workover rig cost per day manufacturer

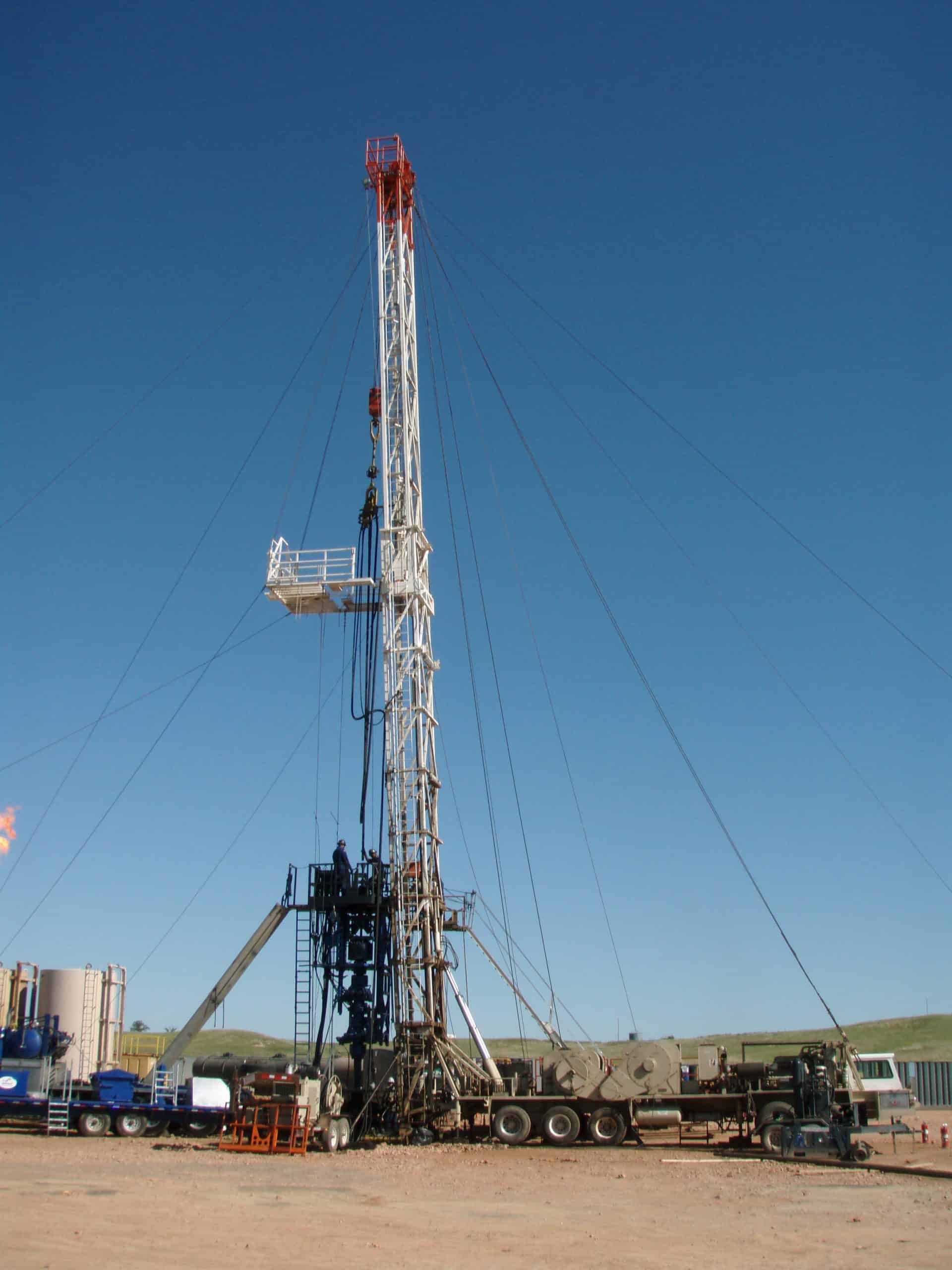

Workovers are the most common expenditure operators need on their oilfields. However, finding a service provider and getting their rates are not readily available in the industry. Operators would benefit from knowing the market average for a workover and gain reassurance they are getting a fair price for their services. This research is based on finding workover rigs for Zapata, Texas. The graph represents four service provider companies and their hourly rate for a workover rig.

It is important to note that due to slower oil development in recent years from the downturn in 2015 to the pandemic and downturn in 2020, smaller workover rig companies in Zapata, Texas have increasingly moved to the Permian Basin or have been acquired by larger service companies in the area. This has caused the workover rig service industry to be dominated by a few major servicers around Zapata. For Zapata, the ideal areas to look for servicers or workover rigs are Alice, Laredo, and Freer in Texas.

Hourly rates for workover rigs vary and there are always competitors for services, especially for services as common as a workover rig. The market average price for a service provider is intended to provide the oil and gas operator better insight on the cost of services around their area.

An operator who wanted bids on a workover for his well requested this vendor list and decided to get connected with Company B to get the work done. He said it was a quick decision because what he was already paying for and what he was going to pay for cost more than the rates on this list.

