workover rig companies in oklahoma pricelist

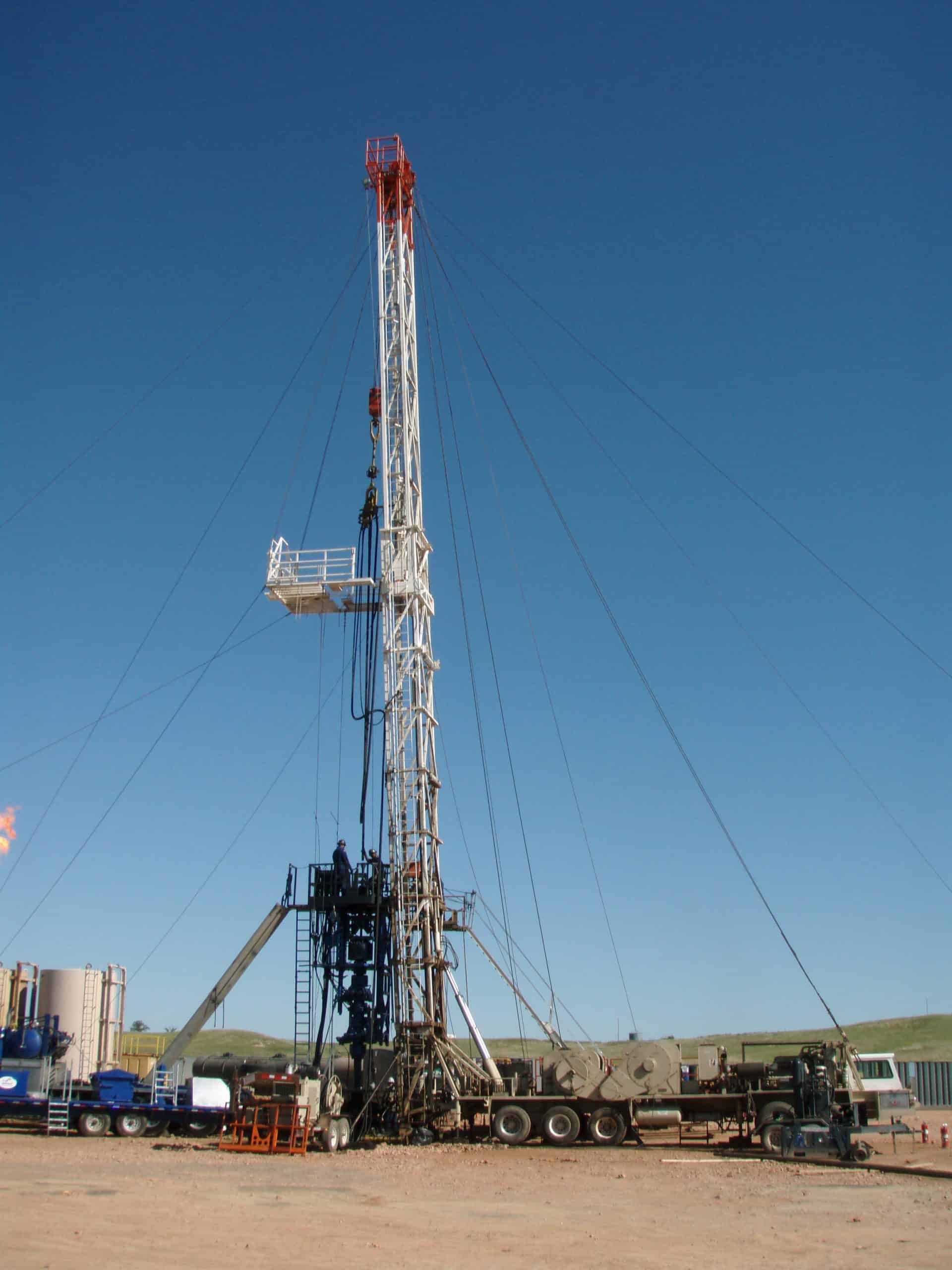

Atlas Drilling, LLC is an independent oil and gas drilling contractor based in Woodward, Oklahoma.We currently operate 10 drilling rigs in the Anadarko and Arkoma Basins. Our diverse rig fleet allows our clients to choose the right equipment to meet their needs. Our rig fleet is capable of drilling depths ranging from 7,000 ft. to 25,000 ft.

