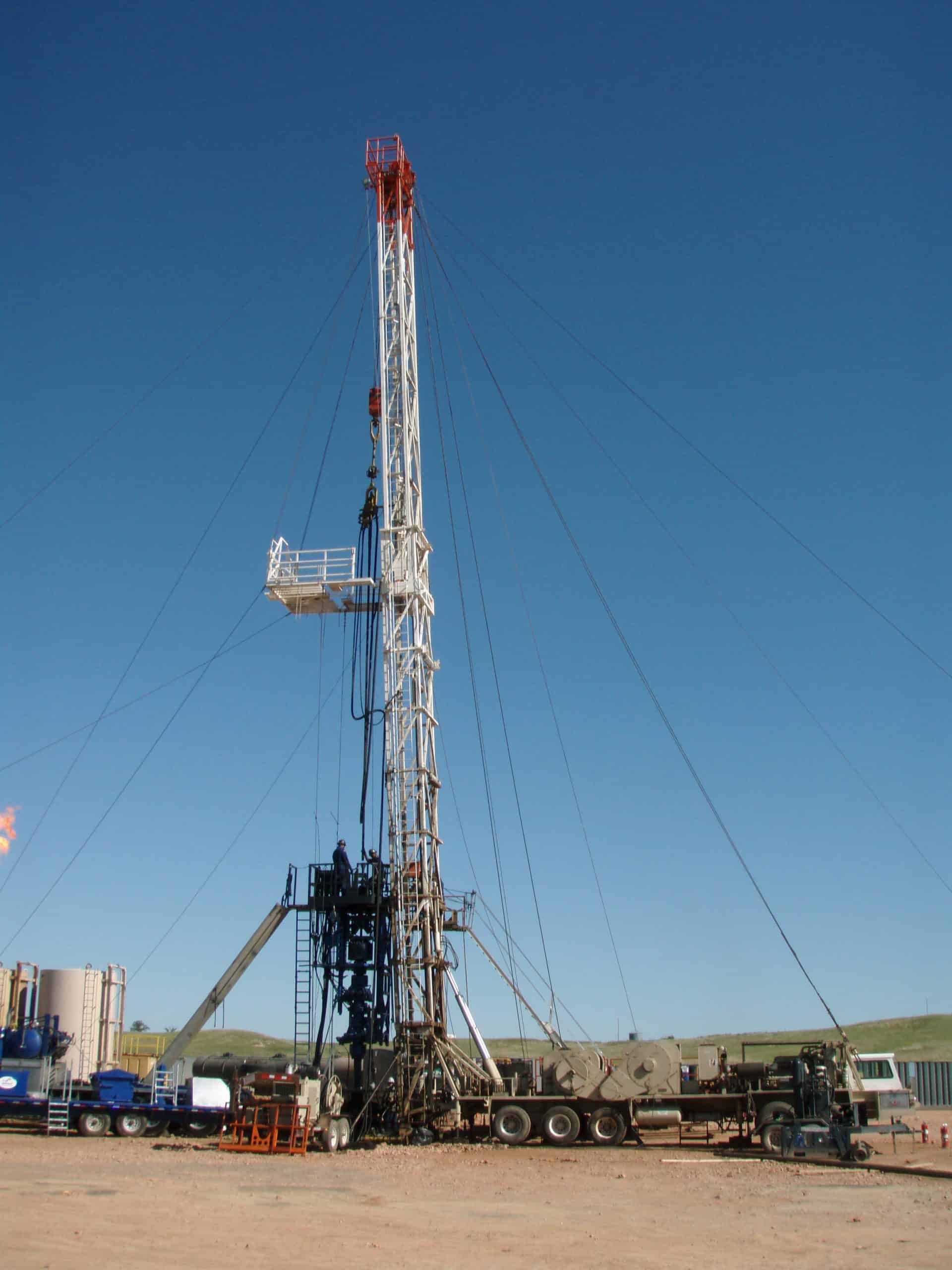

Eastern Colorado Well Service is a premier oil and gas service company in the regions we serve. Our employees provide an array of services to oil and gas producers in Colorado, Wyoming, Kansas, North Dakota and Texas. ECWS offers work-over rigs for completion and maintenance services, water hauling, heavy haul services and special rental tools for down-hole applications.