In order to help oil and gas operators reduce operational expenditure, Petrofly researches the servicing market to provide the most economical options for your oilfield service needs. Petrofly’s platform is the complete upstream solution and leveraging the market average is one of the unique tools operators utilize to ensure lower operational costs.

The commodity price downturn is prompting price reductions among well service contractors in the greater Rockies outside the Williston Basin. In mid-January 2015, service providers report rates down about 10% quarter-to-quarter, similar to reports elsewhere in the oil patch as operators push the service sector for cost reduction. Meanwhile, larger service providers worry about further rate cutting from local, privately-held contractors. Rate reductions have not yet translated to reduction in wages for hands, although expectations are that pricing is going to drop further on the basis of lower commodity prices.

Among Survey Participants:Rig Demand Down QTQ [See Question 1 on Statistical Review]. Seven of the eight respondents said that demand had dropped in 1Q15 vs 4Q14 and all but one blamed lower oil prices for the slowing. One respondent that had seen a slowdown in demand said it was because they had finished all of their completion work. The respondent who had not seen an effect on demand said that their work was steady, but they were hearing of others slowing down.Mid-Tier Well Service Manager: “We are seeing demand slow for rigs and prices are being reduced. Operators are asking for 20% reductions, some are asking for 30% and they may get it. The greater reductions will be from people who are local because they don"t have the overhead expense. The service won’t be as good. On average, operators may get 15% of that 30% they are seeking in reductions.”

Number of Rigs Sufficient [See Question 2 on Statistical Review]. Six of the eight respondents said that the workover rig inventory is excessive for the current demand, while two said that it is sufficient but tipping toward excessive.Mid-Tier Operator: “Operators here are basically focusing on the higher production wells and going to ignore the lower ones. We have heard companies are laying down workover rigs. One company is going from 17 to 13.”

Well Service Work Weighted Toward Standard Workovers and Routine Maintenance [See Question 3 on Statistical Review]. Among all respondents, standard workover work accounts for 34% on average, routine maintenance accounts for 34%, plug and abandonment (P&A) accounts for 16% and completion work accounts for 16%.Mid-Tier Well Service Manager: “Our work slowed because we finished our completion work so the client gave us some production work to keep us steady till we finish this fracking job.”

Hourly Rates Consistent Among HP Series [See Question 5 on Statistical Review]. Most workover rig horsepower falls within the range of the 500 series. The 500 HP hourly rates average $310 to $400/hour depending on what ancillary equipment is contracted. See Table II for Average Hourly Rates.

Hart Energy researchers completed interviews with nine industry participants in the workover/well service segment in areas of the Rocky Mountains outside of the Bakken Shale play. Participants included one oil and gas operator and seven managers with well service companies. Interviews were conducted during January 2015.

3. Looking at your slate of well service work - on a percentage basis - how much of it is workover vs. routine maintenance vs. plug & abandonment (P&A) vs. completion work?

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

Well work and well servicing is a complicated subject and there are a lot of moving parts. It is potentially so complex that many oil and gas companies seek to avoid it altogether when they can. A thorough understanding of the rank order of the options available, and what they can do is the key to being able to unlock tremendous value. A few ‘simple’ or fortunate’ or ‘clever’ oil and gas operations can be set up where operations are simple – drill a well, complete it, produce it to abandonment pressure and conduct abandonment. For every other situation well servicing is the key to profitable operations. This is a very general way to look at the cost of well servicing, and how it affects operations in the field. The exact details will vary from country to country, field to field, region to region and company to company.

The following general group of services are available for well work. They are listed roughly in order of cheapest to most expensive for land operations.

In shallow waters with fixed platforms or other facilities with direct well access the chain of costs and values are slightly different - the overall costs are generally higher, but the general ‘ladder of values; is different also.

Pumping services tend to get more expensive offshore, because of the degree to which the equipment must be assembled on location. Wire based services still require assembly, but because the parts are smaller can usually be mobilized in larger ‘chunks’ thus requiring less assembly on location. On land, fluid pumping equipment is much more readily portable on trucks or trailers. Workover rigs on land are incredibly cheap in most places as measured on a per diem basis. Part of their advantage is that they arrive to location with most of their key components already assembled in/on one truck. This advantage disappears offshore where the rig must be assembled on site first.

In deep-water with subsea wellheads where there is no permanent facility available to access the well, costs are turned on their heads, and look roughly as follows:

Paying for a drilling rig or intervention vessel is the price of gaining physical access to the well. Everything else must be added to it to get physical access to the general area and then gain access to the well. There is no need for various forms of standalone pumping services because the vessel or rig will already have a cementing unit and/or the mud pumps available for that sort of work.

Performing the same operation over and over again has significant cost savings attached to it. Once the correct housing and supply arrangements are in place, and all the necessary people and equipment have been assembled, continuing to use it altogether ‘as is’ can save an enormous amount of money compared to dispersing it all and starting over again later. For land operations, this is most pronounced in areas where reservoir, surface, and operational practices allow for grouping wells together in relatively small areas, and for clustering well pads. Depending on what work is being done to the wells and how close together they are it may be possible to ‘hop’ from one well to the other without ever moving the equipment on a road or doing a complete rig-down.