At Atlas, our goal is to drill wells in less time and as efficiently as possible, while not compromising our commitment to both safety and the environment.

We employ a management philosophy that does business on a personal basis and we believe in building our enterprise one well at a time. We know our aims can only be achieved through continuous improvements of our rigs, personnel, and overall operations that produces the highest value drilling services for our customers.

When you contact Atlas, you deal with our executives directly. We have not forgotten the importance of personal communication in a service-oriented industry.

Feel free to browse through our rig inventory to discover which of our equipment configurations fits your needs. We have even included downloadable rig plats so you can decide which rig best conforms to your location.

Southern Plains Energy Services provides many services including workover rigs, 130 bbl water transport, full service fishing and rental tools, hydraulic catwalks, pumps, pitts and swivels. Contact us today for further details. We look forward to doing business with you!

We are committed to total customer satisfaction, achieving excellence in our operations through continuous improvement, development and empowerment of our people, and providing a positive contribution to our community.

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

& TASKS Handle and operate casing running equipment, including: casing running tools, power tongs, elevators, power slips, control panels, and hydraulic power units. Work with hand tools and operate hydraulically ...

Enjoy the best returns on your investment with these supreme workover rig price ranges at Alibaba.com. Their efficacy and reliability will prove that they’re worth their price tags. They will empower you to attain your mining and drilling goals and definitely surpass your expectations.

workover rig price options also include an air compressor, a mud pump, drilling rods of various sizes, connectors, and a drilling tower. Drilling is done using drill bits of various shapes, sizes, and compositions. You can choose between diamond bits, alloy ring-shaped bits, 3-wing alloy bits, PDC bits, and hammer bits. Each drill bit uses different drilling methods, including rotary, percussion, blast hole, and core drilling.

Are you looking for a wholesale workover rig price? Look no more as Alibaba.com has all sorts of pile drivers that will ease your next pile driving process. A pile-driving machine is critical equipment in constructing structures and buildings as it helps in driving piles into the soil. These piles help in providing foundation support for a structure or building under construction. In that way, you can comfortably move a load of the structure to a difficult depth without a machine. Regarding your liking workovers rig price, visit Alibcom.com as they have unlimited pile available at wholesale prices. Inther you are looking for pneumatic tools or hydraulic pipes, you will find them type at affordable prices. If you need a drill, it can advisable to have a workover r price.

When the "80s began with more than 250 rigs drilling for oil and gas in Oklahoma, few forecast anything but rising petroleum prices the best incentive for more drilling.

But as the decade ends, Oklahoma"s active rig count is down to about 150 reflecting the fact that oil and gas prices in current dollars are at about the same level as a decade ago and in real terms, adjusted for inflation, are less than 10 years earlier.

Entering 1980, the nation was coming off a year when gasoline lines reappeared, following a revolution in Iran, and when oil prices were rising, bolstered by hikes by the Organization of Petroleum Exporting Countries.

The 1980 federal Energy Security Act visualized a multibillion-dollar federal campaign to develop a synthetic fuels industry as part of a drive to lower U.S. dependence on foreign oil.

But conventional petroleum was still the most accessible and economical source, accounting for a 43 percent share of the nation"s energy use, a level not wavering by more than three percentage points in 20 years.

To spur exploration for natural gas to prevent future gas shortages, federal price controls were lifted late in the 1970s from new "deep" gas produced from deeper than 15,000 feet which was being found in huge quantities in western Oklahoma"s Anadarko Basin.

The nation"s active drilling rig count rose from about 2,500, including 280 in Oklahoma, at the start of 1980, to 3,328, including 501 in Oklahoma, by the end of the year, in which a record 9,025 Oklahoma wells were completed.

Encouraged by rising demand for drilling equipment, Oklahoma City-based Continental Drilling Co. in 1981 placed a record $263 million order for 42 new land-based drilling rigs, less than half of which ever would be delivered.

An official at Continental, which later would go bankrupt, said the deal would make the firm a major player in the U.S. onshore drilling market "that is certain to become increasingly active and competitive as a result of oil decontrol."