U.S. oil prices rose to $70 a barrel this week — a sign the industry is bouncing back after a bust brought on by the pandemic. That’s bringing a much-needed jolt into the local economy in Weld County.

Energy companies in the area shed thousands of jobs over the past year, but they’re now slowly adding some back. The sector added roughly 500 jobs in the past month, according to the Department of Labor and Employment.

Henry Zimmerman: We know more people are traveling again. They’re flying, taking road trips to see family. And that’s boosting demand for oil. How is that showing up in the job numbers in Weld County?

Matt Bloom: A reminder to listeners we have tens of thousands of active oil and gas wells in Weld County and companies have really just been running a skeleton crew over the past year. That’s because oil prices have been historically low.

But over the past few months, the demand switch has been turned back on and suddenly the price is the highest it’s been in almost three years. Gas prices are up. And a lot of companies in the oilfield have reversed course and started hiring again.

James Smith is a driver. He hauls oil. His income was cut in half last year during the bust, so he left the industry for a while. But last month he got a call that the oilfield needed him again.

James Smith: There’s so much activity to haul oil right now and it"s almost crazy actually. Prior to you calling me, I just received a call from my supervisor saying, “Hey, I had to switch up your dispatches. We had an oil line rupture. We"re sending six trucks out to one location to bottom out every single tank they have.”

Bloom: So people like James are seeing their incomes return to pre-pandemic levels. But when you look at the overall picture in the Greeley metro area, the industry has still added back less than a third of the positions — 31% — that it cut last year. That’s a much slower recovery rate than other industries like restaurants and hotels, which are actually having trouble finding people to hire.

Bloom: I’d say it’s a two-part reason. The first being that companies aren’t actually drilling a ton of new wells yet, which would require more workers to do. They’re just going back to the wells that have already been drilled.

Second is a longer-term trend in the industry of consolidation that we’ve seen really ramp up over the past nine months. That has led to the elimination of a lot of jobs. Just this week, three of Colorado’s largest drillers, Bonanza Creek, Extraction Oil and Gas and Crestone Peak Resources, announced they’d be joining into one new massive oil company called Civitas.

Steve Diederichs:There"s much more of a call for operators to start returning value to shareholders. And generally the way to achieve that is generate free cash flow and start returning that. So it really sets itself up for the kind of that flat to super low growth that we"re seeing operators guide to today.

Bloom: Diederichs says companies — even prior to the pandemic — were not performing well for a number of reasons. So, one way to cut costs is to join forces.

Zimmerman: We know that the energy industry is at the beginning of a major transition away from fossil fuels and toward renewables. Is that at play here, and what does that mean for the local economy in Weld?

Bloom: Well, what Diederichs and other economists have told me is that it means we just aren’t going to see a ton of growth in oil in Weld like we saw during the past decade. There will likely be a little bit of a boom as the world continues recovering from the pandemic. But a lot of investment at the local, state and federal level is in renewable energy projects.

For example, Platte River Power Authority, the electricity provider for most of Fort Collins, Loveland and Estes Park, just announced its plans to build its largest solar farm ever in Weld County starting later this year, which to me is pretty symbolic of what’s happening.

The industry has kept the focus on complaints about regulatory changes in Colorado that have put tough new rules on drilling, and slowed permitting to a crawl they say.

“A well is its most productive in the first 18 months after its completed,” said Dan Haley, with the Colorado Oil and Gas Association. “Then you begin to see a pretty substantial decline curve. Wells drilled in 2018 and 2019 when we were hitting production highs are producing less now.”

But a spokesperson for the state regulator, the Colorado Oil and Gas Conservation Commission, disputed that new rules were primarily responsible for a lack of production, saying the industry is sitting on 2,600 permits already approved. The industry said many of those had expired, and what was left would not be enough to change the larger trend of production declines.

Under the new, more strict rules, that went into effect last year, the state says up to 227 new wells have been approved across 15 different oil and gas development plans submitted by drillers. One plan was rejected, which included 33 wells.

Permits are only part of the story. Even if the industry wanted to ramp up production, there are not enough workers to operate the rigs and wells. Many left during the pandemic slowdown. Mining and Logging employment in Colorado is down by about 10,000 workers, from 29,000 in 2019 to 19,000 in 2022, the lowest number of workers since 2006.