This is one area where offshore operations can see tremendous improvements and synergies. Having facilities with multiple wells at a single physical location allows for extremely high levels of flexibility economies of scale if the same sorts of equipment and skills can be utilized on one well after another in succession.

Deepwater operations can benefit from this too, but not as much as ‘traditional’ fixed or surface access facilities, because the overall day rate of the rig or intervention vessel is often much higher, and the process of switching between wells is often much lengthier.

On land, you hire the unit and crew, and a small diem fee is added to the cost of employing them so they can stay in a hotel and get food when they are not working. The crews will transport themselves to and from the well and move the equipment to and from the well also.

Offshore, housing, food, and transportation to and from the wellsite must be arranged as part of the work to be performed. This involves contracting crewboat(s), work boat(s) helicopter flights, catering services, and crew quarters buildings with a galley, laundry, showers, toilets, etc. Extra space must be allocated or created at or near the wellsite facility for the extra quarters. Many of these same factors are also present in remote land locations. The nature of operations in the Sahara Desert, or the North slope of Alaska, or the Congo jungle are more like those offshore with respect to cost and access than they are to more ordinary land operations where ‘normal’ food and housing operations catering to the population of the area in general are accessible.

For deepwater, everything for offshore must be provided, but with the additional difficulty that none of it can be made permanent, because there are no permanent surface facilities. In addition, simply getting to the wellhead once you have a drillship, semi-submersible, light well intervention vessel or other type of access facility floating over the top of the well is a considerable challenge. Depending on the nature of the operations which must be conducted, the access method, and the weather and current conditions it may take a period ranging from a day or two, to several weeks before access to the well is accomplished and the well work itself can start.

The costs of conducting business in each of these 3 areas tend to scale very roughly in factors of 10. 100 wells making 50 bbls of oil each on land is a cash cow. Offshore that is a disaster, because the cost of servicing those wells is prohibitive. A more reasonable scenario is 10 wells making 500 bbls of oil each. In deepwater, a well making 500 bbls of oil a day is an abandonment candidate, if indeed it got that far along before abandonment. One well making 5,000 bbls a day is more. The direct cost of hiring (for example) a snubbing unit do not scale by factors of 10, but the overall cost of employing a snubbing unit do. As a result, different types of well servicing make sense in one area which may not make sense in another. On land in areas with ordinary access to infrastructure (not the Sahara or Alaska) operations like slickline are often so cheap that they are a routine procedure, with preventative or predictive maintenance schedules to scrape away paraffin or remove small amounts of scale. By contrast, it is completely cost prohibitive to try and attempt to perform similar work in deepwater – you either design and operate the well in such a way that paraffin and scale do not build up in the wellbore at appreciable rates, or you P&A the well. The cost of routine mitigation is simply too high. The relative cheapness of most workover rigs on land is another major factor. Many types of operations which could in theory be carried out in some other way are done with a workover rig simply because it is the most cost-effective technique, even if other methods might be faster, or involve fewer people. The relatively high cost of a rig for offshore facilities means that in most cases every effort short of getting a rig is tried first. Then a catalogue or list of operations to be conducted by a rig at a given facility will be gradually built up over time until they reach a critical level. At that point, a rig will be sent out to conduct all the operations which only it can perform, moving from one well another to save costs by making the work repeatable.

About products and suppliers:Alibaba.com offers 222 workover rig manufacturing products. About 50% % of these are oilfield drilling rig, 28%% are mine drilling rig.

A wide variety of workover rig manufacturing options are available to you, You can also choose from diesel, electric and gasoline workover rig manufacturing,As well as from energy & mining, construction works , and manufacturing plant. and whether workover rig manufacturing is unavailable, 2 years, or 6 months.

Aug 26 (Reuters) - North American onshore rig contractors are spending millions of dollars to add costly “walking” rigs to their fleet, a move that may seem counterintuitive at a time when the slump in crude prices shows no signs of abating.

Such rigs “walk” from wellbore to wellbore, unlike a regular rig that has to be taken apart and reassembled for each move, and save shale producers time and money - as much as 30 percent of the cost to drill a well.

Even though the returns on these investments will not be immediate, rig contractors such as Patterson-UTI Energy Inc and Pioneer Energy Services are pandering to the demand for these rigs.

Demand for rigs have taken a walloping, as oil producers have slammed the brakes on drilling new wells to cope with a 28 percent decline in U.S. crude prices this year.

“As activity starts picking up again, the majority of requests from operators, I think, will be for pad-oriented rigs,” said Pioneer Energy CEO Stacy Locke, referring to the popular practice of drilling several wells in one location.

This promise of higher demand and better rates has led rig contractors to either build new walking rigs or spend $1 million to $2 million to attach giant hydraulic walking systems on their regular rigs.

It costs $20 million to $25 million to build a new walking rig, according to Evercore ISI analyst James West. A regular rig used to cost $10 million to $15 million a decade ago and no one has built one recently, he said.

A walking rig can move from one wellbore to another rather quickly - 10 meters in less than an hour. Moving a regular rig can take days and cost up to $1 million.