Drilling surged as Oklahoma oil prices averaged an all-time high $35.18 a barrel in 1981 and new prices for Oklahoma gas approached record highs of about $9.50 per thousand cubic feet.

Late in 1981, the number of drilling rigs operating nationwide, as counted by oil-field equipment supplier Hughes Tool Co., reached a record 4,530, including 871 in Oklahoma.

Since Hughes excluded from its count any rigs not rated to drill to at least 3,000 feet, Oklahoma"s true active rig count at the peak probably was closer to 950, sources said.

But with the nation"s overall economy caught in a recession, demand for oil and gas fell, pulling down petroleum prices and curtailing drilling plans.

But a fourth quarter drilling surge, due largely to tax considerations, sent the U.S. active rig count by late December back up to 2,870, including 418 in Oklahoma.

With oil and gas prices more or less stabilized and drilling costs down a third to a half from their 1981-82 peak, U.S. drilling activity in 1984 pretty much mirrored 1983, with a year-end high of 2,787, including 352 in Oklahoma. BIOG: NAME:

The U.S. Chemical Safety Board will consider launching a larger investigation into the deadly Oklahoma rig explosion that claimed five lives on Monday... Read More

Energy companies in the 10th District of the Federal Reserve, which encompasses Oklahoma, Kansas, Colorado, Nebraska and Wyoming, along with the western third of Missouri and the northern half of New Mexico, anticipate an average increase in oil and natural gas production of 7.5% this year, the Federal Reserve Bank of Kansas City reports.

Energy companies in Oklahoma and across multiple states in the region anticipate an average increase in oil and gas production of 7.5% by the fourth quarter of 2022.

The Federal Reserve Bank of Kansas City, citing results of its first-quarter Energy Survey, reported Friday that producers are looking to increase output despite restraints on growth including ongoing labor challenges, supply chain issues and investor pressures to maintain capital discipline.

“The world oil price is currently in turmoil due to the Russian war on Ukraine, the negotiations with Iran and other outages and factors such as COVID’s resurgence in China,” the Fed report quoted one producer as saying. “We expect higher prices until some clarity is reached on several of these issues. Expect high volatility to continue.”

In the survey, energy companies were asked what oil and natural gas prices would be necessary for drilling to be profitable across fields in which they are active. The average oil price cited was $62 per barrel, while the average natural gas price cited was $3.72 per million BTU. Asked what prices would be needed to support substantial increases in drilling, the average oil price cited was $86 per barrel. However, across various fields, producers offered answers ranging from $45 to $150 per barrel.

The average natural gas price cited as needed to support substantial increases in drilling was $4.53 per million BTU, with responses ranging from $3 to $6.50.

Notably, prices cited to maintain profitability and to support substantial increases in drilling were the highest in the survey’s history, since 2014.

Firms also were asked what they expected oil and natural gas prices to be six months, one year, two years, and five years from now. They responded that they have record expectations for West Texas Intermediate crude, at $96, $89, $83, and $84 per barrel over those time frames.

By contrast, producers predicted declining prices for natural gas. The average anticipated for Henry Hub natural gas was $4.45 in six months, $4.32 a year from now, and $4.29 and $4.74 for two years and five years from now.

The Federal Reserve Bank of Kansas City serves the 10th Federal Reserve District, encompassing the western third of Missouri; all of Kansas, Colorado, Nebraska, Oklahoma, and Wyoming; and the northern half of New Mexico.

• “(Over the course of the pandemic) technology in fracturing keeps becoming more efficient. … We are beginning to drill and complete our second-tier locations, with a bit of trepidation. I do not believe we will see the big percentage increase year over year as happened this past decade.”

• “(Over the course of the pandemic), the rising cost to drill and complete have operators revaluating this cost to justify drilling. Smaller independents are having a difficult time attracting new investors.”

• “The biggest factor is global demand and the ability for the U.S. to continue expanding liquefaction capacities. If progress is made on that front, higher prices could be in order (for natural gas).”

According to Chad Wilkerson, Oklahoma City Branch executive and economist at the Federal Reserve Bank of Kansas City, the survey revealed that 10th District energy activity has increased moderately, and expectations for future activity remain strong.

“District drilling and business activity grew further in early 2022,” he said. “Firms reported higher prices needed to substantially increase drilling for oil and natural gas. Firms ranked labor shortages and investor pressure to maintain capital discipline as the main factors constraining growth. However, expectations for future production remained positive.”