Lastly, Wall Street investors demand financial discipline from drillers now. The industry has a tendency to overbuild when prices are high, and then get crushed by debt when prices inevitably fall.

A survey by the Federal Reserve’s Dallas office of oil and gas companies across the U.S. found that, “slightly over half — 59 percent — of executives believe investor pressure to maintain capital discipline is the primary reason that publicly traded oil producers are restraining growth despite high oil prices.”

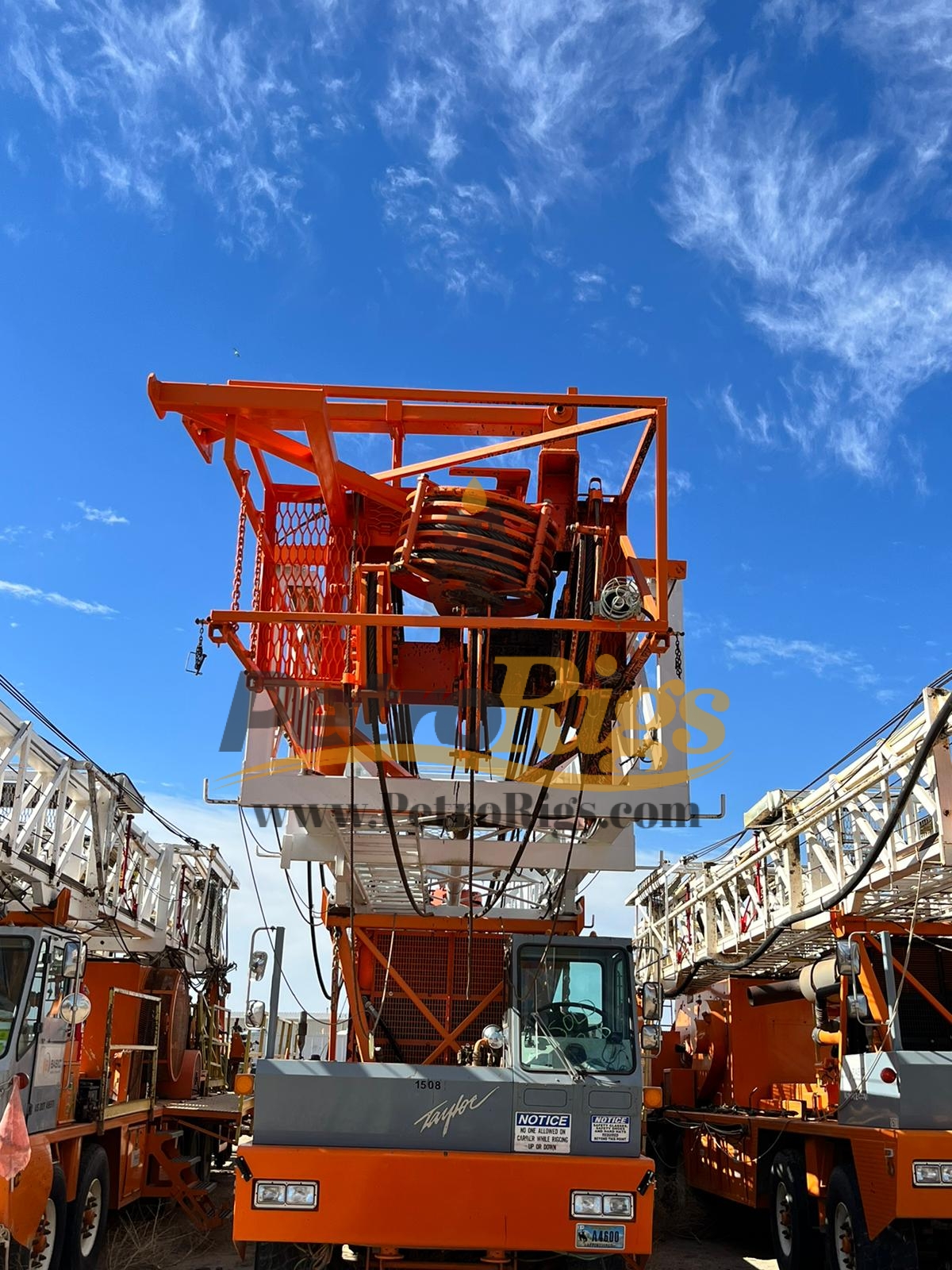

Cartel Drilling got it"s start setting conductors and presetting surface casing and drilling water wells at a turnkey price. What has always set us apart is our focus on performance; all of our rigs are equipped in a manner that allows us to match drilling parameters of big rigs in the market today, yet save the Operator days and big money on rig moves.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