The payback on a new walking rig is three years in a normal demand environment, and between six and nine months on a rig refurbished with a walking system, according to Wunderlich Securities analyst Jason Wangler.

Still, Patterson, one of the top five contractors in North America based on its hi-spec rig fleet, plans to build 16 high-tech Apex rigs this year. Of those, 15 will be able to walk. It already has more than 100 walking rigs in its fleet of 159.

About two-thirds of Pioneer Energy’s 36-rig fleet is now capable of pad drilling. Of them, 24 are walking rigs. The company plans to add another three by the end of the year.

Independence Contract Drilling Inc has 14 rigs and plans to upgrade its last non-walking rig by the end of the year. (Editing by Sayantani Ghosh and Savio D’Souza)

/cloudfront-us-east-2.images.arcpublishing.com/reuters/XMYRPMRVYVIVFDQ3B63SKJODDY.jpg)

OSLO, Sept 14 (Reuters) - Rental rates for offshore oil and gas rigs could rise to $500,000 in the coming months, company executives said on Wednesday.

Daily costs to hire a rig, known as the dayrate, have already more than doubled from two years ago to some $300,000, with some top-end rates reaching close to $400,000, according to Oslo-based brokerage Pareto Securities.

Drilling companies are in a stronger position to demand higher rates to rent their equipment after several lean years led to a wave of mergers and pushed them to scrap older rigs, leaving fewer available now that demand is rebounding. read more

Updated monthly, the Offshore Rig Day Rate Trends report tracks competitive mobile offshore drilling fleet day rates and utilization across three representative rig categories. Constructed with information from rig operators and owners worldwide, offshore rig day rate data is the most accurate information of its type available from any source.

Day rates published by IHS Markit are presented in good faith based on our best understanding of the market at the time, and may be subject to adjustment. Day rates are charted as an average of the high and low for each month. Utilization is the percentage of contracted rigs out of the total competitive fleet supply. The data is updated on or about the 15th of each month. The data points used to derive the averages are available to subscribers to Petrodata"s RigBase or RigPoint market intelligence tools.

The Downstream costs services team would like to invite you to our Houston Enclave Parkway office for the Third Quarter 2022 Downstream Costs Update...

{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales

[num]","alt":"Call Sales

[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"chat","enabled":true,"desc":"Chat Now","mobdesc":"Chat","mobmsg":"Welcome! How can we help you today?"}, {"name":"share","enabled":true,"desc":"Share","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html&text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"email","url":"?subject=Offshore Rig Day Rate Index | IHS Markit&body=http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Offshore+Rig+Day+Rate+Index+%7c+IHS+Markit http%3a%2f%2fihsmarkit.com%2fproducts%2foil-gas-drilling-rigs-offshore-day-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

To ensure our website performs well for all users, the SEC monitors the frequency of requests for SEC.gov content to ensure automated searches do not impact the ability of others to access SEC.gov content. We reserve the right to block IP addresses that submit excessive requests. Current guidelines limit users to a total of no more than 10 requests per second, regardless of the number of machines used to submit requests.

If a user or application submits more than 10 requests per second, further requests from the IP address(es) may be limited for a brief period. Once the rate of requests has dropped below the threshold for 10 minutes, the user may resume accessing content on SEC.gov. This SEC practice is designed to limit excessive automated searches on SEC.gov and is not intended or expected to impact individuals browsing the SEC.gov website.

We are committed to total customer satisfaction, achieving excellence in our operations through continuous improvement, development and empowerment of our people, and providing a positive contribution to our community.

Block Energy Plc, the exploration and production company focused on the Republic of Georgia, is pleased to announce execution of a non-binding Memorandum of Understanding ("MOU") with Georgia-based drilling contractor, JSC Norio Oil Company ("NOC"), for the provision of a drilling and a workover rig. Subject to a final agreement, these will be utilised on the 2018/2019 work programmes across Block"s three licence areas: Norio (100% working interest), Satskhenisi (90% working interest) and West Rustavi (75% working interest after earn-ins described below) which collectively have net proven oil reserves of 1.5 million barrels plus 61 million barrels of oil and c.473 billion cubic feet ("bcf") of gas classified as net unrisked 2C contingent resources.

Subject to a final binding agreement, NOC will provide an A50 workover rig that will be used to undertake a short three well workover programme at Satskhenisi before being moved to the nearby Norio licence where eight candidate wells have been selected for workover. Block is aiming for the eight Norio wells to be completed and on production by Q1 2019. It is anticipated that the rig will also be used at West Rustavi, where two wells will be prepared for side tracks and the re-testing of a legacy gas discovery in the Lower Eocene, a play being targeted on neighbouring licences by Schlumberger, the leading oil and gas services provider and operator. Under an existing agreement, the preparation of the two wells at West Rustavi will trigger an increase in the Company"s working interest in the West Rustavi licence to 50% from 25%.

In addition, it is planned that NOC"s ZJ40 drilling rig will drill two high impact horizontal side tracks in the West Rustavi permitduring Q4 2018 / Q1 2019. Targeting initial oil production of c. 600 barrels per day. The two side tracks will increase the Company"s working interest in the West Rustavi licence to 75% from 50%.