Around 52% of firms reported a slight increase in U.S. well productivity over the course of the pandemic, while nearly 30% reported slight or significant decreases and about 18% of firms reported no change. Moving forward, 14% of firms expected a significant increase in productivity, and 48% expected a slight increase; 24% expected no change, and 14% expected a slight decrease in productivity in 2022.

Working rigs drilling for oil rose by 12 this week, bringing the total up to 759. It was the biggest increase in 10 months. Texas saw a net gain of 13 rigs and the Permian basin rig count accounted for much of this week’s gains, increasing by 18 rigs this week, now standing at 427 rigs versus 291 rigs a year ago this week.

Helmerich & Payne Inc., the biggest U.S. rig contractor by market value, said this week it’s reasonable to expect the rig tally to increase by 100 to 200 rigs this year thanks to the improving outlook for oil prices.

Weekly Summary: Rigs engaged in the exploration and production in the U.S. totaled 947 for the week ended January 26, 2018, up 11 from last week. Land rigs gained 13 while the offshore rig count fell by 2. Rigs drilling in the inland waters were flat for the week.

Oil Rig Count:The US crude oil rig count jumped by 12 to 759 for the week. There are 193 more rigs targeting oil than last year. Rigs drilling for oil represent 80.1 percent of all drilling activity.

Natural Gas Rig Count:The natural gas rig count – which plunged to its lowest last August – lost 1 down to 188. The number of rigs drilling for gas is 43 higher than last year’s level of 145.

For more details on the latest national and state news regarding last Friday’s Baker Hughes rig count data, check out the interactive rig count dashboard on the Oklahoma Index tab of our website.

This is an archived article and the information in the article may be outdated. Please look at the time stamp on the story to see when it was last updated.

OKLAHOMA CITY (KFOR) – President Joe Biden unveiled a ban on Russian oil imports Tuesday afternoon as oil and gas prices continue to skyrocket to record highs.

The next question is will Oklahoma oil companies ramp up production? KFOR spoke to the Oklahoma Petroleum Alliance and a local economist on the ways this Russian oil embargo will affect the Sooner State, as well as what things look like moving forward.

“The cure for low oil prices, is higher oil prices,” said Brook Simmons. President of the Oklahoma Petroleum Alliance. “The cure for higher oil prices is lower prices and what drives both of those is supply and demand drilling activity.”

A barrel of oil as of Tuesday is running over $120 per barrel. With gas prices rising with that, Simmons said Oklahoma’s oil and gas industry is recovering quickly from the lows of 2020.

“So, this recovery is good not only for the industry in Oklahoma, but it’s good for the taxpayers,” he said. “It’s good for anyone who cares about schools, roads, bridges and other state priorities.”

Oklahoma City University professor and economist Dr. Steve Agee said America has a steady supply of oil imports from Canada, the U.S. major supplier of oil with the

“We’re a lot more insulated in other countries in the world too,” Agee said. “Especially Western Europe, who are very reliant on the Russians to provide them with oil and natural gas.”

However, if you’re hoping Oklahoma will help drive down prices, three of the state’s largest oil producers told The Oklahoman they did not plan to ramp up production to offset current costs, something Agee said could help but will cost money and time.

“This isn’t something you can flip a switch and say, ‘Okay, we’re going to produce another million barrels of oil a day to get out there and drill those wells,’” Agee said. “If we get in there and drill new wells, spend a lot of new money, have to borrow that money in order to drill and complete those wells and then all of a sudden, six months from now, let’s suppose this crisis is over and oil markets go back to normal. Then they could have spent a whole lot of money and the price of oil may drop back down to $70 a barrel.”

“Our members will operate responsibly, and they will do everything they can to make certain that they are not only producing a good product…but also returning those funds to the shareholders, the owners, which frequently are many Oklahomans,” Simmons said.

We reached out to Devon, Chesapeake and Continental for comment but have not received any statements from them. Dr. Agee said gas prices will continue to be affected by the fighting in Ukraine and he predicts gas prices will remain over $4 per gallon for the rest of the year.

More and more oilfield equipment is going for bargain-basement prices in auctions held throughout the industry as rigs and equipment are idled due to the coronavirus pandemic and the oil price crisis.