After a year in which dollars and oil from drilling rigs flowed freelyinto Colorado, the nine major drillers on the Front Range are slashing 2015 spending by 30 percent, about $2 billion.

The number of rigs running has already dropped by a third in five months to 44 at the end of February, according to the oil field services company Baker Hughes.

So far, the cutbacks haven’t had a severe impact on the state or on Weld County, the heart of Colorado oil country, partly the result of a diversified economy and continued big-dollar commitments by operators — even after the cuts.

“Hotels and restaurants still look to be full,” said Eric Berglund, CEO of Greeley-based Upstate Colorado Economic Development. “Beyond drilling, there is a large oil and gas industry presence here.”

There are thousands of existing wells that still need to be serviced, pipelines are being built, and gas processing and water recycling plants need employees, Berglund said.

“We haven’t seen any uptick in unemployment claims in the oil and gas sector,” said Bill Thoennes, a spokesman for the Colorado Department of Labor. “This may be something coming down the road, but we haven’t seen it yet.”

The two largest operators, Houston-based Noble EnergyInc. and Anadarko Petroleum Corp., based in The Woodlands, Texas, say they have no layoff plans.

Some of the job losses tied to the decline in rigs will end up in the unemployment reports of the rig companies based in Texas and Oklahoma, Berglund said. A rig employs about 110 people.

Statewide, the oil and gas sector employs just 1.2 percent of the workforce and losses in that sector may be offset by growth in others, said Mark Vitner, an economist with Wells Fargo Securities.

“The price of oil isn’t going up to $100 anytime soon,” Vitner said. “So we’d expect the slowdown to be more pronounced later this year. … But the industry is not going away.”

The nine operators — which, based on state data, produced at least a million barrels of oil each in 2014 — are projected to spend up to $4.6 billion in Colorado in 2015, down from $6.6 billion last year.

In addition to the spending cuts, operators are trying to improve their efficiencies — focusing on drilling in the areas with the best yields and getting better prices for materials and services.

Most operators hire oil field service companies, such as Baker Hughes and Halliburton, for drilling and hydrofracturing, or fracking, which pumps pressurized fluids into wells to crack rock and release oil.

The combination of horizontal drilling and fracking in tight shale formations has enabled Colorado to more than double its oil production in the past four years to about 82 million barrels in 2014.

The activity is centered in the Denver-Julesburg Basin, which stretches from Denver to the Wyoming border, and the Wattenberg field, within the basin.

Operators are now getting lower prices for materials and services, said Craig Rasmuson, chief operating officer of Platteville-based Synergy Resources Corp.

“The services companies are giving better prices and are willing to have smaller margins to keep operating and keep their people employed,” Rasmuson said. “We are all sharing the pain.”

Synergy is the one company among the nine big drillers planning to increase its capital spending in 2015. Company officials expect to boost spending to $180 million this year from $160 million in 2014.

“The Wattenberg continues to be one of the more attractive assets in our portfolio,” Chuck Meloy, an Anadarko vice president, said during an investor conference call Tuesday.

Noble had 10 rigs running in 2014. The company is projecting four rigs in 2015, and they will be working in northeastern Weld County— far from residential areas.

Synergy estimates that drilling near homes adds 3 to 5 percent to the cost of wells because of extra noise mitigation and landscaping requirements, Rasmuson said. On the high side, it can add 10 percent to the cost.

In addition to focusing on high-yield areas, Stover said the company will increase the length of some of its horizontal wells to as much as 9,000 feet.

Depending on the length of the well and the number of stages needed to complete it, a frack job can cost between $1 million and $1.7 million, according to figures cited by companies in their presentations.

Houston-based Carrizo Oil and Gas is cutting activity and deferring some completions, company CEO Sylvester Johnson told stock analysts in a February conference call.