Paul Haywood, Director of Block Energy, said: "The MOU signals the start of exciting times for Block during which shareholders can expect high-impact news flow on work programmes commencing across our three licence areas in Georgia. Following a comprehensive tendering process, the principles for favourable terms for rig contracts have been negotiated which we expect, once finalised, will secure considerable cost savings.

"The Company is fully funded to complete the first of a three phase work programme focused on scaling up production to a gross 900 barrels of oil per day within 24 months and on testing legacy gas discoveries at West Rustavi, which have been assigned 600 bcf of gross, unrisked contingent resources. The MOU secures two suitable rigs for the Company for a period of 12 months, giving us the flexibility and security to execute and complete our first phase of work before immediately moving into phase two with the same rig and crew. Furthermore, the terms of the agreement reduce the risks related to rig availability and cost overruns associated with hiring on a daily rate basis. We look forward to providing further details of the final contracts along with updates as operations get underway."

Block Energy (BLOE.L) is an AIM quoted oil and gas company with a growing portfolio of production, development and exploration assets in the Republic of Georgia. Block holds a 100% Working Interest ("WI") in the producing Norio licence, a 90% WI in the producing Satskhenisi licence and a 25% WI in the West Rustavi licence with the right to farm-in to up to a 75% WI. Block"s three licences lie in the heart of the Schlumberger"s 100% held position in the Kura basin, which at its peak produced ~70,000 barrels of oil per day ("bopd") in Georgia and is estimated to hold over 7 billion barrels of proven reserves in Azerbaijan and North Caucasus (Russia).

The licences currently hold estimated net proven oil reserves of 1.5 million barrels plus 60 million barrels unrisked contingent oil resources ("2C"). Furthermore, the West Rustavi permit has estimated gross unrisked contingent gas resources (2C) of 608 bcf. Multiple gas discoveries have already been made in the Lower Eocence and Upper Cretaceous within the Licence and lie on trend with the same play currently being targeted by Schlumberger on neighbouring licence, Block XIb. The estimated cost of gas development and production at West Rustavi is c.US$2.00/Mcf which equates to operating netbacks of c.US$2.6/Mcf (assuming a 75% working interest) - Georgia currently purchases its gas for c.US$5.5 /Mcf (c.US$600m project value to the Company).

Appraisal of West Rustavi is being conducted contemporaneously with the rehabilitation of the producing Norio (100% WI) and Satskhenisi fields (90% WI) which provide immediate production uplift on commencement of field operations in Q3. The near-term target is to raise production to 900 bopd from 15 bopd within 18 months via a low cost, low risk workover and sidetrack programme, and then to utilise the cash flow to drill horizontal wells and sidetracks to raise production to c.2,000 bopd. Oil production on the fields offers excellent netbacks, with the current cost of production of c.US$25 per barrel providing netbacks of c. US$30-35 per barrel.

Despite the blizzards that walloped Bakken production in April, Continental not only expects to deliver on predicted production for the year, but it has raised its guidance to 210,000 barrels of oil per day.

In its most recent earnings call, Continental President and CEO Bil Berry and Chief Operating Officer Doug Lawler said the company is confident in its numbers for the full year, as well as sequential production growth each quarter.

Lawler credited the increased guidance to better than expected productivity from recently completed wells, as well as increased workover rig activity.

Continental also raised its natural gas production guidance to between 1.1 to 1.2 billion cubic feet of natural gas per day, due to strong early performance of wells in the Scoop and Stack areas of the Anadarko Basin.

The increase in workover rig activity has added to expected production expense, but the workovers are paying for themselves within two weeks, Lawler added.

“We have completed 301 workovers in the Bakken in the first quarter alone,” he said. “That is 65 more than the company’s ever done, and historically, just an outstanding job that they’re executing in the field up there, at tremendous economics.”

Lawler said the Bakken has the most opportunities for workovers that make sense, but Continental will look at its entire portfolio for such opportunities, and expects to find them in the Permian and Anadarko as well.

“We are now investment grade rated with all three major credit rating agencies,” Berry said. “With an approximately 31 percent return on capital employed projected for full year 2022.”

Continental officials also spent a good bit of time discussing the $250 million project with Summit carbon solutions, expected to be operational by 2024.

The project will sequester 10 to 12 million tons of carbon dioxide per year, Berry said. By comparison, Continental’s 2020 Scope One emissions were just 2.3 million metric tons.

“Summit is currently raising additional equity and once finalized, we expect to own approximately 25 percent of this enterprise as anequity investment,” he said. “Our investment will be funded throughout 2022 and 2023.”

The exact nature of the commercial arrangement between Continental and Summit has not yet been divulged, but Berry said ethanol is one of the lowest cost sequestration projects available with today’s technology. The project also fits well with Continentals skill sets and knowledge base.

“The emissions from ethanol plants are 97, 98 percent pure carbon dioxide and the remainder is largely water vapor, so that benefits the economics significantly, Lawler added.

As far as acquisitions go, Continental officials said they would continue to look for bolt-ons, but added the current price environment has dampened acquisitions right now.