Fast-talking auctioneer Greg Highsmith sung out dozens of prices – “seventy-five-hundred now, $10,000 now, be able to get 15,000?” – before a North Dakotan buyer paid $27,500 for a used Caterpillar oil swabbing rig on Friday.

The rig was one of more than 2,000 lots offered in an online auction of oil, gas and industrial equipment out of North Dakota’s Bakken shale region on Friday.

The auction market is more active than at any point since the downturn of the 1980s, said Dan Kruse, a San Antonio-based auctioneer and founder of Superior Energy Auctions, which specializes in energy equipment.

Oil prices crashed this year, dropping at one point to negative-$37 a barrel. While the U.S. crude benchmark

Spending is down about 35% from the first quarter to the second. The cutbacks have prompted auctions from Odessa, Texas to Alberta, Canada, where auctioneers like Highsmith are banging gavels to close deals on equipment. Even if oil prices remain in the high-$30s, that will not be enough to spur much in the way of additional drilling.

“We’ll need fewer coal tubing units, fewer well service rigs, fewer trucks, sandmines, everything,” said James West, analyst and senior managing director at Evercore ISI.

Ritchie Brothers, the biggest industrial auctioneer, conducted its largest-ever Texas auction in Fort Worth earlier this month, selling nearly 5,300 equipment items and trucks for over $81 million. Due to the coronavirus pandemic, the auction was held online, drawing 11,600 prospective buyers from 68 countries.

“Top of the line – it could bring $5 million, but maybe not,” said Kruse, of Superior Auctions. He will know in coming days when he steps up to the podium in Odessa, Texas, for his first auction since the downturn.

Every piece of equipment will be sold, as there is no minimum bid, he said. Buyers from construction and other industries often stream in to purchase trucks or sandhaulers that are not specific to the energy industry.

Energy-specific equipment is a harder sell. Some scrap metal buyers enter the market, looking for iron that has more value than the equipment itself. In the 1980s, Kruse recalls, scrappers bought about a third of all rigs sold at auction.

The auction houses are talking to different types of buyers. Superior has talked to Wall Street hedge funds about acquiring equipment that may appreciate in a few years, while Ritchie Brothers said international representatives have looked as far afield as New Zealand for buyers.

“Every auction we have bidders from Brazil, Venezuela, Trinidad and Tobago,” said Sam Wyant, Ritchie Brothers’ senior vice president of strategic accounts.

As Highsmith called out prices on Friday, a gavel icon next to his name, buyers pressed a button to indicate they wanted to bid. Lot 430, a workover rig, used in well completion, opened at $50,000, but Highsmith dropped the price to $25,000 due to a lack of interest.

While most of the investment and lending world is seeking to purchase ‘Proved Producing Reserves’ as an entry to obtaining upside potentials such as offset drilling locations, OTEC has proven that there is a better return opportunity by putting a bit in the ground or enhancing existing production, especially today since drilling and completion costs have dropped dramatically. OTEC’s proven formula has created positive cash flow much faster. As oil and gas prices rise again, OTEC looks to capitalize on created reserves that have a low cost or basis to entry or acquisition.

Several large and mid size companies in severe cash flow crunches along with trying to service huge debt loads. Much of this debt was created in the reckless race to pay outrageous prices for shale oil and gas leases in anticipation of drilling very expensive deep horizontal wells that are now, for the most part, on hold due to high development, drilling and lifting costs.

Many oil and gas investors wanted in at $135+ oil. Consider the cost of entry now versus then, along with the vulnerable position several companies are in. OTEC is poised to take advantage of this, and hopefully benefit from the current market situation in conjunction with its experience and unique relationships to important industry insiders.

Quality, reliability, and integrity are three words synonymous with Tulsa Rig Iron. Since 1987, we have engineered and manufactured industry leading products for the HDD, oilfield, and water well drilling industries. Our specialties are mud mixing and recycling systems rated from 50 to 1500 GPM, mud pumps rated from 5 to 880 GPM, and hydrostatic test pump packages.

You can read more about Tulsa Rig Iron on our about us page. Additional product information can be found at new products, equipment available for rental, used equipment, or our parts pages.

8613371530291

8613371530291