Calgary-based Encana Corp., the third-largest Colorado operator, plans to spend $170 million to $200 million in 2105, about a third less than last year, said company spokesman Doug Hock.

Faced with oil at $50 a barrel, bringing on more production “just doesn’t seem to make good business sense,” Bill Barrett CEO Scot Woodall told analysts in a February call.

Bonanza Creek Energy, based in Denver, is trimming spending by 36 percent overall, with just under $400 million for its Wattenberg operation, according to a company presentation.

Quoting T. Boon Pickens, Bonanza Creek CEO Richard Carty told stock analysts “it has become cheaper to look for oil on the floor of the New York Stock Exchange than in the ground.”

Axis is a completion and workover company built for today’s operators, as you shift into manufacturing mode while drilling ever-longer laterals. We’re advancing both goals through our core mission: optimizing completions.

For too long, well services has lagged other oil and gas sectors in innovation. Axis is changing that with integrated, data-driven services. New, purpose-engineered equipment. And a team that unites oilfield veterans with the next generation of crews and engineers through our leading-edge training culture.

Wellsite Services, Inc. is your full-service, independently owned wellsite supervision service company providing quality workover rig and completions supervision, contract pumping, water pipeline management, coordination and logistics, and sampling for commercial oil and gas customers on the Front Range in Northern Colorado and Southern Wyoming. We take care to assign competent, experienced wellsite supervisors to each project recognizing each operation is unique in complexity and variability.

As field and office veterans in oil and gas for over 20 years, we understand the importance of providing quality and experienced wellsite supervisors to every project, backed by our commitment to Environmental, Health, and Safety (EHS) compliance. From the vetting and hiring process, formal training and ongoing mentorship, and every other aspect of our business, we conduct ourselves with integrity and a strong ethical commitment to our team, customers, and community.

At Wellsite Services, we believe in doing everything the right way, the first time, and not taking shortcuts. Let us help your operation and identify the most optimal and specialized wellsite supervision services to effectively address the challenges and manage your wellsite. We look forward to working with you.

Over the past month, oil prices have trended downward. On August 26th, prices closed at $93.06. On August 29th, prices hit a high of $97.01. Since then, prices have fallen steadily. On September 23rd, prices closed at $78.74.

The September 23rd Baker Hughes rig count report shows the active rig count is steady. Baker Hughes reports 764 active drilling rigs in the US. One month ago, the total active rig count was 765, and one year ago, it was 521 rigs.

The oil rig count is currently 602 rigs, compared to 605 one month ago, and 421 one year ago. The gas rig count is 160, compared to 158 one month ago and 99 last September.

TCI Business Capital is a leading provider of accounts receivable factoring for oilfield service companies. Factoring is a type of financing many companies use to get immediate cash for their open receivables.

If your oilfield services company is being held back by slow cash flow, or if you need money to meet those daily expenses, call TCI Business Capital at 800-707-4845, or contact us via the web.

Quiet is descending on the Wattenberg Field in Weld County — at least compared to the past five years of rapid drilling, constant fracking and heavy truck traffic.

“Basically, there aren’t many areas that at $30 a barrel provide rates of return that are adequate to put capital in the ground,” said David Zusman, chief investment officer at Talara Capital Management, a New York private equity firm that invests in energy assets.

That includes the Wattenberg, the crown jewel of the surrounding Denver-Julesburg Basin, which has come to account for about 90 percent of oil and gas activity in Colorado.

Last year, the D-J Basin seemed to be holding out better than competing prospects. It suffered only a one-third cut in investment and outgunned other areas in winning shares of shrinking capital budgets among the producers that knew it best.

But nine of the largest producers active in the D-J plan to invest only half of what they did this year compared with 2015, according to a Denver Post analysis of the guidance those companies provided to investors.

Anadarko Petroleum and Noble Energy, who account for about 60 percent of the production in the basin, are planning to average only three rigs this year versus the 24 they ran back in 2014.

In dollars, the nine producers together plan to invest about $2 billion in the D-J Basin this year, down from $4.3 billion last year and $6.4 billion in 2014.

“In southern Weld County, producers are drilling wells and capping them. Smaller companies are cutting back and battening down the hatches,” said Rich Werner, president and CEO of the economic development group Upstate Colorado in Greeley.