“We have allocated an additional $100 to $125 million toward inflation, as we see inflationary pressure of up to 20 percent versus 2021,” Lawler said. “With the strength and year over year consistency of our operations, we have options when it comes to service providers and products we use to execute our program. We will continue to monitor inflation and respond accordingly, including pursuit of further operational and technical efficiencies, as well as adjusting our capital program up or down as economics dictate.”

Day rate refers to all in daily costs of renting a drilling rig. The operator of a drilling project pays a day rate to the drilling contractor who provides the rig, the drilling personnel and other incidentals. The oil companies and the drilling contractors usually agree on a flat fee per contract, so the day rate is determined by dividing the total value of the contract by the number of days in the contract.

Day rate (oil drilling) is a metric that investors in the oil and gas industry watch to evaluate the overall health of the industry. The day rate makes up roughly half the cost of an oil well. Of course, the price of oil is the most important metric by far in the oil and gas industry.

That said, investors can gain insights into the oil supply and demand picture by watching metrics like day rate and rig utilization in addition to global inventories. Day rate fluctuations, which can be wide, are used by investors as an indicator of the health of the drilling market. For example, if day rates fall, investors may take it as a sign to exit oil and gas positions.

Day rates can be used to assess the current demand for oil, ultimately gleaming insight into where oil prices are headed. An increase in the price of oil increases the number of projects that can recover their extraction costs, making difficult formations and unconventional oil reserves feasible to extract. The more projects greenlit on an economic basis, the more competition there is for the finite number of oil rigs available for rent – so the day rate rises. When oil prices waver and fall, the day rate that rigs can command drops.

As an example of actual day rates – Transocean signed a contract in December 2018 with Chevron to provide drilling services. The contract is for one rig, will span five years and is worth $830 million. The effective day rate for the rig is $455,000:

Like the day rate, the rig utilization rate is a key metric for determining the overall health of the oil and gas sector. The day rate lays out a large part of the costs of drilling a well, while the utilization rate is how many wells are being used.

Investors use both of these metrics and a fall in each could signal a slowdown in oil demand. High utilization rates mean a company is using a large part of its fleet, suggesting oil demand, and ultimately, oil prices are on the rise. There is a positive correlation between oil prices and both day rates and rig utilization.

The strength of the correlation between oil prices and day rates is not consistent. The correlation is strong when oil prices and rig utilization are both high. In this situation, day rates increase almost in lockstep with prices. In an environment of rising oil prices and high utilization, the day rates in a long-term contract will shoot up even faster than short term contracts as rig operators demand a premium for being locked in on a project.

In a low price environment with falling utilization, however, the day rate may plunge much faster than the oil prices as rigs enter low bids on long contracts just to keep busy in a potential slowdown. Due to the volatility and the varying strength of the correlation, investors and traders can flip between seeing day rates as a leading or a lagging indicator for oil prices and the health of the oil and gas industry as a whole.

The following is a list of seasonal work gear worn by drilling rig workers. Savanna supplies rig employees with coveralls, hard hat, safety glasses & impact gloves (1 pair).

Drilling rig crews are generally made up of six (6) people: Rig Manager, Driller, Derrickhand, Motorhand, Floorhand, and Leasehand. Each crew works 12 hours shifts as the rig operates 24 hours per day, and each position is vital to the operation of the rig.

Work in the oil and gas services industry is seasonal. Because of the weight of rigs and their equipment, and the remote location of wells, these locations are often only accessible when the ground conditions can tolerate heavy loads. Therefore, wells are typically drilled and serviced in the winter when the ground is frozen solid, or in the summer, when the ground has thawed and dried sufficiently. During the spring and fall, when the ground is in a transitional state, it is too soft to move equipment on and easily damaged. For this reason, provincial governments implement “road bans” prohibiting heavy loads from operating in certain areas. During this time, rig work is slower, and many rigs are shut down and their crews sent home. Be prepared to be off for anywhere from 6 to 12 weeks without pay during this time. However, rigs that are shut down are usually in need of maintenance, and there may be opportunities for employees who would like to help in this regard. Employees may be eligible for Employment Insurance benefits during seasonal shutdowns.

To work on a drilling rig, you must be able to get to and from all of your work locations. As drilling often occurs in remote areas, having reliable transportation is considered mandatory for non-camp locations. Drilling rigs commonly operate 24 hours per day, 7 days per week with either three crews working 8 hour shifts or two crews working 12-hour shifts. Most often day crews and night crews will alternate weekly, so each crew has a chance to work during both the day and night. Most crews will work 14 days straight with 7 days off in-between. The typical living situation while working falls into three categories: Non-Camp, Full Camp and Texas Camp.

Non-Camp: When the rig site is near a town, non-camp conditions normally apply. Crews will stay in hotel rooms and receive a per day living allowance for food and accommodation. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and accommodation out of your own pocket.

Full-Camp: When a rig site is in a remote location, crews may stay in a full camp. In a full-camp all food and full accommodation is provided. Once at the camp, the crew travels to and from the rig in the crew truck. Almost all camp work is available in the winter only.

Texas Camp: These camps are typically located nearby the rig location. Crews are responsible for supplying their own bedding, cooking supplies, groceries and toiletries. While staying at a texas camp, a daily allowance is provided for food and toiletries. The living allowance is paid out on your pay cheque based on days worked, therefore you will need to be able to pay for your food and toiletries out of your own pocket.

Once you have completed your orientation, you will immediately receive any other necessary training. This involves Workplace Hazardous Materials Information System (WHMIS) and Transportation of Dangerous Goods (TDG), along with an in-depth General Safety Orientation. This training is mandatory and provided by Savanna at no cost to the employee. Job-related, hands on training is conducted in the field through Savanna’s Rig Mentoring Program.

Some well locations have sour gas (Hydrogen Sulfide or H2S) present which is extremely dangerous. All employees are required to possess a valid H2S Alive certificate regardless of whether they are working on a sour gas well. This can be obtained by signing up for and completing a one-day (8 hour) course.

Courses are available at various locations across the province. For more information, contact Energy Safety (formerly Enform) at (780) 955-7770 or visit www.enform.ca or Leduc Safety Service at (780) 955 3300 or visit www.leducsafety.com. The cost of the course is usually between $130 and $150 plus tax, and the certification is valid for three years.

While it is not mandatory to have this certification, each service rig crew is required to have two members who are certified in Standard First Aid with CPR level C. Therefore, obtaining a certification beforehand is a great way to improve your chances of being hired.

Please try again in a few minutes. If the issue persist, please contact the site owner for further assistance. Reference ID IP Address Date and Time d94a2288d76f819e65e1cc71545d07c7 63.210.148.230 10/22/2022 01:40 PM UTC

The oil market ebbs and flows and is probably far more complicated than the average consumer can understand (without putting in the time and effort, that is). There are many steps to take petroleum out of the earth and put gasoline in your car, and a lot of decisions have to be made along the way. Sometimes these decisions include the oil rigs themselves, particularly in instances of an oversaturated market.

Oil rigs and drillships are expensive, high-tech pieces of equipment that are expensive to operate, whether they’re actively drilling or not. So when one or several rigs are not currently engaged in the oil production, the owners of said rigs have options: they can either cold-stack or warm-stack them.

A crew must be present on warm-stacked rigs to ensure the rig’s preservation and preventative maintenance schedules are followed for drilling and general ship equipment. Typically, these rigs are warm-stacked when the owners anticipate a work contract soon, so they are always ready to be mobilized within a few days. They are actively marketed and are considered part of the marketable supply.

Because routine rig maintenance continues, the daily costs may be reduced, but are actually similar to those in drilling mode. Warm-stacked can still cost, for example, an estimated $40,000 a day, without the profitable drilling of oil.

Cold-stacking a rig is also sometimes called “mothballing” because the rig is shuttered and put away; This is more of a cost-reducing step when an adequate return on investment doesn’t seem likely, or isn’t great enough to make the unit work-ready.

Mothballed rigs are shut down and stored in a shipyard, harbor, or designated offshore area. Crews are either reduced to zero, or else a skeleton crew might remain, greatly reducing the cost of maintenance.

Before storing the rig, crews take necessary steps to protect the rig’s facilities, including the application of protective coatings to fight corrosion, filling engines with protective fluids, and installing dehumidifiers. Unlike warm-stacked rigs, these may be out of service for extended periods of time and are not actively marketed. Including maintenance and a small crew, a cold-stacked rig might cost around $15,000 a day.

Going by numbers alone, cold-stacking seems like a better way to save money, right? Especially given that"s what companies want to do--not lose money on unproductive pieces of equipment that cost millions of dollars themselves (if not more).

But cold-stacking isn"t the magical answer, even if saving $30,000 a day seems like a win-win. The truth is, it"s a lot of work to make mothballed rigs ready for production--and a lot of money. To return a rig to service can easily means tens of millions of dollars for refitting costs.

As Bloomberg recently pointed out, mothballing drillships during an oil slump is a "massive gamble." But it doesn"t stop companies from taking that risk, especially if they"re losing millions of dollars on these behemoths. According to their reports, "Nearly half of the world’s available floating rigs are out of work today, and most observers expect that number will climb further." And not everyone is using the same method--not all companies are willing to turn engines off, for fear of not being able to turn them back on. It"s like Vegas that way--everything"s a gamble (but what happens in the ocean doesn"t necessarily stay in the ocean...or the ground, for that matter).

This website is using a security service to protect itself from online attacks. The action you just performed triggered the security solution. There are several actions that could trigger this block including submitting a certain word or phrase, a SQL command or malformed data.

What does it take to maintain a successful business? If you said profit, you hit the critical component to any good business. However, if you said the right equipment and team, your thought process drills deeper. I bet the rest of you were shouting, “Customers is what it takes!”

Maintaining a successful business was a top discussion point at the recent Mountain States, Maryland-Delaware, and Virginia groundwater conferences I attended as a presenter. To get a well-rounded perspective on this important topic, I interviewed a driller within our community and a custom home-builder connected to our community.