Hotels that catered to field workers are taking a hit, but not hotels serving the general public. Firms that rented equipment to oil companies are down, but restaurants are still busy. Field service firms are laying off, but wind turbine maker Vestas can’t find enough workers, and neither can general contractors, Werner said.

“We are keeping an eye on things more for the second half of a year,” Werner said. “That is where we want to hope that oil and gas prices will be stabilized.”

When oil is in the low- to mid- $30 a barrel range, about 18 percent of the wells drilled in the D-J Basin last year are profitable, said Erika Coombs, a senior energy analyst at BTU Analytics in Denver.

If prices recover above $40 a barrel, then about 40 percent of those wells would be in the black. Adding capacity now risks selling production at a loss or accepting a razor-thin margin on reserves that will be more valuable in the future.

Only 17 rigs were actively looking for oil and gas in Colorado at the end of the first week of March, according to counts from Baker Hughes, which has tracked drilling-rig activity since 1944.

That said, Andarko’s entire onshore budget of $1.1 billion in 2016 is less than half of the $2.3 billion the company directed just at the D-J Basin back in 2014.

A consolidated land position, heavy infrastructure investments and the company’s ownership of mineral rights are keeping the Wattenberg as one of the top two onshore U.S. assets the company has,

Last year, Anadarko and other producers talked about focusing on the lowest cost and most productive opportunities. Increasingly, they now talk about preserving their best assets for the price rebound.

“Because of its importance to our company, we’re being very prudent and not drilling up the best opportunities in our portfolio in the current price environment,” Olsen said. “This will ensure we are well-positioned to accelerate when the time is right.”

But that new approach means Anadarko, which had held out against layoffs, is under pressure to bring its workforce of 1,500 in the state into line with its much smaller investment budget.

Noble Energy, the state’s second-largest producer, will funnel $600 million into the D-J Basin, a big portion of the $1.5 billion in total capital investments it plans to make this year.

Denver-based Whiting Petroleum is winding down its exploration efforts in North Dakota’s Bakken formation and focusing a shrinking budget on the D-J Basin. It is planning to invest $163 million and two rigs this year there, down from $575 million and four rigs in 2014.

Two other Denver-based producers, Bill Barrett and Bonanza Creek, plan to let go of the one remaining rig they each have at the end of the first quarter. Bonanza Creek, in particular, is winding down capital spending.

Encana Oil & Gas USA, the basin’s third-largest producer, remains in a state of limbo, waiting for a $900 million saleof its D-J assets to The Broe Group, a Denver-based conglomerate, and the Canada Pension Plan Investment Board later this year.

“With the sale of the asset pending, we haven’t allocated any capital to the D-J for 2016. And so, there are no rigs running,” said spokesman Doug Hock.

On Thursday, Hock said Encana expects to cut its workforce by 20 percent companywide. How the cuts shake out in Colorado, where Encana employs 1,042 people, will be announced late this week, he said.

One company, however, is bucking the trend. Denver-based PDC Energy will deploy four rigs, down from five last year, but enough to make it the dominant driller in the D-J Basin.

The company has comparatively low debt, low operating costs and contracts that allow it to sell its production at prices far above the going market rate.

As a result, stock investors have continued to support the company. When PDC offered 4 million shares last week, it ended up selling closer to 5.9 million, raising $301 million.

And the sale didn’t drive down the value of PDC Energy shares, which remained in the low $50 range, despite the comparatively large size of the offering.

Some D-J firms are planning to drill wells but not frack them until prices recover, while others have stopped drilling and are looking to spend their limited capital on fracking wells they drilled earlier.

“We’re really not in a mode of building completion inventory, and it’s also an efficiency issue for operating teams. They are really set up with the four rigs to obviously drill the pad out, build the schedule. We’re (working) very closely with our completion provider,” PDC president and CEO Bart Brookman told analysts in a conference call last month.

That said, other producers, in their guidance statements, are leaving themselves room to ramp up capital spending quickly should prices suddenly rebound.

“As has been our historical practice, we regularly review capital expenditures throughout the year and will adjust our investments based on changes in commodity prices, service costs and drilling success,” Denver-based Synergy Resources advised its shareholders.