First up, Charles “Buddy” Sebastian of Sebastian and Sons Well Drilling based in Michigan is a long-time industry friend and president of the Michigan Ground Water Association. Sebastian has presented talks on job costs, company sustainability and the future of drilling companies at the MGWA’s annual conference. He also just presented at the Montana Water Well Drillers Association Convention & Trade Show.

A. The first talk I did on knowing your cost at MGWA, I had a question from the audience that said: “You have your business figured out. What"s your exit plan?” I said, the day you start your business is the day you start planning to sell your business. What I mean is, to be able to sell your business you have to be able to set your market. You can either be the market setter or market followers. You have to be able to set the market that your business is solvent. To be solvent, you have to have enough money in your profit margin to maintain, repair and replace equipment. Then, beyond sustaining the business, you can’t just work for beer and pizza. So you have to have enough profit in there to pay the team and yourself.

A. We are in some dangerous times for new equipment in our industry. Rig manufacturers are for sale for the second time in less than a decade, and the latest trend is to build smaller, less expensive rigs.

A. First of all, we have to stop pricing our product according to our competitor. We fix that by knowing our cost per hour and cost per day for equipment and project. That thinking that my competitor is drilling for $18, so I need to drill for $17 needs to go away. We need to know our costs on the first job and be profitable because it isn’t going to get any better if you don’t.

A. It is based on how many wells you do a year. I figure today’s drilling equipment’s life as 10 to 15 years, and yes, some older conventional rigs had a longer lifecycle. You know I did a cost analysis of some of my older table-drive rigs to replace belts, bearings, bushing and drivelines. What I saw was [that having] bushing and bearing that were relatively cheap to repair was no longer the case. Replacement parts were not built as good as the originals; importing cost had increased and, overall, these parts were becoming obsolete due to American manufacturers no longer making them. Conventional rigs are not as easy or cheap to repair as they were. You have to take into consideration downtime versus complete replacement.

A. OK, how about an $800,000 new rig that is going to be maintained to last 15 years. I use 2,080 working hours in a year, and I take into consideration 15 years of life. That comes out to $25 an hour to operate that rig.

That’s the per-hour cost to own that rig. That’s not interest, maintenance, repairs, tires, mud pumps or wearables. It’s just the cost to own the rig. Next, you have to take into account everything to operate and maintain the rig, including the labor to repair, update and replace. A good number to start with for a new $800,000.00 rig is about $75,000 a year to own and maintain it. The best advice I can give to a new rig owner is to save $25 an hour for every hour of rig operation to replace that rig.

A. The rig payment comes from profit. If you can’t pay the rig out of profit, you are in big trouble. We must make a business that is sustainable that can attract and hire good people and, on top of that, pay ourselves. We must know our costs.

Q. How does the industry value water at a cost that makes the drilling business sustainable? How do we change the stigma that a water well must cost X but even interior amenities such as cupboards can cost so much more?

A. Pricing is consistent throughout our area, so pricing is not outrageous. The drilling companies’ professionalism and expertise exclusively drive my priority when choosing an installer.

A. It is all about location. Location of the well may seem like a no brainer, but choosing a site, particularly on nonconforming lots or lake homes, can be somewhat problematic. Distance from property lines, septic systems and sewage ejection pumps can often become a balancing act. A drilling company willing to work with the footprint I have is invaluable.

A. I have had very positive experiences with the two drilling companies I use. Both are excellent, and overall I had similar experiences. The estimates and proposals aligned, and they both researched well logs on adjacent properties to present reasonable estimated well depths. One thing that makes me use one company over the other is when they go the extra mile to educate my customers on the process and me. I have a backup drilling company just because of schedules.

A. With the significant increase in the cost of wood over the last 10 years paired with the massive jump in labor costs, framing the home is typically the most expensive component of new construction. Other added costs come from the special footing or extensive land improvements/excavation.

A. We build custom homes that meet each client’s specific wants and needs. Not only do we accomplish this but at the same time we build quality homes. Energy-efficient and structurally sound homes are the starting point for our homeowners. These are our core values and a starting point from where we build to create a functional and architecturally pleasing home that exceeds our homeowners’ expectations. Building a home is like entering into a serious relationship with someone you just met. You are going to spend hundreds of hours with them, answer multiple calls a day and then respond to their weekend emails. You have to get along, or you’ll both walk away from the process drained and upset. I have found the best way to get along is to require perfection from my employees and my subs. That’s it. I do not allow mediocrity; my customers know it, and it establishes a basis for trust.

A. The entry barrier has working capital to pay subcontractors and material suppliers between bank draw. I typically need 20-25% of the contract price in liquid assets to fund the project. Then it’s about managing my project and understanding the profit I need to sustain my business, pay my employees and, at the end of the day, I need to provide for my family.

We need customers and builders, and they 100% require the drilling industry to provide water. We have to establish our message of value to our customers. The problem cannot be solved with one company or region that cannot solve our image; it will take the entire community discussing how we make the change together. In the end, we need the same thing our builder requires, to be able to recruit and pay good men and women to progress our industry, buy the right technology to be successful, and provide the consumer with a quality product that they value.

8613371530291

8613371530291