If oil price forecasts from the U.S. Energy Information Administration pan out, things are likely to get even quieter before they get busier in northeastern Colorado.

The EIA forecasts that West Texas Intermediate crude will average $34 a barrel in 2016 and $40 a barrel in 2017 — too low to revive capital investment in Colorado’s biggest oil field.

And that creates another problem. The longer producers take to wind down, the harder time survivors will have gearing back up when demand requires it, Coombs said.

Sleep too long and you may never wake up. That happened to the home construction industry following the housing bust last decade, and it created a lack of capacity that Denver home buyers are paying dearly for years later.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

No New Competition [See Question 7 on Statistical Review]. All respondents said that competition had not increased QTQ, and they were not anticipating it would, given lower oil prices.Mid-Tier Well Service Manager: “We worry about the small local companies undercutting prices but we are not seeing anything now.”

2015 Rates Under Pressure [See Question 8 on Statistical Review]. Five of the eight respondents said 2015 would see further reductions in demand and hourly rates and even labor rates if the price of oil did not rise. One respondent said that “iron would start laying down” if oil prices did not rise. One respondent said he expects that work demand would come back up after a couple of months as everyone adjusted.Manager for Mid-Tier Well Service Company: “As a company, we have backed off our growth budget for 2015 and our capex has been nixed. We implemented a 10% reduction in our rates. We are just going to lower rates not wages, because we can buy equipment and leave it sit, but if you do that with people, they starve.”

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

The Niobrara shale formation is situated in northeastern Colorado and parts of adjacent Wyoming, Nebraska, and Kansas. Primarily an oil play, it is in the Denver-Julesburg Basin, which has long been a major oil and gas province. Technological advances in horizontal drilling and hydraulic fracturing in the last decade has helped create new opportunities in this U.S. energy play.

Based on the industry’s plans, shale and other “tight rock” fields that now produce about half a million barrels of oil per day, will produce up to three million barrels per day in…

Attend Rigzone"s Oil & Gas Job Fair on November 10 and meet with the best employers in the industry to find your next Oil & Gas job. Employers will be on-site discussing open positions with many interviewing and Hiring on the Spot. Register today!

Bolstered by activity gains in the Denver Julesburg (DJ)-Niobrara Basin, the U.S. rig count rose two units to reach 771 for the week ended Friday (Oct. 21), according to the latest tally from oilfield services provider Baker Hughes Co. (BKR).

Net changes domestically included a two-rig increase in oil-directed drilling, with natural gas-directed drilling unchanged for the period. Total land rigs increased by one, with one rig added in the Gulf of Mexico. An increase of three horizontal rigs was partially offset by a one-rig decline in vertical drilling.

The combined 771 active U.S. rigs as of Friday compares with 542 rigs running in the year-earlier period, according to the BKR numbers, which are partly based on data from Enverus.

Tracking changes by major drilling region, the DJ-Niobrara saw a notable shift week/week, adding three rigs to raise its total to 20. That’s up from 11 in the year-ago period, according to BKR.

Counting by state, Texas added six rigs week/week, while Colorado added two. On the other side of the ledger, New Mexico posted a four-rig decline for the period. Wyoming added a rig, while Louisiana and Utah each dropped a rig from their respective totals, the BKR data show.

The U.S. oil and natural gas industry is hedging less to avoid leaving money on the table, but overall, operators appear less optimistic regarding their ability to borrow funds, according to a recent survey.

“Strong oil and gas prices are not directly resulting in strong borrowing base increases,” Haynes and Boone LLP researchers said in their fall 2022 Borrowing Base Redetermination Survey. “Despite oil and natural gas prices reaching heights not seen since 2014 (in the case of oil) and 2008 (in the case of natural gas), respondents are not expecting robust borrowing base increases in fall 2022.

Meanwhile, U.S.producers raised oil output modestly in the week-earlier period, growing production by 100,000 b/d to 12.0 million b/d, according to the Energy Information Administration’s latest data.

Output for the week ended Oct. 14 was up by 700,000 b/d from a year earlier, but it was below the 2022 high of 12.2 million b/d and far off the record level of 13.1 million b/d reached in March 2020, prior to the pandemic’s onset.

8613371530291

8613371530291